Lessons From Terry Smith You Can Use Today!

Terry Smith and his fund, Fundsmith, have returned approximately 607.3% since its inception in 2010, equating to an annualized return of about 14.8%. Here's how he did it.

Hi, partner! 👋🏻

Plenty of successful super investors exist, but some are the cherry on the cake. One of these super investors is Terry Smith.

Terry Smith and his fund, Fundsmith, have returned 607.3% since its inception in 2010, an annualized return of roughly 14.8%, beating the annualized S&P 500 returns of 10%.

Terry Smith’s achievements are nothing short of excellent.

In this article, we’ll go over:

Who is Terry Smith?

Terry Smith’s investment philosophy

Holdings of Fundsmith

At the end of this article, you might be able to invest like Terry Smith and reap the same returns as he does.

Happy reading!

Key takeaways

Buy and Hold Quality Companies:

Terry Smith focuses on investing in high-quality businesses with strong ROCE, free cash flow, and durable competitive advantages (moats).Patience is a Virtue:

His low-turnover strategy emphasizes holding investments for the long term, allowing compounding to drive superior returns.Focus on Durable Moats:

Smith prioritizes companies with competitive advantages like brand power, network effects, scale, and high switching costs.Cash Flow Drives Growth:

Smith believes growth should come from free cash flow, not debt, ensuring sustainable and reliable business expansion.Simplicity Works:

His mantra—"buy good companies, don’t overpay, do nothing"—is a straightforward and effective approach that any investor can follow.

Who Is Terry Smith?

Terry Smith is a well-known British fund manager, entrepreneur, and author. He is best known for his work as the founder, CEO, and CIO of Fundsmith, one of the UK’s most successful investment management firms. He has been referred to as "the English Warren Buffett" for his growth investing style, which involves buying and holding shares in a relatively small number of established companies.”

Let’s explore Terry Smith's past and how he ended up where he is now.

Smith grew up in East London, where he attended Stratford Grammar School before reading history at University College Cardiff in 1974, graduating with a First. He turned down an offer of a research fellowship to pursue a business career.

Smith worked for Barclays Bank from 1973 to 1984. He managed the Pall Mall branch before transferring to the firm's finance department, where he developed an interest in stock analysis. In 1979, he obtained an MBA from Henley Management College.

He left Barclays to work at W Greenwell & Co as a research analyst. Later, he joined Barclays de Zoete Wedd, holding the position of the top-rated bank analyst in London from 1984-89.

In 1990, he was appointed Head of UK Company Research at UBS Phillips & Drew, a position he held until his dismissal in 1992 following his best-selling book Accounting for Growth.

In 1990, a series of high-profile FTSE 100 public companies, including Polly Peck and British and Commonwealth, went bust. Whilst working for UBS Phillips & Drew, Smith's clients wanted to know why these firms had failed despite posting healthy profits. In response, Smith wrote an analyst circular showing that these firms had run into difficulties with cash flow rather than profitability and, in some cases, had used deliberately misleading accounting techniques.

Smith's paper examined 12 of these techniques; the paper's title, Accounting for Growth, was intended as a pun. The paper was well-received and led to a book publishing contract with Random House. UBS asked Smith to withdraw the book. Both Smith and Random House refused. UBS suspended Smith before firing and suing him. Smith counter-sued; the two parties settled out of court 18 months later.

The controversy helped propel the book to the top of the bestsellers chart, displacing Stephen Hawking's A Brief History of Time from the no.1 spot and eventually selling over 100,000 copies.

In 2010, Smith established Fundsmith, a fund management company headquartered in London. The business has one strategy: seek to buy good companies, avoid overpaying, and then do nothing. Fundsmith was established as the primary vehicle for Smith's investments; he now has over £250m invested in the Fundsmith Equity Fund. As of December 2023, Fundsmith manages over £36bn.

Smith is a noted critic of the established fee structure of investment management firms, claiming that most managers churn their stocks too often and that retail investors often lose the bulk of gains to excessive management fees and expenses. Writing in the Financial Times, Smith has used a Tour de France analogy to explain his long-term investment philosophy. He states that searching for a fund manager who can perform well in all market conditions is pointless, likening them to cyclists in the Tour, which "has never been won by a rider who won every stage, and it never will. Like the Tour, investment is a test of endurance, and the winner will be the investor who finds a good strategy or fund and sticks with it".

