Top 5 Stocks For May

May has begon and the market is offering excellent opportunities. Here are five of the best opportunities for May.

May has only been around for nine days, and the market already offers investors opportunities with significant upside potential.

There’s significant greed in the equities market right now. The fear and greed index scores 63 as of writing this. We must be greedy, alongside everyone else, right now. We’ve all heard the famous quote ‘‘be greedy when others are fearful, and be fearful when others are greedy,’’ which is valid to a large extent. But there are asymmetric opportunities in the market right now, and we need to be greedy like the rest.

Here are five opportunities that need our greedy mindset.

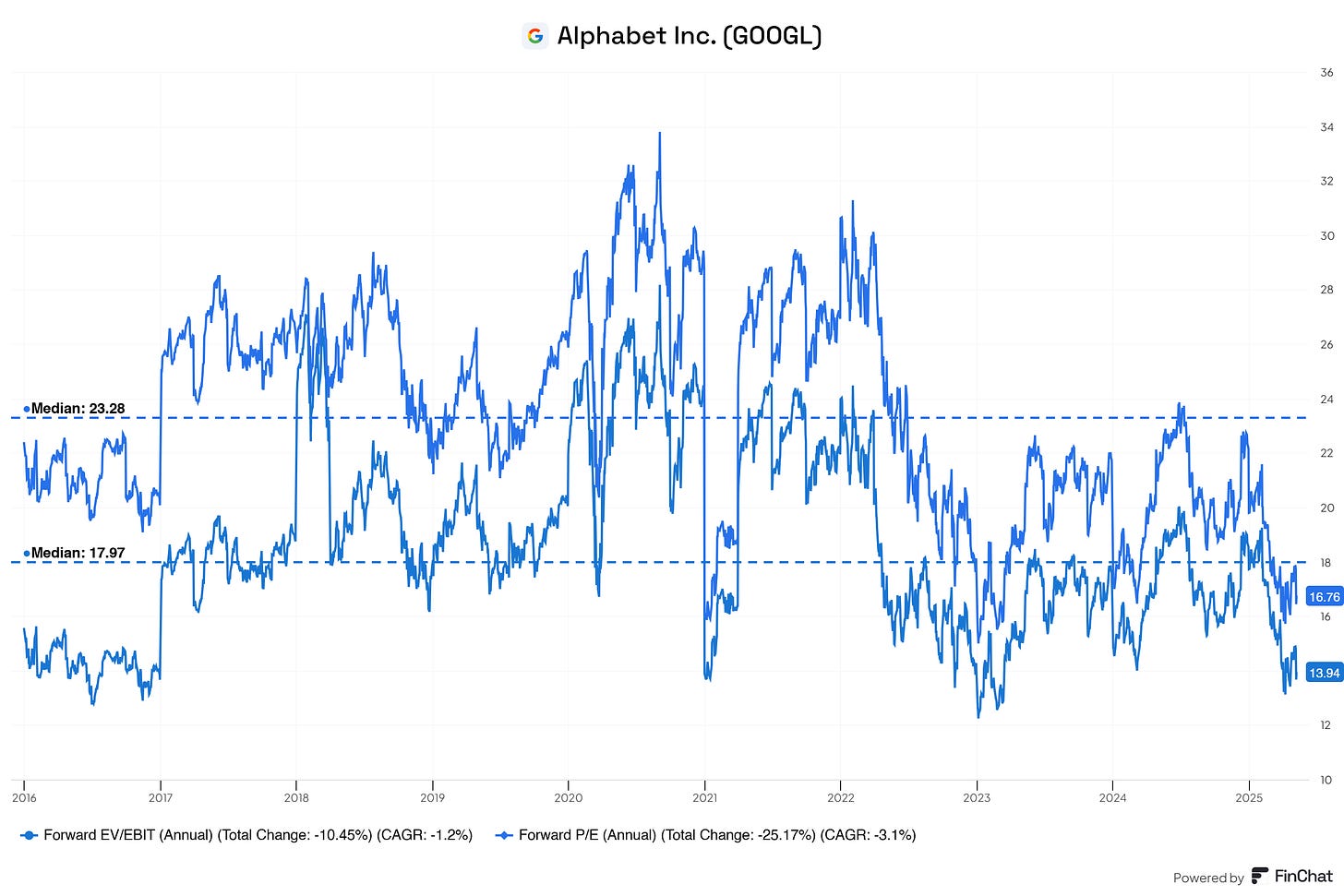

Opportunity 1#: Alphabet (Ticker: GOOGL)

People think Alphabet is just a search engine. That’s the mistake.

