Medpace: A Compelling Long-Term Opportunity And High-Quality Compounder!

This business holds a 5% market share but has been growing its total revenues at a CAGR of 22.32% since 2014, achieving a cumulative growth of over 1,200% during the same period.

Hi, partner! 👋🏻

I had asked in our subscriber chat to recommend a company, and Medpace (NASDAQ: MEDP) was recommended. At first glance, I was blown away by the growth, management, the industry, its business model, and the simplicity of the business. Right there and then, I knew I had to make this investment case on Medpace; I had to share my findings with you all.

As shown here, Medpace is not a leader in its market, but the business has something unique. But is Medpace ‘‘unique’’ enough to be a compelling investment, or is this a knife we would instead not catch?

In this detailed investment case, I will go over every layer of the business, discuss my findings, and share them in great detail with you. I will end this investment case with a valuation of the business. From then on, you can decide if this is a quality compounder hidden in plain sight or a truck heading for a cliff.

I would love to have you join the subscriber chat. Subscribe to my newsletter and join the chat for free.

Thank you for being part of another investment case, and happy reading!

Before we begin, if you’re interested in more investment cases, check out previous investment cases I’ve written. I’m convinced these will add tremendous value to you and your portfolio.

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationInsider and institutional ownership

Competitive and Sustainable Advantages (MOAT)

Industry Analysis

5.1 Current Industry Landscape and Growth Prospects

5.2 Competitive LandscapeRisk Assessment

Financial Stability

7.1 Asset Evaluation

7.2 Liability AssessmentCapital Structure

8.1 Expense Analysis

8.2 Capital Efficiency ReviewProfitability Assessment

9.1 Profitability, Sustainability, and Margins

9.2 Cash Flow AnalysisGrowth Projections

Value Proposition

11.1 Dividend Analysis

11.2 Share Repurchase Programs

11.3 Debt Reduction StrategiesQuality Rating

Valuation Assessment

1. Corporate Analysis

1.1 Business Overview

We must ask ourselves a simple question: ‘‘Do we understand the business and how it generates its revenue?’’. We will know the business well enough if we answer this question in a couple of sentences.

Simply put, Medpace manages the process of clinical trials, which are studies done to test whether new medicines or treatments are safe and effective. These trials are always required before any drug can be approved by regulators like the FDA.

Oké, but how does Medpace generate its revenues? Medpace earns its revenues by charging fees to companies for handling different parts of the clinical trial process, such as:

Planning the study

Finding patients

Monitoring progress

Regulatory support

Handling data gather from trials

You might ask why these companies pay Medpace. Running these clinical trials is extremely complex and heavily regulated, so many companies outsource this work to experts like Medpace instead of doing it themselves.

Now we understand what Medpace is and how it generates its revenues.

1.2 Revenue Breakdown

We’ve discussed Medpace's revenue generation in short. Now, let's explore its revenues and important KPIs in more depth.

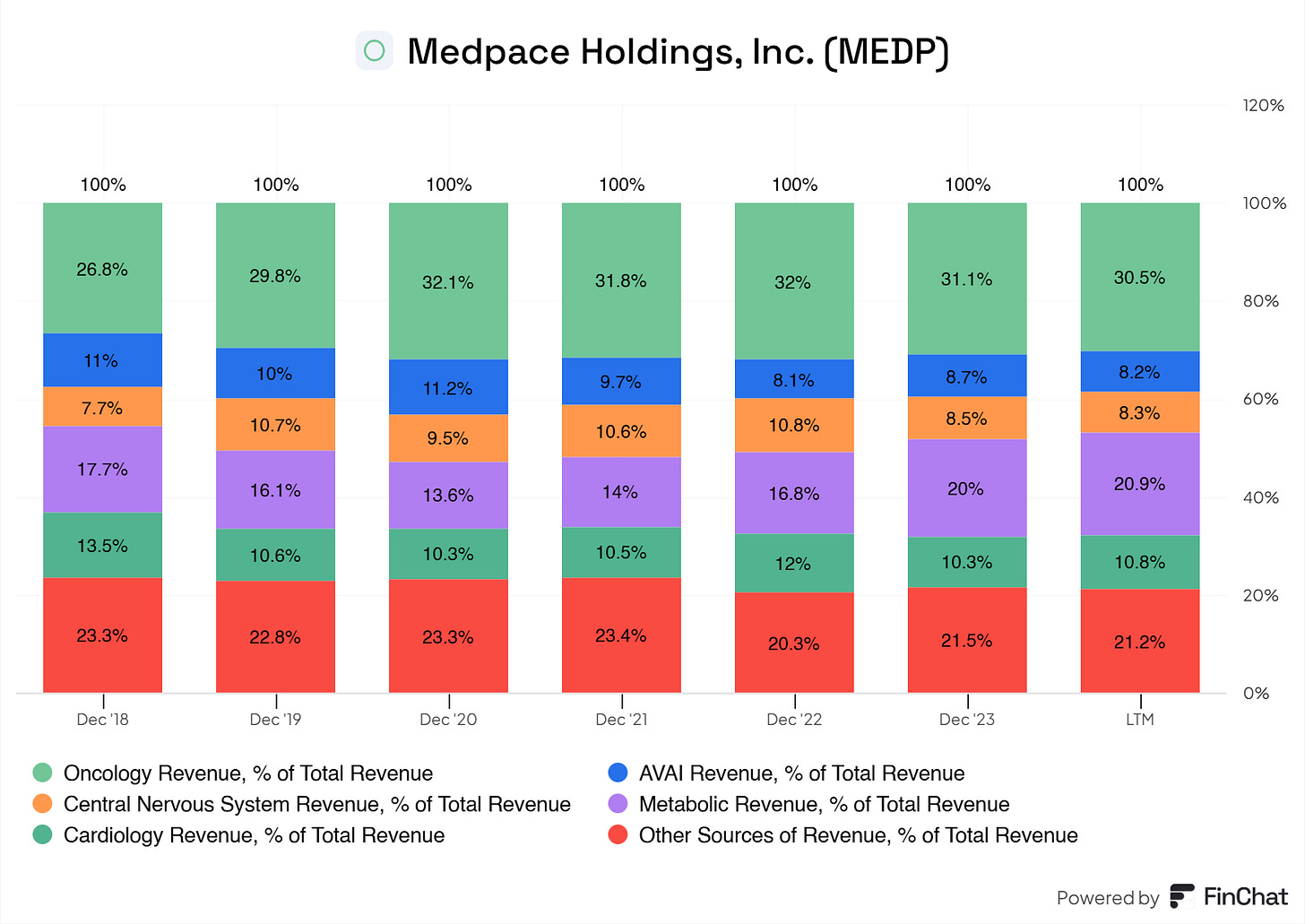

Medpace’s primary revenue drivers are as follows:

