The Myth of Technical Analysis: Why You Should Refrain From It!

Fibonacci levels, support and resistance, supply and demand, moving averages, and other technical analysis tools—are they truly profitable and, furthermore, a reliable strategy?

Technical analysis is something we've all been guilty of exploring at some point in our careers. We observe recurring patterns and believe we've deciphered where prices are headed. We begin to time the market based on technical perspectives and notice some profits here and there. However, the story progresses. You start to believe you've gained an edge over the entire market solely based on price and certain levels.

My Personal Experience With Technical Analysis

So, I'm not afraid to admit the following, even though it's a dark past of mine.

I used to be solely a technical analyst. I believed that based on patterns, supply and demand, and more, I could predict or forecast the market's next moves. I was active in the currency world, trading pairs like EUR/USD, EUR/JPY, EUR/NZD, and many others. Every day, I would log into Tradingview.com and start analyzing the charts, entering trades based on my analysis. I specialized in swing trading, where I would analyze the 4-hour, 1-day, and 1-minute charts, conduct my analysis, wait for my Point of Interest (POI) to be hit, and then enter the trade.

The fun part was that, actually, I was profitable for the majority of my time doing this! So why am I writing this article and refraining from technical analysis? Keep reading as I explain the issues with technical analysis.

What is Technical Analysis?

Technical analysis is a trading method that revolves around analyzing past market data, primarily focusing on price and volume. Investors use this data to forecast future market movements (you might already notice some flaws in this approach). This method relies solely on the belief that historical price movements tend to repeat themselves and that patterns can be identified to predict future price points. Technical analysts utilize various tools and techniques, such as chart patterns and technical indicators, among others. The aim of technical analysis is to identify opportunities to buy or sell assets based on perceived patterns and trends in market data.

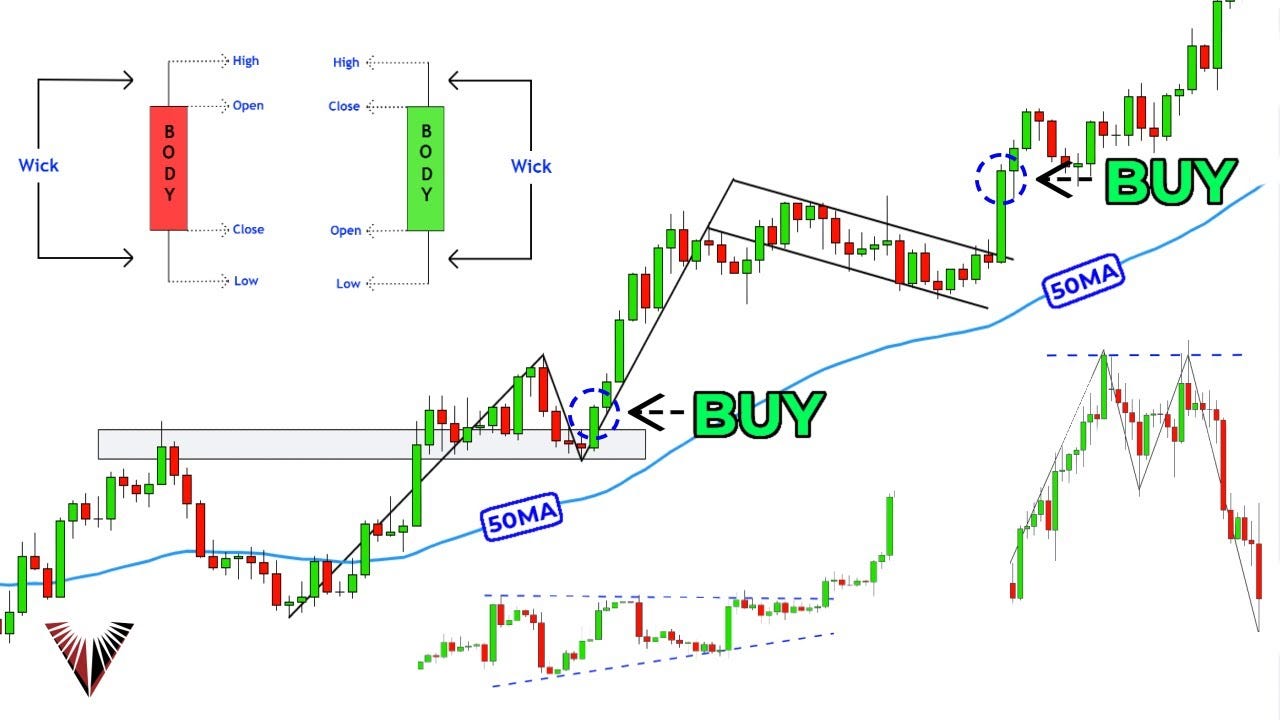

Here's a visual representation of marking up the chart and entering trades based on price action.

Why Does The Market Move?

