Novo Nordisk is a Danish powerhouse.

Few companies have the dominance and pricing power that Novo Nordisk wields in the rapidly growing diabetes and obesity markets.

With blockbuster drugs like Ozempic, Wegovy, and Rybelsus, Novo isn’t just selling treatments—it’s shaping the future of metabolic health.

Backed by secular tailwinds, an expanding TAM, and a history of high-margin growth, this isn’t just another pharma stock—it’s a long-term compounder with structural advantages.

But… is Novo Nordisk now investable? Are there items we need to be on the lookout for?

Without further delay, let’s break down this pharmaceutical powerhouse.

Happy reading!

Oh, before we dive in—quick reminder!

🚨 The 33% off sale ends TOMORROW! 🚨

This is your last chance to lock in 33% off your annual or monthly subscription forever. Twenty-seven like-minded investors have already joined—don’t miss out!

Will I see you on the other side? 👇🏻

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue Breakdown

1.3 KPIsExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationInsider and institutional ownership

Competitive and Sustainable Advantages (MOAT)

Industry Analysis

5.1 Industry Growth Prospects

5.2 Competitive LandscapeRisk Assessment

Financial Stability

7.1 Asset Evaluation

7.2 Liability AssessmentCapital Structure

8.1 Expense Analysis

8.2 Capital Efficiency ReviewProfitability Assessment

9.1 Profitability, Sustainability, and Margins

9.2 Cash Flow AnalysisGrowth Projections

Owner Earnings & Expect Annual Return

Value Proposition

11.1 Dividend Analysis

11.2 Share Repurchase Programs

11.3 Debt Reduction StrategiesQuality Rating

Valuation Assessment

1. Corporate Analysis

1.1 Business Overview

By now, you know the drill—do we understand the business and how it generates revenue? If we can answer that, we have a solid grasp of the company.

Novo Nordisk is a global leader in diabetes and obesity treatments, developing life-changing medications that dominate their respective markets.

Its strength is built on:

A dominant position in the GLP-1 drug market

Strong pricing power in essential treatments

Massive addressable market driven by global health trends

How does Novo Nordisk generate its revenues? Simple!

Diabetes Care

Novo Nordisk is a leader in insulin and GLP-1 receptor agonists, with drugs like Ozempic and Rybelsus driving double-digit growth. Diabetes is a chronic condition, ensuring recurring revenue from long-term treatment plans.Obesity Care

The obesity epidemic has created massive demand for Wegovy, Novo’s GLP-1 weight-loss drug. With limited competition and strong clinical results, Novo is expanding rapidly in this category.Rare Diseases & Other Therapies

While a smaller segment, Novo sells treatments for hemophilia, growth disorders, and hormone deficiencies, diversifying its revenue streams beyond diabetes and obesity.

Here’s an example of the process. Simplified.

Diabetes patient gets prescribed Ozempic for blood sugar control—Novo earns revenue per dose.

Overweight individuals seeking weight loss are prescribed Wegovy, generating recurring revenue.

Novo expands capacity to meet demand, increasing global adoption and market penetration.

Now that we understand how Novo Nordisk generates revenue let’s dive deeper.

