Welcome back, Fluenteers!

June has officially begun! I started it off with my birthday yesterday, and to make this month even more special, we’re discussing the best buys for this month. These companies have a proven track record, predictable revenues, stellar management, and a robust secular trend, ensuring continued growth for the years to come. You do not want to miss this list.

Here are the best buys of June.

Happy compounding!

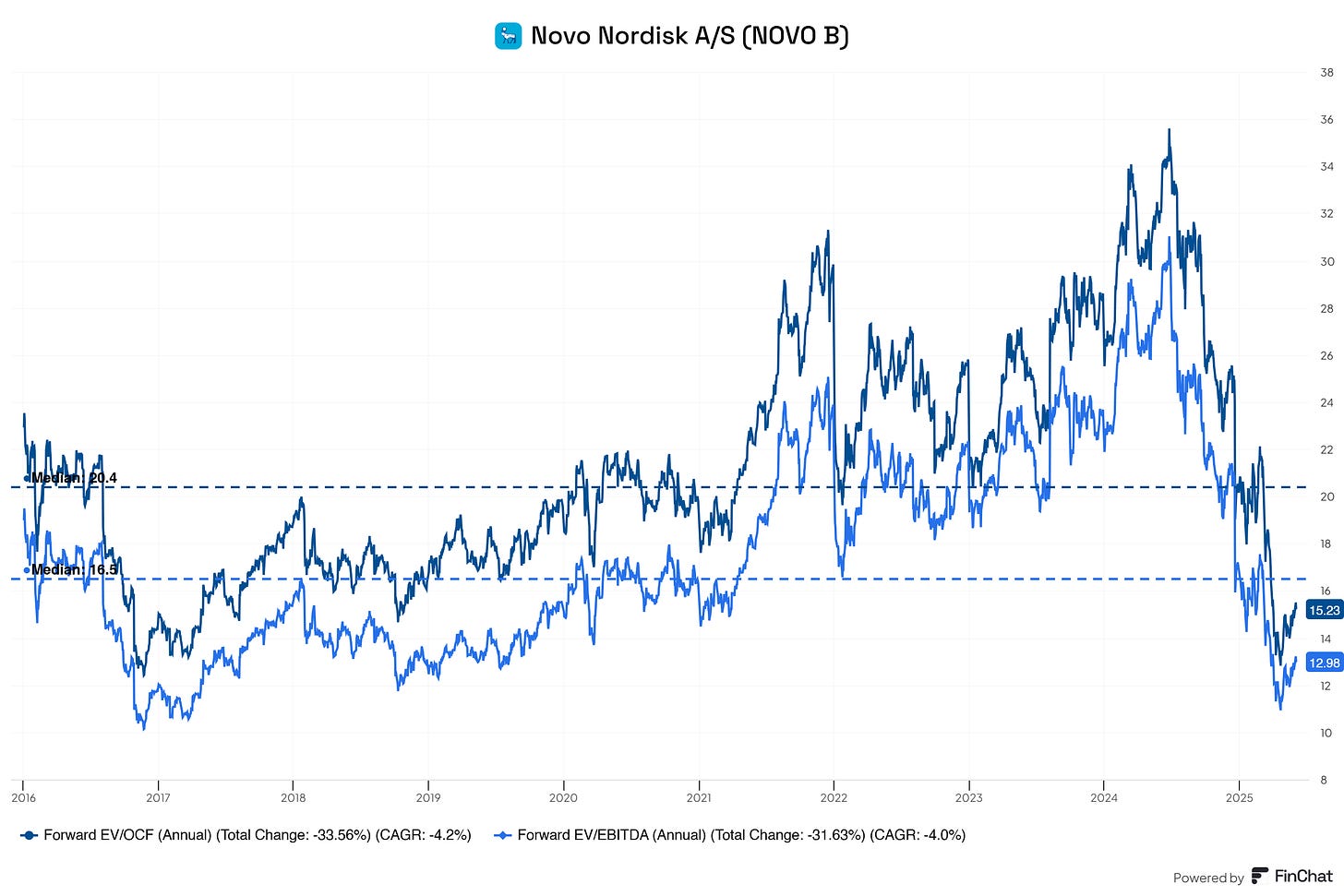

Best Buy #1: Novo Nordisk (Ticker: $NVO)

Live Longer, Live Better. Novo Nordisk is reshaping global health.

Novo Nordisk isn’t just another pharma company.

It’s a purpose-built powerhouse with one mission:

Defeat diabetes and chronic diseases with relentless innovation.

While rivals diversify across therapeutic areas, Novo Nordisk goes deep, relentlessly advancing metabolic health through:

Best-in-class diabetes care

Game-changing GLP-1 therapies

Long-term R&D in obesity and rare diseases

This isn’t about pills. It’s about impact, access, and scientific excellence.

