Portfolio Update; March 2024

The month is over and there's been some changes and more changes are coming!

Hey there, friends! 👋

My name is Yorrin, and I’m the author of Fluentingrowth. Weekly, I write articles to help others, as well as myself, better understand the stock market. I am also all about 100% transparency and share my portfolio, performance, actions, and my thoughts on it. Here’s an update.

If you missed the previous portfolio update, check it out here:

Portfolio update; February 2024 📈

Let’s recap the previous update, which was my first ever public one.

In my previous article regarding my portfolio, I mentioned Pfizer, Charles Schwab Corp, and Blackstone. I wasn’t pleased with those positions, and this is still the case. I’ve completely dropped Pfizer and Charles Schwab. Blackstone remains a part of my portfolio; nothing has changed there.

I've added new positions and closed a bunch. I'm really focusing on increasing the value in my portfolio, so I'm readjusting my investment strategy accordingly. This entails dropping some stocks and adding others. Let's take a look at the actions I've taken this month.

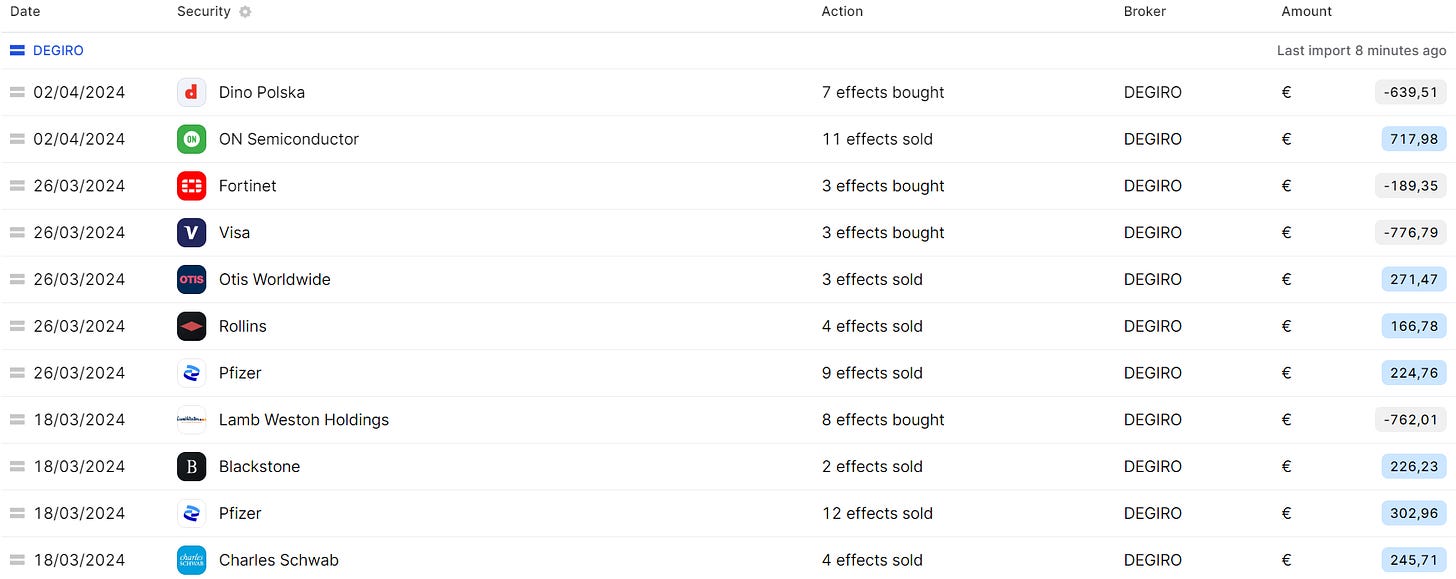

March Transactions

As you can see, I've made significant changes to my portfolio by either selling positions entirely or reducing them. I decided to eliminate both Charles Schwab and Pfizer entirely due to my dissatisfaction with their performance. While I did make some decent profit on Charles Schwab, I incurred a 20% loss on my total investment in Pfizer. Additionally, I removed ON Semiconductor from my portfolio because I no longer support their operational practices and do not foresee a future for the company aligning with my long-term vision.

I also removed Rollings from my portfolio because it no longer aligns with my newly redefined strategy, making way for other stocks that do.

Regarding Otis, I decided to scale down my investment. It had become too large a portion of my portfolio, almost functioning as a cornerstone, which I found concerning. Therefore, I reduced its allocation from almost 11% to 8.73%.

I've increased my investment in Fortinet slightly because I believe it still offers significant value to my portfolio and aligns well with my investment strategy. I've raised its allocation from 1% to 3% of my portfolio. The current price is well below my fair value estimate, and there's still a considerable margin of error.

In exchange, I've added some high-value companies that fit my long-term vision:

1. Visa

2. Dino Polska

After conducting an in-depth analysis of Visa, despite its high price, I decided to purchase some shares. I avoid timing the market and prefer to buy gradually, allowing for dips in the price to accumulate more shares. This approach helps me establish a strong position in a quality company over time.

