I Am Buying This Stock Right Now!

For many, this company or industry is considered a "sin business," and I could say the same. However, it's a wonderful company offering significant potential that must be seized!

I’ve had this company in my portfolio a while back, but I sold it.

Why? I saw better opportunities elsewhere, namely ASML. Evolution is trading at a discount I can not ignore anymore, and I won’t.

Just today, Evolution dropped another 12% because Evolution announced that the UK Gambling Commission had launched an investigation into identifying gambling in the UK by operators without a license.

The kicker? The U.K. market is ‘‘only’’ 3% of Evolution’s Total Revenue.

You could say that Mr. Market is having an episode here. I’m willing to capitalize on Mr. Market’s episode.

Today, I bought Evolution AB; I made it roughly 5% of my portfolio.

I’ll go over it in a blimp, and maybe later this month, I’ll release a deep dive covering this wonderful business.

What Is Evolution AB?

Evolution AB is a company that creates and runs online casino games.

They’re best known for their live dealer games, where real people deal cards or spin roulette wheels in a studio, and players can watch and bet online in real-time.

What They Do:

Live Casino Games – Games like blackjack, roulette, and poker are streamed live, giving players an experience similar to a real casino.

Game Shows – They also make interactive games, like Dream Catcher and Crazy Time, which feel more like TV game shows.

Software Provider – They supply their casino software to online gambling platforms, making them a middleman between casinos and players.

What Makes Evolution Unique?

Evolution AB pioneered live casino gaming and was one of the first to focus heavily on live dealer games. It has become the largest player in this space, giving it a strong brand reputation and trust among online casinos.

Evolution offers high-definition video streaming, multiple camera angles, and low-latency connections for a seamless user experience. Their scalable servers allow thousands of players to join the same game without performance issues, giving them a technological edge over competitors.

Evolution recreates the feel of a real casino with professional dealers and interactive features that keep players engaged. They also lead the market with innovative games like Crazy Time and Monopoly Live, which blend traditional casino elements with game-show-style entertainment that competitors struggle to match.

Evolution is a trusted software provider for hundreds of online casinos. Its customization options enable casinos to brand their games and create unique user experiences, making Evolution a preferred partner for many operators.

Evolution has consistently grown by acquiring other companies, such as NetEnt and Big Time Gaming, and expanding into slot machines and other gaming formats. It has also established a global presence, operating in North America, Europe, and Asia while constantly expanding into new markets.

Evolution’s business model is highly scalable. Once a game is developed, it can be played repeatedly without additional costs, leading to high-profit margins. The company earns a percentage of bets through its platform, creating a steady stream of recurring revenue.

Evolution is a leader in game innovation. It frequently releases exclusive games like Lightning Roulette and Deal or No Deal Live, ensuring its offerings stay fresh and entertaining. Evolution also explores new technologies, including virtual reality (VR) and augmented reality (AR), to enhance gameplay and stay ahead of industry trends.

Some Risks

Evolution provides software and other gambling services. Many frown upon this industry, so investing in Evolution carries significant risks.

60% of their total revenue comes from the "grey market," which means there are no or limited regulations.

Evolution is reliant on a couple of big clients.