Oncology Revenue (accounts for 31% of Medpace’s Total Revenue)

This is revenue generated from helping companies test and develop cancer treatments.Metabolic Revenue (accounts for 21% of Medpace’s Total Revenue)

This is revenue generated from managing trials for medicines related to metabolic disorders, such as diabetes, obesity, and thyroid issues.Other Sources Revenue (accounts for 21% of Medpace’s Total Revenue)

This is revenue generated from additional services or smaller areas that don’t fit the main categories, like rare diseases or general health studies and trials.Cardiology Revenue (accounts for 11% of Medpace’s Total Revenue)

This is revenue generated from running clinical trials focused on heart—and blood-related conditions, such as high blood pressure or heart failure.Central Nervous System Revenue (accounts for 8% of Medpace’s Total Revenue)

This is revenue generated from studies testing treatments for brain and nerve-related disorders, like Alzheimer's, Parkinson’s, or epilepsy.AVAI Revenue (accounts for 8% of Medpace’s Total Revenue)

This is revenue generated through advanced analytics and imaging services, which is long for AVAI. These help collect and analyze medical data during clinical trials.

Medpace benefits from a broad portfolio of services. As many of you know, I favor businesses that are not reliant on one segment for most of their revenue. Medpace has an excellent portfolio of services. If one starts facing (temporary) headwinds, another segment can continue driving revenue.

Looking at the previous years, we can get a clearer picture of all the segments and their weighing.

The segments have remained stable except for Metabolic Revenue, which grew from 17.7% in 2018 to 21% in the last twelve months. With the growth in the metabolic segment, we saw a slight decrease in Medpace’s other sources segment, Which decreased from 23.3% to 21.2%.

Overall, have all the segments been stable and provided with Medpace's overall revenue.

Medpace, unfortunately, doesn't specify what revenue comes from which country, but it does specify its customers and how reliant they are, or aren’t, on these customers; let us go over it.

Note: The top is YTD 2024, and the bottom is YTD 2023

We can see that Medpace's customers are smaller biopharma businesses, which is also for a good reason. Medpace focuses on small to mid-sized biopharma companies because those often lack the in-house resources and expertise to conduct these complex trials. These trials can take up to three to seven years! Going through these trials bears a lot of weight on the shoulders of these smaller biopharma companies.

Here’s a bird’s view from A to Z.

Medpace is involved in Phase I (clinical trials) through Phase IV (post-approval). As you can see, this is a hefty roadmap for smaller biopharma, but luckily, Medpace can assist along the way.

In addition, Dr. August Troendle, the founder and CEO, emphasized that when Medpace can fully engage with its teams and operate under its own standard operating procedures (SOPs), the company performs at the highest levels and efficiently delivers outstanding results. This integrated approach lowers the need for duplicate management oversight from the sponsor, streamlining the development process.

Moreover, Medpace's focus on this segment allows it to build collaborative relationships, offering a full partnership rather than merely serving as an 'extra set of hands.' This commitment is particularly beneficial for emerging biotechs with limited resources and experience, as Medpace's comprehensive services and collaborative model help streamline development.

Note: the top is YTD 2024, and the bottom is YTD 2023

Comparing the top 10 customers vs customer concentration, we do note a couple of things:

The Top 5 customers had a slight decrease of (1%) in reliance on those top 5 customers, showing a tad less concentration risk.

The rest of the Top 10 showed a small increase of 1%, indicating a broader contribution from mid-sized customers within the top 10.

All Other has stayed stable, with highly diversified revenue across smaller biopharma clients outside the top 10.

What jumps out to me here is a slight reduction in dependency on Medpace’s largest client while spreading revenue more evenly across its top 10 and smaller clients. If this continues, it could indicate a more balanced revenue mix, minimizing risk for Medpace. We must keep track of this in the coming quarters/years.

Review some relevant KPIs for Medpace: its book-to-bill ratio, Net New Business Awards, and Total Backlog.

Let us start with the book-to-bill ratio.

The book-to-bill ratio is a metric used to measure the demand for Medpace’s services, comparing it to its ability to deliver them.

Book-to-bill ratio = New Order (Bookings) / Revenue (Billings)

Anything above 1.00 means that Medpace is booking more orders than billing. A ratio of 1.00 flat means that the order and revenue are balanced, and below a ratio of 1.00 would indicate that Medpace is billing more than it is booking (fewer new orders).

We’re seeing a steady decline in the book-to-bill ratio. This is mainly due to the cancelations of biopharma. This cancelation is due to the lack of funding for these smaller biopharma companies. With COVID, we saw increased funding for these smaller biopharma companies. With COVID mostly out of the picture, the funding followed as well. Biopharma relies on venture capital and government funding to continue its operations. If this funding slows down, biopharma isn’t in the right space to start these trials or needs to extend their trials.

Most of this venture capital is going toward cancer, the primary (30%) driver of Medpace’s revenue and customer base, indicating some ‘positivity.’

(P.S. Fuck cancer)

Back to the book-to-bill ratio.

These cancellations impacted both the current backlog and pipeline opportunities, resulting in depressed net new business awards and a book-to-bill ratio of 1.0 in Q3 2024.

