January 2025: Portfolio Update

2025 has officially started and the month of January sets the tone for the rest of the year, let us check what tone has been set!

Hi, fellow quality investor! 👋🏻

‘‘How January goes, the rest of the year goes’’

You might have heard this since January.

Did you know this is called the ‘‘January Barometer’’? It suggests that the stock market’s performance in January can indicate how it will perform for the rest of the year. The idea is that if January is positive, the market will likely have a strong year, and if January is negative, the year may be weak.

It’s just a saying, of course, but for our portfolio, it would be lovely to see January’s performance stretched out over the whole year.

January has been nothing shy of being excellent for our portfolio.

In this month’s portfolio update, we’ll go over:

Portfolio Performance

Portfolio Value

Portfolio Holdings

January’s Transactions

Outlook

Happy reading!

If you’ve missed previous updates, you can check those out here. 👇🏻

Portfolio Performance in January

My portfolio is worth €21.379,94, up from € 19.593 the previous month. €300 of this growth is cash I deposited into my brokerage account. I try to deposit between €200 and €400 monthly. When I purchase my new car, this will increase to roughly €500 per month in personal contributions.

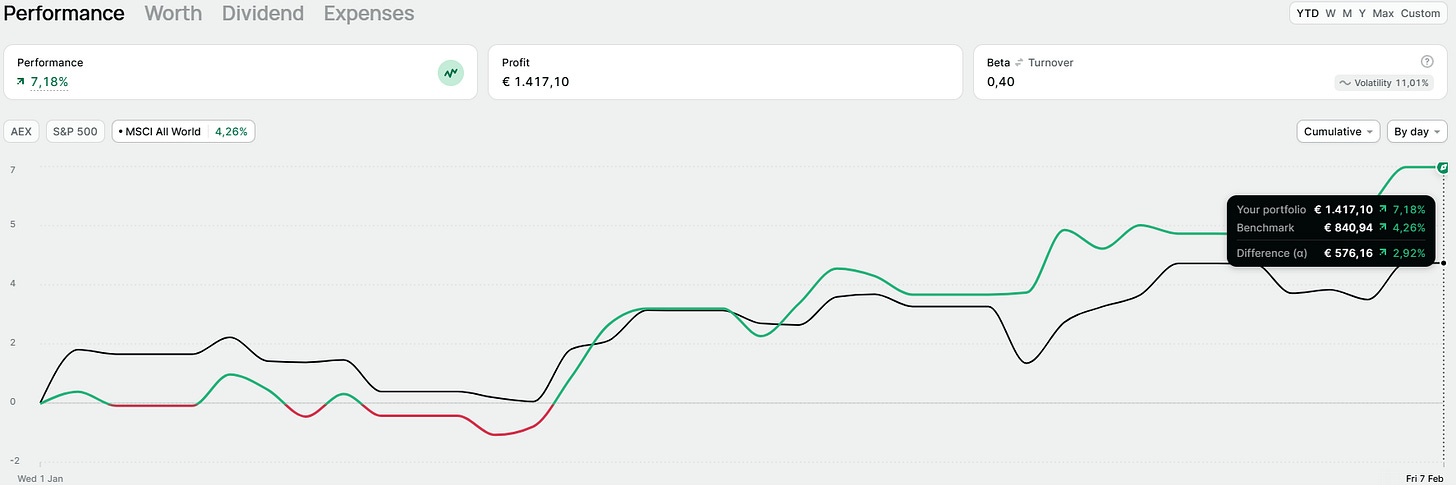

My portfolio is up 7.18% year to date, beating the S&P 500's 2.84% and the MCSI All-World's 4.26%. These returns are mainly the result of two new positions I bought at fair prices that have run up; more on this later.

Here’s a snapshot of my YTD results compared to the MSCI All-World. I’ve questioned why I picked the MSCI All-World, not the S&P 500 and ‘‘benchmark’’. Simply because I have U.S.A. stocks and European stocks in my portfolio, benchmarking this to a tech-driven S&P 500 is unreasonable.

My portfolio has a beta of 0.40 compared to the MSCI All-World Index. This means my portfolio moves less with the index. Moreover, I currently have a high turnover rate due to recent transactions. Currently, my turnover is 24.99% for the month of January. This means that 24.99% of my portfolio was replaced in this month, more on this later.

