Top 6 Under The Radar High-Quality Compounders In Asia

Asia is filled with high-quality compounders, you just need to look in the rights cracks.

Welcome back, Fluenteers! 👋🏻

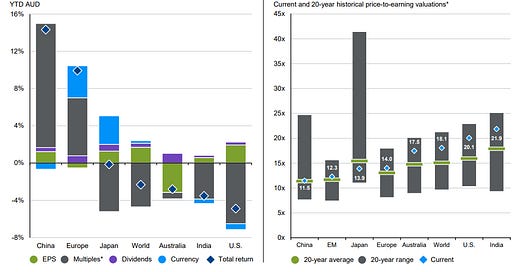

This chart paints a clear picture: India and the U.S. are trading well above their historical valuation averages, while China, emerging markets, and Japan appear to be undervalued or fairly valued.

Should we start shifting focus toward Asia instead of the U.S., India, or Europe?

Let’s dive into six high-quality compounders in Asia that could deliver outstanding returns over the next few years.

Happy compounding!

High-Quality Compounder #7: NAURA Technology Group (Ticker: SZSE-002371)

Built quietly. Grows deliberately.

NAURA develops front-end semiconductor equipment:

etching, deposition, cleaning, and polishing.

These tools sit at the heart of chip fabrication.

Precision isn't optional. It's the product.

Strategic by design

NAURA doesn’t chase global share.

It exists to serve China’s semiconductor independence.

Core supplier to SMIC, YMTC, CXMT

Embedded in China’s 5- to 10-year industrial plans

One of the few domestic firms capable of volume front-end tool delivery

Beneficiary of $100B+ in national capex support

NAURA is not a cyclical vendor.

It’s a geopolitical asset.

The moat is qualification

Semicap tools take years to validate.

Once qualified, they are rarely replaced.

Switching costs are operational, not contractual

Equipment becomes embedded in process IP

Repeat orders come from line extensions, not RFPs

This isn’t a product sale.

It’s a long-term dependency.

Disciplined financials

No hype. Just hard numbers.

Gross margins: consistently >40%

R&D: 12–14% of revenue

Capex-light; high R&D ROI

Balance sheet: debt minimal, cash generative

Growth is tied to national infrastructure, not consumer cycles.

Not fast. Just inevitable.

NAURA wins by being reliable, not revolutionary.

Domestic content mandates reduce competition

Every new fab is a customer

Every export control deepens demand for local tooling

Its job isn’t to innovate at the frontier.

It’s to ensure the frontier is locally sourced.

Compounding without headlines

NAURA doesn’t need global brand equity.

It needs process stability, support reliability, and trust at the fab level.

Limited marketing spend

Direct technical sales model

High client retention through installed base servicing

Revenue scales with the installed tool base.

Optionality grows with every node advance.

For the long-term holder

This is not a momentum story.

It’s a national capability story.

If semiconductors are the new oil,

NAURA is building the drills.

High-Quality Compounder #5: Zuken (Ticker: TSE-6947)

Zuken builds software for complex electronic systems.

Not code for hobbyists—tools for mission-critical design.

Its core platforms power the development of:

Printed circuit boards (PCBs)

Electrical wire harnesses

Multi-domain system architectures

Used in aerospace, automotive, industrial, and defense.

Not optional. Essential.

Where electrical complexity lives

As products become more electronic, design risk rises.

Zuken operates in that risk.

Clients include Airbus, Toyota, NASA, Siemens

Integrated into workflows with 10+ year retention

Tools support compliance, simulation, and manufacturability at once

Deep interoperability with PLM, CAD, and ERP systems

Design errors here aren’t bugs.

They’re recalls.

Focused. Disciplined. Profitable.

Zuken doesn’t chase the entire EDA market.

It specializes.

70%+ revenue from ECAD and electrical systems

Gross margins >60%

Operating margins consistently 20–25%

R&D spend 20%+ of revenue, fully expensed

Recurring license and maintenance income >50%

Lean headcount. High leverage per engineer.

Growth with control.

Sticky Through Integration

Zuken’s software is technical debt by design.

Clients don’t leave because they can’t afford to.

Design data stays inside proprietary systems

Switching vendors means retraining teams, rewriting processes

Migration risk is career risk

Retention is built in.

Revenue scales with product complexity.

Quiet compounding

Zuken isn’t loud. It doesn’t need to be.

Listed in Tokyo since 1991

Founder-led through the decades

Acquisitions are rare, and integration is thoughtful

No dependence on VC capital or marketing spend

Steady execution. Global reach.

