Is Kelly Partners Group A Buy Right Now?

Kelly Partners might be the rare firm turning a boring industry into investor gold.

Welcome back, Fluenteers! 👋🏻

Most investors wouldn’t look twice at a small-cap accounting firm. But Kelly Partners Group is no ordinary back-office business.

With a founder-CEO who thinks like an owner, a recurring revenue model tailored to high-net-worth clients, and a culture most companies would kill for—KPG checks more boxes than you’d expect.

But is it investable today? That’s the question we’ll unpack. Let’s look at the numbers, the moat, the man behind the mission, and whether this ‘boring’ business might quietly compound for years.

Happy compounding!

Table of Contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue Breakdown

1.3 KPIsExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationInsider and institutional ownership

Competitive and Sustainable Advantages (MOAT)

Industry Analysis

5.1 Industry Growth Prospects

5.2 Competitive BenchmarkingRisk Assessment

Financial Stability

7.1 Asset Evaluation

7.2 Liability AssessmentCapital Structure

8.1 Expense Analysis

8.2 Capital Efficiency ReviewProfitability Assessment

9.1 Profitability, Sustainability, and Margins

9.2 Cash Flow AnalysisGrowth Projections

Owner Earnings & Expect Annual Return

Value Proposition

11.1 Dividend Analysis

11.2 Share Repurchase Programs

11.3 Debt Reduction StrategiesQuality Rating & Checklist

Valuation Assessment

1. Corporate Analysis

1.1 Business Overview

Kelly Partners Group (ASX:KPG) is a network of accounting firms providing tax, audit, advisory, and wealth services to private business owners and high-net-worth families. Founded in 2006 by Brett Kelly, the company now operates over 30 offices across Australia, with recent expansion into the U.S., Hong Kong, India, and the U.K.

KPG’s core offering includes:

Compliance: Bookkeeping, tax preparation, audit, and forensic accounting.

Advisory: Strategic and operational consulting for SMEs, including M&A, succession planning, and risk management.

Wealth Services: Family office support, estate structuring, and intergenerational wealth transfer.

The firm’s competitive edge lies in its Partner-Owner-Driver (POD) model. Every KPG office is co-owned by its lead advisor, aligning incentives and reducing churn, a sharp contrast to traditional accounting partnerships or corporate roll-ups where equity rarely trickles down. KPG also provides centralized back-office support, branding, and IT infrastructure to its partner firms, enabling them to focus on client service while benefiting from scale.

Growth has been driven by disciplined M&A. KPG targets culturally aligned, subscale firms in fragmented markets and offers them partial equity, operational leverage, and succession planning. Acquired firms are retained under the KPG brand but run locally, minimizing disruption while preserving autonomy.

As of FY24, KPG serves over 15,000 clients and employs 500+ staff. The group has grown revenue at a ~20% CAGR since listing in 2017, with recurring income comprising over 80% of the top line. Expansion into the U.S. began in 2022, with a beachhead acquisition in New York, signaling intent to replicate its Australian playbook abroad.

The founder’s motivation was personal: after his family business suffered from embezzlement by its accountant, Brett Kelly left law school to pursue accounting, aiming to raise professional standards. His ownership of over 47% of KPG shares suggests long-term alignment and continued founder-led execution.