1.2 Revenue Breakdown

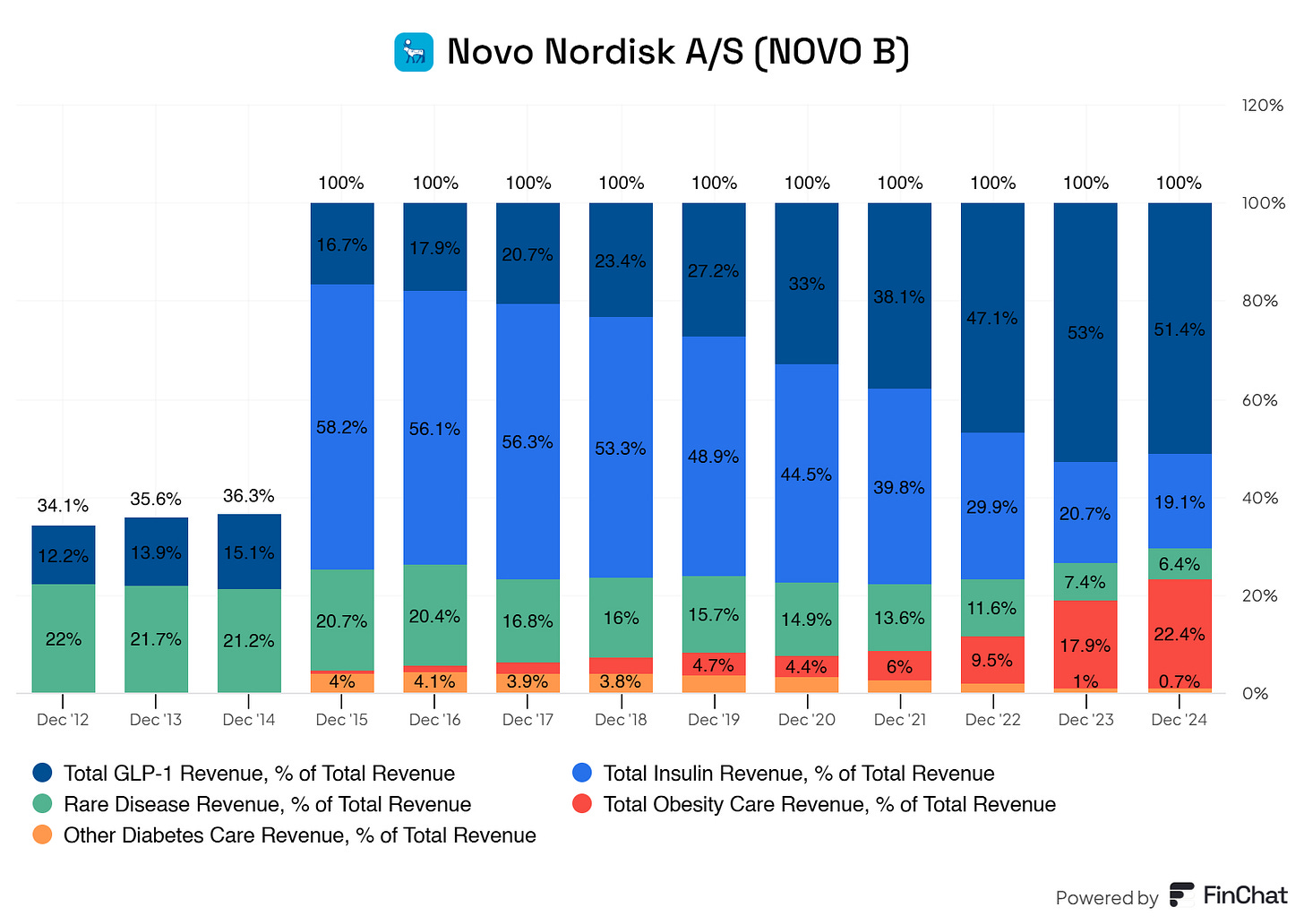

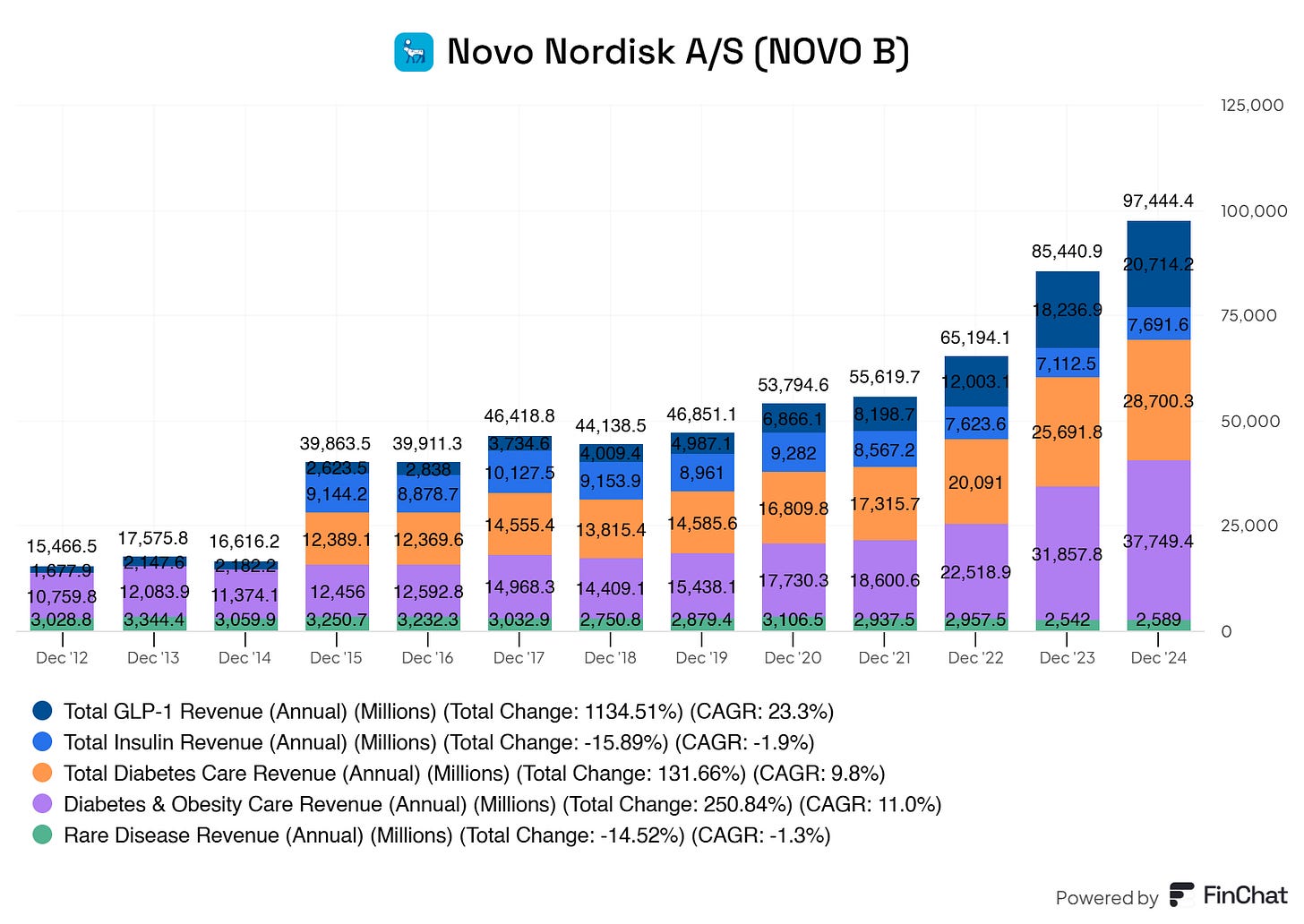

GLP-1 Revenue (Accounts for roughly 51% of the total revenue)

Rybelsus

Ozempic

Victoza

Human Insulin Revenue (accounts for roughly 19% of the total revenue)

Long-Acting Insulin

Premix Insulin

Fast-Acting Insulin

Human Insulin

Diabetes Care Revenue (accounts for roughly 23% of the total revenue)

Wegovy

Saxenda

Rare Diseases Revenue (accounts for roughly 7% of the total revenue)

Rare Blood Disorders

Rare Endocrine Disorders

Other Rare Diseases Revenue

Novo Nordisk shows a strong and robust portfolio of revenue sources. However, there is a slight reliance on its GLP-1 segment, which went from 16.7% of its total revenues to 51%. Insulin revenue went from 58% to 19%. Sales for its GLPs are skyrocketing and taking up more and more of its total revenues. This growth is reflected in their compound annual growth rate. Novo Nordisk boasts a whopping 25.78% CAGR from 2015 to the latest twelve months. This type of growth is nothing but spectacular for Novo Nordisk.