I listened to the latest earnings calls and caught a glimmer of hope about the book-to-bill ratio. Management thinks cancellations are expected to persist into Q4 ‘24 and Q1 ‘25, which will continue to weigh on the backlog and ratio. Assuming cancellations return to normal levels and the business environment stabilizes, management expects the book-to-bill ratio to improve to above 1.15 in the second half of 2025. Despite these temporary headwinds, management expressed optimism about future growth, citing a stable business environment and a healthy pipeline of opportunities outside the cancellations.

Now, let us go over the Net New Business Awards for Medpace.

Net New Business Awards refers to the total value of a new project contract that Medpace has won and added to its backlog.

Net New Business Awards decreased (12.7%) year over year to $533.7M. This decline directly resulted from the cancellations through Q1/Q3 we discussed previously. These cancellations are expected to depress the net new business awards in Q4 ‘25 and Q1 ‘25, the same as with the book-to-bill ratio. However, management is also optimistic that as the cancellations stabilize, the pipeline will rebuild, and the net new business awards should also improve.

Now, let us go over the Total Backlog.

Medpace has seen an 8.8% YoY growth in its backlog, reaching $2.9B. Medpace estimates that roughly $1.62B of the back converts into revenue within the next 12 months, again not too shabby. Besides this recent quarter, Medpace has a steadily increasing backlog. While backlog growth remains positive, elevated cancellations have temporarily slowed new business awards and backlog replenishment. Management is optimistic that backlog growth will recover in the second half of 2025, driven by stabilized funding environments and improved pipeline performance.

A closer look at the years before 2022 shows that Medpace has been steadily increasing its Total Backlog and overall wonderful performance!

Having a solid backlog is lovely, but does Medpace convert any of the backlog into revenue? Let’s check it out.

Medpace has had a solid Backlog Conversion since Q4 ‘22, staying between 19.1% and 18.2%.

Backlog Conversion Rate = Revenue Recognized in the Period / Beginning Backlog Value x 100

Simply put, this percentage tells us how much of the backlog has turned into revenue. This means 18.2% of the backlog at the start of the quarter was converted into revenue. A higher conversion rate can indicate operational efficiency and strong project execution.

Overall, I’m impressed by Medpace’s performance. I note that their book-to-bill ratio must be monitored for the coming quarters. Although management is optimistic, this is a ratio we need to keep track of. Management notes that the primary reason is the lack of funding since COVID, which was already three years ago. I wonder how long this will be a ‘burden’ for Medpace.

Their backlog and conversion of the backlog are healthy to me and should pose no issues or worries as long as these are maintained, talking about the conversion rate.

2. Executive Leadership

2.1 CEO Experience

This is where Medpace outshines almost every other business listed on the stock exchange, and I truly believe this.

Dr. August Troendle has been the Chief Executive Officer and Chairman of the Board of Directors of Medpace since he founded Medpace in July 1992.

Before founding Medpace, Dr. Troendle was a manager from 1987 to 1992 at Sandoz (Novartis), where he was responsible for the clinical development of lipid-altering agents. From 1986 to 1987, Dr. Troendle worked as a Medical Review Officer in the Division of Metabolic and Endocrine Drug Products at the FDA.

Dr. Troendle also has extensive experience serving as a director for a diverse group of public and private companies, including as a director of Coherus BioSciences, Inc. from 2012 to February 2018, as a director of Xenon Pharmaceuticals Inc. from 2007 to 2008, as director of LIB Therapeutics, LLC since 2015, as a director of CinCor Pharma, Inc. from March 2018 to November 2021, and as a director of CinRx Pharma, LLC since 2015. Dr. Troendle received his Medical Degree from the University of Maryland School of Medicine and his Master of Business Administration from Boston University.

As many of you know, I’m a big fan of founder-led companies (here’s an amazing study on founder-led companies outperforming the overall market) and CEOs / founders with heaps of skin in the game. August Troendle still holds roughly 17%+ shares of Medpace, worth roughly $2.7B. Most of August Troendle’s worth is tied up in Medpace. This ensures us investors that August Troendle’s insensitivity is aligned with those of the investors.

Show me the incentives, and I'll show you the outcome

- Charlie Munger

2.2 Employee Satisfaction Ratings

I wish I could continue my fanboy parade here, but unfortunately, the opposite is true.

Here, I find reviews with the headers like:

Make it your last option to work here

CEO is killing the company

Dread going to work

Worst place you could ever work

Run the other way

Great department, terrible upper management

The strangest corporate, goodby

Of course, there are good reviews out there. But, the majority is inherently negative about Medpace.

How should we look at these reviews? Well… take a look.

I’ll leave this here and leave it up to you to decide.

I’m sorry to anyone invested in Medpace. This is pathetic. I’m not the person to touch up results. I’m blunt. These results are shocking, and results like this could keep me a mile away from a company.

I truly hate seeing such a wonderful business overthrown with a culture that stinks…

I saw a comment on a Reddit post about Medpace’s culture but never reviewed it. A part of me wishes I had never seen this.

I take back what I said about O’Reilly’s culture. I said and quote, ‘‘This is awful, cutting to the chase here. We’ve seen Tesla, Amazon, Lululemon, and many other businesses that are often bigger, scoring better.’’.

There’s worse…

2.3 CEO Value Creation

Let us hope we can start loving Medpace again. Let us also check whether August Troedle has created value for its shareholders.

I can confidently say that August Troedle is creating value for the business and its shareholders. Free cash flow per share, earnings per share, and the return on invested capital are my favorite quick metrics to see how the business is performing, and we can see a trend of YoY improvements in all of the metrics, creating more value for shareholders and the business.

3. Insider and institutional ownership

Quality investors like you and I would love to see insiders (management) accumulate more shares. Let us check if this is the case for Medpace.

Insiders sell for many reasons but buy for one — Peter Lynch

Out of the 31.08M outstanding shares…

89.31% are owned by institutions

2.58% are owned by insiders (management)

8.11% are owned by ‘‘others’’, private equity etc.

Usually, I prefer businesses where insiders own at least 3% of the outstanding shares, but 2.58% comes close, so I do give a mental check for inside ownership for Medpace.