A pipeline designed with a purpose.

Novo’s strength lies in focus, and it shows in the data:

Semaglutide (Ozempic, Wegovy): A category-defining GLP-1

Obesity treatment: Addressing a $100B+ global problem

Insulin: Still innovating after a century of leadership

Early-stage pipeline: Cardiovascular, NASH, Alzheimer’s

This isn’t chasing fads. It’s building solutions that last.

Trust, not hype.

Novo isn’t a hype-driven biotech. It earns its premium by staying disciplined:

Consistent operating margins above 40%

20+ years of uninterrupted dividend payments

Vertical integration from R&D to manufacturing

Heavy reinvestment in data, trials, and education

While others talk growth, Novo delivers sustainability.

Global reach. Local relevance.

With operations in 80+ countries, Novo adapts without diluting:

Affordable insulin in low-income markets

Tiered pricing and access programs

Education partnerships with physicians and health systems

Direct-to-consumer obesity awareness campaigns

Healthcare isn’t one-size-fits-all. Novo builds bridges, not walls.

Obesity is a megatrend, and Novo is leading it.

GLP-1s are changing the game—and Novo is years ahead:

First-mover advantage in a rapidly expanding market

Real-world outcomes: weight loss, lower A1C, cardiovascular benefit

Expanding manufacturing capacity to meet insatiable demand

Clinical trials now targeting kidney disease, dementia, and more

What started with diabetes could redefine modern medicine.

Understated, overperforming.

Novo doesn’t scream. It compounds:

Ranks among Europe’s most valuable companies

Robust free cash flow and low debt

Steady buybacks and shareholder-friendly policies

Relentless focus on return on invested capital

It’s not about growth at all costs—it’s growth with conviction.

A business with leverage inside.

Every success in one area strengthens another:

Diabetes → Obesity

Obesity → Cardiovascular

GLP-1 platform → Multiple indications

Global brand → Local trust

Each breakthrough feeds the flywheel.

Novo Nordisk stands apart.

Not because it’s the flashiest.

But because it’s:

Mission-driven

Financially elite

Operationally flawless

Deeply trusted by physicians and patients alike

While others dilute or diverge, Novo stays focused and flourishes.

It’s not just medicine. It’s longevity, powered by purpose.

Novo isn’t for every investor.

But if you believe healthcare can be profitable, precise, and principled, this is one you should know by name.