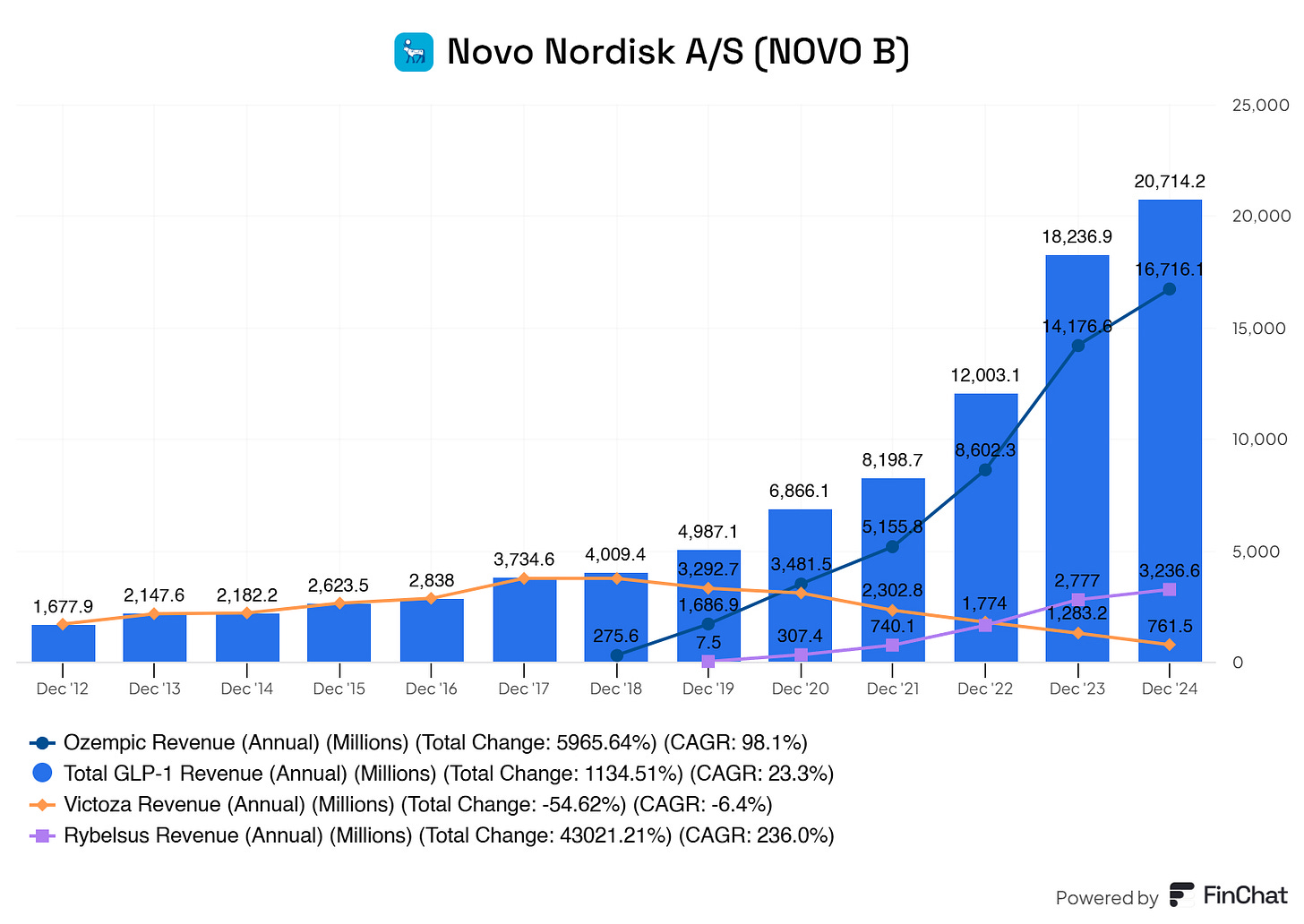

The growth in their GLPs is due to increased demand for their blockbuster drug Ozempic.

Ozempic truly is carrying the boats here for Novo Nordisk.

But is this worrying to us? Well, not right now. However, there could be future issues regarding their dominant Ozempic sales.

Novo Nordisk currently holds a patent for Ozempic, but it expires in 2031/2032. Once generics enter the market, revenue could drop significantly. Competitors like Eli Lilly’s Mounjaro (tripeptide) are gaining traction in the GLP-1 space, offering potentially better efficacy for weight loss and diabetes management. If Ozempic loses market share, Novo Nordisk’s revenue could take a hit.

With 87.7% of revenue coming from diabetes and obesity care and a large portion of that from GLP-1 drugs, Novo Nordisk is heavily concentrated in one therapeutic area. The decline in insulin and rare disease revenue further exacerbates this lack of diversification. If the GLP-1 market faces a downturn (e.g., due to market saturation, new treatment paradigms, or economic factors affecting drug pricing), Novo Nordisk could face significant financial challenges.

So yes, there are definitely some risks to Novo Nordisk's concentration on GLP revenue, which is primarily driven by Ozempic sales.

However, Novo Nordisk is aware of this matter, is working on its pipeline, and is investing in next-generation GLP-1 drugs and combination therapies.

More on this in the KPIs section, though!

1.3 KPIs

The essential KPI for Novo Nordisk boils down to their pipeline. First we go over how this works for Pharma.

The image outlines the biopharmaceutical research and development (R&D) process, which is how new medicines are discovered, developed, tested, and brought to market. It’s a long, complex journey that takes an average of 10 years and costs around $2.6 billion. The success rate is low—less than 12% of drugs that enter Phase 1 clinical trials ultimately get FDA approval.

The process starts with a large pool of potential new medicines (thousands of ideas or compounds) and narrows them down through rigorous testing until, ideally, one FDA-approved medicine emerges. The stages are:

Basic Research

Drug Discovery

Pre-Clinical Testing

Clinical Trials (Phase 1, Phase 2, Phase 3)

FDA Review

Post-Approval Research & Monitoring (Phase 4)

Basic Research

This is the very first step, where scientists explore the biology of a disease to understand what causes it and how it might be treated. They ask questions like, “What’s going wrong in the body?” or “What can we target to fix it?”

What Happens:

Scientists study diseases at a molecular or cellular level, often using lab tools like microscopes, genetic sequencing, or computer models.

They identify “targets” (e.g., a protein or gene involved in the disease) that a drug might interact with.

This stage involves a lot of brainstorming and foundational science, often in universities or research labs.

What to Expect:

There are no actual drugs yet—just ideas and hypotheses.

This stage can take years because it’s about building a scientific foundation.

Many ideas fail here if the disease is too complex or the target isn’t viable.

Example for Novo Nordisk: When Novo Nordisk started working on GLP-1 drugs (like Ozempic), basic research involved understanding how the GLP-1 hormone regulates blood sugar and appetite in diabetes and obesity. Scientists studied how GLP-1 receptors work in the body to see if mimicking or enhancing this hormone could help patients.

Drug Discovery

Once a target is identified, scientists try to find or create a compound (a potential drug) that can interact with that target to treat the disease.

What Happens:

Scientists screen thousands of compounds (chemicals or biologics) to find ones that might work against the target. This can involve lab experiments or computer simulations.

They narrow down the list to a few “lead compounds” that show promise.

