Welcome back, Fluenteers! 👋🏻

From time to time, we cross a business that’s hiding in plain sight. Röko is one of the businesses. Wall Street isn’t covering them, retail investors have not picked up yet, and the most significant funds haven’t jumped the gun yet. This is our opportunity to analyze this compounder and determine if the next spot in our portfolio should be reserved for Röko.

Let’s peel back every layer of Röko to find out everything we need to know about the business and determine if now is the right time to invest.

Happy compounding!

Table of Contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationInsider and institutional ownership

Competitive and Sustainable Advantages (MOAT)

Industry Analysis

5.1 Industry Growth Prospects

5.2 Competitive BenchmarkingRisk Assessment

Financial Stability

7.1 Asset Evaluation

7.2 Liability AssessmentCapital Structure

8.1 Expense Analysis

8.2 Capital Efficiency ReviewProfitability Assessment

9.1 Profitability, Sustainability, and Margins

9.2 Cash Flow AnalysisGrowth Projections

Owner Earnings & Expect Annual Return

Value Proposition

11.1 Dividend Analysis

11.2 Share Repurchase Programs

11.3 Debt Reduction StrategiesQuality Rating & Checklist

Valuation Assessment

1. Corporate Analysis

1.1 Business Overview

Röko AB is a Swedish investment firm that acquires and holds small to medium-sized European companies for the long term. It was founded in 2019 by Tomas Billing (ex-CEO of Nordstjernan) and Fredrik Karlsson (ex-CEO of Lifco).

The company provides patient capital, light-touch oversight, and strategic support, without interfering in day-to-day operations.

How It Works

Röko’s model is built around five pillars:

Business Acquisition

Targets profitable, niche companies in fragmented markets, typically with €2–10 million EBIT (earnings before interest and taxes). Sectors include industrial, consumer, and business services.Permanent Ownership

Röko doesn’t plan to sell its businesses. Its “buy and hold forever” model allows for long-term decision-making, stable leadership, and cultural continuity.Decentralization

Every Röko company operates independently. Local management has full control, with Röko offering only light financial guidance and succession support.Entrepreneurial Culture

Founders often stay on post-acquisition. Röko encourages management to reinvest in their businesses and maintain autonomy.Disciplined M&A Strategy

Röko has scaled through steady, quality-driven acquisitions. As of 2024, it owns 25+ companies across Sweden, Germany, Norway, the Netherlands, and the UK, focusing on recurring earnings and cash flow, not aggressive expansion.

What Makes Röko Different

No exit pressure. Röko is backed by long-term institutional capital and avoids the short-termism common in private equity.

Founder alignment. The founders retain a significant ownership stake, aligning their interests with long-term shareholders.

Scandinavian roots. Röko draws inspiration from successful industrial holding companies like Lifco and Indutrade, but is applying those principles to a broader European canvas.

Röko is building a decentralized portfolio of durable, cash-generative businesses with minimal overhead and long-term alignment.

TL;DR:

Röko is a Swedish investment company acquiring niche, profitable businesses across Europe.

Inspired by Lifco and Indutrade, it follows a permanent ownership model and decentralized structure.

The firm is quietly building a compounding machine of resilient, cash-generating companies.

1.2 Revenue Breakdown For Röko AB

Note: All revenue figures are in SEK.

Röko classifies revenue under B2B when their acquired companies primarily sell products or services to other businesses rather than directly to individual consumers.

Portfolio examples:

ArboCenter – Floor coating and maintenance products

Hot Screen – Transfers for work and sports clothing

Addeco – Software and consultancy services

Bilomsetningen – Car parts distributor

Lundberg Tech – Waste handling systems

Oppigårds – Craft brewery

Ekstralys – Automotive lighting solutions

Renovotec – Rugged IT hardware solutions

Rocket Medical – Single-use medical device manufacturing

4x4 A&T – Pickup truck accessories

Smit Visual – Whiteboards and acoustic panels

Brownell – Technical components

ETB Tech. – Refurbished IT hardware

Dorsey – Niche construction products

TECCON – Electrical products

AJAT – Uniforms and custom tailoring for schools and professionals

CHP – Transport system components

Pureoptics – Optical transceivers and cables

Characteristics here are larger and recurring contracts, niche expertise, technical requirements, and more stability and business-cycle resistance.

Revenue is classified under B2C when their portfolio companies sell directly to individual customers.

