Hey there, partner! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Please share it on your favorite social media channel

Comment on this article to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

If you missed my previous articles, you can catch up on them here:

I haven’t made a portfolio update in a while because I thought these updates didn’t add value, but I was wrong. I did a poll, and you all voted that these add value. I even got messages requesting these updates again. That’s why I am restarting this segment on my Substack.

Thank you all for your valuable feedback; I truly appreciate it.

Portfolio Performance in November

The current value of my personal investment portfolio is roughly €18.810,-. In November, my portfolio gained a whopping 11% compared to the MSCI All-World index’s 4.92%.

Most of my profits came in the last couple of months. My portfolio hovered at roughly 10% YTD gains for the year's first two quarters. I’m close to having relocated my capital and adjusted my portfolio to my strategy, making room for better quality stocks and more reliable and sustainable growth. Because I am nearing when relocating is not needed anymore, unnecessary costs for broker activity decrease, and I can focus more on DCA’ing into my favorite businesses. The shift was capital intensive, but this will pay out on the longer term.

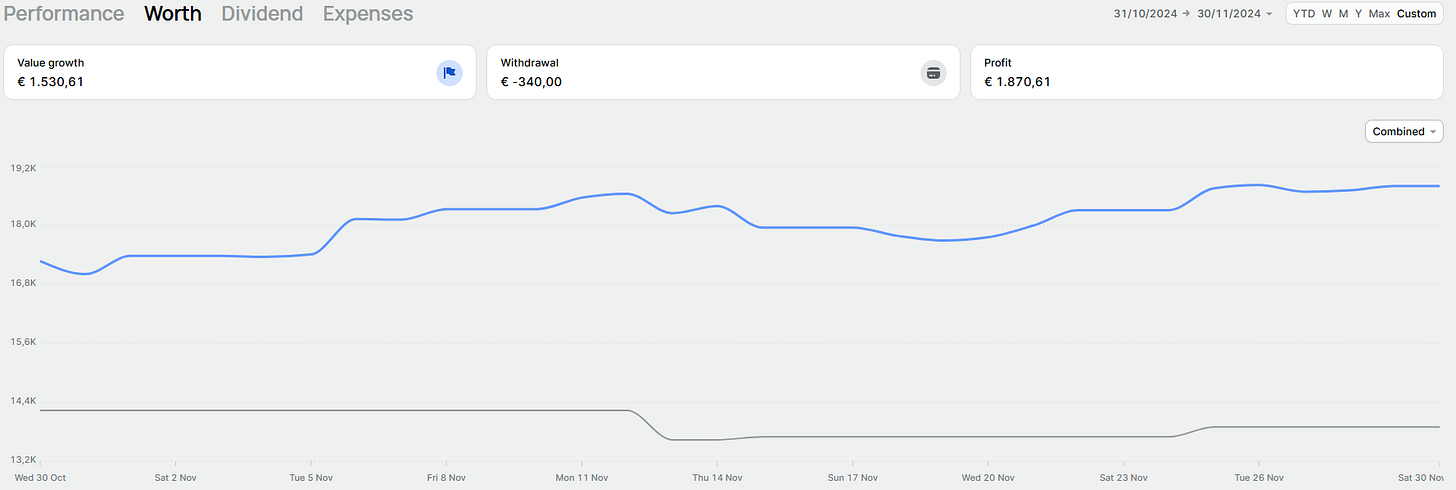

Portfolio Value in November

At the beginning of November, my portfolio was worth €17.271,-. As shown in the graph above, it has been steadily growing daily in November, reaching its current worth of roughly €18.810. I did make a withdrawal to fund my driver's license, haha. I had closed my Accenture position, and due to the refinement of my strategy, this business had to go. I had enough free capital to re-invest in ASML and use some for personal enjoyment. I firmly believe that sometimes, taking a very small portion for personal enjoyment is worth considering. We all invest for the long term, but we must enjoy our wins along the way, too; this keeps us going. Of course, I did my calculations and made a well-thought-out decision here, not anything impulsive. I do recommend running the numbers before going with anything.