These compounds are then optimized—chemists tweak their structure to make them more effective, safer, or easier to deliver (e.g., as a pill or injection).

What to Expect:

Still no human testing—this is all in the lab.

Out of thousands of compounds, only a handful (tens) might move forward.

This stage can take 2-4 years, as it’s a process of trial and error.

Example for Novo Nordisk: For semaglutide (the active ingredient in Ozempic and Wegovy), drug discovery involved creating a synthetic version of the GLP-1 hormone that lasts longer in the body. Scientists modified the molecule to improve its stability and effectiveness, turning it into a viable drug candidate.

Pre-Clinical Testing

Before a drug can be tested in humans, it needs to be studied in the lab and in animals to see if it’s safe and if it works as intended.

What Happens:

The lead compounds are tested in cells, tissues, and animals (like mice or rats) to see if they have the desired effect on the disease.

Scientists also check for toxicity—does the drug harm the animals, cause side effects, or affect organs like the liver or heart?

They study how the drug is absorbed, distributed, metabolized, and excreted (this is called pharmacokinetics).

What to Expect:

The goal is to gather enough data to convince regulators (like the FDA) that the drug is safe enough to test in humans.

Many compounds fail here if they’re too toxic, don’t work as expected, or can’t be delivered effectively.

The image shows this stage narrowing the pool from “tens” of compounds to just a few that are ready for human testing.

This stage typically takes 1-3 years.

Example for Novo Nordisk: Before semaglutide entered human trials, it was tested in animals to confirm that it could lower blood sugar and promote weight loss without causing serious side effects. Pre-clinical studies also helped determine the best dosing (e.g., once-weekly injections).

If pre-clinical testing is successful, the company submits an Investigational New Drug (IND) application to the FDA to get permission to start human trials.

Clinical Trials

This is the longest and most expensive part of the process, where the drug is tested in humans. It’s broken into three phases (Phase 1, Phase 2, Phase 3), and the image shows how the number of volunteers increases with each phase.

Phase 1: Safety Testing

The drug is tested in a small group of healthy volunteers (tens of people, typically 20-80) to see if it’s safe for humans.

What Happens:

The focus is on safety: Does the drug cause side effects? How does the body handle it (absorption, metabolism, excretion)?

Researchers start with very low doses and gradually increase them to find the safest and most tolerable dose.

They also look at how the drug is administered (e.g., pill, injection) and how often it should be given.

What to Expect:

This phase is about safety, not effectiveness. The drug might not even be given to patients with the disease yet—just healthy volunteers.

About 70% of drugs move from Phase 1 to Phase 2, meaning 30% fail due to safety issues or poor pharmacokinetics.

This phase usually takes 1-2 years.

Example for Novo Nordisk: In Phase 1 trials for CagriSema (a combination of semaglutide and cagrilintide for obesity), Novo Nordisk tested the drug in a small group to ensure it was safe, didn’t cause severe side effects, and could be tolerated as a weekly injection.

Phase 2: Effectiveness Testing

The drug is tested in a larger group of patients (hundreds, typically 100-300) who have the disease the drug is meant to treat.

What Happens:

The focus shifts to effectiveness: Does the drug actually work for the disease? For example, does it lower blood sugar in diabetes patients or reduce weight in obesity patients?

Researchers continue to monitor safety and side effects.

They also refine the finding of the right balance between effectiveness and safety.

What to Expect:

This phase is a big hurdle—only about 33% of drugs move from Phase 2 to Phase 3. Many fail because they don’t work well enough or have unexpected side effects.

Patients in this phase are closely monitored, often in controlled settings like hospitals.

This phase typically takes 1-3 years.

Example for Novo Nordisk: In Phase 2 trials for CagriSema, Novo Nordisk tested the drug in patients with obesity and type 2 diabetes, measuring outcomes like weight loss and blood sugar control. Early results showed up to 20% weight loss, which was promising enough to move to Phase 3.

Phase 3: Large-Scale Testing

The drug is tested in a much larger group of patients (thousands, typically 1,000-3,000) to confirm its effectiveness, safety, and overall benefit-risk profile.

What Happens:

Researchers compare the drug to a placebo (a dummy treatment) or an existing standard treatment to see if it’s better.

They collect detailed data on effectiveness, side effects, and long-term safety across a diverse population (different ages, genders, ethnicities, etc.).

This phase provides the data needed for FDA approval.

What to Expect:

This is the most expensive and time-consuming phase, often taking 2-4 years.

About 50-60% of drugs that reach Phase 3 get FDA approval, but many still fail if they don’t show enough benefit or have unacceptable risks.

The image shows the funnel narrowing significantly—out of all the drugs that started, only a small fraction reach this point.

Example for Novo Nordisk: Semaglutide (Ozempic) went through Phase 3 trials in the SUSTAIN program, which involved thousands of patients with type 2 diabetes. The trials showed that semaglutide significantly reduced blood sugar and body weight compared to other treatments, with manageable side effects like nausea. This data was key to its FDA approval in 2017.

If Phase 3 is successful, the company will submit a New Drug Application (NDA) or Biologics License Application (BLA) to the FDA for approval.

FDA Review

The FDA reviews all the data from clinical trials to decide if the drug is safe and effective enough to be approved for use.

What Happens:

The company submits a massive application (the NDA or BLA) with all the data from pre-clinical and clinical studies.

FDA experts review the data, looking at effectiveness, safety, manufacturing processes, and proposed labeling (e.g., what the drug is approved for, dosing instructions, and warnings).

The FDA may ask for more data or clarifications, or convene an advisory committee of experts to discuss the drug.

What to Expect:

This phase typically takes 6-12 months (faster for priority drugs, like those for serious diseases with unmet needs).

The image highlights that less than 12% of drugs that enter Phase 1 clinical trials ultimately get FDA approval. Many fail here if the FDA finds the risks outweigh the benefits.

If approved, the drug can be sold to patients. If not, the company may need to do more studies or abandon the drug.

Example for Novo Nordisk: Wegovy (semaglutide for obesity) was approved by the FDA in 2021 after a thorough review of its Phase 3 STEP trials, which showed an average weight loss of 15-18% in patients with obesity. The FDA also required warnings about potential side effects like gastrointestinal issues and a rare risk of thyroid tumors.

The image shows that, on average, 1 FDA-approved medicine emerges from the thousands of potential drugs that started the process.