So, let me explain why relying on price action as individual investors may not be worthwhile in the long run, and why it may not lead to profitability and sustainability.

Subjectivity is a major issue. Technical analysis heavily depends on interpreting chart patterns, indicators, and trends. However, these indicators often lag and provide information about the past rather than the future. Moreover, each of these factors is inherently subjective, leading to varying interpretations.

The market's movements are driven by interest in the underlying asset, the company itself. Factors such as the company's income statements, balance sheet, competitive advantage (MOAT), and other fundamentals determine the true value of a stock, which ultimately dictates its price. By focusing solely on price action, investors overlook critical information about the company's fundamentals. For instance, you may invest in a stock based on an uptrend in its price and patterns, only to see the price suddenly drop. Without considering the underlying fundamentals or recent news, relying solely on price action may seem ineffective. This discrepancy arises because while the technical analysis may suggest a long position due to observed patterns, unexpected news regarding the company's future outlook can trigger a significant drop in the stock price. This decline is driven by external factors such as news events rather than past price movements. As a result, past price action alone cannot accurately predict future events that might influence stock prices.

The stock market's movements are influenced by a multitude of factors, including news events, a company's financial performance, and various broader economic indicators.

Inability to Account for Fundamental Factors

Technical analysis primarily focuses on analyzing past price and volume data. However, it often fails to consider fundamental factors that play a crucial role in determining the long-term value of an asset.

Fundamental analysis, on the other hand, examines various factors such as earnings, growth prospects, industry trends, market competition, and macroeconomics. These factors are essential for understanding the intrinsic value of an asset and its potential for growth and profitability, which ultimately influence its price.

For example, fundamental analysis involves analyzing a company's financial statements, including its income statement, balance sheet, and cash flow statement, to evaluate its financial health and performance. Metrics such as revenue growth, profit margins, debt levels, and return on equity are assessed to determine the company's ability to generate profits and sustain growth over time.

In contrast, technical analysis focuses solely on price and volume data without considering the underlying fundamentals that drive these movements. While technical indicators and chart patterns can help identify short-term trading opportunities and market trends, they may not capture the broader economic and fundamental factors that influence asset prices.

By neglecting fundamental analysis, technical traders may overlook critical information that could impact their investment decisions. For instance, a company's strong earnings growth and market leadership position may indicate long-term value and growth potential, even if its stock price experiences short-term volatility or declines.

The Market is Noisy, Random and Annoying!

The stock market is often characterized by randomness and noise, leading to erratic and unpredictable movements. You may have experienced this firsthand in your portfolio of stocks. For instance, a stock might suddenly drop 1%, then gain 2%, ultimately ending the day with a modest 0.50% increase. Despite checking the news and releases, you find no clear explanation. This is because the market is influenced by constant activity, with people entering and exiting positions, making personal statements, and more, creating noise that can be difficult to decipher. This unpredictability makes it challenging to predict price movements accurately, as attempting to do so is akin to trying to predict randomness, which is inherently impossible.

Predictive Powers?! No.

If you're into technical analysis, it's like saying, "Hey, I've got a crystal ball that tells me where the price is headed—just trust me." But in reality, relying solely on price movements and some key levels with higher volume doesn't guarantee you'll know where the price is going. It's like trying to predict the future without understanding what's really driving the market.

If you're not considering the underlying assets and their fundamentals, it's more like gambling than investing for the long term. Long-term investing is about making informed decisions based on solid factors and fundamentals that have stood the test of time. It's the opposite of taking chances—it's about carefully weighing your options and understanding the true value of what you're investing in.

Apophenia Syndrome

Essentially, you begin to see connections between unrelated things. You notice a pattern that seems to "work" and assume it will work for all other stocks as well. Sound familiar?

You start seeing what you want to see in every chart, believing that all patterns are effective and will keep you actively trading in the markets. However, this often ends up benefiting your broker more than yourself. Just because something worked somewhere doesn't mean it will work elsewhere, especially in the case of stocks.

Conclusion

The market is not something you can reliably predict. It's inherently unpredictable, especially in the short term. However, in the long term, strategies like Dollar-Cost Averaging (DCA), Discounted Cash Flow (DCF), Dividend Discount Model (DDM), Free Cash Flow to Equity (FCFE), Free Cash Flow to Firm (FCFF), and more can be utilized. These approaches rely on fundamentals, concrete facts, and have a proven track record of success.

Fundamental analysis and truly understanding the asset is the essence of investing and creating value for yourself.

What I failed to mention after mentioning my profitability is that all the profits were eaten up by costs, and shortly after experiencing profitability, it ceased to exist. My so-called "proven strategy" didn't work anymore. How did this happen? Because it never truly worked in the first place. Sometimes you get lucky, make some money, but ultimately end up losing it, paying broker fees, and more.

Don't fall into the trap of believing in a magic solution like technical analysis. It doesn't work the same way as other strategies. With the limited tools available to individual investors, playing the short-term game for the long run is often futile.