The market never stops moving. Neither does my portfolio.

February was a month of shifting narratives. AI hype is still running hot. Interest rates are still the topic of every earnings call. Some stocks soared, some stumbled—but through it all, the strategy stays the same: own great businesses, stay patient, and take advantage of opportunities when they come.

This update isn’t about chasing trends. It’s about compounding intelligently. What changed? What stayed the same? And where do I see the best opportunities going forward?

Let’s break it down.

Happy reading!

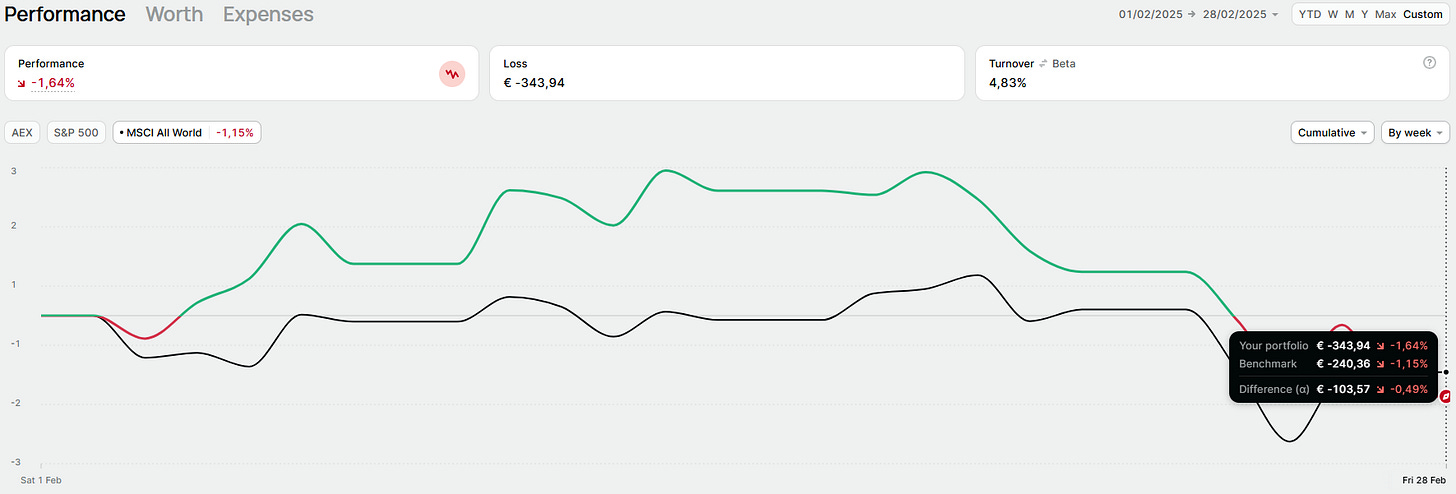

Portfolio Performance in February

February shook the market. NVIDIA led the charge in January, lifting my portfolio 6%, then 10%. This week? A different story. NVIDIA’s earnings dropped, and the market didn’t react how I expected. Down 14% in five days. Some gains erased.

Am I worried? Not at all.

I own high-quality compounders. Businesses that don’t just survive, they thrive. Over time, they’ll do the heavy lifting.

The numbers?

January portfolio: €21,379.94 (including cash)

Now: €20,918.59 (including cash)

P/L dropped from €7,100 to €6,215

Deposit: €250

A setback? Maybe. An opportunity? Absolutely.

Short-term drops = long-term entries. I’m adding. Scaling. Positioning. I even funded another €250 for a new investment.

More on that soon. Stay tuned.

February started strong. My portfolio was ahead—beating the MSCI All-World Index and even the S&P 500.

Then? The market hit back.

Another drop. Another test.

Am I concerned? Not at all.

You and I? We’re long-term investors. We don’t panic over price swings. We don’t flinch at macro fears.

Why? Because these are just short-term disruptions. They don’t change a company’s intrinsic value.

The market moves. We stay the course.

This is what matters.

Our long-term track record of high, sustainable, and predictable growth.