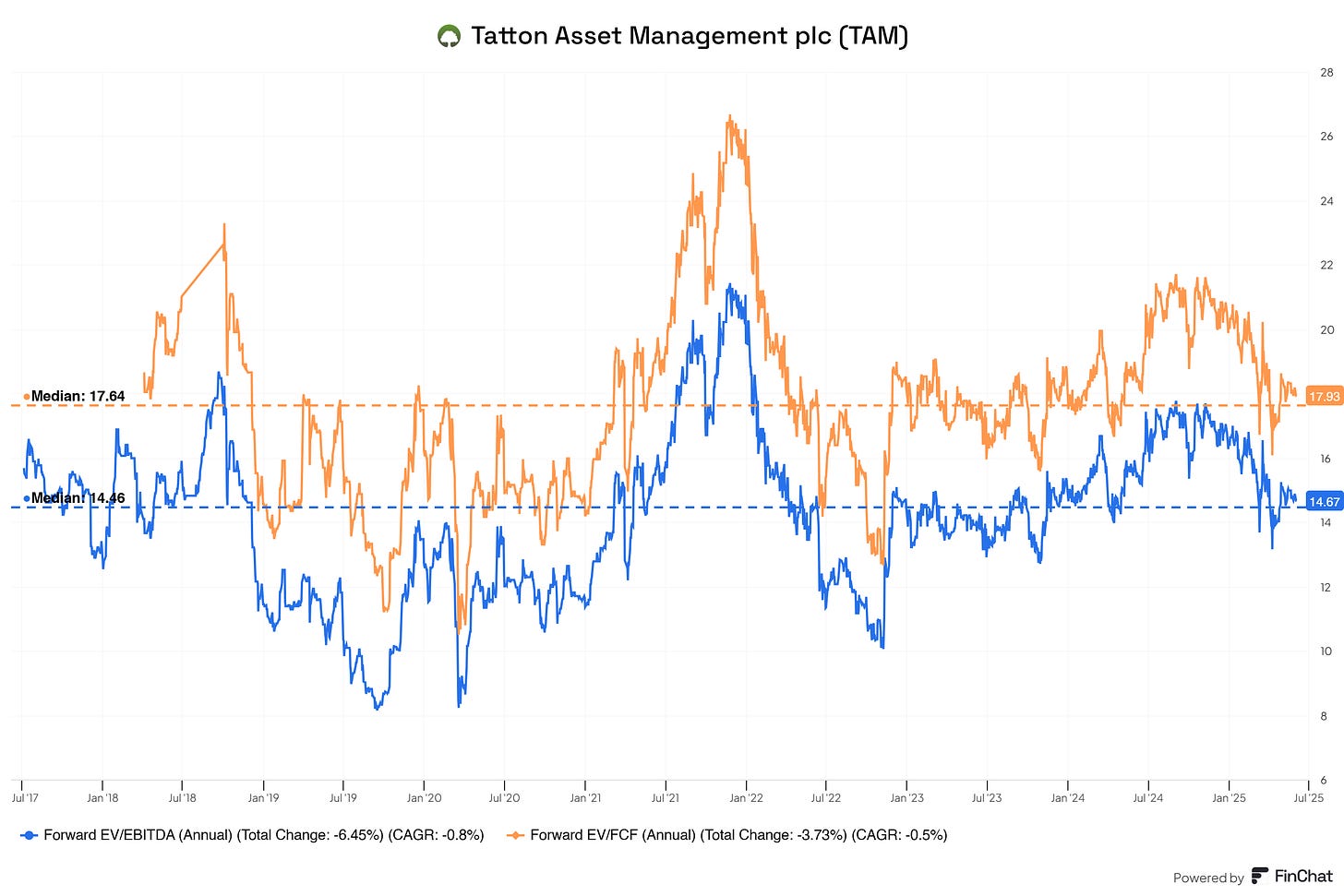

Best Buy #2: Tatton Asset Management (Ticker: $TAM)

Tatton isn’t just another asset manager.

It’s a quietly compounding business built around one belief:

Financial advice should be accessible, efficient, and independent.

While legacy players cling to outdated models, Tatton simplifies the stack:

Platform-agnostic portfolios

Scalable DFM (Discretionary Fund Management) services

Low-cost, high-touch support for IFAs

This isn’t Wall Street flash. It’s a UK-based discipline with an advisor-first edge.

Built for advisors. Tuned for scale.

Tatton’s model is lean by design:

No direct-to-consumer conflicts

Serves 900+ IFA firms across the UK

17.6 bn+ in AUM and growing

Offers model portfolios, ESG options, and retirement strategies

IFAs keep the client. Tatton does the heavy lifting.

Recurring. Predictable. Profitable.

Tatton doesn’t chase performance fees or exotic risk.

Its revenue engine is simple and resilient:

~85%+ of revenue is recurring

High client retention

Minimal capital requirements

Operating margins ~45%

In a volatile world, that kind of visibility is rare and valuable.

Light touch, deep trust.

Advisors use Tatton because it saves time and earns trust:

Seamless portfolio integration across platforms

Consistent outperformance vs. passive benchmarks

FCA-aligned risk profiling

Ongoing support and compliance help

It’s not just software. It’s service with soul.

Bigger forces at play.

Tatton sits at the crossroads of three structural tailwinds:

Regulatory pressure: IFAs need compliant, scalable solutions

Advisor consolidation: Outsourced investment management becomes a must

Aging population: Growing need for retirement advice and steady portfolios

Tatton doesn’t need to chase the future—it’s already positioned for it.

Compounding with class.

While fintechs burn and pivot, Tatton compounds:

Debt-free, cash-rich balance sheet

High ROCE with low capital intensity

Consistent dividend growth

Bolt-on acquisitions to expand reach without diluting the model

It doesn’t shout. It stacks quietly and effectively.

There’s leverage inside.

Every IFA added increases lifetime value:

More AUM with zero marketing cost

Cross-sell with Paradigm (compliance & mortgage services)

Operating leverage as scale increases

Optionality for future fee models or B2B tools

This is a flywheel hidden in plain sight.

Tatton stands apart.

Not because it’s the biggest.

But because it’s:

Trusted by advisors

Loved by clients

Efficient by design

Predictable in its growth

While asset managers wrestle with redemptions and reinvention,

Tatton just grows—slow, steady, and sticky.

It’s not just fund management. It’s infrastructure for the modern IFA.

But if you believe simplicity, trust, and recurring revenue still matter, this might be your kind of business.

