These Are The Only 10 High-Quality Compounders You Need

Sometimes, your ten best ideas are the ones worth holding for life. Here are 10 unstoppable compounders you can add to your portfolio—and never look back.

Imagine building the ultimate superhero team—not just any heroes, but the strongest, most resilient, and battle-tested legends. The ones who never lose, never fade, and always come back stronger. Now, imagine applying that to your portfolio.

These 10 high-quality compounders are like the Avengers of investing—indestructible, consistently winning, and built to dominate for decades.

You’ve got your Iron Man (tech innovator), Captain America (time-tested resilience), Thor (powerful, global reach), and even your Doctor Strange (the one no one understands but keeps compounding like magic).

You don’t trade the Avengers, and you don’t trade these stocks. You hold them, and they do the heavy lifting for you.

Let’s meet the team.

Happy reading!

10. Thermo Fisher Scientific (Ticker: TMO)

Thermo Fisher Scientific serves biotech. It serves pharma. It serves healthcare. It serves research.

A global leader in scientific instruments, laboratory equipment, reagents, and software.

Names like Invitrogen. Applied Biosystems. Trusted brands. Trusted science.

But how does it generate revenue?

Laboratory solutions. Life science tools. Analytical instruments.

And beyond the tools? Recurring revenue.

Consumables. Services. The essential supplies that labs need. Again and again.

But what makes Thermo Fisher a high-quality company?

Precision. Reliability. Innovation.

Its instruments deliver accuracy. Its reagents ensure consistency. Its lab solutions drive results.

Scientists trust it. Researchers depend on it.

And it’s not just about performance.

User-friendly design. Seamless integration. Efficiency at every step.

Thermo Fisher doesn’t just provide tools. It makes research easier. It makes discovery faster.

This isn’t just a company selling lab equipment.

It is enabling breakthroughs. Empowering science. Advancing medicine.

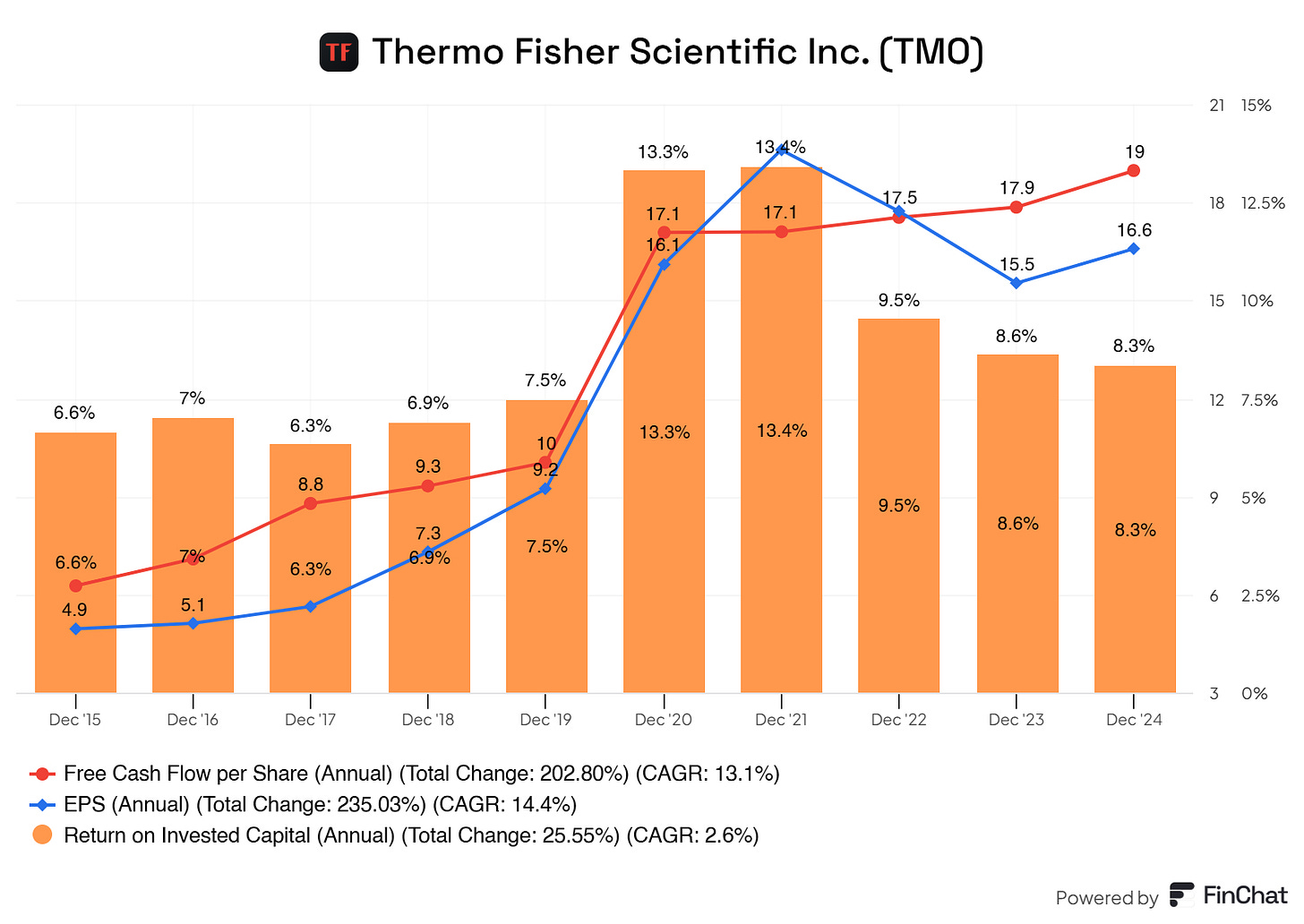

As shown here, Thermo Fischer has consistently created shareholder value per share.

This per-share growth is getting a solid boost from the modest buybacks that Thermo Fisher does. There is an extra bonus here!

Quick Overview

Gross Profit Margin: 41.3%

Operating Profit Margin: 17.9%

Free Cash Flow Margin: 16.9%

ROIC (5Yr Avg): 11.2%

ROCE (5Yr Avg): 12.1%

EPS (long-term) Growth Estimates: 9.6%

Revenue 5YR CAGR: 10.9%

9. Watsco (Ticker: WSO)

Watsco is North America's largest distributor of HVAC/R equipment.