Japan, Europe, and North America each make significant contributions.

Positioned for the long game

Megatrends work in Zuken’s favor.

Electrification

EV platforms

Aerospace modernization

Industrial automation

All require more wiring, more coordination, more design control.

Zuken builds the infrastructure for that control.

Software that engineers use for what comes next.

High-Quality Compounder #4: Organo Corporation (Ticker: TSE: 6368)

Organo designs, builds, and maintains water purification systems.

It doesn’t sell filters. It engineers reliability.

Focused on industries where water isn’t optional:

Semiconductors

Chemicals

Food and beverage

Pharmaceuticals

Power generation

Precision treatment. Long-cycle infrastructure. Quiet scale.

Built into the system

Organo’s solutions are embedded, not replaceable.

Ultrapure water for fabs

Industrial wastewater treatment

Membrane, ion exchange, and biological systems

End-to-end: design → construction → operation → maintenance

Clients don’t switch.

They sign multi-year contracts and renew.

Recurring by design

Revenue doesn’t reset every year.

It builds.

High-margin chemical supply and maintenance income

Installed base drives service demand

Low churn across Japanese industrial customers

Project wins create annuities

Recurring revenue is over 40% of the total.

Service margins exceed system margins.

Financially disciplined

Organo doesn’t chase growth. It compounds steadily.

Gross margins: ~34%

Net margins: ~15%

ROE consistently above 10%

Minimal debt. Strong balance sheet.

Dividend payout ratio: ~30%

Growth is self-funded. Returns flow back.

Strategically positioned

The tailwinds are long-term and structural:

Semiconductor capacity build-out

Stricter environmental regulations

Water reuse and zero-liquid discharge mandates

Industrial build-up in Southeast Asia and China

Demand compounds with regulation.

Organo sits at the intersection of compliance and continuity.

For the patient holder

This isn’t a brand story.

It’s an engineering business that scales with installed trust.

No hype

No venture bets

Just contracts, renewals, and results

High-Quality Compounder #3: Nakanishi Inc. (Ticker: TSE-7716)

Nakanishi doesn’t make drills.

It builds high-speed precision tools that professionals trust with human lives.

Its core products:

Dental handpieces

Surgical micromotors

Industrial spindles

Used in dental clinics, operating rooms, and precision factories.

Reliability isn’t a feature. It’s the baseline.

Microns of advantage

Nakanishi competes in what others can’t fake:

300,000+ RPM rotation with zero vibration

Ultra-compact motors with long duty cycles

Durability tested for years of clinical use

100% of products are manufactured in Japan

Tolerances are measured in microns.

Reputations built over decades.

Recurring, embedded, global

70% of revenue is overseas.

50% comes from dental.

Customers include dentists, hospitals, and OEMs

Handpieces are replaced every 3–5 years

Consumables and repairs create high-margin follow-on revenue

Global regulatory approvals deepen switching costs

Once adopted, products stay installed.

Support becomes recurring income.

Financial precision

Margins reflect craftsmanship and scale.

Gross margin: ~60%

Operating margin: ~30%

ROE: consistently above 15%

Zero debt. Net cash position.

High free cash flow conversion

Dividend payout ratio: ~40%, growing slowly

No waste. No leverage. Just profitable engineering.

Manufacturing discipline

All production remains domestic.

A single factory model ensures quality control

No outsourcing of critical components

Expansion funded through internal capital

Growth doesn’t dilute precision.

It refines it.

Structural growth

Tailwinds compound quietly:

Global aging population → more dental care

Demand shifts to high-precision, low-maintenance instruments

Growth in emerging-market dental and surgical infrastructure

Miniaturization in electronics → spindle demand

Nakanishi doesn’t ride hype cycles.

It grows as certainty grows.

For the focused hHolder

No big bets. No pivots. No reinvention.

Just:

Niche dominance

Expanding installed base

Elite product retention

Financial consistency

Hold it for the niche.

Keep it for the integrity.

High-Quality Compounder #2: Lion Rock Group Limited (Ticker: SEHK-1127)

Lion Rock is not a traditional printer.

It’s a scaled, specialized producer of high-volume, high-complexity print products.

Core segments:

Educational publishing

Trade books and premium packaging

Institutional clients across the US, UK, and Australia

Production is industrial.

Customers are recurring.

Margins are earned through scale and precision.

Deep in the supply chain

Lion Rock serves the backend of global publishing.

Long-term contracts with major international publishers

Print-on-demand, high-mix production capabilities

B2B model with minimal consumer exposure

Mission-critical vendor for educational cycles and retail distribution

It is not subject to shelf trends.

