The Hidden Secrets of Founder and Family-Led Companies

Founder-led companies outperformed others by 3.1x, and family-owned businesses by 4.2x over 20 years—discover the secret formula behind their success!

Hi, partner! 👋🏻

In my journey to find the best companies with the best total returns, I found something unique, and I have to share this with you.

This secret boosted my returns, even in the short term. However, it also limited my downside when the market was extremely pessimistic. Thus, you’ll have better returns in bull markets and fewer losses in bear markets.

This sounds almost impossible, right? Well, it’s not, and there are one or two simple yet extremely important factors to this…

Family-owned and founder-led companies.

This will not just be an article with my opinion, but my opinion mixed with actual research. This way, I can provide you with the most accurate and best information to boost your portfolio even more, all facts and research-based.

Before I share this secret sauce with you—all for free—I would appreciate it if you could share my newsletter with your friends and family and restack this article. The golden nuggets I’m about to share are worth it, and I truly believe so.

Without taking any more of your time. Sit back, grab your notebook, and enjoy.

Happy reading! 😄

What Are Founder-led and Family-owned Companies?

First, Let me briefly explain founder-led and family-owned companies so you can fully grasp this concept.

Founder-led companies are businesses where the original founder (or one of the co-founders) is still actively involved with a leadership result role, often CEO, executive chairperson, or another influential role within the company.

Family-owned companies are businesses where a significant portion of the ownership or control remains within a family, often across multiple generations. These companies are usually led or heavily influenced by family members, and their strategies and operations usually reflect the family's values, vision, and long-term goals.

Founders and families usually have most of their wealth locked in the company via stock (remember the quote about incentives?)

Show me the incentive, and I’ll show you the outcome - Charlie Munger

Why Do Family-Owned Companies Outperform?

I found a study by McKinsey & Company a while back, talking about family-owned companies and why these companies tend to outperform. I want to share this with you to back up any claims made and show you the true power of FOBs.

If you’re interested in this study, click here.

I’ll be showing parts and summaries of this study; therefore, all the information belongs to McKinsey & Company. This study has helped me understand FOBs and immensely shaped my investing approach. I’m certain that the study by McKinsey & Company will add value to you.

McKinsey conducted a study on family-owned companies. They analyzed 600 publicly listed family-owned companies (FOBS) and compared their performance with that of 600 publicly traded companies that are not family-owned. In addition, McKinsey surveyed another 600 primarily private FOBS around the world.

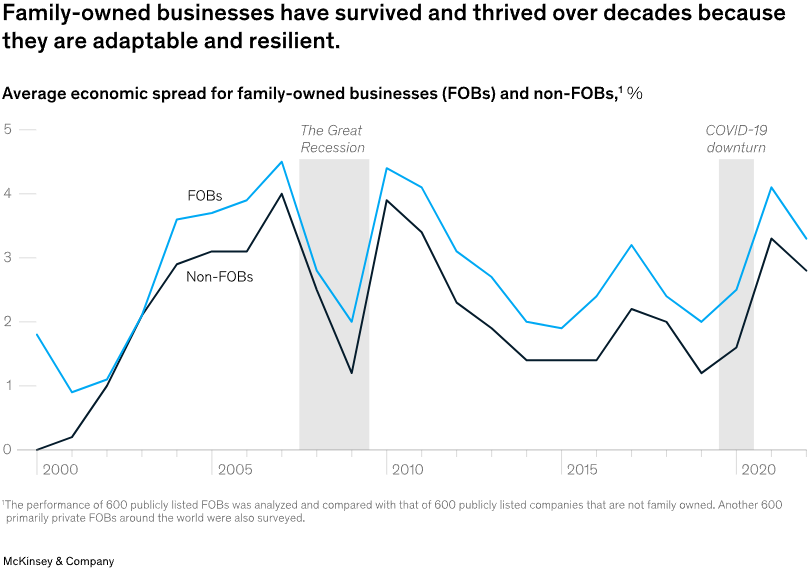

As I mentioned in the intro of this article, there’s more upside in a bull market. There are fewer downsides in a bear market (or temporary economic downturn), and the graph, which results from McKinsey’s extensive research, clearly backs up my claim.

We’ve known for a while that family-owned companies tend to outperform non-family-owned companies, but the real question is, “Why do FOBs outperform?”