1.2 Revenue Breakdown For Kelly Partners Group

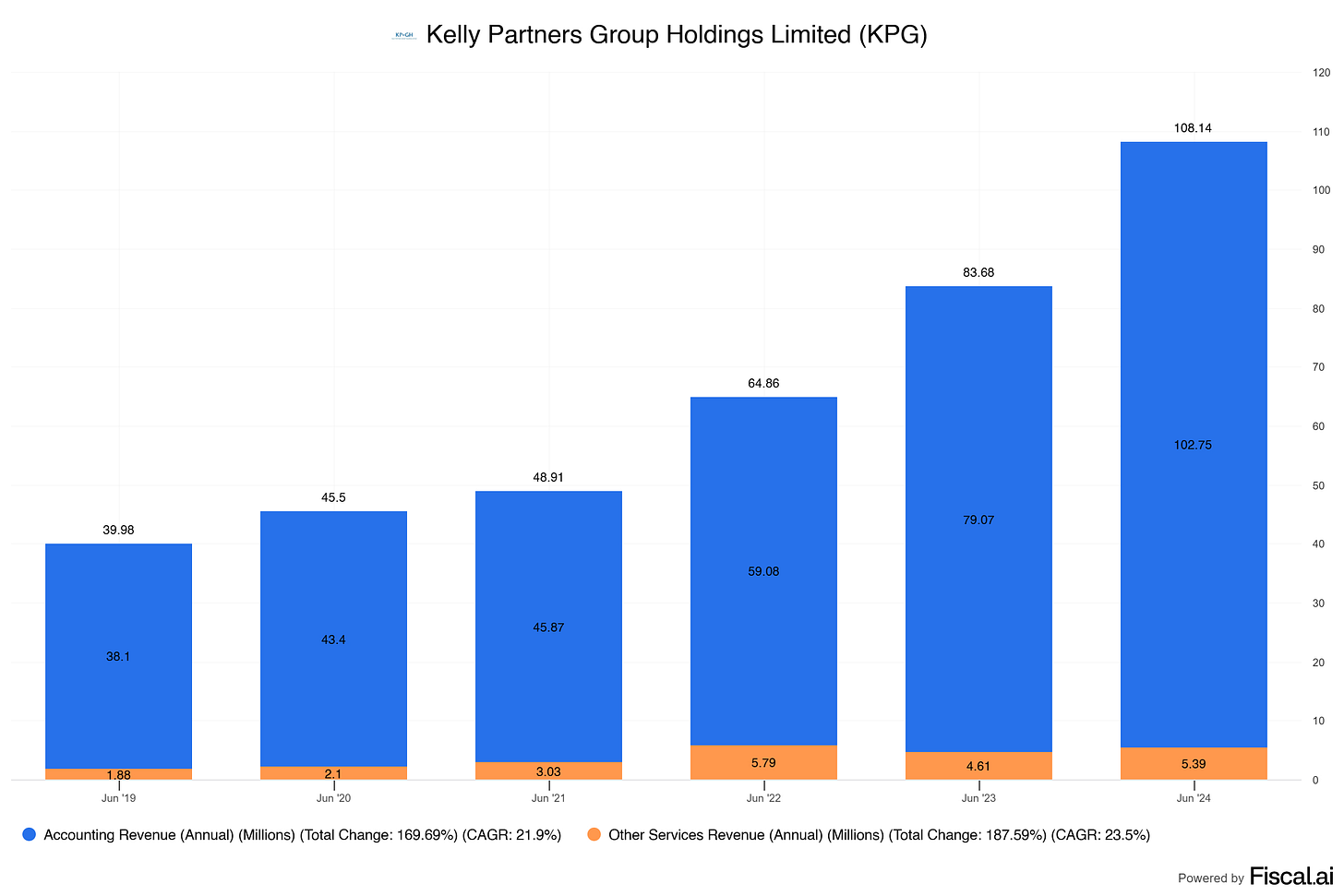

Kelly Partners Group derives the majority of its revenue, consistently over 90%, from core accounting services. These include business tax preparation, compliance, and advisory work for private business owners. The remainder comes from complementary services, which span wealth management, finance, HR consulting, and a nascent investment office.

From FY17 to FY24, total revenue grew from ~$30m to over $108m AUD. Accounting services have been the primary driver, while the “Other Services” segment remains small and relatively flat in contribution. Based on management’s data, wealth and finance consistently contribute less than 1% each to annual revenue. HR and the investment office remain experimental and immaterial.

This concentration is not necessarily a weakness. Accounting revenues are highly recurring, sticky, and relationship-based. Most clients are multi-year engagements, and churn remains low.