Portfolio examples:

Beth’s Beauty – Skincare clinics and retail

Dan-Form – Furniture brand

Sixty Stores – Garden equipment e-commerce platform

Les Deux – Fashion brand

Golf Experten – Golf equipment retail chain

Silk-Ka – Artificial flower designer

Godiva – Uniforms for schools and choirs

Snowminds – Ski instructor training programs

ATEMAG – CNC accessories (may straddle B2B/B2C)

Some key characteristics include direct-to-consumer marketing, shorter purchase cycles, a trend-sensitive nature, and increased exposure to consumer confidence and seasonal fluctuations.

The B2B and B2C markets are then further divided into services and goods, as some companies offer either services or products exclusively to B2C or B2B customers.

Röko AB is showing resistance in both the B2C and B2B categories. Both categories offer unique value to the Röko AB value chain.

B2B

Stable, recurring revenue

Many of Röko’s B2B companies provide essential products or services to other businesses like TECCON (electrical products), Renovotec (rugged IT hardware), and Rocket Medical (single-use medical devices). These offerings are often mission-critical, leading to long-term contracts and lower volatility.High switching costs

Clients in industrial sectors, such as those served by Brownell (technical components) or Smit Visual (whiteboards/acoustic panels) tend to stay with trusted suppliers. This creates stickiness, pricing power, and predictable revenue.Less marketing spend

Companies like Addeco (software consultancy) and ETB Tech. (refurbished IT hardware) rely more on technical performance and B2B relationships than on mass marketing, fitting Röko’s lean, decentralized approach.Fragmented markets = M&A ppportunities

Niches like pickup truck accessories (4x4 A&T) and niche construction products (Dorsey) remain highly fragmented. Röko can continue bolt-on acquisitions without intense competition or overpaying.Defensive in downturns

Röko targets profitable, cash-generative B2B companies in stable sectors. Businesses like CHP (transport systems) and Hot Screen (workwear transfers) offer products that are needed regardless of the economic cycle, giving the group resilience.

B2C

High gross margins

Consumer brands like Les Deux (fashion) and Godiva (school uniforms) sell direct-to-consumer branded products, often commanding premium pricing and attractive margins.Digital acalability

Röko owns several e-commerce-driven companies such as Sixty Stores (garden equipment) and Dan-Form (furniture). These platforms scale without the overhead of physical retail, which is ideal for a decentralized owner like Röko.Brand value growth

Brands like Silk-Ka (artificial flowers) and Snowminds (ski instructor training) have strong niches. If brand affinity compounds, the underlying value can outpace reported profits, offering upside optionality.Seasonal diversification

Seasonal B2C businesses (e.g., Beth’s Beauty in skincare or Golf Experten) add variety to Röko’s revenue stream. This helps offset flatter industrial cycles from the B2B side.Acquisition bargains

Many of Röko’s B2C holdings were acquired from founders or families, often under-optimized. With operational support and a long-term horizon, Röko can extract more value without micromanaging.