Terry Smith’s Investment Philosophy

Let us go over Smith’s investment philosophy, shall we? At the end of this part, I will provide you with a simple overview of Smith’s investment philosophy. This way, you will always have a simple step-by-step overview if you need it.

Terry Smith focuses on high-quality companies. You might wonder, what are high-quality companies? It’s a broad segment. It isn't. Let me share the secret sauce with you.

High-quality companies are companies that have:

High returns on Capital Employed (ROCE)

Companies with sustainable competitive advantages (also known as their moat)

Strong free cash flow generation

Consistent and predictable revenues

Let’s briefly review these bullet points to ensure we truly understand these concepts.

Return on Invested Capital

Returns on Capital Employed (ROCE) is a financial metric that measures a company’s profitability and efficiency in using its capital to generate returns. This metric is extremely useful because it tells us how well a company uses all its capital (debt and equity) to create profits.

ROCE = EBIT (Earnings Before Interest and Tax) / Capital Employed x 100

Imagine a company has:

EBIT: $10 million

Total assets: $50 million

Current liabilities: $10 million

ROCE = 10 / 40 ×100 = 25% ROCE

The company generates $0.25 in operating profit for every $1 of capital employed.

Usually, a company with a higher ROCE indicates better profitability and more efficient use of capital. It tells us that management is effectively using its equity and debt to generate returns, making it an excellent financial metric for investors to keep an eye out for. We need to watch for the levels of debt any company has. Why? high debt levels may show artificially inflated ROCE due to lower equity values in the denominator. But, if this lines up and there’s nothing odd about their high debt, ROCE is an excellent metric to use.

Terry Smith aims for roughly a 15% to 20% ROCE for a company to become investable for him.

Sustainable Competitive Advantage

The downside to the competitive advantage is that there’s no formula to figure this out. It would’ve been amazing if there had been one, right?! The competitive advantage might be less tangible, but we can luckily measure it.

The competitive advantages a company might have are:

Brand power

Network effect

Scale and cost advantage

Switching costs

PatentsAttracting talent

Terry Smith doesn't think patents are competitive advantages. Why? Because patents expire, so does (partially) the competitive advantage. According to Smith, attracting talent is also not a competitive advantage. He mentioned this numerous times in appearances.

So, let’s focus on the first four, so does Terry Smith.

Brand power

The name of the competitive advantage already explains what this consists of: the business's branding.

Simply put, it means having a brand name known in every crevice worldwide. Let’s go over some examples of strong brand power:

Google

Starbucks

Nike

Apple

Microsoft

These are probably names that you’ve heard of.

These names are so recognized, trusted, and valued by customers that they create loyalty and allow the company to command pricing power, resist competition, and sustain profitability over the long term.

Consumers pick Starbucks not because of the coffee and hot chocolate but because saying they got their drink from Starbucks puts a heavy and positive load on the item they brought and the sentiment that derives from it. The same goes for Apple. Apple can release new iPhones (which, let’s be honest, usually do not look or feel different and are slightly better or the same as previous models), and consumers will get the latest edition solely because Apple released it.

A disadvantage of this type of moat is impairment to the brand due to a scandal or misstep that could significantly impact the brand, as seen with companies like Volkswagen during the emissions scandal.

Network effect

The networked effect occurs when the value of a product or service increases as more people use it. This creates a self-reinforcing cycle that gives a company a competitive advantage. The more users a network has, the more attractive it becomes to new users, making it difficult for competitors to disrupt or replicate it.

Examples of the network effect in full force:

Facebook

X

TikTok

Amazon

Slack

Zoom

PayPal

Uber

Once a network reaches a critical mass of users, competitors find it difficult to lure them away. For example, people rarely leave LinkedIn because their professional connections are already there. To be viable, competitors must replicate or exceed the existing network, which is extremely difficult once the market leader has scaled.

Scale and Cost Advantage

Scale and cost advantage are other powerful economic moats that give companies a competitive edge. By leveraging their size, companies can lower costs, improve efficiency, and increase market share. This advantage comes from economies of scale, where more extensive operations result in lower per-unit costs and create significant barriers for smaller competitors.

As companies grow larger, their fixed costs are spread over more units of production or sales, reducing their cost per unit.