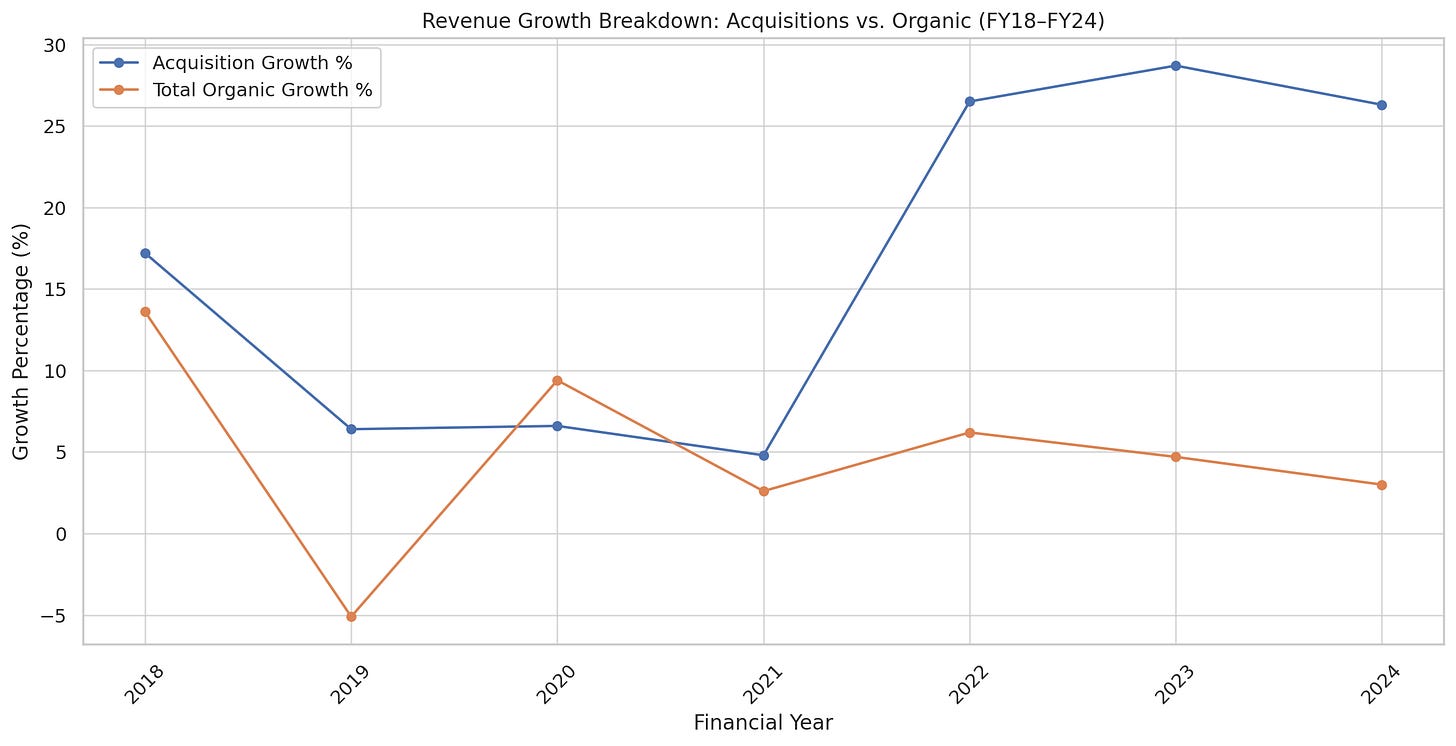

Growth has been driven largely by acquisitions. Between FY21 and FY24, more than 80% of total revenue growth came from acquired firms. Organic revenue growth has averaged ~3.1% across the last seven years, ranging between 2% and 6% annually, a modest but steady figure.

Management frames these acquisitions as “partnerships,” in line with their Partner-Owner-Driver model. The language emphasizes long-term alignment rather than opportunistic roll-ups. However, structurally, these are M&A deals: KPG takes an equity stake, integrates operations, and provides back-office support.

“Acquisitions remain the key strategic growth driver. We aim to double the business every 3–5 years through targeted acquisitions and integrations.”

— FY23 Annual Report“Our M&A playbook is disciplined. We only acquire profitable firms aligned with our values and model, then integrate them into the Kelly+Partners system.”

