Warren Buffett Would Love These 11 Stocks

Timeless businesses, strong moats, and owner-minded leaders—these companies check all the Buffett boxes.

Welcome back, Fluenteers! 👋🏻

Let’s skip the Buffett biography.

You know the name. You know the principles.

Today, I’m giving you ten companies that actually meet them, businesses that reflect the kind of quality, durability, and discipline Warren Buffett has preached for decades.

If you’re looking for portfolio additions that would make even Omaha nod in approval, this list is your starting point.

Happy compounding!

Warren Buffett Stock #11: Exponent Inc. (Ticker: $EXPO)

Built on Expertise. Paid for Clarity.

Exponent isn’t just a consulting firm.

It’s a team of scientists, engineers, and PhDs solving the problems companies can’t afford to get wrong.

No billboards. No buzzwords.

Just hard-earned trust across courtrooms, boardrooms, and crisis rooms.

This isn’t advisory work.

It’s a technical truth—sold by the hour.

Exponent wins when the stakes are high.

Product failures

Catastrophic accidents

Safety disputes and litigation

When the outcome matters, Exponent gets the call.

Reputation is the moat.

The business doesn’t scale like software.

It scales like trust.

90+ disciplines under one roof

Clients include Fortune 100 giants, regulators, and law firms

Most new business comes from referrals

It takes decades to build this credibility.

And one wrong hire can cost you.

Exponent has never compromised.

Premium rates. Minimal capital.

This isn’t a labor-driven consulting shop.

It’s intellectual capital at its purest.

Gross margins north of 65%

Minimal capex

Debt-free balance sheet

Revenue per employee is among the highest in the industry.

Because expertise—real, scarce expertise—commands a premium.

Slow headcount. Fast trust.

Exponent grows carefully, not aggressively.

Hiring is selective, often from academia and government

Partners stay for decades

Client relationships last just as long

Growth here is not about adding bodies.

It’s about deepening relevance.

Optionality in complexity.

The more complicated the world gets, the more valuable Exponent becomes.

EV batteries failing?

Consumer product recalls?

AI systems creating liability?

Exponent doesn’t need to invent the future.

It gets paid to explain it.

That’s a Buffett-style advantage: enduring, non-cyclical, and quietly growing.

No noise. Just expertise.

There are no SaaS metrics. No ARR targets.

Just:

Mission-critical work

Irreplaceable people

Clients who need clarity, not opinions

And financials that are as consistent as the advice.

Hold it for the intellect. Keep it for the discipline.

For long-term investors, Exponent offers:

A reputation that compounds slowly and defensibly

Asset-light, cash-rich economics

High-margin, low-drama growth

Leadership that values quality over flash

Exponent doesn’t sell hype.

It sells certainty.

Warren Buffett Stock #10: Stella-Jones (Ticker: $SJ.TO)

Built for Rail. Paid by Utilities.

Stella-Jones isn’t just a lumber company.

It’s the backbone of North America’s infrastructure—supplying what few notice, but none can operate without.

No homebuilders. No housing cycles.

Just poles, ties, and treated wood engineered to last decades in the ground.

This isn’t a commodity business.

It’s contract-driven, essential infrastructure.

Stella-Jones wins by owning a corner of the market others overlook.

Top supplier of railway ties and utility poles in North America

Long-term contracts with railroads, telecoms, and power companies

Limited competition due to regulation, scale, and customer trust

It’s not about trees.

It’s about replacement cycles.

Predictable demand in a rugged business.

Stella-Jones doesn’t sell growth stories.

It sells critical inputs to systems that must be maintained, no matter the economy.

Utility poles need replacing every 30–40 years

Railroads operate on fixed maintenance schedules

Volume driven by wear and regulation, not GDP

This is the infrastructure’s consumable layer.

Recession? The power grid still needs poles.

Inflation? Replacement costs get passed through.

Vertical control, pricing power.

Stella-Jones controls the process end-to-end.

Wood sourcing

Treatment facilities

Logistics network

That’s not just efficiency. It’s leverage.

Margins expand when raw costs fall.

Prices adjust when raw costs rise.

A rare balance in a resource-heavy business.

Growth without reinvention.

Stella-Jones grows by:

Expanding treatment capacity

Making bolt-on acquisitions in fragmented regions

Securing long-term supply agreements

No technology pivots. No reinvention required.

