Top 9 Stock To Buy And Hold Forever!

Sometimes all you need is nine high-quality compounders and patience, it's truly as easy as that. And here, I'm giving you the nine you need.

Welcome back, Fluenteers! 👏🏻

It sounds too good to be true, but there are companies out there you can buy and truly rarely have to look back at. How’s this possible? They’re true visionaries, excellent capital allocators, and overall, wonderfully managed by competent management, limiting the need to check up on your investments or the decisions made by management. You do have to dig a bit to find these compoundersand understand why it’s the case with this company, but I've got you fully covered here.

Here are nine companies you can own and truly forget.

Happy compounding!

Set & Forget Company #9: Amazon (Ticker: $AMZN)

Relentless Scale. Built for Forever.

Amazon isn’t just an online store.

It’s the infrastructure behind modern consumption.

From checkout to cloud, it owns the rails.

This isn’t retail.

And it’s not just tech.

Amazon is what happens when customer obsession meets infinite reinvestment.

The Amazon flywheel isn’t a metaphor. It’s the business model:

Lower prices

Better selection

Faster delivery

Higher customer loyalty

Lower customer acquisition costs

It turns. And turns. And scales.

The operating leverage of a lifetime.

Retail funds the cloud.

The cloud funds everything else.

AWS is the cash engine:

30%+ margins

Market-leading infrastructure

Mission-critical clients, from startups to governments

It’s not cyclical—it’s foundational.

Marketplace dominance with take-rates.

Over 60% of units sold come from third-party sellers.

Amazon takes a cut, charges for logistics, and rents shelf space in the cloud.

It’s like owning the mall, the delivery fleet, and the power grid.

Prime isn’t a membership. It’s a moat.

Fast shipping, exclusive content, free returns.

And a billion+ purchase triggers are baked into one subscription.

Every new perk deepens the habit.

Every new member lowers the cost per customer.

Logistics empire, invisible to most.

Amazon didn’t just outsource shipping. It built its own:

100+ fulfillment centers

Thousands of last-mile delivery partners

Global warehouse footprint

It's FedEx, UPS, and Shopify rolled into one—at Amazon scale.

Optionality through integration.

Few companies can experiment like Amazon:

Alexa

Advertising

Healthcare

AI tools

Physical stores

Satellite internet

Most bets won’t move the needle.

But one big winner is all it needs.

Culture of Day 1.

Jeff Bezos institutionalized urgency:

Long-term thinking

Frugality as a feature

Relentless iteration

Even without him, the DNA persists.

Amazon isn’t cheap. It’s proven.

High capex? By design.

Low GAAP profits? By choice.

Cash flow dominance? Undeniable.

It sacrifices optics to build infrastructure, then monetizes at scale.

Set & forget.

If you're investing for the next 10+ years, Amazon offers a rare combo:

Durable moats

Cash flow compounding

Irreplaceable infrastructure

Embedded in consumer habits and enterprise software

It’s not hype. It’s architecture.

Amazon doesn’t chase trends.

It builds them.

Set & Forget Company #8: Constellation Software (Ticker: $CSU)

Software Forever. Bought, Not Built.

Constellation Software doesn’t develop the next big thing.

It quietly owns thousands of small ones.

This isn’t Big Tech.

And it’s not chasing unicorns.

Constellation is what happens when disciplined capital allocation meets niche domination.

Vertical markets. Eternal customers.

These are not flashy apps.

These are mission-critical systems embedded deep in industries:

Municipal ERP

School transportation routing

Veterinary practice software

Marina booking systems

Public transit ticketing

Each niche is too small for Oracle.

Too vital to be replaced.

An acquisition machine with a memory.

While others pitch synergies, Constellation sticks to a playbook:

Profitable on day one

Founder-led or family-run

Low churn, high stickiness

Real customers. Real cash flow.

No turnarounds. No roll-the-dice moonshots.

It doesn’t scale products. It scales the process.

Every business stays independent.

Every team runs its own P&L.

Every lesson compounds at the parent level.

This is M&A turned into muscle memory.

Capital allocation as a religion.

Mark Leonard—former venture capitalist turned capital compounding monk—set the tone:

No earnings calls

No stock splits

No media circus

Just investor letters and ruthless discipline.

Margins with moats.

Constellation’s businesses often have:

Recurring revenue

Minimal competition

Low customer acquisition costs

Decade-long relationships

The software may be old. But the contracts are gold.

