Portfolio update April 2024

Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back here for another portfolio update.

In case you have missed previous articles, click on the link below:

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Let me start with that last month & this month has been a rollercoaster for my portfolio. Why? As I mentioned in the previous portfolio update, I am shifting my investment approach. I am putting more focus on quality and value companies. Adding to this is also the fact that I am getting more strict in my requirements for companies before adding them, scaling into a position, removing a position, or scaling down a position. This reflects a lower return due to the increase in costs.

My case is that my current actions will pay me back later in wonderful returns.

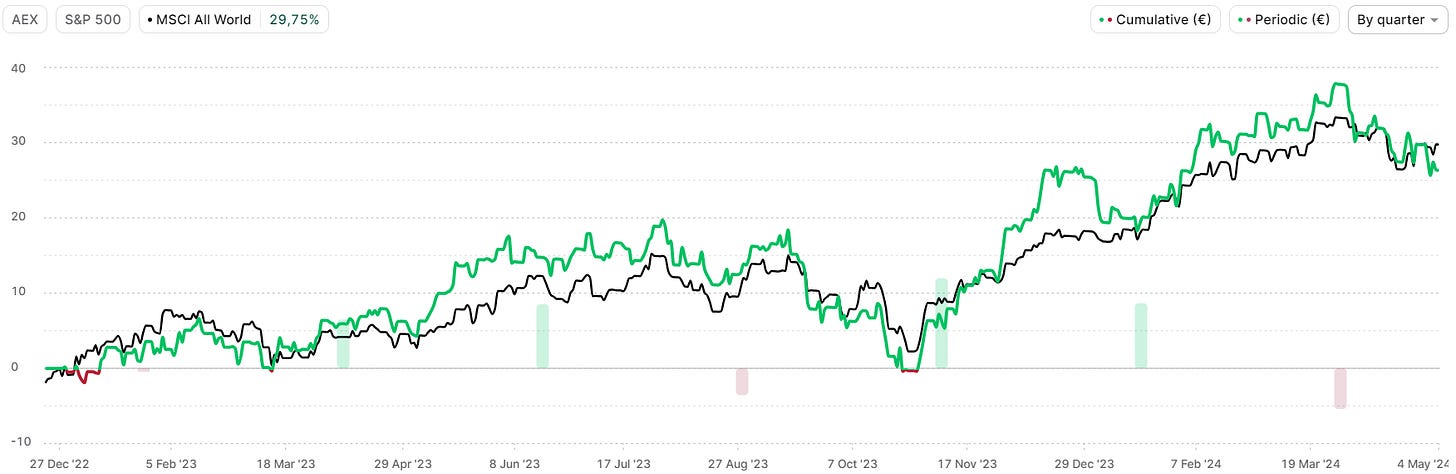

YTD the MSCI All World Index has performed well, the MSCI is currently up 8.75%. My portfolio is currently up a meager 2.47%. We’re still up YTD, that thought keeps me going as of now, haha.

Since I started I am up 26.37% and fighting the MSCI All-World Index closely. The MSCI All World Index is up 29.75% since.

We can see I am closely hugging the index, which is perfectly fine. On average I am ‘‘beating’’ the index and I hope sooner or later I can reach the point where I outperform the index on a more consistent basis, otherwise, I am better off investing in the index. ;-)

After all, my goal is to outperform the market in the end.

What are we discussing in this update?

What companies got added or scaled up?

Which company got removed or scaled down?

Serious candidates I am interested in adding to my portfolio

How May will be looking like for me

Fundamentals from my portfolio

What companies got added?

There have been two new positions in my portfolio.

