December 2024 Portfolio Update

2025 is coming closer and we're ending 2024 soon, but how did we perform this last month and how are we going into 2025? Let us go over it.

Hi, partner! 👋🏻

I hope you all had a wonderful New Year's Eve with your family, friends, neighbors, and pets.

Before we dive in, I wish you a prosperous, thriving, and healthy 2025—filled with growth and well-being!

To start the month, we will review my portfolio and its performance. December has been a relatively quiet month, and that’s perfectly fine. It gives me more time to read, better understand my current holdings, and explore new possibilities for the year ahead.

My aspirations for this year are:

Reading more, one book a month at least.

Getting in shape (I’ve been skipping out on the gym the last two months of 2024; I need to keep myself accountable, haha)

Provide (even) more high-quality content on X and Substack.

I need to educate myself even more about investing and psychology.

Spent more time with friends and family.

Go full-time into writing on Substack and X.

I would love to hear your aspirations for 2025 and share them in our private chat or here on this post. Let’s help each other achieve our goals. We’re one community striving to be the best community filled with achievers!

One last thing: I’ve started a referral program! This means you can invite friends to my newsletter and be rewarded. To see what the rewards are, head over to the leaderboard page.

Start now by pressing the share button.

In case you’ve missed previous portfolio updates, you can check those out here

Portfolio Performance in December

My portfolio is worth roughly €19.593, up 4.16% compared to last month’s €18.810.

The last month of 2024 was a quiet year, which I am completely fine with! This allowed me to reflect on positions I already have and think more about my plans with my portfolio going into 2025. I’ve been reading a lot of books and articles, and I’m getting a good grasp of what my goals are going to be for 2025. along the way, I will share all the little details with you all, of course.

Portfolio Value in December

Currently, my portfolio is worth roughly €19.593. My portfolio reached a top of €20K at the beginning of December due to a huge run-up in two positions. After this, my portfolio took a big hit after Adobe’s earnings. Adobe was up 20% for me, but after its earnings and the fallout the days after, these gains were wiped off the board. Am I worried about my Adobe position? No, not at all. I still truly believe that Adobe is a high-quality business and is poised for success over the long term. Am I worried about AI disrupting the business? That’s also a firm no. I truly believe that Adobe will successfully monetize AI as it did in its document segment. I've discussed this previously in their earnings release.

I’ve hit the €20K, and after this drop, I feel more empowered to keep finding high-quality positions, narrow my portfolio down more, and benefit greatly from the returns that these high-quality compounders tend to offer.

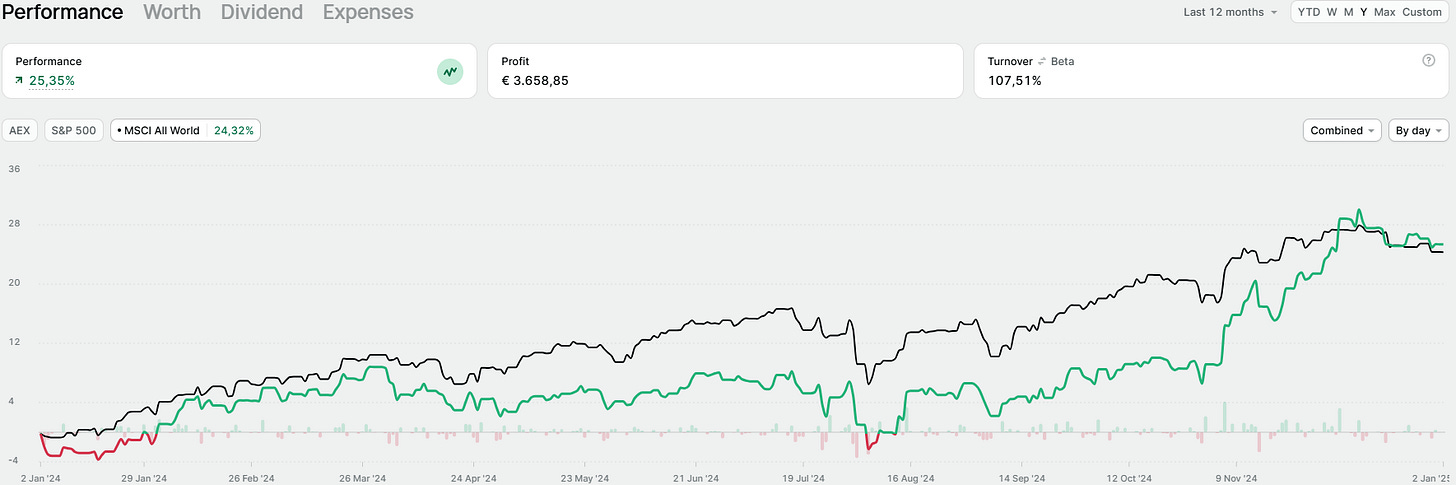

YTD Overview

With December out of the way, let us look at how we did in 2024, shall we?

Did I manage to outperform the index? No, I did not. Does this bother me? No, not at all.

