Is Games Workshop Group Plc A Buy?

Is this mid-cap the generational compounder for the next decades? Lets find out!

Who knew that figurines and games could generate generational shareholder returns? I didn’t until I found Games Workshop, a mid-cap company compounding in the darkness.

Sometimes we, as investors, need to look in cracks where others aren’t looking. I’m not saying that Games Workshop is a company missed by many, not at all. There’s a charming aspect to this simple yet effective company.

Let’s go over Games Workshop in great detail, a complete breakdown so you know what the business looks like, how it’s managed, what we could expect, and most importantly… if we could invest in this gem.

What Does Games Workshop Do To Generate Its Revenues?

Games Workshop sells miniature figures, games, and books set in their own fantasy and sci-fi universe, most famously Warhammer.

Miniature models that you can build and paint.

Tabletop strategy games like Warhammer 40.000 and Age of Sigmar.

Rulebooks, novels, and artwork tied to their respective worlds.

Games Workshop generates revenues by selling miniatures and accessories in its own branded stores and online. It also licenses its IP, like Warhammer, to video game companies, books, and TV studios, which gives them revenue for the licensing.

Games Workshop holds all its intellectual property and controls the whole process, from designing and manufacturing in-house to global retailers and online distribution.

Companies and publishers like SEGA, Fatshark, Frontier Developments, Behavior Interactive, and NeocoreGames are all licensed by Games Workshop to use their work and create their own games. Even Amazon is using the license!

In late 2022, Games Workshop announced its deal with Amazon to develop Warhammer 40.000 film and TV content, with actor Henry Cavill attached as executive producer.

Not bad for this U.K. compounder, right?

*U.K. companies report half-year reports, not quarterly reports.

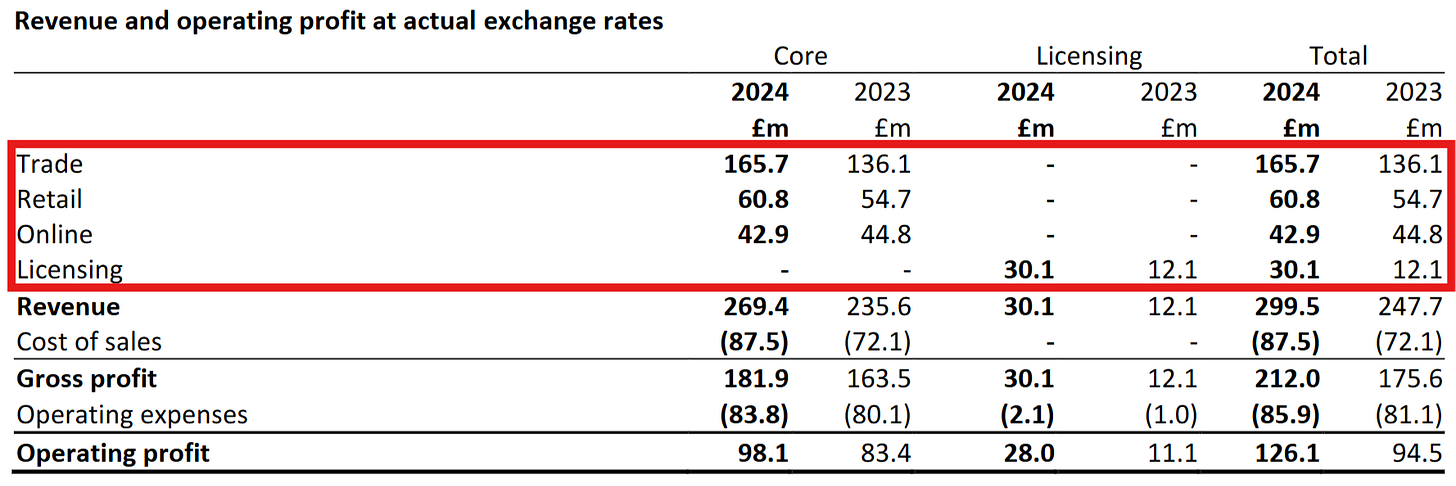

Core revenue (online, trade, and retail) is sales of its products, such as miniature figures, rulebooks, novels, etc.

