10 High-Quality European Compounders You Need In Your Portfolio

Trump Is Making Europe’s Market Great Again.

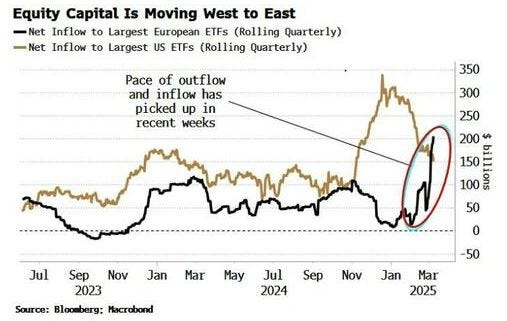

The money is moving—and it’s not staying in the U.S.

Capital is quietly escaping the U.S., slipping through cracks created by tariffs, fiscal uncertainty, and market fatigue. It’s not a collapse. It’s a shift. And the shift is favoring Europe and Asia.

Someone’s about to win big.

The winners? Not who you'd think. European industrials. Asian conglomerates. Companies with quiet moats and global ambition. In this article, I’ll show you 10 overlooked high-quality European stocks positioned to catch this capital migration like a well-placed sail in a changing wind.

Before we dive in—

Subscribe to the newsletter. Restack this article. Bookmark it like it's a secret.

Because it is.

In return? You get 10 European companies most investors aren’t even looking at.

Seems like a fair deal.

Now, let’s get into the list.

Happy compounding.

10. ASML Holdings N.V. (Ticker: ASML)

Yeah, yeah, yeah.

You’ve heard the name a thousand times. Maybe you’re even rolling your eyes.

But listen—this Dutch giant is still worth your attention.

Why? Because they’re not just big. They’re dominant. They’re quietly running a monopoly while the rest of the market sleeps on it.

Ignore the noise. Watch the moat.

The semiconductor linchpin? Still untouchable.

ASML doesn’t just make machines. It enables the entire tech ecosystem.

EUV lithography systems

DUV machines for legacy nodes

Software and metrology tools

Deep supplier integration and service contracts

ASML powers the most advanced chips in the world—chips that run your phone, your data center, and soon, your car.

It’s not just part of the supply chain. It is the supply chain.

A bottleneck. A gatekeeper.

Moats built on physics and time.

Its edge is simple. But impossible to replicate:

Over €200B in cumulative R&D and capex

Protected IP in high-NA EUV (and what comes next)

A supplier network that took decades to assemble

Roadmap-level partnerships with TSMC, Intel, and Samsung

No one else can build an EUV machine.

Not in a year. Not in five. Maybe not ever.

Revenue growth? Powered by megatrends.

The world is digitizing—everything, everywhere, all at once.

And ASML is riding the wave:

The AI compute arms race (more chips, more wafers, more lithography)

The move to 2nm and beyond (only possible with EUV)

Re-shoring of chipmaking (more fabs, more machines)

Smarter chips in cars, medtech, IoT—everywhere

This isn’t cyclical. It’s foundational.

ASML is selling shovels in a semiconductor gold rush.

And the flywheel? Keeps spinning.

Despite being one of Europe’s most valuable companies, ASML still operates with:

Fat margins (50%+ gross)

Cash-flow-positive service contracts

Virtually no competition

Wild pricing power (>€200M per EUV machine)

Every machine expands their install base.

Every install guarantees service revenue.

Every new fab means another order.

Geopolitics? ASML sits at the center.

Blocked from selling EUV to China—yet essential to Western tech ambitions.

Governments fund the fabs. ASML equips them.

It doesn’t just have leverage over companies. It has leverage over countries.

The chip war isn’t just about silicon.

It’s about who can shrink transistors—and that future runs through Veldhoven.

Underappreciated upside? Oh, it's there.

People still see ASML as a machine seller. But what if it’s more?

It’s building a platform around chip manufacturing optimization

High-NA EUV could unlock new frontiers in quantum and AI

Software, analytics, and automation could bring sticky, recurring revenue

Its influence over future node transitions gives it strategic control

This isn’t just a hardware company.