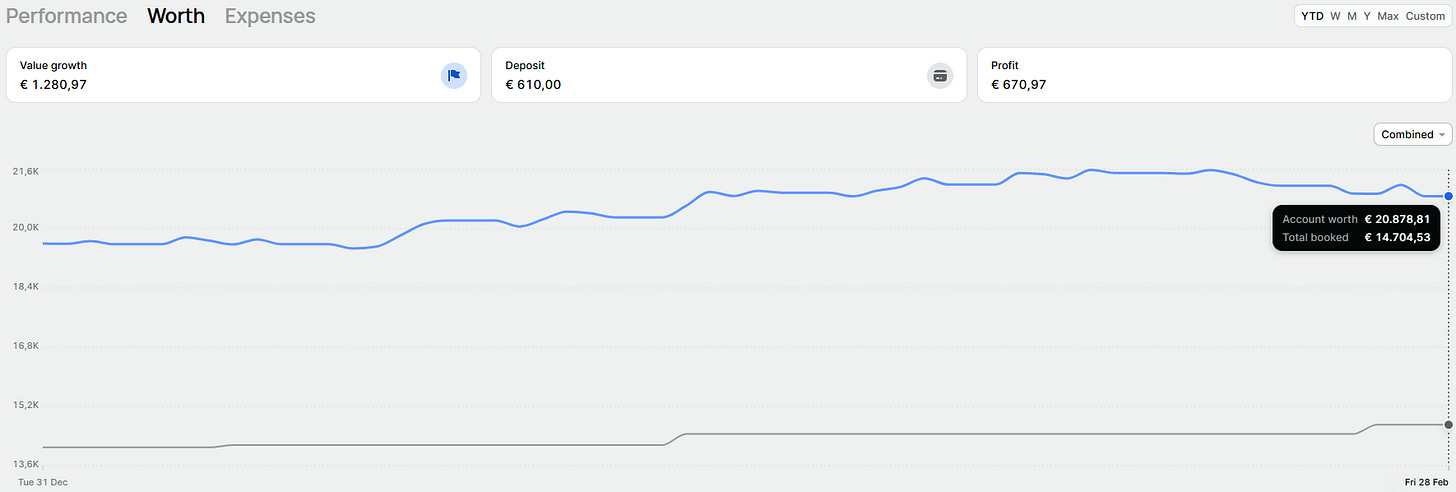

Portfolio Value in January

Peak: €21,589 (Feb 13).

Now: €20,918.59. A drop? Yes. A problem? No.

What matters is the bigger picture.

The gap between what we’ve invested (€14,704) and what our portfolio is worth keeps growing.

That’s compounding. That’s progress. And that’s exactly what we want.