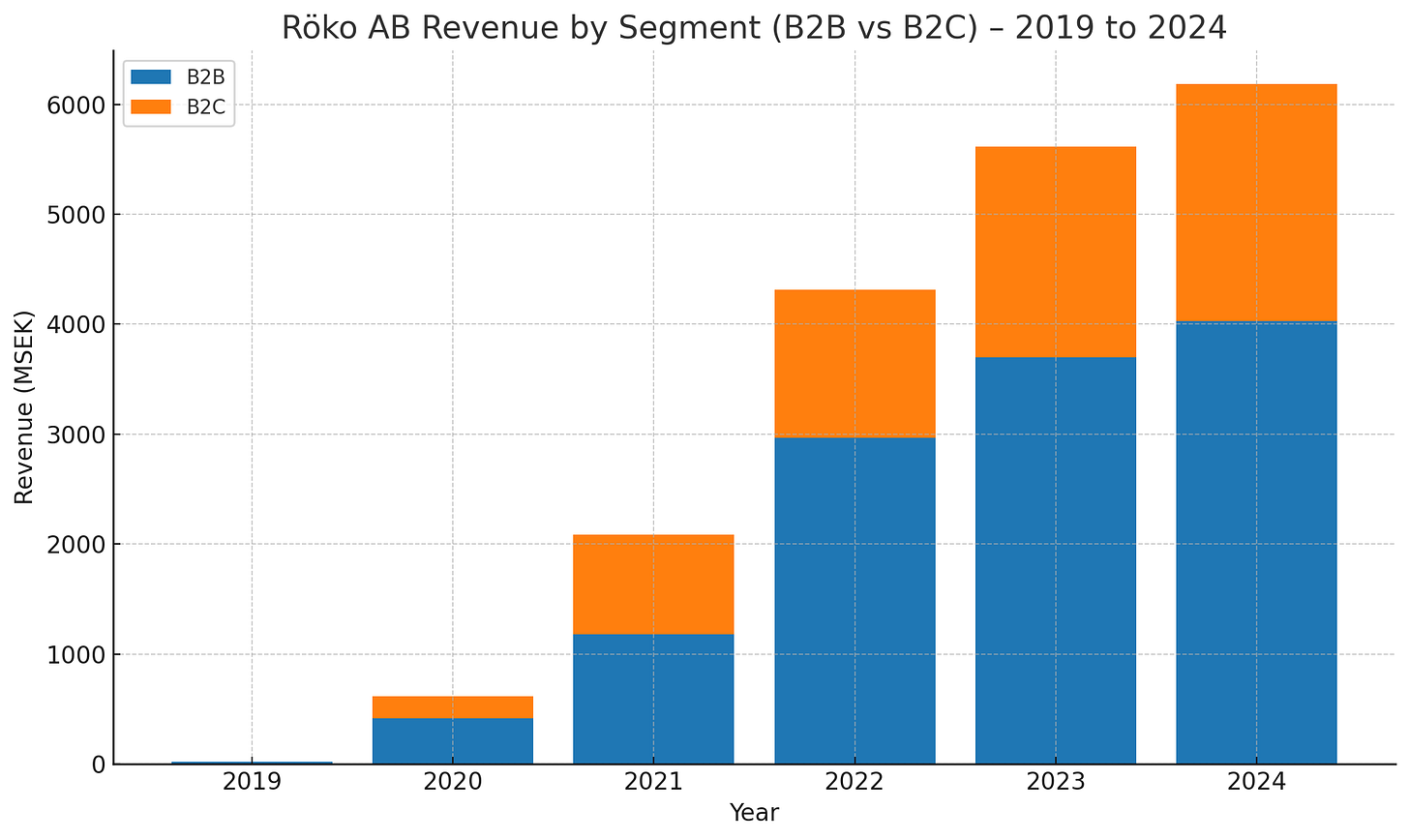

B2B consistently makes up the majority of Röko’s revenue each year.

By 2024, B2C has grown steadily and now contributes roughly 35% of total revenue, creating a diversified and resilient income mix.

B2B is the foundation of Röko’s model.

These companies operate in less cyclical industries, benefit from long-term customer relationships, and generate recurring cash flow.

Think of businesses like TECCON (electrical products), Renovotec (rugged IT hardware), or Rocket Medical (disposable medical equipment).

Their clients are typically industrial, public sector, or enterprise-level, meaning low churn, predictable demand, and sticky contracts.

This provides Röko with the reliability and consistency needed to run a decentralized, hands-off ownership model.

B2C adds strategic upside.

While it may be more sensitive to market cycles, consumer-facing businesses like Les Deux (fashion), Sixty Stores (e-commerce for gardening gear), and Silk-Ka (artificial flowers) offer higher gross margins, brand leverage, and scalable online operations.

These companies can grow organically with low capital expenditures (capex) and benefit from direct customer relationships and seasonal surges (e.g., holidays and fashion cycles).

Röko isn’t constrained by sector or customer type.

It can acquire stable B2B “cash machines” when available or pursue under-optimized consumer brands with growth potential.

That flexibility:

Broadens the M&A pipeline

Allows them to act opportunistically

And supports sustainable, compounding growth over time

This visual clearly confirms Röko's strategy. Buy profitable, niche firms, then let them grow incrementally within a decentralized model.

From 2021 to 2024, Röko added billions in revenue. But the real story is how they did it, through a combination of disciplined M&A and steady organic gains:

In 2021, Röko added 829 MSEK through acquisitions and 61 MSEK organically

In 2022, 2,003 MSEK came from acquisitions, 230 MSEK from organic growth

In 2023, organic growth held steady at 224 MSEK, with 1,074 MSEK from acquisitions

In 2024, acquisition growth slowed (328 MSEK), but organic growth was solid at 240 MSEK

Röko consistently sources and acquires profitable, niche businesses:

Adds meaningful revenue year after year

Stays focused on quality, not hype

It shows it can scale without integration headaches

The organic growth line proves something crucial:

Röko isn’t just buying revenue, the companies it owns keep growing

That’s a sign of strong underlying business models and smart acquisition selection

2024 shows a key strength:

Even with fewer acquisitions, Röko still grew

This flexibility means they don’t have to overpay or force deals, they can wait for the right ones

Röko uses acquisitions to accelerate and organic growth to sustain. That’s a rare combo. And it’s precisely what long-term investors should be looking for.