Institutions are clearly taking up more % of the business YoY.

Insiders are keeping their positions rather stable. There’s no significant selling or buying in Medpace.

Now, let us take a closer look at how the insider shares are distributed among management, shall we?

Mr. August Troendle holds 654656.000 shares, accounting for 83% of the inside-owned shares.

Ms. Susan E Burwig holds 65000.000 shares, accounting for 8.24% of the inside-owned shares.

Mr. Brian T Carley holds 21830.000 shares, accounting for 2.77% of the inside-owned shares.

August Troendle holds a significant portion of the inside-owned shares. If I check his net worth and his stocks/options, clearly, most of his wealth is tied up in his stocks and options. This should, in theory, mean that August Troendle is aligned with Medpace's shareholders.

4. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Medpace is a well-recognized and trusted full-service clinical contract research organization that manages complex clinical trials. Its reputation for quality and efficiency attracts pharmaceutical and biotech clients, reinforcing loyalty and repeat business.

So yes, Medpace has brand power!

Patents

Medpace holds no significant patents. People argue that their data management systems and their power to navigate the regulatory pathways act like patents, but that’s just not the case. There are no patents, and Medpace doesn't need patents to function or generate its revenues.

Scale and Cost Advantages

Medpace operates with a focused, mid-sized model, balancing scale and flexibility. Unlike larger CROs, it can deliver personalized service while keeping costs competitive. Its established infrastructure reduces overhead for clients, making it a cost-effective partner.

Switching Costs

Due to the complexity of clinical trials, switching CROs mid-trial can be risky, costly, and time-consuming. Medpace benefits from high switching costs, as clients are less likely to shift providers once trials are underway. Long-term relationships and integration deepen this barrier.

Network Effect

While not a traditional network effect, Medpace builds a knowledge network through repeated engagements with sponsors, regulators, and investigators. Its experience in specific therapeutic areas further strengthens its appeal as the go-to CRO for niche expertise.

Attracting Talent

Medpace's focus on hiring highly skilled medical and regulatory professionals does give it a small edge, but I wouldn’t go as far as to say that Medpace has a MOAT in attracting talent. Its ability to attract and retain physician-scientists is good, but it doesn't help in any way shape or form.

5. Industry Analysis

5.1 Current Industry Landscape and Growth Prospects

According to Fortune Business research, the global contract research organization (CRO) services market was valued at $79.54 billion in 2023. The market is projected to grow from $86.33 billion in 2024 to $175.46 billion by 2032, exhibiting a CAGR of 9.3% during the forecast period.

Here’s a quick summary of the research from Fortune Business:

Market Drivers:

Rising R&D Costs: Increasing drug development expenses push pharmaceutical and biotech companies to outsource clinical trials.

Emergence of Small and Mid-Sized Firms: Limited resources for in-house R&D create demand for CRO services.

Chronic Disease Burden: Growth in cardiovascular diseases, cancer, and neurological disorders drives demand for cost-effective treatments.

Technological Advancements: Adoption of AI and decentralized clinical trial technologies boost efficiency.

Key Trends:

High R&D spending—$46.79 billion in 2022 (EFPIA)—fuels clinical trial growth.

Focus on oncology trials, followed by neurology and cardiology, due to rising disease prevalence.

Growth in early-phase development services for new drugs.

Challenges:

Skilled Labor Shortage: Competition for experienced professionals impacts efficiency.

High Costs and Regulations: Compliance with stringent standards can limit flexibility, especially for smaller firms.

Regional Insights:

North America leads due to robust infrastructure and pharmaceutical investments.

Europe follows, driven by aging populations and rising healthcare needs.

Asia-Pacific is projected to grow fastest due to lower costs and increased outsourcing.

5.2 Competitive Landscape

I identify the following as Medpace's peers or competitors.

Charles River Laboratories International, Inc.

Thermo Fisher Scientific Inc. (PDD, part of Thermo Fisher)

ICON Plc (PRA Health, part of Ion

IQVIA Holdings Inc.

Labcorp Holdings Inc.

Return on Invested Capital (ROIC - 5-Year Avg): 16.19%

Medpace leads the group with the highest ROIC, showcasing exceptional efficiency in generating returns from its capital, significantly outperforming peers like ICLR (7.44%) and IQV (6.34%).

Return on Capital Employed (ROCE - 5-Year Avg): 37.21%

Medpace dominates this metric, far surpassing competitors. Its 37.21% ROCE indicates superior operational efficiency and profitability compared to ICLR (9.61%) and IQV (8.65%).

Gross Profit Margin: 67.22%

Medpace has the highest gross profit margin, reflecting strong pricing power and excellent cost management. It outshines peers like TMO (40.68%) and CRL (35.93%).

Free Cash Flow Margin: 25.87%

Medpace demonstrates the best free cash flow conversion, indicating outstanding cash-generating capability. It leads competitors such as TMO (18.35%) and ICLR (14.79%).

Diluted EPS Growth (5-Year CAGR): 35.63%

Medpace delivers impressive earnings growth, leading the pack by a wide margin over peers like IQV (44.7%) and ICLR (6.21%).

Net Income Growth (10-Year CAGR): 27.53%

Medpace has exceptional long-term profitability growth, significantly outperforming competitors like ICLR (16.62%) and IQV (15.21%).

EBITDA Margin: 21.13%

Medpace maintains strong profitability, outperforming ICLR (20.29%) and IQV (18.46%).

EBITDA Growth (5-Year CAGR): 23.82%

Medpace also shines in EBITDA growth, reflecting robust operational performance behind only ICLR (30.04%).

6. Risk Assessment

Unfortunately, the biopharma and CRO industries involve many risks. Let's review some of Medpace's major risks.

Competition: The CRO industry is highly competitive, with larger players like ICON plc, IQVIA, and Syneos Health dominating the market.

Regulatory risks: Clinical trials must comply with strict regulatory requirements from the FDA and EMA.

Dependence on skilled labor: The CRO industry lacks skilled professionals, such as clinical research associates and biostatisticians.