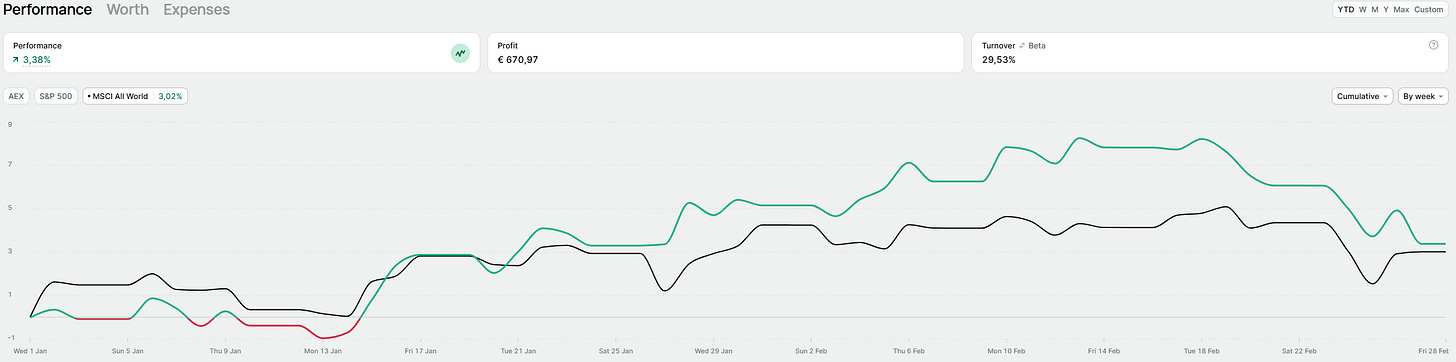

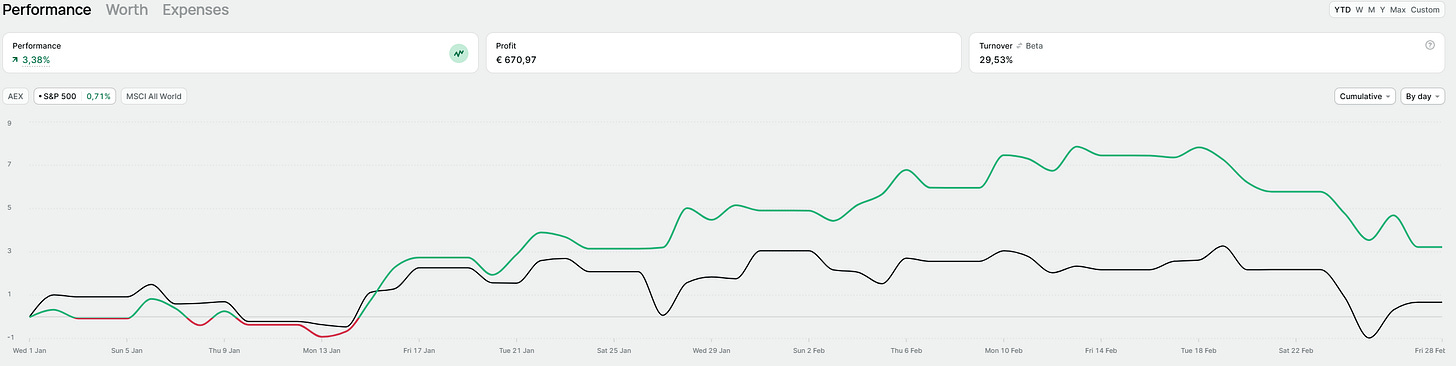

YTD Overview

YTD? We’re crushing it.

Since the start of the year, we’ve been outpacing the MSCI All-World Index.

Not just keeping up—outperforming. And we’ve been doing it almost from day one.

Even against the S&P 500, we’re winning.

Not just holding our ground—excelling.

The performance speaks for itself. We’re ahead.