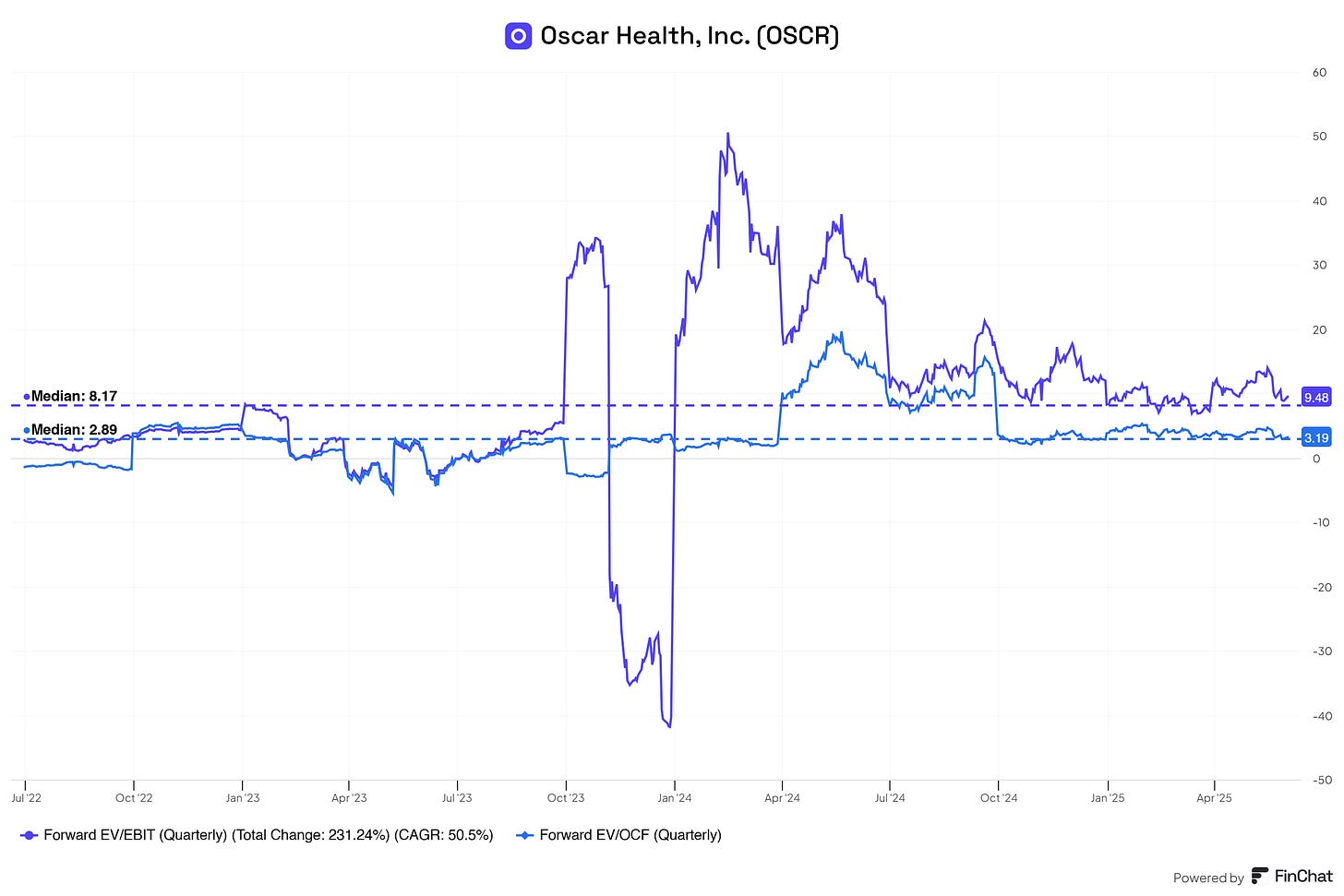

Best Buy #3: Oscar Health, Inc. (Ticker: $OSCR)

Oscar Health is rethinking what insurance feels like.

Not just policies. A platform. A partner. A product people actually like using.

Born in a broken system, Oscar is doing something radical:

Making health insurance human.

Where most insurers hide behind paperwork, Oscar builds:

Intuitive tech for members and providers

Real-time support, not 2-hour hold music

Smarter networks that lower costs without cutting care

This isn’t just about healthcare access. It’s about healthcare experience.

Software where there used to be silence.

Oscar’s edge isn’t branding. Its infrastructure:

A full-stack insurance platform built in-house

Scalable claims engine and care routing

Smart engagement tools that improve outcomes

Modular technology now powering external partners via +Oscar

They’re not just selling plans. They’re licensing the future.

Small footprint. Outsized ambition.

Oscar’s membership is concentrated but growing:

1M+ members across Individual, C+O, and Medicare Advantage

Top share in ACA marketplaces like Texas and Florida

Employer group plans on the horizon

Expanding revenue via platform deals with names like Health First

Each new state or partnership brings flywheel effects.

Not profitable yet—but getting surgical.

Oscar spent years building the rails. Now the focus is on tuning:

Medical Loss Ratio (MLR) down

Admin costs falling due to automation

Underwriting precision is improving every quarter

Narrowed loss in 2024, aiming for full profitability in 2025

They’re not scaling chaos. They’re scaling control.

