Welcome friend! 👋🏻

I'm pleased to have you back again! My name is Yorrin, and today we will be discussing the stocks I think will be a good addition to a portfolio.

In case you missed it, please read the following articles once you're done here. 😉

Let's talk about stocks! 2024 is in full swing, and the market is moving again like never before. New highs are on the horizon, or companies have already doubled in market capitalization; it's been a crazy three months. I mean, look at Nvidia for a second. Nvidia is up +402.87 (83.64%), this is unheard of. Meta, +150.69 (43.52%), I mean, wow!

There have definitely been some rides we've missed out on, but there are companies out there with still a lot of potential. Here's my top 5 list for 2024.

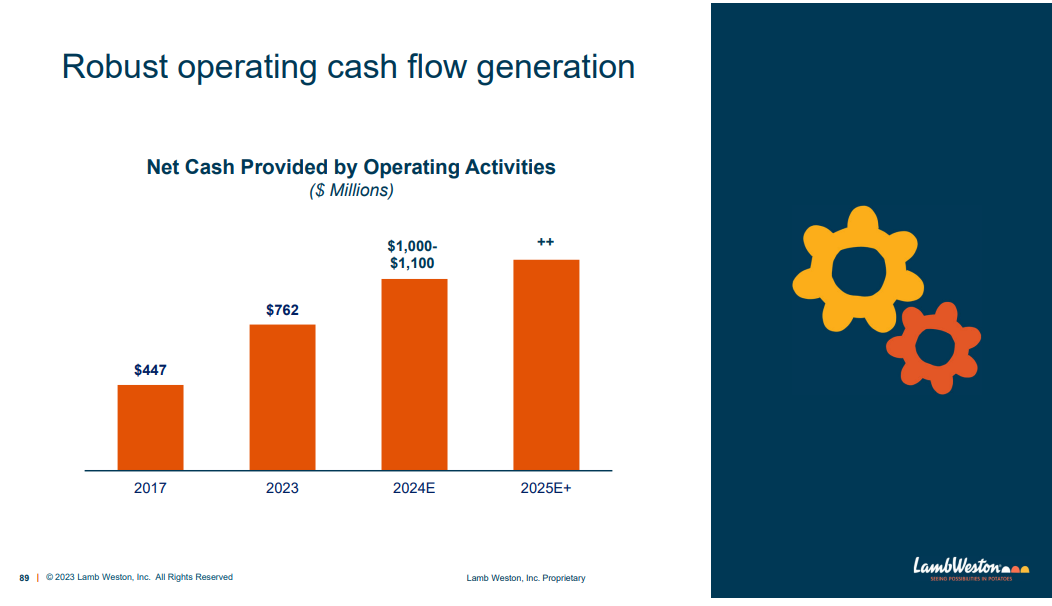

Lamb Weston Holding Inc. TICKER: LW 0.00%↑ YTD: -3,70 (-3,47%) PRICE: $102.68

🍟 Sector: Food processing

🏢 Located: Idaho, USA

📈 Expected revenue growth: $6,891.91 million

📈 Expected EPS growth: $6.01

💵 Net profit margin: 17.71%

💡 ROE/ROA/ROCE/ROIC: 44.69% / 9.41% / 18.52% / 15.65%

🏆 Price target: $128.45

Lamb Weston Holding Inc. is a position I already have at this moment. Currently, LW represents 5% of my portfolio, and I'm happy to have added it to my investment portfolio.

Lamb Weston Holdings, Inc. engages in the production, distribution, and marketing of value-added frozen potato products. It operates through the following business segments: Global, Foodservice, Retail, and Other. The Global segment includes branded and private label frozen potato products sold in North America and international markets. The Foodservice segment comprises branded and private label frozen potato products sold throughout the United States and Canada. The Retail segment consists of consumer facing retail branded and private label frozen potato products sold primarily to grocery, mass merchants, club, and specialty retailers. The Other segment comprises vegetable and dairy businesses.

