5 Compounders In The Making In Denmark

Here are some of my favorites from Denmark that are rarely discussed.

Welcome back, Fluenteers! 👋🏻

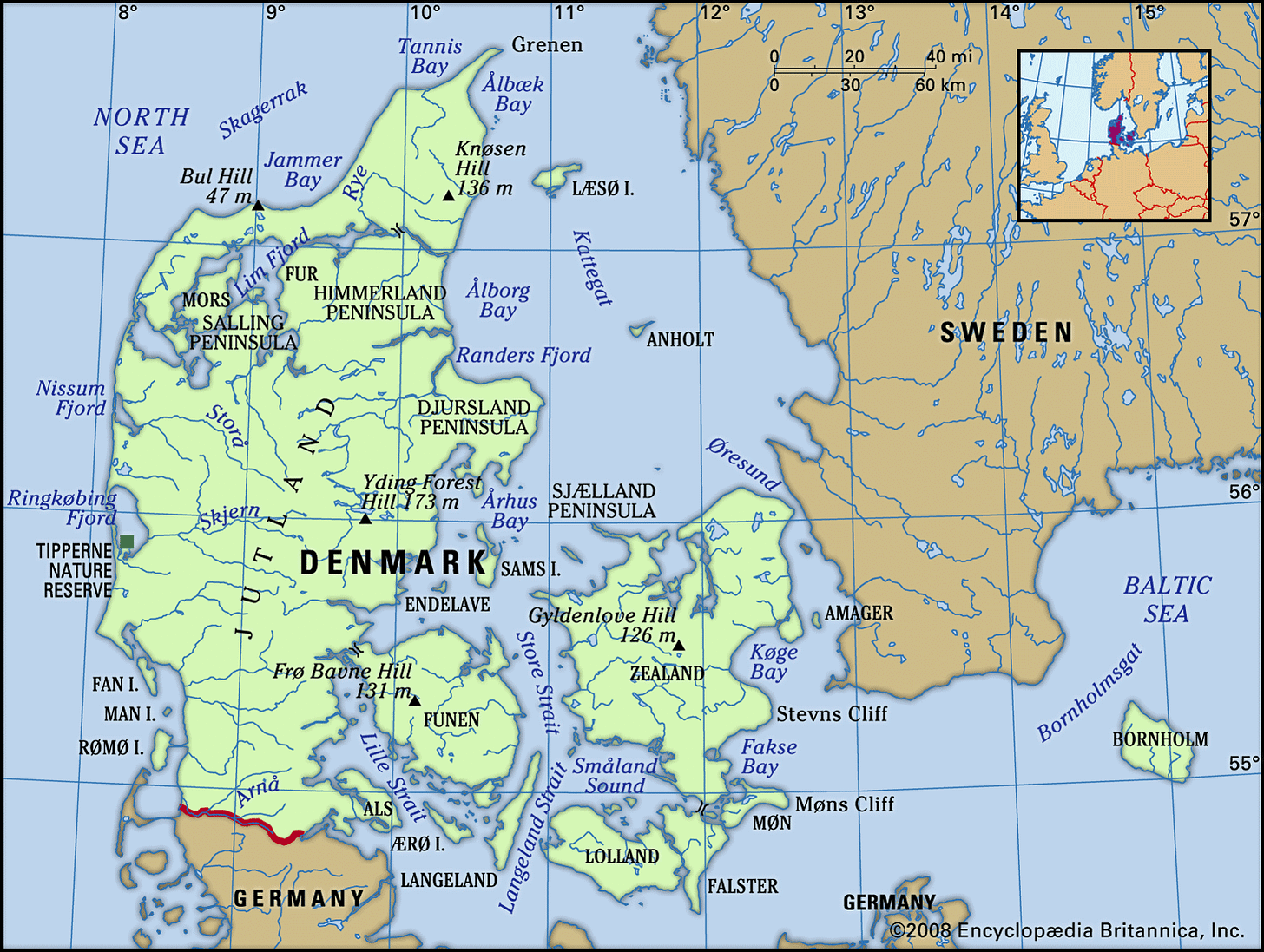

It’s our job to find the next Novo Nordisk, and I genuinely believe we can find it in the list I will be discussing here. Denmark offers one of the best landscapes for companies to innovate and conquer the world, look at Novo Nordisk, A.P. Møller - Mærsk, DSV, Vestas Wind Systems, Lego, and Carlsberg. It's not just luck, it's the location that matters.

