I Bought This High-Quality Compounder!

In the last five years, this company grew its share price by 22.01%, with an estimated long-term EPS growth of roughly 24%, and a 10-year revenue CAGR of a whopping 40%.

Hi, partner! 👋🏻

I came across this excellent business a while back, but it was too expensive to buy into the company. After following its earning calls for a while, reading its shareholder letter, and finally putting in more effort to truly understand the business, I pulled the trigger. It is still not cheap today, but it is cheap enough for my liking compared to the required return rate that I’m looking for.

I had to close two positions entirely to cover this massive buy. Therefore, I had to dive as deep as possible to justify making this investment and leaving two wonderful businesses behind me. That’s a difficult decision for any investor, including myself.

Without taking more of your time, let’s get into it!

Happy reading!

What Compounder Am I Talking About?

MercadoLibre, ticker MELI.

A quick summary of the business:

MercadoLibre is like Amazon and PayPal in Latin America. It is an online marketplace where people can buy and sell products. MercadoLibre operates in countries like Brazil, Argentina, and Mexico.

Here’s how it makes money:

Marketplace Fees: When people or businesses sell products on MercadoLibre, the platform takes a small cut of each sale. This is a transaction fee for using the marketplace.

Shipping Services (Mercado Envios): These companies offer logistics and delivery services, ensuring items reach buyers. Sellers often pay for these shipping solutions.

Payment Services (MercadoPago): MercadoLibre has its own payment system, similar to PayPal. MercadoLibre earns fees whenever someone uses MercadoPago to pay for items on its platform or elsewhere.

Advertising: Sellers can pay to promote their products on the site, helping them stand out to buyers.

Credit and Loans: MercadoLibre offers loans to small businesses and individuals. They make money from the interest on these loans.

In short, MercadoLibre is more than just an online store – it’s a mix of e-commerce, payment services, and logistics, all wrapped into one, and they earn revenue from every part of this ecosystem.

Why Did I Buy The Stock?

MercadoLibre is at the moment of writing a hyper-growth business. Mercado Libre's revenue was up 35.1% year over year, reaching $5.31 billion and beating the consensus by $30 million. That’s impressive, but it gets even better!

On an FXN basis (so the foreign currencies Mercado Libre gets for its products and services), revenue was up a blistering 103%.