Between 2017 and 2022, FOBs posted a TSR (Total Shareholder Return) of 2.6 percent, compared with 2.3% non-FOBs, due to a combination of unique mindsets and strategic actions. Additionally, FOBs who are 25 years old and younger tend to have a rather aggressive growth mindset. For instance, FOBs increase revenues twice as fast as non-FOBs.

FOBS prioritizes sustainable and long-term growth over short-term profits and earnings. FOBS do this because they’re in it for the long haul, with horizons longer than decades. A family continues to live on until humanity stops. Therefore, families want to maintain or increase their wealth. Most of their wealth is tied up in their company. Therefore, families are eager to ensure that their company thrives for decades. FOBs reinvest earnings into the business rather than focus on high dividend payouts, enabling continuous growth.

High-performing FOBs focus on a purpose beyond shareholder returns, such as maintaining their legacy, brand reputation, and community impact. This type of purpose fosters loyalty among employees and shareholders. In addition, FOBS tend to have more conservative financial policies, including lower leverage ratios, which help them weather economic downturns.

Another unique aspect of FOBs is their decision-making policies. Due to their centralized approach and processes, FOBs are usually more streamlined. They balance quick decisions with deliberative strategies, minimizing inefficiencies common in non-FOBs.

FOBs, especially high-performing ones, prioritize attracting, developing, and retaining top-tier talent. They ensure the company is run to their liking and placed perfectly for the long term, ensuring strong leadership and operational effectiveness across generations. They actively shift resources to high-growth businesses, regions, or opportunities, demonstrating their agility in capital deployment.

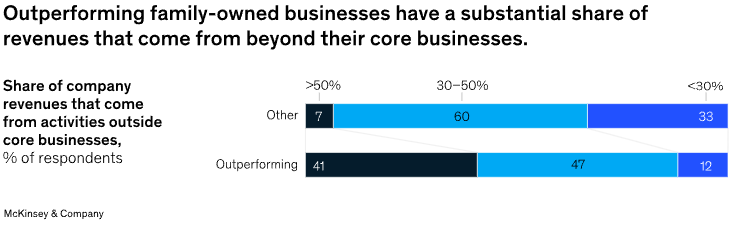

FOBs also tend to diversify beyond their core business. This is a strategic form of risk mitigation and capturing opportunities in new markets or industries.

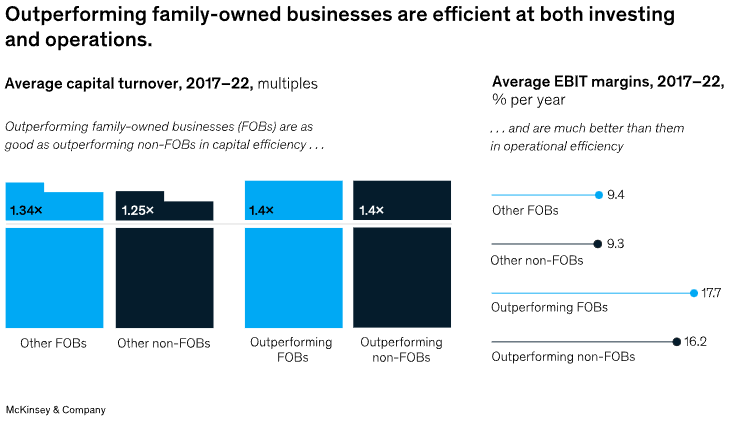

FOBs also tend to outperform due to their more strategic capital allocation style. FOBs allocate their capital on a more efficient matter. The graph below shows that FOBs and outperforming FOBs are more efficient at investing and operations.

FOBs benefit from legacy hands-on leadership. Founders or leaders directly engage in their operations, creating employee loyalty and ownership. This involvement helps FOBs identify challenges and motivate employees to propose solutions.

FOBs tend to invest heavily in R&D and implement systems to support innovation. They create ecosystems, such as accelerators and job-creation programs, to drive technological advancements while gaining access to top-tier talent and innovations.

I could go on about FOBs, but I recommend you check out McKinsey & Company’s study.

Why Do Founder-Led Companies Outperform?

In this part, I’m referencing this paper by Anchor Capital. Therefore, all this information respectively belongs to them.

Check out their paper!

