Is UnitedHealth Group A Buy Right Now?

America’s biggest health insurer — but is it a buy right now?

Welcome back, The Fluent Few!

UnitedHealth Group is the largest and most robust insurance company in the United States, holding 18% market share in its respective industry.

UnitedHealth Group is facing significant headwinds, which have tanked its stock price by 40% in a few days. Price drops like these are either excellent buying opportunities or falling knives we should rather avoid. Unfortunately, I feel this is a falling knife we’re better off avoiding for now.

Let’s peel back every layer of this insurance behemoth to discover everything about this insurance and healthcare monster.

If you’re new here, read the Fluent Manifesto and return here.

Table of Contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue Breakdown

1.3 KPIsExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationInsider and institutional ownership

Competitive and Sustainable Advantages (MOAT)

Industry Analysis

5.1 Industry Growth Prospects

5.2 Competitive LandscapeRisk Assessment

Financial Stability

7.1 Asset Evaluation

7.2 Liability AssessmentCapital Structure

8.1 Expense Analysis

8.2 Capital Efficiency ReviewProfitability Assessment

9.1 Profitability, Sustainability, and Margins

9.2 Cash Flow AnalysisGrowth Projections

Owner Earnings & Expect Annual Return

Value Proposition

11.1 Dividend Analysis

11.2 Share Repurchase Programs

11.3 Debt Reduction StrategiesQuality Rating & Checklist

Valuation Assessment

1. Corporate Analysis

1.1 Business Overview

UnitedHealth Group is a diversified healthcare company based in the U.S., operating through four key divisions. UnitedHealthcare provides health plans and services to individuals, employers, and government programs. Optum Health delivers care directly, manages provider networks, and supports wellness programs. Optum Insight focuses on healthcare analytics, software, and consulting for hospitals, insurers, and governments. Optum Rx manages pharmacy benefits, offering prescription services, home delivery, and drug management programs. Founded in 1977 and headquartered in Minnetonka, Minnesota, the company integrates care, data, and services across the healthcare ecosystem.