Yes, Google Search still dominates.

Yes, YouTube eats up global screen time.

But Alphabet’s strength isn’t any single product—it’s the layered control over distribution, data, and digital infrastructure.

This isn’t a company competing for traffic. It owns the roads.

And with AI shifting into the mainstream, Alphabet’s foundational advantage is becoming even more pronounced.

Core businesses are still wildly profitable.

Search is the cash engine—with 80%+ gross margins and billions of daily queries.

YouTube monetizes intent and attention, reaching over 2.7 billion users monthly.

Google Cloud is finally profitable—and growing faster than Azure in some sectors.

Android powers 70%+ of smartphones worldwide, quietly reinforcing ecosystem dominance.

Chrome, Gmail, and Maps serve as daily-use gateways into a data-rich feedback loop.

AI is not new here—it’s native.

DeepMind has been building leading-edge models long before ChatGPT was a thing.

Gemini is being deeply integrated into Search, Workspace, and Android.

Google already has billions of users to distribute AI products to—no need to “acquire” customers.

It’s not just growth—it’s optionality.

Google Cloud expands into enterprise AI and cybersecurity.

Waymo continues to push forward in autonomous mobility.

YouTube is building shoppable video, live sports, and streaming bundles—all inside a platform it owns.

And with $100B+ in cash, Alphabet can fund R&D, buy back stock, or make bold acquisitions—without blinking.

In short:

Alphabet isn’t following the trend.

It’s been building the backbone of the internet—and now AI—since day one.

Still dominant. Still evolving. Still underrated.