Client dependency: Medpace relies heavily on small and mid-sized biotech and pharmaceutical companies for business. These businesses rely on venture capital or external funding to continue operating. If funding falls short, Medpace will be impacted.

7. Financial Health

7.1 Assets Assessment

My aim is to highlight areas of interest or concern. Going over every little aspect would require a separate article; it’s too much. If I don’t mention a particular item, you can assume it meets expectations or doesn’t pose any significant issues.

We aim to have companies with a Goodwill-to-Assets ratio below 20%, but Medpace sits above 30%, which is not a huge concern, but we rather see it done differently. Medpace has done some acquisitions in previous years:

2007 – Medpace acquires Monax in the Czech Republic

2009 – Medpace acquires PharmaBrains AG in Switzerland

2010 – Medpace acquires Symbios, a medical device consultancy in Minneapolis, Minnesota

2010 – Medpace acquires Medical Consulting Dr. Schlichtiger, GmbH, in Germany

2012 – Medpace acquires MediTech BV, a medical device consultancy in the Netherlands.

However, in Goodwill, there are a lot of intangible assets, like client relationships, brand reputation, and technological capabilities. Therefore, a higher ratio is more ‘‘common’’ for these types of businesses.

Besides this, there’s not anything that stands out or should be monitored more closely.

Medpace is building a solid cash and short-term investment position, which is good! As I mentioned in all my investment cases, cash is king, and every business should have a solid cash position, especially in the bio-industry, where volatility is common.

7.2 Liabilities Assessment

Medpace offers an extremely healthy liabilities sheet here. There’s no long-term debt on the balance sheet, which is lovely. Yes, some liabilities are locked in their leases, but I do not see this as a liability. Leases make a business more agile, in my honest opinion. Medpace’s unearned revenue is increasing, but that’s common for this type of business and should not be a concern for now.

8. Capital Structure

8.1 Expense Analysis

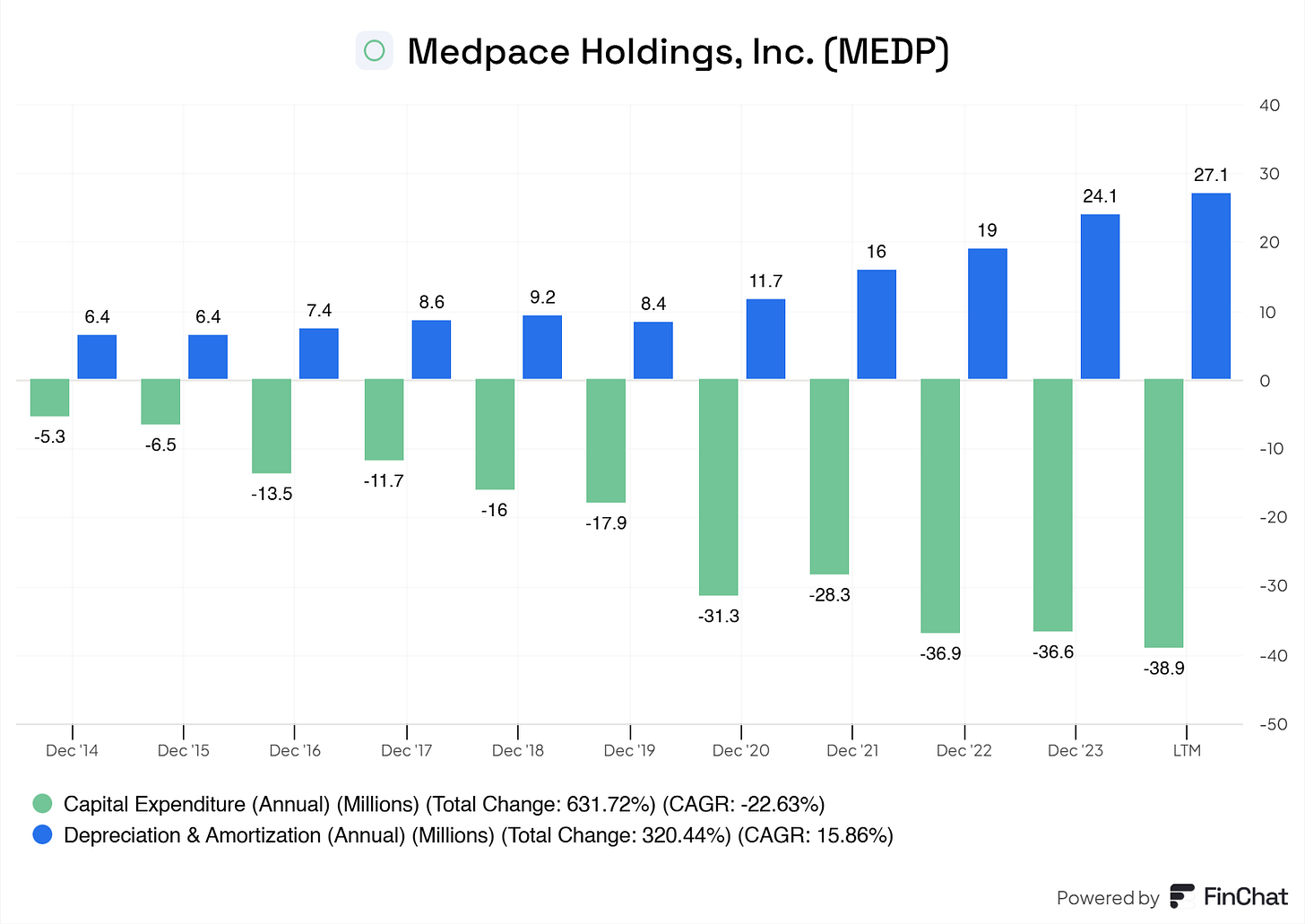

Medpace offers a CapEx light business model, which is reflected on the balance sheet. CapEx-to-Revenue is a mere 2%.

Now, there’s Growth CapEx and Maintenance CapEx. If we subtract the D&A from the CapEx, we get the growth CapEx.