Companies with a cost advantage can undercut competitors on price while maintaining profitability, often driving less efficient competitors out of the market. An example is Ryanair, which keeps its operating costs extremely low, enabling it to offer some of the cheapest airfares in the industry. Or Amazon. Amazon’s extensive warehouse network and delivery infrastructure lower shipping costs per order. Even Tesla! Tesla reduced the cost of battery production through continuous innovation and scaling its Gigafactories.

Examples of scale and cost advantages are:

Walmart

Amazon

Coca-Cola

McDonald’s

Switching Costs

Switching cost as a moat refers to the economic or psychological barriers that make it difficult or undesirable for customers to switch from one company’s product or service to another. When switching costs are high, customers are "locked in," providing the company with a competitive advantage and protecting it from losing business to competitors.

Simply put, the monetary expense of switching, such as fees, new equipment, or higher upfront costs. An example here is breaking a contract with a telecom provider and paying the termination fee. Or the new efforts of switching systems and learning the new software. Also, familiarity with a product interface or customer support could be a switching cost.

This gives companies better customer retention, pricing power, stable revenue streams, and a higher barrier to entry for potential competitors.

Examples of switching costs in action are:

Microsoft (Office & Azure)

Apple

SAP

Oracle

Banks

Netflix

Adobe

For Terry Smith to invest in a company, it must have one or more competitive advantages we’ve discussed. Smith doesn't mind which of the four but does mention that the competitive advantage must be excellent. The company must have decades of proven track record for a competitive advantage to be great. This means that you will most likely end up with companies that have been around since the 1900’s. These companies have endured all this time and have proven that their competitive advantages will withstand wars, trade wars, etc.

In addition, Terry Smith tends to avoid sectors like airlines or mining due to their unpredictable nature. Moreover, Terry Smith puts a lot of emphasis on companies that generate heaps of free cash flow. According to Terry Smith, growth in any company is driven by free cash flow and the ability to reinvest this free cash flow back into the business at high return rates.

You will find everything I’ve just mentioned in a brief overview.

After finding his stock, Terry Smith waits until the company trades at a fair value, opens his positions, and holds on to it for as long as possible.

According to his 2024 FEF Semi-Annual Letter, Fundsmith had a turnover ratio of 3.7% on July 1, 2024. This trailed a 12-month period, showing the proper buy-and-hold strategy of Terry Smith and his fund. Fundsmith averaged roughly a 3% to 4% turnover ratio in previous years.

Mutual funds or actively managed portfolios often have turnover rates of 50%-100% or higher.

Fundsmith Holdings

These are Terry Smith's current holdings. For the sake of valuing your time, I will not go over every single one; it would take days to get through reading, and I appreciate your time. Therefore, I will review his top 5 holdings, weighing the most significant amount on Smith’s portfolio and returns (or losses).