It sells air conditioners. It sells furnaces. It sells everything contractors need to install, repair, and maintain comfort.

But Watsco does more than just supply equipment.

Contractors need parts. They need refrigerants, thermostats, and tools.

Watsco provides them. Steady. Reliable. Always in stock.

And it doesn’t stop there.

Watsco invests in e-commerce. It builds data-driven platforms. It makes buying easier, faster, smarter.

Efficiency for contractors. Growth for Watsco.

But what about maintenance?

Every system needs servicing. Every unit needs replacement.

Watsco is there, selling the parts, selling the tools, selling the expertise.

Recurring demand. Consistent sales. A network so strong that independent contractors depend on it.

And in an old-school industry, Watsco’s tech advantage sets it apart.

This isn’t just distribution. It’s dominance.

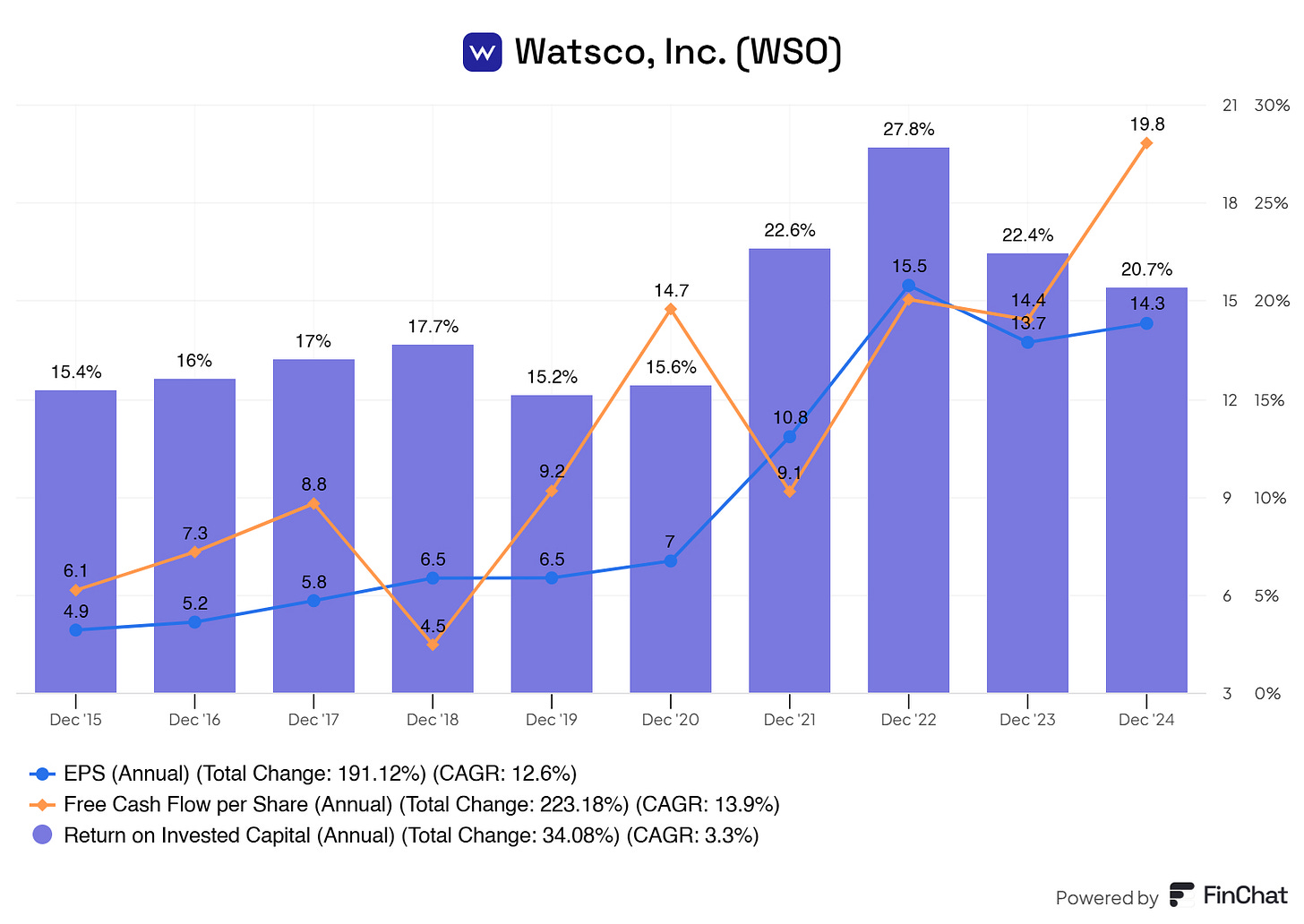

Watsco benefits from a wonderful ROIC and excellent per-share growth!

Quick Overview

Gross Profit Margin: 26.8%

Operating Profit Margin: 9.9%

Free Cash Flow Margin: 9.8%

ROIC (5Yr Avg): 22.2%

ROCE (5Yr Avg): 26.5%

EPS (long-term) Growth Estimates: 9.0%

Revenue 5YR CAGR: 9.8%

8. Chipotle (Ticker: CMG)

Chipotle serves burritos. It serves bowls. It serves tacos, salads, and fresh ingredients.

Real food. No artificial flavors. No preservatives. Just high-quality, responsibly sourced ingredients.

But how does Chipotle make money?

It sells food. Fast. Fresh. Made-to-order.

Customers line up. They choose their protein. They pick their toppings.

And every choice? An upsell. Guac costs extra. So does double meat.

But that’s not all.

Chipotle thrives on efficiency. No freezers. No microwaves. Just a streamlined process that keeps lines moving and orders flowing.

Faster service. More customers. Higher sales.

And then there’s digital.

Online orders. App rewards. Delivery partnerships.

Less friction, more convenience, higher margins.

This isn’t just fast food. It’s fast-casual, built for scale.

And it’s not just a restaurant. It’s a brand. A movement. A commitment to real food, real fast.

