Lessons From The Greatest: François Rochon

In 30 years, François Rochon achieved an annualized return of 15.1% compared to the 10,6% of the S&P 500. Here is everything you need to know to achieve results like this.

Welcome back, fluenteers!

François Rochon is not your average investor but one of the best-quality investors ever, yet rarely does anyone talk about him, his fund, or his phenomenal results.

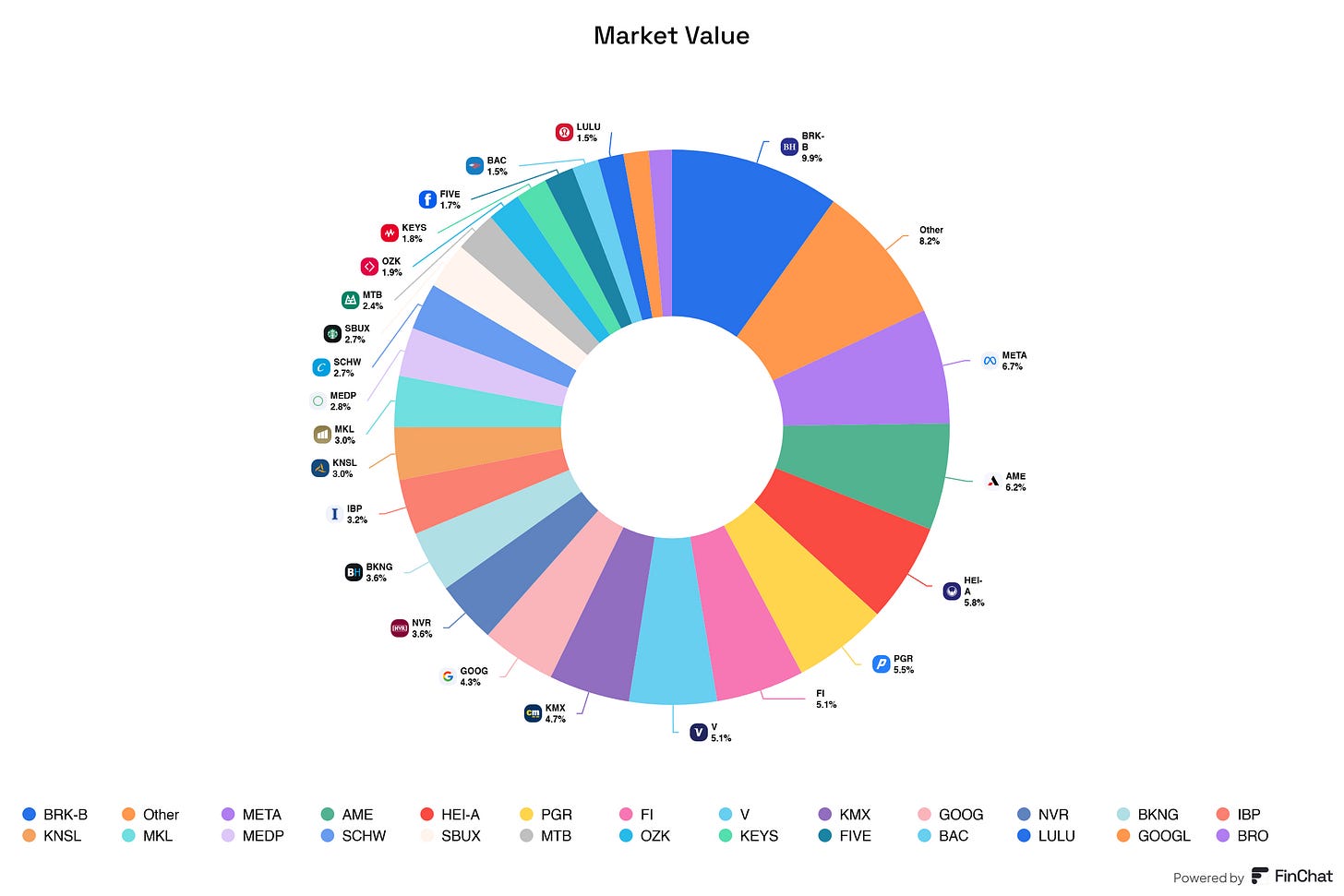

François Rochon and his fund Giverny Capital have had an annualized return of 15.1% compared to 10.6% for the S&P 500 in the same period. François Rochon holds the world’s best companies, such as Berkshire, Meta, Ametek, HEICO, Progressive, and many more. These compounders have allowed François Rochon to outperform the index and most of the other super investors globally.

Meet François Rochon and learn from the best.