— FY22 Annual Report

Organic growth remains a secondary lever, not the main event. While 7–10% organic growth would indicate a stronger pricing or volume advantage, the current range is acceptable given the recurring nature of revenue, stable margins (~30% EBITDA), and proven ability to scale through acquisitions.

1.3 KPIs For Kelly Partners Group

KPG’s model is built on disciplined acquisitions, partner-aligned incentives, and strong cash generation. The following KPIs assess how effectively the company converts growth into value, manages profitability with capital efficiency, and aligns internal incentives with shareholder returns.

Growth KPIs

Revenue Growth: Revenue has grown from AUD 30.2m in FY17 to AUD 108.1m in FY24, a 19.8% CAGR.

Acquisition-Driven Growth: Between FY21 and FY24, acquired businesses accounted for 25–28% of total revenue growth annually.

Organic Growth: Organic growth has ranged from 2.9% to 8.4% since IPO, averaging ~3–6%. While modest, it has remained consistently positive.

Earnings Per Share (EPS): EPS increased from 4.97c (FY17) to 13.30c (FY24), a 14.5% CAGR. FY23 saw a dip (12.01c), followed by recovery, consistent with short-term integration costs.

Efficiency KPIs

EBITDA Margin: Margins have remained between 27%–34% since IPO, finishing FY24 at 29.6%. Management targets 35% long-term, implying room for operational leverage as scale increases.

Return on Invested Capital (ROIC): ROIC has ranged from ~20% to 31%, reflecting strong returns despite acquisition activity. Recent years (FY22–FY24) trend closer to 20%.

Return on Equity (ROE): ROE has consistently exceeded 35%, peaking at 47.8% in FY21, an unusually high figure for a professional services business.

Cash Conversion: Cash conversion has exceeded 90% in FY19–21, while remaining healthy but below that mark in FY22–24.

Alignment KPIs

Partner Ownership: KPG’s Partner-Owner-Driver structure ensures that partners typically retain a 49% equity stake in their practices. This aligns economic incentives with long-term client service and business performance — a structural edge over top-down roll-up models.

Owner’s Earnings: Management emphasizes “owner’s earnings” — net income + non-cash charges – required capex – working capital — as its true economic profit metric.

Intrinsic Value per Share: Management repeatedly references long-term per-share value as its north star. Sustained EPS growth, high ROIC, and strong reinvestment discipline suggest this is more than lip service.

2. Kelly Partners Group Executive Leadership

2.1 CEO Experience

Brett Kelly is the founder and CEO of Kelly Partners Group (ASX:KPG). He established the firm in 2006 after observing structural misalignments in traditional accounting networks, particularly the disconnect between ownership, incentives, and service quality.

His motivation was partly personal. In interviews, he cites an early experience where his father’s business was financially harmed by an accountant’s misconduct, a formative event that led him to pursue accounting over law. Professionally, he trained at PricewaterhouseCoopers and a listed investment banking group, gaining exposure to large-scale finance but becoming disillusioned with the bureaucracy and short-termism he observed.

Kelly launched KPG with a differentiated model:

Decentralized ownership: Partners retain 49% equity in their local practices.

Centralized support: KPG retains 51%, offering shared services, systems, and capital.

M&A-led expansion: KPG acquires culturally aligned firms, integrates operations, and aligns incentives around long-term value creation.

This Partner-Owner-Driver model underpins the firm’s strategy and capital allocation. It’s designed to scale without sacrificing accountability, service quality, or retention. Since listing in 2017, revenue has grown from AUD 30m to AUD 108m (FY24), with consistently high returns on equity (30–45%) and strong cash conversion, validating the economic engine he built.

Kelly also distinguishes himself through his focus on intellectual rigor and cultural discipline. He has authored several books, conducted hundreds of interviews with high-performing Australians, and embeds learning systems within KPG’s internal processes. This emphasis on reading, reflection, and values-driven execution appears to influence hiring, partner selection, and firm-wide strategy.

In short: Kelly is not a typical corporate manager. He is a founder-operator with long-term alignment (owns >50% of KPG), a codified business philosophy, and a track record of scaling a highly efficient services firm with owner-led DNA.