Here are five companies that are high-quality compounders in their DNA and will start showing this in the future.

Future Compounder #5: SP Group A/S (Ticker: SPG.CO)

SP Group A/S manufactures advanced plastic and composite components for demanding industries.

Their parts are designed where metal fails, where hygiene is paramount, and where durability isn’t optional.

This is not commodity plastic.

It’s engineered performance.

Where SP Group thrives:

In corrosive environments

In sterile medical settings

In chemically aggressive processes

In sectors where failure means downtime

What they deliver:

Medical-grade components

Food-safe tanks and systems

Custom-machined technical plastics

Composite parts for transport, energy, and industry

Products are molded, machined, and laminated, then tested to perform for years.

Sticky by design.

SP Group doesn’t compete on cost.

It competes on trust, certification, and application-specific knowledge.

Switching suppliers requires:

Requalification

Compliance reviews

Operational risk management

Once embedded, it is rarely replaced.

Compounding through precision.

Growth doesn’t rely on new customer wins alone.

It scales within existing footprints.

Repeat orders from long-life applications

Maintenance, replacements, and upgrades

Expansion into adjacent use cases

Cross-selling across group subsidiaries

Each sale strengthens the ecosystem.

Each solution deepens the partnership.

Operationally lean. Financially focused.

Strong EBIT margins

Solid ROIC across segments

Scalable production with low capital intensity

Strategic bolt-on acquisitions to expand capability

Global footprint. Local execution.

Production across Denmark, Poland, the US, China, and Latvia

In-house tool design and cleanroom molding

ISO and industry-specific certifications

Local support with global reach

Secular tailwinds at their back:

Metal-to-plastic conversion

Lightweighting in transportation

Growth in medical device production

Rising hygiene and food safety standards

Renewable energy infrastructure (e.g., wind)

Each shift in regulation, efficiency, or safety strengthens demand.

This isn’t a cyclical supplier.

It’s a structural enabler.

SP Group embeds itself in systems that need to run, cleanly and reliably, for years.

It doesn’t advertise loudly.

It compounds quietly.

Future Compounder #4: Columbus A/S (Ticker: COLUM.CO)

Columbus A/S is a global consultancy specialized in digital solutions for manufacturing, food, and retail.

They don’t just implement ERP. They optimize entire value chains.

Where generic consultants fail to adapt, Columbus embeds industry logic from day one.

Expertise where complexity lives:

Discrete & process manufacturing

Food production & safety compliance

Retail, distribution, and omnichannel operations

Not tech-first. Industry-first.

Tools are tailored. Systems aligned.

What Columbus delivers:

ERP modernization (Dynamics 365 & Infor M3)

Cloud infrastructure and data strategy

Supply chain transparency

Customer experience platforms

Cybersecurity and compliance support

From back-end systems to customer-facing interfaces, fully integrated.

Deep implementation. Long-term engagement.

Most projects don’t end with go-live.

Columbus builds lasting partnerships:

Application management

Continuous optimization

Change management

Cross-border scalability

Clients don’t just adopt tech.

They evolve their operations.

Why clients stay:

Industry-specific accelerators reduce time-to-value

Templates built from 30+ years of implementation experience

Experts with deep vertical understanding

On-site and nearshore delivery blended for efficiency

Switching costs aren’t contractual.

They’re embedded in integration, training, and strategic alignment.

Profitable growth. Strategic clarity.

Recurring revenue from long-term service contracts

Focus on high-margin advisory and cloud services

Divestment of non-core assets to strengthen positioning

Ambition to be the preferred digital advisor in select verticals

Global reach. Local depth.

Presence in 9 countries

Strong foothold in Northern Europe and the US

Delivery hubs in India and Lithuania

Nordic roots, global execution

Secular drivers shaping demand:

Cloud migration in legacy-heavy industries

Need for real-time supply chain visibility

ESG and traceability requirements in food and manufacturing

Omnichannel complexity in retail

Data-driven decision-making as a competitive edge

Each shift makes Columbus more critical, not louder, just more relied upon.