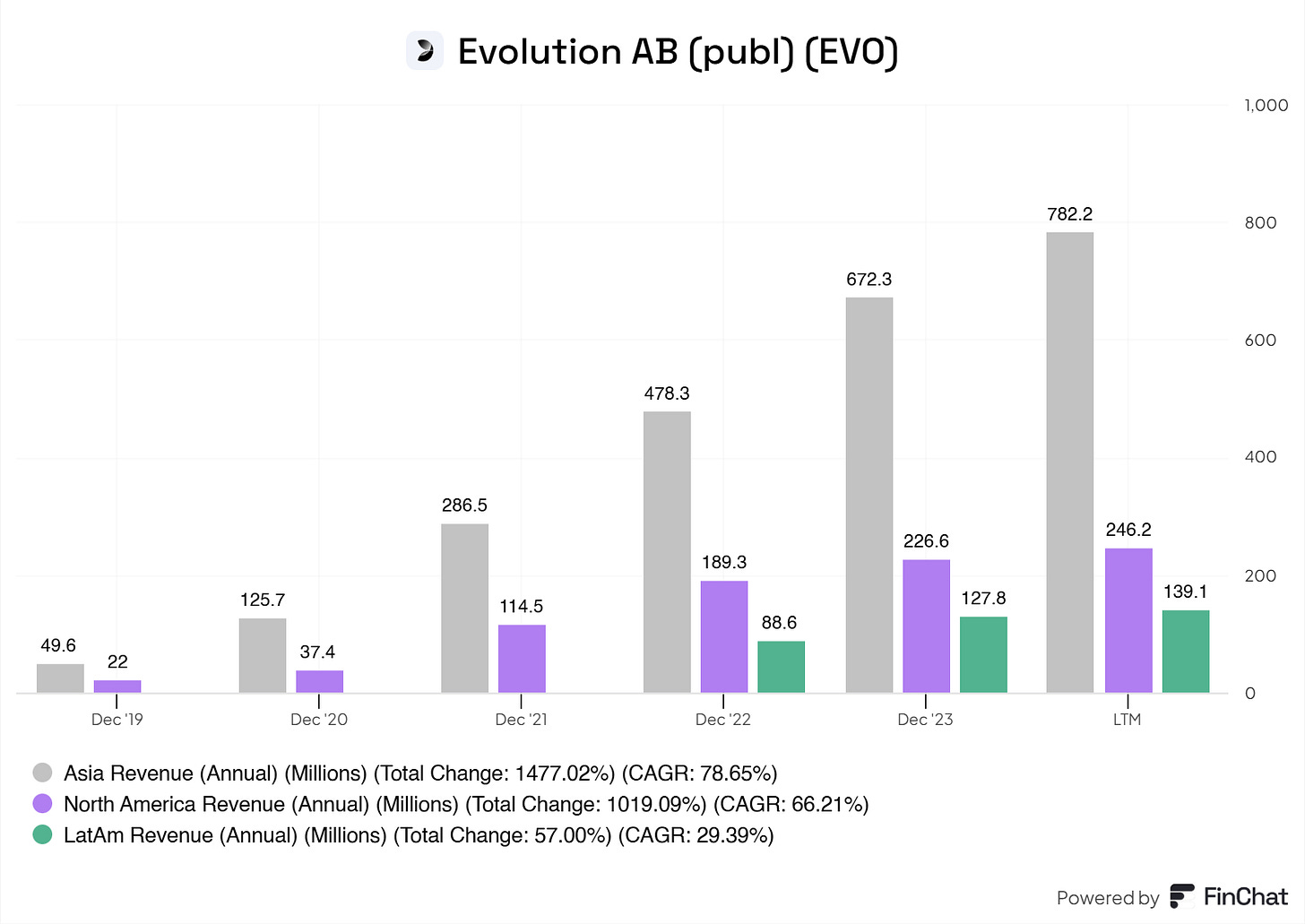

Their primary revenue driver is… Asia, accounting for roughly 38%.

Regulations are significant pain points for this industry. I would argue that governments would love the tax on gambling, but you never know, and they might ban it as they did in other Asian countries.

Cyberattacks. Evolution experienced cyberattacks that impacted their revenue. These issues are resolved, but they remain a factor we must watch for.

Even after calculating these risks into my valuations, Evolution is an excellent addition to my portfolio at its current valuation.

Risks are part of the game; we should embrace them.

Ray Dalio once said:

"Risk-taking is part of the process of success. The people who achieve the most are those who take the biggest risks."

I’m confident in Evolution’s management and execution in efficiently tackling the current hurdles; otherwise, I wouldn’t bet my money on it.

The CEO, Jens von Bahr, thinks the same way. He currently owns roughly 10%. Insiders are buying, and management is confident in the business—and so am I.