It’s a precision monopoly—still expanding

9. Wolter Kluwer (Ticker: WKL)

The quiet engine behind global professionals.

Wolters Kluwer doesn’t make headlines.

It makes systems that professionals trust not to fail.

From tax and accounting to law, compliance, and healthcare, its expert software powers decisions where precision is everything—and mistakes cost millions.

This isn’t a publisher turned tech firm.

It’s an expert solutions business, deeply embedded in the workflows of industries that don’t tolerate guesswork.

Deep roots. Deeper integration.

Wolters Kluwer thrives where the stakes are highest:

Tax compliance platforms trusted by CPAs and firms

Clinical decision tools used in 180+ countries

Legal and regulatory databases trusted by courts and corporates

GRC platforms that anchor banks and insurers through chaos

These aren’t “nice-to-haves.”

They’re mission-critical.

The invisible scaffolding that lets professionals navigate regulation, liability, and complexity—daily.

Digital transformation? Old news.

While others pivot to digital, Wolters Kluwer already lives there:

90%+ of revenue is digital or service-based

Recurring revenue dominates

Cloud-first, expert software drives growth

The shift didn’t happen overnight—it was slow, strategic, and surgical.

Now, it compounds.

A compounder in disguise.

Steady. Understated. Relentless.

High single-digit revenue growth—year after year

20%+ operating margins

Robust free cash flow and razor-sharp capital allocation

Quiet buybacks. Growing dividends. No drama.

It flies under the radar.

But it outperforms the loudest names in tech.

Moated by regulation—and routine.

Wolters Kluwer’s edge isn’t flash. It’s stickiness.

Professionals are trained on these tools—they don’t switch

Accuracy is non-negotiable in regulated environments

Legal, tax, and clinical systems must be up-to-date, jurisdiction-specific, and precise

New entrants face steep walls of trust, regulatory nuance, and content depth

AI won’t disrupt it. It’ll make it stronger.

Wolters Kluwer isn’t racing against AI.

It’s weaving AI into its DNA:

NLP that extracts insight from dense legal texts

Predictive analytics that guide audits and tax planning

Clinical tools that assist—not replace—healthcare pros

AI isn’t the product.

Expertise is.

AI just sharpens it.

The overlooked reality? It’s a digital utility.

In a world flooded with data and rising in risk, Wolters Kluwer sells clarity.

Compliance.

Control.

It doesn’t sell hype.

It sells peace of mind.

And that’s worth more than most people realize.

8. SAP SE (Ticker: SAP)

Not sexy. Just essential.

SAP isn’t chasing hype.

It builds the invisible machinery that global business runs on.

From manufacturing to logistics, finance to HR—SAP embeds itself in over 400,000 enterprises.

It's not a vendor. It's infrastructure.

The ERP backbone of the world economy.

And far stickier than you think.

The real enterprise cloud story.

Everyone talks about the cloud. SAP rebuilt in it.

SAP S/4HANA isn’t just software—it’s how businesses function

25+ industry-specific modules—deep vertical fit

End-to-end integration: supply chain, finance, HR, procurement

This isn’t “move to the cloud.”

It’s re-architecting your operations.

Locked in. And leveling up.

SAP doesn’t flirt with startups.

It marries the Fortune 500.

Swapping ERP midstream? Like changing your plane’s engine mid-flight

Clients stay for decades, because they have to

Recurring cloud backlog? Over 80% of the total

Once you're in orbit, there's no escape velocity.

Margins rising. Leverage building.

The pivot is paying off:

Cloud revenue is now the fastest-growing segment

Gross margins are widening as subscriptions scale

Efficiency gains are freeing up capital for AI and R&D

SAP is becoming leaner, smarter, and primed for profitable compounding.

Built for complexity.

This is where spreadsheets break—and SAP steps in.

Global supply chains with thousands of dependencies? SAP.

Multinational compliance? SAP.

Real-time planning, predictive ops? SAP.

It handles the kind of logic where failure is a catastrophe.

AI, but grounded.

SAP isn’t tossing ChatGPT into dashboards.

It’s embedding AI where it drives outcomes:

Demand forecasting at an industrial scale

Auto-reconciliation of millions of invoices

ESG and procurement intelligence baked into workflows

No noise. Just output.