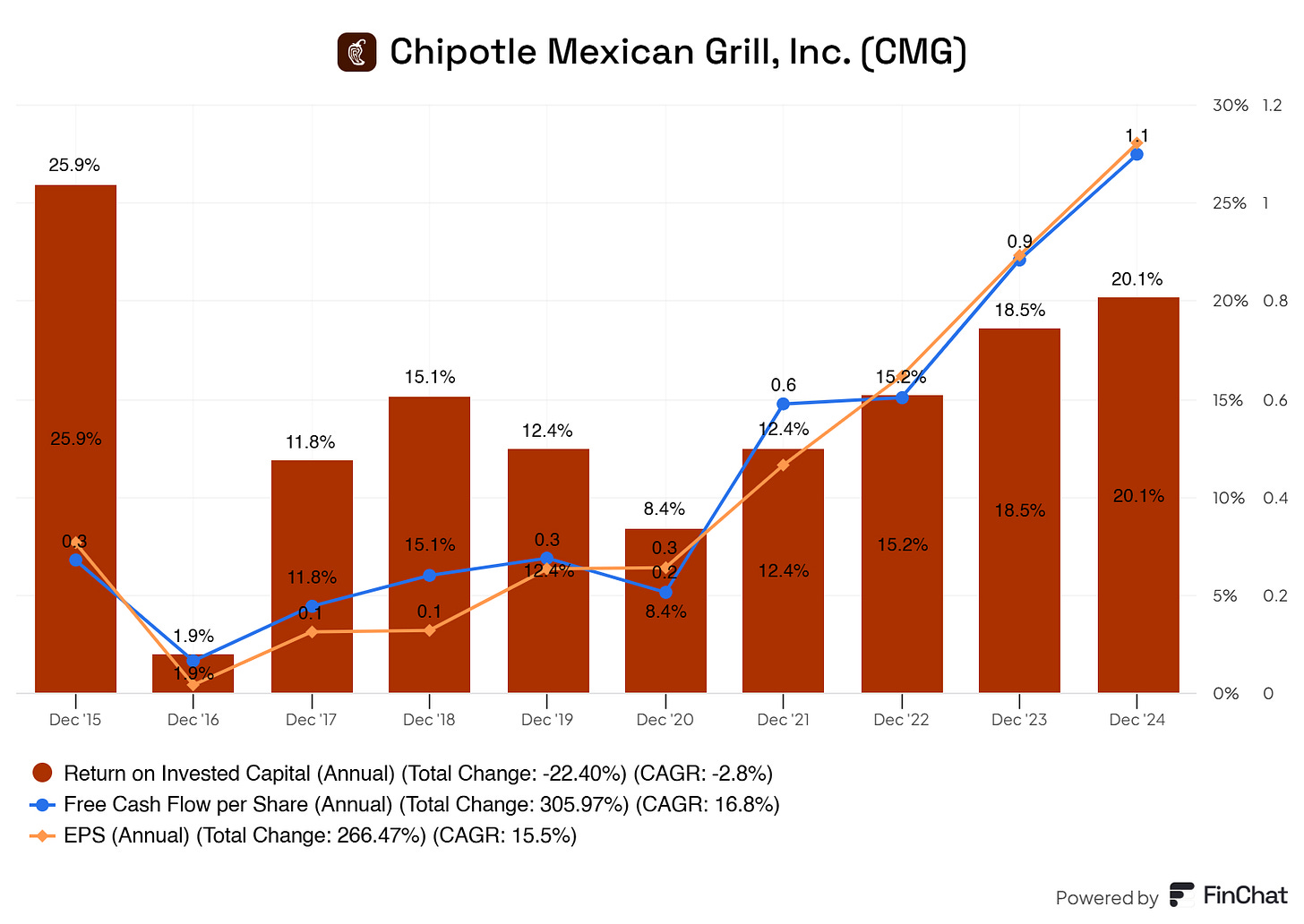

Chipotle is showing reliable and sustainable growth

Just how we like it as quality investors.

Quick Overview

Gross Profit Margin: 40.5%

Operating Profit Margin: 17.3%

Free Cash Flow Margin: 13.4%

ROIC (5Yr Avg): 15.9%

ROCE (5Yr Avg): 19.9%

EPS (long-term) Growth Estimates: 19.5%

Revenue 5YR CAGR: 15.2%

7. Costco (Ticker: COST)

Costco sells in bulk. It sells groceries. It sells electronics. It sells everything from toilet paper to diamond rings.

But how does it make money?

Memberships. That’s the secret.

Customers pay to shop. They pay for access. And they keep paying, year after year.

High renewal rates. Recurring revenue. A business model built on loyalty.

But there’s more.

Costco runs on efficiency. No fancy displays. No excessive branding. Just pallets stacked high, prices kept low.

Buy in bulk. Sell in volume. Move inventory fast.

And then there’s the food court.

$1.50 hot dogs. Rotisserie chickens are at a loss.

Why? Because cheap food brings people in. And once they’re in? They spend.

This isn’t just a store. It’s a system. A machine built for scale.

Low margins. High turnover. Relentless customer loyalty.

Costco doesn’t just sell products.

It sells value. It sells trust. It sells the smartest way to shop.