Growth CapEx = Total CapEx − Depreciation Expenses

2014: -1.1M

2015: 0.1M

2016: 6.1M

2017: 3.1M

2018: 6.8M

2019: 9.5M

2020: 19.6M

2021: 12.3M

2022: 17.9M

2023: 12.5M

LTM: 11.8M

2020 and 2022 saw the highest Growth Capex, focusing on expansion during those periods. Recent years (2023 and LTM) show a decline in Growth Capex, which may indicate a shift toward efficiency or slower expansion.

Now let us compare the maintenance CapEx to Total Revenue to get a clearer picture. So, the maintenance Capex is the growth CapEx minus the Capex, then we get:

2014: 6.4M accounts for 2.21% of Total Revenue

2015: 6.4M accounts for 2.00% of Total Revenue

2016: 7.4M accounts for 2.00% of Total Revenue

2017: 8.6M accounts for 2.23% of Total Revenue

2018: 9.2M accounts for 1.31% of Total Revenue

2019: 8.4M accounts for 0.98% of Total Revenue

2020: 11.7M accounts for 1.26% of Total Revenue

2021: 16.0M accounts for 1.40% of Total Revenue

2022: 19.0M accounts for 1.30% of Total Revenue

2023: 24.1M accounts for 1.28% of Total Revenue

LTM: 27.1M accounts for 1.31% of Total Revenue

So, Medpace is a CapEx-light business, especially since we removed the Growth Capex from the formula.

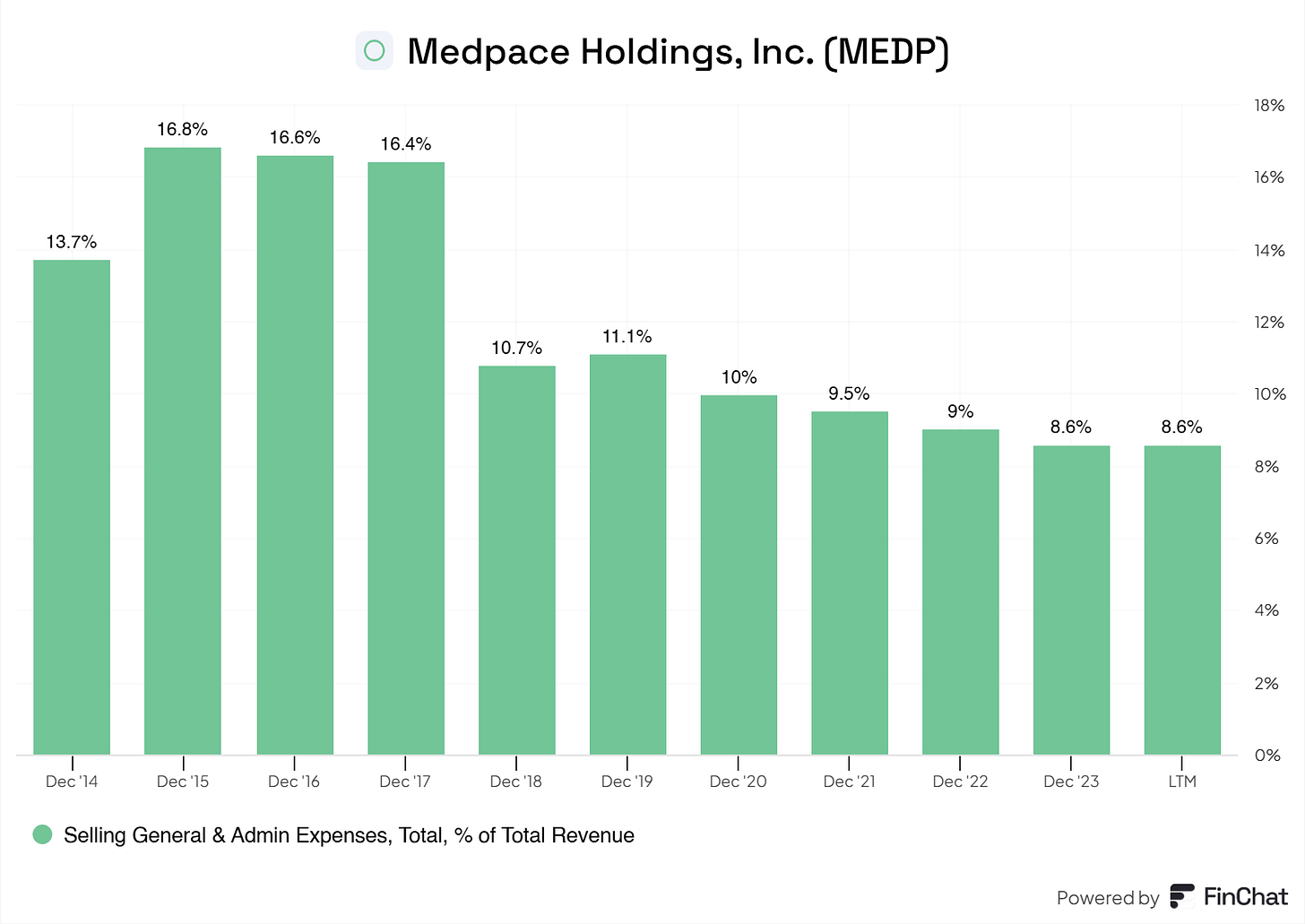

Now, let us go over the COGS and SG&A.

This is modest! For the industry where Medpace operates, this is the average.

Again, it's the same story here! SG&A costs are managed well and are in line with the industry average. If Medpace can maintain this level, we should be content. They should be low for this type of business because there’s no big need for marketing and advertising, R&D, travel and business development, etc. Due to its service-based model, it’s an asset-light business.

8.2 Capital Efficiency Review

This is wonderful! Medpace is becoming more efficient yearly in terms of its return on invested capital and return on capital employed. As you may know, I prefer businesses with metrics above 20%, and Medpace fulfills this wish with a wide margin!