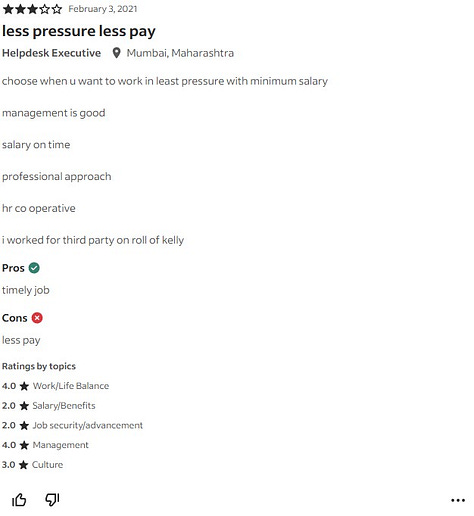

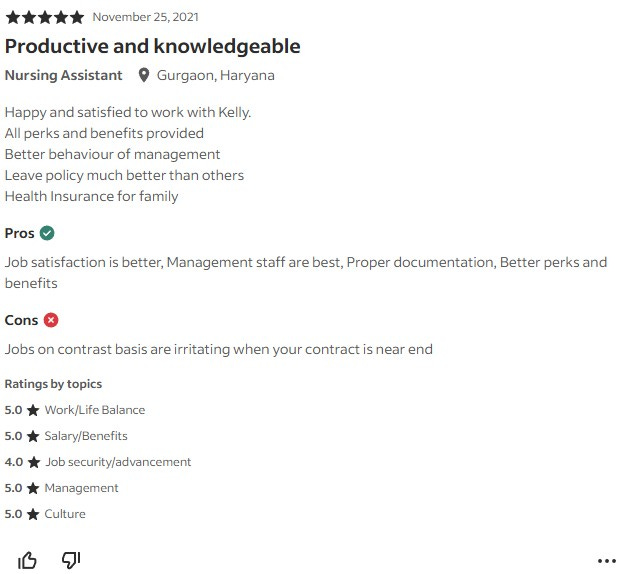

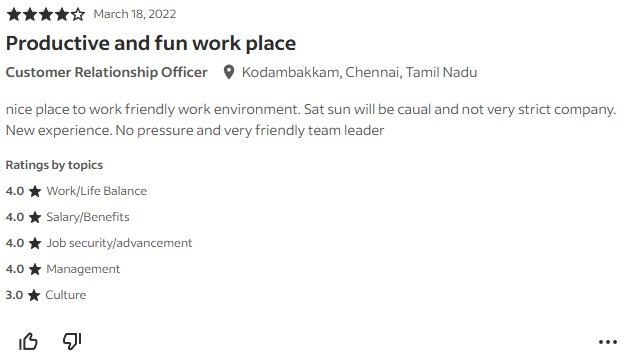

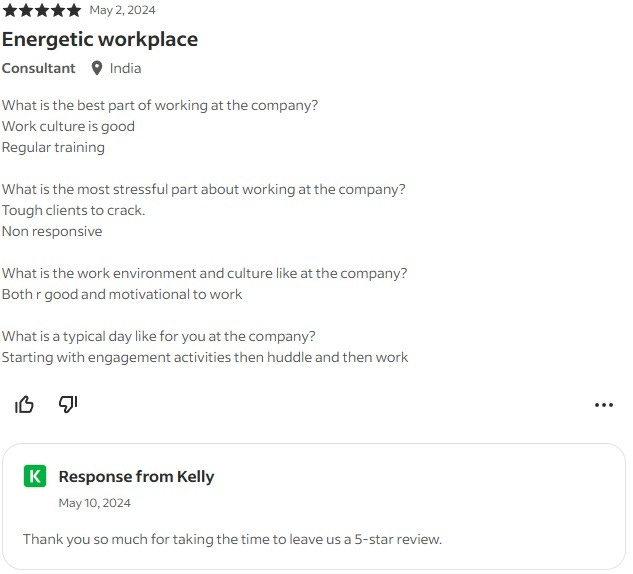

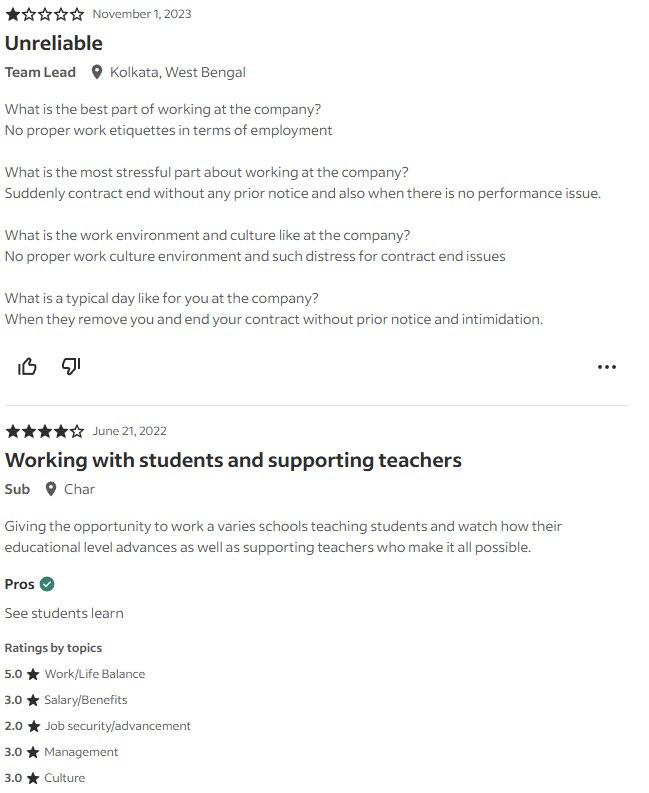

2.2 Employee Satisfaction Ratings

In service-based firms, especially those reliant on recurring relationships, talent retention and cultural alignment are critical to long-term performance. Continuity of advisors reduces client churn, preserves institutional knowledge, and lowers integration friction in M&A.

Kelly Partners Group emphasizes cultural fit and long-term alignment through its Partner-Owner-Driver model. Partners retain 49% equity in their firms, directly linking professional success with financial outcomes. This decentralized ownership structure is designed to reduce turnover among key personnel and preserve client trust over time.