Why now? Because healthcare is finally changing.

Three shifts, Oscar is riding with precision:

Digital-native patients who expect seamless care

ACA stabilization and Medicaid expansion

Health systems seeking better data and more aligned payers

Oscar’s model doesn’t resist these trends. It enables them.

The tech is working. The timing is right.

Most insurers can’t build software.

Most tech companies lack a comprehensive understanding of healthcare.

Oscar lives in both worlds—and that’s its moat.

90%+ of claims are auto-adjudicated

Member NPS scores that crush industry norms

Platform revenue that scales faster than membership

Leadership that combines health policy, actuarial rigor, and design thinking

It’s messy. But it’s moving.

Oscar isn’t the safe choice.

It’s the one you make when you believe the system has to change—and someone’s finally figured out how.

Not for value investors.

Not for yield chasers.

But if you bet early on platform-first plays,

Oscar deserves your attention.

Not just a health insurer.

A user experience company in a $4T industry that forgot what users even are.

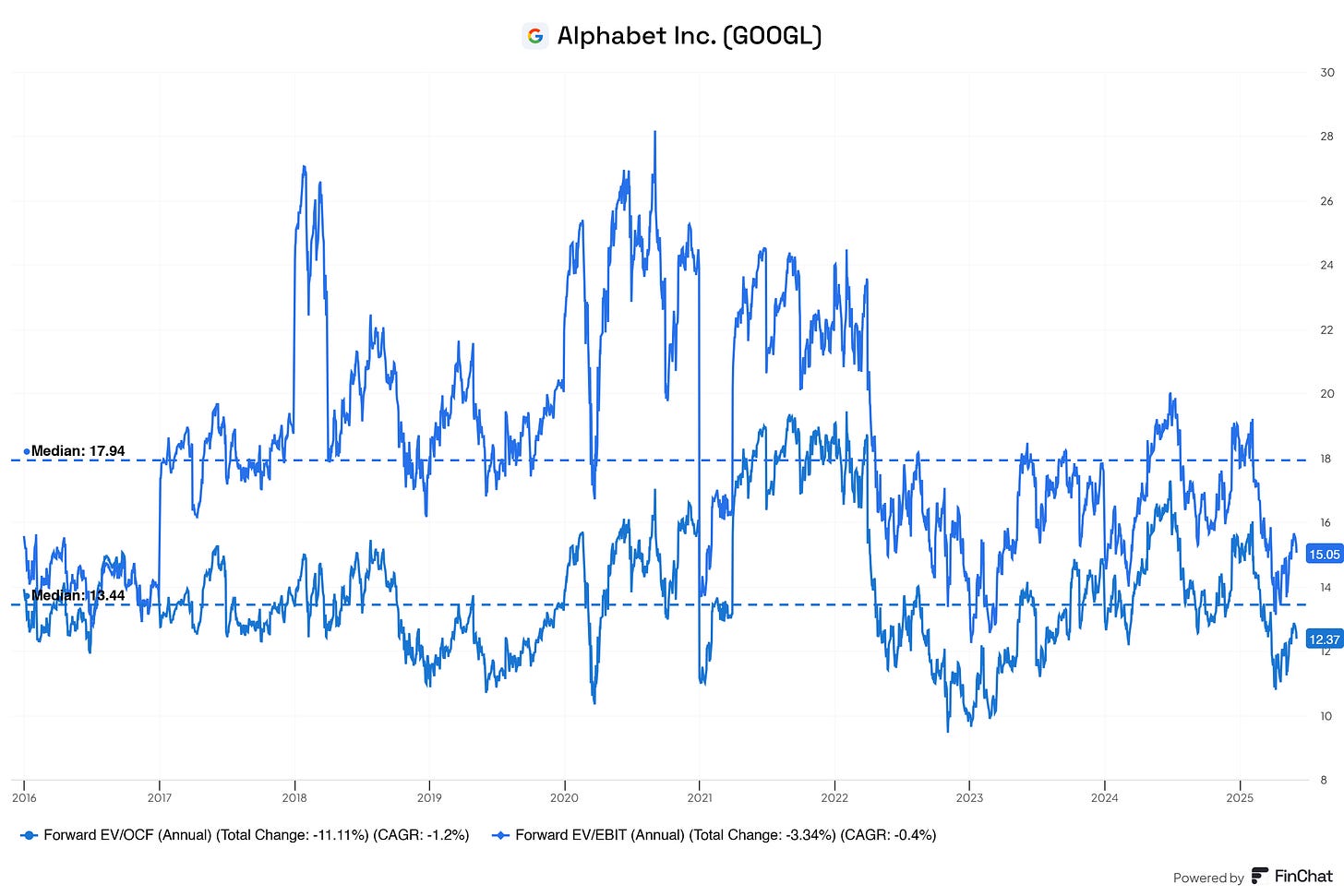

Best Buy #4: Alphabet Inc. (Ticker: GOOG/GOOGL)

Yes, I’ve previously mentioned GOOGL 0.00%↑ . But it’s worth mentioning again.