Who Is François Rochon?

Originally trained as an engineer, Rochon earned his Master's degree in Science from the École Polytechnique of Montreal. He began his professional career as a researcher and network engineer before transitioning into finance. After managing family accounts between 1993 and 1996, he joined Montrusco & Associates as an analyst and was later promoted to Portfolio Manager, overseeing U.S. accounts totaling more than $250 million. In December 1998, he founded Giverny Capital to offer investment management services based on his philosophy of owning outstanding companies for the long term.

François Rochon’s Investment Philosophy

Rochon's investment approach centers on the belief that investing is both an art and a science. He emphasizes the importance of owning a concentrated portfolio of high-quality companies with sustainable competitive advantages, strong financials, and competent, passionate management teams. His strategy involves a bottom-up approach, focusing on individual businesses rather than macroeconomic trends, and maintaining a long-term perspective with an average holding period of about seven years.

Key principles of his philosophy include:

Long-Term Ownership: Investing in companies with the intention of holding them for many years.

Quality over Quantity: Maintaining a focused portfolio of 20 to 30 carefully selected companies.

Valuation Discipline: Purchasing stocks at prices that are at a significant discount to their estimated intrinsic value.

Behavioral Traits: Cultivating rationality, humility, and patience to navigate market fluctuations.

Giverny Capital

‘‘From the very first days of Giverny, the cornerstone of our portfolio management philosophy was to manage client portfolios in the same way that I was managing my own money’’ —François Rochon

Giverny Capital is a Montreal-based investment management firm founded in 1998 by François Rochon. The firm specializes in private wealth management and offers services to individuals, foundations, endowments, institutions, and family offices. Giverny Capital's investment philosophy is rooted in long-term fundamental analysis, aiming to invest in high-quality companies with sustainable competitive advantages.

The firm's approach is modeled after Rochon's personal portfolio, known as the Rochon Global portfolio, which has historically delivered returns above its benchmarks. Giverny Capital emphasizes transparency and integrity in its operations, providing clients with detailed insights through regular letters and communications.

In addition to its core investment services, Giverny Capital is involved in the arts community through initiatives like the Prix Giverny Capital, a bi-annual award established in 2007 to support contemporary visual artists in Quebec.

François Rochon’s Performance & Track Record

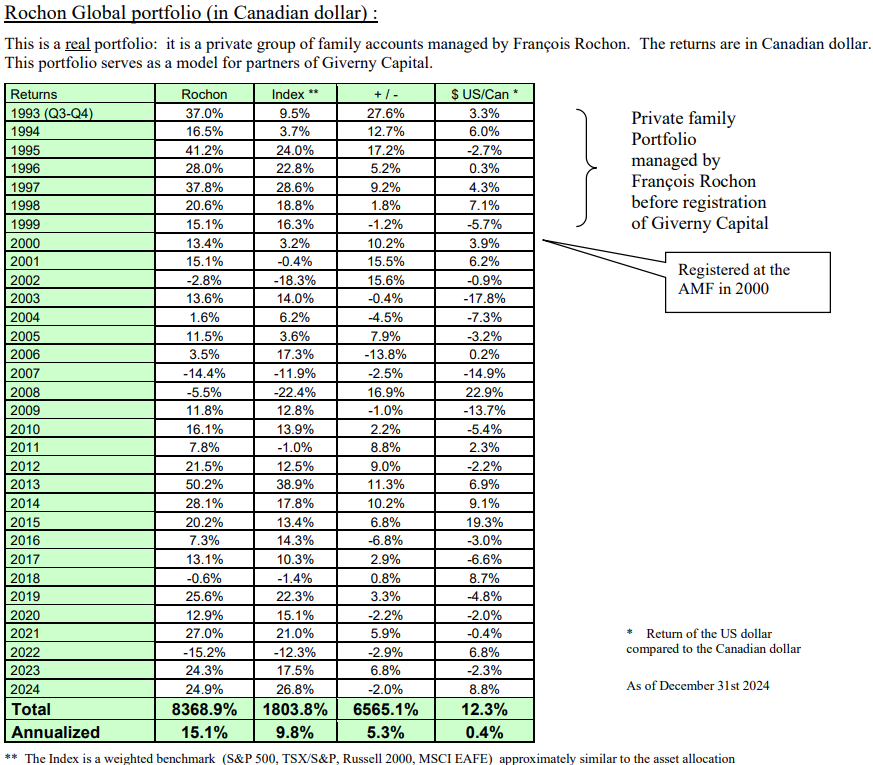

Since its inception in 1993, Rochon's personal portfolio, which serves as a model for Giverny Capital's clients, has achieved remarkable returns. For instance, an investment of $100,000 in July 1993 would have grown to approximately $7.6 million by the end of 2023, translating to an annualized return of about 15.1%.

