Full Guide to Valuing Stocks Like a Pro + Download My DCF Models

These two DCF models are all you need. I'll tell you everything you need to know so you can start valuating companies right away. Sounds good, right!

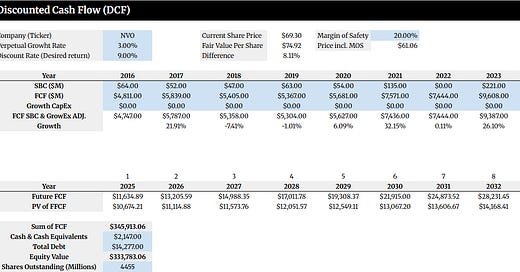

The photo looks scary, right?

All these numbers and assumptions are packed together to spit out a ‘fair’ price of the stock.

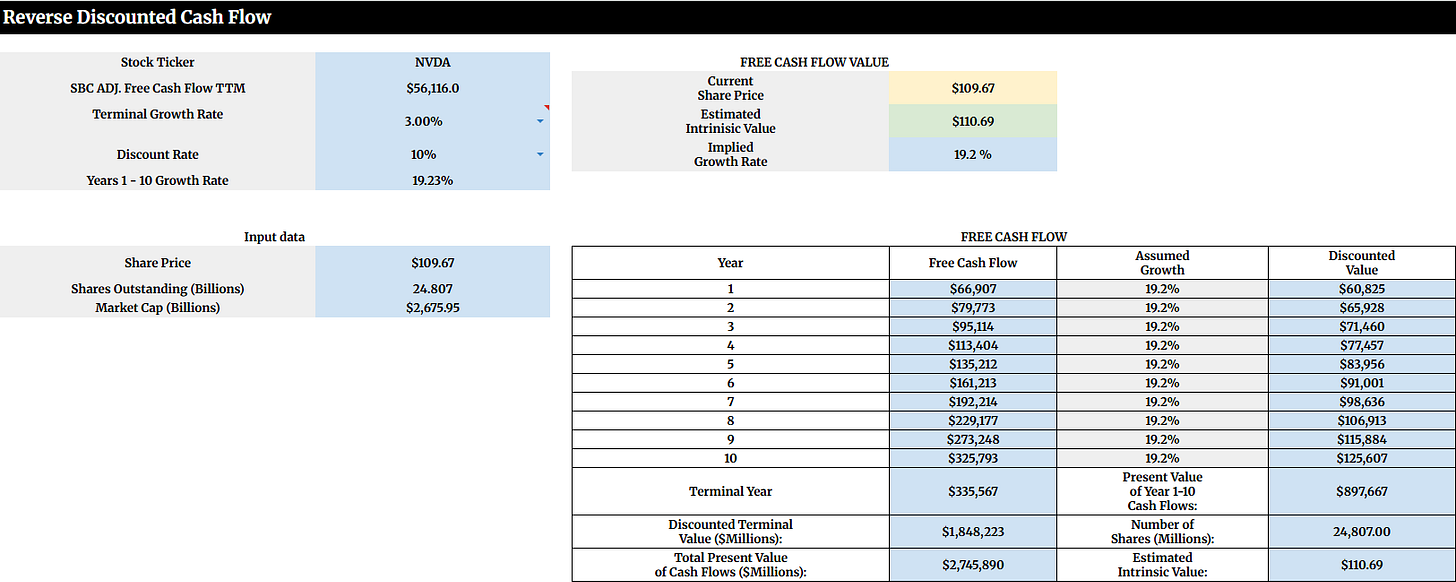

Same here? Scary!

More numbers and assumptions all working together to spit out a ‘fair value’

Don’t focus on the numbers, inputs, and all the other jibberish. This is purely a randomized example.

But!

By the end of this article, I promise you’ll know everything about the discounted cash flow method and the reverse discounted cash flow method.

The kicker?

You can have my personal sheets for FREE!

Before we dive into the DCF models, here’s a quick heads-up.

Right now, there’s still a 33% discount available for full access.

This isn’t a one-time promo — it’s a lifetime discount that locks in for as long as you stay subscribed.

Many people have already joined the boat — and I’d love to welcome you aboard, too.

Are you not ready to commit just yet? That’s okay; it's understandable. Try it for free, with no strings attached. Start a free trial for 7 days.