The second act of an enterprise giant.

SAP is ditching the legacy suit:

Cloud-first

Margin expansion

Deeper hooks into mission-critical systems

It’s not a startup.

It’s not a moonshot.

It’s the software empire beneath the business empires.

7. Rheinmetall AG (Ticker: RHM)

From steel to strategy.

Rheinmetall doesn’t just make tanks.

It builds the sharp edge of Europe’s defense future.

Legacy industrial? Sure.

But now laser-focused on 21st-century tailwinds: rearmament, autonomy, electrification.

This isn’t the old defense contractor.

It’s a modern military-tech hybrid—scaling fast, playing long.

Two engines. One direction.

Rheinmetall runs on twin pillars:

Defense: Vehicles, munitions, electronics, sensors, air defense

Automotive tech: Clean propulsion, thermal systems, industrial electrification

The crossover? Strategic.

Military-grade mobility informs EV innovation

Thermal and power systems built for both battlefield and civilian platforms

This duality gives Rheinmetall a rare edge:

Optionality across sovereign defense and industrial decarbonization.

Geopolitics just made it non-optional.

Europe is rearming. And Rheinmetall is the tip of the spear.

Germany’s €100B special fund? Rheinmetall is a primary recipient

NATO 2%+ GDP targets? Orders incoming

Eastern Europe restocking defense? Rheinmetall is first call

This isn’t cyclical—it’s structural.

Defense spending isn’t a debate. It’s a mandate.

Backlog like a fortress.

Defense orders are ballooning:

Record multi-year contracts locked

Ammo plants expanding across Europe

Joint ventures with governments—embedding Rheinmetall into supply chains

This isn’t quarter-to-quarter visibility.

It’s years of compounding momentum.

Not just hardware. Defense tech.

This isn’t your grandfather’s arms dealer:

Autonomous UGVs for battlefield logistics

Counter-drone platforms and smart air defense

AI-enhanced targeting, surveillance, and decision systems

Steel meets software.

Armor meets autonomy.

The battlefield is digital—and Rheinmetall is ready.

Margins are moving. So is the model.

Defense scaling = expanding margins

Auto tech stabilizing = baseline profitability

New plants and co-pro contracts = lower risk, higher returns

And as software and systems grow?

Margins get even fatter.

What the market might be missing.

Yes, the stock’s up.

Yes, the narrative’s catching steam.

But:

Multi-year sovereign contracts aren’t fully priced in

Civil/military tech fusion is early, not mature

Global defense demand—beyond Europe—is just getting started

Most see a defense play.

Some see industrial upside.

But Rheinmetall?

It’s becoming a sovereign systems partner—with leverage over policy, procurement, and pace.

It’s not just making weapons.

It’s embedding itself into national strategy.

6. Argenx SE (Ticker: ARGX)

A platform in plain sight.

argenx isn’t chasing biotech lottery tickets.

It’s scaling a repeatable model in autoimmune disease.

One mechanism.

Multiple indications.

A pipeline with platform leverage.

This isn’t a biotech story.

It’s an autoimmune engine, fine-tuned.

From rare to everywhere.

The flagship? Vyvgart.

First-in-class FcRn blocker

Approved for generalized myasthenia gravis (gMG)

Expanding to CIDP (chronic inflammatory demyelinating polyneuropathy)

Trials across autoimmune hematology, dermatology, nephrology

The beauty? One mechanism, many markets.

Each success unlocks adjacent diseases—and scales fast.

This is not about blockbuster chasing.

It’s building dominance across autoimmune niches.

Chronic diseases. Recurring revenue.

Autoimmune diseases don’t resolve. They persist.

Vyvgart already hitting €1B+ annualized revenue

Subcutaneous formulation = easier access, higher adherence

Global rollout underway: Europe, Japan, China expanding reach

New indications? Each adds layers to the TAM.

This isn’t one-time therapy revenue.

It’s chronic treatment in underserved markets.

The engine under the hood.

argenx is more than Vyvgart:

A scalable antibody platform with FcRn biology at the core

Multiple pipeline candidates (efgartigimod variants) targeting new autoimmune arenas

Preclinical programs expanding into oncology and nephrology

One discovery platform.