Google doesn’t chase attention. It organizes the world.

At its core, Alphabet is still what it started as:

An information infrastructure company.

But what once meant ten blue links on a webpage,

now means:

Organizing the internet

Hosting half the cloud

Powering global devices

Running the rails of AI itself

Google Search was the gateway.

The rest? Compounding dominance at scale.

Cash cow with compute muscle.

Search and YouTube print the cash.

But Alphabet reinvests relentlessly:

AI supercomputing via TPU and DeepMind

YouTube is the second-largest video engine on Earth

Google Cloud is quietly taking the B2B share

Android in 3B+ hands with embedded monetization

This isn’t a one-trick pony.

It’s a platform of platforms—each one sticky, scaled, and essential.

Not just advertising. Algorithms with an edge.

Google doesn’t just sell impressions. It sells intent.

World-leading data set of human behavior

Performance-maximizing ad tools for SMBs to Fortune 500s

Search is still dominant despite years of challengers

AI-enhanced results surfacing faster, better, and more personally

Every click sharpens the model.

Every query improves the moat.

AI-native, not AI-reactive.

Alphabet didn’t pivot into AI. It helped invent it.

DeepMind’s AlphaFold cracked protein structures

Gemini is their answer to large language models

Google Photos, Gmail, Maps—already infused with AI

TPU hardware is built to run internal models faster than off-the-shelf chips

They’re not bolting AI onto the side.

They’re running AI through the core.

Optionality in plain sight.

Alphabet has quietly stacked levers of future growth:

Waymo (autonomous driving) scaling in Phoenix and SF

Verily (health tech) focused on clinical-grade data

Google Workspace is winning corporate hearts post-Zoom

Cloud absorbing legacy IT budgets across sectors

Some will flop. Some will fly.

But even one hit could be another billion-dollar business.

Financials that fund everything.

What happens when a company has:

$80B+ in annual free cash flow

55%+ gross margins

Zero debt

$10B+ in cash

They invest in decade-long bets—

and don’t need your permission to wait.

Alphabet doesn’t need hype.

Its products already run the modern world.

Search. Android. YouTube. Chrome. Gmail. Docs. Maps. Photos.

Ubiquity doesn’t need reinvention. It just needs reinforcement.

This isn’t a turnaround story.

This is foundational infrastructure for the digital age,

still innovating from a position of absurd strength.

If you want moonshots, go elsewhere.

If you want deep moats and cash-fueled optionality,

Google’s been doing that since before it was cool.

Best Buy #5: Salesforce (Ticker: $CRM)

Salesforce doesn’t sell software. It sells certainty.

In a world drowning in data and disconnected tools,

Salesforce brings it all together.

It started with CRM.

Now, it’s the operating system for a customer-centric business.

Sales

Service

Marketing

Commerce

Analytics

AI

One platform. Every customer touchpoint.

The cloud was step one. Integration was step two.

Salesforce mastered the vertical stack:

Build once, serve every industry.

Then it bought the horizontal puzzle pieces:

Slack for communication

MuleSoft for integrations

Tableau for data clarity

Heroku for developers

ExactTarget and Pardot for marketing reach

Now it’s not just one product. It’s gravity.

From licenses to lifetime value.

Salesforce thrives on long-term relationships, not one-time sales:

90%+ revenue is subscription-based

Net revenue retention above 100%

Multicloud adoption = deeper wallet share

Gross margins that fund aggressive innovation

This isn’t project work. It’s embedded infrastructure.

AI-native from the inside out.

Every Salesforce product is getting smarter:

Einstein → predictive sales, automated support

AI-generated insights directly into dashboards

Code-free automation for non-technical users

Slack GPT for faster internal decision-making

It’s not AI for show. It’s AI where work actually happens.

Enterprise-first, but everywhere.

Salesforce owns the high ground in enterprise SaaS:

Fortune 500 penetration is off the charts

Trusted in regulated sectors like healthcare and finance

Expanding internationally while keeping churn low

Strong partner ecosystem of consultants and integrators

It’s not just in the building. It is the building.