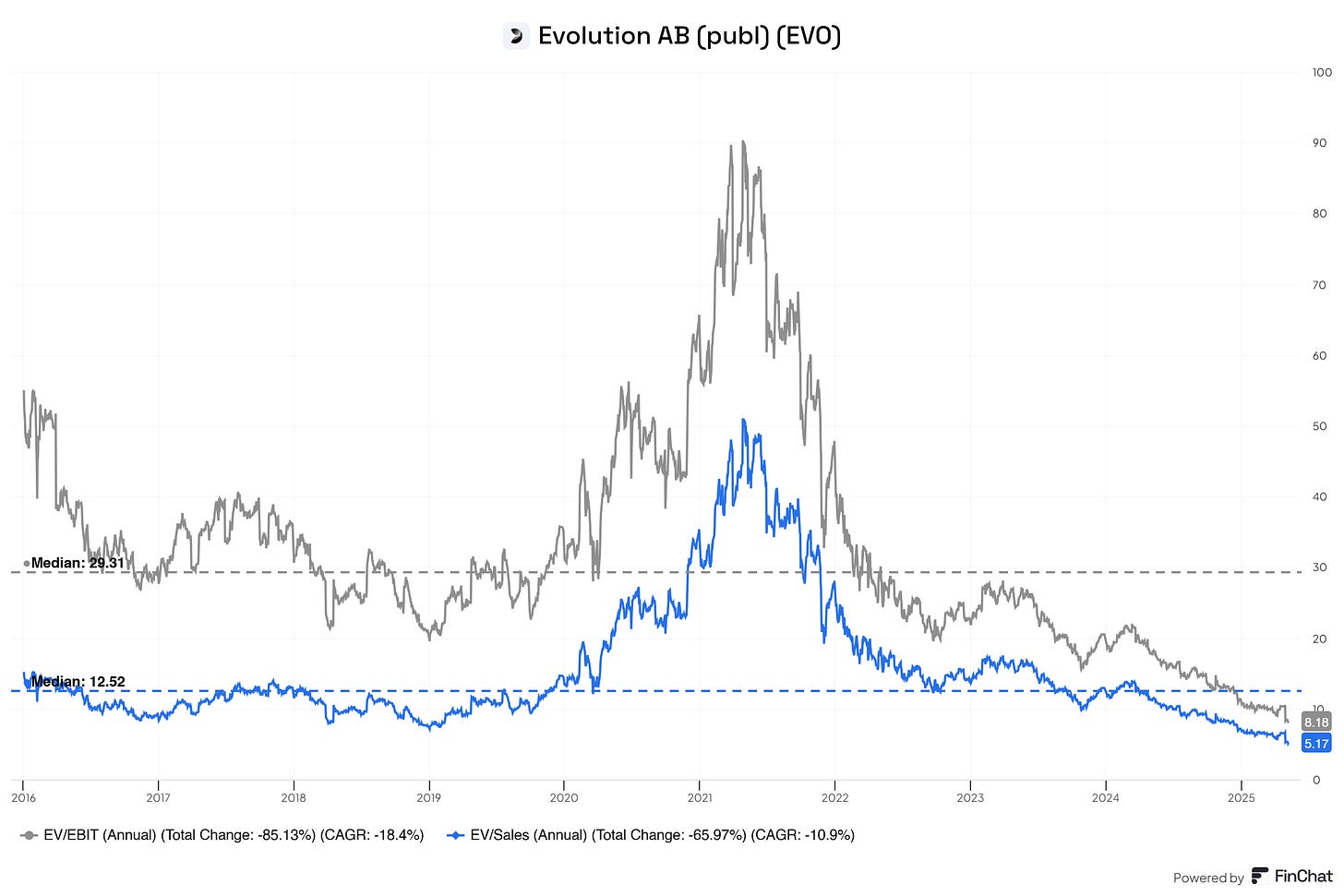

Opportunity #2: Evolution AB (Ticker: EVO / EVVTY)

Most people think of online gambling as crowded and commoditized. Evolution proves otherwise.

It doesn’t operate casinos. It powers them, quietly sitting behind the scenes of over 700 operators. Evolution runs the tables, hires the dealers, builds the infrastructure, and takes a cut of the action—every spin, card, or roll.

It’s not just a business. It’s a toll booth on the global expansion of real-money gaming.

This is what dominance looks like in online gambling.

Live casino is the crown jewel.

Evolution hosts thousands of real-time tables with human dealers, streamed across regulated markets.

It sells this service to 700+ operators who plug in instead of building in-house.

Every spin, bet, and card dealt flows through Evolution’s pipes—earning it a platform fee.

Scale, trust, and licensing create a wide moat.

Studios across Europe and North America allow localized service in 15+ languages.

Regulatory approvals in major markets like the UK, New Jersey, Ontario, and Sweden.

Decade-long partnerships with tier-one operators, from DraftKings to Bet365.

And they went wider with slots.

Through acquisitions like NetEnt, Big Time Gaming, and Nolimit City, Evolution added high-margin RNG titles and jackpot IP to its offering.

Now it sells:

Live dealer games

Game-show style experiences (e.g., Crazy Time, Monopoly Live)

Premium slots to the same operators, without extra distribution costs

Financial profile? Few can match it.

65–70% EBITDA margins

Consistently high double-digit revenue growth

Strong cash conversion with low capital needs

Zero debt, and expanding internationally without diluting returns

In short:

Evolution is not a bet on gambling trends.

It’s a bet on infrastructure, distribution, and scale.

A toll operator on the growth of online casinos—still expanding, still underpriced.