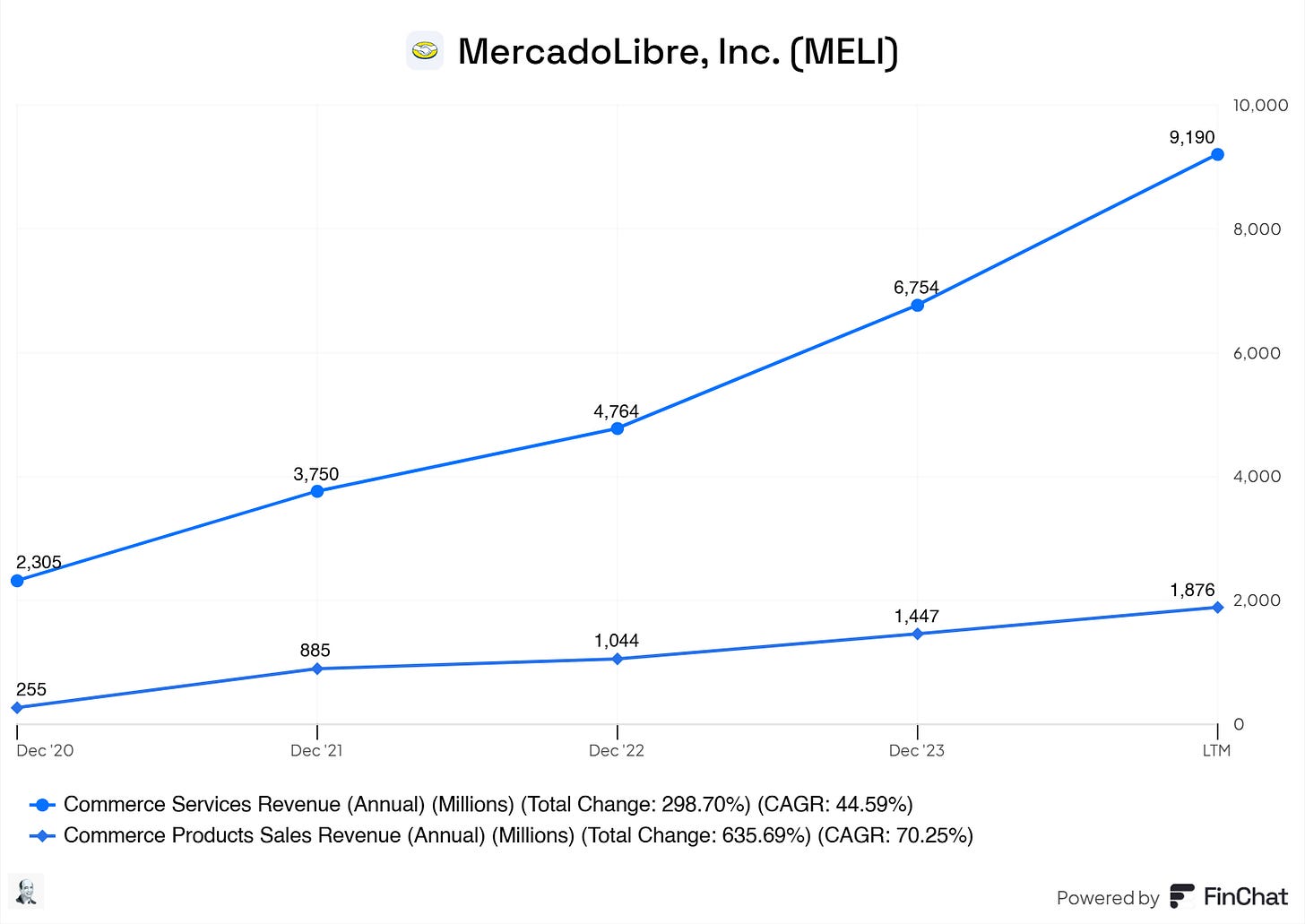

Let us look at their marketplace segment in short.

The gross merchandise volume of MercadoLibre, the value of the items sold on the marketplace, was up 14% yearly. On an FXN basis, this number is 71%. However, due to the extreme headwinds of the currencies in Argentina and Brazil, the real and the peso, the numbers are skewed due to inflation.

The total number of items sold on the marketplace was 455.9M, a 28% year-over-year growth for MercadoLibre. Overall, this is impressive growth.

In addition, MercadoLibre’s Unique Active Buyers have been growing at substantial rates in the last quarters.

More consumers are using MercadoLibre’s platform to sell and buy products, buying more per buyer (as shown below), driving excellent growth for MercadoLibre.

Buying more

Selling more

More new unique customers QoQ

What more can we ask for, right?