Licensing revenue comes from their IP licensing to other companies like Amazon, Fatshark, and others I’ve previously mentioned.

(For your information: Trade is their sales to independent third-party retailers. Retail sales are made through branded stores, and online sales from the website.)

How is Their Revenue Broken Down?

The graph gives us a better picture of the primary revenue drivers for Games Workshop.

Games Workshop has shown stability across all segments. There’s no decline or odd acceleration in either of their respective segments. This tells us that Games Workshop is managing all its segments accordingly, but it also tells us that the demand for all segments is still there.

Other parties are still buying products, companies are licensing from Games Workshop, and customers are heading to stores to get figures, books, and more.

Overall, Games Workshop is showing excellent growth.

Games Workshop’s revenues have also been showing stable growth. On average, its sales grow ~13.% year over year.

There was disappointing growth in May ’20, but I think we can all figure out why. That period was challenging for every company worldwide.

In May ‘21, we see a hefty increase in year-over-year growth. This was primarily fueled by partnerships Games Workshop formed with independent retailers, which helped boost retail sales by 20%. Revenue growth like this should continue since their customer base is extremely valuable and it contains a core group of hobbyists who are willing to pay hundreds, if not thousands of pounds, for the figures, novels, and other products.

To give you an idea of how valuable their customers are, here are some videos that give you the scope of Game Workshop products' average buyer.

Oh, South Park even mentioned it in one of their episodes!

And what is even more bizarre?

Thousands of YouTube channels cover Game Workshop’s products, and these videos garner millions of views.

Since most of their products are complementary, fanatics usually go out of their way to expand their collection, which adds more value to the collection and the collector. This is an actual flywheel of a business. You do not just buy one and think you’re done. You buy one, but to get a more exciting collection or an even better experience, you buy another, and another, etc.

Overall, Games Workshop has shown sustainable and predictable growth since 2015. Moreover, Games Workshop has complementary products, and none of them are a drag on its sales. Although its trade segment accounts for a significant portion of its total revenue, I would argue that there is no reliance on this segment.

However, if the trade segment accounts for more of its total revenue in the coming years, we should revisit our thesis if trade exceeds 65% of its total revenue.