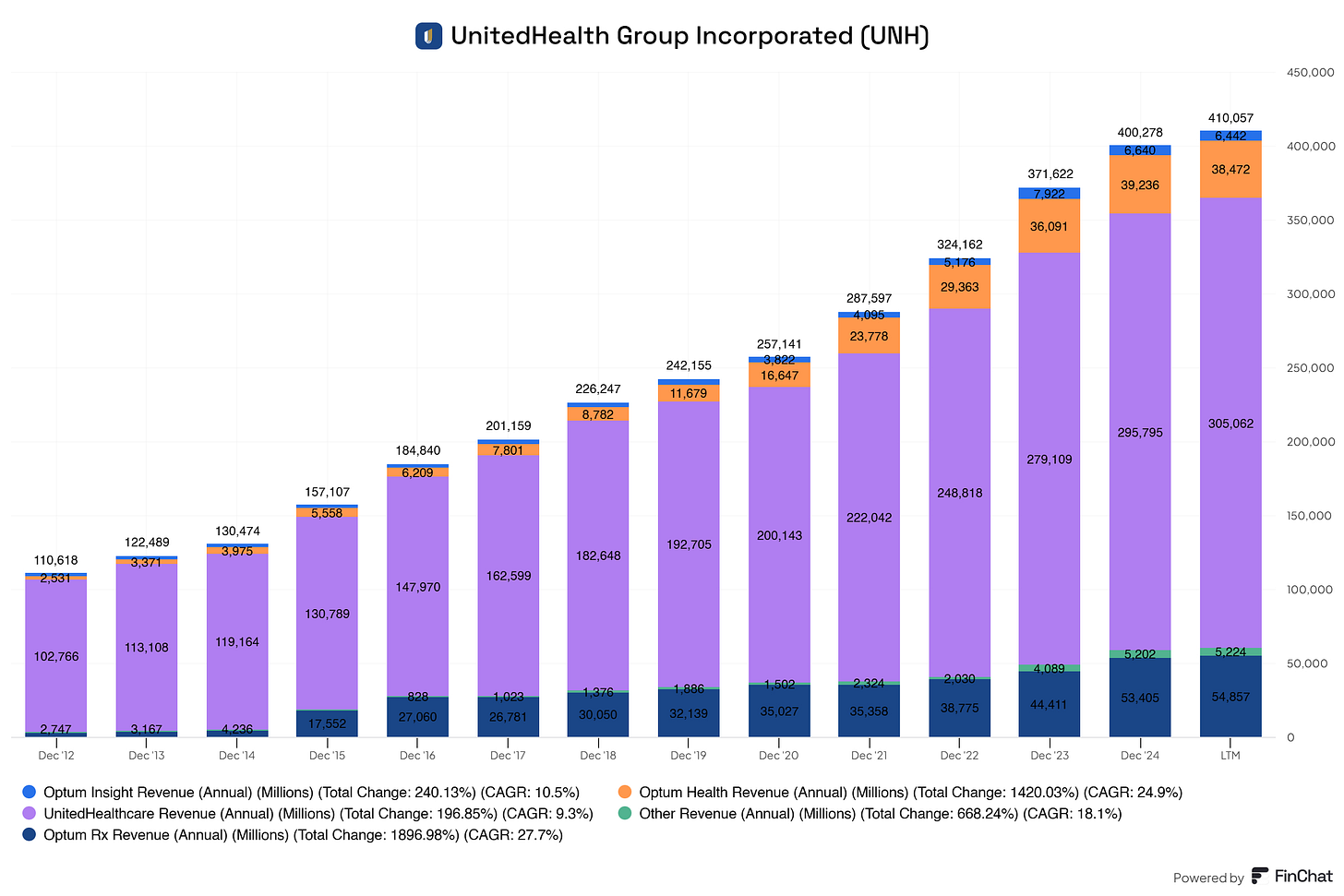

1.2 Revenue Breakdown For UnitedHealth Group

UnitedHealth Group is the holding company of other companies.

UnitedHealthcare: serving individuals and employers, and Medicare and Medicaid beneficiaries.

Optum: serves the global health care marketplace, including payers, care providers, employers, governments, life science companies, and consumers. (It does so via Optum Rx, Optum Insights, Optum Health.)

These combined form the group.

UnitedHealth Group’s primary revenue driver is the premiums and annuities resulting from their policies with the government, individuals, and employers.

OptumRx is their second-largest revenue driver. This includes home medication deliveries, support for patients with complex health conditions, and infusion therapies tailored to the individual's specific needs at home or in infusion suites.

The third-largest revenue driver is Optum Health. This part offers care through a network of clinicians and care facilities, provides mental health support and substance use disorder treatments, delivers virtual healthcare to patients, and focuses on improving health outcomes for specific populations through coordinated care efforts.

The fourth-largest revenue driver is Optum Insights. Here, they provide revenue cycle optimization, coding, and billing services for care providers, offer tools to enhance care quality, support practice growth, facilitate the transition to value-based care models, and develop platforms that simplify connections across healthcare systems, improving interoperability and data sharing.

Lastly, we have ‘‘other revenue’’ or ‘‘miscellaneous’’ revenue. This is revenue from their investments and administrative costs. This is, as of now, the smallest revenue stream for UnitedHealth Group

Here you get a clearer picture of the revenue drivers from UnitedHealth Group.

We can see that UnitedHealth Group's acquisition of Optum is paying off. Optum generates more revenue yearly, adding value to the company and its patients. Moreover, all segments for UnitedHealth Group are showing consistent year-over-year growth. UnitedHealth Group operates in the healthcare sector and benefits from a strong secular trend in health and the need for insurance.

Overall, there is excellent growth and stability in all segments, although the insurance segment (UnitedHealthcare) is clearly the backbone of the business and its primary revenue driver.