Nike TICKER: NI 0.00%↑ YTD: -7,72 (-7,25%) PRICE: $98.83

👟 Sector: Consumer Non-Durables

🏢 Located: Beaverton, USA

📈 Expected revenue growth: $1,024.34 million

📈 Expected EPS growth: $3.59

💵 Net profit margin: 10.28%

💡 ROE/ROA/ROCE/ROIC: 41.04% / 10.65% / 23.48% / 27.72%

🏆 Price target: $120.54

Nike, who doesn't know the brand? Everywhere you go, even in countries where it's not available, everybody knows the brand. The brand is the biggest in its category, and for a good reason.

NIKE, Inc engages in the design, development, marketing, and sale of athletic footwear, apparel, accessories, equipment, and services. It operates through the following segments: North America; Europe, Middle East & Africa; Greater China; Asia Pacific & Latin America; Global Brand Divisions; Converse; and Corporate. The North America; Europe, Middle East & Africa; Greater China; and Asia Pacific & Latin America segments refers to the design, development, marketing, and selling of athletic footwear, apparel, and equipment. The Global Brand Divisions represents NIKE Brand licensing businesses. The Converse segment designs, markets, licenses, and sells casual sneakers, apparel, and accessories. The Corporate segment consists of unallocated general and administrative expenses.