Multiple shots on goal.

Lower risk with each success.

This is platform biotech, not asset biotech.

Margins? They’re coming.

Yes, R&D spend is heavy—fuel for pipeline momentum.

But revenue scale changes the game:

Manufacturing efficiencies

Global expansion leverages fixed costs

Operational leverage unlocking over time

argenx is scaling past the investment trough.

Margins are on an upward curve.

The overlooked edge.

Most see argenx as a single-asset play.

Some as a rare disease company.

But:

The autoimmune market is vast and fragmented

argenx has a first-mover advantage in FcRn biology

Pipeline optionality isn’t fully priced in

M&A potential is always live in biotech

argenx isn’t just filling gaps.

It’s becoming the backbone of autoimmune biologics.

A platform company in biotech disguise.

5. LVMH (Ticker: LVMH)

LVMH doesn’t sell products. It sells status.

Luxury is cyclical?

Tell that to the richest consumers on earth.

When the world tightens its belt, LVMH tightens its grip.

75+ brands. 6 verticals.

From Louis Vuitton to Dom Pérignon, Sephora to Bulgari.

LVMH isn’t a luxury retailer.

It’s a luxury empire.

Pricing power? Untouchable.

LVMH doesn’t discount.

It dictates.

Price hikes across flagship brands—no demand destruction

Waitlists for high-end products

Direct control over distribution—no reliance on third-party retailers

This isn’t selling handbags.

It’s selling identity.

Diversified. Focused. Relentless.

Fashion & Leather Goods (Louis Vuitton, Dior, Fendi)

Wines & Spirits (Moët, Hennessy, Dom Pérignon)

Perfumes & Cosmetics (Sephora, Givenchy, Guerlain)

Watches & Jewelry (TAG Heuer, Bulgari, Tiffany & Co.)

Selective Retailing (DFS, Sephora)

Other activities (luxury hotels, media)

Each vertical feeds the same machine:

Aspirational demand. Global scale. Brand dominance.

Margins that speak volumes.

Fashion & Leather Goods hit 40%+ operating margins

Group margins hold steady—even in downturns

Massive free cash flow fuels reinvestment and acquisitions

LVMH doesn’t survive cycles.

It capitalizes on them.

Global reach. Local precision.

Europe, U.S., Asia—balanced exposure

China remains a core growth engine

Emerging markets expand luxury appetites

Luxury isn’t just global.

It’s localized—and LVMH tailors demand across regions, cultures, and currencies.

The flywheel keeps spinning.

Brand heritage fuels pricing power

Scarcity sustains desirability

Cash flow funds next-gen craftsmanship and marketing

Acquisitions (like Tiffany & Co.) refresh the portfolio

Innovation wrapped in heritage.

AI-powered clienteling in stores

Virtual try-ons, AR experiences

E-commerce scaling—without compromising exclusivity

This isn’t flooding the market.

It’s controlling it.

What the market may be missing.

Resilience through economic cycles (luxury is a wealth play, not an income play)

Margin expansion via direct-to-consumer scale

Brand equity compounding faster than spreadsheets reflect

Emerging markets could double TAM in the decades ahead

Most see LVMH as a luxury stock.

Some as a cyclical consumer play.

But LVMH?

It’s a cultural institution.

A brand monopoly with global pricing power.

And the flywheel?

Still accelerating.

Now, for the best part of this article…

Let’s break down my top 4 picks.

Some of these are already in my portfolio.

Some? I’m watching closely—they’re just too good to ignore.

These aren’t the obvious names you’ll find in every hedge fund or index fund.

They’re under-the-radar winners—missed by portfolio managers and big players alike.

P.S. Support the newsletter by joining the community. One month of divvies pays off the monthly subscription.

It’s a no-brainer.

4. Adyen N.V. (Ticker: ADYEN)

Adyen doesn’t process payments. It powers commerce.

From checkout to settlement, fraud prevention to data insights—Adyen is the infrastructure beneath global transactions.

One platform.

Unified. Scalable. Global.

This isn’t another fintech.

It’s the operating system for modern payments.