Decentralized, not disorganized.

Six operating groups. Thousands of CEOs.

And one mandate: run a great software business.

Best practices get shared, but autonomy is sacred.

It’s not top-down management. It’s bottom-up excellence.

Optionality via replication.

Constellation doesn’t chase scale for bragging rights.

It replicates its playbook globally.

From Canadian public safety software to Brazilian logistics platforms—

It’s hunting quality, not geography.

Buy. Hold. Forget.

Constellation doesn’t need to invent the future.

It quietly owns the plumbing that keeps the world running.

No hype. No headlines.

Just high ROIC and relentless reinvestment.

If you believe in cash compounding and discipline over drama,

Constellation Software is the one you quietly keep and never question.

Set & Forget Company #7: Rollins (Ticker: $ROL)

Pest Control Royalty. Built on Recurrence.

Rollins isn’t flashy.

It kills bugs for decades at a time.

This isn’t tech.

It’s not AI.

It’s ant trails, termite tunnels, and household peace of mind.

And it’s one of the most quietly compounding machines on the planet.

Boring? Beautiful.

Pest control is:

Mandatory, not optional

Local, not globalized

Fragmented, not consolidated

Rollins thrives in that sweet spot—recurring need, stable margins, zero disruption risk.

Recurring revenue with retention.

80%+ of revenue is service-based.

Contracts stretch across seasons and lifetimes.

It doesn’t rely on one-time projects.

It monetizes the calendar.

Orkin is the face. The engine is deeper.

Orkin is the flagship.

But the real story is the portfolio:

Western Pest

HomeTeam

Clark Pest Control

Critter Control

And dozens more...

A quiet army of regional brands—each with local trust and national backing.

M&A that knows the neighborhood.

Rollins doesn’t buy platforms.

It buys mom-and-pop firms with route density.

High customer overlap

Low churn risk

Operators stay post-acquisition

Integration with a soft touch

Every deal adds scale and saves on spray miles.

Defensible by design.

This is not a software platform anyone can spin up.

It’s trucks, licenses, technicians, and trust.

Local regulatory know-how

Decades-long customer relationships

Trained, background-checked service staff

On-site execution, not digital disruption

You don’t switch pest control with a swipe.

Margins in the mundane.

High gross margins

Low capital intensity

Predictable cash flow

Insulation from economic cycles

Bugs don’t care about recessions.

And neither do Rollins shareholders.

A dividend compounder in disguise.

Modest dividend.

Backed by a fortress balance sheet.

Grows slowly, but never stops.

It’s the kind of company you only notice when it’s been in your portfolio for 20 years—and quietly 10x’d.

Built to be ignored. Until you run the numbers.

Rollins doesn’t need buzz.

It just needs bugs.

If you believe in everyday necessities, route density, and long-term customer loyalty.

Rollins is the pest control king who rewards patience.

Quiet compounders don’t raise their voice.

They raise their value.

Set & Forget Company #6: Kelly Partner Group Holdings (Ticker: $KPG)

Owner-Accountants. Built to Last.

Kelly Partners Group doesn’t just do accounting.

It turns it into a compounding engine—one partner, one client, one decade at a time.

This isn’t the Big Four.

And it’s not chasing VC-funded tech dreams.

KPG is what happens when long-term thinking meets local trust.

Private business focus. Public company playbook.

Kelly Partners serves Australia’s economic backbone:

Private business owners

Family enterprises

High-net-worth individuals

It doesn’t scale with speed.

It scales with depth.

Small firms. Big vision.

KPG doesn’t buy accounting practices and gut them.

It invites partners in—literally.

Co-ownership structure

Skin-in-the-game incentives

Decentralized operations

Succession is baked into the model

Partners stay. Clients stay. Culture compounds.

A flywheel built on trust.

Every accounting firm KPG acquires adds:

Recurring revenue

Cross-sell opportunity

Local brand equity

Defensive customer relationships

Clients don’t churn. They grow.

And they bring their kids with them.

The accounting is boring. The structure isn’t.

KPG’s model is engineered for endurance:

Owner-operator alignment

High-margin, capital-light services

Minimal client concentration

Consistent, long-duration cash flow

It’s boring—but with teeth.

M&A with soul.

No private equity tactics. No short-term flips.