The Rochon Global Portfolio: Returns since July 1st, 1993

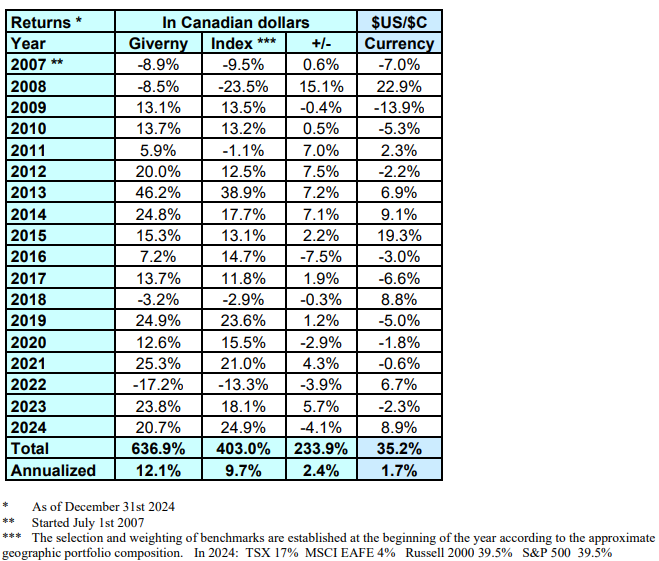

The Rochon US Portfolio

The Rochon US Portfolio corresponds approximately to the US portion of the Rochon Global Portfolio. In 2024, it realized a return of 17.0% compared to 25.0% for the S&P 500. The Rochon US Portfolio, therefore, underperformed its benchmark by 8.0%. Since its inception in 1993, the Rochon US Portfolio has returned 6.349%, or 14.1% annually. The S&P 500 returned 2.286%, or 10.6% annually, during this same period.

Their added value has therefore been 3.5% annually.

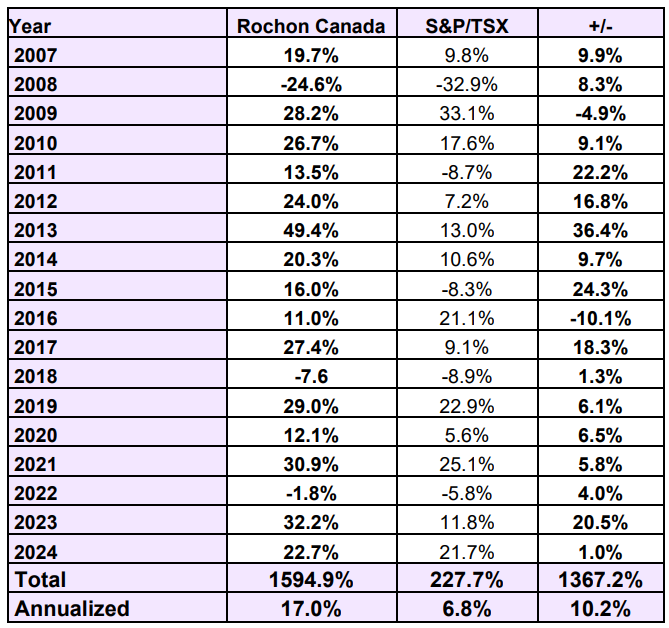

Rochon Canada Portfolio

In 2007, François Rochon introduced a portfolio that is 100% focused on Canadian equities.

In 2024, the Rochon Canada Portfolio returned 22.7% versus 21.7% for the S&P/TSX, outperforming its index by 1.0%.

Over 18 years, the Rochon Canada Portfolio has returned 1.595%, or 17.0%, annually. During this same period, its benchmark gained 228%, or 6.8%, annually. Therefore, its annual added value was 10.2%.

How To Analyze Stocks Like François Rochon?

✅ ROE: > 15%

✅ EPS Growth: > 10%

✅ Debt/profit ratio < 4x

✅ Market leader

✅ Competitive advantage (economic moat)

✅ Low cyclicality

✅ High level of (inside)ownership

✅ Constructive acquisitions

✅ Good capital allocation

✅ 5-year valuation model (EPS-to-multiple valuation)

✅ Try to purchase at half the estimated value in 5 years

Lessons From François Rochon

François Rochon is not just a successful investor—he’s a philosopher of capital. His firm, Giverny Capital, isn’t just a money management operation; it’s an extension of a deeply personal belief system shaped by decades of study, experience, and reflection. Rochon’s letters to partners are more than performance updates—they are timeless lessons on how to think like a quality investor.