Just scaling a model that already works.

Capital discipline, industrial clarity.

No complicated capital structure.

No exotic financial engineering.

Consistently high returns on invested capital

Steady dividend growth

Conservative leverage and healthy free cash flow

Buffett doesn’t need disruption.

He needs durability. This is that.

Invisible to most. Essential to all.

There’s no consumer brand here.

Just:

7 million utility poles in service

Millions of railway ties are delivered annually

Customers who don’t shop on price

When you're the backbone of long-term infrastructure, visibility is optional.

Execution is everything.

Set it, hold it, collect cash.

For long-term investors, Stella-Jones offers:

Durable, recession-resistant revenue

Scale advantages in regulated markets

Strong pricing power, vertically integrated operations

A quiet compounding engine, hiding in plain sight

Stella-Jones doesn’t try to impress the market.

It just keeps North America running—one pole at a time.

Warren Buffett Stock #9: MSC Industrial Direct (Ticker: $MSM)

Nuts. Bolts. Moats.

MSC Industrial Direct doesn’t make the tools.

It makes sure America never runs out of them.

Cutting tools. Fasteners. Safety gear.

Millions of SKUs that keep factories humming.

It’s not sexy.

It’s indispensable.

The plumbing of American industry.

Serving 350,000+ customers.

From machine shops to Fortune 500s.

Same-day delivery. Next-morning availability.

Downtime costs money.

MSC keeps it from happening.

Distribution with a moat.

This is a logistics story with sticky economics.

SKU density

Vendor-managed inventory

Just-in-time fulfillment

Recurring demand

It doesn’t just ship parts.

It embeds itself in the production line.

Scale as a service.

MSC wins because it’s big enough to matter—

But small enough to care.

100+ fulfillment centers and branch locations

Direct sales reps on-site

Vending machines on factory floors

It’s Amazon meets Grainger—industrial edition.

Margins are built on muscle memory.

Reorders don’t require thought.

They happen automatically.

60%+ of sales are repeat business

Long-standing customer relationships

Switching costs disguised as convenience

This isn’t e-commerce.

It’s industrial muscle memory.

Capital-efficient. Buffett-approved.

High returns on tangible capital

Steady free cash flow

Low capex needs

Conservative balance sheet

MSC doesn’t overreach.

It executes.

Buffett would appreciate the restraint and reward the results.

Family DNA. Public discipline.

Founded in 1941. Still majority-owned by the founding family.

80+ years of uninterrupted operations

Skin in the game

Long-term thinking is baked in

No fads. No pivots.

Just profitable consistency.

Boring is beautiful.

No AI dreams. No viral stories.

Just bolts, bearings, and bottom-line discipline.

MSC doesn’t promise exponential.

It delivers durability.

For long-term investors, MSC offers:

Industrial recurring revenue

Owner-operator mindset

Embedded customer relationships

Cash returns and steady growth

Warren Buffett wouldn’t just admire MSC.

He’d recognize it instantly

as a business built to last.

Warren Buffett Stock #8: Markel Group (Ticker: $MKL)

Built to Last. Paid to Wait.

Markel isn’t just an insurer.

It’s a cash-generating compounder hiding in plain sight.

No hype. No headlines.

Just underwriting profits, investment returns, and boring-but-beautiful private businesses.

This isn’t momentum. It’s financial architecture.

Markel wins by combining three durable engines—quietly, effectively.

Insurance

Public equities

Private ventures

Specialty? Yes. Scalable? Absolutely. Durable? Without question.

The model is long-term by design:

Recurring float

Equity compounding

Private business cash flows

Conservative capital allocation

It’s not a moonshot.

It’s a Berkshire in miniature.

Float that works while you sleep.

Markel underwrites niche, complex risks—and earns durable float.

That float doesn’t sit still.

It compounds.

Combined ratio ~95%

Float reinvested in long-duration assets

No stretch, no spin—just surplus turned into long-term value

Compounding across three lanes.

In 2024, Markel’s equity portfolio returned ~20%.

Roughly 14% of it is invested in Berkshire Hathaway.

Private investments span:

Dredging gear

Luxury handbags

Bakery equipment

Industrial service firms

Insurance funds equities.

Equity funds venture.

Ventures build permanence.

M&A without the noise.

Markel Ventures quietly acquires controlling stakes in real businesses.