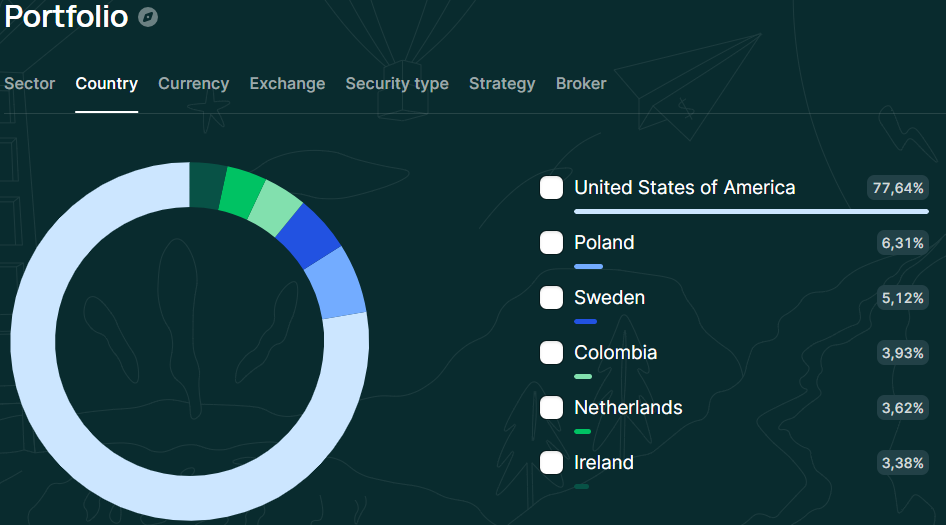

In April I bought Dino Polska, currently accounting for 6.27%. Also, I bought Kinsale Capital Group, that positions accounts for 7.46% of my portfolio. To begin with, Kinsale was not supposed to be 7.46% of my portfolio but 5%. The reason why there’s more? Because my late-night mind did the calculations wrong, adding more shares than I should have added, haha. I made one of the biggest and avoidable mistakes and I have learned my lesson. I’m going to try to dilute the position in the coming months, bringing it down to 5% without selling any positions.

Let us start with

Dino Polska

Dino Polska is one hell of a Polish distributor! Dino Polska is currently only active in, as the name suggests, Poland. Dino Polska has shown to have brilliant capital allocation and an undefeatable price-to-quality ratio.

