5 High-Quality Compounders You've Never Heard Of

These five elite compounders could supercharge your portfolio—minimal effort, maximum returns.

You’ve made your voice heard in the poll from my last post. I appreciate it.

If you haven’t checked out five high-quality stocks that should be on your radar, give it a read after this.

You ask, I deliver.

Today, I’m thinking outside the box—no "typical" high-quality companies.

I’m bringing you names you might have never heard of.

The best of the best, right on your radar.

What makes these companies high quality?

Competent management with skin in the game

Strong balance sheet

Predictable, sustainable growth

Riding a strong, long-term trend

A deep moat—or one being built

I’ll stop keeping you on the edge of your seat.

Let us go over these five high-quality companies.

Happy reading!

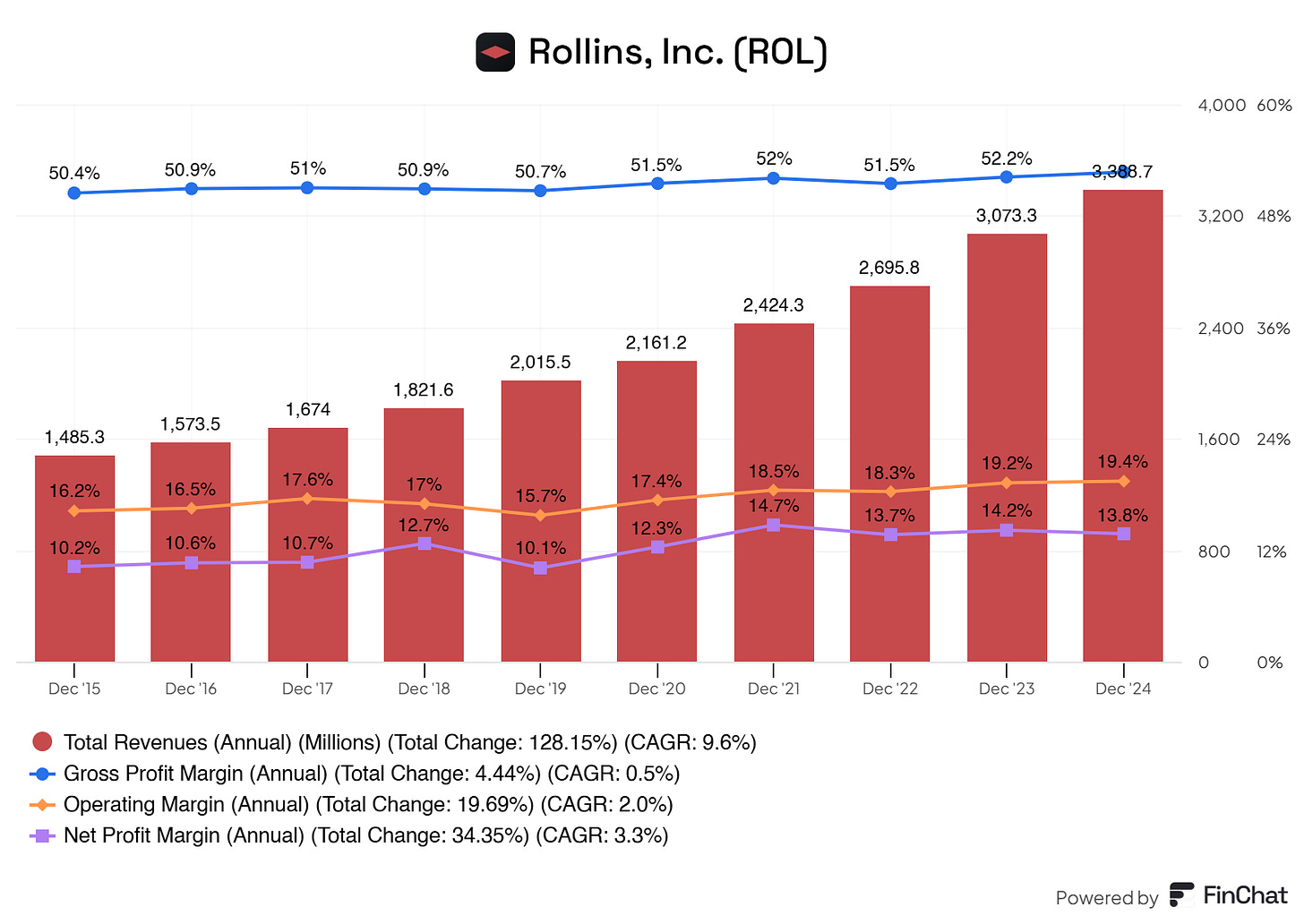

5. Rollins (Ticker: ROL)

Rollins is a global leader in pest control services, operating through subsidiaries and franchises like Orkin and Critter Control.

With 2.8 million customers across North America, South America, Europe, Asia, Africa, and Australia, its reach is unmatched.

A recurring revenue powerhouse

80% of revenue is contractual & recurring

Provides a stable, predictable income stream

Resilient across economic cycles

Financially strong and extremely profitable.

$10B+ market cap as of mid-2023

19.4% operating margin, reflecting efficiency

Consistently reinvesting in growth & acquisitions

Growing industry? Check. Strong secular trend? Check. The market leader? Check!

The pest control industry is large & fragmented

Rollins’ scale provides unique competitive advantages

Long-term demand remains strong across all markets

Quality comes from customer retention. Rollins. Has it!

✔ Best-in-class service enhances loyalty & retention

✔ Strong brand recognition solidifies market dominance

With a leading brand portfolio, a resilient recurring revenue model, and strong financials, Rollins is a high-quality company with a sustainable competitive advantage in the pest control industry.

Rollins? Going nowhere but to the top.

