My Quality Investment Approach

Here's my investment philosophy summed up in a couple of minutes!

Hi, partner! 👋🏻

I started my journey on Substack on March 2, 2024. I aim to help other investors, including myself, become 1% better at investing day by day.

Since many of you know me but do not know my approach/attitude toward investing, I thought it would be of much value to talk about my approach to investing. This way, you know if your approach aligns with mine and if this newsletter is of added value to you.

Happy reading!

Quality Investing

To me, quality investing is all about finding companies that:

Have a wide MOAT (also known as their competitive advantage).

Predictable growth over a more extended period of roughly 10 years.

Management that is excellent at their capital allocation.

Strong profitability and reinvestment opportunities.

Companies that aren’t CapEx intense.

Management with skin in the game and management’s incentive aligned with their shareholders.

A strong and robust balance sheet.

Companies with a secular trend of optimistic outlook, again that 10+ year period.

MOAT

Companies just starting out and aiming to be the next big hit in the market tend to lack a sustainable and reliable MOAT. Therefore, I invest in companies with decades of proven track records in which their MOAT works. These companies have proven that their product or service is working and has been working for decades. In addition, these brands usually benefit from either:

Branding power

Network effect

High switching costs

Scale advantages

The latter three are preferred.

Does the moat matter in the returns we can expect from this company? Yes, it does matter.

Examples of a wide moat

Apple

Alphabet

Visa

Microsoft

Coca-Cola

Berkshire Hathaway

Nestlé

Amazon

Moody’s

Procter & Gamble

Examples of a narrow moat

Starbucks

3M

Netflix

SAP

BlackRock

Nike

Intel

Autodesk

Qualcomm

Kellogg’s

Examples of no-moats

Delta Air Lines

Bed Bath & Beyond

Snap Inc

Ford

Gamestop

Carnival

Macy’s

Peloton

AMC Theatres

Zoom Video

As the list suggests, companies with a wide moat have substantial, durable competitive advantages, such as brand power, network effect, economies of scale, or high switching costs. They dominate their respective industries, making it harder for competitors to erode their market positions.

The narrow moat companies have some competitive advantages but are less substantial and durable. Competition, innovation, or market shifts can quickly challenge their market positions.

No-moat companies lack any significant competitive advantage. They operate in highly competitive or commoditized markets, are vulnerable to external factors, or struggle to maintain pricing power or market share.

This doesn’t mean that they can not be excellent investments, not at all. But, I instead own companies that have a more sustainable trajectory due to their wide moat compared to a no-moat business.

Predictable growth

Let’s start with the fact that we can not predict anything. We can predict that we’re forced to pay taxes and that, eventually, we’ll die. That’s the only thing we can predict, and that is guaranteed.

However, we can take advantage of the odds and get a higher score on the predictable scale. This fictive scale measures how likely something is to happen. We should score predictability from one to ten.

“The big money is not in the buying and selling, but in the waiting for the right company to grow predictably over time.” - Charlie Munger

What are the characteristics of highly predictable growth companies?

Stable and growing industry

High customer retention or subscription models

Essential or non-cyclical products or services

Examples of highly predictable growth companies:

Consumer Staples (e.g., Procter & Gamble, Nestlé)

Utilities

Healthcare (e.g., Johnson & Johnson)

Software-as-a-Service (SaaS) (e.g., Microsoft, Adobe)

Real Estate Investment Trusts (REITs) (e.g., Public Storage, Simon Property Group)

What are less predictable growth companies?

Characteristics of less predictable growth companies:

Cyclical or seasonal demand.

High dependence on consumer confidence or discretionary spending.

Exposure to geopolitical or macroeconomic factors.

Examples of less predictable growth companies:

Energy (e.g., ExxonMobil, Chevron)

Automotive (e.g., Tesla, Ford)

Technology Hardware (e.g., AMD)

Retail/Consumer Discretionary (e.g., Nike, Lululemon)

Travel and Leisure (e.g., Carnival)

Of course, some companies operate in predictable sectors but perform poorly in unpredictable ways, and vice versa, this happens. But there’s often some sort of overlay or correlation.

Like you and me, quality investors want to focus on industries with more predictable growth and less reliance on market or consumer phases. This gives us more peace of mind and allows us to make better estimates of what to expect in the future.

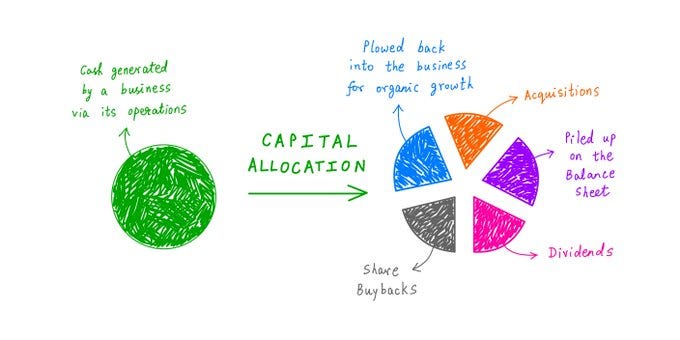

Good Capital Allocators

"Superior capital allocation is the hallmark of a great CEO. It’s not about operations; it’s about deciding where to invest resources for the highest long-term return." - Wiliam N. Thorndike

Organic growth (preferred option)

Share buybacks

Acquisitions

Dividends

Debt reduction

Piled up on the balance sheet (least preferred option)

The Return on Invested Capital (ROIC) measures how efficiently management allocates its capital. Let's examine this metric more closely.