Portfolio Value in January

Currently, my portfolio is worth €21.374,94, and €14.454,53 is my own contribution through deposits. As I mentioned previously, new positions have been carrying my portfolio YTD, giving me an unrealized gain YTD of €1.424,70. I’m not cheering on this growth at all. I know that timing, luck, patience, and consistency prevail over the long term. Therefore, I have a limited emotional attachment to my overall portfolio growth and my positions. This emotional detachment gives me a slight edge. Why? Because this means that I can drop positions when better opportunities are given by the market without having to doubt. When I started out, I got attached to my positions, and this caused me to miss a couple of opportunities. The tricky part is that getting too detached can cause me to increase my portfolio beta, meaning I’m consistently shifting positions. Luckily, I’ve found a healthy balance and a support beam to help me stay rational as much as possible and prevent me from trying to get on every hype train. I suggest getting a mentor or support beam to avoid making costly mistakes. :-)

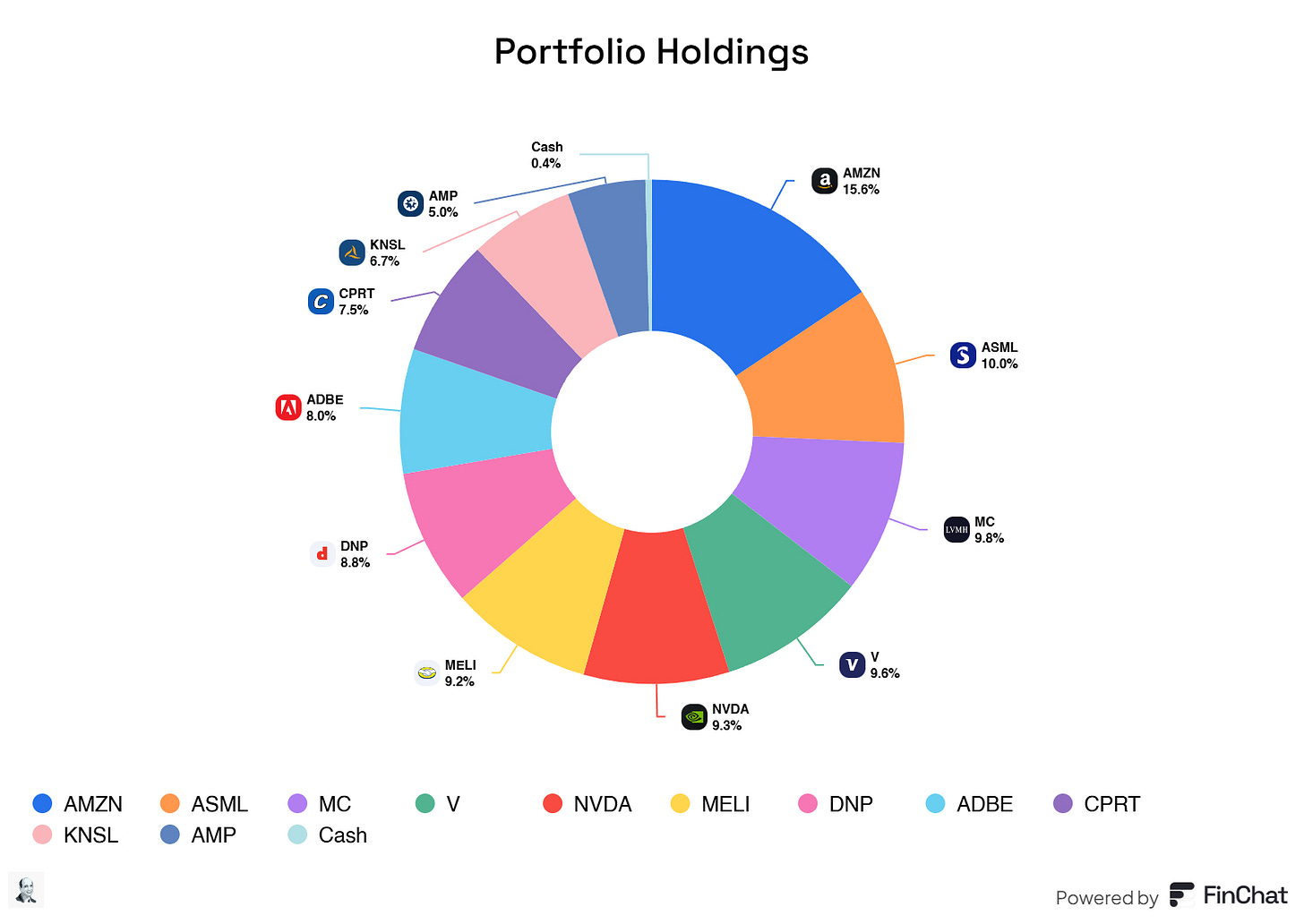

Allocation Breakdown

Those with a keen eye might have noticed that Ulta Beauty left my portfolio and that MercadoLibre and NVIDIA have joined it. Let's review these in brief.