I’ve been rambling on too much.

TL;DR

Röko operates a scalable portfolio of niche companies across both B2B and B2C markets. Each segment brings distinct strengths to the group’s long-term growth strategy.

The B2B portfolio generates stable, recurring revenue through companies such as TECCON, Renovotec, and Rocket Medical. These firms serve essential needs, operate in less cyclical sectors, and maintain long-term customer relationships.

The B2C segment adds margin potential and flexibility. Brands like Les Deux, Sixty Stores, and Silk-Ka benefit from consumer appeal, digital reach, and seasonal demand. Many of these businesses scale with minimal capital investment.

Since 2021, Röko has grown revenue from 2.1 billion SEK to over 6.1 billion SEK. B2C now accounts for approximately 35% of total revenue. The combination of steady industrial income and dynamic consumer growth creates a well-diversified revenue base.

Growth has come from both acquisitions and internal expansion. Between 2021 and 2024, Röko added more than 4 billion SEK in new revenue. Organic growth has remained consistent, even in years with fewer acquisitions.

The group avoids central management and instead empowers local leadership. Subsidiaries operate with autonomy while benefiting from shared ownership, strategic guidance, and long-term support.

Röko continues to execute a proven growth model. With a clear acquisition strategy, a decentralized structure, and a pipeline of opportunities in fragmented markets, the company is well-positioned to keep compounding for years to come.

2. Röko AB Executive Leadership

Fredrik Karlsson has been the co‑founder, CEO, and board member of Röko AB since its founding in 2019.

Background & early career

Holds dual M.Sc. degrees in Engineering Physics from KTH (Royal Institute of Technology) and Business Administration from the Stockholm School of Economics.

He began his career at Boston Consulting Group, later joined the German firm Mercatura, and then became CEO of Lifco AB in 1998 at the age of 36.

Under his leadership, Lifco grew significantly, with exceptional returns over two decades, including a 100× increase in shareholder value.

Founding & leading Röko

In 2019, Karlsson teamed up with Tomas Billing to establish Röko, a serial-acquisition holding company inspired by the Lifco model.

As CEO, he's applied his acquisition experience to build Röko into a scalable platform:

Completed ~33 deals across eight countries, growing EBITA close to 1,227 MSEK in just five years.

The company went public in March 2025, with an initial valuation of approximately 30 billion SEK.

Leadership style & strategy

Focused on “asset‑light,” profitable niche businesses; maintains decentralized oversight, letting acquired companies operate autonomously while ensuring monthly reporting.

Typically acquires a 70–80% stake, keeping founders engaged via retained equity to align incentives

Karlsson has recently continued to signal confidence by purchasing shares.

As per 08-07-2025, Karlsson owns 1.5M shares (%10.54) worth 3.2B SEK

TL;DR

Fredrik Karlsson is a seasoned builder of shareholder value, combining deep strategy expertise, a strong M&A track record, and hands-on leadership. At Röko, he has rapidly scaled a serial acquisition model, maintaining founder alignment and operational autonomy, all while taking the company public and continuing to invest personally in its growth.

2.2 Employee Satisfaction Ratings

There’s a lack of trustworthy employee reviews for Röko. For this reason, I will refrain from making any assumptions on this matter.

Sorry!