Some Fundamentals

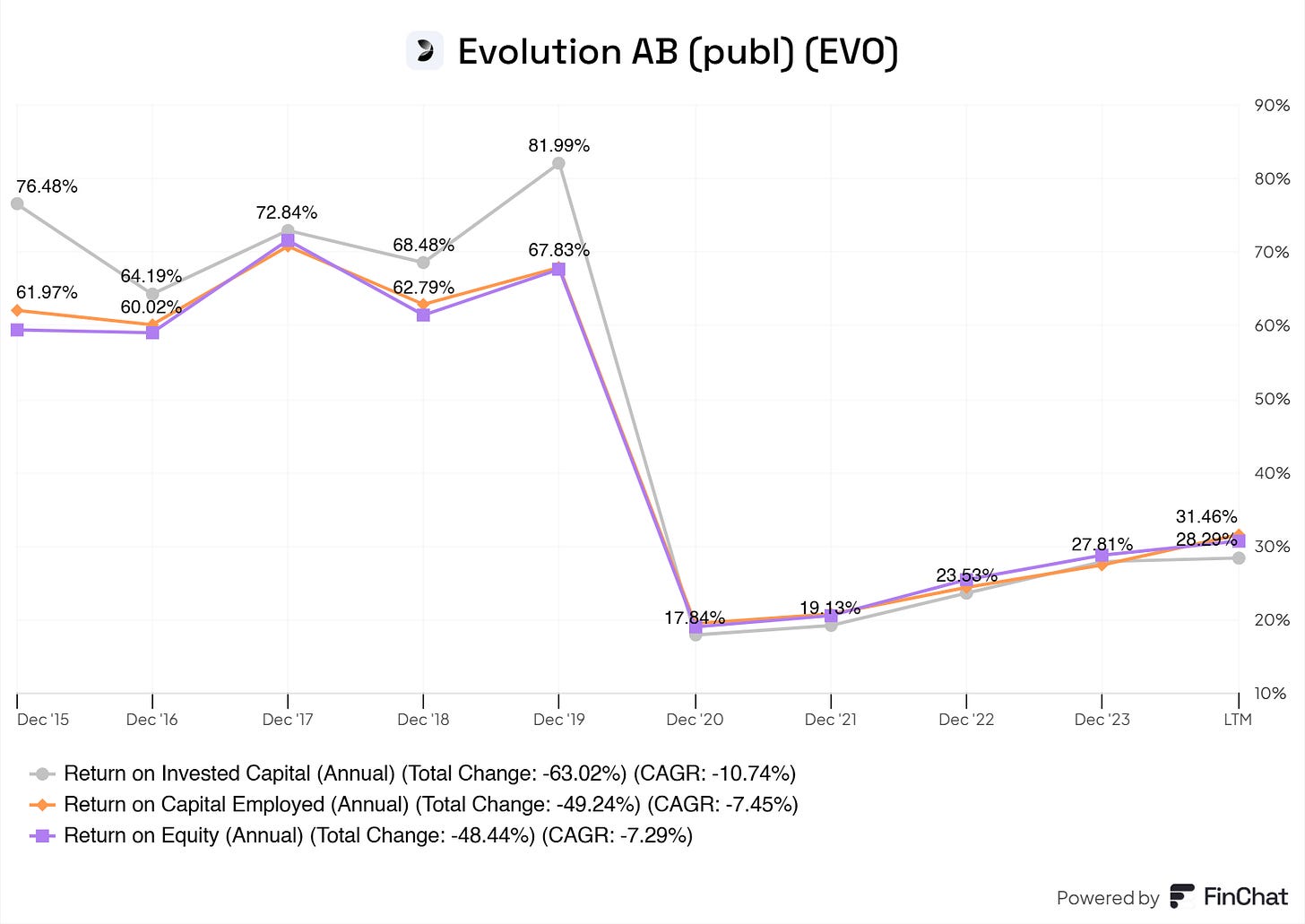

Evolution benefits from solid ROIC, ROCE, and ROE. They dropped significantly, but these metrics are still far above the industry average and seem to be sustained at excellent ratios.

Evolution has margins almost every business, even your favorite tech business, must be jealous of. Evolution is expanding its margins extremely efficiently. This is the result of the scalability of their business, something I truly admire.

The total Number of Tables is growing rapidly, giving Evolution an even bigger scale advantage later on; it is wonderful!

As you can see here, Evolution is highly dependent on Asia, but it is also growing rapidly and dominating the market in Asia. In North America, there could be some hurdles due to state-specific regulations, but it is a wonderful market for Evolution to tap into if they can do so successfully, and I am confident they can. LatAm is the newcomer, and Evolution is digging down here, recently opening locations in Brazil. For instance, there’s heaps of growth room here for Evolution.