As per the value of my portfolio, I am extremely happy with the results booked in the last couple of months. Here is some food for thought: in June, my portfolio was worth roughly €15.500, and a couple of months later, we’re up significantly. These reflections motivate me to keep quality investing and enjoy these little wins.

"The process is more important than the outcome."

– Warren Buffett

The process is indeed more important than the outcome. I interpreted this as appreciating the small steps and victories along the way rather than only focusing on the big results.

YTD Overview

YTD, I am slightly underperforming compared to the MSCI All-World Index, but I am not worried about this slight underperformance. There will be years to come when I keep underperforming, and there will be years when I outperform the MSCI All-World Index.

It all boils down to having solid returns, having a robust portfolio, not worrying about my investments, and creating a certain future for myself, my wife, and maybe later in life, even kids.

Is my goal to outperform the MSCI All-World Index? Yes! Will I be saddened by the fact there will be years where I am underperforming? No.

If your goal is to YoY outperform the market, I wish you the best of luck.

In short, about the total worth of my portfolio YTD, we’re doing well!

At the beginning of 2024, my portfolio was worth €12.893, of which €11.004 was the total booked into my broker account, so €1.885 was profit. As shown in the graph above, the discrepancy between my input in my brokerage account and profit is becoming more significant, indicating higher returns. My portfolio is worth €18.810, and I booked €13.894 in my brokerage account. The goal is to keep adding capital and grow my investment, so the capital booked in will increase, as will my profits on my positions. I hope next month we see an even bigger discrepancy, haha.