Post-Approval Research & Monitoring (Phase 4)

After a drug is approved and on the market, the company continues to monitor its safety and effectiveness in the real world.

What Happens:

The drug is now used by a much larger population (tens of thousands or millions of patients), so rare side effects that weren’t seen in clinical trials might emerge.

The company conducts Phase 4 studies to monitor long-term safety, explore new uses (new indications), or compare the drug to competitors.

The FDA may require post-marketing studies to address specific concerns.

What to Expect:

This phase continues for as long as the drug is on the market (potentially decades).

If serious issues are found, the FDA can issue warnings, require changes to the label, or even pull the drug from the market.

This phase also allows companies to expand the drug’s use—for example, getting approval for new diseases or patient groups.

Example for Novo Nordisk: After Ozempic was approved in 2017, Novo Nordisk conducted Phase 4 studies to monitor its long-term safety in diabetes patients. They also used this phase to study semaglutide for new indications, like cardiovascular risk reduction (the SELECT trial showed a 20% reduction in major cardiovascular events in 2023) and potential use in Alzheimer’s disease.

Why Each Phase Matters for Novo Nordisk

Novo Nordisk’s pipeline (like CagriSema, oral semaglutide, or concizumab for hemophilia) must go through these phases to become approved drugs. Understanding the phases helps explain why the pipeline is a critical KPI, as we discussed earlier:

High Failure Rate: The image notes that less than 12% of drugs that enter Phase 1 get approved. For Novo Nordisk, this means they need a large pipeline to ensure some drugs make it through. If CagriSema fails in Phase 3, for example, it could delay their next big obesity drug.

Time and Cost: The 10-year, $2.6 billion average means Novo Nordisk must carefully manage R&D spending (14% of revenue in 2023) to balance innovation with profitability.

Expanding Indications: Post-approval research (Phase 4) is key for Novo Nordisk, as they’ve successfully expanded semaglutide from diabetes (Ozempic) to obesity (Wegovy) and are now exploring NASH and Alzheimer’s.

So, what does the Novo Nordisk pipeline look like?

I’m really curious about Novo Nordisk’s pipeline—it’s such a big part of how they’ll keep growing, especially since they rely so much on drugs like Ozempic. They’ve got about 30 projects in the works, from early ideas to newly approved drugs, which feels like a solid effort to stay ahead. But I’m also a bit worried about some things. Here’s what stands out to me:

Exciting Projects on the Horizon: I’m intrigued by CagriSema, which is in Phase 3 and could help people lose 20-25% of their weight—that’s huge for obesity and diabetes, and it might even challenge Eli Lilly’s Zepbound! They’re also testing semaglutide (the key ingredient in Ozempic) for new conditions like liver disease (MASH) and Alzheimer’s, which feels pretty ambitious. Plus, they just got Insulin Icodec (a once-weekly insulin) and Concizumab (for hemophilia) approved, so those should start bringing in money soon.

A Big Concern About Focus: Here’s what’s bugging me: over 70% of their pipeline is focused on diabetes and obesity, just like their revenue (87.7% in 2024, with GLP-1 drugs like Ozempic making up 38.7% of their $97,444.4 million total). That feels risky. The drug development process is tough—less than 12% of drugs that start in Phase 1 even make it to FDA approval. What if something goes wrong with their GLP-1 drugs, or competition gets too fierce?

Not Enough Variety: They’ve got some projects in other areas like MASH and rare diseases, but it’s not enough to make me feel totally confident. I’d love to see them work on more non-diabetes areas to spread their bets a bit.

What to Watch For (Their Report Card): I think the big things to keep an eye on are: Can they keep a good success rate in Phase 3 trials, maybe above 60%? Can they launch 1-2 new drugs or uses every year for the next five years? I’d also like to see them get non-diabetes projects up to 40-50% of their pipeline by 2030. And I think new products should make up 20-30% of their revenue by 2030, so they’re not so dependent on Ozempic when its patent runs out around 2031.

Novo Nordisk’s pipeline has a lot of potential, but I’ll feel better once they expand into other areas.

2. Executive Leadership

2.1 CEO Experience

Lars Rebien Sørensen was employed by Novo Nordisk in 1982 to market enzymes, having joined right out of military service. He then became sales and marketing director for the enzyme department in 1989. He joined the Group Executive Board of Novo Nordisk in 1994 and was handed the responsibility of the medical department of Novo Nordisk. In 2000, the enzyme department was de-merged from Novo Nordisk and became its own entity, Novozymes, and Lars Rebien Sørensen took over the position of CEO for Novo Nordisk after Mads Øvlisen. In January 2017, Lars Rebien Sørensen was succeeded as CEO by Lars Fruergaard Jørgensen.

Lars Fruergaard Jørgensen joined Novo Nordisk in 1991 as an economist in Health Care, Economy, & Planning and has, over the years, completed overseas postings in the Netherlands, the US, and Japan. In 2004, he was appointed senior IT & Corporate Development vice president. In January 2013, he was appointed executive vice president and chief information officer, assuming IT, Quality & Corporate Development responsibilities. In November 2014, he took over the responsibilities of Corporate People & Organisation and Business Assurance and became chief of staff. Mr Jørgensen was appointed president and chief executive officer in January 2017.

2.2 Employee Satisfaction Ratings

Novo Nordisk scores well based on their 1.126 review on LinkedIn.

The most prominent reviews I see are:

Great culture

Wonderful place to work

Excellent compensation

Healthy work/personal life balance

The culture built on development

Productive and fun company

Fair/Ethical

Overall, Novo Nordisk seems to embrace a strong and sustainable culture with its employees. Solid compensations exist, employees have a healthy balance, and employees seem aligned with the company's long-term vision.