9. Profitability Assessment

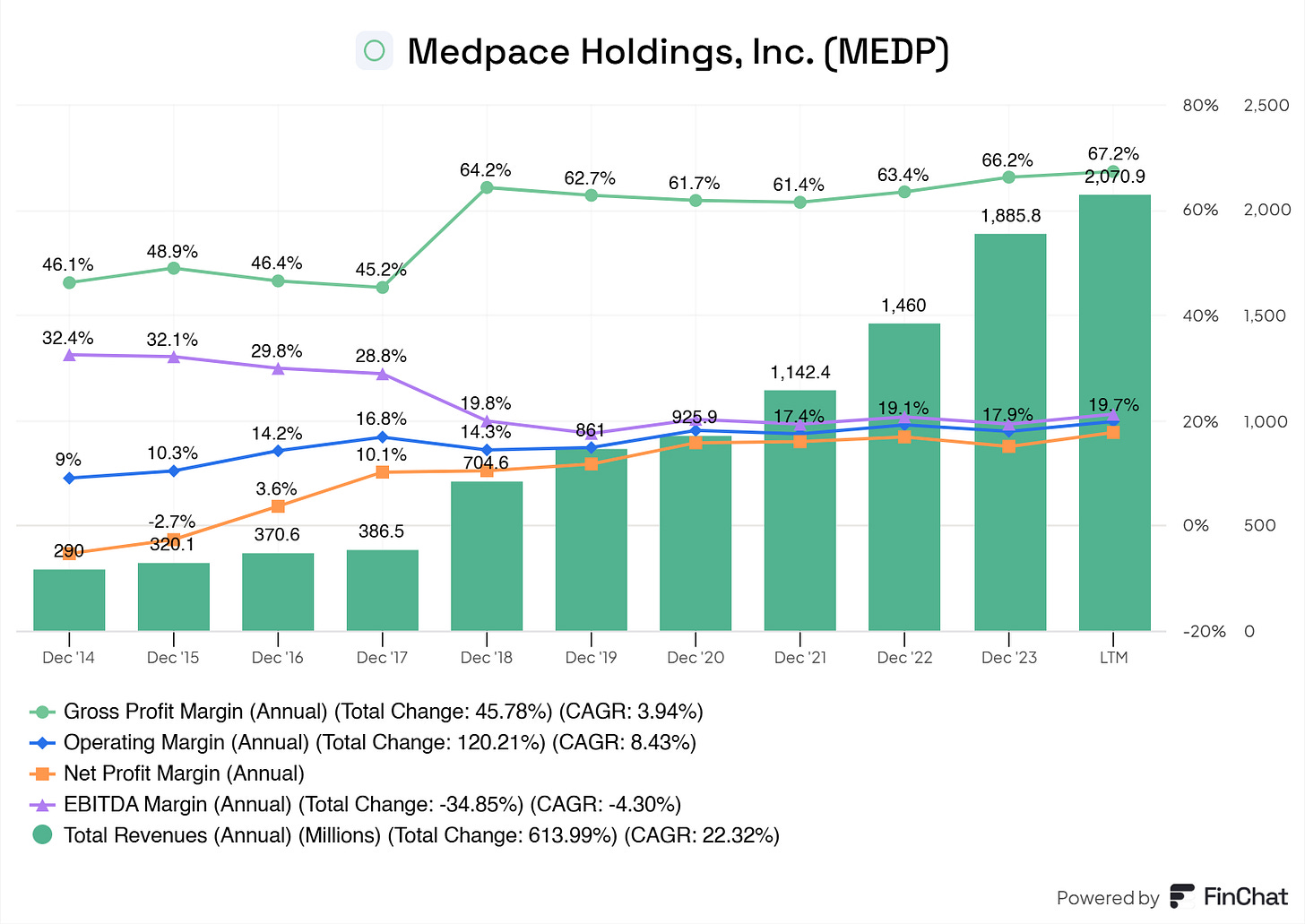

9.1 Profitability, Sustainability, and Margins

This chart paints a remarkable picture of Medpace’s performance! The company has maintained strong profitability with stable margins since 2017–2018, demonstrating consistency and operational efficiency. Given that Medpace has sustained these margins for nearly a decade, it’s reasonable to expect this trend of stability and profitability to continue.

With excellent gross, operating, and net profit margins, Medpace is a highly efficient and resilient business and a solid performer in its industry.

9.2 Cash Flow Analysis

Although Medpace’s Free Cash Flow (FCF) margin fluctuates, the company consistently demonstrates its ability to generate solid FCFs for reinvestment in the business and potential returns for shareholders. Year over year, we observe strong growth in FCF, reflecting Medpace’s efficient operations and scalable business model. Overall, this remarkable performance highlights financial strength and discipline.

Of course, when checking the Free Cash Flow of any business, we also need to check out their SBC; let us check this.

SBC is peanuts compared to the FCF, which is good! We love that SBC is roughly below 5% to 110% of the FCF, which is the case here. Of course, with tech, we need to expect higher SBC, but for Biopharma, we should expect lower, and that is the case for Medpace.

10. Growth Projections

EPS Fwd 2Yr 19.53%

EPS LT Growth Est 15.7%

Rev 5Yr 20.26%

Rev 10Yr 22.68%

EBITDA Fwd 2Yr 15.53%

These are excellent growth projections for Medpace(!!).

Medpace’s FCF is currently growing at a CAGR of 23.21%. I think that for the next five years, Medpace is capable of growing its FCF with a CAGR of roughly 17%; this is what their FCF would look like.

Year 1: $626.8 million

Year 2: $733.3 million

Year 3: $858.0 million

Year 4: $1,003.8 million

Year 5: $1,174.5 million

Does this excite me? Yes! This would mean that Medpace’s FCF is projected to double over the next five years. FCF is the bloodline of the business, and it looks like Medpace is setting up for a hefty FCF position if it keeps up its current growth.

11. Value Proposition

11.1 Dividends Analysis

Luckily there’s no dividend for Medpace’s shareholders. Medpace currently has enough room to expand its operations and scale the business. In my humble opinion, handling out dividends in its current phase is wasted cash.