It is embedded in publisher workflows.

Asset efficiency. Global reach.

Operations are spread and lean.

Plants in China, Malaysia, Singapore, and Australia

Just-in-time capabilities

Freight and warehousing integrated

Unit economics improve with scale, not price hikes

The customer is the publisher.

Not the bookstore.

Predictable economics

Lion Rock doesn't chase volume for growth.

It builds consistency.

Gross margins: ~25%

Net margins: ~8–10%

High asset turnover

Strong cash conversion

Conservative capex

Regular dividend with ~5% yield

Not capital-intensive. Not debt-dependent.

Growth is retained, not borrowed.

Defensible by execution

This is a low-glamour, high-detail business.

Long bidding cycles

Complex procurement terms

Reliability > novelty

Quality assurance is the product

Clients stay because switching is risky.

Every missed delivery costs them more than it costs you.

Subtle optionality

Lion Rock has expanded quietly:

Acquisitions in Australia and the UK

Print-on-demand and packaging extensions

Long-term thesis: consolidation of legacy print supply

The print industry shrinks.

Lion Rock consolidates what remains.

For the patient allocator

This isn’t high growth.

It’s high control.

No tech multiples

No dependence on sentiment

Just orders, margins, and execution

High-Quality Compounder #1: China XLX Fertiliser Ltd. (Ticker: SEHK-1866)

China XLX doesn’t sell stories.

It sells ammonia, urea, and methanol—at scale, with discipline.

One of the largest compound fertiliser producers in China.

Fully integrated. Low-cost. Regionally dominant.

Inputs that feed nations

XLX makes essential agricultural inputs:

Urea

Compound fertilisers

Melamine

Methanol and DME (dimethyl ether)

Core demand is non-discretionary.

Customers include farmers, wholesalers, and industrial buyers across Central China and Southeast Asia.

Scale is the moat

XLX isn’t competing on brand.

It wins on cost per ton.

Captive ammonia and coal-based inputs

2+ million tons of urea capacity

3+ million tons of compound fertiliser capacity

Logistics is integrated from the plant to the field

Vertical integration means pricing power when supply is tight.

And margin defense when prices fall.

Financially durable

Commodity exposure is real.

So is cost discipline.

Gross margin: typically 20–25%

Net margin: ~10% across cycles

Operating cash flow is strong in upcycles, neutral in downcycles

Debt kept moderate

Dividend paid even in weak years

Balance sheet built to survive troughs.

Cash is deployed carefully in peaks.

Policy-linked demand

Food security is a national priority.

Fertiliser is politically sensitive

State policy supports production stability and price controls

Environmental compliance grants larger players a license to operate

Export access to Southeast Asia provides volume flexibility

This is not speculative revenue.

Its volume is tied to land, yield, and season.

Optionality in industrial chemicals

Beyond agriculture, XLX monetizes scale through:

Melamine for laminates and plastics

Methanol for fuels and solvents

DME as an LPG substitute

Plants run full-year, not just in growing seasons.

Non-ag use smooths revenue volatility.

For the Commodity-Disciplined Investor

Not a growth story.

A resilience story.

Cost leader in an essential input

Counter-cyclical capacity expansion

Dividends backed by cash, not forecasts

Operational leverage in pricing upturns

🔥 Ready to go from reading about great businesses to owning them with conviction?

You’ve just seen 6 of the best buy companies in Asia.

Now imagine having the full edge—every single week:

✔️ Full research reports and timeless deep dives (valued at €1,597)

✔️ Monthly buy/sell portfolio updates with commentary (€987)

✔️ Access to a private Discord of high-conviction investors (€743)

✔️ Tools, templates, investor interviews & PDF briefs (€2,013)

Total value: €5,340 — yours for just €44.99/month or €445/year.

No fluff. No noise. Just real work, trusted by 1,200+ long-term investors.

This isn’t just insight. It’s an investing advantage.

Delivered weekly. Backed by research. Built to compound.

🟢 Become one of The Fluent Few

Let’s build wealth the right way—brick by brick.

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds to refer this edition to a friend? It will go a long way in helping me grow the newsletter (and bring more quality investors into the world).

Great investments don’t shout, they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all the charting, analysis, and keeping up with earnings calls. You can now get 15% off your subscription. Click here and start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

Take a look at Credit Bureau Asia! No longer undervalued as it ran plus 50% in a year, but high-quality business nonetheless.

This isn’t a comment. It’s a concise, essential statement of opinion on the platform where flowery language is the norm.