Kelly Partners only acquires when:

The culture fits

The books are real

The leaders want legacy, not exit

Each acquisition makes the group stronger, financially and culturally.

Capital allocation with clarity.

Brett Kelly runs KPG like a steward, not a CEO:

Owner of ~50% of the company

Writes to shareholders like partners

Reinvests free cash, raises dividends, pays down debt

There’s no empire-building. Just shareholder-building.

Defensive with upside.

In every market, taxes must be filed.

Books must be audited. Trust must be earned.

Recession-resistant. Regulation-protected. Referral-driven.

And yet, it still grows faster than most tech firms.

Compounder in plain sight.

If you believe in:

Long-term alignment

Owner-operator models

High retention services

Small businesses as an economic engine

Kelly Partners is a rare public company with a private company soul.

No flash.

Just founders, families, and forever clients.

Set & Forget Company #5: ASML Holding (Ticker: $ASML)

The Most Important Company You’ve Never Touched.

ASML doesn’t make chips.

It makes the machines that make the chips.

This isn’t semiconductors.

It’s semiconductor infrastructure, down to the atomic level.

ASML is what happens when physics, precision, and monopoly meet.

It holds a chokehold on the most advanced chipmaking process on earth:

EUV lithography.

13.5 nanometer light waves

Mirrors from outer space materials

Precision aligned to the billionth of a meter

Competitors? Zero.

No ASML, no AI.

ASML machines are the gatekeepers to:

NVIDIA’s accelerators

Apple’s processors

AMD’s GPUs

Intel’s comeback

TSMC’s foundries

Every chip that powers your phone, your car, your datacenter—it all starts here.

It doesn’t compete. It enables.

TSMC, Intel, Samsung: all rely on ASML

EUV tools: $200M+ per machine

Backlog: measured in years, not months

ASML doesn’t sell. It allocates.

Patents are deep. Moats are deeper.

20+ years ahead in EUV

Thousands of patents

Components sourced from hundreds of irreplaceable suppliers

Mirrors from ZEISS, light sources from Cymer

Even with an unlimited budget, you couldn't replicate ASML in a decade.

Capital intensive? Yes.

Capital stupid? Never.

Gross margins are near 50%

Returns on capital are far above the industry

Free cash flow converted into buybacks and dividends

Every new node = higher ASP

Every new machine = higher lock-in

Governments care. Rivals can’t.

ASML is the only Western company making advanced lithography tools

Geopolitical asset for Europe

Strategic bottleneck for global supply chains

Banned from China, protected by allies, and courted by every chip fab on earth.

The flywheel is technological, not psychological.

As chips shrink, complexity rises

As complexity rises, demand for ASML precision grows

The fewer players that can keep up, the more dominant ASML becomes

The next generation (High NA EUV)? Already in motion.

Set & forget? This is a set & fortress.

ASML doesn’t rely on trends.

It enables them:

AI

EVs

Data centers

IoT

Edge computing

National security

If you believe in chips, you must believe in ASML.

It’s not a bet on semiconductors.

It’s a bet on the laws of physics—and who best commercialized them.

Set & Forget Company #4: Fair Isaac (Ticker: $FICO)

The Algorithm That Decides Your Life.

FICO doesn’t lend money.

It decides who gets it.

This isn’t a credit bureau.

And it’s not just software.

FICO is what happens when proprietary data meets pricing power and becomes embedded in the financial system.

One number. Massive impact.

Your FICO score:

Approves your mortgage

Sets your car loan interest rate

Decides your credit card limit

Impacts your insurance premiums

It’s used by 90 of the top 100 U.S. lenders.

And it shows up in 10 billion+ credit decisions per year.

FICO is the default. Not a brand—an industry standard.

Installed across banks, credit unions, and fintechs

Embedded in underwriting workflows

Trusted by regulators, insurers, and capital markets

No sales pitch needed. Just a system that runs quietly in the background.

Recurring. Reliable. Required.

FICO doesn’t just sell scores.

It also sells the tools that financial institutions use to build and execute credit strategies:

Analytics software

Decision management platforms

AI-driven risk modeling

License renewals? Predictable.

Switching cost? Astronomical.

Software that commands pricing power.

FICO has something most software companies dream of:

No credible competition

Deep integration with regulated systems

Mission-critical use cases

Permission to raise prices repeatedly

Margins are thick. Cash flow is sticky. Churn is basically non-existent.