Columbus doesn’t sell software.

It sells transformation.

Strategic. Integrated. Long-lasting.

A trusted partner for the companies that make, move, and feed the world

Future Compounder #3: Chemometec A/S (Ticker: CHEMM.CO)

Chemometec A/S develops and manufactures analytical instruments for cell counting and quality control.

Their solutions power critical processes in biotech, pharma, and cell-based research.

Where manual methods fall short, Chemometec automates precision.

Used where accuracy isn’t optional:

Cell therapy development

Bioprocessing and upstream manufacturing

Quality control in pharmaceuticals

Basic and applied cell research

Manual counting is too slow.

Flow cytometry is too complex.

Chemometec sits in between, optimized for speed, simplicity, and reproducibility.

Flagship platform:

NucleoCounter® system

Automated cell counters using fluorescence microscopy

Closed systems to eliminate human error

No calibration needed

Consistent results across operators, labs, and time

Why customers choose Chemometec:

Fast, standardized cell counts

Minimal sample prep

High reproducibility across global labs

Validated in GMP and regulated environments

Plug-and-play usability

It’s not just hardware.

It’s embedded in workflows from R&D to commercial production.

Sticky by nature.

Once validated, it is rarely replaced.

Switching would mean:

Requalification of production processes

Risk to consistency in yield or viability

Regulatory rework in GMP environments

Chemometec grows by staying in and expanding its use cases.

Where growth compounds:

New unit installations

Expanding usage within existing clients

Recurring revenue from disposable cassettes

Software modules and system upgrades

High customer retention and long replacement cycles

Each counter is a beachhead.

Each cassette sale reinforces it.

Operationally sharp. Financially robust.

High gross margins from consumables

Low capital intensity, strong cash flow

Self-financed growth

Relentless focus on profitable scalability

Global demand. Centralized excellence.

Production in Denmark

Direct sales in key markets: US, EU, China

Customers in 80+ countries

Focused commercial expansion in high-growth biotech regions

Structural tailwinds:

Growth in cell and gene therapies

Rise in biologics and personalized medicine

Demand for GMP-compliant, reproducible tools

Shift from manual to automated lab workflows

As biotech scales, so does the need for precise, reliable cell analysis.

Chemometec doesn’t chase trends.

It enables them.

Installed in the world’s leading labs.

Trusted where certainty is critical.

Growing quietly, precisely, and persistently.

Future Compounder #2: RTX A/S (Ticker: RTX.CO)

RTX A/S designs and develops wireless communication solutions for professional and industrial use.

They specialize where consumer-grade tech fails, and reliability can’t be compromised.

No noise. No dropouts. No surprises.

Where RTX delivers:

Enterprise-grade wireless handsets and VoIP systems

Industrial headsets and secure communication tools

Customized modules for OEMs and ODMs

Wireless audio for healthcare, logistics, and defense

Optimized for environments where connectivity is essential and conditions are unforgiving.

Not off-the-shelf. Purpose-built.

RTX doesn’t sell generic wireless tech.

It develops tailored solutions for niche applications:

Long-range, low-latency audio

Interference-resistant radio protocols

Multi-device communication under heavy load

Compliance with telecom, medical, and industrial standards

From hardware design to embedded software, fully integrated and tightly controlled.

Why customers embed RTX:

Custom radio protocols, not just Wi-Fi or Bluetooth

Full-stack R&D and product development

Proven track record in high-reliability use cases

White-label solutions for global OEMs

Switching is rarely an option.

The platform becomes part of the product.

Where revenue compounds:

Development agreements with licensing models

Long-term supply of proprietary hardware

Recurring revenue from modules and IP

Expansion across client portfolios and geographies

Each design win seeds a multi-year relationship.

Segmented go-to-market model:

Design Services

– Tailored R&D for OEM clients

– High entry barriers via deep collaborationEnterprise Products

– RTX-branded wireless communication systems

– Focus on healthcare, hospitality, and industrial usersProAudio

– Ultra-low latency and multichannel audio

– For intercoms, stage equipment, and specialized audio systems

Financially stable. Strategically focused.