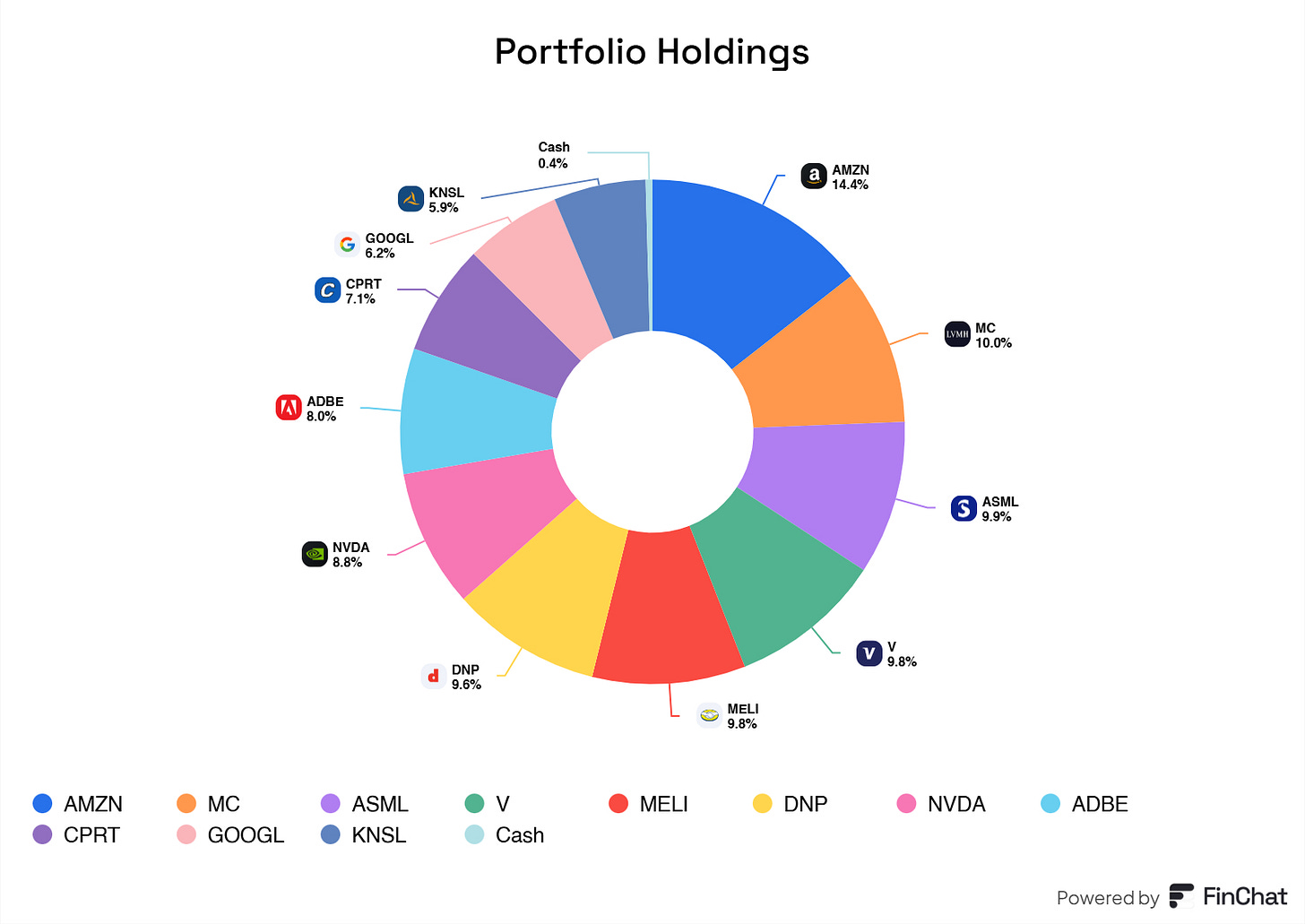

Allocation Breakdown

A shift in the portfolio.

Ameriprise is out. Alphabet (Google) is in.

Why? More potential. Better upside. At today’s valuation, my calculations show Google offers a greater return. Ameriprise? Still a great company. But for my strategy, Google fits better.

The moves:

Sold Ameriprise: Locked in 25% profit. A solid gain. No regrets.

NVIDIA: Took a hit, dropped in portfolio weight, almost back at my entry. Still holding.

Dino Polska: Up 1% from price appreciation. Love to see it.

The takeaway?

I’m happy with this portfolio. Built for growth. Positioned for returns.