Built for scale. Designed for speed.

Adyen supports:

Global giants like Spotify, Meta, H&M

Every channel: online, in-store, mobile

One platform: no patchwork, no third parties

End-to-end control over payments.

For merchants?

Fewer failure points. Faster innovation. Smarter data.

For Adyen?

Leverage. Every client compounds scale.

Margins fintech dreams of.

While competitors race to the bottom, Adyen holds the high ground:

Gross margins north of 50%

EBITDA margins climbing toward 50%

Minimal capex—the platform scales without burning cash

More volume doesn’t mean more cost.

It means more flow-through to profit.

Global reach. Local execution.

Adyen is built for:

Merchants expanding worldwide

200+ payment methods (from cards to wallets)

30+ currencies, local acquiring licenses baked in

Global commerce is messy.

Adyen simplifies it—with local precision.

Not just payments. A data engine.

Every transaction feeds:

Behavioral insights

Fraud detection patterns

Optimization levers for conversion

Adyen doesn’t just move money.

It empowers merchants to make smarter decisions.

The overlooked moat.

Most processors rent infrastructure.

Adyen owns it.

Direct acquiring licenses in key markets

No middlemen, no third-party processors

Full control of the payment lifecycle

Speed. Control. Margins.

Few can replicate it.

Growth? Still wide open.

Enterprise wins stack up

Mid-market expansion underway (higher margin, faster cycles)

POS scaling in physical retail

Cross-border commerce accelerating volumes

The model compounds.

Every market adds leverage.

Every client adds scale.

What the market might miss.

Mid-market push—high margin, low competition

Operational leverage still unlocking

Data-driven services (fraud, analytics) expanding TAM

Most see Adyen as a payment processor.

Some see a fintech.

But Adyen?

It’s a global payments infrastructure.

Scaling with commerce.

Transaction by transaction.

3. Judges Scientific Plc (Ticker: JDG)

Not just instruments. Infrastructure for innovation.

Judges Scientific doesn’t chase trends.

It builds the tools that fuel discovery.

Precision instruments for materials testing, microscopy, thermal analysis

Niche. Critical. Under the radar.

Judges isn’t flashy.

It’s essential.

Buy. Build. Compound.

Judges is an acquisition machine—with discipline:

Targets small, specialized scientific instrument makers

Focuses on profitable, niche leaders

Keeps operations independent—but optimizes financially

This isn’t a roll-up for scale’s sake.

It’s buying durable cash flows—one niche at a time.

Margins that punch above their weight.

Gross margins ~50%+

Operating margins mid-teens, consistently

Strong cash conversion fuels reinvestment and dividends

These aren’t commodity products.

They’re precision tools—with pricing power.

Recurring tailwinds.

Science doesn’t stop.

Universities, research labs, industrial R&D—steady buyers

Government and academic funding anchors demand

Instruments have long lifespans—but require upgrades, servicing, replacements

This isn’t cyclical consumer spending.

It’s mission-critical infrastructure for progress.Acquisitions: small bets, big returns.

Judges targets:

Fragmented markets with limited competition

Companies too niche for private equity—but too specialized to disrupt

High-margin, cash-generative businesses with loyal customers

The playbook?

Small bolt-ons. Low risk. Cumulative upside.

Over time, they compound into a diversified, resilient cash engine.

Resilient through cycles.

When the macro slows:

Research spending holds steady

Mission-critical tools don’t get cut

Service and replacement cycles smooth revenue

Judges doesn’t ride consumer waves.

It rides scientific progress.

What the market might miss.

A long runway of small niche players still untapped

Operational improvements unlock post-acquisition margin expansion

Diversified end markets—academic, industrial, government—spread risk

Most see Judges Scientific as a small-cap industrial.

Some see an acquisition story.

But Judges?

It’s scientific infrastructure—compounding quietly, niche by niche.

The backbone of discovery.

2. Ferrari N.V. (Ticker: RACE)

Ferrari doesn’t sell cars. It sells dreams.

Automotive? Sure.

But Ferrari plays in a different universe.

Iconic brand heritage

Limited production—by design

A customer base that collects, not commutes

This isn’t transportation.