This year has been one of the biggest years in my learning curve. I want to find high-quality businesses, refine my strategy and approach, explore more about myself as a person and investor, etc. This year has been a thrilling challenge for me and paved the way for the coming decades. I aim to perform excellent YoY; getting above the industry average of 10% would be ideal. As I mentioned previously, I do not benchmark myself against anything. It is fun to outperform a broader index, but this is not my main focus. I want to own the best companies at fair prices and sit on my ass and do nothing, haha. This year, I returned 25.35%, and that’s an impressive return (yes, even when the index did roughly the same).

As shown here, I increased my worth by a whopping €6.7K this year —that’s amazing! The grey line shows my deposits into my brokerage account; the difference is the growth I accumulated from my positions. I started this account at the end of 2022 and can proudly say that I am learning more every day, and my portfolio is starting to show this as well.

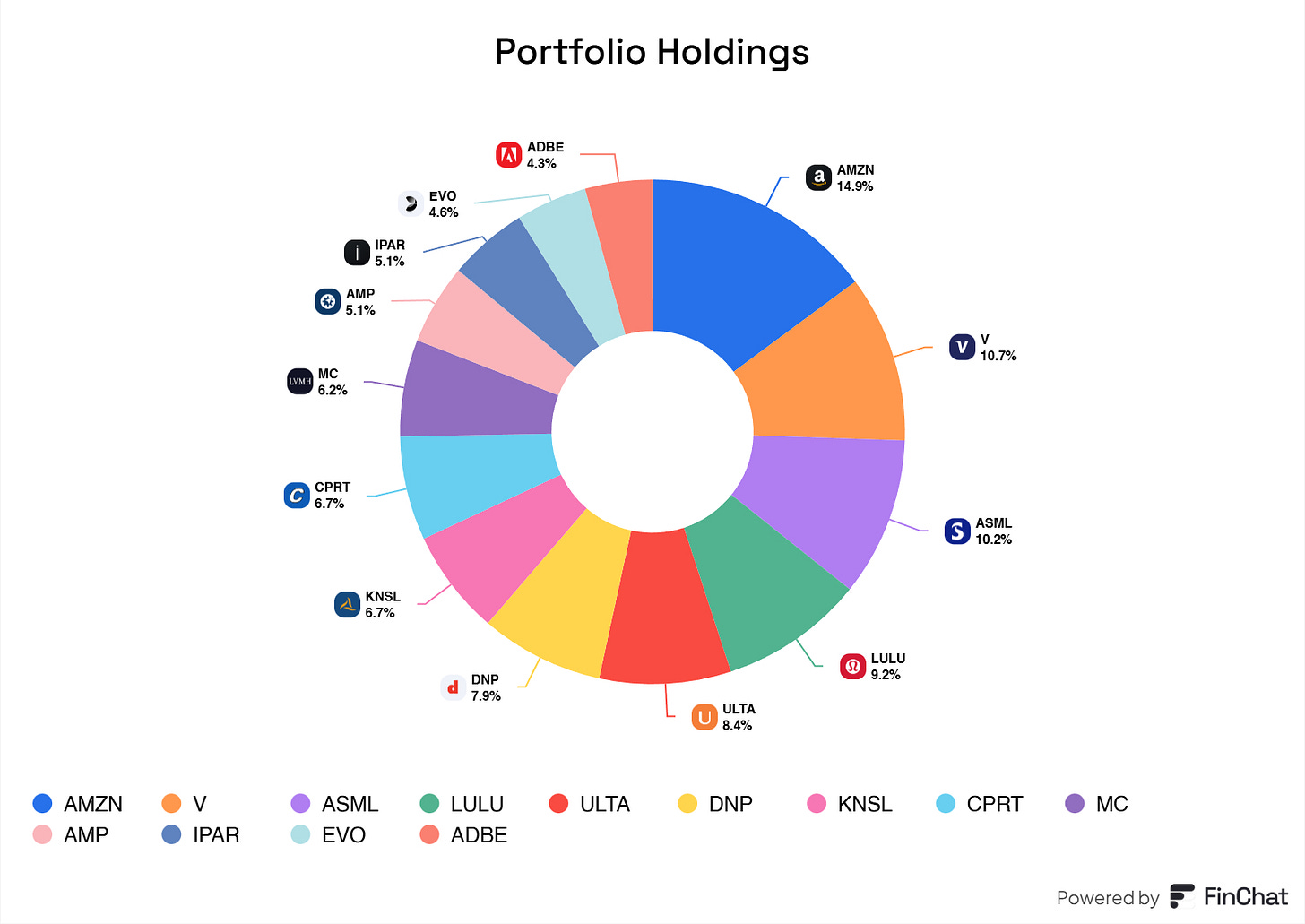

Allocation Breakdown

As you might have noticed, Evolution AB is back in my portfolio! Not too long ago, I posted about buying the stock.

I could not let it go at the discount it was trading at, even with the risks calculated. Therefore, I allocated 4.5% to this excellent business with an average share price of 808SEK. Currently, I am up 7% on this position.

I’ve been studying Dev Kantesaria's methodology for allocating more to your biggest convictions, which resonates with me. Why would I be so convinced about, for instance, Visa and only do 10%? Therefore, you might see me drop positions to explore my biggest convictions, but I will let time and compounding do their work now.