Ulta Beauty is a cannibal of a stock, and the underlying business is still excellent. There is nothing to complain about here. However, I am uncomfortable with the increasing dissatisfaction with management and how employees are reviewing management; sentiment is dropping here. As many of you know, I tend to favor businesses where employees are aligned with management. Ulta Beauty is lacking here. In my humble opinion, growth is stable, but MercadoLibre and NVIDIA offer better growth, and employees are aligned with management, driving more sustainable future growth. Again, with the Ulta business itself, there are no issues; it's solely the management story that I’m uncomfortable with. And that’s the beauty of being a ‘‘retail’’ investor: I can close my position when I feel like the company doesn’t meet my criteria anymore.

MercadoLibre and NVIDIA offered me their stock at a fair value (I’ve had discussions on X debating whether it was fair value, but I deemed them fair value at the prices I bought them at). MercadoLibre is benefiting from immense growth in Latin America, and NVIDIA is benefitting from the increasing CapEx spending of big tech in data, AI, LLMs, data centers, etc. Both companies have tremendous room for growth, and both are well-positioned for sustainable and predictable future growth, giving them a perfect spot in my portfolio.

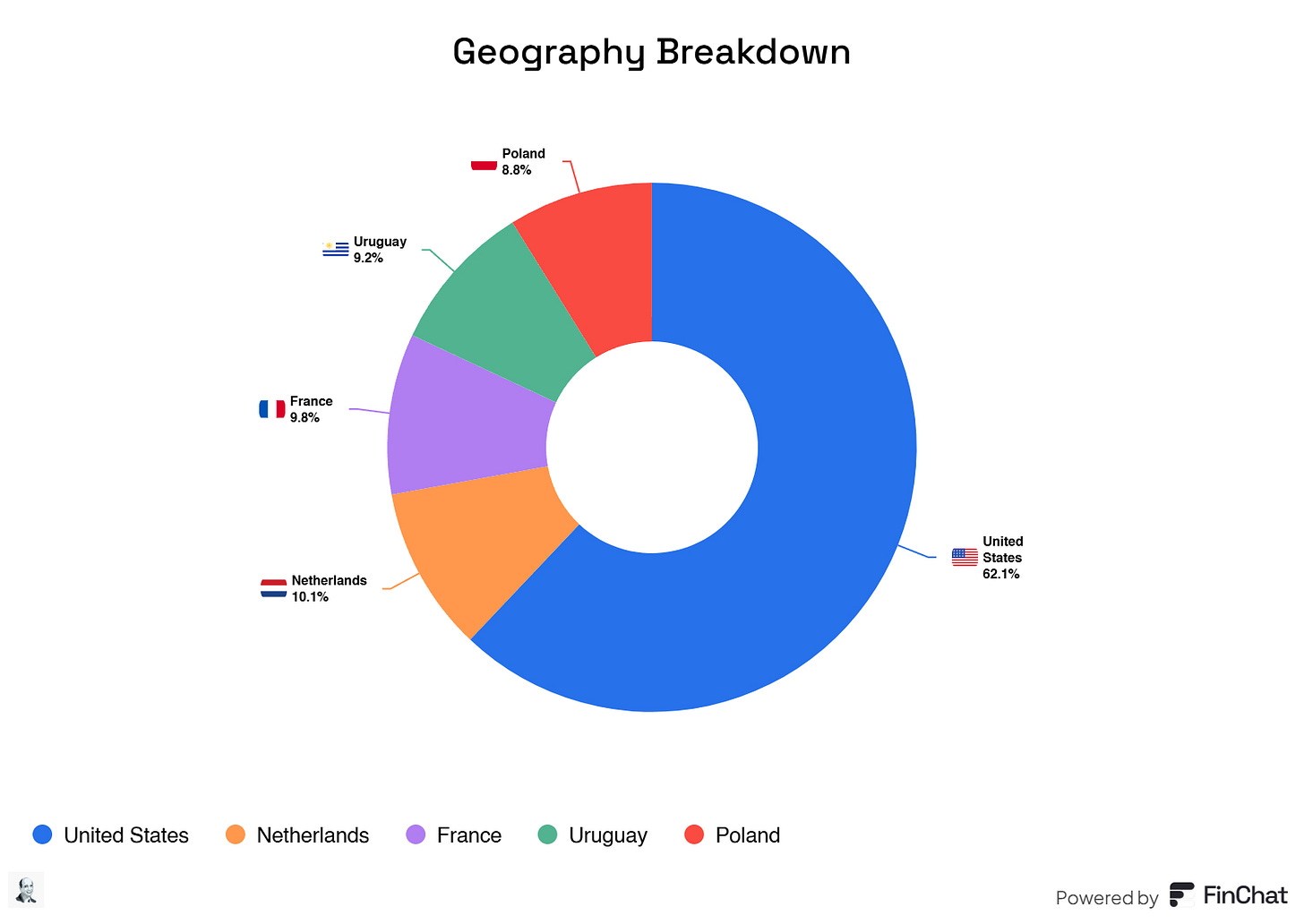

Here’s the geography breakdown of my portfolio

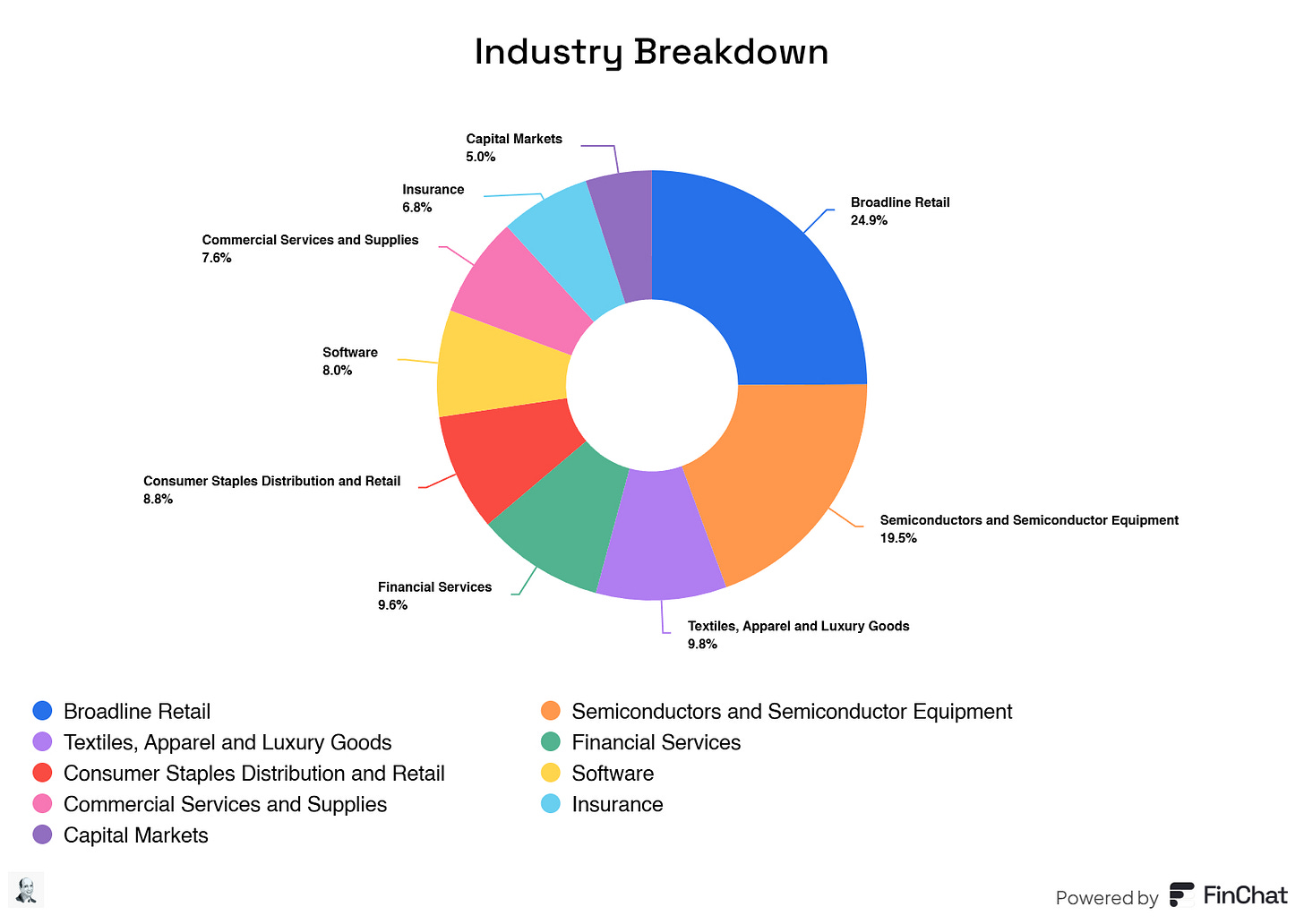

And here’s the sector breakdown of my portfolio:

Portfolio Metrics

The metrics of all the companies I own, averaged out, look beautiful! The returns on assets, invested capital, and equity look solid. Overall, there are excellent margins, low debt, a solid FCF yield, and solid expected revenue and EPS growth.

Transactions of January

In January, I sold out entirely of

Evolution AB

Inter Parfums

Lululemon

Ulta Beauty

In return, MercadoLibre and NVIDIA were added to the portfolio.

Watchlist & Outlook

Currently, there are no stocks on my watchlist that I am actively looking out for. With Trump in office, there will be more volatility in the stock market, which could result in companies coming back on my watchlist, but for now, the stock market is on the pricey side. There are loads of outstanding companies, but the prices linked to these companies, even the ones I currently own, are not the correct prices to either increase my position or make other adjustments.

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.

Could I read up somewhere on the reason you sold Lulu and Evo? I own both.

Love the conviction in Amazon