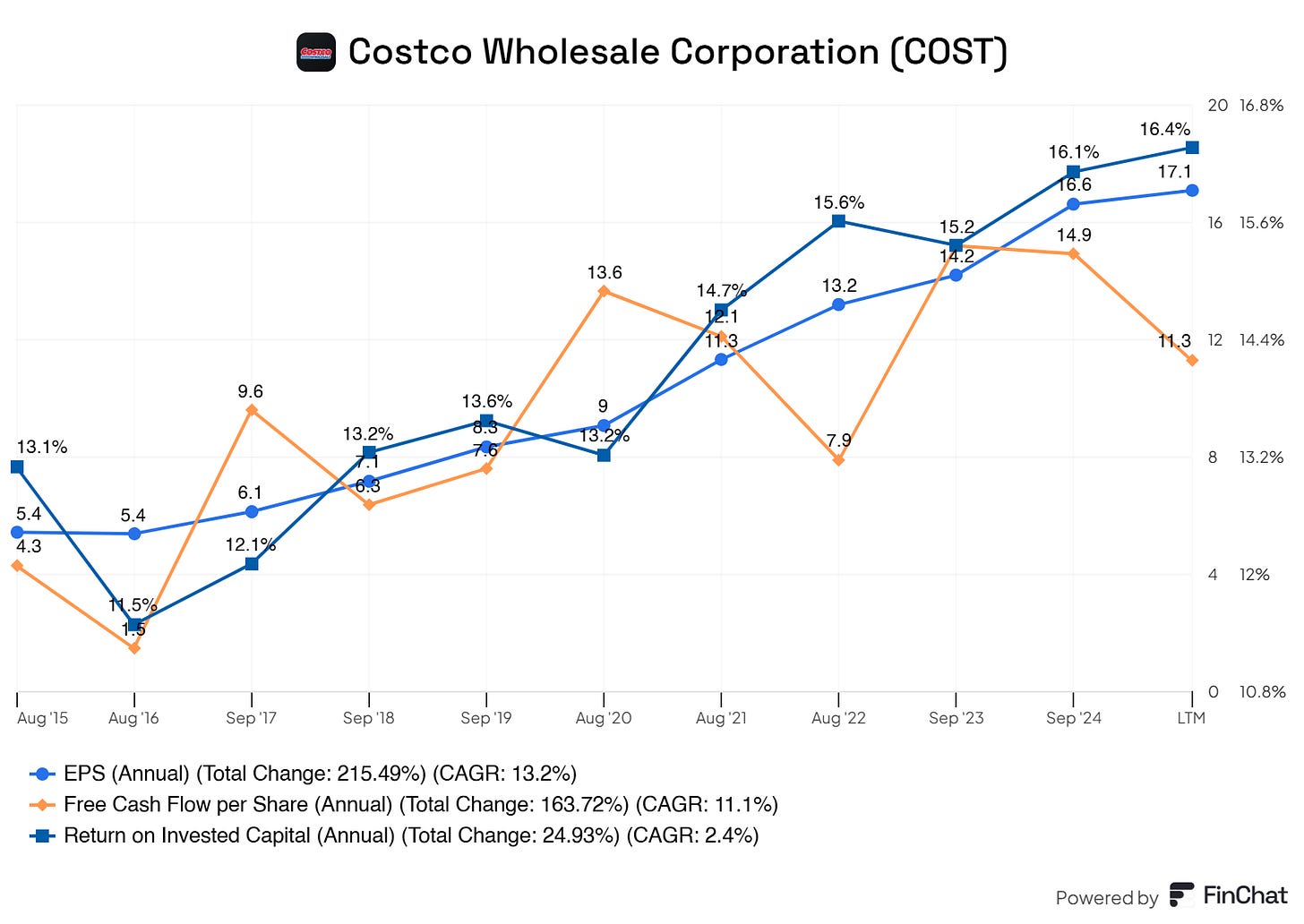

Again we see sustainable, reliable, and predictable growth here for Costco.

Are we starting to see patterns here with these high-quality compounders? I am.

Quick Overview

Gross Profit Margin: 12.7%

Operating Profit Margin: 3.7%

Free Cash Flow Margin: 1.9%

ROIC (5Yr Avg): 15.3%

ROCE (5Yr Avg): 25.1%

EPS (long-term) Growth Estimates: 9.4%

Revenue 5YR CAGR: 10.8%

6. Visa (Ticker: V)

Visa doesn’t issue cards. It doesn’t lend money. It doesn’t charge interest.

So how does Visa make money?

Transactions. Every time you swipe, tap, or click—Visa takes a cut.

Merchants pay a fee. Banks pay a fee. Billions of payments, tiny fees, adding up fast.

But there’s more.

Visa runs the network. A global payment highway.

Secure. Fast. Reliable. Moving trillions of dollars across the world.

And the best part?

No credit risk. No loan defaults. Just pure transaction volume.

More spending. More fees. More revenue.

Digital wallets? Covered. Online shopping? Growing.

Every trend in payments? Visa is there, collecting its cut.

This isn’t just a company. It’s infrastructure.

An invisible tollbooth in the global economy.

Visa doesn’t sell a product. It sells access. And it wins every time money moves.