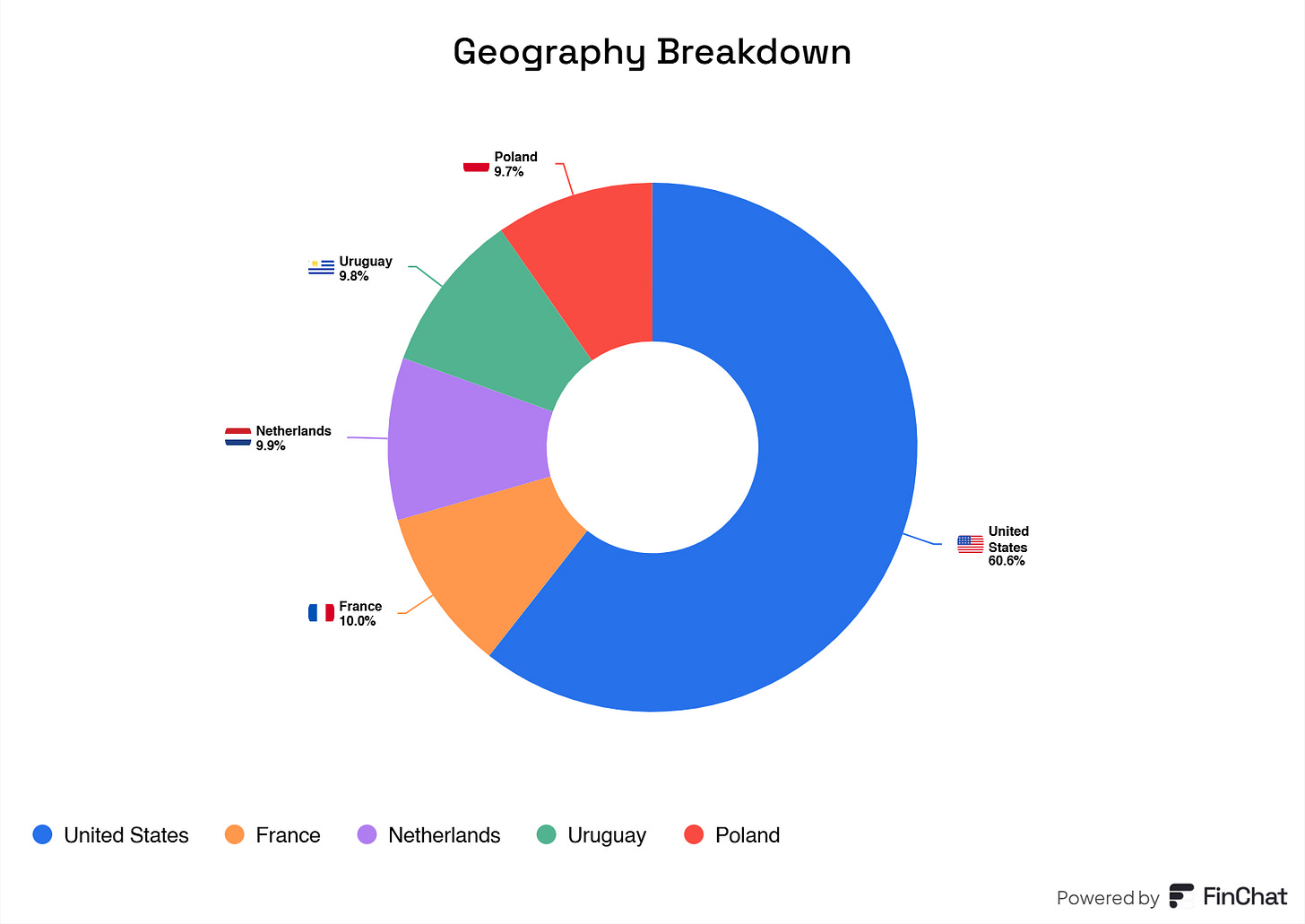

Here’s how I’m spread globally.

Still pleased.