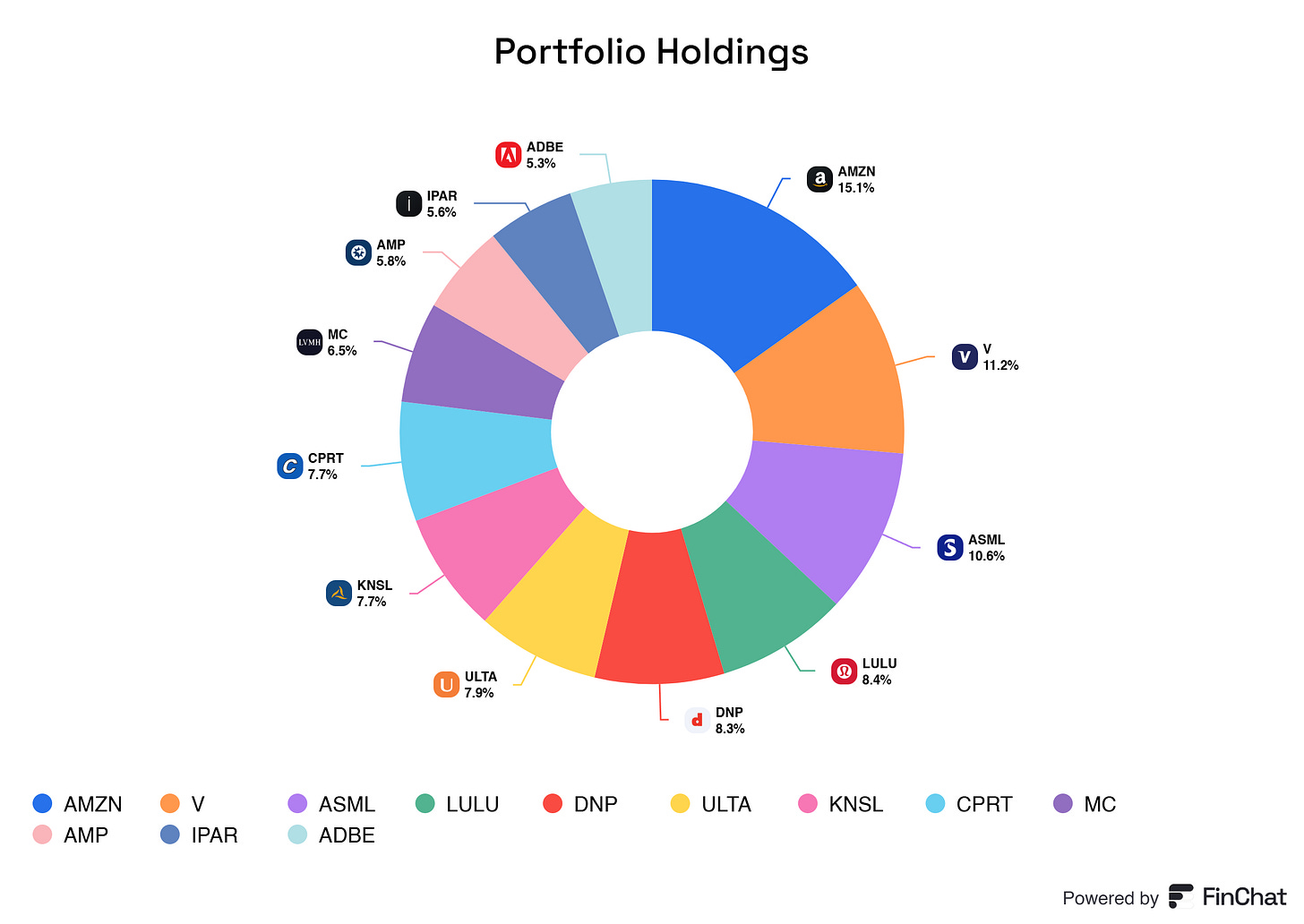

Allocation Breakdown

Here’s an overview of my current portfolio, the businesses are:

Amazon

Visa

ASML

Lululemon

Dino Polska

Ulta Beauty

Kinsale Kapital

Copart

LVMH

Ameriprise Financial

Inter Parfums

Adobe

I’m thrilled with my current allocation and the stocks I own. I might scale down to 10 positions to narrow my portfolio in the future, but the diversification suits me well. When scaling down, I would need more spare time to spend the right amount of time and effort creating a resilient portfolio. With my current full-time job, time and energy are limited. With limited time, resources, and energy, I might lose track of my positions, which could become too risky.

Peter Lynch once said:

"Know what you own, and know why you own it."

– Peter Lynch

If I had more spare time, resources, and energy, I could scale my portfolio to roughly 10 positions and understand the businesses I own, why I own them, and what to expect.

I intend to scale positions like Adobe, ASML, and Copart shortly. These three businesses are real compounding machines, and increasing their weight in my portfolio is a good decision. As of now, ASML is the only business that is priced for more allocation. Adobe and Copart are both teeny but extended when it comes down to their valuations.