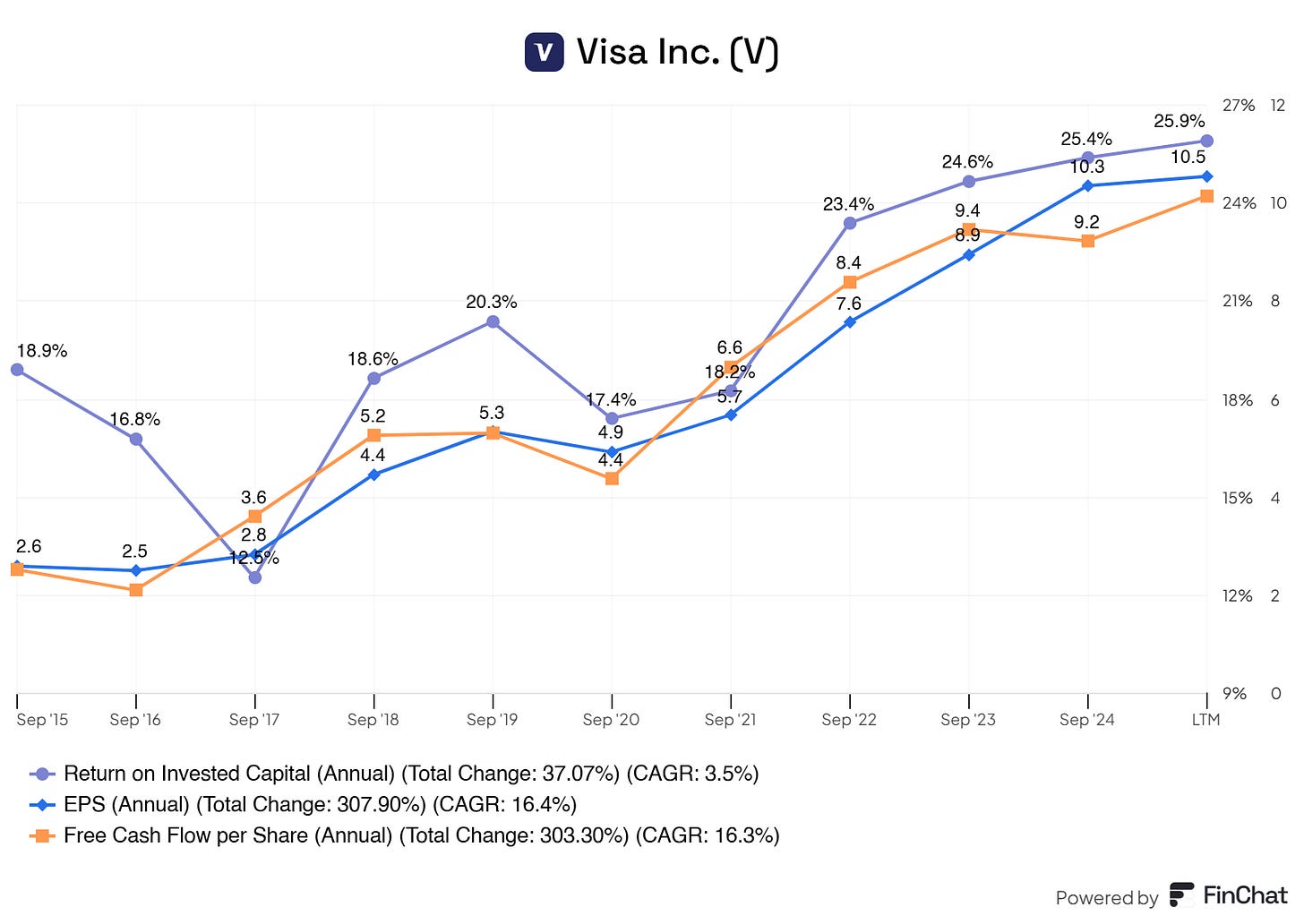

What a beautiful chart to look at, right? An actual compounding machine it is.

Quick Overview

Gross Profit Margin: 97.8%

Operating Profit Margin: 66.6%

Free Cash Flow Margin: 55.4%

ROIC (5Yr Avg): 22.5%

ROCE (5Yr Avg): 30.1%

EPS (long-term) Growth Estimates: 12.4%

Revenue 5YR CAGR: 9.4%

5. MercadoLibre (Ticker: MELI)

MercadoLibre is e-commerce. It’s payments. It’s logistics. It’s the Amazon, PayPal, and FedEx of Latin America—rolled into one.

But how does it make money?

It sells products. It powers transactions. It moves money.

Sellers list. Buyers shop. MercadoLibre takes a cut.

But that’s just the beginning.

Mercado Pago—its payment system—processes billions.

Online. In-store. Peer-to-peer. Every transaction? A fee.

Then there’s Mercado Envios.

Fast shipping. Warehouses. Last-mile delivery.

More logistics control. More convenience. More sales.

And don’t forget credit.

Mercado Credito lends money. To shoppers. To sellers.

More financing. More spending. More revenue.

E-commerce. Payments. Logistics. Lending.

A complete ecosystem, built for a growing market.

This isn’t just a marketplace.

It’s infrastructure. It’s dominance. It’s the future of commerce in Latin America.