2.3 CEO Value Creation

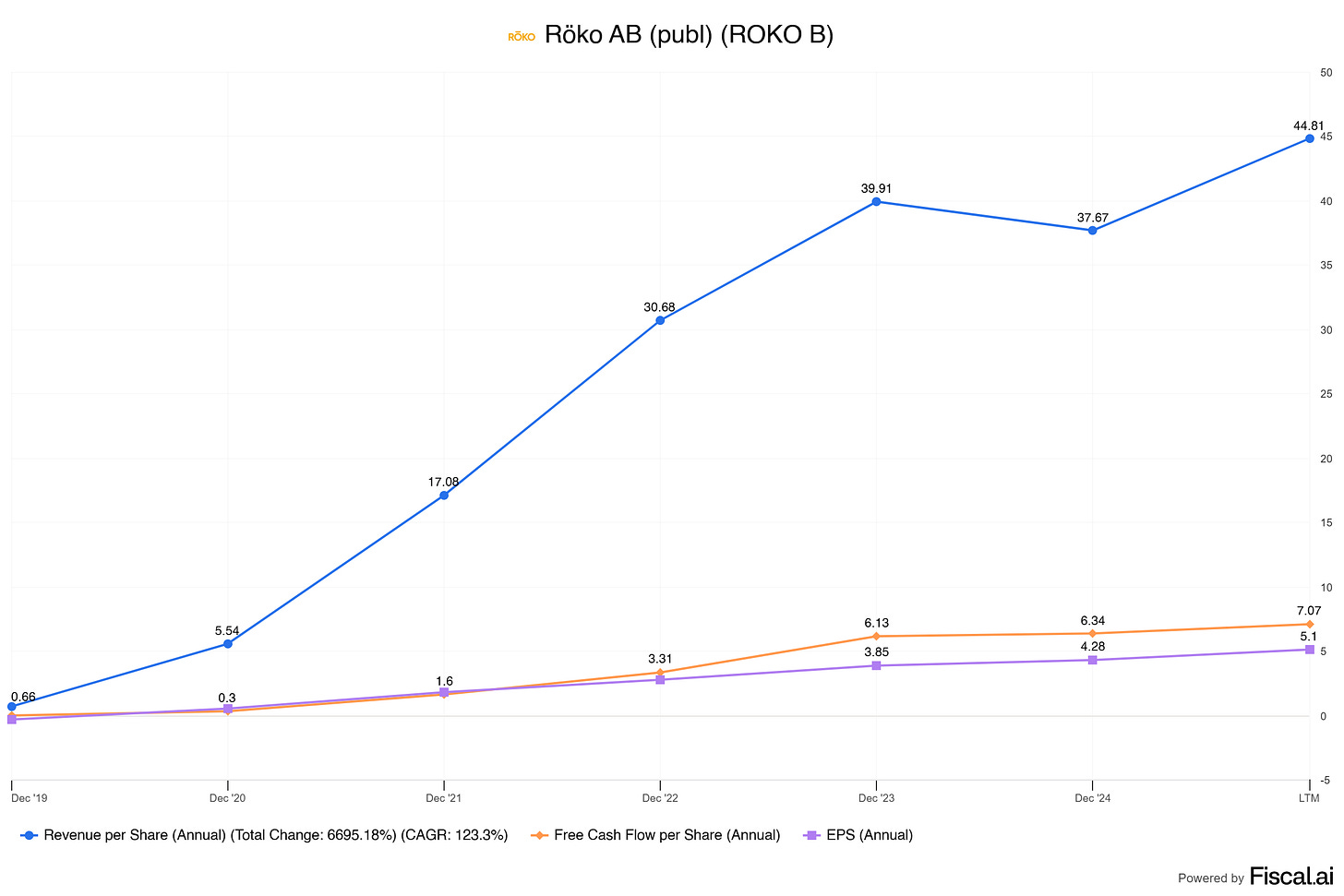

Röko has been issuing new shares, which causes some shareholder dilution. Why is this important? Despite this dilution, their earnings per share, revenue per share, and free cash flow per share have all grown substantially. This indicates Röko’s ability to create real per-share value, even while expanding its share base.

In other words, Röko is a rare case of a company that dilutes, but still compounds per-share fundamentals. That’s the kind of business you want to hold long-term.

We’ll explore ROIC and ROCE later, since there are important nuances to consider when analyzing these metrics for a company like Röko.

Note: Young companies dilute because they’re trading ownership for fuel.

They need capital, prioritize growth, and use equity to scale. Dilution is the price of ambition, and it’s only bad if the capital is wasted.