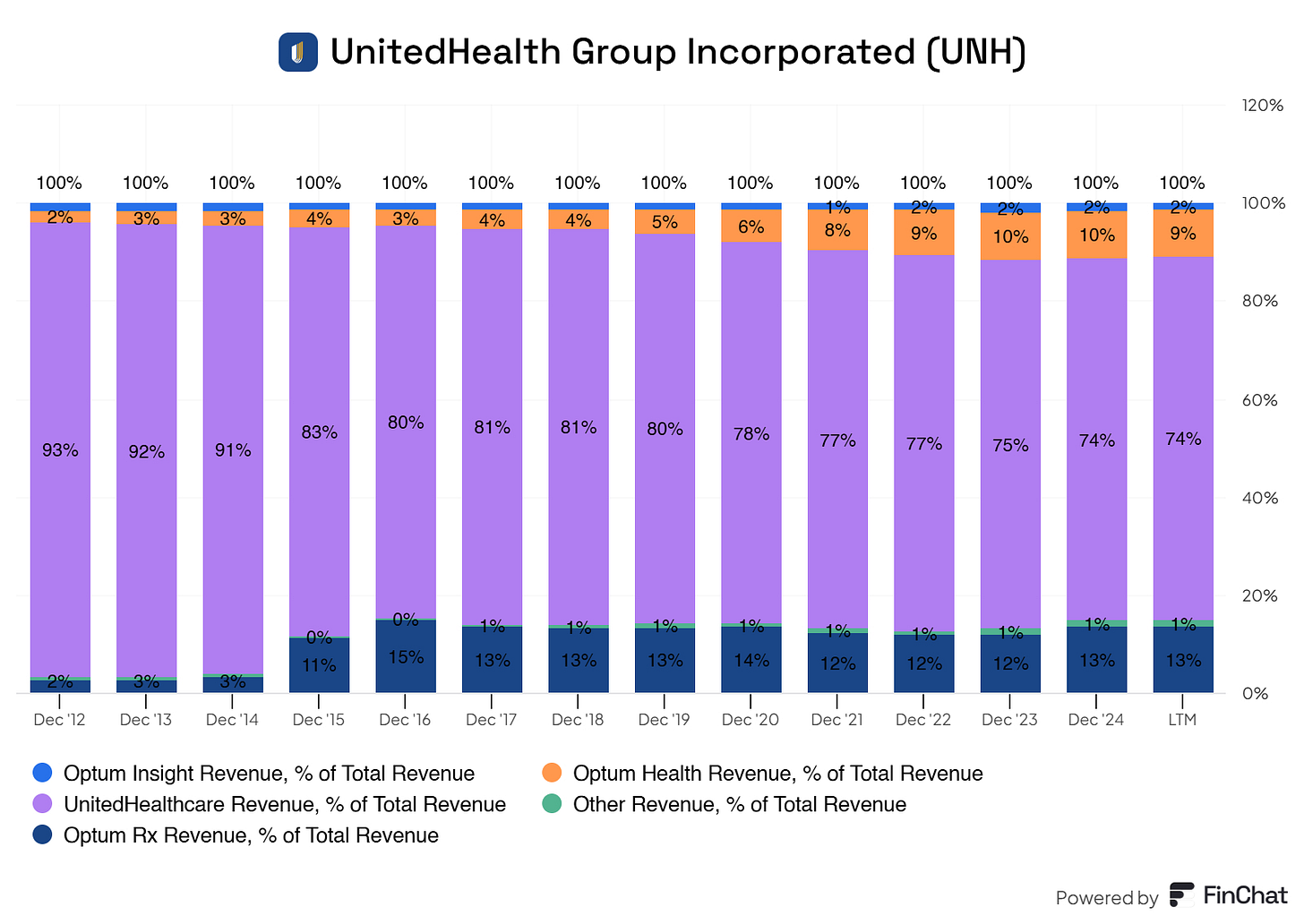

This graph shows the revenue segments for UnitedHealth Group as a percentage of their total revenue.

As expected, premiums and annuity revenue (the insurance part) are their primary revenue drivers. However, we do see that their ‘diversification’ efforts with Optum are gaining ground. They are gaining ground without limiting the growth of their insurance segment.

Optum complements its insurance segment, increasing value per patient and allowing UnitedHealth Group to provide better cost management through this vertical integration.

Where Is UnitedHealth Group’s Revenue Coming From Globally?

The vast majority of UnitedHealth Group’s revenue comes from within the United States, roughly 99%. Approximately 1% of the company’s revenue came from international operations.

UnitedHealth Group’s international business is primarily managed through its UnitedHealthcare Global division, which serves roughly 2.2M individuals across countries like Chile, Colombia, and Peru. Notably, in February 2024, the company completed the sale of its operations in Brazil, which had previously been a significant component of its international portfolio.

UnitedHealth Group’s primary focus remains within the United States, and it shows.

