Lessons From The Greatest: Terry Smith

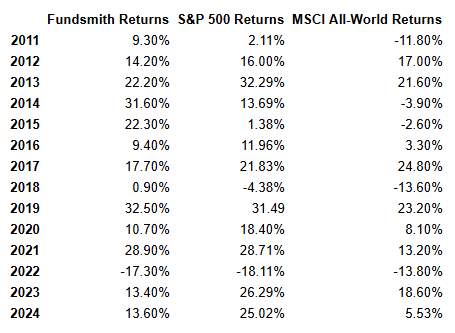

Terry Smith, and his fund ''Fundsmith'', had an annualized return of 15.2% from 2010. Here is everything you need to know about Terry Smith.

Welcome back, Fluenteers!

The man you see in the picture isn’t your ordinary man; he’s referred to as ‘‘the English Warren Buffett.’’ You don’t get this name for mediocre returns by picking companies for your portfolio. Terry Smith launched his Fundsmith fund in 2010 and, to date, has achieved an annualized return of 15.2%. The S&P 500 returned roughly 12.8% during the same period, outperforming the index by approximately 2.4%.

Here’s everything you need to know to achieve similar results to Terry Smith.

Happy compounding!

P.S. Share this with your friends and family! Let’s all compound for a more promising and financially secure future. ❤️

P.P.S You can download a PDF at the end of this article with a Terry Smith checklist for companies!

Who Is Terry Smith?

Terry Smith, born on May 15, 1953, in East London, is one of Britain’s most respected investors. Often dubbed “the English Warren Buffett,” he is the founder of Fundsmith and a long-time advocate for simple, disciplined, long-term investing.

After attending Stratford Grammar School, he graduated with a first-class degree in history from the University of Cardiff in 1974. He went on to earn an MBA from Henley Management College in 1979. Though his early interests leaned toward academia, Smith chose a career in finance instead.

He began at Barclays Bank in 1973 and quickly developed a reputation for rigorous stock analysis. By the late 1980s, he was a top-rated bank analyst at Barclays de Zoete Wedd and later led UK company research at UBS Phillips & Drew. His 1992 book Accounting for Growth, which exposed misleading corporate accounting practices, became a bestseller—though it also led to his dismissal from UBS. From 1992 to 2010, he served as CEO and then chairman of Collins Stewart before launching Fundsmith.

Terry Smith’s Investment Philosophy

Smith's philosophy is grounded in the core principles behind Fundsmith’s mantra:

Buy good companies. Don’t overpay. Do nothing.

He invests in businesses that consistently deliver high returns on capital, exhibit strong free cash flow, and possess durable competitive advantages—typically in the form of brand power, patents, or network effects. These are companies like Microsoft or L’Oréal, which continue to grow without requiring excessive capital or facing constant threats of obsolescence.

Notably, Smith avoids chasing trends or paying inflated valuations. He only invests when a company’s free cash flow yield looks attractive relative to long-term interest rates and other investment options. His refusal to participate in speculative bubbles, like the Dotcom boom, is a reflection of his commitment to intrinsic value.

His approach requires minimal trading. Fundsmith’s annual portfolio turnover is typically just 1–2%, and dealing costs have been as low as 0.005%, compared to the 1–1.5% common among UK funds. This not only saves costs but also avoids the behavioral pitfalls of constant repositioning.

Smith also avoids companies that depend on leverage, operate in cyclical industries, or face high disruption risk. Instead, he prefers businesses that can grow steadily with minimal outside capital. He’s famously skeptical of market timing, pointing out that missing just the 20 best days between 1980 and 2009 would have reduced returns from 700% to just 240% in a UK index fund.

He takes a global approach, ignoring short-term macro or currency concerns, and communicates his views clearly through shareholder letters. For investors seeking long-term wealth creation based on clarity, quality, and cost-efficiency, Smith offers one of the most compelling frameworks in modern investing.

You can read everything about his investment philosophy in his owner's manual here.

Fundsmith

Founded in 2010 by Terry Smith, Fundsmith was established with a clear mission: to deliver superior long-term investment returns through a focused, low-cost strategy that diverges from the conventions of traditional fund management.

To date, Fundsmith has grown to a £20+ billion fund, investing on behalf of a wide range of clients, including wealth managers, private banks, families, charities, and individual investors. Its flagship product, the Fundsmith Equity Fund, returned an impressive 15.2% annualized from inception to today, comfortably outperforming its benchmark.