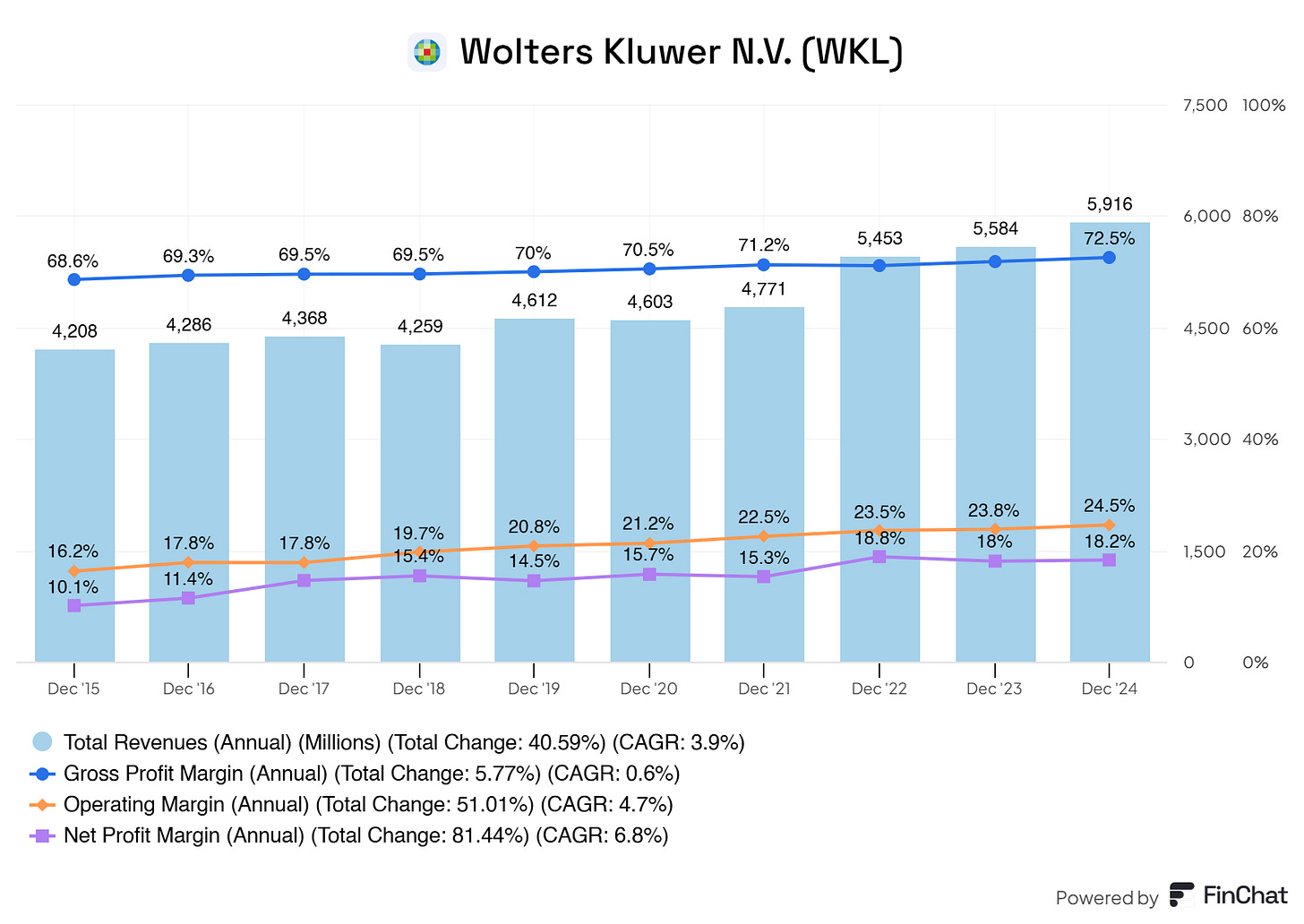

4. Wolter Kluwer (Ticker: WKL)

Wolters Kluwer is a dominant force in professional information, software, and services—serving industries like:

Healthcare

Tax & Accounting

Finance & Compliance

Legal & Regulatory Affairs

With nearly two centuries of history, the company has successfully transitioned from traditional publishing to cutting-edge digital solutions, making its offerings indispensable to professionals worldwide.

In 2023, Wolters Kluwer delivered strong performance:

€5.58 billion in revenue (+5% in constant currency, +6% organic growth)

82% of total revenue is recurring, growing 7% organically

94% of revenue from digital & services, up 6% organically

Cloud software revenue surged 15% organically

By blending deep domain expertise with advanced technology, Wolters Kluwer has built expert solutions that:

✔ Enhance decision-making for professionals

✔ Drive efficiency in critical industries

✔ Strengthen its competitive moat

Since 2003, CEO Nancy McKinstry has led Wolters Kluwer’s major transformation—pivoting from publishing to fully digital solutions.

The result? Sustained growth, increased relevance, and a leading position in an evolving market.

Wolters Kluwer’s commitment to innovation, recurring revenue strength, and digital expansion makes it a high-quality, long-term compounder.

A trusted partner in mission-critical industries—built to last.