Not consumer-facing. Consumer-essential.

FICO doesn’t chase buzz.

It powers systems that determine:

Loan approvals

Credit line increases

Risk thresholds

Portfolio stress tests

It’s as close to an operating system for U.S. lending as it gets.

The moat is institutional trust.

FICO’s business isn’t just code.

It’s regulation-hardened, compliance-ready, and time-tested.

Built into the bank infrastructure

Validated by decades of results

Backed by score adoption requirements in many financial contracts

Rip it out? You’d have to rewrite the whole industry.

Capital-light compounder.

FICO is:

High-margin

Low headcount

Light on fixed assets

Heavy on intellectual property

Every new contract, every score recalibration, every AI model—it all scales beautifully.

Set & forget. Literally.

FICO doesn’t need to reinvent itself.

It just needs to:

Keep improving the model

Stay embedded

Expand use cases (like fraud, insurance, telecom)

This is software as infrastructure, not software as service.

If you believe finance runs on trust and data, FICO is the algorithm behind it.

Not loud.

Not optional.

Just quietly deciding the credit economy, one number at a time.

Before we go into the highly anticipated top three…

I’m providing you with compounders to guide you into a more secure and financially stable future.

Return the favor by restacking & liking this post and top it off with a comment.

It took me significant time to put this together. It takes 10 seconds to return te favor. ❤️

Set & Forget Company #3: S&P Global (Ticker: $SPGI)

The Pulse of Capitalism. Measured & Monetized.

S&P Global doesn’t trade.

It tracks, rates, indexes, and informs.

This isn’t Wall Street hype.

It’s the plumbing behind modern finance.

S&P is what happens when trust, data, and monopoly meet.

It’s not one business—it’s four engines of financial infrastructure:

S&P Ratings: the creditworthiness compass for trillions

S&P Indices: where ETFs and benchmarks are born

S&P Market Intelligence: the Bloomberg alternative in stealth mode

S&P Commodity Insights: the pricing oracle for global energy & metals

If markets move, S&P gets there first.

Everywhere, but never loud.

$100+ trillion in assets track S&P indices

95% of bond investors check their ratings

ETFs pay licensing fees just to use the name

Banks, insurers, and hedge funds rely on their data terminals

It doesn’t matter if the market is up or down—S&P gets paid either way.

Indexing is the annuity.

Every passive ETF that tracks the S&P 500? Pays a royalty.

More assets flow in → more fees → no additional cost.

This is IP with infinite scalability.

Ratings are the tollbooth.

When governments or corporations issue debt, they need a rating.

Investment-grade? Junk?

Refinance? Raise capital?

They can’t skip the process.

And S&P collects a toll on every issuance.

Data is the next frontier.

S&P Market Intelligence + IHS Markit = a beast.

Deeper data

Smarter terminals

AI-powered analytics

It's not just reporting on the markets.

It’s predicting them.

Margins that defy gravity.

This isn’t capital-intensive.

It’s content + code + credibility.

70%+ gross margins

Recurring revenue

Low churn

Pricing power with institutional clients

And very few head-to-head competitors.

Embedded in the system.

You can argue about valuation.

You can’t argue about relevance.

Asset managers need it

Governments reference it

Banks embed it

Traders track it

Journalists quote it

It’s not a service. It’s financial infrastructure.

Set & forget? This is the scoreboard.

If you believe capitalism will continue to allocate capital—

S&P Global will be there, measuring it, charging for it, and defining how it flows.

No flash.

Just function.

Not cyclical exposure.

Systemic importance.

Set & Forget Company #2: Copart (Ticker: $CPRT)

Wrecks into Riches. Infrastructure for Insurance.

Copart doesn’t sell cars.

It sells certainty in the chaotic world of vehicle loss.

This isn’t a used car lot.

It’s the exchange where insurance claims turn into liquidity.

Copart is what happens when logistics, data, and dominance collide.

Totaled car? Flooded truck? Hail-damaged sedan?

Insurers call Copart. Every time.

Not a marketplace. A monopoly in slow motion.

250+ yards

190+ countries serviced

Exclusive contracts with almost every major U.S. insurer

It’s not just scale—it’s access.

If you want salvage inventory, Copart owns the gates.

Volume begets value.

More totaled vehicles → more buyers

More buyers → higher recovery prices

Higher prices → happier insurance partners

Happier insurers → more exclusive contracts

The flywheel is real and built on asphalt.