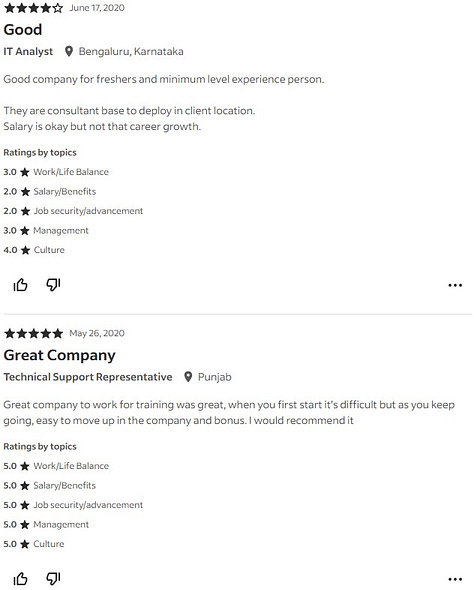

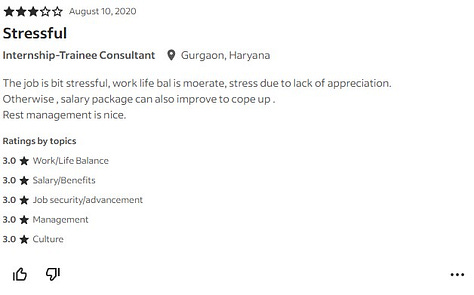

While comprehensive employee satisfaction data is limited, available reviews (e.g., Indeed) indicate broadly positive sentiment, particularly around internal culture, autonomy, and training. Some variability exists at the office level, expected in a decentralized model, but no systemic issues appear across the group.

The founder’s public emphasis on self-development, reading, and long-term thinking also seems to inform the internal operating rhythm. However, without full internal engagement survey data or disclosed turnover metrics, this remains a qualitative signal rather than a confirmed advantage.