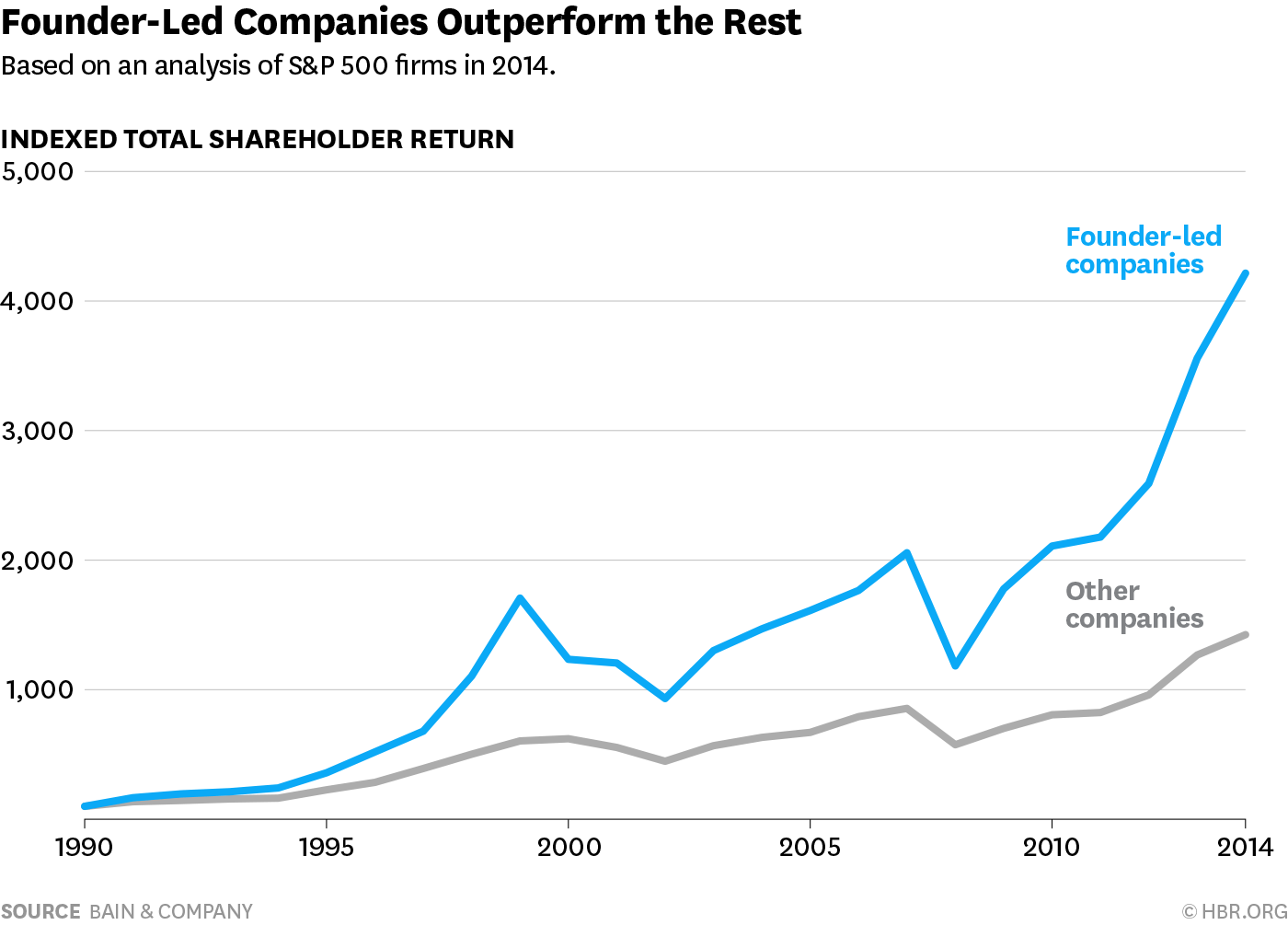

In the book The Founder Mentality, Chris Zook of Bain and Company identifies three key elements that set founder-led companies apart from the rest.

According to Zook, founders clearly understand the "big why" of their company’s purpose. They are so committed to developing customer loyalty and advocacy that they empower frontline employees to solve problems and invent better solutions and products. Lastly, the owner’s mindset. This includes an aversion to bureaucracy, a bias for action, and a strong cash focus.