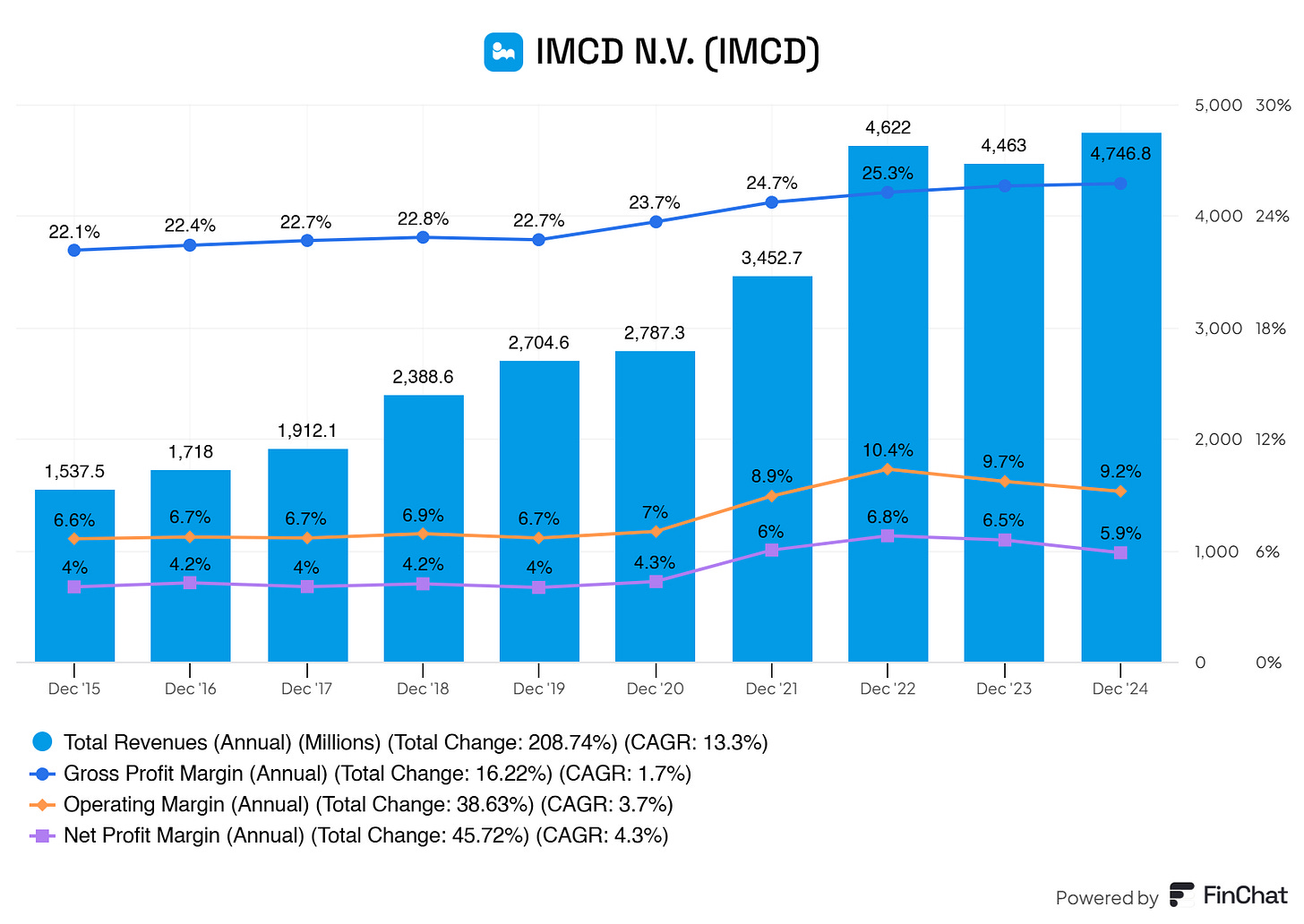

3. IMCD (Ticker: IMCD)

Founded in 1995, IMCD has grown into a leading distributor and formulator of specialty chemicals and ingredients across key sectors:

Pharmaceuticals

Personal Care

Food & Nutrition

Coatings & Industrial Applications

With an asset-light business model, IMCD focuses on delivering technical expertise and tailored solutions, fostering strong supplier and customer relationships.

In 2024, IMCD reported:

€4.73 billion in revenue (+6% YoY)

€1.2 billion in gross profit (+7% YoY)

€531 million in operating EBITA (+3% YoY)

Despite market challenges, IMCD continues to grow profitably, reinforcing its resilience.