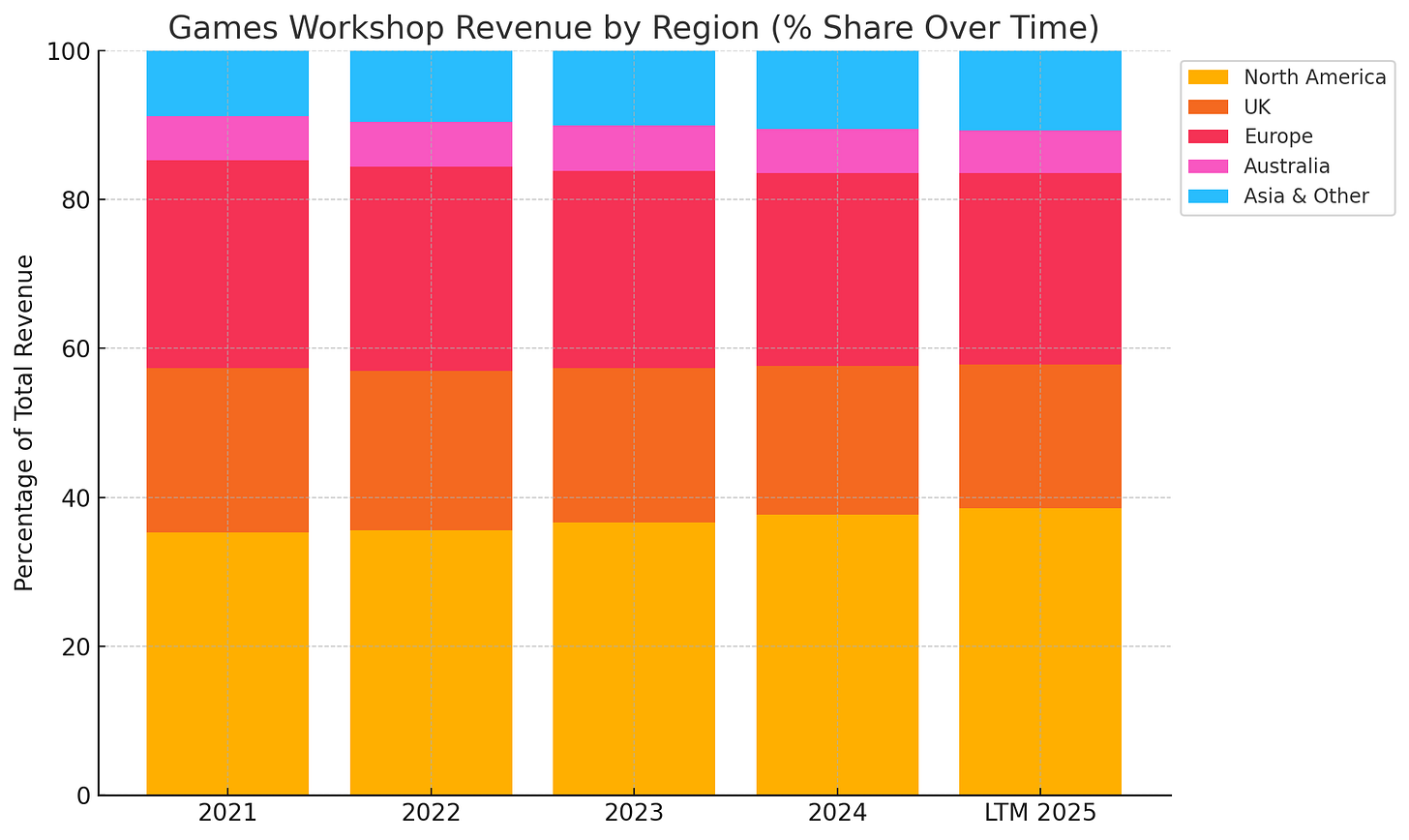

Where Is Revenue Coming From Globally?

Good question! ;-)

Revenue is primarily coming from North America and Europe. Australia and Asia are still underpenetrated markets, offering many opportunities for Games Workshop.

The market in those regions, especially in Asia, is significant. Asia is known to have a substantial portion of consumers passionate about this type of product. Although local competitors in Asia already exist, like Kings of War, Archon Studio, JoyToy, Tencent, NetEase, and many others, Games Workshop still has significant room to grow.

Games Workshop is actively expanding in Asia, with plans to open its first store in South Korea and a significant store opening plan for Japan, identifying over 30 locations.

Australia hasn’t shown much growth, and management acknowledged this. Their most recent report mentioned that they are actively reviewing their operational structure in Australia to see if there are more possibilities and to ensure adequate resources are available.

Closing this part off.

Games Workshop has healthy global diversification. Again, there’s no reliance on a specific region, which offers investors a cushion of safety. Moreover, management is actively taking measures to capitalize on the opportunities within Asia and addressing Australia in the process.

Who Is Running The Company?

Kevin Rountree, CEO. Kevin joined Games Workshop in March 1998 as an assistant group accountant. He then had various management roles within Games Workshop, including head of sales for the Other Activities division (including Black Library, Licensing, and Sabertooth Games). Kevin was appointed CFO in October 2008, COO in 2011, and CEO on 1 January 2015. He is a qualified chartered management accountant, and before joining Games Workshop, Kevin was the management accountant at J Barbour & Sons Limited.

Kevin Rountree holds ~0.05% of the total outstanding shares worth ~$2.8M. Unfortunately, most of his wealth isn’t locked in Games Workshop shares.

Kevin Rountree receives roughly $2.40M in salary per annum. His compensation has also drastically increased by 20% over the past year. Of his salary, ~41% is cash, the rest is stock compensation and bonuses.

Although this isn’t a direct red flag, we must remind ourselves.