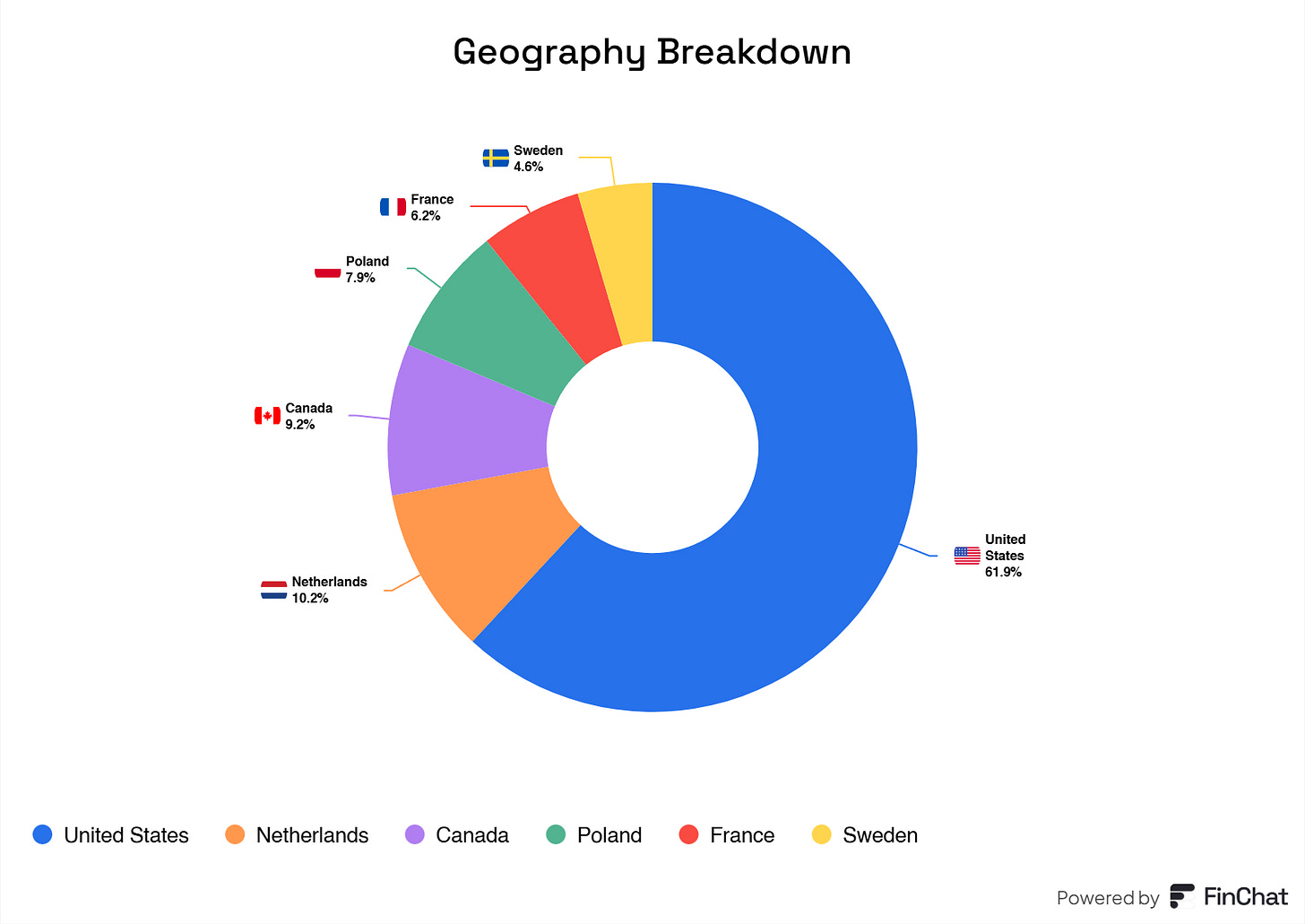

Here’s the geography breakdown of my portfolio:

And here’s the sector breakdown of my portfolio:

Portfolio Metrics

The current metrics are those of all my holdings averaged out.

As I said in my previous portfolio update post, I'm still convinced these will perform well in 2025.

If these were the metrics of a business, I would invest in them!

Transactions of November

I sold some Lululemon, Visa, and Amazon.

Why?

Funding Evolution! Very simple. I've experienced many gains in all these positions, and downsizing was needed to balance the portfolio more. I am not planning on sizing down any positions for the foreseeable future.

Watchlist & Outlook

For now, Brown & Brown and Medpace are on my watchlist. I like both businesses, but I require more understanding before delving deeper.

Besides these, there aren’t many good opportunities in the market. As I said in the previous update, the stock market in the U.S.A. is pretty pricey. EU stocks aren’t going anywhere, so I will sit on my hands and do the bare minimum.

For January of 2025? This will be a rather boring month, and that’s fine. I will focus on my goals this month and let my portfolio be; the beginning of the year is always a bit slow for the currency and stock market, but this gives me time to spend on my goals, family, friends, and my wife.

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.