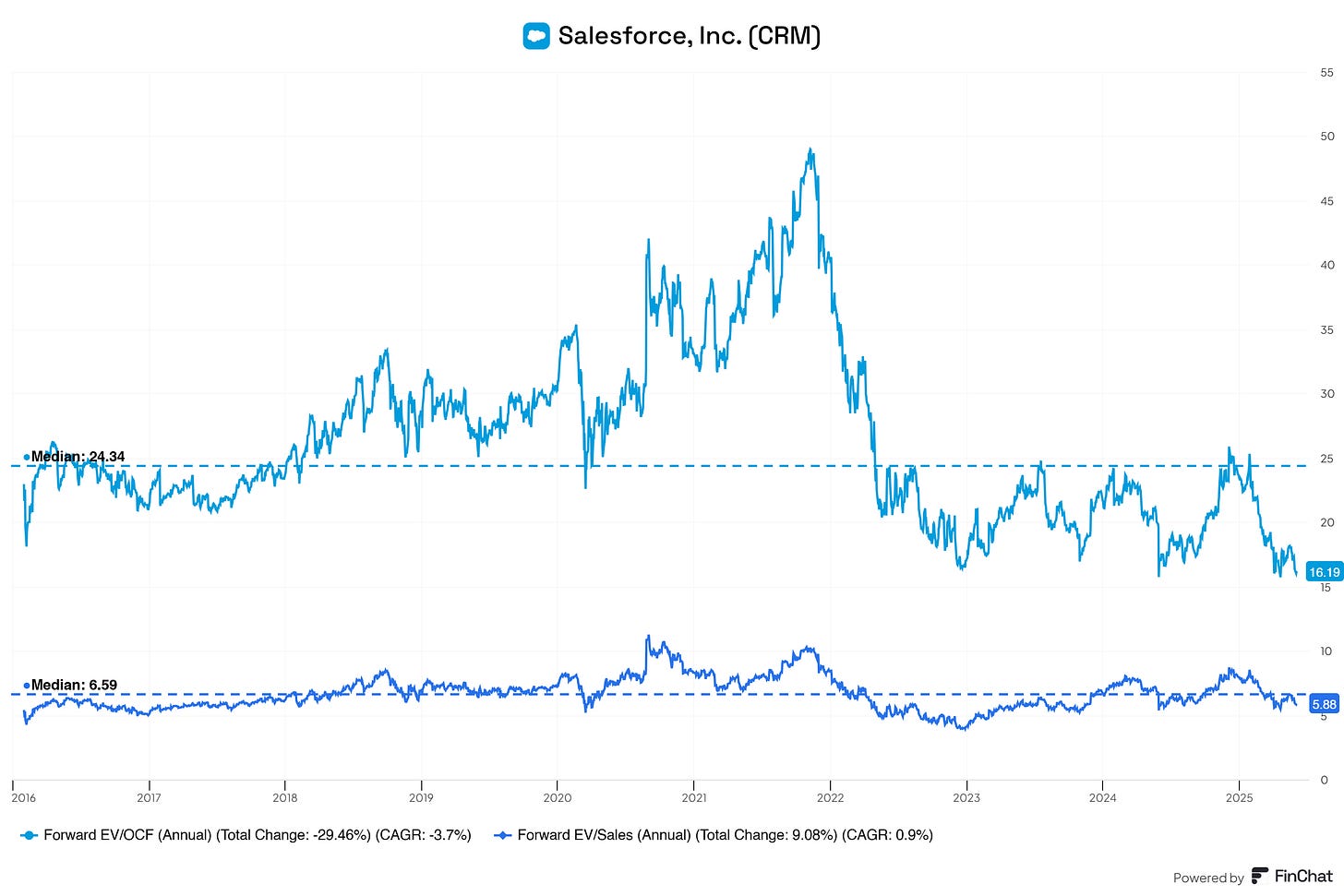

From growth story to cash machine.

For years, Salesforce prioritized scale.

Now it’s showing discipline:

Operating margins expanding

Share buybacks initiated

Profitable across segments

Focus on ROI and shareholder returns without sacrificing vision

The rocket is in orbit. Now it’s optimizing fuel.

Salesforce stands out by stitching it all together.

Most software solves one slice of the problem.

Salesforce unifies the full experience—from lead to loyalty.

Trusted brand

Embedded deeply

Platform leverage

Constant iteration

It compounds through connection.

This isn’t just enterprise software.

It’s a blueprint for how modern companies operate.

If you believe the future of business is digital, integrated, and AI-enhanced—

Salesforce isn’t riding the wave.

It’s building the tide.