No auctions

No turnaround plays

No integration drama

Just simple, profitable companies added to the flywheel.

Optionality without distraction.

Buffett would nod in approval.

Float without the frenzy.

This isn’t Buffett’s float, but the cash dynamics rhyme:

Premiums in

Claims paid later

Earnings harvested early

No trading. No hedge fund moves.

Just disciplined reinvestment.

Owner-operators in a tailored suit.

Markel is led by Tom Gayner, Buffett-aligned in temperament and timeline.

30+ years of cultural consistency

Executives with skin in the game

Frugality as a feature, not a fad

Run like a family business.

Built like a public compounder.

Boring on purpose.

No AI spin. No growth theater.

Just:

Solid underwriting

Long-horizon investing

Quiet execution in every cycle

Earnings that walk uphill—even in storms.

Set it, own it, let it grow.

For long-term investors, Markel offers:

Insurance-fueled compounding

Ventures that print cash

Public equities that outperform

Shareholder alignment without the spotlight

Markel doesn’t chase attention.

It builds value.

Warren Buffett Stock #7: Fastenal (Ticker: $FAST)

Built for the Bin. Paid for the Refill.

Fastenal isn’t just a distributor.

It’s the industrial supply chain’s last-mile solution—optimized, automated, and embedded where work happens.

No storefront glitz. No marketing budget.

Just vending machines, warehouse bins, and relentless reorders.

This isn’t retail.

It’s an industrial utility.

Fastenal wins by being everywhere work gets done.

1,200+ branches

1,500+ Onsite locations

Over 100,000 vending machines installed in customer facilities

It’s not about selling tools.

It’s about never running out of them.

Recurring revenue, not transactional sales.

Fastenal embeds into customer operations, then becomes invisible.

Vending restocks and Onsite inventory services drive daily reorders

Fast-moving SKUs—fasteners, safety gear, drills, gloves—on autopilot

High retention, long-term contracts, and low customer churn

Once inside the operation, Fastenal remains in place.

It gets relied on.

Logistics scaled like software.

Fastenal is a physical business run with digital discipline.

Route density, local inventory hubs, and vendor-managed stock

Real-time demand data from embedded machines

Minimal working capital, high turns, steady cash conversion

Every refill improves the system.

Every new customer improves the margins.

Growth without reinvention.

Fastenal doesn’t pivot. It expands.

Opens Onsite locations inside customer warehouses

Grows wallet share by stocking more categories

Wins business by lowering total cost, not bidding the lowest price

It’s not splashy growth.

It’s incremental dominance.

Balance sheet built to last.

Fastenal doesn’t borrow to expand. It doesn’t dilute to scale.

Strong returns on capital

Conservative financials

Steady dividend growth and regular special payouts

Buffett might not buy it at 30x earnings—

But he’d respect how those earnings show up, every single quarter.

Boring by mandate.

There’s no platform story.

No founder charisma.

No narrative arc.

Just:

Screws, safety vests, wire brushes

Reordered daily

Delivered faster than competitors can bid

And a service model that gets more profitable the deeper it digs in.

Set it. Stock it. Let it earn.

For long-term investors, Fastenal offers:

Recurring industrial cash flows at scale

A moat built on location, data, and trust

Expansion via customer intimacy, not broad marketing

Quiet execution in a messy, price-sensitive industry

Fastenal doesn’t chase attention.

It earns permanence—one bin at a time.

Warren Buffett Stock #6: TransDigm Group (Ticker: $TDG)

Built Into the Aircraft. Paid Every Takeoff.

TransDigm isn’t just an aerospace supplier.

It’s the quiet owner of proprietary parts flying on nearly every commercial and military aircraft in the world.

No consumer brand. No bidding wars.

Just thousands of parts—small, critical, and impossible to swap out.

This isn’t manufacturing.

It’s an engineered monopoly.

TransDigm wins by controlling the details others ignore.

~80% of sales from proprietary, sole-source parts

Thousands of SKUs with deep FAA certification moats

Long-term visibility baked into decades of platform life

You don’t notice these parts.

But the plane doesn’t leave without them.

Margins are built into the airframe.

TransDigm doesn’t win contracts.

It wins pricing power.

EBITDA margins consistently above 45%

Strong aftermarket mix—recurring, high-margin, high-stability

Product-level control allows regular price increases

When you own the IP and no one else can produce it—

You name your price.