Maintaining a strong internal culture during periods of rapid acquisition is difficult. Integrating firms, aligning incentives, and preserving service quality puts strain on even the best-run organizations. In such environments, employee dissatisfaction, process breakdowns, and knowledge loss are common.

Kelly Partners Group appears to be an exception. While some negative feedback exists, as is typical in any services firm, the majority of available reviews suggest satisfaction with autonomy, professional development, and firm values. Turnover rates are not publicly disclosed, but management's emphasis on cultural fit during acquisitions, partner equity retention, and training suggests proactive effort to preserve alignment.

This cultural consistency matters. In a people-intensive business, high employee retention reduces onboarding friction, preserves client relationships, and sustains productivity. Culture isn’t ancillary to performance, it underpins it.

To date, there is no evidence that KPG’s pace of acquisitions has degraded employee sentiment or organizational cohesion. If anything, the firm’s decentralized structure may reduce cultural disruption by allowing acquired firms to maintain operational continuity while aligning on financial outcomes.

Long-term, this will be a key indicator to watch. Sustaining culture while scaling M&A is rare, and valuable.

2.3 CEO Value Creation

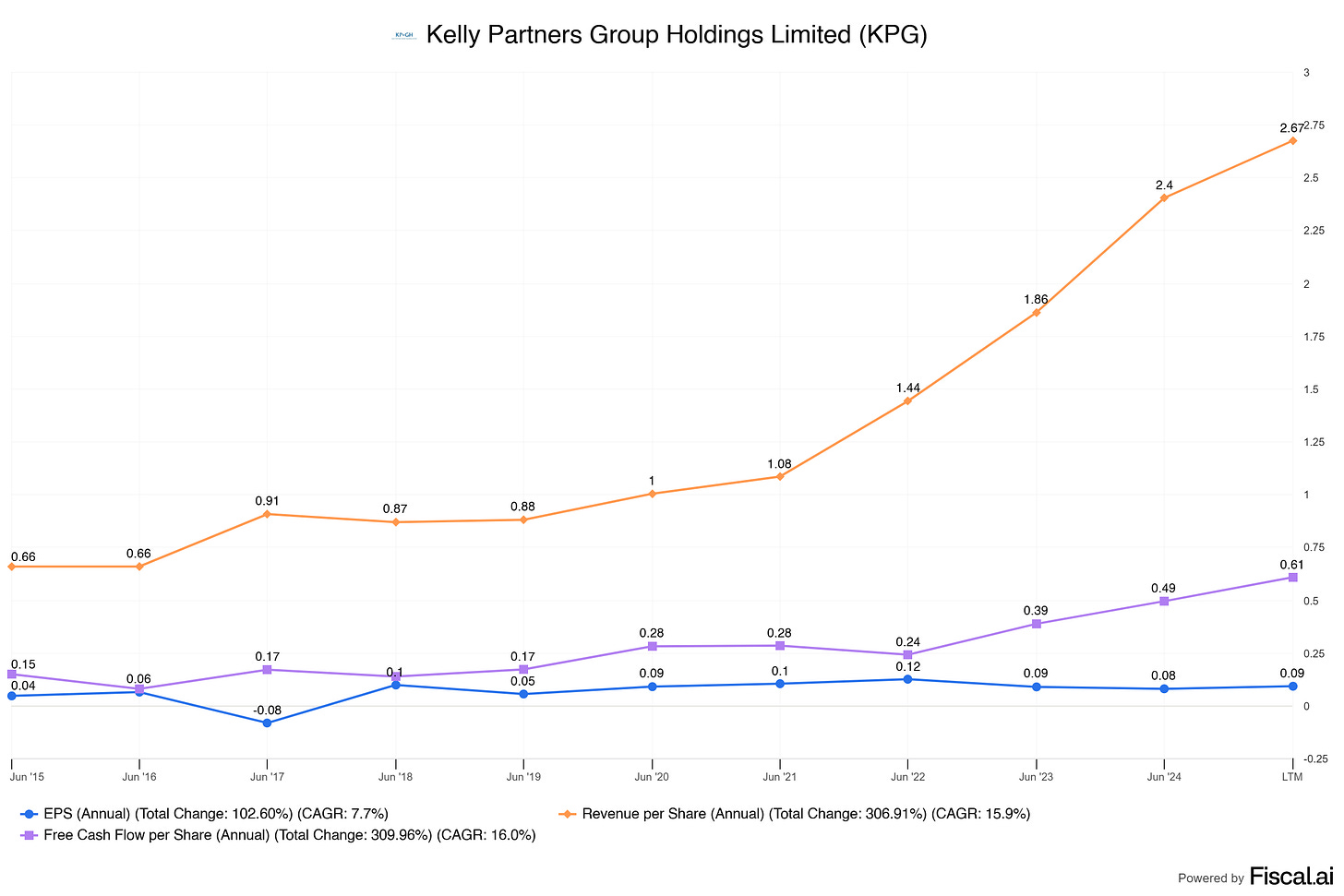

From FY15 to FY24, Kelly Partners Group delivered solid gains across per-share metrics, despite modest equity dilution. Revenue per share grew at a 15.9% CAGR, while earnings per share (EPS) increased at 7.7% annually — more than doubling over the period. While not hypergrowth, this reflects steady execution in a capital-efficient, services-based business.

Return on invested capital (ROIC) and return on equity (ROE) — two key indicators of value creation — have remained within or above industry norms. ROIC has averaged in the low-to-mid 20s, peaking at 31.2% in FY18 and stabilizing around 20–21% in FY22–FY24. ROE has remained above 35% every year, peaking at 47.8% in FY18, and landing at 37.3% in FY24.

These figures remain competitive versus sector benchmarks, where:

Typical ROIC in consulting/accounting: 15–22%

Typical ROE: 25–35%

KPG’s modest dilution — primarily linked to its acquisition model — has not meaningfully offset per-share gains. The business has managed to grow revenue per share and EPS in parallel with its expansion, suggesting disciplined capital allocation.