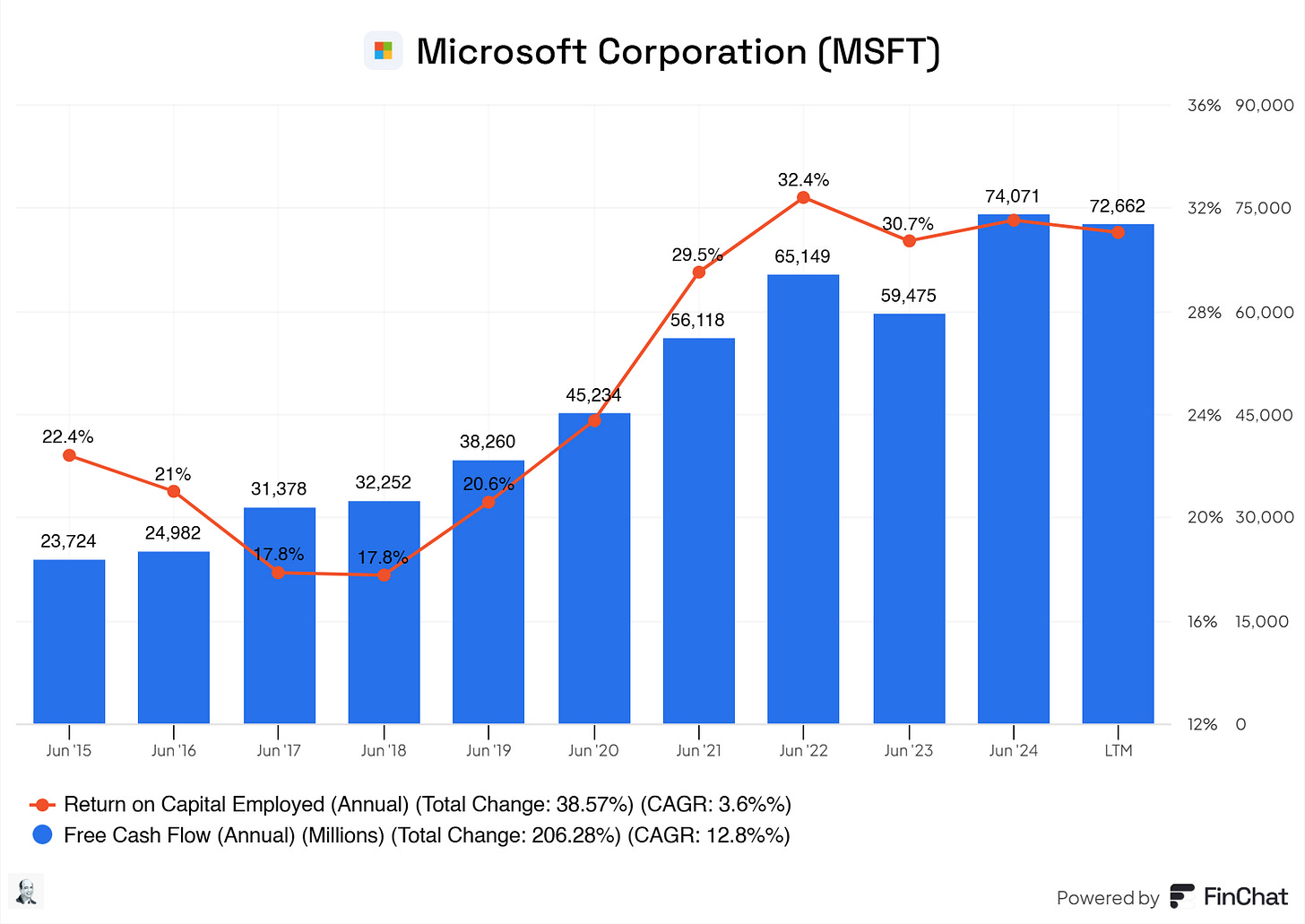

Microsoft

We’ve all heard this name at least a couple of times in our lives.

Does Microsoft benefit from a high ROCE? It does.

Does Microsoft have a strong and sustainable moat?

- Brand power = As one of the largest and most recognizable tech companies globally, Microsoft’s brand instills trust in enterprises and individual users.

- Network Effect = Windows OS and Office Suite.

- Scale and cost advantage: Azure and cloud services enable it to spread fixed costs over a massive customer base.

- Switching costs = Products like GitHub, Visual Studio, and Power Platform lock developers into Microsoft's ecosystem.Does Microsoft benefit from either recurring revenue or predictable revenue?

- Microsoft generates excellent recurring revenues via its Cloud offering, Microsoft 365, Dynamics 365, LinkedIn, Xbox Pass, GitHub, advertising, and Microsoft Viva. Microsoft has excellent, reliable, sustainable, and predictable revenues coming into the business.Does Microsoft generate solid free cash flows? It does!