Aftermarket is the engine.

New production matters. But the real cash comes after the sale.

55–60% of EBITDA from the aftermarket

Replacement cycles driven by flight hours, not airline capex

Decades-long platform tailwinds: A320s, 737s, F-35s, and more

It’s not just the installed base.

It’s embedded dominance.

M&A is a discipline, not a strategy.

TransDigm acquires companies with similar traits to those it already owns.

Sole-source products

High margins

Defensible intellectual property

No integration drama.

No cultural rewiring.

It’s bolt-on by blueprint—small, repeatable, and instantly accretive.

Financial structure with intention.

TransDigm isn’t afraid to use leverage because its cash flow is predictable.

High free cash conversion

Long runway of contractual revenues

Shareholder returns via special dividends and repurchases

Not reckless. Just calculated.

A capital structure built for cash-rich resilience.

Buffett may avoid leverage.

But he’d respect the discipline.

No story. Just systems.

There’s no software narrative.

No AI pivot. No visibility splash.

Just:

Proprietary parts

Recurring revenue

A portfolio that gets stronger as platforms age

TransDigm isn’t flashy.

It’s fundamental.

Hold it through the cycles. Count on the aftermarket.

For long-term investors, TransDigm offers:

Moat-like control of aerospace’s smallest, most profitable parts

High-margin, high-visibility cash flow

Relentless capital efficiency and operational discipline

A compounding engine built into the global fleet

TransDigm doesn’t need the spotlight.

It already owns the plane.

Warren Buffett Stock #5: Old Dominion Freight Line (Ticker: $ODFL)

Built to Last. Paid to Wait.

Old Dominion isn’t just a trucking company.

It’s a logistics powerhouse with decades of quiet domination.

No cargo planes. No global story.

Just precision shipping, regional density, and margin leadership.

This isn’t flashy.

It’s industrial elegance.

ODFL wins by doing one thing better than anyone else—LTL freight.

99% on-time delivery

Lowest claims ratio in the industry

Network coverage across all 48 continental states

Specialized? Yes. Disruptable? No. Essential? Absolutely.

The model is engineered for endurance:

Recurring business customers

Dense terminal network

Route optimization through technology

Decades of pricing power and service reliability

It’s not a sprint.

It’s a precision race run every day.

Cash flow on wheels.

ODFL doesn’t chase volume. It perfects service.

That operational edge turns freight into a financial engine.

Operating ratio ~72%—best in class

High returns on invested capital

Free cash flow is well above maintenance capex

The more it ships, the more efficient it gets.

Scale turns into margins.

Built from terminals, not tech.

The moat isn’t digital—it’s physical.

250+ service centers

Modern fleet, short asset replacement cycles

Hub-and-spoke model with owned real estate

Competitors rent. ODFL owns.

That makes all the difference in downturns.

The kind of structural edge Buffett looks for—simple, repeatable, hard to replicate.

M&A was avoided on purpose.

ODFL doesn’t grow by buying. It grows by executing.

No distractions

No integration risk

No goodwill impairment down the line

It builds its network route by route, center by center.

The moat compounds quietly.

Predictable, profitable, and proudly boring.

Owner-operators in high-vis vests.

ODFL is still family-influenced—run with care and cost control.

Long-tenured leadership

Conservative financial management

Culture of operational excellence

Frugal. Focused. Execution-first.

Buffett would recognize the DNA instantly.

Boring on purpose.

There’s no AI angle here. No global expansion narrative.

Just:

99%+ delivery precision

Margin leadership through cycles

Pricing power earned, not assumed

Earnings that grind uphill—even in recessions.

Set it, own it, let it run.

For long-term investors, Old Dominion offers:

Logistics done right, at scale

A durable cost advantage in a brutal industry

Disciplined, debt-free growth

A high-quality business trading below its potential

ODFL doesn’t chase attention.

It compounds quietly—the kind of business Buffett would never sell.

Warren Buffett Stock #4: Kinsale Capital (Ticker: $KNSL)

Built from Scratch. Run with Precision.

Kinsale isn’t just an insurer.

It’s a purpose-built underwriting business with no legacy baggage—and no desire to be average.

No broad market exposure. No half-measures.

Just excess & surplus lines, priced carefully and delivered with speed.

This isn’t copy-paste insurance.

It’s specialty-first, discipline-always.