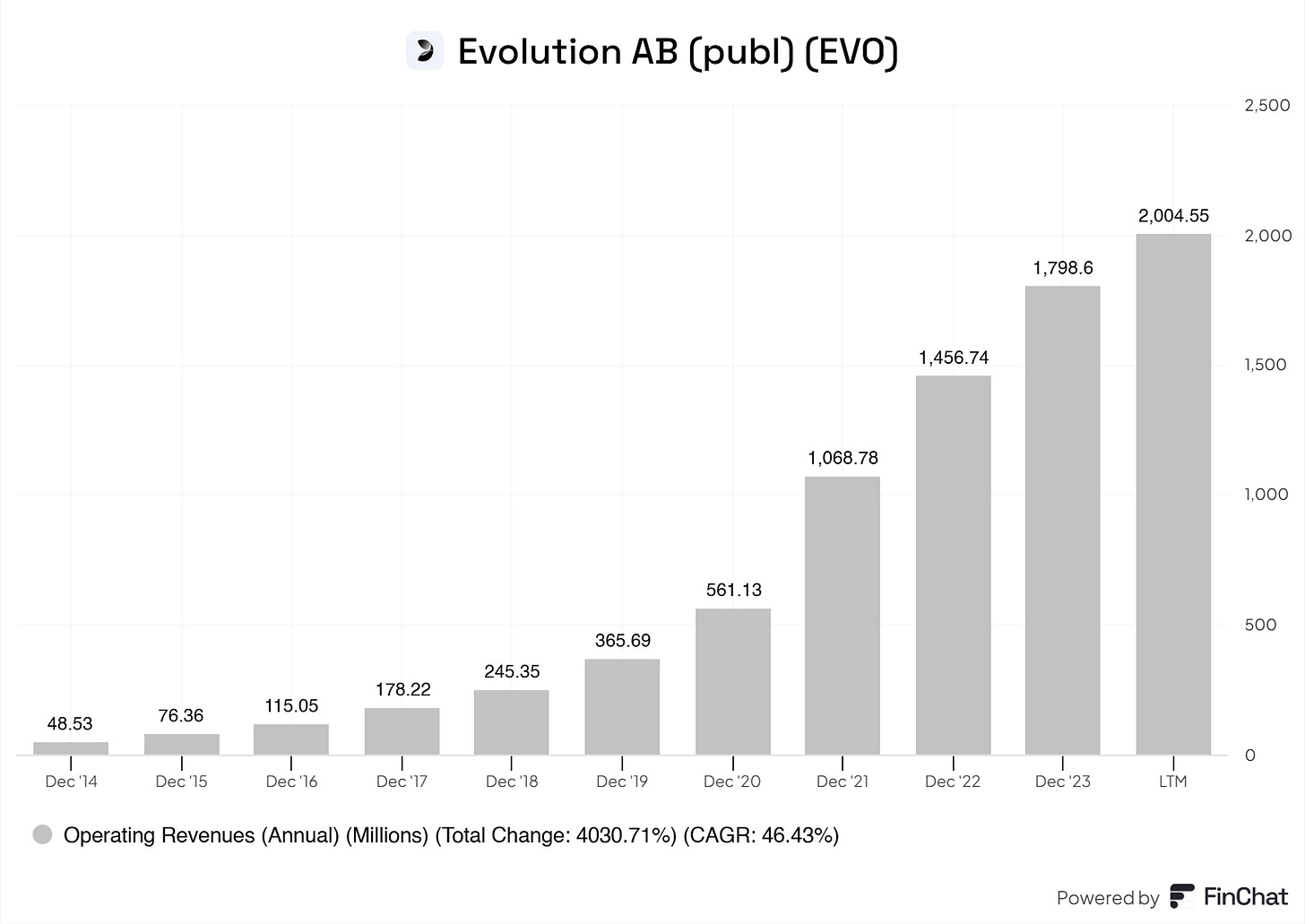

Evolution is growing its Total Revenue at rates every business must dream of. Growing your total revenue with a CAGR of 46% is incredible, to say the least. I do not expect any slowdown here. Of course, maintaining this CAGR is silly, but Evolution still has heaps of growth on the horizon; therefore, high growth is expected.

I hurriedly went over some major parts, I'm sorry. I plan to release a deep dive into Evolution soon.

Stay tuned!

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.

Interesting. Hopefully a good catch. I’ll take a look too as I have seen this company discussed before. One of my thoughts is someone may have gotten a margin call and it happened to occur with this news.