Usually, management is better aligned with its incentives as well. Owners usually hold a significant amount of equity in the business. We tend to see that a large chunk of their net worth is tied up with the company. Of course, when your wealth is at risk, there’s a stronger drive and motivation to make the business succeed, right? Who wants to lose money? Nobody does. A UVA study suggests CEOs with high insider equity ownership outperform managers with little to no inside ownership. At the same time, a Stanford Business School analysis found that high CEO equity ownership delivers superior stock market returns.

Due to the large ownership stake in the business, the founder tends to think of what is best for the business in the long term. Founder and investor Travis Wiedower offers an interesting take on this. He notes that professional CEOs tend to own far less stock than founders. They can be fired anytime; their average tenure is only eight years. As a result, they have more reason to focus on next year’s bonus than the company’s performance 20 years from now. By contrast, a founder CEO with a large equity stake typically has greater incentive to plan for the long term and more job security to ensure they stay around to enjoy it. Wiedower finds that founder-led companies spend more money investing in the future through R&D and patents than companies run by professional or “agent” CEOs.

Another item could be the long-term commitment. In my humble opinion, there’s a profound difference in the perspective of professional CEOs and founder CEOs. Professional CEOs tend to be primarily driven by job-related rewards, such as compensations and career advancements, while founder CEOs are primarily driven by their life’s work, making their company succeed over the long term. Founder CEOs strive to build something of significance and purpose rather than strive for compensation and short-term goals. These differences are usually reflected in the (operational) efficiency of the business, its revenues, capital allocation, and culture.

Frugality and capital allocation are at play as well.

I firmly believe that founder CEOs and professional CEOs tend to think differently about spending. For a founder, their budget is personal capital, and for a professional CEO, it’s ‘‘just a budget’’. This behavior will be reflected in the business's bottom line, with greater reinvestment and less temptation to throw away cash at flashy acquisitions or lose projects. Ask yourself. How would you handle your own cash versus cash from a business that, if something went wrong, there’s no repercussion to it? If it’s not your own capital at risk, you’ll be more tempted to take on projects just for the sake of it without deepening the possible long-term benefits or pitfalls. Having your brand, reputation, and capital at stake with every move because you're the founder, you’ll approach it with a completely different mindset. You will pick out more profitable projects or possible M&As that generate excellent returns for the long term.

List of Examples of FOBs And Founder-Led Companies

You will see familiar names here, and I hope they stick with you and maybe even promote you to your watchlist. These FOBs and founder-led companies are the definition of excellence—not only the high-performing ones but also the ‘normal’ ones.

Founder-Led Companies

Meta

NVIDIA

Berkshire Hathaway

Salesforce

Palantir

Adyen

Mercado Libre

Fortinet

Paycom

Intuit

Danaher

Doordash

The Trade Desk

Sea Limited

Synopsys

Family-owned Companies

LVMH

Hermés

Ferrari

Dell

Roche

Exor

Hershey

Walmart

Nike

Loblaw Companies

Kering

ArcelorMittal

Volkswagen AG

Tyson Foods

L’Oréal

Conclusion

Research shows that you have a greater chance of higher returns when you’re invested in a business run by the founder or where a family has the largest stake in the business.

I’ve always favored these businesses, and I screen for businesses with higher inside ownership, a company run by its founder, or a company where a family has the largest stake in the business. However, I do not solely invest in these because investing in them does not result in greater returns. In addition, I do not like every business that is FOB or founder-led. Moreover, many of these businesses are outside my circle of competence, making them less attractive for me to invest in.

Nevertheless, these types of companies are beautiful. I’ve been researching them for a while, and they are more interesting and more resilient over the long term.

Does this mean you should solely focus on FOBs or founder-led companies? No, not. You could argue that it would be helpful to do further research on FOBs and founder-led companies to see what these companies might have to offer you. And, if you like what you’ve found out, you could consider investing in one or two businesses. But, do not solely invest in these businesses because the founder is at the wheel or a family has a larger stake in the business. Although plenty of research shows their excellence, some founders and families are not shareholder- or long-term-oriented. Dive into the founder and the family to figure out their motivational drivers and see if these align with those of yourself.

Overall, there’s a charm to having and researching FOBs and founder-led companies. The right companies can be extremely beneficial to investors, but always check the incentives of these founders and families.

That’s it for today!

If you found this article helpful, you can return the favor by restacking it and sharing my newsletter with your friends and family. That would mean the world to me. ❤️

And remember.

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.

Great list and article! Bruker (BRKR) is another company I would add to the founder-led companies. Bruker also has good inside ownership by the family.