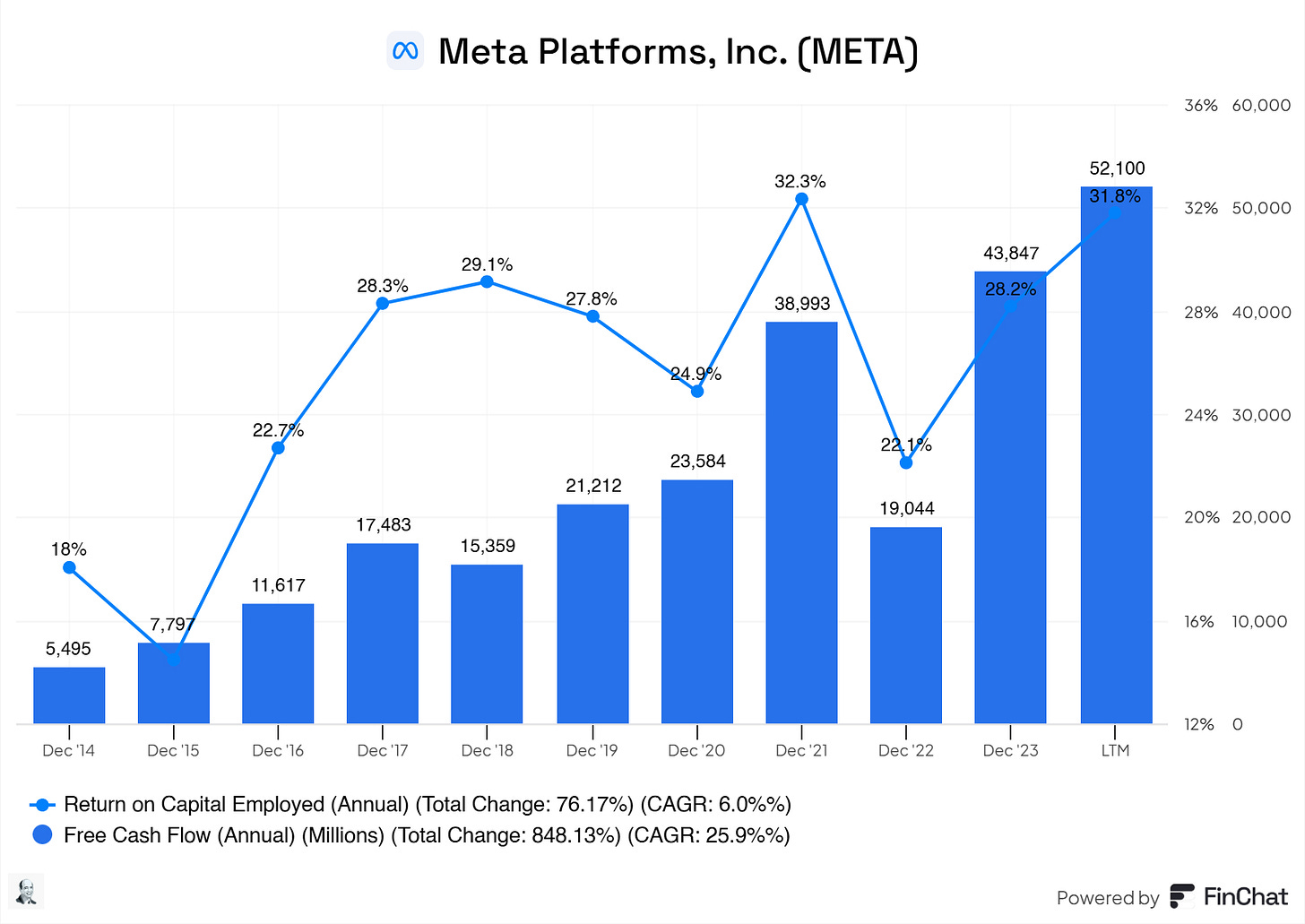

Meta

Does Meta benefit from a high ROCE? It does.

Does Meta have a strong and sustainable moat?

- Brand power = Meta owns globally recognized brands, including Facebook, Instagram, WhatsApp, and Messenger. These platforms are deeply embedded in people’s lives and businesses, making Meta a household name worldwide.

- Network Effect = Meta's platforms thrive on network effects. The more people who use Facebook, Instagram, or WhatsApp, the more valuable these platforms become for users and advertisers.

- Scale and cost advantage: Meta operates at an immense scale with billions of users, which allows it to spread fixed costs (like R&D and data center investments) across its vast user base.

- Switching costs = While switching between social media platforms might seem easy for users, businesses and advertisers face high switching costs due to Meta's advanced targeting tools, analytics, and reach.Does Meta benefit from either recurring revenue or predictable revenue?

- Advertising, Meta Quest, WhatsApp Business API, and Workplace.Does Meta generate solid free cash flows? It does!

Stryker

Does Stryker benefit from a high ROCE? It’s good, but not in line with Terry Smith’s target of at least 15% to 20%.

Does Stryker have a strong and sustainable moat? It does.

- Brand power = Stryker is one of the most trusted names in the medical technology industry. It is recognized for its high-quality surgical, orthopedic, and neurotechnology products.

- Network Effect = I would argue there’s no moat here for Stryker.

- Scale and cost advantage: Stryker operates globally, allowing it to achieve economies of scale in manufacturing, R&D, and distribution. Its size also enables better negotiation power with suppliers and healthcare systems, driving down costs and improving margins.

- Switching costs = Once hospitals adopt Stryker’s surgical or robotic systems, switching to another provider is costly and disruptive. Systems often require specific consumables and accessories, locking customers into Stryker’s ecosystem.Does Stryker benefit from either recurring revenue or predictable revenue?