Digital roots. Physical grip.

While others scrambled to “go digital,”

Copart has been online since the early 2000s.

VB3 platform powers global auctions

AI and data analytics optimize inventory flow

Virtual bidding with real-time logistics

This isn’t a tech layer over a physical business—it’s deeply integrated.

Logistics empire disguised as salvage.

Owns most of its land

Operates its own transportation fleet

Controls the full loop: tow, store, auction, transfer

Low dependence on third parties.

High control over margin.

Counter-cyclical resilience.

When the economy slows? People repair instead of replace.

When does inflation rise? Salvage parts surge in value.

When miles driven increase? More accidents, more inventory.

Headwinds for others often become tailwinds for Copart.

Global growth, local edge.

Copart is replicating its U.S. model abroad:

Expanding in Germany, Brazil, UK, UAE

Same playbook: land first, logistics second, scale third

No one else can match the footprint, tech, or contracts.

Set & forget—and tow the flywheel.

If you believe:

Cars will keep crashing

Insurers will keep outsourcing

Global mobility won’t stop

Then Copart is the silent compounder hiding in the salvage yard.

This isn’t a bet on the auto market.

It’s a bet on inevitability.

Set & Forget Company #1: Adyen (Ticker: $ADYEN)

Unified Payments. Engineered, Not Assembled.

Adyen isn’t a payment processor.

It’s an infrastructure company disguised as a payments firm.

This isn’t a patchwork of bolt-on acquisitions.

It’s one single platform—built from scratch.

Adyen is what happens when software meets scale without compromise.

No legacy tech.

No Frankenstein mergers.

Just pure code, serving the most demanding merchants on the planet.

Enterprise-grade from Day One.

Built for:

Uber

Spotify

Meta

Microsoft

Booking.com

Not small shops.

Not freelancers.

But global businesses are moving billions.

They don’t just need payments.

They need orchestration across countries, channels, and methods.

One integration. Global reach.

Adyen combines:

Online + in-store

Card + bank + local methods

Risk + compliance + settlement

Everything, in one backend

Fewer vendors. Fewer bugs. More data.

Merchants love it. Developers love it more.

It doesn’t follow trends. It builds the rails.

While others fight over take rates, Adyen owns:

The platform

The acquiring of licenses

The terminals

The data layer

Every layer is vertically integrated.

No middlemen. No third-party fees. No excuses.

Margins by design.

No outsourced costs = higher take-home on every transaction.

50%+ EBITDA margins

High merchant retention

Efficient headcount (per dollar processed)

Profitable even at rapid scale

And despite all that, they still reinvest heavily in engineering.

Merchant-first to a fault.

No flashy card programs.

No consumer apps.

No cash-back distractions.

Adyen builds for merchants, period.

It doesn’t chase noise. It compounds trust.

Disciplined when others sprint.

While peers overspent in the zero-rate frenzy, Adyen stayed calm:

Avoided unprofitable merchants

Stayed lean

Kept pricing rational

Grew through product, not promotions

The result? A slower 2023. A stronger 2024. A structurally better decade ahead.

Built in Amsterdam. Priced globally.

Dual-listed, European DNA

Transparent updates

No earnings call theater—just letters, slides, facts

The company culture mirrors the product: efficient, quiet, and highly scalable.

Set & forget because the architecture won’t break.

If you believe:

Payments will keep growing

Digital and physical commerce will blur

Merchants will demand consolidation over complexity

Then Adyen is the quiet backbone worth owning.

Not hyped.

Just built right—and built once.

🔥 Ready to go from reading about great businesses to owning them with conviction?

You’ve just read 9 of the world’s best buy and hold forever companies.

Now imagine what you could do with the full toolkit:

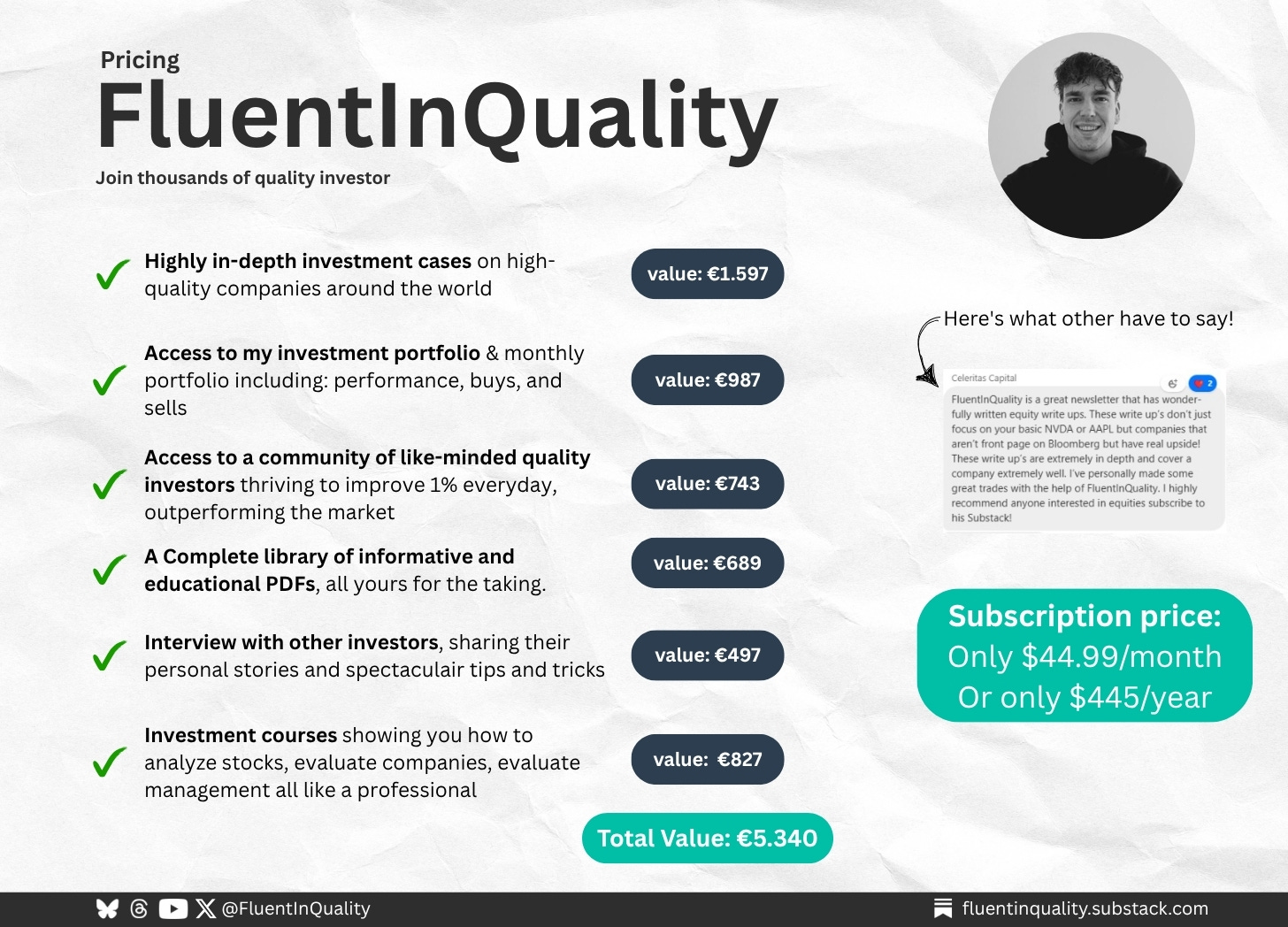

Full research reports and deep dives worth €1,597

My monthly buy/sell portfolio updates (€987)

Private Discord group of high-conviction investors (€743)

Downloadable tools, investor interviews & PDF briefs (€2,013)

Total value: €5,340 — yours for €44.99/month or €445/year.

This isn’t just insight. It’s an edge.

Delivered weekly. Backed by work. Trusted by 1,200+ investors.

🟢 Become one of The Fluent Few.

Let’s build wealth the right way — brick by brick

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds to refer this edition to a friend? It will go a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards like free access to the paid community!

Great investments don’t shout, they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all the charting, analysis, and keeping up with earnings calls. You can now get 15% off your subscription. Click here and start today!

Disclaimer

I do hold shares in some of the companies mentioned in this article. Therefore, I might be biased towards these companies. With every article, I do my utmost to ensure clarity, transparency, honesty, and quality.

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

Waste Management (WM) would be a solid stock as well! I'd have recommended PepsiCo if not for the recent drop which makes it attractive in terms of valuation

Nice list!