It’s status. Scarcity. Emotion.

Volume capped. Margins uncapped.

Ferrari’s playbook is simple:

~15,000 cars a year—intentionally limited

Demand that dwarfs supply

Waitlists on every launch—never discounts

This isn’t chasing EV volume.

It’s controlling the market through scarcity.

The payoff?

EBITDA margins north of 35%—better than most luxury brands

Pricing power that holds through any cycle

Luxury first. Automotive second.

Ferrari’s revenue breakdown:

70%+ from car sales

But accessories, personalization, and brand experiences are scaling fast

Theme parks. Fashion. Sponsorships.

Every touchpoint expands the Ferrari ecosystem.

This isn’t just an automaker.

It’s a luxury platform.

Innovation—without diluting the badge.

Ferrari doesn’t follow trends.

It redefines performance:

Hybrid models like the SF90 lead the charge

First fully electric Ferrari on the horizon—but at Ferrari’s pace

F1 technology fuels road innovation

The brand evolves—but never compromises.

Resilient demand. Global pull.

Americas, Europe, Asia—diversified appetite

China’s luxury market keeps growing

Buyers aren’t price-sensitive. They’re emotionally invested.

Recessions?

They don’t derail Ferrari demand.

They refocus capital.

What the market might miss.

EV won’t disrupt Ferrari—it’ll enhance exclusivity

Personalization and experiences will keep expanding margins

Brand equity compounds faster than models predict

Most see Ferrari as an automaker.

Some see a luxury brand.

But Ferrari?

It’s scarcity monetized.

A luxury empire—in a league of its own.

And it’s still accelerating.

1. Hermés (Ticker: RMS)

Hermès doesn’t follow fashion. It defines it.

This isn’t seasonal hype.

It’s timeless luxury.

No logo splashes.

No celebrity gimmicks.

Just craftsmanship, heritage, and scarcity—executed flawlessly.

Demand exceeds supply. Always.

Birkin and Kelly bags? Waitlists that last years.

Handcrafted by one artisan per bag—production can’t be rushed.

No discounting. Ever.

While other luxury brands scale, Hermès constrains.

And in doing so, tightens its grip on desire.

Margins that break the mold.

Forget fashion margins. Hermès operates on its own level:

70%+ gross margins

35%+ operating margins—best in luxury

Steady cash flow with minimal capex

This isn’t a brand selling products.

It’s a cash machine selling exclusivity.

Diverse. Disciplined.

Hermès spans:

Leather goods (the crown jewel)

Silk & textiles (scarves, ties)

Ready-to-wear & accessories

Fragrances, watches, homeware

Every category feeds the same engine:

Artisanal quality. Controlled distribution. Zero compromise.

Global brand. Local scarcity.

Asia-Pacific is now the largest market—China leads

Europe and the Americas remain strongholds

All stores company-owned—total control over brand experience

Hermès doesn’t chase volume.

It manages access.

Craftsmanship as a moat.

One bag. One artisan.

A tradition that scales slowly—by design.

Artisans are trained for years

Production isn’t scalable like competitors—and that’s the point

Competitors can imitate.

But they can’t replicate.

The overlooked flywheel.

Scarcity fuels demand

Pricing power compounds margins

Brand equity deepens—generation after generation

Add carefully crafted digital experiences and new ateliers expanding artisan capacity—

Hermès is growing without diluting.

What the market might miss.

Margins could expand further as leather goods dominate mix

Emerging markets (India, Southeast Asia) are untapped luxury pools

The resale market only strengthens the brand’s value

Most see Hermès as a luxury brand.

Some see it as fashion’s pinnacle.

But Hermès?

It’s scarcity institutionalized.

Craftsmanship monetized.

The benchmark for luxury margins.

That’s it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

Hi Yorrin, 4 of them are in my portfolio - 2 of the top 4. Besides what you shared today, are you also on top of their numbers and did you establish (a possible) entry point to open a position?

I am Dutch too - read: practical 🤣- and I am curious in which ones you’ve got your own ‘skin in the game’.

Yorrin, thank you. That was an excellent write up, and more food for thought. Really appreciate your efforts.

Jeff.