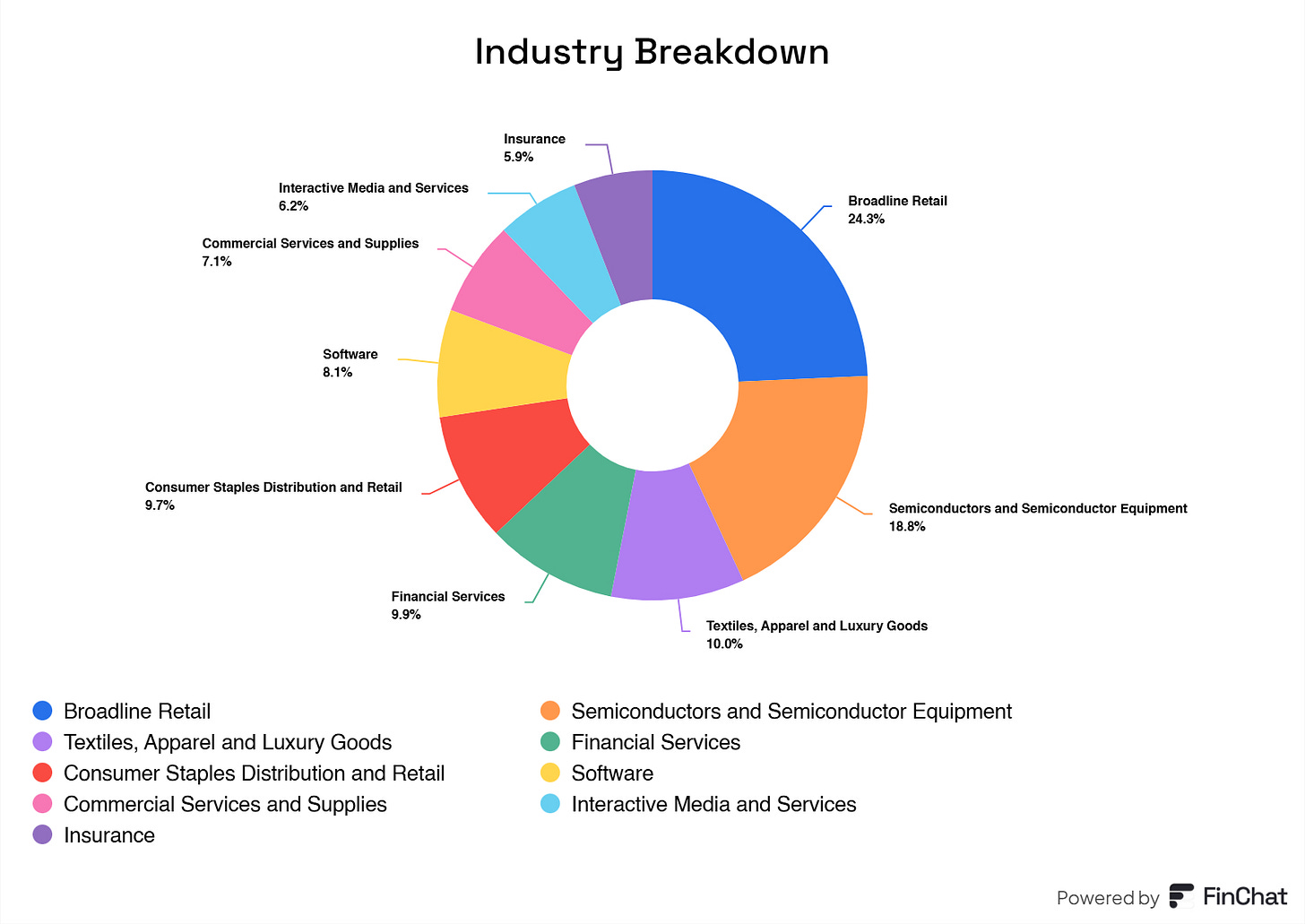

And here’s what industries I’m in.

Again, still very much pleased.

Portfolio Metrics

These are the metrics of my portfolio. They reflect high-quality companies.

And guess what? They check every box.

✅ Strong revenue growth

✅ Excellent margins

✅ Low debt

✅ High returns on capital & invested capital

✅ Low CapEx to sales

✅ Shrinking share count

This is what quality looks like.

Transactions of February

As I said.

✅ Ameriprise out, Google in.

✅ Cash deposit made.

✅ Broker fees paid.

✅ ASML dividends received.

Minimal moves. Maximum focus. Just how we like it.

Watchlist

Two companies on my radar.

✅ Trane Technologies (TT) – Solid potential. But expensive. Their debt? A concern. More research needed.

✅ Kaspi (KSPI) – Looks superb. Valuation is attractive. But it’s in Kazakhstan. I need to dive into the country, its regulations, and how it all functions.

Both are on the watchlist. Both demand deeper research. Stay tuned.

The outlook for next month?

I’m hoping for bigger dips. More chances to deploy capital wisely into high-quality compounders.

I’m no fortune teller. I can’t predict the future.

But here’s what I can do—wait for great opportunities. And when they come? I grab them with both hands.

We’re long-term investors. We think long-term. We act long-term. We win long-term.

And that is it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Useful Sources

Finchat is used for all the charts and analysis. You can now get 15% off from your subscription. Click here and start today!

(I’m affiliated with Finchat, but not sponsored. With this link, your plan does NOT get more expensive; I only get a small cake cut. Thank you in advance)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.

Great review of a good and balanced portfolio.

I love the end: We think long-term. We act long-term. We win long-term.

Cheers :))