Mercado Pago

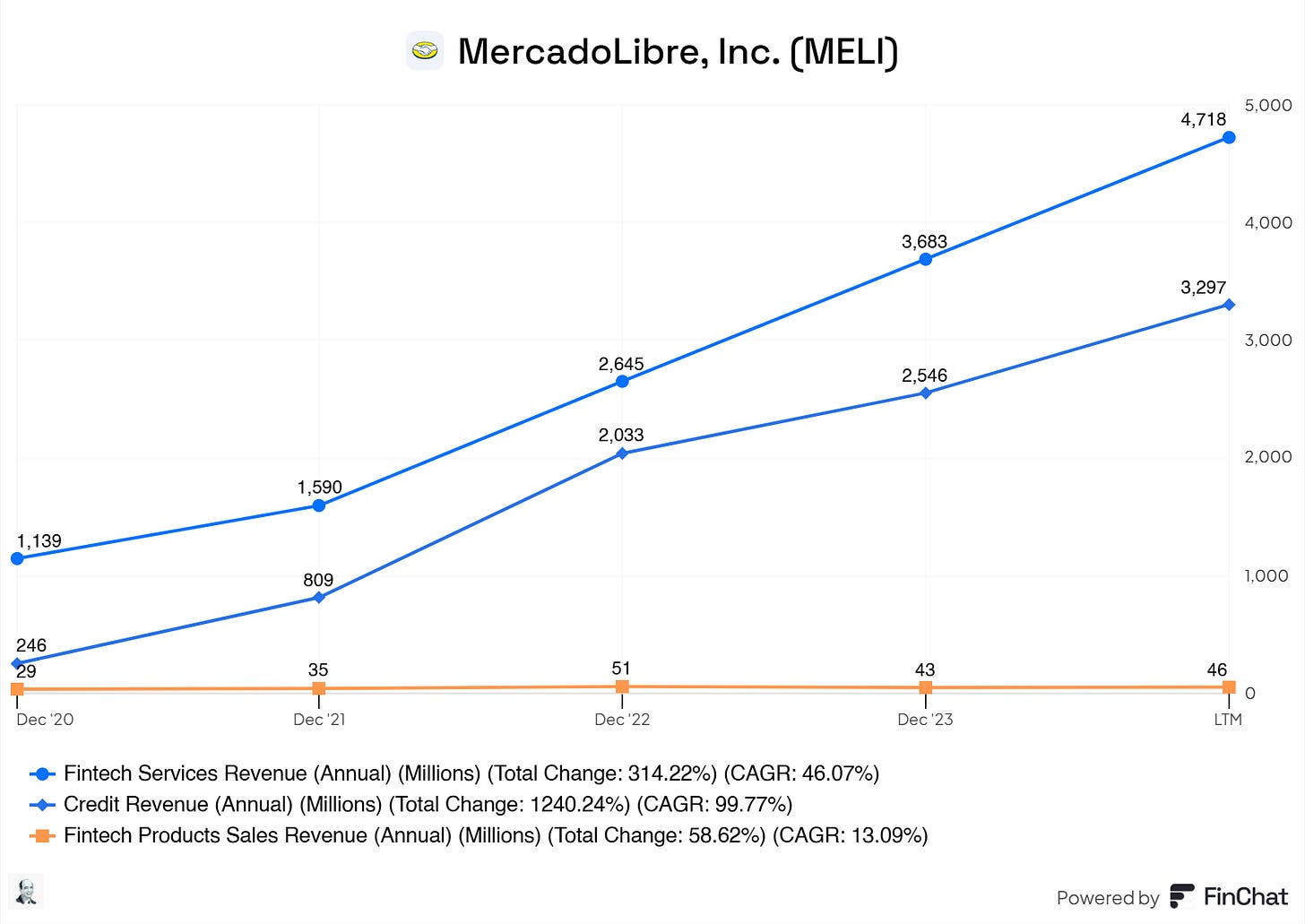

This is the fintech segment of the company. Here, the same picture as in the marketplace can be painted for the business, a lot of growth!

The company saw a whopping 35% year-over-year growth in their fintech segment regarding their monthly active users, something American businesses can solely dream of achieving.

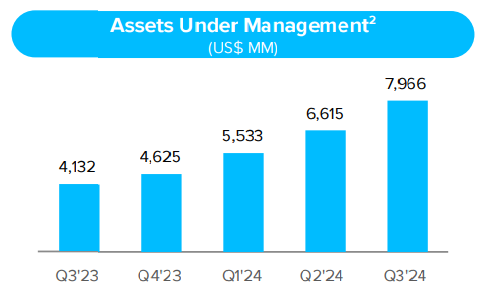

The assets under management, AUM, grew by a whopping 93% year over year! This is unprecedented growth. AUM in Brazil grew at the fastest pace of their three major geographies, and they continue to see strong inflows in Argentina. They continue to see millions of new users of their remunerated accounts, which points to the strength of the value proposition.

The credit portfolio was up 65% year-over-year. Mercado Pago issued 1.5 million new credit cards in Q3, and the credit card TPV grew by 166% compared to last year. Stable asset quality and good accuracy from their credit underwriting models mean they continue to grow the credit portfolio at an accelerated pace, with the credit card growing the most at 172% YoY.