Strong gross margins on proprietary tech

Capital-light development model

Balanced revenue mix between custom projects and own products

Focus on select verticals with high lifetime value

Global customer base. Danish engineering core.

HQ and R&D in Denmark

Manufacturing partners in Asia

Sales across Europe, North America, and Asia-Pacific

Close collaboration with industry leaders in telecom and electronics

Secular drivers:

Growth in wireless enterprise communication

Rising need for interference-free, secure audio links

Expansion of industrial automation and mobility

Shift from analog to digital voice systems in critical settings

Every device, headset, or module from RTX is built for one job:

To work flawlessly.

RTX doesn’t work for everyone.

It builds for the few who demand precision, stability, and custom control.

Invisible to the end user.

Indispensable to the system.

Engineered to stay.

Future Compounder #1: Tryg A/S (Ticker: TRYG.CO)

Tryg A/S is one of the leading non-life insurance providers in the Nordics.

They operate where risk is real, regulation is tight, and trust drives retention.

Insurance isn’t a product.

It’s a relationship built over time.

Where Tryg operates:

Denmark, Norway, Sweden, and Finland

Private, commercial, and corporate segments

Auto, property, liability, health, and specialty lines

Broad in coverage. Focused in execution.

What sets Tryg apart:

Strong brand recognition and customer loyalty

Best-in-class claims handling

Nordic cost discipline and digital efficiency

Deep data and pricing capabilities

Tryg doesn’t just insure.

It manages risk at scale.

Sticky by design.

Insurance isn’t a one-time sale.

It’s a multi-year engagement with multiple touchpoints:

Renewals and bundled policies

Add-on products over time

Premiums priced to reflect loyalty and risk profile

Switching means friction.

Tryg reduces it for onboarding, not for leaving.

Where growth compounds:

High retention across core markets

Upselling through customer platforms

Efficiency gains from digital claims and automation

Cross-selling through partners and bancassurance channels

Organic growth layered with operational leverage.

Strategic M&A executed at scale:

Codan acquisition solidified #1 position in Denmark

Created the largest non-life insurer in the Nordics

Synergies driven by IT integration, shared back-office, and claims optimization

Bigger isn’t enough, integration is where value is realized.

Financial profile:

Combined ratio: consistently below 90

Stable underwriting margin

Strong solvency position

Dividend commitment and capital discipline

Insurance is a game of risk pricing and cost control.

Tryg plays it with Nordic precision.

Secular drivers:

Rising demand for personal and health insurance

Digital-first customer expectations

Climate-related insurance needs (e.g., flood, storm)

Regulatory pressure favoring scale and stability

Each trend reinforces the moat.

Tryg gets stronger by doing what it’s already good at, better.

Tryg doesn’t sell peace of mind.

It delivers it.

Quietly underwriting daily life for millions.

Profitable. Predictable. Persistent.

Here Are 10+ More Quality Companies! 👇🏻

Ready to go from reading about great businesses to owning them with conviction?

You’ve just gotten some of my archive of the best gems that no one talks about…

Now imagine having the full edge—every single week:

✔️ Full research reports and timeless deep dives (valued at €1,597)

✔️ Monthly buy/sell portfolio updates with commentary (€987)

✔️ Access to a private Discord of high-conviction investors (€743)

✔️ Tools, templates, investor interviews & PDF briefs (€2,013)

Total value: €5,340 — yours for just €44.99/month or €445/year.

No fluff. No noise. Just real work, trusted by 1,200+ long-term investors.

This isn’t just insight. It’s an investing advantage.

Delivered weekly. Backed by research. Built to compound.

🟢 Become one of The Fluent Few

Let’s build wealth the right way—brick by brick.

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds to refer this edition to a friend? It will go a long way in helping me grow the newsletter (and bring more quality investors into the world).

Great investments don’t shout, they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all the charting, analysis, and keeping up with earnings calls. You can now get 15% off your subscription. Click here and start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

اتمنى العمل معكم متواصل وانتم احد أعضاء المنتدى الكرام وشكرا لكم جميعا على مروركم الطيب

This feast was so good that friends gathered at instead Ivan got anything very thoughtful about mastery