1.3 UnitedHealth Group KPIs

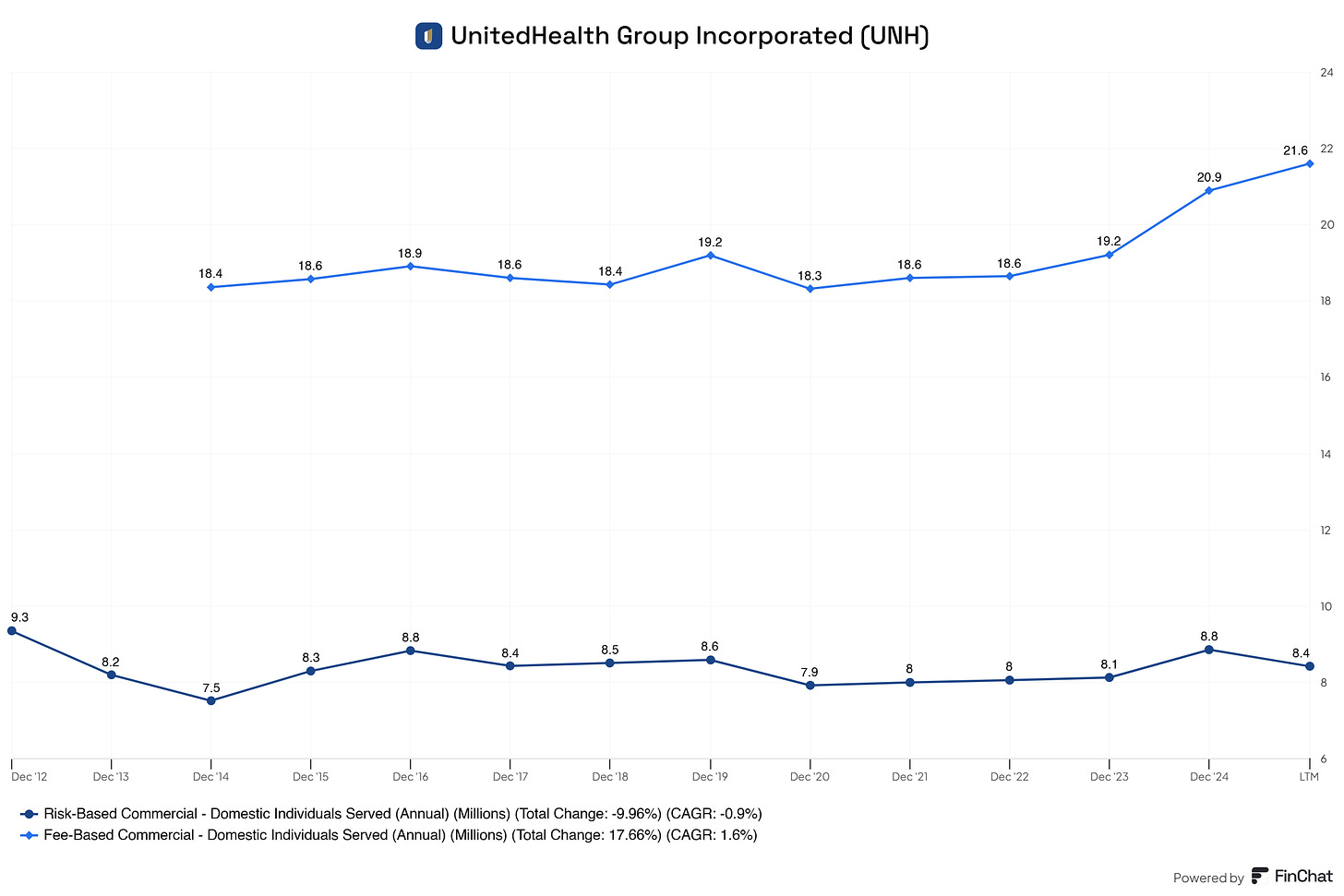

Risk-Based Individuals

These are members for whom UnitedHealthcare takes on the financial risk of their medical expenses.

How it works: UnitedHealthcare receives a fixed monthly premium per member (capitation or insurance premium).

If the member’s medical costs are less than the premium → UNH keeps the difference as profit.

If the costs are more than the premium → UNH absorbs the loss.

This is a high-margin model if managed correctly.

Fee-Based Individuals

These are members for whom UnitedHealth simply administers the insurance plan, without taking on financial risk.

How it works:

UNH handles claims processing, customer service, and provider networks.

The employer (usually large corporations or government bodies) pays UNH a fixed administrative fee per member.

UNH does not pay for actual medical care—the employer does.

This is a low-risk, steady-revenue model, but with lower margins than risk-based models.

Why This Matters

We clearly see that risk-based clients are outgrowing the fee-based clients UnitedHealth serves.

This means that the higher-margin business is growing faster, which should positively impact margins and profitability over time.

But that also means more financial risk, so we need to check if UnitedHealth manages it well.

To evaluate UnitedHealth’s efficiency, we use the premium-to-policy benefits ratio:

Premium-to-Policy Ratio = Premium & Annuity Revenue / Policy Benefits Paid

This tells us whether UNH is becoming more efficient, holding steady, or losing margin due to rising healthcare costs.

2015: 1.22x

2016: 1.23x

2017: 1.22x

2018: 1.22x

2019: 1.21x

2020: 1.26x

2021: 1.21x

2022: 1.22x

2023: 1.20x

2024: 1.17x

LTM: 1.17x

The historical average sits around 1.22x, which is strong. Recently, however, we’ve seen a slight compression to 1.17x.