Importantly, while investors may be conditioned to expect explosive compounding from U.S. tech names, it’s essential to benchmark KPG against the context of its industry and geography. For an Australian mid-cap services group with heavy recurring revenue and stable margins, these metrics indicate durable and sustainable shareholder value creation.

(Dilution has stopped since 2020.)

3. Insider and institutional ownership

Insider ownership at Kelly Partners Group is unusually high — and by design.

As of May 2025, Brett Kelly, the founder and CEO, owns 21.2 million shares, equivalent to 47.1% of the company. At current prices, that stake is valued at approximately AUD 221 million. In total, insiders collectively hold 50.2% of the company, with positions distributed across senior executives and board members.

This level of ownership is materially above market norms. In most public companies, insider ownership above 5–10% is considered a signal of strong alignment. KPG’s insider stake — especially concentrated in the founder — aligns incentives around long-term value creation and downside protection.

A notable addition to the board is Lawrence A. Cunningham, former professor, governance expert, and author of Quality Investing and The Essays of Warren Buffett. Cunningham joined as an independent director following direct engagement from Brett Kelly, who had adopted principles from Cunningham’s “Quality Shareholders” framework.

Cunningham brings three core benefits to KPG’s governance structure:

Governance Depth: Experience across multiple listed boards focused on long-term shareholder alignment.

Cultural Fit: His philosophy of concentrated, patient ownership mirrors KPG’s Partner-Owner-Driver model.

Oversight Discipline: As an independent director, Cunningham enhances board objectivity while reinforcing best-in-class governance standards.

Board independence, high insider alignment, and founder-led ownership form a robust governance triad. There’s no evidence of dual-class shares or entrenchment mechanisms, and compensation appears modest relative to peer norms.

Together, these elements suggest that capital allocation decisions are made by stakeholders who are deeply invested — both financially and philosophically — in the company’s long-term performance.

👉 You're one step away from joining the Fluent Few—rational investors who don't just watch from the sidelines. Get full access to this investment case, future deep dives, and the private portfolio by upgrading today.