2.3 CEO Value Creation

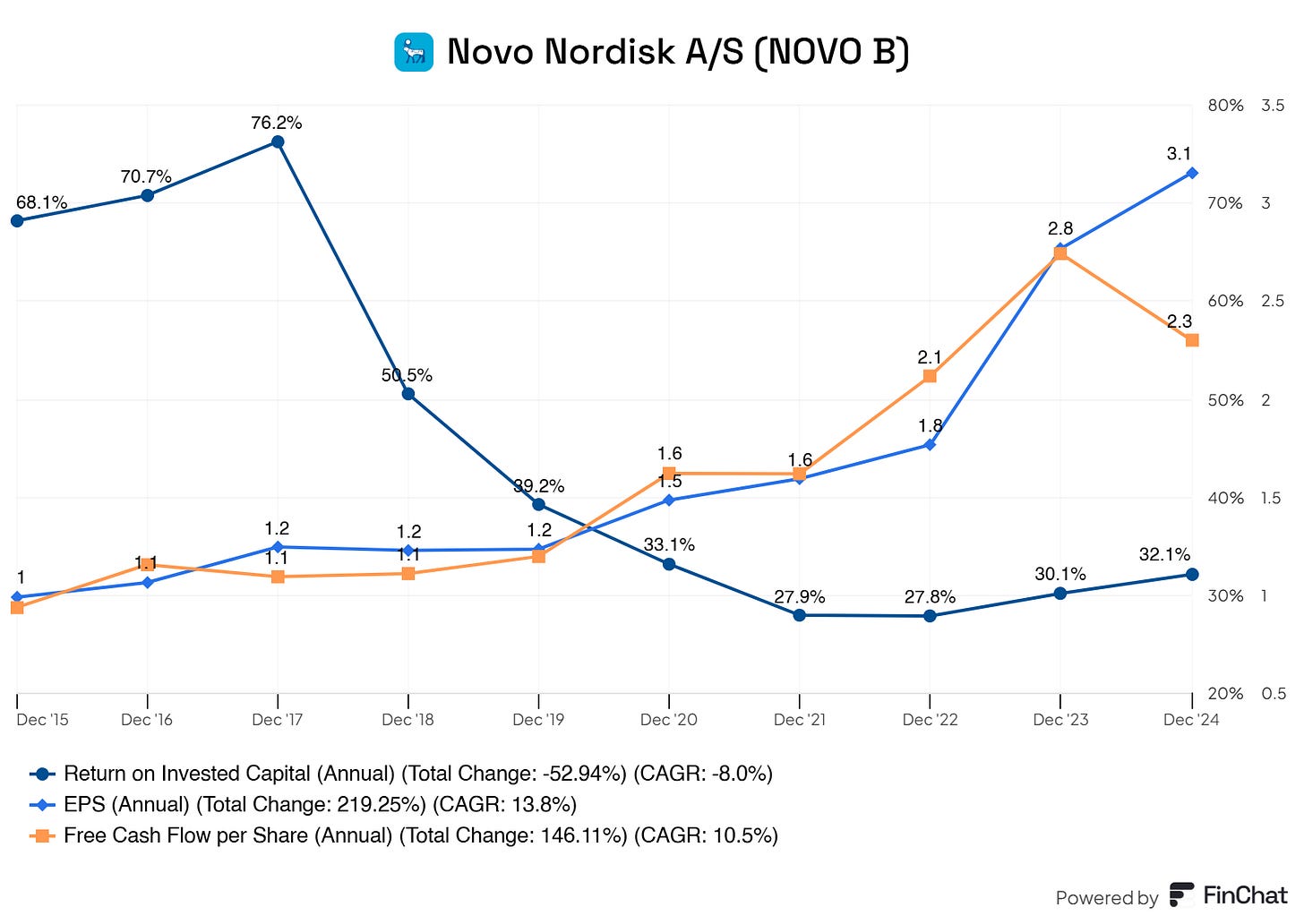

Is management creating value for the company and for shareholders?

Yes, management is creating value for its shareholders. Novo Nordisk boasts an excellent ROIC of 30%. This is the return on capital you’re used to seeing with tech companies—nothing short of excellent here.

Moreover, Novo Nordisk is generating more earnings per share (boosted by share buybacks) and free cash flow per share. Although Novo Nordisk is expanding and pressing the fcf of the business, it continues to print free cash flow.

3. Insider and institutional ownership

Lars Fruergaard Jorgensen holds 0.015% of Novo Nordisk shares worth $405.3M.

Most of his net worth is locked in his stake in Novo Nordisk (skin in the game)

Recent management buys and sells of Novo Nordisk stock:

Insider combined holds roughly 0.025% of the total outstanding shares.

Something notable is that independent directors are also shareholders in the company. As far as I can find, most of their net worth is locked in these stakes in Novo Nordisk.

This ensures us (not 100%, but for a significant part) that the independent directors also will act in the interest of shareholders since they are shareholders. Their choices and oversight will impact the company. Because most of their net worth is locked in Novo Nordisk, we could assume that management and independent directors will act in their own interest and that of the shareholders, creating long-term value for all parties involved.

Novo Nordisk themselves, their holding, holds a significant portion of the company. Novo Holdings A/S holds 28.22% of the total outstanding shares! Talking about skin in the game, ay?

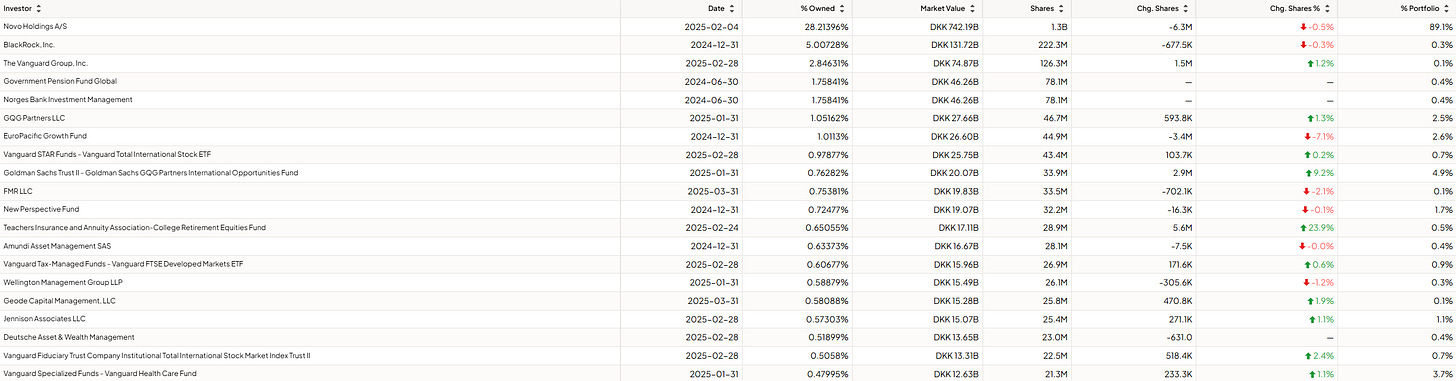

Now, regarding the institutional investors of Novo Nordisk. Here, we clearly see a 50/50 picture.