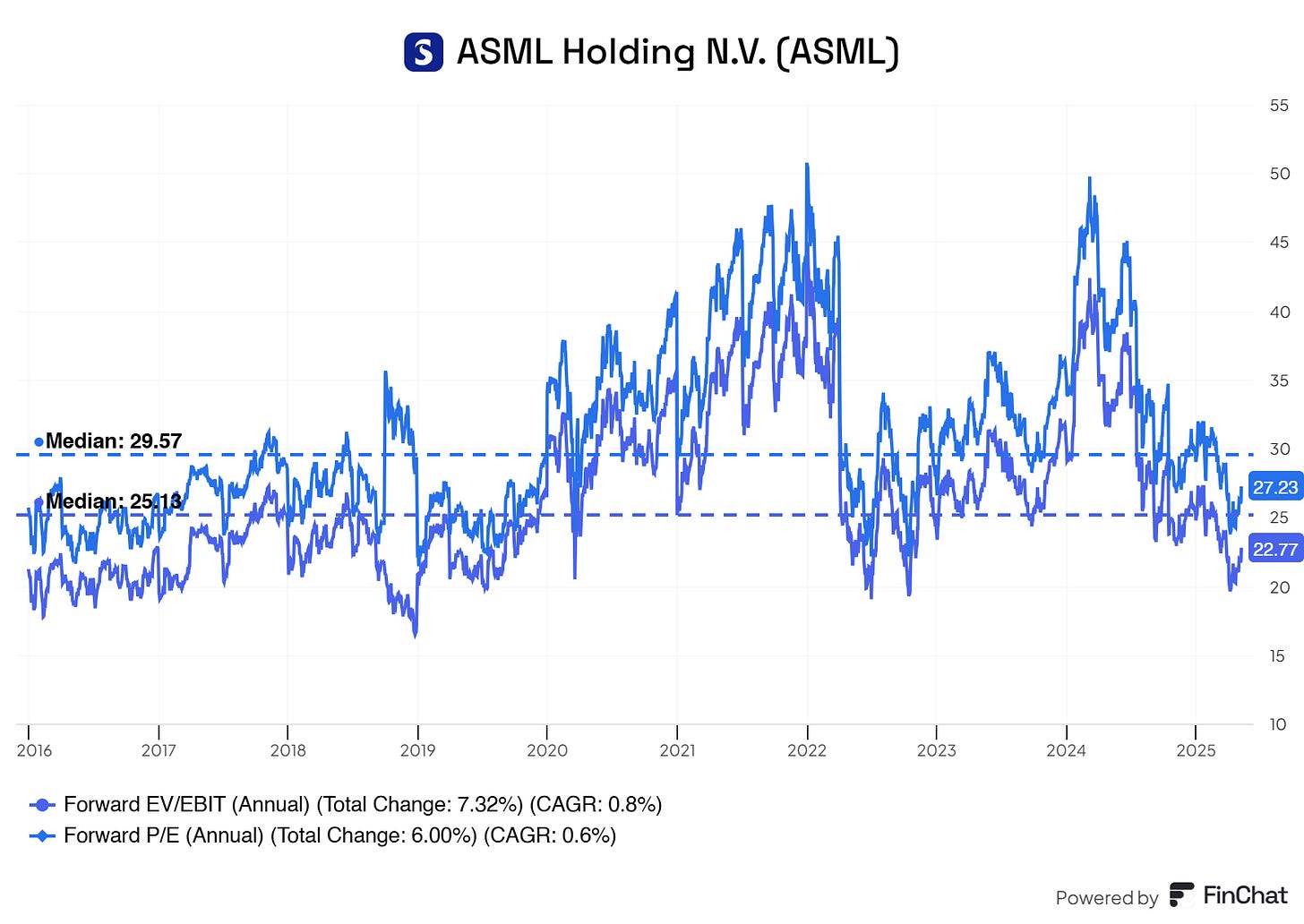

Opportunity #3: ASML Holdings N.V. (Ticker: ASML)

Most people never consider the machines behind their phones, laptops, or cars. But without ASML, none of it works.

ASML is the only company on Earth that can build extreme ultraviolet (EUV) lithography machines. These €200 million+ systems etch the world's most advanced chips, which power AI, smartphones, cloud computing, and defense.

Their customers? Intel, TSMC, Samsung—essentially every leading-edge chipmaker. Their backlog? Fully booked years in advance.

And their technology? So advanced that each machine is made of 100,000+ parts and takes six Boeing 747s to deliver.

This isn’t a competitive moat. It’s a fortress.