Kinsale wins by staying out of crowded markets.

Avoids standard risks

Targets hard-to-place policies

Operates with a focus that others can’t afford

It doesn’t scale broadly.

It scales intelligently.

Profit comes before premium.

Every dollar written is measured. Every risk is scrutinized.

Combined ratio in the mid-70s

Underwriting profits, not investment returns, drive the engine

No history of red ink—rare in this corner of insurance

This isn’t float-first.

It’s underwrite-first.

And Buffett has always preferred companies that make money before investing a cent.

Technology without the buzzwords.

Kinsale built its own platform.

No vendors. No patches. No excuses.

Faster quoting

Lower overhead

Fewer people per dollar of premium

Automation isn’t the story.

Profitability is.

A narrow path, followed strictly.

Kinsale won’t chase size.

It turns down more business than it writes.

Small account focus

No admitted products

No pressure to grow just to impress

Underwriting integrity comes first—always.

Growth is welcome, but only when it’s priced right.

Still founder-led. Still focused.

CEO Michael Kehoe built Kinsale from zero.

He still runs it with the same clarity of mission.

Insider ownership remains meaningful

No empire-building

No distractions outside E&S

The kind of operator Buffett trusts: experienced, measured, and in no rush.

No noise. Just results.

There’s no marketing engine. No investor hype cycle.

Just:

Thoughtful risk selection

High returns on equity

A business model that doesn’t rely on chasing capital

And a track record that continues to improve with scale.

Built to grow carefully. Priced to hold confidently.

For long-term investors, Kinsale offers:

A rare underwriting-first insurer with founder alignment

Structural cost and speed advantages

A clean balance sheet and no underwriting skeletons

A focused model in a messy, underpenetrated market

Kinsale doesn’t need a headline to perform.

It just needs a policy—and a price.

Warren Buffett Stock #3: Topicus (Ticker: $TOI.V)

Built in Europe. Structured for Forever.

Topicus isn’t just a software company.

It’s a quiet aggregator of essential tools that keep entire sectors running.

No Silicon Valley playbook. No blitzscaling.

Just vertical software for education, healthcare, government, and finance—built to endure.

This isn’t growth theater.

It’s a grounded operating system for society.

Topicus wins by embedding deeply, industry by industry, region by region.

Local dominance in non-English-speaking markets

Software tailored to niche workflows

Revenue that renews, expands, and sticks

It doesn’t chase users.

It becomes infrastructure.

Profit matters more than pitch decks.

Every acquisition must bring customers, cash flow, and autonomy.

90%+ of acquired revenue is recurring

Founder-led teams stay in place

Profitability is required, not optional

The model doesn’t assume scale.

It earns it over time.

A framework, not a formula.

Topicus doesn’t integrate.

It equips.

Best practices are shared, not imposed

Each business retains its own leadership

Culture is decentralized by design

This isn’t synergy math.

It’s measured stewardship.

The result is a portfolio of companies that learn from each other, without losing their edge.

European, by design.

While Constellation Software built the blueprint, Topicus adapted it to continental Europe.

Smaller addressable markets

Heavier regulation

Language-specific complexity

These aren’t hurdles.

They’re moats—ones competitors don’t want to jump.

Buffett wouldn’t call it a moat builder.

He’d call it a moat buyer.

Quiet excellence.

There’s no product keynote. No cult brand.

Just:

Industry-specific software

Strong retention and renewal dynamics

Durable cash flows are growing in the background

It doesn’t need attention to perform.

It just needs time.

Hold like a local. Think like an owner.

For long-term investors, Topicus offers:

Early-stage access to a proven playbook

Decentralized compounding in underpenetrated markets

Management trained in Constellation’s capital discipline

The rare software business where growth doesn’t mean control

Topicus won’t send out press releases.

But it will quietly deliver—acquisition by acquisition, quarter by quarter.

Warren Buffett Stock #2: Rollins (Ticker: $ROL)

Compounding in the Crawlspace.

Rollins isn’t just pest control.

It’s one of the quietest compounders in the market.

Roaches. Rats. Termites.

Not glamorous—but guaranteed demand.

This is defensive growth, door-to-door.

Every home. Every season. Every year.

Over 2.9 million customers.

More than 800 locations.

Recurring revenue is baked into biology.

Pests don’t pause for recessions.

Neither does Rollins.