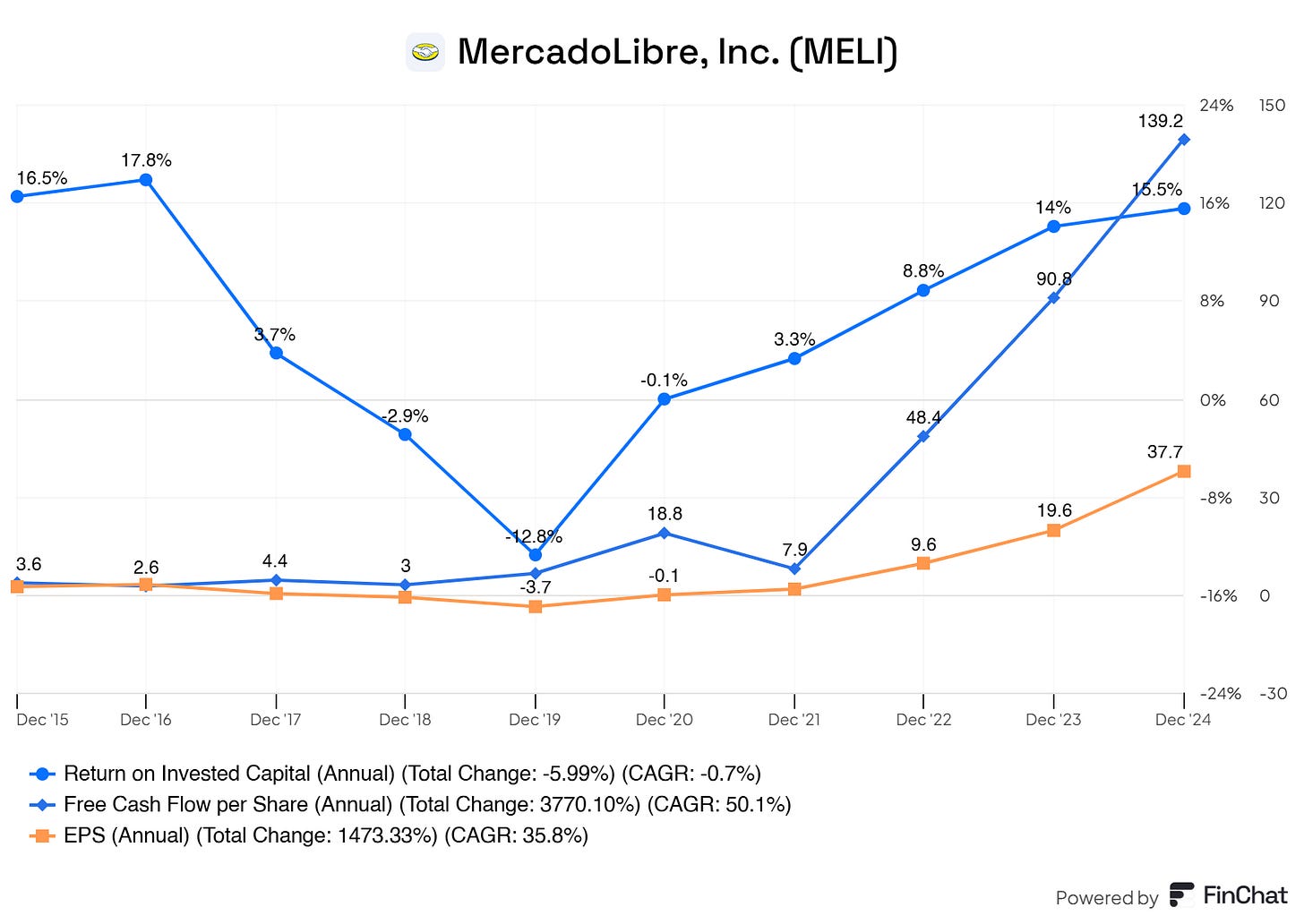

Where does it stop? The moon? I don’t know, but I am here for it!

Quick Overview

Gross Profit Margin: 52.7%

Operating Profit Margin: 12.7%

Free Cash Flow Margin: 34.0%

ROIC (5Yr Avg): 8.9%

ROCE (5Yr Avg): 25.2%

EPS (long-term) Growth Estimates: 30.5%

Revenue 5YR CAGR: 55.3%

4. Amazon (Ticker: AMZN)

Amazon sells everything. Books. Electronics. Groceries. Cloud computing.

If you need it, Amazon has it.

But how does Amazon make money?

E-commerce? Yes. But margins are thin. The real money? Elsewhere.

AWS. Amazon Web Services.

The backbone of the internet. Hosting. Storage. Computing power.

High margins. Massive scale. Billions in profit.

Then there’s Prime.

Fast shipping. Exclusive content. A subscription that keeps customers locked in.

More Prime members. More spending. More loyalty.

And advertising.

Brands pay to be seen. They pay for clicks. They pay for top placement.

More shoppers. More data. More targeted ads.

Logistics? Amazon owns it.

Warehouses. Planes. Trucks. A supply chain built for speed.

This isn’t just an online store.

It’s cloud computing. It’s logistics. It’s a data empire.

Amazon doesn’t just sell products.

It controls how the world buys.

It ain’t pretty, but it ain’t ugly either!

Quick Overview

Gross Profit Margin: 48.9%

Operating Profit Margin: 10.8%

Free Cash Flow Margin: 5.2%

ROIC (5Yr Avg): 8.4%

ROCE (5Yr Avg): 10.6%

EPS (long-term) Growth Estimates: 21.6%

Revenue 5YR CAGR: 17.9%

Alright, let us get into the top three! Buckle up.

3. S&P Global (Ticker: SPGI)

S&P Global isn’t just an index.

It’s data. It’s ratings. It’s intelligence. It’s the backbone of global finance.

But how does it make money?

Credit ratings. Companies issue debt. Investors need trust. S&P rates the bonds.

More bonds. More ratings. More fees.

Then there’s market data.

Traders need insights. Hedge funds need numbers. Banks need information.

S&P sells it. In real time. At a premium.

And the indices?

The S&P 500. The Dow Jones. ETFs tracking them, funds replicating them.

Every trade. Every rebalance. Licensing fees flow in.

But wait—there’s more.

Software. AI-driven analytics. Risk assessment tools.

Faster decisions. Smarter investing. Priceless data.

This isn’t just a financial company.

It’s infrastructure. It’s intelligence. It’s the foundation of markets.

S&P Global doesn’t just track the economy.

It powers it.