3. Insider and institutional ownership

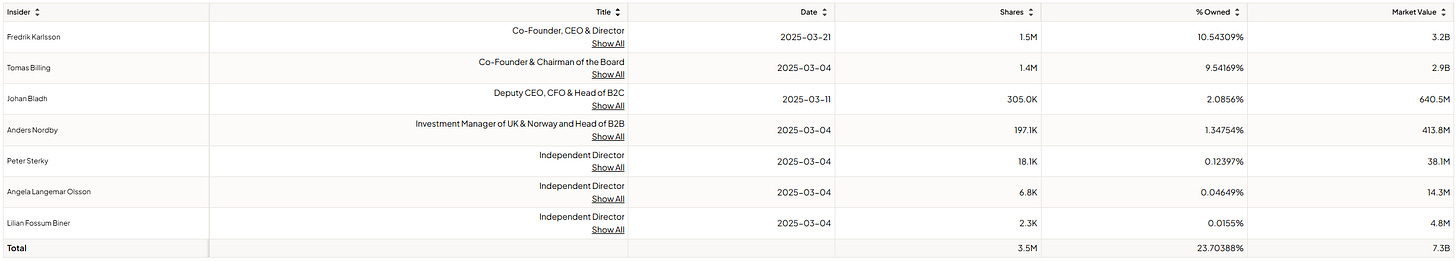

Insiders hold a significant stake in the company. In total, insiders own 23.70% of the company. The CEO and Co-founder, Fredrik Karlsson, owns 10.54%, Co-Founder and Chairman Tomas Billing owns 9.54%, Deputy CEO, CFO, and Head of B2C Jonah Bladh owns 2.08%.

In March, Fredrik Karlsson significantly increased his stake in Röko.

Inside ownership is extremely high, something we admire.

Although nothing is guaranteed, high insider ownership gives us a better probability that management will act in the best interest of the company and shareholders.

Why so?

If management starts executing value-destructive acquisitions, making Röko’s position worse and dragging the fundamentals down, management will feel this error in their own pockets due to their vast amounts of personal capital that’s locked in stocks in their company.

High inside ownership ensures that management will most likely act in the company’s best interest, and in return, in its shareholders’ best interest.

Top insider and institutional holders are:

Fredrik Karlsson: 10.54309%

Tomas Billing: 9.54169%

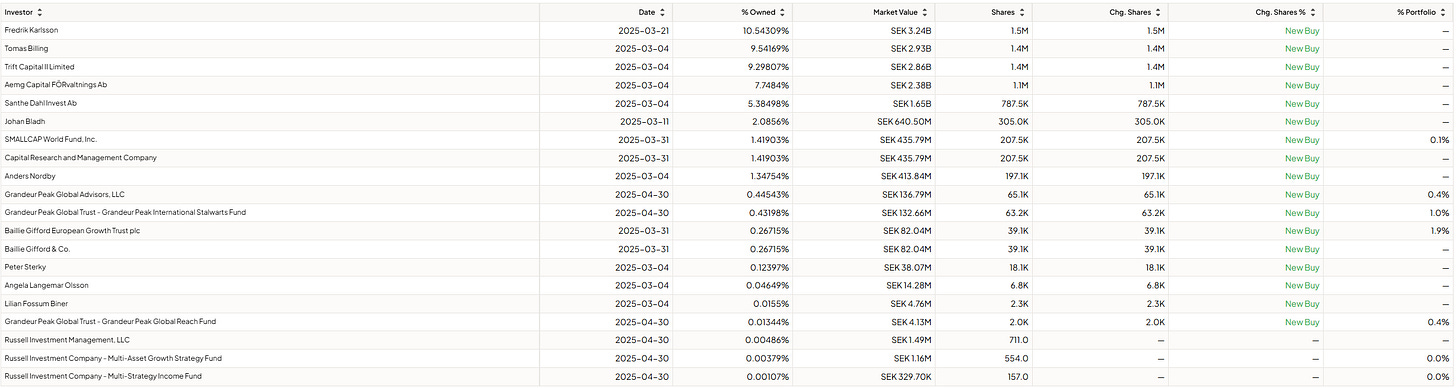

Trift Capital II Limited (Trift Capital markets itself as providing “selective and patient capital” to exceptional technology-led businesses): 9.29807%

Aemg Capital FÖRvaltnings Ab (It manages financial assets and operates as a vehicle for strategic holdings and investments on behalf of a small group of shareholders, led by the Gerge family): 7.7484%

Santhe Dahl Invest Ab (It’s a family-run investment firm owned and operated by Santhe Dahl): 5.38498%

Johan Bladh: 2.0856%

SMALLCAP World Fund, Inc.: 1.41903%

Capital Research and Management Company (Capital Research and Management Company (CRMC) is the investment advisory arm of The Capital Group Companies): 1.41903%

Anders Nordby: 1.34754%

Grandeur Peak Global Advisors, LLC (Grandeur Peak is a boutique active equity manager with a global footprint, focusing on smaller-cap quality-growth companies in undervalued markets): 0.44543%

👉 You're one step away from joining the Fluent Few, rational investors who don't just watch from the sidelines. Get full access to this investment case, future deep dives, and the private portfolio by upgrading today.