Institutions are buying and selling Novo Nordisk. There’s no real indication here since there’s a near-perfect split between those buying the company and those selling/decreasing their position.

The key takeaway is that there’s significant skin in the game for management and Novo’s holding, ensuring alignment with share- and other stakeholders. Although the sentiment of institutional investors is mixed, Novo Nordisk and its management make a clear statement regarding owning stock and how they think about the company.

4. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Novo Nordisk is a trusted name in healthcare, synonymous with innovation in diabetes care and, increasingly, obesity treatment. Physicians, patients, and healthcare systems worldwide rely on its therapies for chronic disease management.

Ozempic and Wegovy (semaglutide) have become household names, driving perception of Novo as a pioneer in GLP-1 therapies for diabetes and weight loss.

Rybelsus, the first oral GLP-1, reinforces its leadership in patient-friendly innovation.

Global reputation for quality – Novo’s insulin portfolio (e.g., NovoLog, Tresiba) is a gold standard in diabetes management, used by millions.

Deep trust among healthcare providers – Novo’s decades of clinical data and patient outcomes build credibility that new entrants struggle to match.

Competitive edge – its focus on chronic diseases with massive patient populations (diabetes, obesity) gives it an edge over smaller biotech firms.

Pricing power – insurers and governments pay premium prices for Novo’s drugs due to proven efficacy and lack of comparable alternatives.

Scale and Cost Advantages

Novo Nordisk operates at a scale unmatched in diabetes and obesity therapeutics, with global manufacturing and distribution networks that drive efficiency.

Massive R&D investment – Novo spends billions annually on clinical trials and drug development, spreading costs across a vast patient base.

Global manufacturing – facilities in Denmark, the U.S., and China produce drugs at scale, reducing per-unit costs for insulin and GLP-1 therapies.

Supply chain optimization – Novo’s ability to secure raw materials and manage complex biologics production gives it a cost edge.

High margins – drugs like Ozempic generate blockbuster revenue with relatively low incremental costs after R&D is sunk.

Competitors struggle to match Novo’s production capacity or global reach, especially for complex biologics like semaglutide.

Reinvestment moat – profits fund next-generation therapies (e.g., oral semaglutide, new obesity drugs), keeping Novo ahead of rivals.

Switching Costs

Once patients, physicians, or healthcare systems adopt Novo Nordisk’s therapies, switching to alternatives is challenging due to clinical, logistical, and systemic barriers.

Patient dependence – diabetes and obesity patients on Ozempic or Wegovy often stay on therapy long-term due to efficacy and tailored dosing regimens. Switching risks destabilizing treatment.

Physician familiarity – doctors trust Novo’s drugs based on extensive clinical data and patient outcomes, making them hesitant to prescribe unproven alternatives.

Payer lock-in – insurers and healthcare systems negotiate long-term contracts for Novo’s drugs, integrating them into formularies. Switching would require renegotiations and risk patient backlash.

Clinical trial barriers – competitors must replicate Novo’s decades of safety and efficacy data, a costly and time-consuming hurdle for prescribers and regulators.

Predictable revenue – chronic disease therapies ensure recurring prescriptions, with patients often staying on Novo drugs for years.

High retention – once a healthcare system adopts Novo’s portfolio, inertia and trust keep them loyal.

Network Effect

Novo Nordisk does not benefit from the ‘traditional’ network effect. Yes, there are patient communities and physician advocacy, but I would argue that this isn’t a network effect that is part of their economic competitive advantage or adds enough value to be considered.

Attracting Talent

Novo Nordisk’s reputation and resources make it a magnet for top talent in pharmaceuticals, biotechnology, and healthcare innovation.

Industry prestige – Novo’s leadership in diabetes and obesity research attracts scientists, clinicians, and executives eager to work on high-impact therapies.

R&D opportunities – its robust pipeline (e.g., next-gen GLP-1s, insulin innovations) offers researchers a chance to shape global healthcare.

Global presence – offices and facilities across Denmark, the U.S., China, and beyond provide diverse career paths, appealing to international talent.

Sustainability ethos – Novo’s commitment to affordable insulin access and environmental goals resonates with mission-driven professionals.

Novo Nordisk moat is the strongest in switching costs, patents, and economies of scale.

5. Industry Analysis

5.1 Industry Growth Prospects

The pharmaceutical world, especially the chronic disease corner, is on fire. We’re not talking a slow burn—this is a full-on blaze, fueled by big trends that aren’t slowing down. Here’s why the sector’s booming and how Novo Nordisk is grabbing a front-row seat:

Massive market growth:

Diabetes care? It’s a $130 billion market (2023 numbers) and growing 6–8% a year through 2030. Over 600 million people will have diabetes by 2045—crazy, right?

Obesity’s the new kid on the block, with a $15 billion market now that could hit $30–50 billion by 2030. Some folks even say $100 billion if things get wild.

Chronic diseases are eating up healthcare budgets worldwide, and with 1 billion obese people and counting, the need for solutions is only climbing.

What’s driving it:

People are living longer, but not always healthier—think aging populations and more burgers than gym days. That’s spiking diabetes and obesity rates.

Healthcare spending’s up, especially in places like China and India, where folks are getting better access to meds.

Obesity’s losing its stigma. It’s not just “eat less” anymore—people want drugs that work, and insurers are starting to pony up.

Tech’s a booster, too—AI and biotech are helping companies like Novo crank out better drugs faster.

Not all rosy:

U.S. price wars could pinch profits—politicians love targeting drug costs.

Competition’s heating up, especially in hot areas like GLP-1 drugs.

Regulations and patent expirations are always a headache, but the demand’s so huge it’s hard to derail this train.

Now, let’s talk Novo Nordisk. They’re not just in the game—they’re rewriting the rules. Here’s why they’re set to surf this wave like pros:

Riding high on blockbusters:

Their GLP-1 drugs—Ozempic, Wegovy, Rybelsus—are basically rock stars. They pulled in $42 billion in 2024, a 25% jump from 2023.

Wegovy’s crushing it in obesity (70% market share), and Ozempic’s a diabetes staple. They’re forecasting 16–24% sales growth for 2025, even with some supply hiccups.

These aren’t just pills—they’re life-changers, cutting weight by 15–20% and even slashing heart risks by 20%. Docs and patients can’t get enough.

Nailed the trends:

Diabetes epidemic? Novo’s got a 52% lock on insulin and 34% of GLP-1s. With only 6% of patients on their drugs, there’s tons of room to grow.