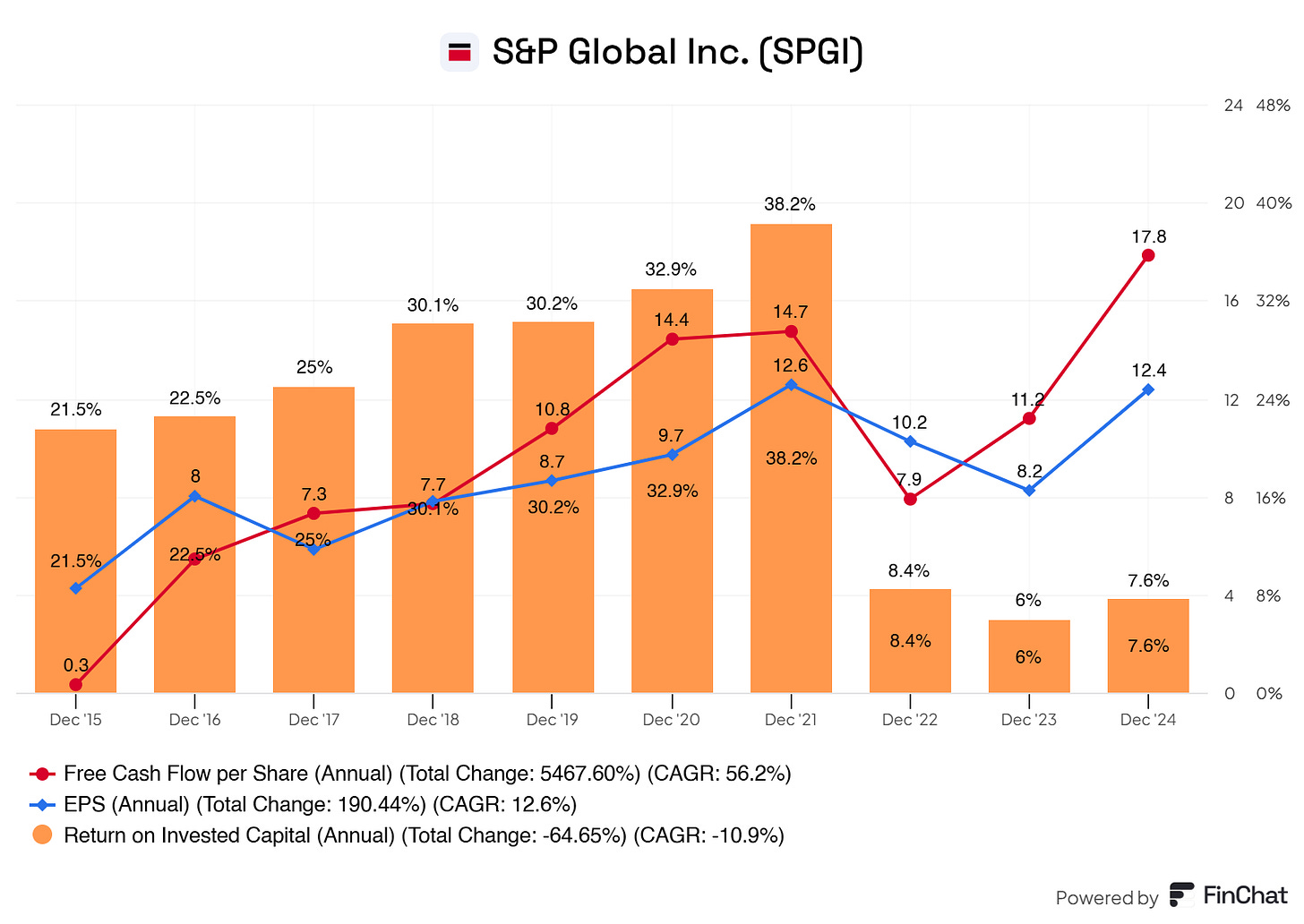

What rating, market data, and indices can bring us, right? Lovely returns!

Quick Overview

Gross Profit Margin: 69.1%

Operating Profit Margin: 40.8%

Free Cash Flow Margin: 39.2%

ROIC (5Yr Avg): 14.4%

ROCE (5Yr Avg): 18.9%

EPS (long-term) Growth Estimates: 14.3%

Revenue 5YR CAGR: 16.2%

2. ASML (Ticker: ASML)

ASML doesn’t make chips.

It makes the machines that make chips.

But how does it make money?

Lithography machines. The most advanced in the world.

Every major chipmaker—TSMC, Intel, Samsung—needs them.

ASML sells them. And they don’t come cheap.

But that’s just the start.

EUV technology. The future of semiconductors.

Smaller transistors. More power. More efficiency.

No EUV? No cutting-edge chips. No AI. No smartphones.

And then?

Service contracts. Maintenance. Upgrades.

Every machine needs upkeep. Every update keeps ASML essential.

A monopoly. A bottleneck. A business built on the impossible.

ASML doesn’t just sell equipment.

It sells the future of computing. And it’s the only one who can.

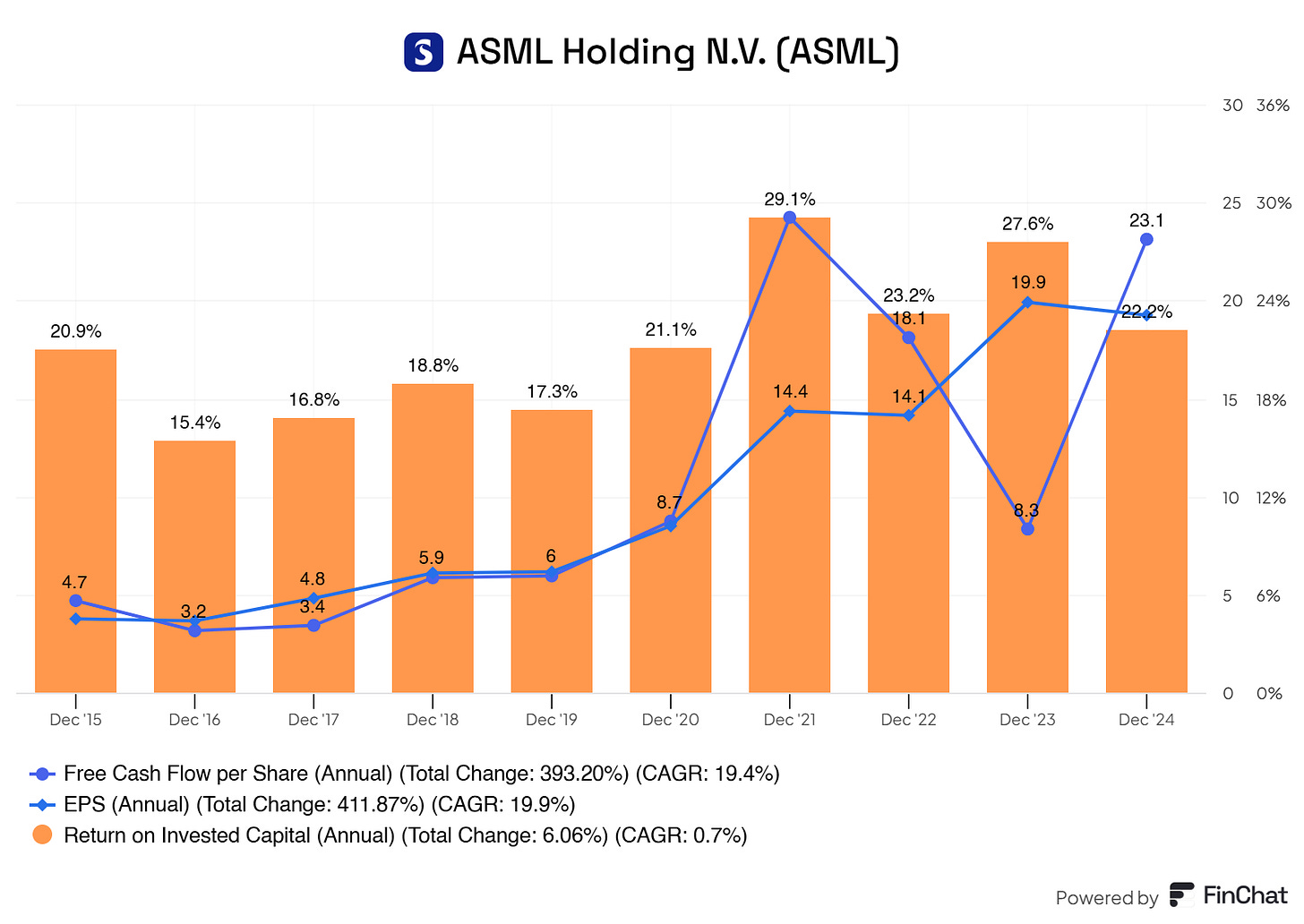

A monopoly giving outstanding returns? Sign me up!