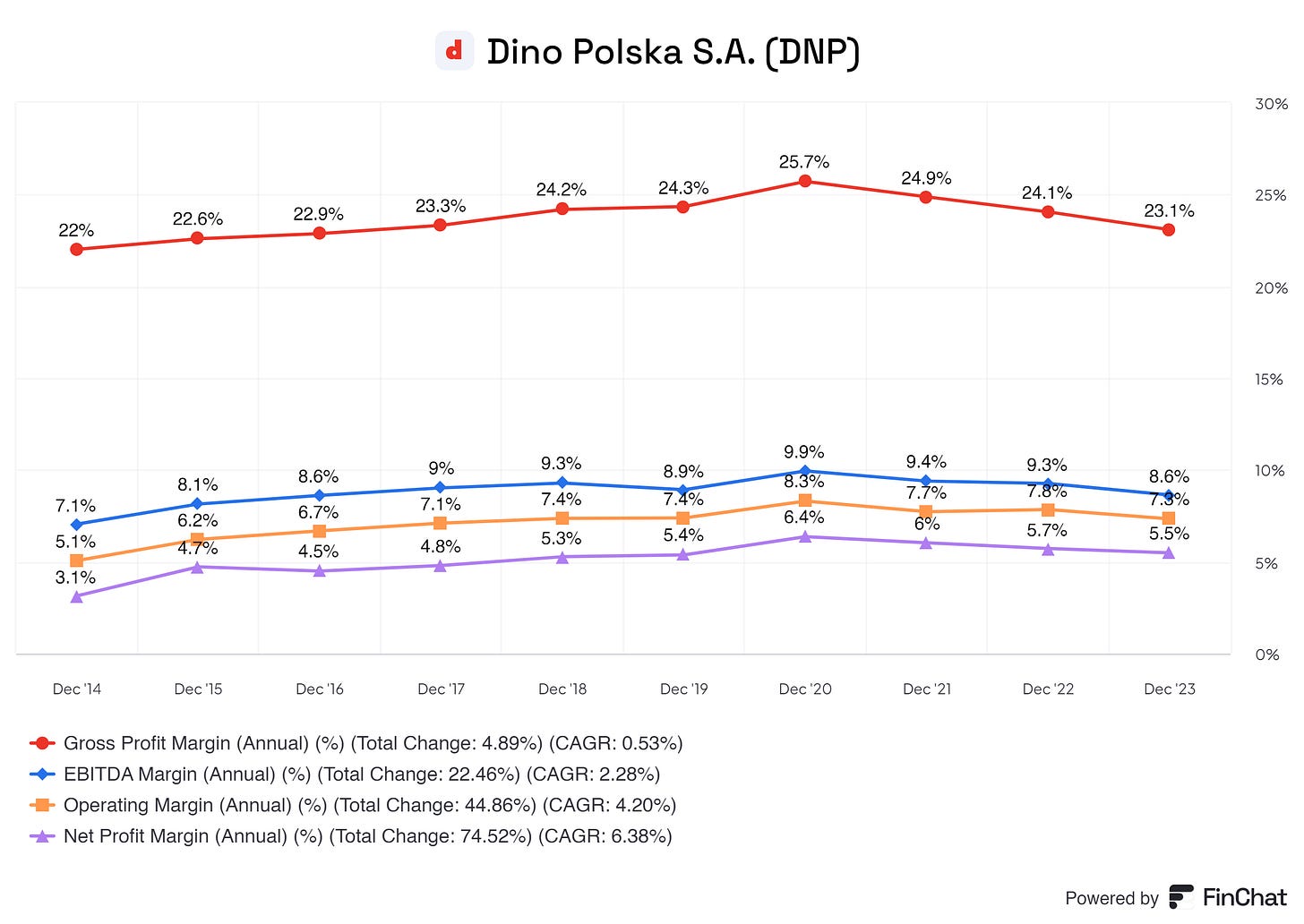

Usually, I tend to avoid supermarkets. Why? Because supermarkets and their margins and investment opportunities are very minimal. But, Dino is an expectation to the rule. Dino has wonderful margins and reinvests its FCF 100% back into the business, which in return creates wonderful returns.

For a supermarket, having a steady %20+ Gross Profit Margin is crazy! If I compare this with Delhaize, it is blowing its margins away. Delhaize profits from Bol.com and other stores, boosting its gross profit margin. Dino solely has its supermarkets operating for them. This vast difference already caught my eye, but there is more!

Dino shows to be very well with their capital. Their ROIC was 20.2% in December of '23, growing YoY. The same goes for their ROA, ROE, and ROCE!

It is pleasing to see that Dino knows how to deploy shareholder equity. Their ROCE (Return on Capital Employed) shows us that shareholder equity is being put in very, and I mean very, good places to generate solid returns for Dino itself but also its shareholders.

Their capital efficiency is through the roof and ever so improving.

Come with that is the steadily growing EPS, growing with a CAGR of 64.06%!

December '14 = EPS 0.7

December '15 = EPS 1.2

December '16 = EPS 1.5

December '17 = EPS 2.2

December '18 = EPS 3.1

December '19 = EPS 4.2

December '20 = EPS 6.6

December '21 = EPS 8.2

December '22 = EPS 11.5

December '23 = EPS 14.3

I’m pleased to have Dino added to my portfolio. I am sure that Dino, which its brilliance in allocation and management, will perform solid in the coming years. This is, as of now, a company I would like to hold for 15+ years.

Kinsale Capital

Kinsale Capital solely operates in the E&S market. This market is known to have attractive margins and is growing at a wonderful pace.

The E&S (Excess and Surplus insurance) caters to the non-traditional, unique, or higher-risk insurance that is needed. More and more companies and individuals require more complex insurance, many companies offer traditional insurance but this does not meet the needs of the new wave of people who need unique types of insurance. In these types of situations, the E&S players play a pivotal role.