Obesity boom? Wegovy’s go-to; its heart benefits are getting insurers to open their wallets wider.

Emerging markets? They’re big in China (50% insulin share) and growing fast where healthcare’s expanding.

Future-proofing with a killer pipeline:

They’re not chilling on today’s wins. Stuff like CagriSema (next-gen obesity drug) and oral semaglutide upgrades are in late-stage trials—think 2026 launches.

They’re dipping their toes into heart disease, kidney issues, and even liver conditions. It’s a hedge against crowded diabetes markets down the road.

With $6.8 billion sunk into R&D and new factories last year, they’re building muscle to stay ahead.

Sticky as glue:

Doctors trust Novo’s drugs—decades of data don’t lie. Patients stick with what works, and insurers keep paying because alternatives are scarce.

They’re global too—half their cash comes from the U.S., but Europe and emerging markets are picking up steam, spreading the love.

The edge, but no free lunch:

Novo has a head start and a trusted brand, but Eli Lilly is breathing down their necks with drugs like Mounjaro.

Supply chain snags are a pain—Wegovy’s been tough to get for some folks.

Still, their grip on the market and deep pockets make them a tough bet to beat.

So, there you go—the pharma sector’s chronic disease space is a goldmine, and Novo’s digging in with both hands. They’re not flawless—competition and politics could stir the pot—but with drugs that change lives and a pipeline to keep the hits coming, they’re in a prime position to keep winning.

5.2 Competitive Landscape

I identify the following as peers or competitors of Novo Nordisk

AstraZeneca

Pfizer

Sanofi

Eli Lilly

Return on Invested Capital (ROIC):

Novo: 29.3% | AZN: 13.4% | PFE: 7.0% | SAN: 6.5% | LLY: 25.4%

Where Novo Excels: Novo’s ROIC is a beast at 29.3%, second only to Eli Lilly. This means they’re squeezing a ton of value out of every dollar they invest—think efficient R&D and blockbuster drugs like Ozempic and Wegovy paying off big time. They’re clearly allocating capital to high-return areas like GLP-1 therapies.

Where Novo Lags: Eli Lilly edges them out slightly at 25.4%. Lilly’s been pouring money into tirzepatide (Mounjaro, Zepbound), which is stealing some thunder in the obesity space. Novo’s got to keep innovating to hold that top spot.

Return on Capital Employed (ROCE):

Novo: 80.0% | AZN: 18.7% | PFE: 6.4% | SAN: 8.3% | LLY: 34.3%

Where Novo Excels: Novo’s ROCE is a jaw-dropping 80%, leaving everyone in the dust. This shows they’re insanely good at turning their capital into profits, likely thanks to their laser focus on high-margin diabetes and obesity drugs. They’re not spreading themselves thin across too many areas.

Where Novo Lags: There’s no real lag here—Novo’s in a league of its own. Lilly’s 34.3% is solid, but Novo’s focus on chronic diseases with massive demand gives them a clear edge.

Free Cash Flow Margin:

Novo: 23.4% | AZN: 18.4% | PFE: 15.5% | SAN: 16.6% | LLY: 8.3%

Where Novo Excels: Novo’s free cash flow margin at 23.4% is the highest in the group. This means they’re generating a ton of cash after expenses, giving them flexibility to reinvest in R&D (like their $6.8 billion manufacturing push) or weather any storms. It’s a sign of a healthy, cash-rich business.

Where Novo Lags: No major lag here, but AstraZeneca and Sanofi aren’t far behind at 18.4% and 16.6%. Novo’s edge comes from its high-margin GLP-1 drugs, but if competitors catch up in obesity or diabetes, that gap could narrow.

Operating Margin:

Novo: 48.2% | AZN: 23.9% | PFE: 25.7% | SAN: 20.0% | LLY: 38.9%

Where Novo Excels: Novo’s operating margin is a stellar 48.2%, the best of the bunch. This shows they’re keeping costs in check while raking in profits—those GLP-1 drugs are goldmines with high prices and relatively low production costs after R&D.

Where Novo Lags: Lilly’s 38.9% is pretty close, and their obesity drug Zepbound is gaining traction fast. If Lilly keeps eating into Novo’s market share, Novo might feel some pressure on margins, especially with pricing battles in the U.S.

Gross Profit Margin:

Novo: 85.0% | AZN: 82.2% | PFE: 74.2% | SAN: 70.2% | LLY: 81.1%

Where Novo Excels: Novo’s gross margin is the highest at 85%, just nudging out AstraZeneca and Lilly. This reflects their ability to charge premium prices for drugs like Wegovy and Ozempic, which have limited competition and high demand.

Where Novo Lags: The gap isn’t huge—AZN and LLY are right behind. If generics or biosimilars hit the market sooner (Novo’s semaglutide patents start expiring around 2032), they could face pricing pressure that dents this margin.

Revenue 5Y CAGR:

Novo: 18.9% | AZN: 17.3% | PFE: 9.2% | SAN: 3.3% | LLY: 15.1%

Where Novo Excels: Novo’s revenue growth over the past five years is a solid 18.9%, beating everyone. This ties back to their dominance in diabetes (52% insulin market share) and obesity (70% of weight-loss drugs). They’re riding the wave of a chronic disease epidemic like champs.

Where Novo Lags: AstraZeneca’s 17.3% and Lilly’s 15.1% aren’t far off. Lilly’s growth is accelerating with Mounjaro, and if Novo’s supply issues with Wegovy don’t clear up soon, they might lose some momentum.

Diluted EPS 5Y CAGR:

Novo: 22.5% | AZN: 34.4% | PFE: -12.9% | SAN: 15.2% | LLY: 5.7%

Where Novo Excels: Novo’s earnings per share growth at 22.5% is strong, second only to AstraZeneca. This shows they’re not just growing revenue—they’re making sure it trickles down to shareholders, a sign of solid management and profitability.

Where Novo Lags: AstraZeneca’s 34.4% is the standout here, likely thanks to their oncology portfolio (drugs like Tagrisso) and COVID-related boosts in recent years. Novo’s growth is steadier but less explosive, and Lilly’s lower 5.7% reflects heavier R&D spending that hasn’t fully paid off yet.

Now, let’s get to the best parts of this investment case!

Want the full investment case? Join us for €20/month or €220/yearly.

Believe me—with these insights and potential opportunities, you'll make that back in no time.

A no-brainer.