10.2 Share Repurchase Programs

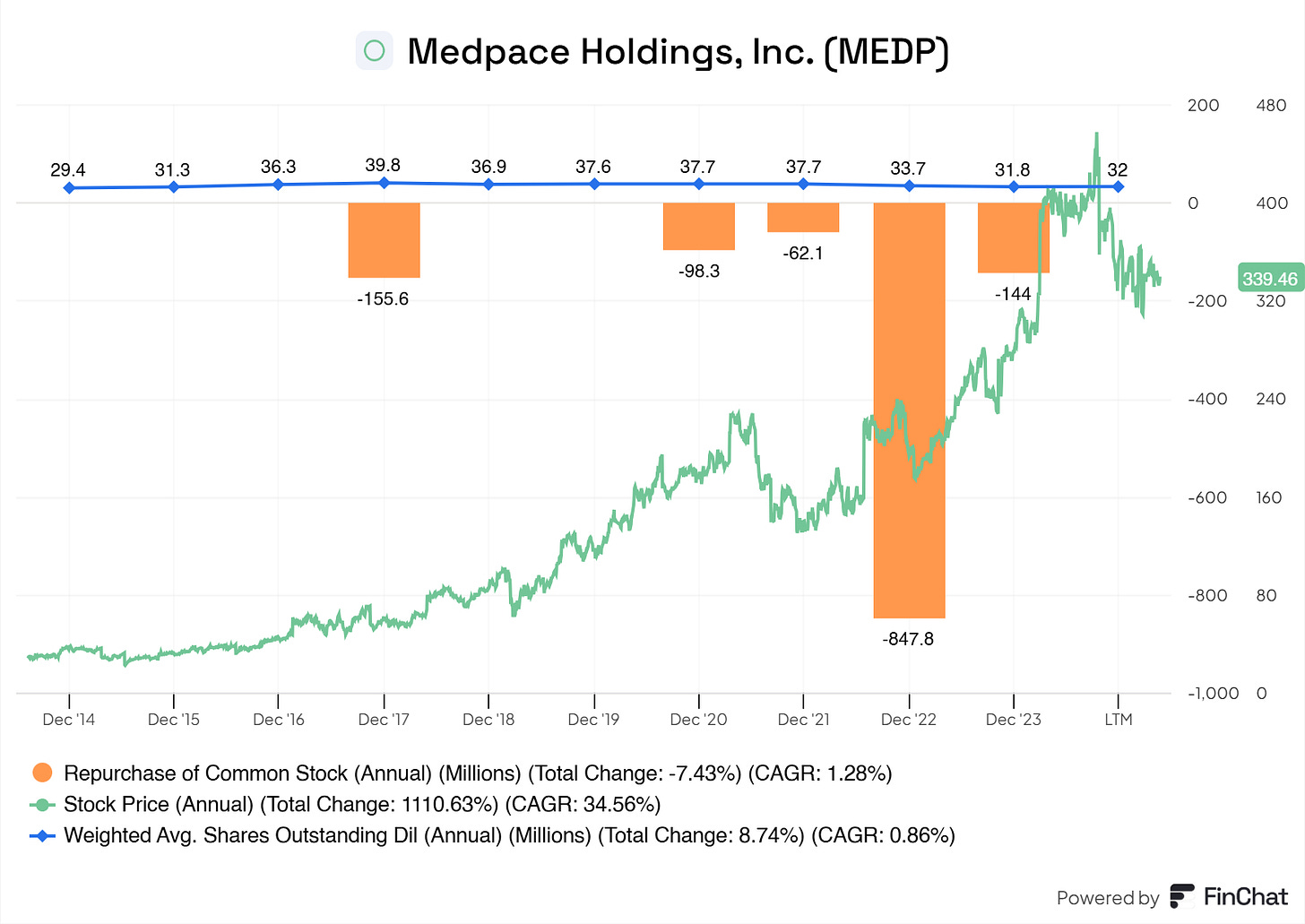

Medpace is not significantly diluting its shareholders. Yes, in 2014, there were 29.4 million outstanding shares, at its peak 37.7 million, and currently 32 million, but there’s no continued dilution, and management is buying back shares. The graph shows that management repurchases shares when the valuation/price is favorable for shareholders and the business. They don’t buy back shares at random.

11.3 Debt Reduction Strategy

There’s no debt for Medpace! :-)

12. Quality Rating

13. Valuation Assessment

Now we know a lot about Medpace. Let us crunch some numbers to find out how Medpace is currently valued and what a fair value for Medpace is.

Discounted Cash Flow: $453.54

Multiples Valuation: $292.81

Benjamin Graham Valuation: $327.91

If we take all these prices and include the analyst’s expectations of $332.23 per share and average these out, we get:

Although the margin of safety can be set at 3%. That’s not enough for us. We would rather invest in a business that is still a buy with a roughly 10% margin of safety added to the calculations.

With a 10% margin of safety, the acceptable buy price for Medpace would be $317.68. Currently, Medpace is valued at $339.46.

Last but not least!

My favorite valuation method is the reverse DCF!

Note: FCF is adjusted for SBC.

At the current price, 8.50% year-over-year growth is baked into the price for the coming 10 years. I expect Medpace to grow substantially faster, making it undervalued. Of course, I leave it up to you to decide if you agree.

Do you want to go even deeper?

If you enjoyed this breakdown of Medpace and found the insights useful, I’ve got even more tools to help you make smarter investment decisions:

A spreadsheet with ALL the high-quality stocks on my radar?

A personalized investment case just for you?

Or a 30-minute Zoom call to discuss anything investment-related?

Here’s how you can get them—completely free. Simply refer a friend using my new referral program, and these bonuses are yours!

Click below to get started and level up your investing game!

Useful Sources

Finchat: Financial Data (get it with 15% off using my affiliate link)

Buy Me a Coffee: If you want to support my content, you can buy me a coffee! All the upbringings will go to improving the newsletter, of course.

Disclaimer

I do not own Medpace shares and do not intend to buy any within the next six months.

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.

Great deep dive!

Thanks for putting this company on my radar.