Read the best buys of the previous months. There are still tremendous opportunities waiting to be taken advantage of by you! 👇🏻

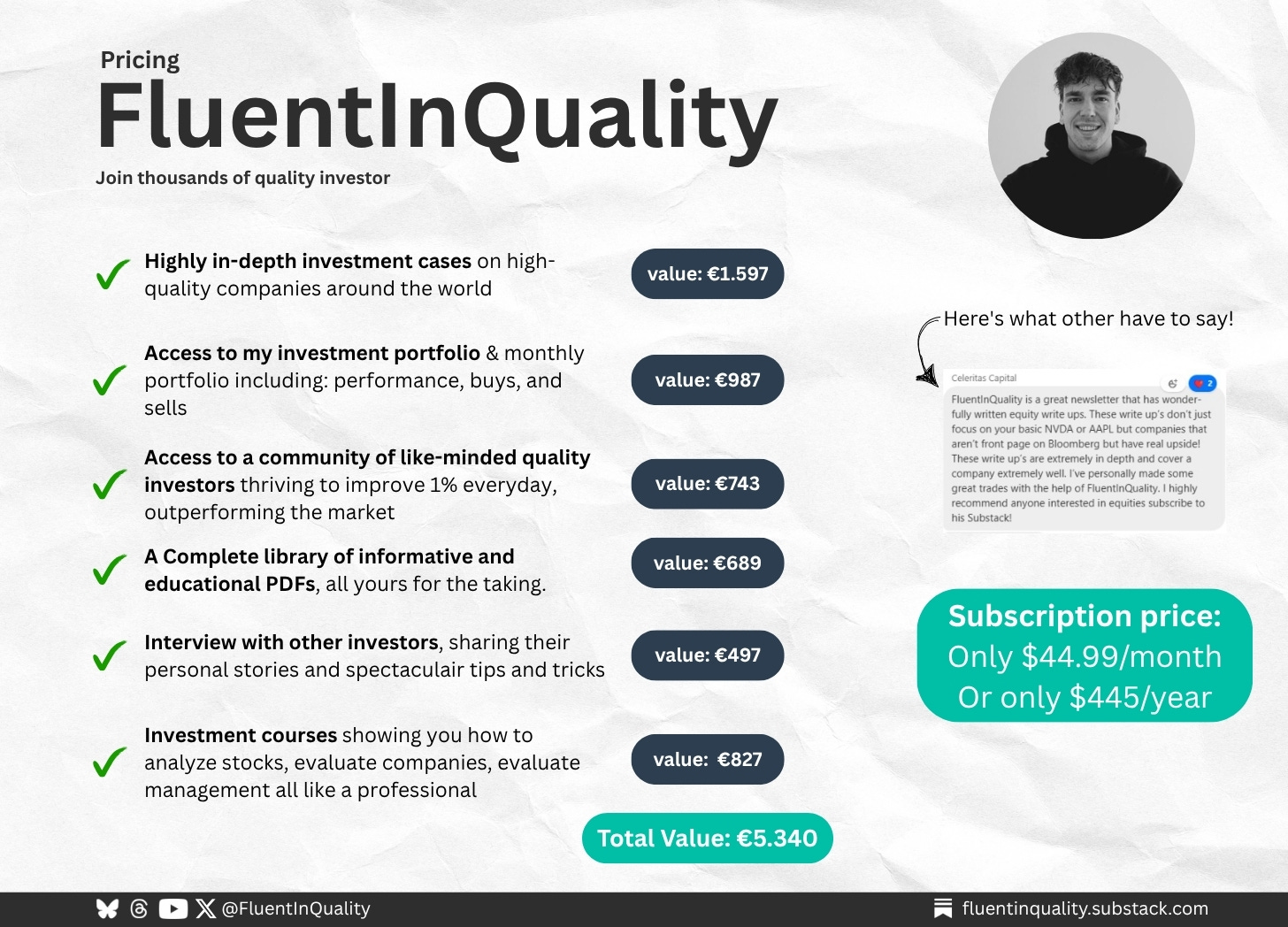

🔥 Serious About Investing? Let’s Get to Work.

You’ve read the free stuff.

Now imagine what you could do with everything behind the paywall:

✅ In-depth investment breakdowns worth €1,597

✅ Access to my monthly portfolio: performance, buys, and sells (€987)

✅ A private community of like-minded investors (€743)

✅ Downloadable PDFs, tools, investor interviews, and more (€2,013 total)

Total value: €5,340 — Yours for just €44.99/month or €445/year.

This is not just information. It’s insight, strategy, and confidence — delivered weekly.

🟢 Join The Fluent Few and unlock your edge.

And that is it for today!

P.S.… if you’re enjoying FluentInQuality, could you take 3 seconds to refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more Fluenteers into the world).

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all the charting, analysis, and keeping up with earnings calls. You can now get 15% off your subscription. Click here and start today!

Disclaimer

I do hold shares in Google, and I intend to buy shares in Tatton Asset Management in the future.

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

Excellent analysis of Novo Nordisk !!!! (I have it in my PTF). In my opinion, A key factor for income-focused investors will be whether its dividend growth rate (DGR) can keep pace with earnings, or if capital will be prioritized for R&D and expansion.

Novo remains interesting. I started my position in April and it's still at a decent price imo