- Hospitals and clinics enter into multi-year service agreements to maintain and support Stryker’s robotic surgery systems and other significant medical devices, providing predictable revenue streams.Does Stryker generate solid free cash flows? It does!

Automatic Data Processing

Does Automatic Data Processing benefit from a high ROCE? It’s excellent!

Does Automatic Data Processing have a strong and sustainable moat? It does.

- Brand power = ADP is a globally recognized leader in payroll, HR, and workforce management services. Its reputation for reliability, compliance expertise, and technology solutions has made it a trusted partner for businesses of all sizes.

- Network Effect = I would argue there’s no moat here, bu some argue that the more consumers use ADP, the more valuable their ecosystem becomes, I’ll leave this one up to you to decide.

- Scale and cost advantage: ADP serves over 1 million clients across 140+ countries, enabling it to spread fixed costs like R&D, compliance updates, and technology investments over a vast customer base.

- Switching costs = ADP’s payroll and HR systems are deeply integrated into many businesses’ operations, making a switch to another provider costly and disruptive.Does Automatic Data Processing benefit from either recurring revenue or predictable revenue?

- ADP’s core offering, payroll processing, operates on a subscription-based model with fees typically charged per employee or payroll cycle. This creates a steady, recurring revenue stream.Does Automatic Data Processing generate solid free cash flows? It does!