That means for every $1 in policy benefits paid, UnitedHealth now keeps ~$0.17 in margin, down from ~$0.22 previously.

UnitedHealth is still very profitable, but cost pressures—from medical inflation and rising pharmacy costs—are slowly chipping away at its margins.

They can offset this by:

Raising pricing, or

Doubling down on risk management to improve the premium-to-policy ratio.

Either way, this trend is worth monitoring closely as the business grows its risk-based exposure.

Medicare Advantage

Medicare Advantage has been on an absolute tear.

From 2.6 million in 2012 → to 8.2 million today

That’s a +221.4% total growth at a 10.0% CAGR

This program allows private insurers like UNH to offer Medicare plans with extra benefits. It’s highly profitable due to:

Government funding

Tight cost management

Optionality to bundle more services

This is the fastest-growing and highest-margin government program for UNH.

Medicaid

UNH’s Medicaid enrollment also grew nicely:

From 3.2 million → to 6.3 million

A +97.65% total increase at a 5.7% CAGR

Medicaid growth depends on state contracts and expansions like the ACA. It’s a lower-margin business than Medicare Advantage but still meaningful.

A solid, recurring revenue stream, though more politically and economically sensitive.

Medicare Supplement

Here’s where we see stagnation.

Enrollment peaked around 4.5 million in 2018–2020

It’s now declined slightly to 4.3 million

+35.5% total growth since 2012, but only 2.5% CAGR

This makes sense as more seniors opt for Medicare Advantage, the need for supplemental traditional Medicare plans falls.

This segment is no longer a growth driver. It’s stable but slowly losing share.

UnitedHealth is leaning into Medicare Advantage, and for good reason. It’s the fastest-growing, most profitable, and strategically scalable part of its government programs.

While Medicaid brings stability, Medicare Supplement slowly fades. The story is clear:

Medicare Advantage is the future, and UnitedHealth is riding the wave.

UnitedHealth’s Optum Health Arm

Optum Health is UnitedHealth’s care delivery and services division, where patients are touched directly through clinics, virtual care, and chronic condition management.

Let’s look at the number of Optum Health consumers served annually, which reflects the scale of their reach.

2014 → 2019: Strong, steady growth from 63M to 98M

2020–2022: Flatlining around 100M–103M

2023–LTM: Slight decline, now at 99M

This data tells us two things:

Optum has reached significant scale. Touching nearly 100 million lives is massive.

But growth has slowed, and even dipped slightly in recent years.

This could be due to:

Saturation of employer contracts

Post-pandemic shifts in utilization

Focus on value-based care vs volume

Or natural plateauing after years of expansion

Optum Health is supposed to be UnitedHealth’s growth and margin engine, providing higher-margin services (like care delivery, chronic care, and virtual health) than traditional insurance.

So, while they’re serving a vast population, flat or declining engagement may mean revenue growth needs to come from deepening services per patient rather than simply adding more patients.

2. UnitedHealth Group Executive Leadership

2.1 CEO Experience

Three days ago, UnitedHealth Group announced that it would replace Andrew Witty, the current CEO, with former CEO Stephen Hemsley.

For simplicity, I will cover both briefly.

Andrew Witty began his career at Glaxo in 1985 and rose through the ranks to become CEO of GlaxoSmithKline in 2008. During his tenure, he introduced major pricing reforms to improve global drug access and championed a patent pool initiative. He later held advisory roles with the UK government, UNAIDS, and the UN.

After leaving GSK in 2017, Witty led the NHS’s Accelerated Access Collaborative and then became CEO of Optum, a UnitedHealth Group subsidiary. In 2021, he was named CEO of UnitedHealth Group. He played a role in global pandemic efforts and joined the G7’s Pandemic Preparedness Partnership.

Witty’s final years at UnitedHealth were marked by controversy, including a 2024 insider trading lawsuit and a public backlash over a leaked internal video following the murder of the UnitedHealthcare CEO. He stepped down in May 2025.

Stephen J. Hemsley is an American businessman and long-serving executive at UnitedHealth Group. After graduating from Fordham University in 1974, he began his career at Arthur Andersen, eventually becoming Managing Partner and CFO. He joined UnitedHealth in 1997, rising to President by 1999 and CEO in 2006.

Under Hemsley’s leadership, UnitedHealth experienced massive growth, expanding significantly through its Optum division and transforming into one of the world’s largest healthcare companies. He stepped down as CEO in 2017 but remained Chairman of the Board.