A Fund Built on Principles—Not Trends

Smith founded Fundsmith to address a problem he observed across the investment world: active managers charging high fees, engaging in frequent trading, and often mimicking benchmarks, yet consistently underperforming. In the U.S. alone, 89% of active global equity funds underperformed their benchmarks over the 20 years leading up to 2022. To Smith, this wasn’t just inefficient. It was unacceptable.

Inspired by Sir John Templeton’s belief that

“if you want to have better performance than the crowd, you must do things differently from the crowd,”

Smith built Fundsmith on a rigorous but straightforward philosophy:

Buy high-quality businesses

At reasonable valuations

And hold them for the long term

This approach avoids the typical pitfalls of the industry, including chasing fads, using excessive leverage, over-diversifying, or attempting to time the market. Instead, Fundsmith focuses on companies with durable competitive advantages, consistent cash flows, and the ability to grow over decades, not quarters.

Built for Compounding, Not Complexity

From the start, Smith’s goal was ambitious: to build the best fund ever. This meant creating a structure aligned with investors, rather than managers. In 2022, the Total Cost of Investment for T Class Shares was just 1.06%, well below industry averages. There are no initial or performance fees, and the firm’s costs remain deliberately low.

Crucially, Smith has substantial personal capital invested in the fund, reinforcing alignment with every investor. His strategy emphasizes risk-adjusted returns, not short-term performance, and every decision is supported by thorough research and a long-term conviction.

A Different Kind of Fund Manager

In an industry often driven by career risk and quarterly headlines, Fundsmith stands apart. Its transparent, focused, and long-term approach is designed to do one thing exceptionally well: compound wealth over time.

Whether you're a private investor or a professional allocator, Fundsmith offers a rare combination of simplicity, discipline, and performance, led by someone who believes investors deserve better than the industry’s status quo.

Terry Smith’s Performance & Track Record

The values of Fundsmith:

No Fees for Performance

No Up-Front Fees

No Nonsense

No Debt or Derivatives

No Shorting

No Market Timing

No Index Hugging

No Trading

No Hedging

Note: All returns for Fundsmith have been sourced from annual reports, fact sheets, Trustnet, and Morningstar. They might differ slightly, just be aware of this.

How To Analyze Stocks Like Terry Smith?

What Does “Good” Mean to Terry Smith?

Terry Smith doesn’t chase trends or rely on abstract theory. His definition of a “good” company is grounded in measurable, durable traits that indicate a business can thrive over time. Here's what he looks for:

High Return on Capital Employed (ROCE)

To Smith, ROCE is the most accurate indicator of a company’s ability to create value. A consistently high ROCE—often above 20%—signals that a company has strong capital efficiency and a meaningful competitive advantage.High Gross Margins

Companies with gross margins of 60% or higher typically benefit from pricing power and product differentiation. High gross margins also tend to indicate resilience in inflationary environments.High Operating Profit Margins

Operational efficiency matters. Strong profit margins reflect disciplined cost control and a scalable business model.Strong Free Cash Flow (FCF) Conversion

Smith puts greater trust in cash flow than in reported earnings. He prioritizes companies that consistently convert profits into real, usable cash—an essential trait for compounding value over time.Low Capital Intensity

He favors businesses that don’t require heavy reinvestment to maintain growth. Capital-light models are easier to scale and often more resilient. He typically avoids asset-heavy, cyclical industries like airlines, banks, and automakers.Repeat Purchase Models and Predictable Revenue

Smith prefers companies embedded in people’s daily routines—products or services that are bought regularly and almost automatically. Think: L’Oréal, Microsoft, Novo Nordisk. These firms enjoy consistent demand and low customer churn.Economic Moats

Whether it’s brand power, a vast distribution network, or high switching costs, Smith looks for companies that are hard to compete with. Moats protect margins, market share, and long-term growth.

Don’t Overpay

Smith is disciplined not just in what he buys, but in how much he’s willing to pay. He avoids simplistic shortcuts like the price-to-earnings (P/E) ratio, which he considers misleading, and instead focuses on more meaningful metrics:

Free Cash Flow Yield

This tells him how much real cash the business generates relative to its price (FCF / Market Cap). It’s a more honest measure of valuation than earnings multiples.Price vs. Growth Potential

Smith is comfortable paying a premium for the right reasons. If a business has high-quality fundamentals and a long runway for sustainable growth, he’ll buy—but not at any price. Bubble valuations are a red flag.Avoiding Value Traps

He’s vocal about the danger of investing in companies that look cheap but don’t grow. A low valuation is meaningless if the business can’t compound capital.