After decades of trying, no one else has been able to replicate EUV tech.

ASML holds critical patents, relationships, and supply chain partnerships that are irreplaceable.

Every step forward in semiconductors—smaller, faster, more power-efficient—relies on their next-generation tools.

Governments know it too. The U.S. and EU monitor exports, and China’s most advanced fabs can’t progress without ASML.

Financially, it’s elite.

Gross margins of 50%+ with massive operating leverage

€40+ billion order backlog

30%+ ROIC

Asset-light model with deep pricing power

Long-term secular demand from AI, automotive, HPC, and 5G

It’s rare to find a company this technical, this necessary, and this protected.

When semiconductors become the most important resource in the digital world,

ASML becomes the modern equivalent of an oil rig.

Except there’s only one of them.

Opportunity #4: Uber Technologies (Ticker: UBER)

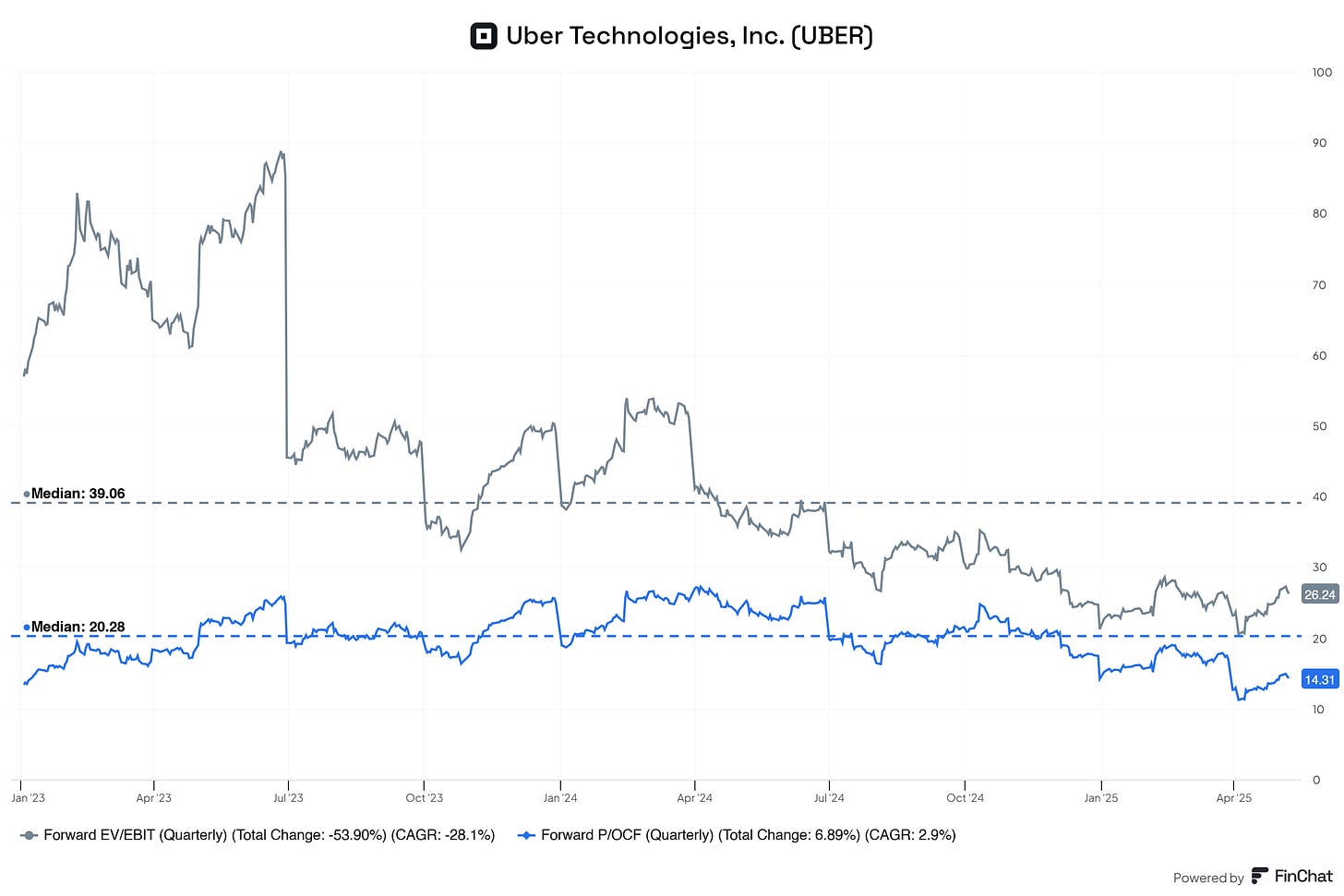

Uber was once seen as a cash-burning ride-hailing app. Not anymore.

Today, it’s a multi-sided logistics platform: rides, food, freight—all scaled globally.

It has a dominant share in North America, strong international momentum, and a cost structure finally under control. Years of cleanup and discipline have transformed Uber from a growth story into a cash-flow machine.

And Wall Street is only beginning to reprice it.

Mobility is the front door—but the ecosystem is much bigger.

Uber has over 130 million monthly users across rides and delivery.

Uber Eats is now profitable in most regions, with higher-order value and merchant fees.

Freight is being reshaped into a more asset-light model with room to scale.

Uber One (its subscription service) locks in high-value customers and increases usage frequency.

The company is increasingly monetizing maps, ads, and payment rails—hidden infrastructure with upside.

Financials flipped. The market missed it.

Adjusted EBITDA hit $1.4B+ last quarter

Free cash flow is now in the billions

Operating leverage is improving quarter by quarter

Net income is positive after years of red ink

Uber no longer needs to prove growth. It’s proving profitability at scale.

And if you believe in logistics, platforms, or optionality in the movement of people and goods—Uber is already there, with the network built and the cash starting to flow.