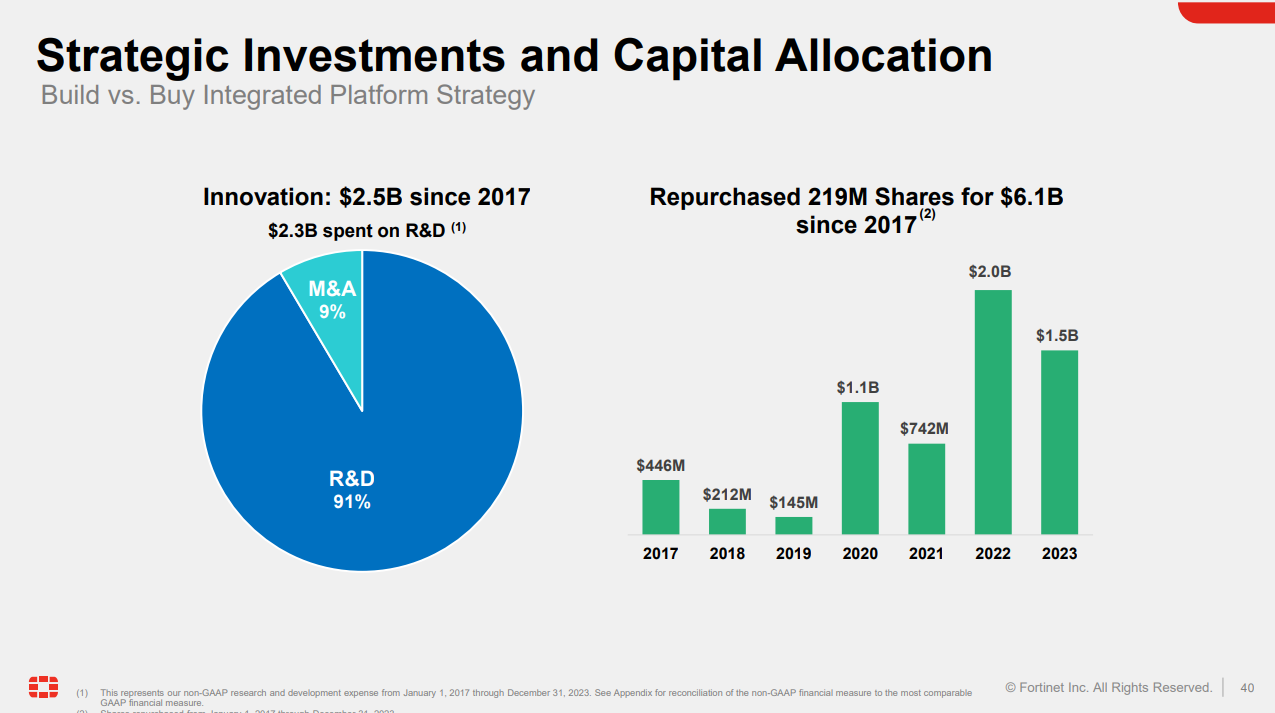

Fortinet, Inc. TICKER: FTNT 0.00%↑ YTD: +8,86 (15,33%) PRICE: $66.64

🧑🏻💻 Sector: Technology Services

🏢 Located: Sunnyvale, USA

📈 Expected revenue growth: $5,787.53 million

📈 Expected EPS growth: $1.71

💵 Net profit margin: 21.64%

💡 ROE/ROA/ROCE/ROIC: 33.93% / 8.71% / 25.1% / 18.48%

🏆 Price target: $76

Fortinet, Inc. is already a position I have open in my portfolio. Currently, it's approximately 1.77% of my portfolio. I am considering expanding my position as I am a fan of their business, management, or capital allocation strategies.

Fortinet, Inc. provides cybersecurity solutions to a variety of businesses, such as enterprises, communication service providers, government organizations, and small to medium-sized businesses. Its product portfolio includes network security, secure access service edge, enterprise networking, security operations, application security, and operational technology.

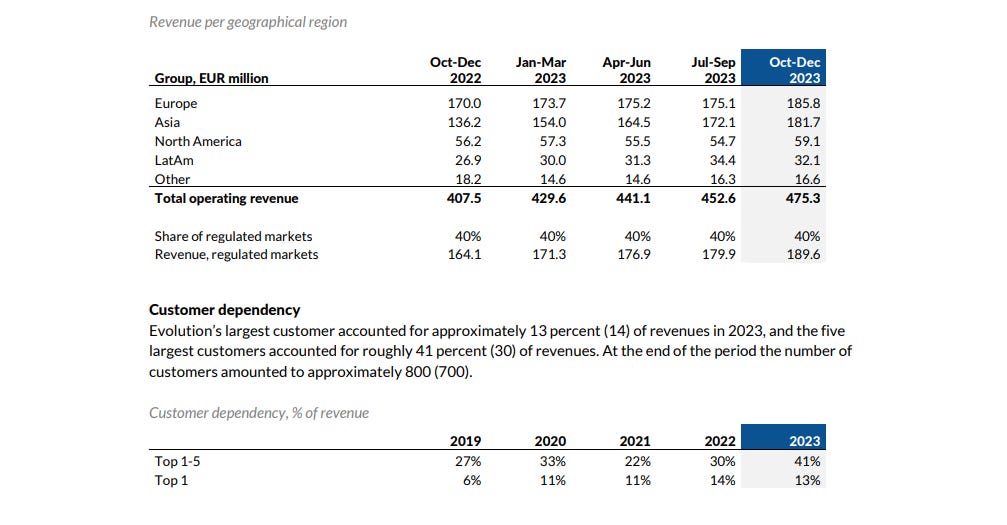

Evolution AB TICKER: EVO 0.00%↑ YTD: +170,20 (14,12%) PRICE: 1.375,60 SEK

🧑🏻💻 Sector: Technology Services

🏢 Located: Stockholm, Sweden

📈 Expected revenue growth: €2,110.6 million

📈 Expected EPS growth: €5.34

💵 Net profit margin: 59.54%

💡 ROE/ROA/ROCE/ROIC: 32.2% / 16.04% / 31.91% / 34.04%

🏆 Price target: SEK 1,441.26

Evolution AB is already a company that I currently hold. Evolution AB currently accounts for 6.01% of my portfolio. In my honest opinion this is one hell of a compounder with quality, value, and growth combined.

Evolution AB engages in the development, production, marketing, and licensing business to business casino solutions to gaming operators. It provides live casino studios, land-based live casino, mobile live casino, and live casino for television.

Thank you for reading. I hope this met your expectations! Please consider subscribing to me; it's free. Just click here:

Let me know your top five for 2024!