Both companies start with $100 capital to invest. Bozo Inc. has a ROIC of 10%, and Alpha Male Inc. has a ROIC of 20%. At year 4, Alpha Male Inc. already generated roughly 39.70% more capital compared to Bozo Inc. In the 10th year, the difference is 280%, and after 15 years, the difference is a whopping 904%.

This shows us that it matters how efficiently management allocates its capital and how profitable it is. That’s why we pick companies with a ROIC of 15% or more. This is the baseline for me.

Profitability

We want companies to generate net profits and convert them into free cash flow. Free cash flow drives and grows the business, so a high free cash flow margin is preferred. If a company has a 20% free cash flow margin, I’m interested in looking more in-depth into the company.

As shown above, the business with a higher free cash flow margin generates significantly more free cash flow. You'll see excellent returns if you reinvest this into a business with a high ROIC.

This shows free cash flows in which 50% are reinvested into the business at the mentioned ROIC. The generated free cash flow and ROIC combined show the true power of compounding. At the end of year 13, Bozo Inc. generated $15.69 over $65 of free cash flow (50% of $130). Alpha Male Inc. generated $89.16 over $130 (50% of $260).

The amount of free cash flow a company generates and how effectively management can reinvest these cash flows are essential to us.

15% or higher ROIC

20% or higher FCF Margin

CapEx Light Companies

As quality investors, we should favor companies that do not maintain CapEx to continue operations and achieve robust future growth.

Why? These companies can use their capital to reinvest it in the business instead of heavily investing it in maintaining their operations. They also benefit from excellent margins, which is a solid indicator.

CapEx-light companies can scale their operations usually quicker than companies that are CapEx-heavy. We want companies that can generate solid FCF, spend little on maintaining operations, and spend loads on scaling their business for long-term growth.

CapEx-to-Sales should be below 7%

CapEx-to-OCF should be below 20%

Skin In The Game

We should prefer companies where both board members and the CEO have significant stakes in the game. Board members represent shareholders. Therefore, to ensure their interests align with those of the investors, most of their wealth should be locked up in stocks in the business. This ensures investors that board members are truly aligned with the business's shareholders.

"Never trust anyone who doesn’t have skin in the game. Without it, accountability is lost, and decisions lack true commitment." - Nassim Nicholas Taleb

The CEO should preferably also have significant skin in the game. The same story here, this ensures that the CEO is appropriately aligned with its shareholders. If the CEO makes a rather dumb decision, shareholders and the CEO will feel this in their pockets instead of solely the shareholders. This should ensure that the CEO makes long-term decisions that benefit themselves, shareholders, and the company.

Ideally, insiders hold roughly 3% of the total outstanding shares.

Most of the wealth of board members and the CEO should be locked in their company's stocks.

Strong And Robust Balance Sheet

Simply put, companies should not rely too heavily on debt and should be liquid enough in case of (temporary) headwinds.

Their assets should outweigh their liabilities.

low interest due to low long-term debt.

Positive equity in the company.

Low Goodwill(-to-Assets) on the sheet.

You get the drill. The balance sheet should be sound and foolproof.

Optimistic Outlook

We don’t invest in companies that rely on printers or any other dying sector or niche. Instead, we focus on industries that will be affected by digitization in the future.

Cybersecurity is the future. We can look at Fortinet, Crowdstrike, Palo Alto, etc.

Healthcare will forever be necessary. We can look at United Health, Pfizer, Johnson & Johnson, etc.

Obesity is a growing issue and will always remain an issue due to high consumption. We can look at Novo Nordisk, Eli Lilly, etc.

People will want to invest in their future. We can look at BlackRock, Vanguard, Statestreet, etc.

Look at what will remain for the foreseeable future, preferably at least the coming 10 years. As quality investors, we seek excellent companies with a long growth runway. These companies are found in every industry, but not all industries are future-proof. We’re looking for the most future-proof industries.

Valuation

As quality investors, the quality of the business is the most essential factor. When it comes to high-quality companies, a premium is usually in play. This means that ‘‘cheap” quality stocks are not easily found on the market, but this doesn’t mean we’re just buying at any point.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

Consider me a shareholder if an excellent company trades at a fair value. I wouldn't mind paying a slight premium for predictable and sustainable growth.

Conclusion

Quality investors like you and I seek proven companies that can withstand their hyper-growth phase and build a solid and sustainable moat. These companies do not need much CapEx to maintain their operations but generate heaps of free cash flow and reinvest this at high rates (ROIC). This, in turn, generates modest returns on a per-share basis, driving up the company's intrinsic value and share price.

Wide moat

Management with skin in the game

Low CapEx

Profitable with a high FCF margin with solid reinvestment opportunities

Strong and optimistic outlook

Healthy balance sheet

After finding these high-quality companies, we’re holding on to them for dear life until our thesis changes. No, we’re not selling out because the stock is too ‘‘expensive’’. It is bound to happen that our picks eventually get too expensive, but we’ll hold on to them. Mean reversion will do its thing; when it does, we can scale our position or leave it be.

We will hold excellent companies for as long as possible so that our capital can compound at excellent rates, low turn-over, and low costs. Not selling also comes with a lovely tax benefit for many out there!

Thank you for reading.

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.