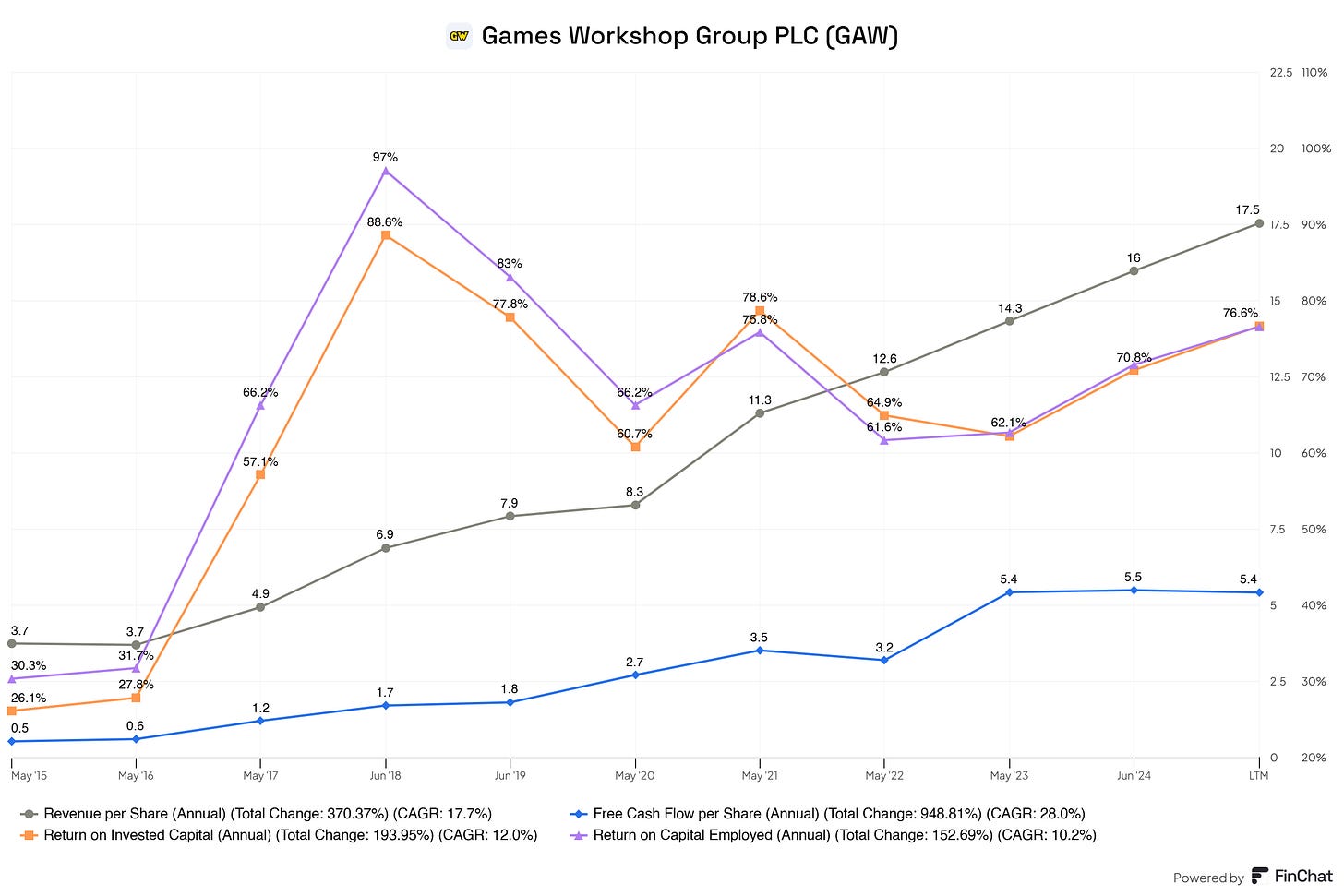

Is Management Creating Value For Shareholders?

There’s no denying that management is creating consistent value for shareholders.

Games Workshop has consistently generated more revenue per share, more free cash flow per share, fantastic returns on invested capital, and phenomenal returns on total capital employed.