Similarly, I've invested in Dino Polska. It's not just an ordinary supermarket; it demonstrates excellent management, solid value, a strong business model, and a robust moat. I highly recommend exploring this stock further!

My Portfolio Now

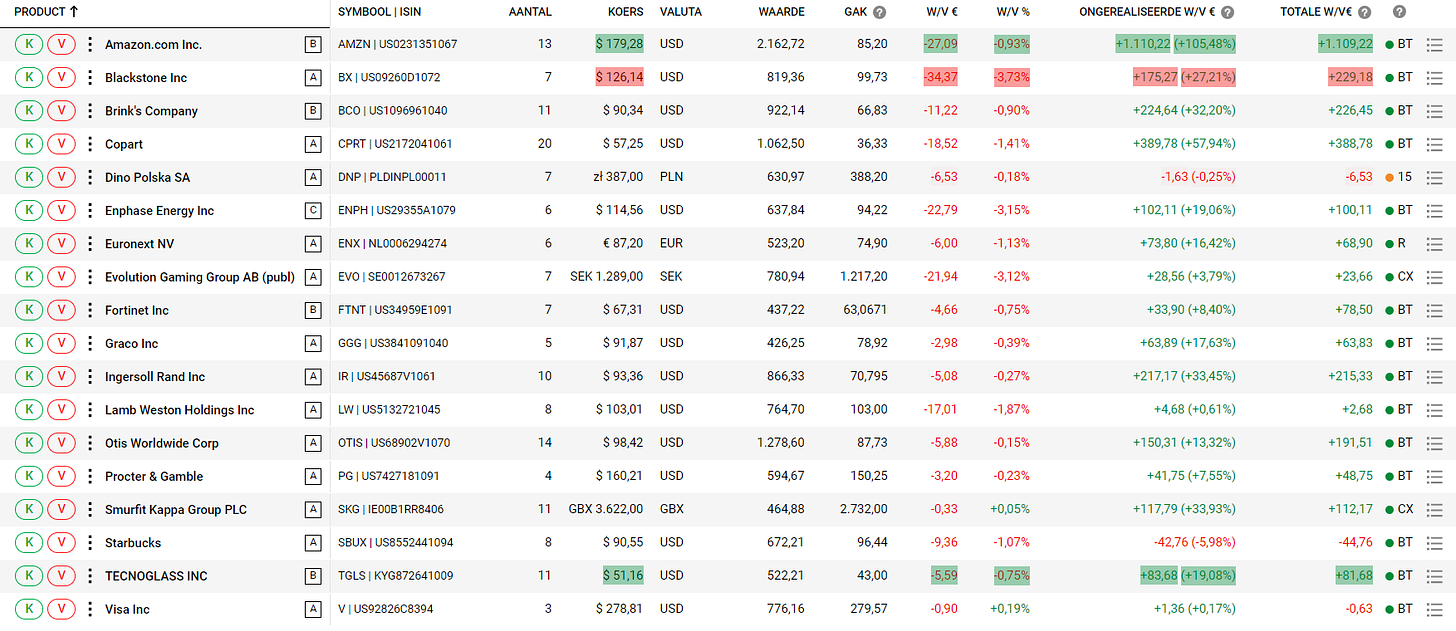

My holdings and their weight is:

Amazon > 14.88%

Otis Worldwide > 8.73%

Copart > 7.34%

Brinks Co > 6.34%

Ingersoll Rand > 5.92%

Blackstone > 5.80%

Evolution > 5.46%

Lamb Weston Holdings > 5.31%

Visa > 5.28%

Starbucks > 4.63%

Enphase Energy > 4.49%

Dino Polska > 4.31%

Procter & Gamble > 4.06%

Technoglass > 3.62%

Euronext > 3.60%

Smurfit Kappa Group > 3.16%

Fortinet > 3.00%

Graco > 1.15%

Currently my portfolio has a value of €14.490,44, with a P/L of +€2.728,74

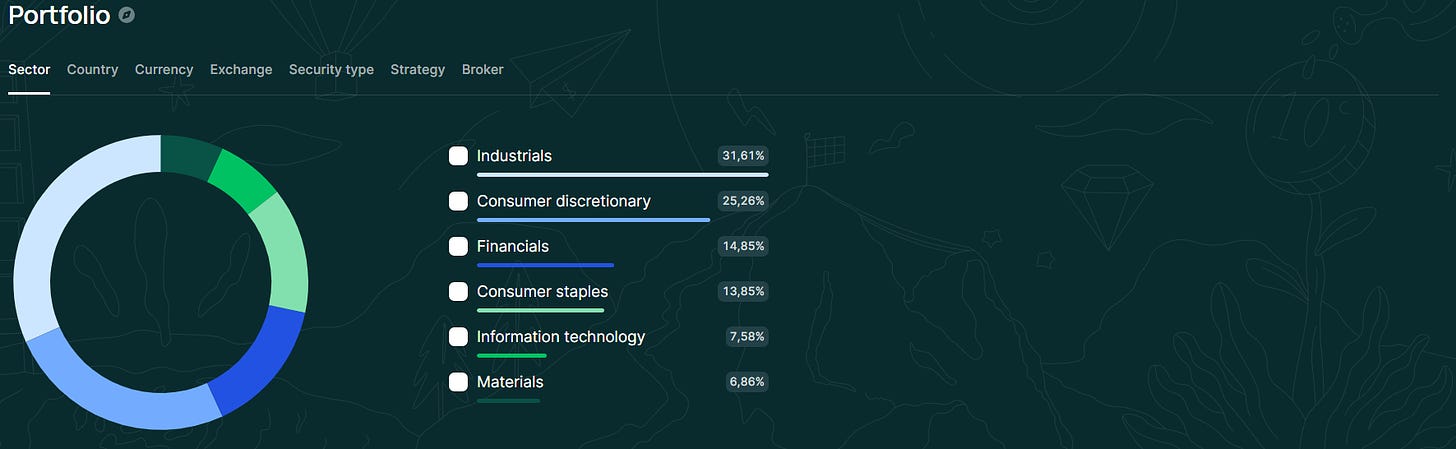

Here’s a overview of what sectors I’m in.

Actions to Be Taken

As of now, I'm still on the lookout for great value stocks to add and hold for the long term. I'll be partially closing my Enphase position to distribute it among my other stocks, reducing Enphase and increasing the weight of other value stocks. I'll probably scale back my position in Dino Polska a bit.

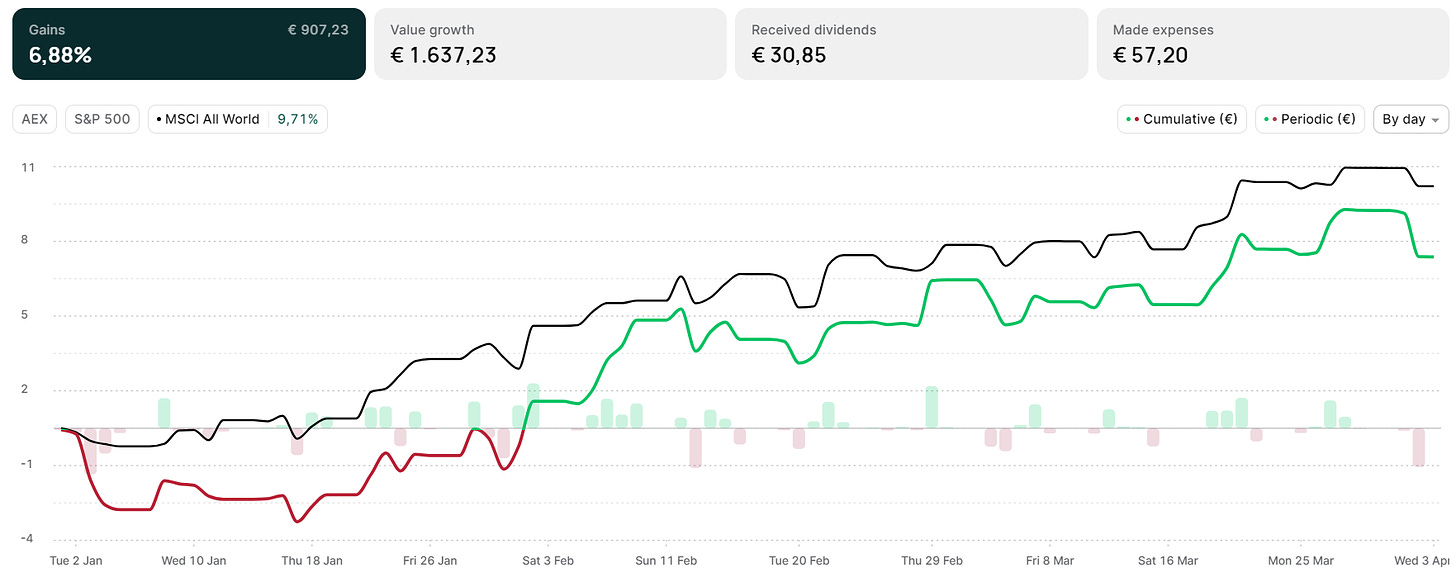

Portfolio vs MCSI All World Index

So, as you can see, up until this day, I haven't been outperforming the market. However, the previous year, I did beat the market. It's not a race for me; I simply play the long-term game and expect that, in the end, I will have beaten the All World index.

The expenses are on the high side, and this will continue. I'm shifting my investment strategy and need to make adjustments, which come with costs. I am confident that sooner rather than later, the costs will diminish.

Conclusion

I'm pleased with the road ahead of me! I am certain that by learning every day, setting the right goals, and ensuring I improve both myself and my investments, I can continue to deliver wonderful results.

Thank you for reading, and I sincerely hope to see you in the next update.

Kind regards,

Yorrin