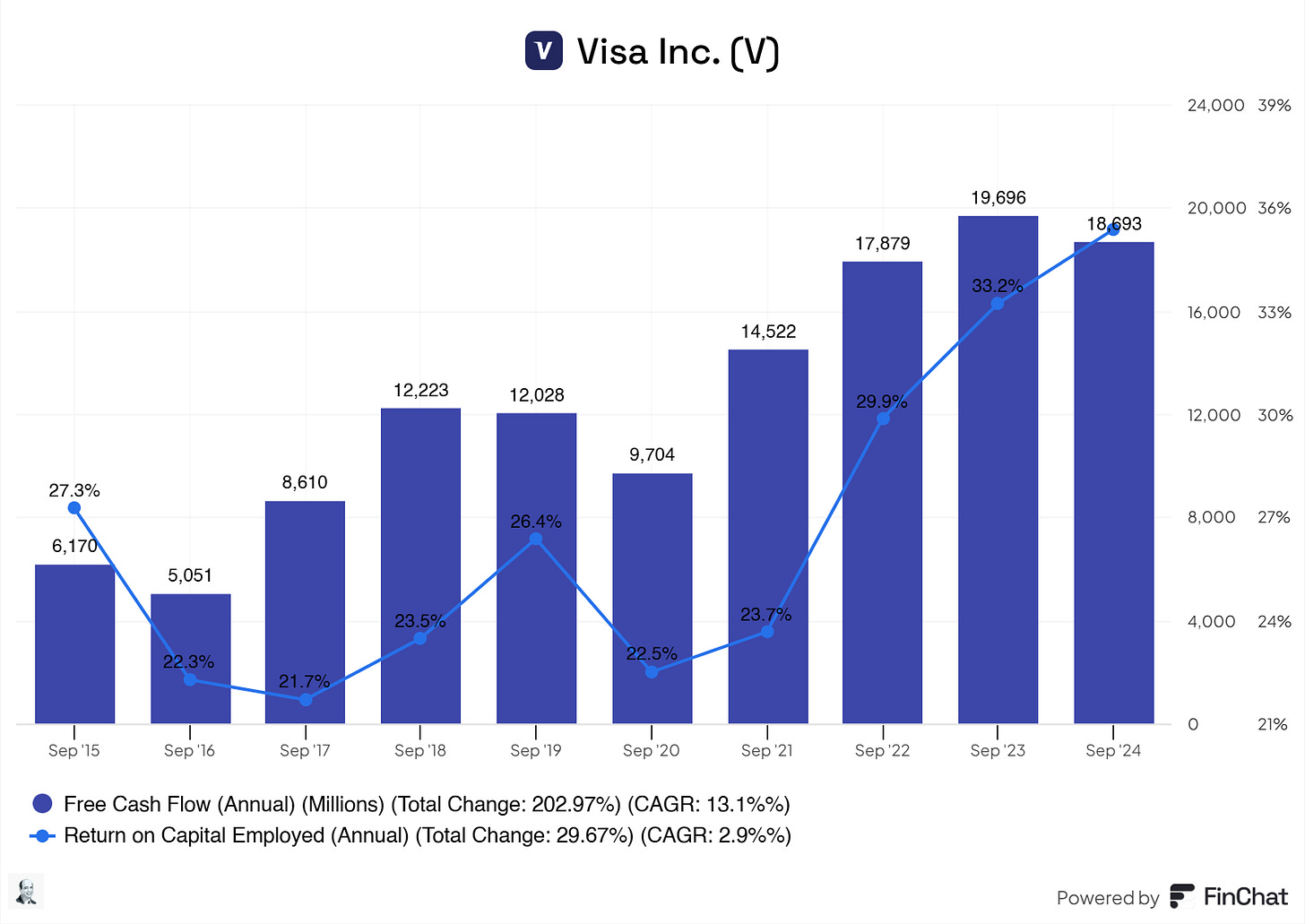

Visa

Does Visa benefit from a high ROCE? It’s excellent!

Does Visa have a strong and sustainable moat? It does.

- Brand power = Visa is one of the most trusted and recognized brands globally in the financial sector. Its logo is synonymous with secure, reliable, and universally accepted payment processing, making it a household name.

- Network Effect = Visa benefits from a two-sided network effect: the more merchants accept Visa, the more attractive it becomes for consumers to use Visa cards, and vice versa.

- Scale and cost advantage: Visa processes billions of transactions annually, leveraging its scale to spread infrastructure and R&D costs across its vast network.

- Switching costs = Merchants are deeply integrated with Visa’s payment network, making it costly and disruptive to switch to alternative systems.Does Visa benefit from either recurring revenue or predictable revenue? It does.

- Visa earns revenue as a percentage of the payment volume processed on its network, as well as fixed fees per transaction. This revenue is recurring and predictable as global card usage continues to grow. (Visa earns higher fees from cross-border and foreign exchange transactions, which happens ofter, giving a boost in the recurring revenue)Does Visa generate solid free cash flows? It does!

Conclusion

Terry Smith stands out as one of the most successful and disciplined investors of our time, often earning comparisons to Warren Buffett for his methodical, long-term approach to investing. His career, from analyzing companies at Barclays to founding Fundsmith, exemplifies his focus on value and quality. Investors can glean numerous insights from his philosophy and practices.

The Essence of Terry Smith's Investment Philosophy

Smith’s strategy revolves around three timeless principles:

Buy Good Companies

Smith emphasizes investing in high-quality businesses with sustainable competitive advantages (moats). These companies are characterized by:High ROCE (15%-20% preferred).

Strong free cash flow generation.

Consistent and predictable revenues.

Durable moats such as brand power, network effects, scale, and switching costs.

Example: Microsoft, one of Fundsmith’s largest holdings, ticks all these boxes with its strong recurring revenue streams, high ROCE, and ecosystem lock-in.

Don’t Overpay

Valuation matters, but Smith doesn’t chase “cheap” stocks. Instead, he looks for fair value in great companies. Overpaying can erode returns, but investing in exceptional businesses ensures compounding wealth over the long term.Do Nothing

Perhaps Smith’s most unique trait is his commitment to a low-turnover, buy-and-hold strategy. With an average turnover ratio of just 3%-4% in Fundsmith, Smith demonstrates that patience and endurance often outperform frequent trading. His analogy to the Tour de France emphasizes that successful investing is about sticking to a strategy through all market conditions.

Key Takeaways for Investors

Focus on Quality Over Quantity:

Smith's concentrated portfolio underscores the importance of focusing on a small number of exceptional companies rather than spreading investments too thin.Understand Competitive Advantages:

Smith’s emphasis on moats teaches investors to prioritize businesses with durable, hard-to-replicate strengths. This includes brands like Visa and Microsoft, where switching costs or network effects create enduring value.Prioritize Free Cash Flow and ROCE:

Smith’s reliance on metrics like ROCE and free cash flow highlights the importance of capital efficiency and the ability to reinvest at high rates of return. Growth fueled by free cash flow is more sustainable than debt-driven expansion.Stay the Course:

Smith’s long-term approach proves that resisting the urge to frequently trade and trusting the power of compounding can yield superior results.Avoid Unpredictable Sectors:

By steering clear of cyclical and capital-intensive industries like airlines and mining, Smith minimizes exposure to sectors with volatile and unpredictable earnings.

Thank you for reading.

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.