IMCD’s long-term success is driven by:

✔ Investments in digital transformation & supply chain efficiency

✔ A strong push toward sustainability & responsible practices

✔ Enhancing customer experiences while driving operational excellence

IMCD operates in 50+ countries across Europe, Asia-Pacific, and the Americas, with a workforce of 5,000+ employees.

This extensive network enables IMCD to meet the diverse needs of customers worldwide.

With strong financials, strategic acquisitions, and a commitment to innovation & sustainability, IMCD stands out as a high-quality, long-term compounder in the specialty chemicals and ingredients industry.

Built for growth. Positioned to lead.

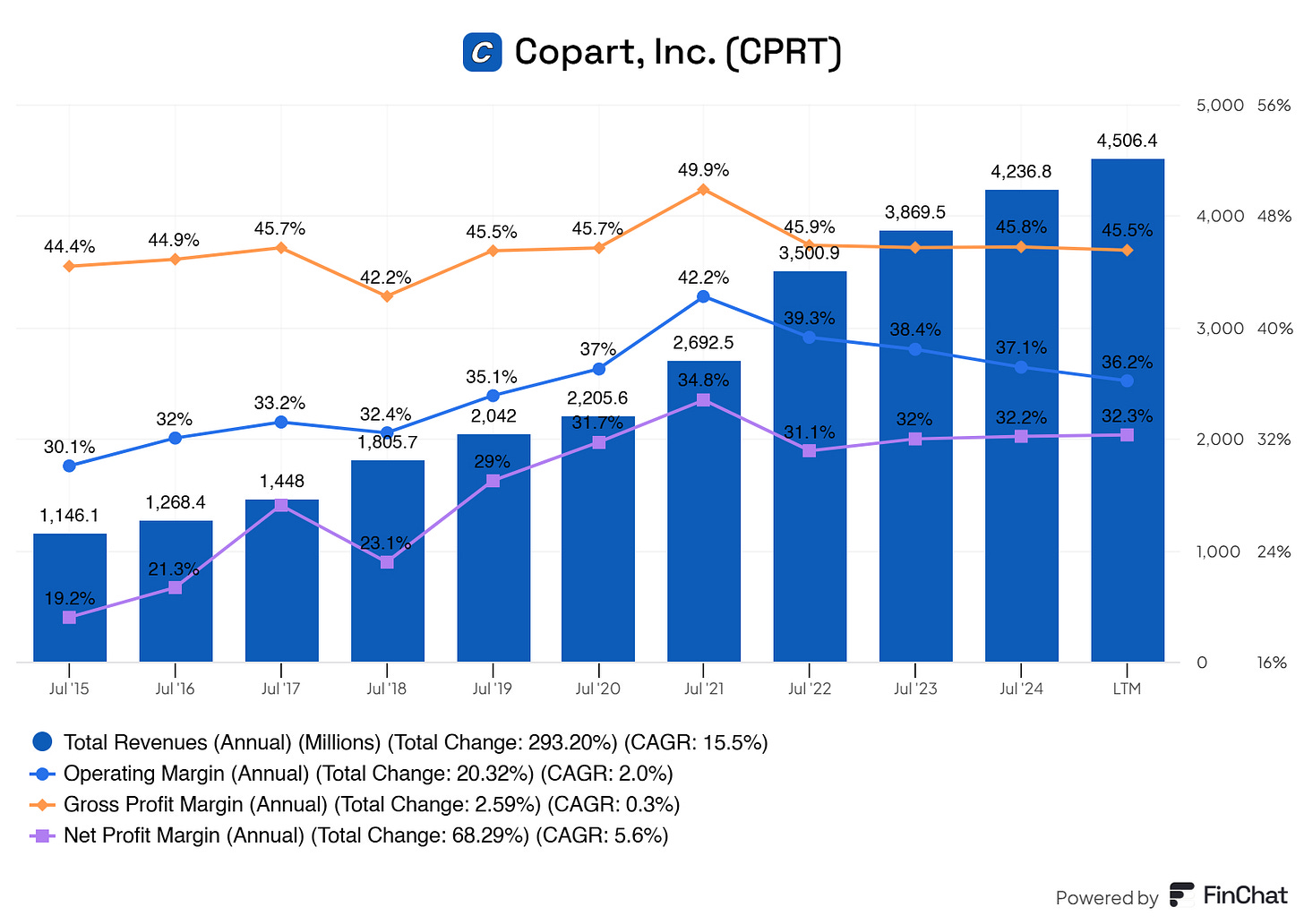

2. Copart (Ticker: CPRT)

Copart is the global leader in online vehicle auctions, specializing in the sale of used, wholesale, and repairable vehicles, primarily sourced from insurance companies.

Its proprietary VB3 auction platform connects buyers and sellers in 190+ countries, facilitating 175,000+ auctions daily.

Unlike competitors that rely on leasing, Copart owns over 10,000 acres of land for its operations.

Ensures stability & scalability

Protects against rising lease costs & market fluctuations

Creates a lasting competitive edge

Technological innovation = market dominance.

Pioneered online vehicle auctions in 2003

Constant investment in digital infrastructure

Optimized operations & seamless user experience

By going fully digital early, Copart expanded its reach, improved efficiency, and cemented its industry leadership.

Large inventory attracts more buyers

More buyers = competitive bidding = better value for sellers

Self-reinforcing cycle that strengthens Copart’s moat

The bigger the network, the stronger Copart becomes.

Asset-light? You bet!

Service fees over vehicle ownership = high margins & stable cash flow

Minimizes financial risk & adapts quickly to market shifts

Leadership? The strongest.

✔ Management is deeply invested in Copart’s success

✔ Consistently prioritizes innovation, efficiency, and shareholder value

Psst… before I reveal number 1.

Subscribe to the newsletter—it’s free and takes just one second.