1. Long-Term Thinking Isn’t a Preference—It’s a Survival Strategy

Since 1993, Rochon’s “Rochon Global Portfolio” has compounded at an impressive annualized rate of over 15%, trouncing its benchmark. But as he’s quick to point out, that return didn't come in a straight line. The stock market has dropped more than 50% twice and over 20% seven times in that span. The lesson? Volatility is not a bug—it’s the price of entry for long-term compounding.

“Perseverance, through thick and thin, along with the rigorous adherence to our investment principles and a good dose of patience, has made it possible to weather the storms and obtain satisfactory results. Fashions come and go but good principles endure.”

2. The Market Is a Tool, Not an Oracle

Rochon draws heavily from the teachings of Benjamin Graham and Warren Buffett. One core belief: the stock market is often irrational in the short term. Trying to time it is not just futile—it’s self-defeating.

“The best stock selection philosophy is futile if you try to predict the stock market… The worst mistake made by stock market investors is trying to predict the direction of the market over the short term.”

Instead, Rochon urges investors to think like business owners. Evaluate companies based on their long-term prospects, not their short-term stock price swings.

3. Give Medals to Your Mistakes

One of Rochon’s most unique—and instructive—traditions is his annual “Podium of Errors,” where he awards bronze, silver, and gold medals to his biggest mistakes. Not to shame himself, but to learn publicly and deeply.

Gold Medal (2022): LVMH

In 2011, LVMH traded at an attractive valuation. Rochon hesitated. The stock went on to compound over 20% annually.

“I seriously considered it but preferred to wait for an even more attractive evaluation… I am still looking for an excuse to explain this indecision.”

Silver Medal (2020): Taiwan Semiconductor

A classic case of overthinking cyclicality in a structurally superior business. Despite clear signals of competitive advantage, Giverny passed. The stock surged.

Bronze Medal (2020): Floor & Decor

After identifying an attractive opportunity, they waited for a price pullback that never came. The stock tripled.

This practice embodies a key Rochon principle: humility is non-negotiable.

“It is not sufficient to say that we were wrong; we must say how we were wrong.” – Claude Bernard (quoted by Rochon)

4. Focus on the Business, Not the Noise

Rochon consistently reminds investors that true risk lies not in price movements but in the deterioration of business fundamentals. That’s why Giverny avoids highly leveraged, cyclical, or hype-driven companies—no matter how tempting the narrative.

“We avoid risky companies: non-profitable businesses, with too much debt, with a lot of cyclicality and/or run by people motivated by ego instead of genuine stewardship.”

5. True Investing Is Emotional Mastery

Rochon doesn’t just preach fundamentals—he emphasizes temperament. The success of Giverny’s approach rests on the investor’s ability to remain rational while the crowd panics.

“The person… who makes decisions based on short-term fluctuations transforms this advantage into a disadvantage. His or her own perception of stock quotes becomes their own worst enemy.”

François Rochon’s work is a blueprint for quality investors: anchored in timeless principles, sharpened by mistakes, and guided by humility. For those who seek to build wealth with purpose and patience, Rochon isn’t just a teacher—he’s a compass.

If you want to become a better investor, start by studying his medals.

Conclusion

François Rochon may not have the spotlight that others do, but his track record, principles, and humility place him among the greatest quality investors of our time. He’s not chasing trends—he’s compounding quietly, methodically, and with conviction.

His philosophy is simple but powerful: own the world’s best businesses, think long term, admit your mistakes, and never confuse noise for knowledge. These aren’t just investing lessons—they’re life lessons.

If you want to build real, lasting wealth, forget the hype. Study Rochon. Learn how to think. And most importantly, learn how to wait.

Before You Go! Here’s The Deal….

Help shape FluentInQuality into your favorite investing read.

I write these for you, so tell me:

💬 What topics do you want to see next?

💬 What’s one insight you’re taking from this edition?

Reply or comment — I read every single one.

And remember…

Great investments don’t shout—they compound quietly.

Welcome to the Fluent Few.

- Yorrin (FluentInQuality)

Tools I Use

I use Finchat for all my charting, fundamental analysis, and earnings tracking. You can now get 15% off for life on your subscription. Click here to start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

fyi, LVMH is at the same P/FCF as in 2011

Believe your holdings chart was based on 12/31 holdings (assuming you were using the 13F); since then, a number of these holdings have been cut--particularly Five Below--to fund increases in smaller positions such as Kinsale Capital.