The model is brilliantly basic:

Route density

Recurring contracts

Low churn

Predictable margins

Rollins sends out techs like clockwork.

Each visit strengthens the moat.

Cash flow in khakis.

This is a service business with a manufacturer’s precision.

Minimal capital required

High return on invested capital

Strong pricing power in plain sight

It’s not software.

It’s better—it doesn’t expire or get disrupted.

The Orkin machine.

Orkin is the crown jewel:

A 120-year-old brand with top-of-mind trust.

National reach

Local service

Premium pricing

Rollins doesn’t compete on cost.

It wins on reliability.

Steady hands at the controls.

Family control keeps it long-term.

No short-term games. No mission drift.

Buffett loves owner-operators.

So would he love Rollins? No question.

M&A, mastered.

Over 100 acquisitions in the last 10 years.

Tuck-ins, not takeovers.

Mom-and-pop sellers

Culture-first integration

No margin dilution

This is consolidation done the old-fashioned way—profitable, disciplined, enduring.

Pests compound. So does Rollins.

Every infestation is an annuity.

Every route added improves the whole.

Organic growth + bolt-ons + pricing power = clockwork compounding.

Predictable. Boring. Beautiful.

No hype. No headlines.

Just clean execution and quarterly consistency.

Rollins isn’t flashy.

It’s flawless.

For long-term investors, it offers:

Defensive growth

Recession-proof demand

Family ownership

Consistent dividend growth

Buffett wouldn’t just admire Rollins.

He’d try to buy it.

Warren Buffett Stock #1: Brown and Brown (Ticker: $BRO)

Built to Last. Paid to Wait.

Brown & Brown isn’t just an insurance broker.

It’s a cash-rich compounder hiding in plain sight.

No manufacturing. No inventory.

Just relationships, contracts, and a steady stream of commission.

This isn’t flashy.

It’s financial gravity.

Brown & Brown wins by being everywhere, quietly.

10,000+ teammates.

300+ offices.

Across all 50 states.

Specialty? Yes.

Complex? No.

Essential? Absolutely.

The model is simplicity at scale:

Recurring revenue

Minimal capital needs

High client retention

Decades-long growth through bolt-ons

It’s not a rocket ship.

It’s a locomotive.

Cash machine with a local face.

Brown & Brown doesn’t underwrite risk.

It earns a cut, regardless of outcomes.

A toll booth on the $2T+ insurance highway.

No claims of liability

High-margin fee streams

Recession-resistant demand

Sticky clients, sticky economics.

Commercial clients can’t afford to switch.

And the personal side is pure autopilot.

Embedded across industries, across regions, across decades.

M&A as a craft, not a sprint.

Brown & Brown has bought 500+ agencies—patiently, profitably.

No bidding wars. No splashy deals.

Just disciplined, accretive tuck-ins—again and again.

Buffett would nod in approval.

Float without the risk.

This isn’t Berkshire’s insurance float.

But the cash dynamics rhyme:

Premium-like commissions

Deferred costs

Upfront cash earnings

No investment portfolio to manage.

Just operating leverage to scale.

Owner-operators in a corporate suit.

Family roots meet public discipline.

30+ years of inside ownership

Skin in the game

Relentless cost control

Brown & Brown is run like a business Buffett would build:

Frugal. Focused. Forever-minded.

Boring on purpose.

There’s no AI story here.

No moonshots. No distractions.

Just consistent execution in a high-trust industry.

And earnings that walk uphill in all weather.

Set it, own it, sleep well.

For long-term investors, Brown & Brown offers:

Predictable compounding

Shareholder-aligned management

Long runway in a fragmented industry

Buffett-grade business model

Brown & Brown doesn’t chase attention.

It earns returns.

🔥 Ready to go from reading about great businesses to owning them with conviction?

You’ve just seen 11 of the world’s best buy-and-hold-forever companies.