Do Nothing

One of Smith’s core advantages is his willingness to hold. In a world obsessed with action, he chooses inaction—when it's the right move.

Low Turnover

Fundsmith’s portfolio turnover is typically under 5% per year. This not only minimizes costs but also reduces mistakes driven by short-term thinking.Rarely Sells

Smith only exits a position under three conditions:The company is acquired

The original investment thesis breaks down

A clearly better opportunity becomes available

Patience, in his view, is a competitive edge.

What He Avoids

Smith is as clear about what he won’t touch as what he will:

Highly leveraged businesses

Cyclical industries like banks, miners, autos, or oil

Government-regulated revenue models

Turnarounds or structurally broken businesses

IPOs—he rarely invests at the point of listing

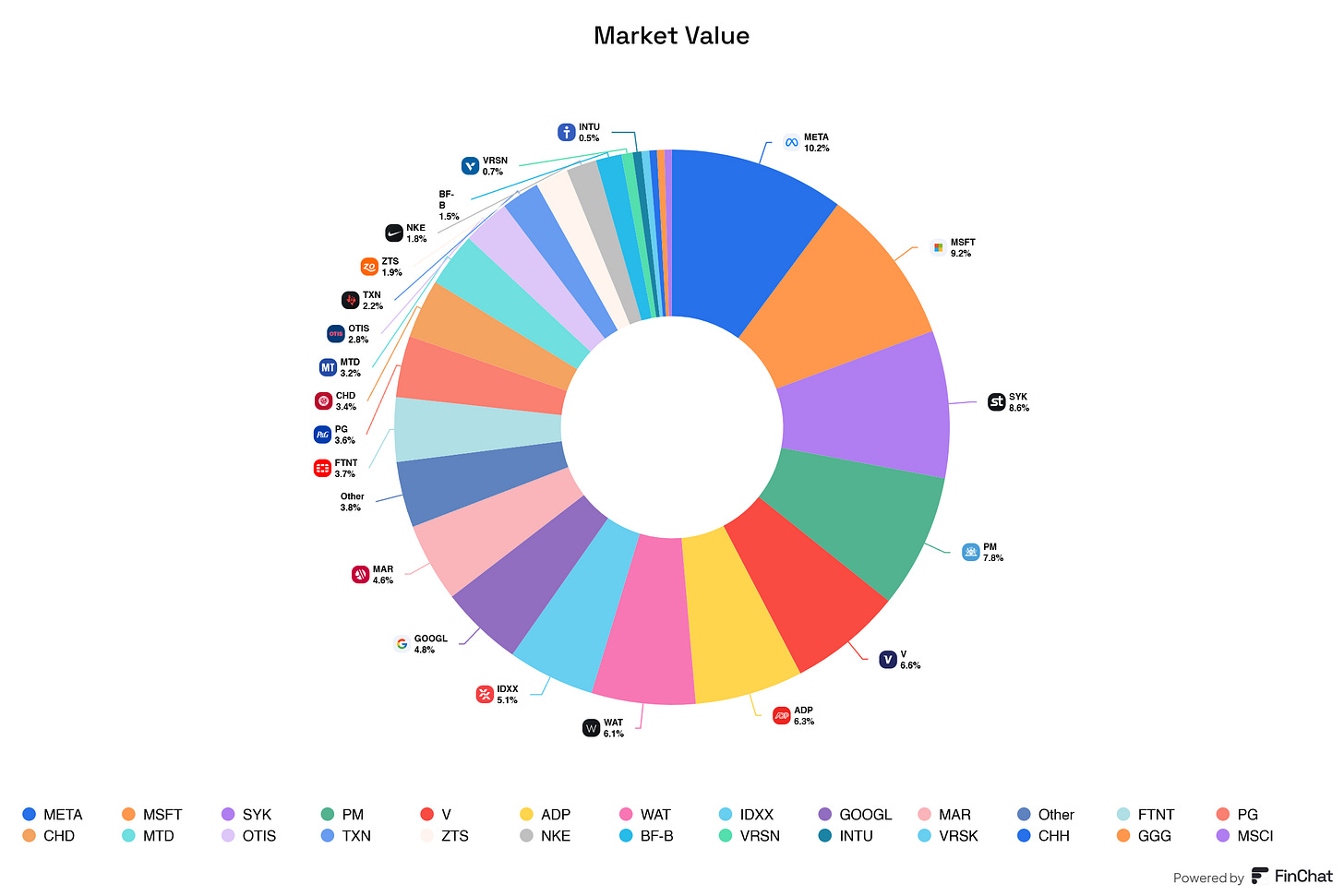

Companies That Reflect His Strategy

Smith’s portfolio includes world-class businesses with consistent earnings, strong moats, and long-term resilience:

Microsoft – Recurring revenue, dominant ecosystem, high margins

L’Oréal – Brand power, repeat purchases, global presence

Novo Nordisk – Market leader in diabetes and obesity treatment

Graco – Durable brands, steady demand, efficient capital use

Lessons From Terry Smith

1. Long-Term Patience Is a Superpower

Terry often reminds investors: “Don’t just do something, sit there.”

He emphasizes patience with quality businesses and resisting the urge to react to short-term noise

“Don’t just do something, sit there.”

2. Focus on a Few Exceptional Businesses

Rather than diversifying broadly, Smith subscribes to a concentrated portfolio of high-conviction stocks, typically 20–30 companies

“Investors should look to buy a small number of high quality, resilient, global growth companies…”

3. Quality Over Cheapness

He warns against chasing low valuations without business quality:

“Time is the friend of the wonderful business, the enemy of the mediocre.”

“As the old saying goes, there are only two types of investor: those who can’t time the markets, and those who don’t know they can’t time the markets.”

4. Seek High Returns on Capital and FCF

Smith looks for durable returns above the cost of capital and strong cash flow. He stresses ROIC/ROCE and free cash flow, rather than EPS or buybacks

“Return on invested capital is a better value creation metric than earnings per share.”

5. Avoid Market Timing

Smith deems market timing futile. He likens investment performance to a multi-stage race—you won’t win every stage, but consistency wins

“To assess an investment strategy or a fund, you need to see its results across a full economic cycle…”

6. Stick to “Buy Good Companies, Don’t Overpay, Do Nothing”

His mantra is simple yet powerful. Consistently applied, it drove Fundsmith’s 15%+ p.a. since 2010.

“Buy good companies. Don’t overpay. Do nothing.”

Useful Sources About Terry Smith

🔥 Ready to go from reading about great businesses to owning them with conviction?

You’ve just read everything you need to know about the English Warren Buffett. I’ve been a ‘student’ of his and have taken in all his knowledge.

Now imagine what you could do with the full toolkit inspired by Terry Smith:

🔍 Full research reports and deep dives worth €1,597

📊 My monthly buy/sell portfolio updates (€987)

🧠 Private Slack group of high-conviction investors (€743)

🗂️ Downloadable tools, investor interviews & PDF briefs (€2,013)

Total value: €5,340 — yours for €44.99/month or €445/year.

This isn’t just insight. It’s an edge.

Delivered weekly. Backed by work. Trusted by 1,200+ investors.

🟢 Become one of The Fluent Few.

Let’s build wealth the right way, brick by brick.

Download the Terry Smith checklist for companies!

And that is it for today!

P.S.… if you’re enjoying FluentInQuality, could you take 3 seconds to refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more Fluenteers into the world).

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all the charting, analysis, and keeping up with earnings calls. You can now get 15% off your subscription. Click here and start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

How do you invest if you're an American? Says they don't accept investors from the US.

I know Terry Smith - in fact, I used to work for him.

He is a nice guy - very smart - and has generated very strong returns (although the last couple of years have been poor).

But the comparison to Warren Buffett? I've heard it before - I think a journalist once used it to sensationalize an article and it stuck.

It's nonsense.

They couldn't be more different. Smith runs the Fundsmith fund which principally invests in public equities. He is a fund manager. They buy and sell interests in companies and while some holdings run to many years, even a decade, they are not investing permanent capital in anything.

Buffett is the CEO and Chairman of a conglomerate. He does invest permanent capital and buys many businesses outright. Furniture stores, railways, energy infrastructure, insurance, etc. He uses insurance float to amplify returns. He does run a public market portfolio of stock - but even then likes to hold on almost forever to some companies (AMEX since 1965 and still holding, Coca Cola since 1988 and still holding).

I don't see the similarity. Do you?