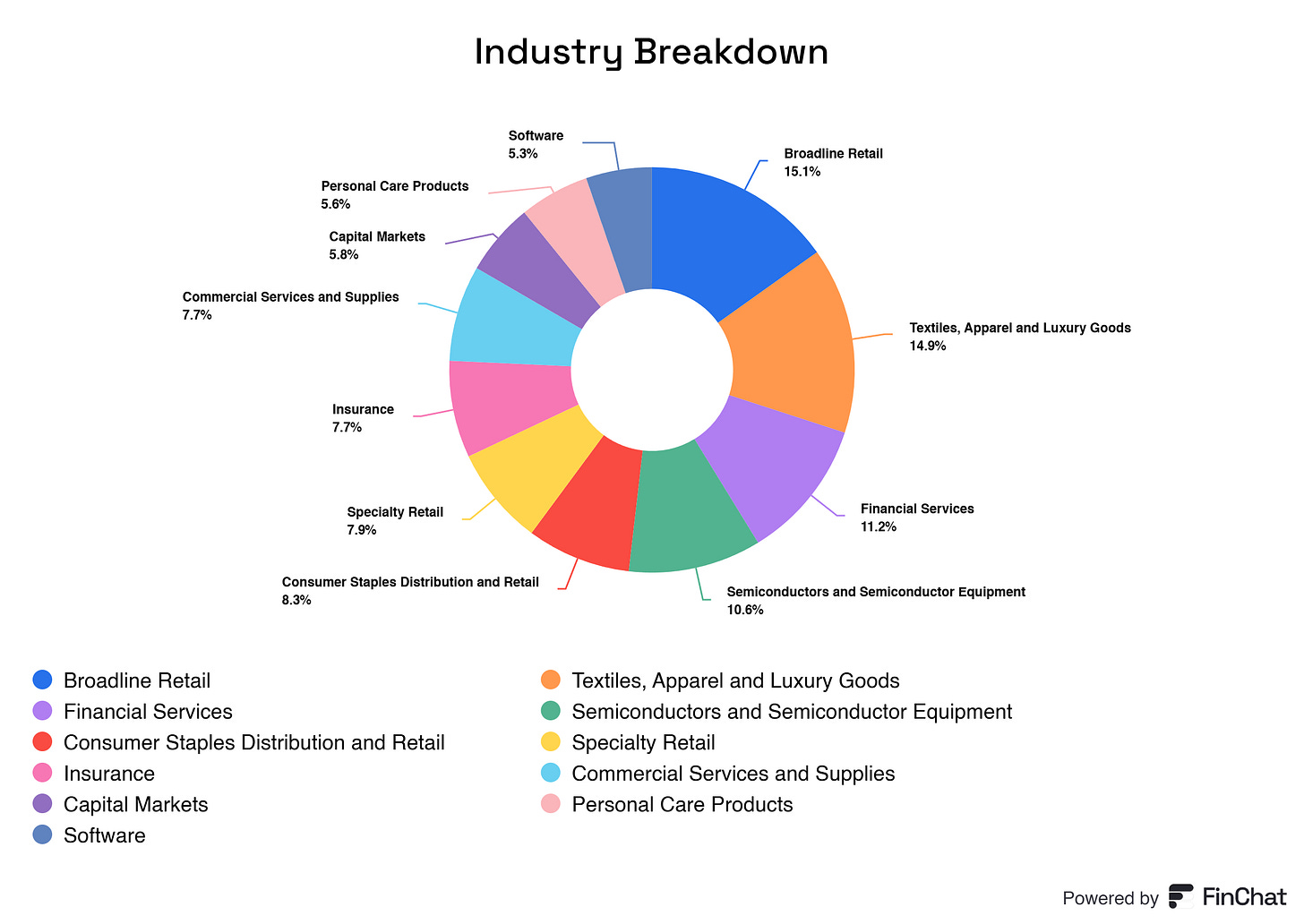

If we look at the industries I am currently exposed to, I am well diversified. I am not reliant on a certain sector or industry. Of course, this is the effect of proper diversification if done correctly, haha.

Portfolio Metrics

These metrics are those of all the businesses averaged down to one.

Overall, these are solid metrics; if this were a business, I would invest in it.

We see:

ROIC > 20%,

Revenue 5YR CAGR > 18%

ROE > 35%

Gross Profit Margin > 54%

FCF Yield > 4%

Shares Out Growth < -1% (meaning there’s no dilution of shareholders via new shares)

Free Cash Flow Margin >22%

ROA > 14%

I have more excellent metrics for my portfolio. Some minor metrics, like debt/equity, are 0.42, and the Cash Flow to Debt ratio is 2.35. Overall, my portfolio has solid metrics.

Transactions of November

As told earlier, I dropped Accenture because this business does not fit my new strategy and, according to my definition, does not qualify as a "quality compounder." Therefore, I closed out of these positions entirely and used these funds to go into ASML.

I’m thrilled to have this Dutch compounder and monopolistic business in my portfolio. I was able to buy it below its ‘'fair value’', allowing me to reap the benefits later on. ASML is also a position I am looking into scaling more in the coming months.

Watchlist & Outlook

As of now, there are no stocks on my watchlist! The U.S. market is getting pricey, and I would rather wait to find the perfect gem than invest in an overpriced stock and get minimal returns.

What about next month? I have a gut feeling nothing exciting will happen. We’re nearing the end of the year, and the stock market tends to start its consolidation phase. If there are any changes or major impacts, I will respond accordingly by doing, you guessed it, nothing. Unless a quality compounder suddenly drops below its fair value and becomes interesting, I will remain at the sideline inactive to reap the benefits of the ‘‘dead investor’’.

"Don’t just do something, stand there!"

– John C. Bogle

P.S. Sometimes it is better to do nothing.

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.