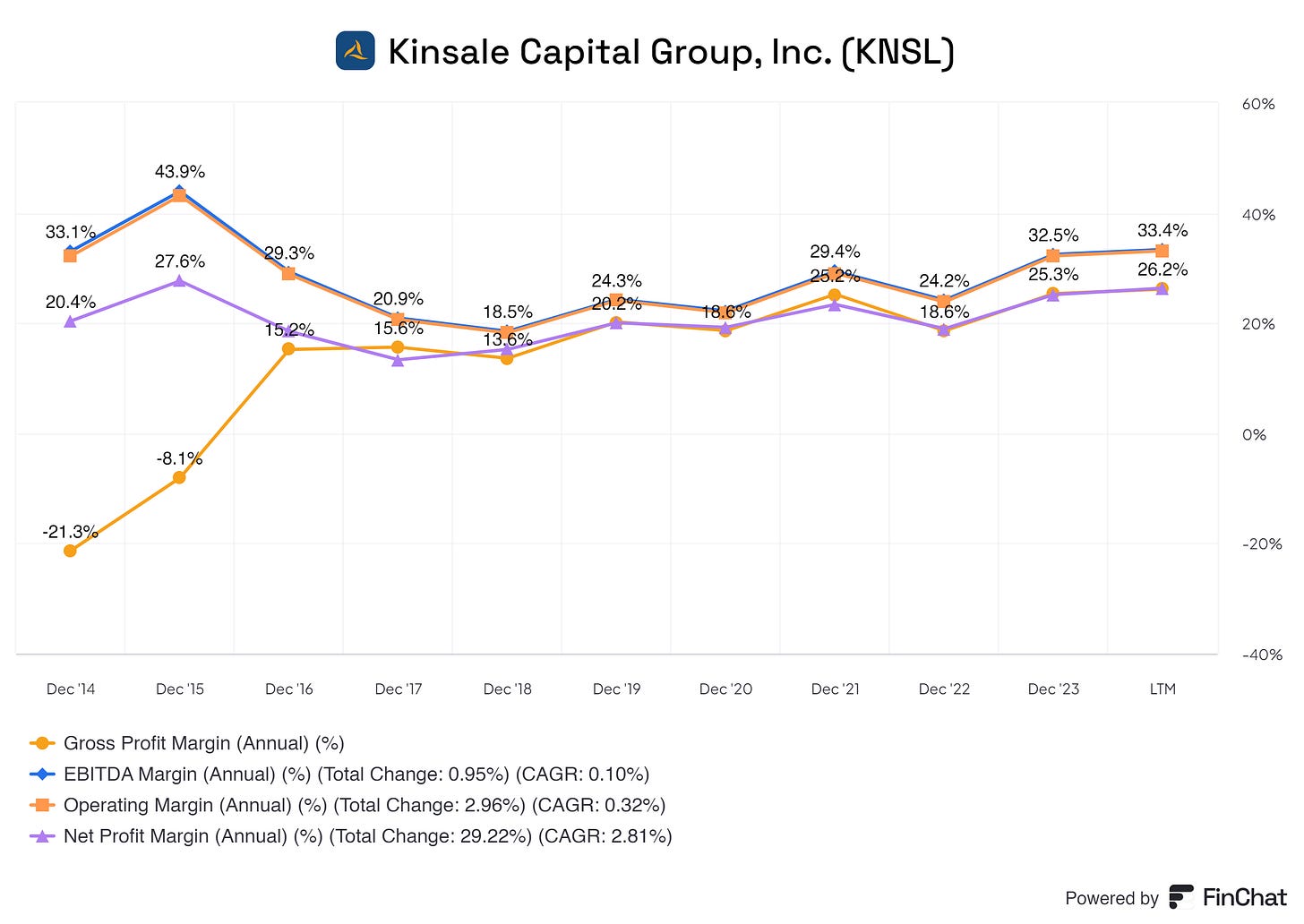

As I said earlier, the E&S market offers wonderful margins. This is due to the nature of the types of insurance. E&S tends to be more ‘‘risky’’ insurance, therefore the consumers pay a premium cost for that insurance, boosting the pricing power and margin for Kinsale.

As shown above, Kinsale is profiting from high margins and increasing margins. Kinsale was founded in 2005 and is led by players with skin in the game and this is visible.

Kinsale their EPS is currently growing with a CAGR of 22.99%, a wonderful CAGR to me!