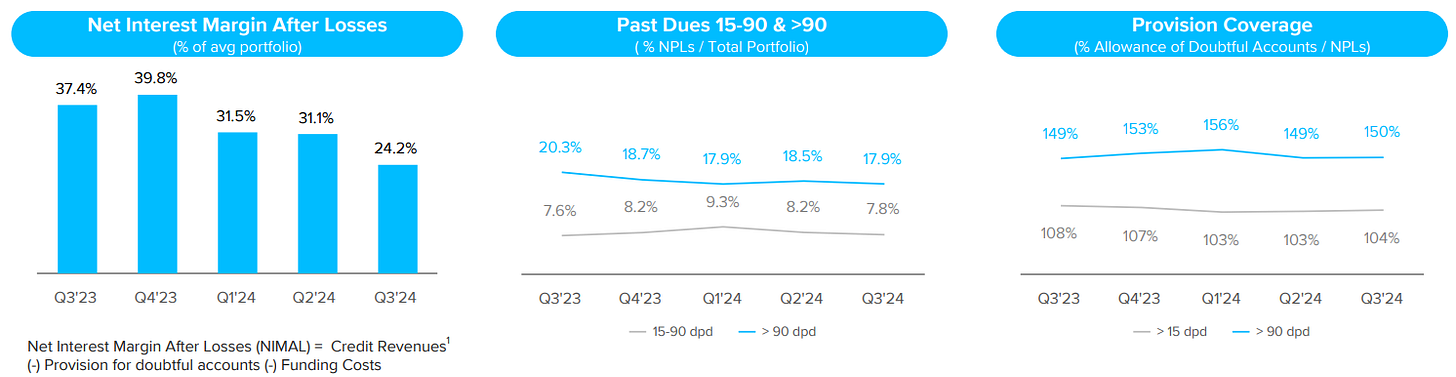

Yes, their net interest margin after losses dropped significantly, but the Fintech president said the following in their latest earnings call.

With regards to NIMAL, yes, NIMAL spread this quarter lost 15% driven by basically three key drivers. The largest one is the ramp-up I'll refer to the minute of the credit card business, whose share in the portfolio rose from 25% a year ago to 39% now. And since this is a lower spread product. This increase in product mix or in credit mix affected NIMAL.

Simply put, the lower NIMAL resulted from the product mix, which is not worrisome!

Mercado Libre remains extremely conservative, with provisions of 150% for loans 90 days or more after the due payment date. Past dues decreased, and the provision coverage (the amount of assets to cover non-performing loans) was 150%.

Acquiring TPV growth of 21% YoY was strong despite FX headwinds across all markets. Growth was robust in Argentina, Brazil, and Mexico. FX-neutral POS growth improved sequentially in Brazil, was still in the triple digits in Mexico, and was well ahead of inflation in Argentina. Cross-selling additional services to its merchants is an important element of its strategy to leverage the MELI ecosystem. Cross-sell of credit rose as a percentage of the merchant base in Q3’24, driven primarily by In-Store merchants across all geographies.

A quick snapshot of their segments.

Overall excellent growth in their Fintech segment!

And also, in their commerce segment, there’s excellent growth.

The margins are declining, but there’s a good reason for this. MercadoLibre is investing in new projects that temporarily impact its margins. Here are some of the projects that MercadoLibre is working on (from their earnings call).

‘‘To increase cross category shopping, we launched a new tool that suggests a new high frequency category for users to shop based on that individual users' profile. This personalized suggestion includes a shortcut button to a category on the home page, a special coupon, a personalized landing page, and push notifications.’’

‘‘In September, we announced plans to more than double the number of fulfillment centers in Brazil by the end of 2025. This means 11 new operations, five of which were added in Q3. These investments will enable us to increase the number of cities where we deliver on the same day in Brazil by 40%. 63% of these operations will be outside of Sao Paulo as we increasingly regionalize our network.’’

In the beauty category, we introduced technology that enables users to see different makeup products apply to their face in our app. This tackles a major barrier to consumers buying makeup online.

In Auto Parts, we launched a new feature that enables buyers to schedule an appointment with the mechanic to install the items they are purchasing, and we ship those items directly to the mechanic.

MercadoLibre is heavily investing in the business for long-term growth and success. Because there’s a good reason for the decline in margins, I’m willing to accept that for now.

I’m here for the long term, and I’ll gladly patiently wait it out with MercadoLibre in my portfolio.

I will not cover every aspect of the business because an investment case is planned for this business.

MercadoLibre is an excellent company overall; I would consider this a high-quality compounder with a long and strong path ahead of itself. I sold out of Evolution AB and Lululemon to cover this position. Evolution has a mid-conviction and less predictable company at its current phase. Lululemon was the same story. Therefore, I put (like I said in the Dev Kantesaria article) my capital on high-conviction ideas like this one.

Yes, both businesses might outperform MercadoLibre, and I will be fine with that (so be it). But now, at least, I know my capital is being used for my higher-conviction idea.

MercadoLibre is officially 8% of my portfolio.

That is it for now. Thank you for reading.

And remember.

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.

Great article. MELI is on my portfolio as well. Thank you.