Now imagine having the full edge—every single week:

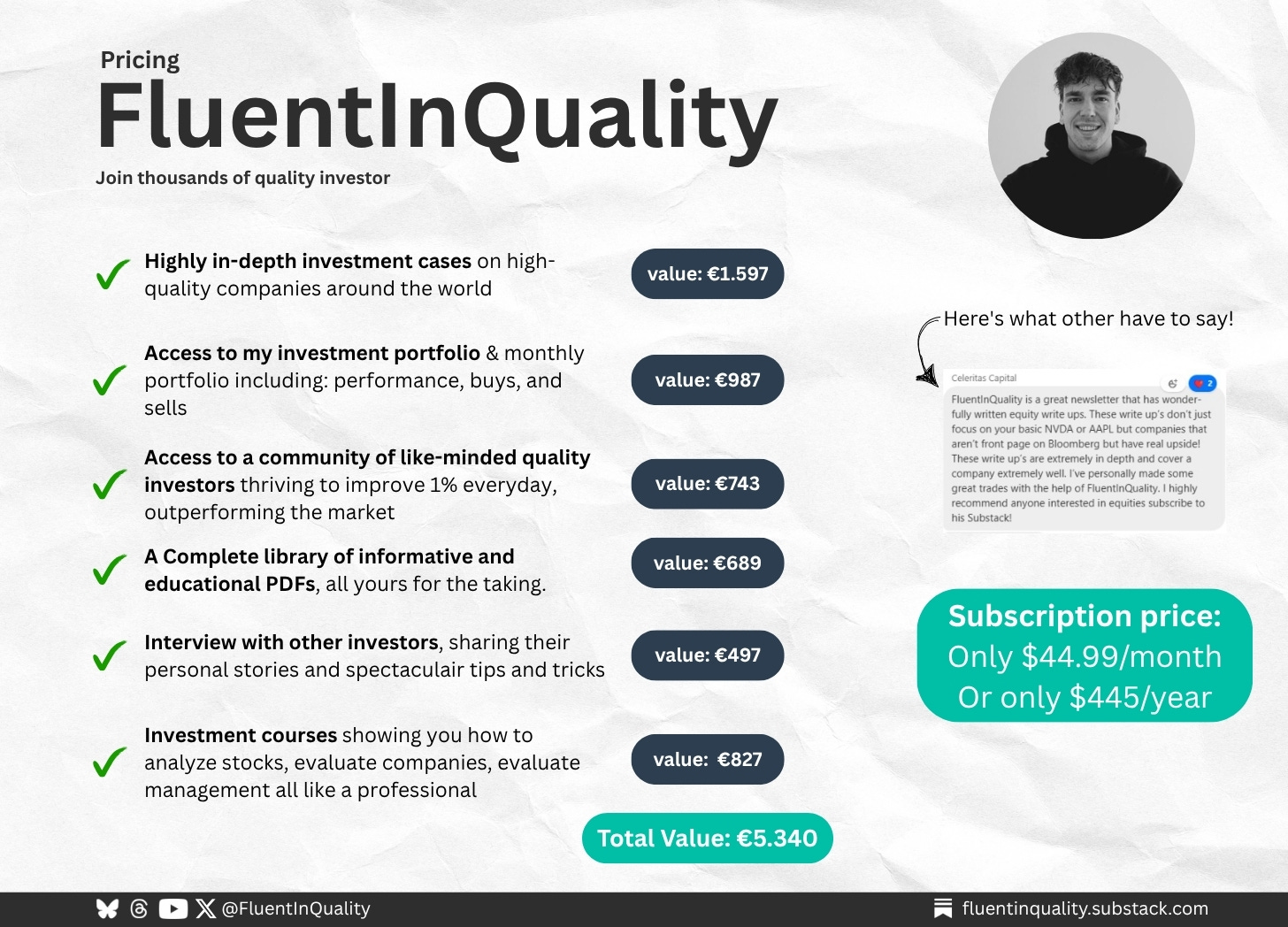

✔️ Full research reports and timeless deep dives (valued at €1,597)

✔️ Monthly buy/sell portfolio updates with commentary (€987)

✔️ Access to a private Discord of high-conviction investors (€743)

✔️ Tools, templates, investor interviews & PDF briefs (€2,013)

Total value: €5,340 — yours for just €44.99/month or €445/year.

No fluff. No noise. Just real work, trusted by 1,200+ long-term investors.

This isn’t just insight. It’s an investing advantage.

Delivered weekly. Backed by research. Built to compound.

🟢 Become one of The Fluent Few

Let’s build wealth the right way—brick by brick.

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds to refer this edition to a friend? It will go a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards like free access to the paid community!

Great investments don’t shout, they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all the charting, analysis, and keeping up with earnings calls. You can now get 15% off your subscription. Click here and start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.