In May 2025, amid internal turmoil, Hemsley returned as CEO. His compensation included a $1 million base salary and a $60 million equity package. Beyond his corporate work, Hemsley has served on the boards of Cargill, Minnesota Public Radio, and the University of St. Thomas, and is involved with the Boy Scouts of America.

2.2 Employee Satisfaction Ratings

As you know, I praise employee satisfaction more than any metric out there.

Does UnitedHealth Group sustain a pleasant work environment, keeping employees aligned with the company's long-term goal?

To find honest reviews on UnitedHealth Group, I went to Indeed, and here are the results.

UnitedHealth Group has 18.843 reviews by current and former employees. The vast majority have shown a preference for working there.

Here are the most recent reviews from current/former employees with UnitedHealth Group:

The overall sentiment is neutral/good.

Occasionally, we see a bad review, which we can not avoid and should not aim to prevent. Everyone is different and has their own perception of a good company, culture, salary, and compensation.

Our job is to take all this data and draw a conclusion.

My conclusion from reading 100+ reviews from employees is that:

UnitedHealth offers a good salary

Provides a healthy work and personal life balance

They’re mission-driven, and employees are aligned with their mission

There’s heaps of room for growth, but employees do need to perform to get growth (that’s good)

Communication could use improvement. There’s a neutral sentiment around communication from management to its team.

A significant portion claims this line of work is worth pursuing, which is a good sign.

I’m overall pleased with the data that I’ve gathered from Indeed.

Due to the size of UnitedHealth Group, the largest insurer in the U.S., it’s common to see some hiccups here and there.