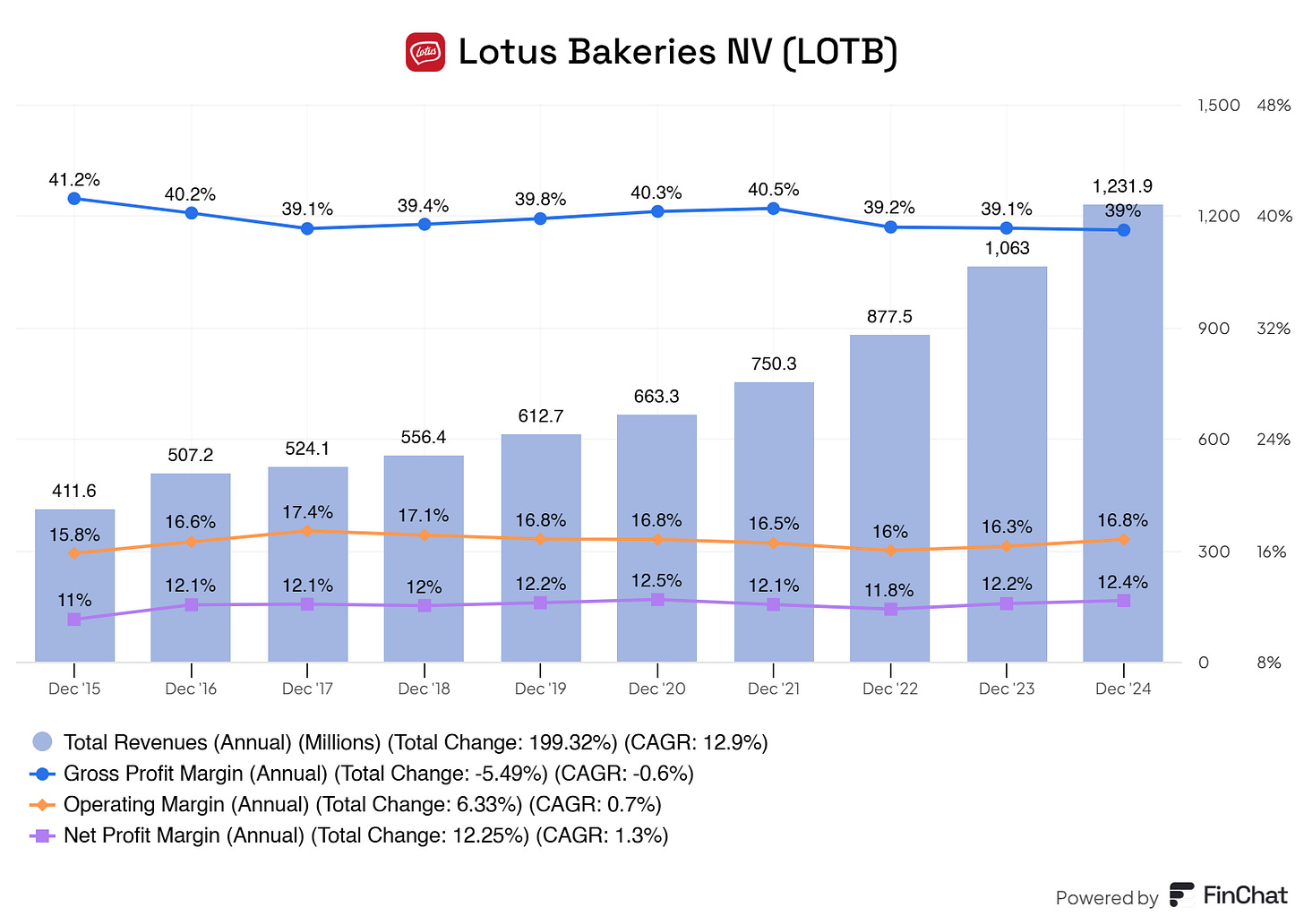

1. Lotus Bakeries (Ticker: LOTB)

Founded in 1932 in Belgium, Lotus Bakeries has grown into a global leader in snack foods, best known for its iconic Biscoff cookies.

Its long-term success is driven by brand strength, strategic expansion, and a commitment to quality.

Lotus Bakeries. Strong brand & loyal customer base.

Biscoff = globally recognized as a premium biscuit brand.

Strong brand identity & product quality create lasting customer loyalty.

Competitive advantage in the global biscuit market.

How many years of consistent growth? 35 years!

10% annual revenue growth for over three decades.

Success fueled by product innovation, marketing, and international expansion.

Expansion, expansion, and expansion.

Expanded beyond Biscoff by acquiring natural snack brands like:

nākd, TREK, BEAR, and Kiddylicious.

Tapping into the growing demand for healthier snacks.

Reduces reliance on a single product line & broadens market reach

Yes, globally as well.

Manufacturing facilities in Belgium, the Netherlands, France, Sweden, South Africa, and the U.S.

A third Biscoff factory in Thailand set to open by 2026.

Global reach ensures efficient distribution & market responsiveness.

Lotus Bakeries. Commitment. Sustainability.

✔ Optimized packaging, saving 117 tonnes of material annually.

✔ Reduced carbon emissions & transportation requirements.

✔ Focused on long-term environmental responsibility.

With a globally recognized brand, steady revenue growth, strategic acquisitions, and sustainability efforts, Lotus Bakeries stands out as a high-quality company in the snack industry.

Built for longevity, positioned for continued success.

Before you go, give me 3 seconds of your time.

Other suggestions? Leave them in the comments of this post.

Thank you.

And that is it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds to refer this edition to a friend? It will go a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Used Sources

Finchat is used for all the charts. Your subscription is now 15% cheaper using my link. Click here to start today!

(I’m affiliated with Finchat, but not sponsored. With this link, your plan does NOT get more expensive; I only get a small cut of the cake.)

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.