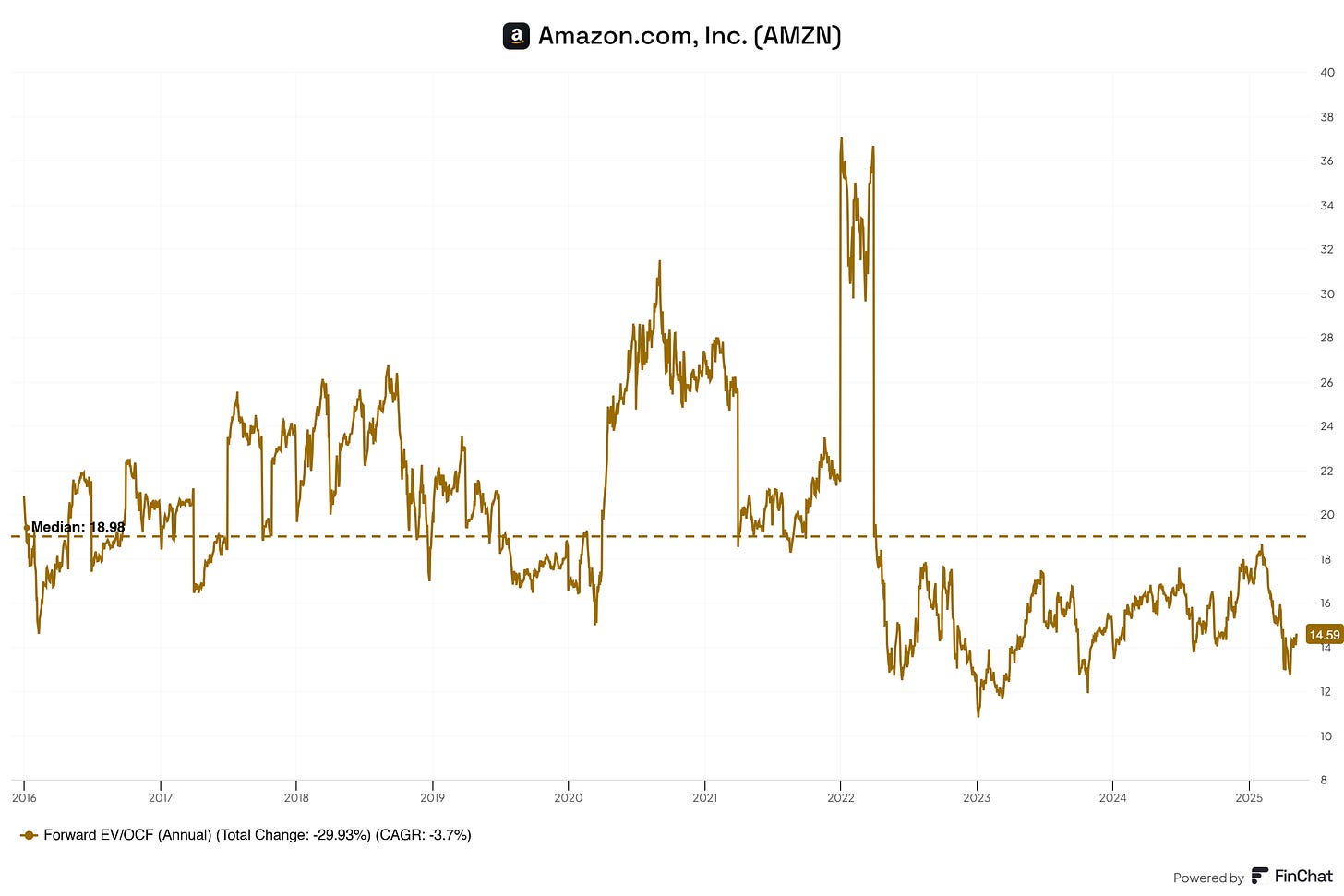

Opportunity #5: Amazon (Ticker: AMZN)

Most still think of Amazon as an online store. That view is outdated—and wildly incomplete.

Yes, e-commerce is the face. However, the backbone is Amazon Web Services (AWS), which is the most profitable cloud business on the planet. Meanwhile, Amazon’s logistics network rivals UPS and FedEx, operating at a scale no other retailer can replicate. Is it the advertising business? Now the third-largest digital ad platform in the world. And with over 200 million Prime members globally, Amazon isn’t just selling products—it’s selling ecosystem access.

This isn’t a retailer. It’s infrastructure for the digital economy.

E-commerce is still the tip of the iceberg.

Amazon controls over 38% of U.S. online retail, more than the next 10 competitors combined.

Its same-day and next-day delivery speeds are nearly untouchable thanks to a vertically integrated logistics engine.

Prime Video, Buy with Prime, and Alexa tie customers deeper into the ecosystem.

Fulfillment by Amazon (FBA) creates stickiness for millions of third-party sellers.

Every click, shipment, and interaction feeds back into an unrivaled data loop.

And then there’s AWS. The cash engine.

$90B+ annual run rate with 25–30% operating margins

Powers Netflix, Zoom, governments, and startups alike

Highest margin segment—funding innovation across the rest of Amazon

Growing AI workloads, machine learning services, and custom chips (Trainium, Inferentia)

Still expanding internationally with strong share in Europe, Asia, and LatAm

Advertising might be the most misunderstood piece.

It’s already doing $45B+ a year. And it’s not ads on Amazon—it’s ads powered by Amazon data, built into search, display, and even Fire TV.

High margin. High intent. And growing faster than Google or Meta.

In short:

Amazon isn’t one business. It’s five—and each is a category leader.

Retail, cloud, logistics, ads, and subscriptions.

Each reinforces the others.

Each throwing off cash.

Each still growing.

Are You Ready To Take It To The Next Level?!

When you join the FluentInQuality PRO community, you will get:

Deep-dive investment cases on high-quality businesses

Access to my personal portfolio, including monthly updates.

See what stocks I am buying or selling and why

A private chat with other pro members

And much, much more

When will I see you in the community?

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds to refer this edition to a friend? It will go a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

What are your takeaways from this post?

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Used Sources

Finchat is used for all the charts. You can now get 15% off your subscription. Click here and start today!

Disclaimer

I own shares in some of the companies that are mentioned.

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.