Quick Overview

Gross Profit Margin: 51.3%

Operating Profit Margin: 31.9%

Free Cash Flow Margin: 32.2%

ROIC (5Yr Avg): 23.3%

ROCE (5Yr Avg): 35.9%

EPS (long-term) Growth Estimates: 18.5%

Revenue 5YR CAGR: 19.0%

And now, for the number one? The company that is time-tested, of the highest quality, outstanding management, loyal and cult like customers…

Nothing short of pure excellence.

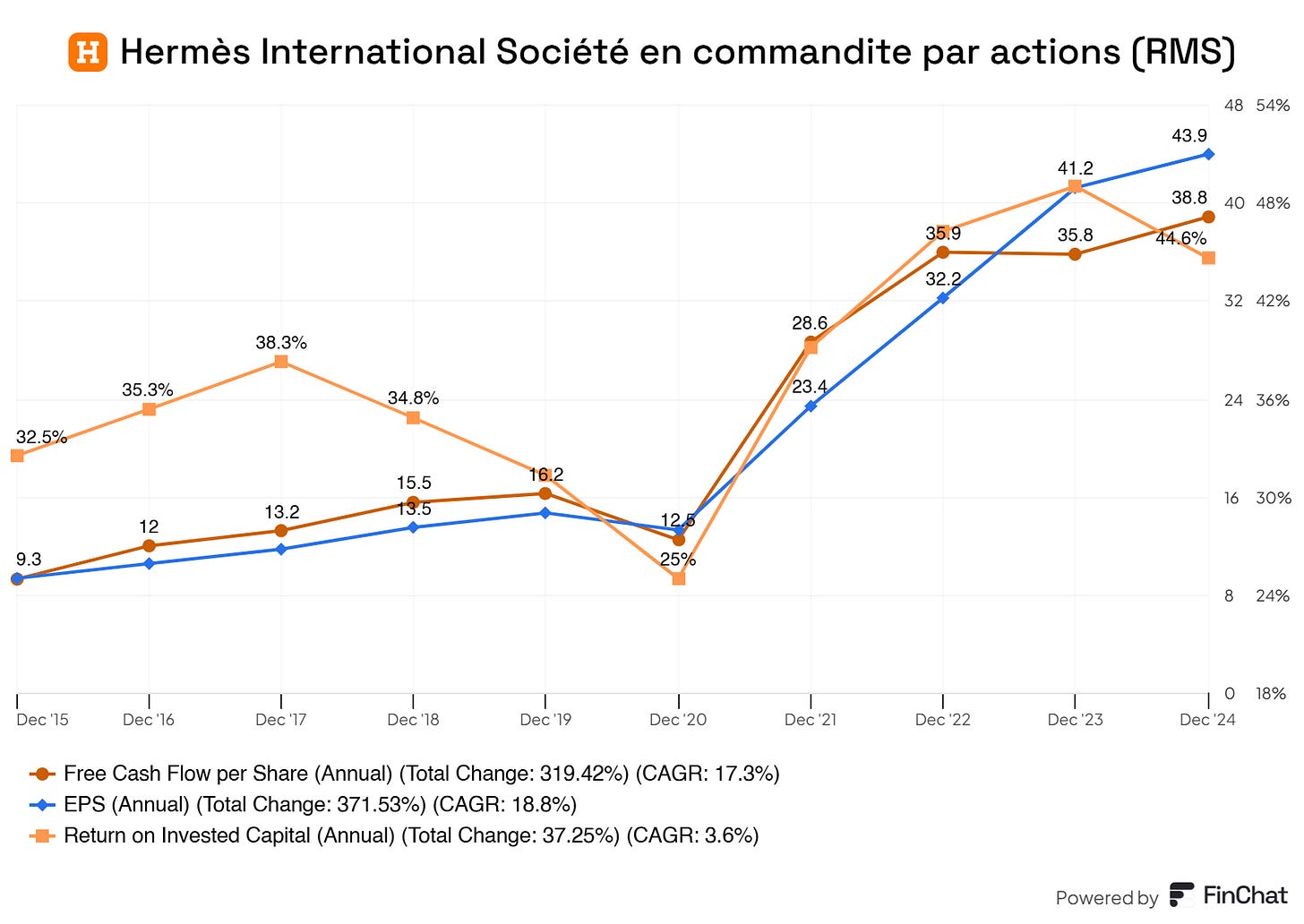

1. Hermés (Ticker: RMS)

Hermès doesn’t sell fashion.

It sells exclusivity.

But how does it make money?

Birkin bags. Kelly bags. Scarcity by design.

You don’t just buy one. You earn the right to.

Leather goods. Silk scarves. Ready-to-wear.

Every piece? Handcrafted. Every detail? Perfect. Every purchase? A statement.

But there’s more.

No discounts. No sales. No mass production.

Controlled supply. Endless demand. Prices rising, always.

And beyond bags?

Fragrances. Watches. Jewelry. Horses to handbags, heritage runs deep.

New categories. Same aura. Same prestige.

This isn’t just luxury.

It’s a fortress. A legacy. A brand immune to trends.

Hermès doesn’t follow fashion.

It dictates it.

If you look up ‘‘pure excellence’’, you’ll see Hermés sitting on the throne.

Quick Overview

Gross Profit Margin: 70.3%

Operating Profit Margin: 40.5%

Free Cash Flow Margin: 26.8%

ROIC (5Yr Avg): 43.5%

ROCE (5Yr Avg): 35.5%

EPS (long-term) Growth Estimates: 11.6%

Revenue 5YR CAGR: 17.1%

And that is it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Used Sources

Finchat is used for all the charts. You can now get 15% off from your subscription. Click here and start today!

(I’m affiliated with Finchat, but not sponsored. With this link your plan does NOT get more expensive, I solely get a small cut of the cake. Thank you in advance)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.

How do you see Kaspi ($KSPI) comparing to Mercado?

Nice list! Some of them seem overvalued forever.