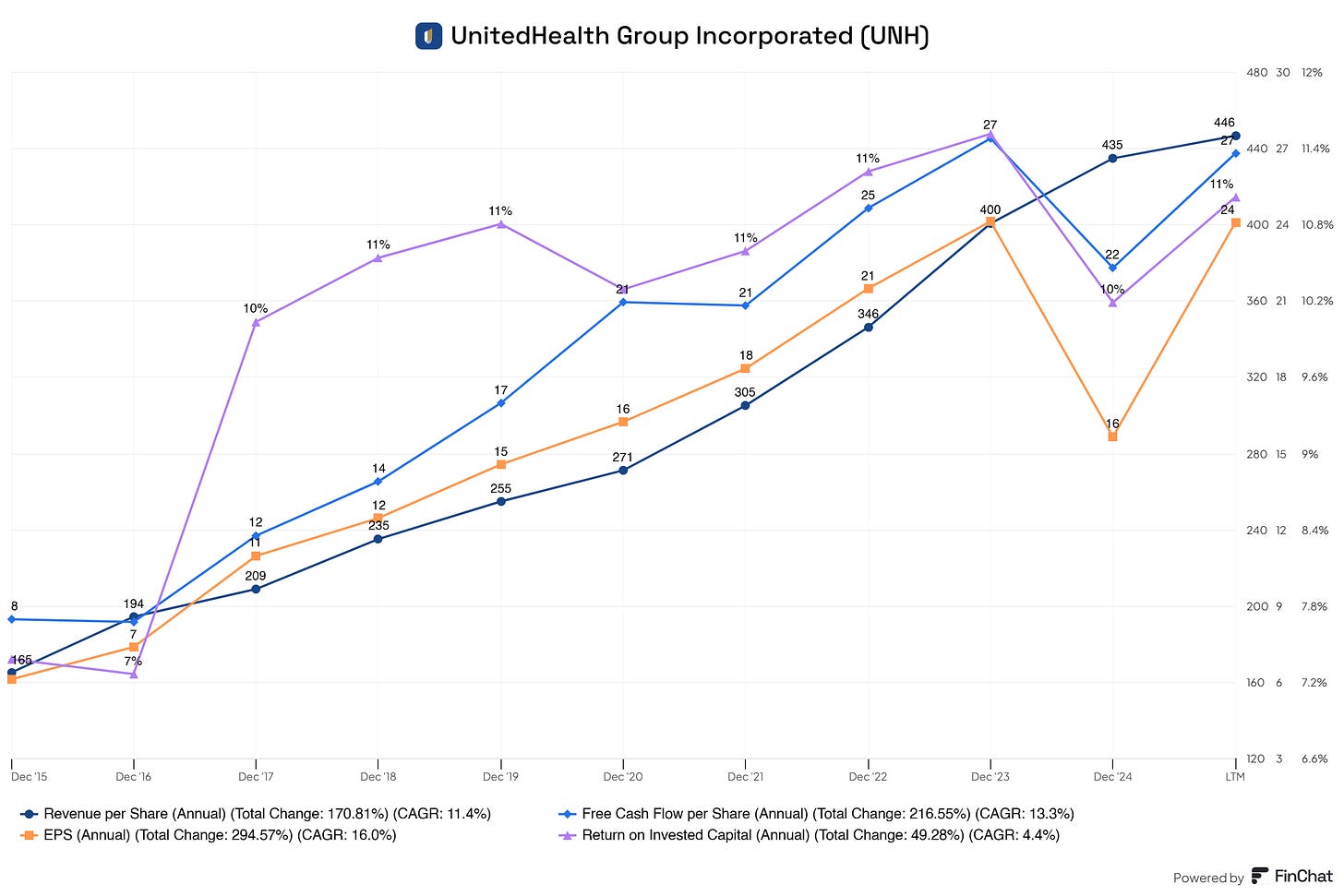

2.3 CEO Value Creation

Management did create value over the long term.

Although the ROIC is low, this is typical in the healthcare and health insurance industry.

They must hold large amounts of regulatory capital and reserves, which are required to pay future claims, meet solvency requirements, or fund acquisitions. This inflates the ‘invested capital’ denominator in the ROIC formula, bringing this ratio down.

However, UnitedHealth Group is at the top of the range compared to its competitors. Most healthcare insurance providers have ROICs between 8% and 15%.

Return on equity (ROE) is a better metric for UnitedHealth Group; more on this later.

3. Insider and institutional ownership

Let’s go over the top five insiders.

Stephen J. Hemsley (CEO & Non-Independent Non-Executive Chairman)

Shares: 1.1M

% Owned: 0.12234%

Market Value: $356.9M

John F. Rex (President & CFO)

Shares: 210.6K

% Owned: 0.02321%

Market Value: $67.7M

Andrew Philip Witty (Non-Independent Director)

Shares: 111.7K

% Owned: 0.01231%

Market Value: $35.9M

Dirk C. McMahon (Former President & COO)

Shares: 97.5K

% Owned: 0.01075%

Market Value: $31.4M

Thomas Edward Roos (Senior VP & Chief Accounting Officer)

Shares: 29.5K

% Owned: 0.00325%

Market Value: $9.5M

Heather Rachelle Cianfrocco (EVP of Governance, Compliance & Information Security)

Shares: 22.4K

% Owned: 0.00247%

Market Value: $7.2M

The new CEO, Stephen Hemsley, has significant skin in the game. A large portion of his personal wealth is locked into UnitedHealth Group stock.

This is a good sign for (potential) investors.

If Mr. Hemsley decides, we can almost be certain this will be in the company's best interest. If not, he will feel this in his own pockets.

The independent directors, who are responsible for safeguarding investors' interests and keeping management in check, also have significant skin in the game.

For independent directors, we would like to see 4 times their annual salary in company stock.

Frederick William McNabb (Independent Director)

Shares: 13.7K

% Owned: 0.00151%

Market Value: 4.4M

Timothy Patrick Flynn (Independent Director)

Shares: 6.0K

% Owned: 0.00067%

Market Value: 1.9M

Michele J. Hooper (Lead Independent Director)

Shares: 3.4K

% Owned: 0.00037%

Market Value: 1.1M

Their annual compensation is ~$150.000. This means their ownership stake in the company is at least 4x larger than their annual salary. This gives extra confidence to investors knowing that they will most likely make calls in the interest of investors, and in return for themselves. And with calls, I mean value-accretive calls.