Management is most definitely creating shareholder value.

How Do Employees Think Of Management?

Any business must have employees aligned with its vision and long-term goals. This fosters a sustainable team that can drive long-term value for the company and its shareholders.

Over on Reddit, (ex) employees seem to talk in favor of Games Workshop. Many (ex) employees talk about their amazing time at the company, perfect work-life balance, reasonable compensation, and high praise for their management.

On Glassdoor, 61% of Games Workshop’s employees would recommend working there to a friend based on the reviews. Employees also rated Games Workshop 3.4 out of 5 for work-life balance, 3.7 for culture and values, and 2.6 for career opportunities.

A couple of searches and scrolling tell me that management has fostered a close team that is most likely to continue driving value to the customers, the company, and, in return, the shareholders.

What Does The Economic MOAT Look Like?

So, a MOAT can be in one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Games Workshop benefits from a strong brand name primarily due to Warhammer 40.000. This has created a strong, cult-like brand loyalty. For many collectors and hobbyists, this is not just a game but an authentic lifestyle. Users invest heavily in miniatures, paints, lore, and in-person communities.

This high emotional investment makes customers extremely loyal as well.

While other tabletop games exist, none have the same rich, decades-old universe or community scale. Even casual players often return due to the brand's pull and the lore associated with it. Alongside this, there is an extreme pricing power position for Games Workshop.

Even if competitors form out of the ground, Games Workshop has already made its name, created a loyal community, and has a hefty scale. For competitors to achieve this, they will need decades.

Scale and Cost Advantages

Games Workshop does not benefit from this economic moat.

While they’re dominant in miniature wargaming, their overall market is niche and not large enough to generate the cost efficiencies you see with Hasbro or Mattel. Their product are premium prices, not cost-advantage. They’re not competing on price, but they’re competing on uniqueness and quality.

They also do not outsource to low-cost countries, so while they maintain quality control, this doesn’t lead to cost leadership.

Switching Costs

Again, there’s no actual economic moat here for Games Workshop.

One could argue that Games Workshop has created and fostered an emotional, financial, and social investment in their universe, working as some moat. Switching costs exist in the time and money people spend on their products, rulebook lock-in, and social network.

But, is this an actual economic moat? I’m 50/50 on this one. Maybe this is because I’m less familiar with the community and the emotional attachment they experience with the products. But, I argue that even if this were an economic moat, it would be a low to moderate one.

Network Effect

Games Workshop indirectly benefits from a network effect.

The more people who play Warhammer, the more valuable it is for others to join—finding opponents, participating in tournaments, or joining clubs is easier. This local network effect is strong in hobby stores and clubs. YouTube channels, Twitch streams, Reddit threads, and fan-made lore all enhance the ecosystem. This drives more engagement and creates FOMO among hobbyists, indirectly pulling new players in.

Games Workshop runs official tournaments and leagues. Local stores organize regular Warhammer nights. The larger the player base, the more robust and sticky this infrastructure becomes.

More users do not make the product more inherently valuable. Players do not interact directly through a Games Workshop-owned platform. It is not viral or self-reinforcing at scale.

So, yes, there’s some network effect in play, but not the type you see with Facebook, eBay, or any other platform we’re all familiar with.

Attracting Talent

There’s absolutely no economic moat here for Games Workshop.

Short and simple.

How Does The Industry Look Like?

For your information. This industry is far outside my circle of knowledge. Therefore, I had to do tons of research to figure this out. If there are any inconsistencies, my apologies. I tried my best.

Games Workshop primarily operates in the hobby and tabletop gaming industry. It overlaps with consumer collectibles, IP licensing, and direct-to-consumer retail.

To clarify this, I’ll cover the hobby & tabletop gaming and consumer collectibles industries. I deem these the most fitting for Games Workshop and their value to the company's future.

Hobby & Tabletop Gaming – Games Workshop’s Core Arena

Is the market growing?

The tabletop gaming market was worth $19.5B in 2024 and is expected to reach $34.1B by 2030 (CAGR ~9.8%).