Something that does ‘‘bother’’ me a tad bit is the dilution of shareholders. Kinsale is YoY increasing their outstanding shares, diluting current shareholders. From 15.1 million outstanding shares in December of ‘15 to 23.3 million outstanding shares in December of ‘23. Kinsale is in the ‘‘start-up phase’’, so I could expect them to keep issuing shares, I hope that in the next 4 to 8 years the dilution stops. As many of you know, I am a fan of reducing the outstanding shares, not printing more.

Let us chat now about positions that I have scaled!

Lamb Weston

Lamb Weston took a huge beating after missing the estimates last earnings release. Also, Lamb Weston lowered their guidance for the coming quarters. This resulted in a drop of a whopping 18.15%! To me, this drop is not justifiable. Lamb Weston is a wonderful company, with good management, solid earnings & growth, and a market leader in its sector.

I still believe in the company, a lot. Therefore I have added and raised my stake from 5% to 7.75%, lowering my ABP (average buy price) by 7 dollars. I am down 7.69% on the position but I am not worried. I believe in the company's long-term and feel that Lamb Weston will shine again in the coming years.

Starbucks

Starbucks had the same story. Starbucks missed the earnings and lowered its guidance. There are now a lot of worries with the investors, dropping the share price. Also here I still believe in the long-term vision of Starbucks. I added 2% to my positions. Starbucks currently is 6.66% of my portfolio and down 15.93%.

Which company got removed or scaled down?

Procter & Gamble

Procter & Gamble just didn’t fit my criteria anymore. As someone who is shifting to quality and value, Procter & Gamble is not a position that deserves a spot in my portfolio. The company performs well, with solid MOAT, modest pricing power, and capable management. The issue is that I do not hold enough conviction that P&G can be in my portfolio for another 10+ years.

Gone but not forgotten, P&G.

Otis Worldwide

Otis was 11% of my portfolio and I scaled Otis down to 4.20%. This is because the growth I was looking for, the performance I want to see, and the actions to be taken are not coming in the time path I gave myself for Otis.

Therefore I have decided to trim down the position and allocate the capital that became available to Kinsale Capital. Here my capital will be put to work more efficiently in my eyes.

Enphase

Enphase was a position that I started trimming in February and finally closed in April as a whole.

Enphase is in a promising sector, green and renewable energy. I thought I knew enough to invest in it and call Enphase quality. But, in my eyes, Enphase is not quality but more a growth stock. I like growth, do not get me wrong here, but Enphase does not meet the current criteria and I am sure that I can allocate this capital more efficiently elsewhere.

ON Semiconductors

I can write a whole story on why I removed ON, but the same I had with Enphase goes for ON.

Serious candidates I am interested in adding or scaling up in my portfolio

Fortinet has been on my radar to scale the position up to 4%, currently, Fortinet is 2.67%.

Fortinet has strong revenue growth, reliable revenue growth, a good balance sheet (a little high on debt), good margins, and overall good capital allocation. The only concern is that Fortinet uses debt to finance its activities. But, I still do see a lot of opportunities for Fortinet. This might be scaled, I will dive deeper into Fortinet.

Of course, I do have other companies in sight, but nothing worth investing in as of now! Keep track of my X (formerly Twitter) to stay updated.

How May will be looking like for me

May will be a month that I still will be calibrating and tweaking my mindset, and my ways of working, and keep improving on my skills and my needs/wishes.

I will try to slow down in how active I am in investing, my expenses with my broker are above my average.

Furthermore, I will be reading more, expanding my universe, and trying to be better day by day. I have found my calling and I am pushing my everything to make this goal happen, the one I have in mind.

Fundamentals from my portfolio

End note

Thank you for reading! I hope you found my findings, my elaborations, my insights, and my opinions valuable in one way or another.

From now on there will be massive changes in my portfolio, personal life, work life, and overall every aspect of my life. I am 26 but my focus is getting future orientated and my mentality is shifting, for the better.

I hope I can keep up providing solid content for you all and keep improving my skills in writing, publishing, delivering information, and providing more and more quality to you all.

Thank you.