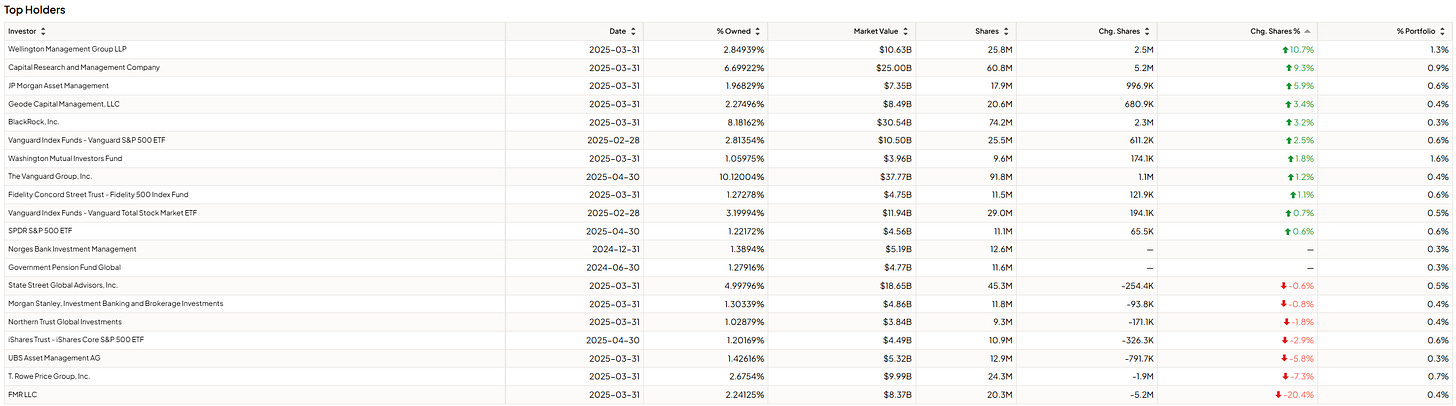

Now, let’s look at what the big players are doing with their stocks.

Are they buying or selling?

11 institutions are increasing their positions in UnitedHealth Group, and only 7 are decreasing their positions. Two have not increased or decreased their position.

4. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

While UNH is a well-known name in the healthcare industry, its brand does not constitute a significant moat. The company's reputation has faced challenges due to regulatory scrutiny and public criticism, which can impact brand perception.

Scale and Cost Advantages

UnitedHealth Group is the largest health insurer in the United States, serving over 50 million members across its diverse range of insurance products. This scale provides predictable premium inflows, strong pricing power, and deep market penetration across both commercial and government-sponsored programs.

UNH maintains contracts with 1.7 million healthcare professionals and over 7,000 hospitals, giving it unrivaled reach and influence across the U.S. healthcare system. This broad network not only ensures member access to care but also provides significant leverage in negotiating rates, managing utilization, and enforcing value-based payment models.

Beyond insurance, UNH owns and operates Optum, one of the most integrated and fast-growing health services platforms in the country. Optum serves providers, employers, governments, and patients through services like pharmacy benefit management (PBM), data analytics, revenue cycle management, and care delivery. This vertical integration reduces friction in the healthcare value chain and allows UNH to control both cost and care quality more directly.

UNH’s massive scale enables it to spread fixed costs—such as investments in IT infrastructure, regulatory compliance, and administrative systems—across a large member and client base. This significantly reduces per-unit costs, creating an efficiency moat that smaller competitors struggle to match.

Switching Costs

UnitedHealth’s integration across insurance, analytics, and pharmacy services creates significant friction for customers considering a switch. Large employers often run tailored UNH plans with wellness, chronic care, and data systems baked in. Replacing these setups with another provider is costly, time-consuming, and disruptive to employees, especially when multiple UNH services are bundled.

For individuals, familiarity and vertical integration through Optum clinics, behavioral health, and home care make switching feel inconvenient, even if theoretically possible. Most Americans receive insurance through employers anyway, limiting personal choice.

On the institutional side, Optum’s contracts with hospitals and governments are deeply embedded into backend systems and payment models. Replacing UNH would require navigating technical, compliance, and regulatory hurdles—something few partners are eager to take on.

Network Effect

Unlike Facebook or Airbnb, one person joining UNH doesn't improve the service for another individual.

The value for each user doesn’t increase because more users join. It increases because UNH uses scale to cut costs and optimize services.

Attracting Talent

As a Fortune 5 company, UNH offers job security, strong compensation packages, and long-term career opportunities. This appeals to high-skill professionals, especially in a volatile healthcare and tech job market.

Healthcare attracts purpose-driven people. UNH’s mission to "help people live healthier lives" helps recruit professionals who care about impact, from clinicians to engineers.

There are some limitations, though.

Healthcare industry bureaucracy can slow innovation and frustrate top talent compared to startup environments.

Public image issues (e.g., claims denials, lawsuits) may deter mission-driven professionals or younger talent seeking more transparent cultures.

Quick note before we continue! You see me using a lot of Finchat charts. You can get a 2-week free trial (no card required) using my link here 👇🏻

5. Industry Analysis

5.1 Industry Growth Prospects

Total U.S. healthcare spending projected to grow from ~$4.5T in 2024 to ~$6.8T by 2032 (CMS).

Healthcare as a share of GDP is expected to rise from ~18% to over 20% by 2030.

Growth CAGR: 5–6% annually, driven by aging population, chronic disease prevalence, and continued demand for managed care and digital health.