Bullish forecasts project $34B by 2029 (CAGR ~16.4%) as social gaming grows.

Europe (especially the UK) remains a stronghold — a key advantage for Games Workshop’s home base — while Asia-Pacific is the fastest-growing region.

What’s driving this growth?

In-person, immersive play: Warhammer’s model-based, narrative-driven gameplay is exactly what players crave post-COVID, real-world, social interaction.

Community & culture: Hobby stores, Warhammer clubs, game cafés, and tournaments (like Warhammer World) create sticky ecosystems that deepen customer loyalty.

Strategic gameplay: Games like Warhammer offer complex, replayable strategy — a draw for the 18–34 demographic.

High-income hobbyists: Many fans treat Warhammer as a lifestyle brand, willing to spend premium amounts on kits, paints, and expansions.

Crowdfunding spillover: While GW doesn’t use Kickstarter, the platform’s popularity helps normalize niche game spending, creating a broader base of tabletop enthusiasts.

Demographics shaping the Warhammer universe

Gender: Historically male-dominated, but more women are joining through entry sets, community painting nights, and narrative play formats.

Age: Warhammer appeals strongly to the 18–34 core, but older players (35–50+) stay engaged due to nostalgia and long-term collection habits.

Income: Warhammer attracts a middle-to-upper-income base (~$100K+ average), making premium pricing sustainable.

Region: The UK, U.S., Germany, and Australia are anchor markets. Asia-Pacific offers upside as younger audiences engage with fantasy IPs.

Consumer Collectibles – The Warhammer Model as a Collectible

Is the market growing?

The global collectibles market was valued at $464.2B in 2025 and is projected to reach $902B by 2035 (CAGR ~7.2%).

The toy/figurine subsegment—where Warhammer miniatures fit—will be worth $52.2B in 2024 and grow at a 24.6% CAGR through 2034.

Growth drivers that benefit Games Workshop

Nostalgia-powered demand: Long-time players and lapsed hobbyists re-enter the space, viewing their armies as both passion and investment.

Investment angle: Rare models, Forge World exclusives, and discontinued miniatures are increasingly considered collectible assets.

Digital marketplaces: eBay and resale forums (often GW-specific) support a large and liquid second-hand economy.

Asia-Pacific pop culture wave: As anime and model collecting rise, GW’s gothic sci-fi/fantasy aesthetic could ride that wave into new markets.

Collector demographics

Gender: Miniatures still skew male, but rising interest from female collectors around lore, painting, and cosplay provides an opening.

Age: Core collectible buyers are 25–45, with Gen Z starting to collect through hobby streams and TikTok. Older buyers invest in rare, vintage models.

Income: High discretionary income supports army-building and high-margin items like terrain kits and exclusive sculpts.

Implications for Games Workshop

Tabletop Gaming

Warhammer dominates the miniatures and strategy niche—it has no true peer in terms of depth, IP, or ecosystem.

Strong alignment with key industry trends: social gaming, complexity, and lifestyle engagement.

Simplify onboarding and create lighter formats to attract more women and younger players.

Collectibles

Warhammer miniatures act as functional collectibles — beautiful, buildable, display-worthy, and usable in-game.

As collectibles boom, Games Workshop is well-positioned to expand in value, brand prestige, and resale activity.

Strategic Future

Sustainability: Eco-friendly packaging and resin innovations could future-proof perception.

Digital integration: Battle apps, lore subscriptions, and connected tabletop tools open new revenue streams.

Global reach: Asia-Pacific and Latin America present expansion opportunities, particularly with the upcoming Amazon Warhammer series as a cultural tailwind.

Games Workshop And Its Competitors

I identify the following as their competitors or peers:

Hasbro

CMON

Games Workshop is in a financial league compared to listed peers. It dominates in capital efficiency, profitability, and margin profile, reflecting a strong economic moat driven by brand, pricing power, and vertical integration.

While Hasbro is more diversified and larger, its declining EPS and lower margins suggest operational complexity and IP volatility. CMON is much smaller and has a lower margin, with weak returns and negative earnings momentum.