Best Buys Of July

We're halfway through the year, and there are still wonderful opportunities in the market.

Welcome back, Fluenteers! 👋🏻

It feels like the year has just begun, but we’re already halfway through. All months so far have presented us with significant opportunities, and we’ve been able to capitalize on a substantial number of them. July is offering similar and newer opportunities.

Here are the top picks for July.

Top Pick Of July #6: Alphabet Inc. (Ticker: $GOOG)

Engineered for scale. Relied on for mission-critical.

Google builds the backbone of the modern internet.

Its platforms don’t just serve data—they organize the world.

The digital world isn’t shrinking.

It’s exploding. Faster. Heavier. Unrelenting.

That’s where Google leads.

Where downtime isn’t an option

Where milliseconds make markets

Where trust scales with traffic

Google doesn’t win by being the cheapest.

It wins by being indispensable.

Core ecosystems:

Search and knowledge indexing

Cloud infrastructure

Android operating system

YouTube content platform

Digital advertising networks

Once integrated, it is rarely abandoned.

It’s not contracts that hold customers.

It’s the weight of data. The depth of tooling. The comfort of familiarity.

To switch is to risk disruption.

To switch is to risk relevance.

To switch is to risk breaking what works.

When scale meets reliability, Google remains.

The install base isn’t static—it’s a growth engine.

Expansion doesn’t just come from new clients.

It multiplies within the current ecosystem.

More searches

More cloud storage

More YouTube content

More advertising reach

More developer integrations

Every click deepens the moat.

Every search sharpens the edge.

Global presence. Local touch.

Operating in nearly every country.

With product teams, cloud engineers, and policy experts on the ground.

Custom solutions for enterprise

Rapid response security teams

Regional compliance support

Customers don’t just use Google.

They build on it. They grow within it.

Financially resilient. Relentlessly innovative.

Operating margins: robust and defensible

Cash flow: fortress-like

CapEx: focused, disciplined, ambitious

R&D: pushing AI, quantum, next-gen computing

Secular growth tailwinds:

An explosion of cloud workloads

Rising digital ad penetration globally

AI model scaling and integration

Mobile-first economies driving Android adoption

Each trend makes Google more central.

Not louder, just more inevitable.

This isn’t a company chasing attention.

It’s building the infrastructure for what comes next.

Steady dominance. Durable compounding. Built to stay.

When digital life depends on it,

Google doesn’t need to persuade.

It just needs to work.

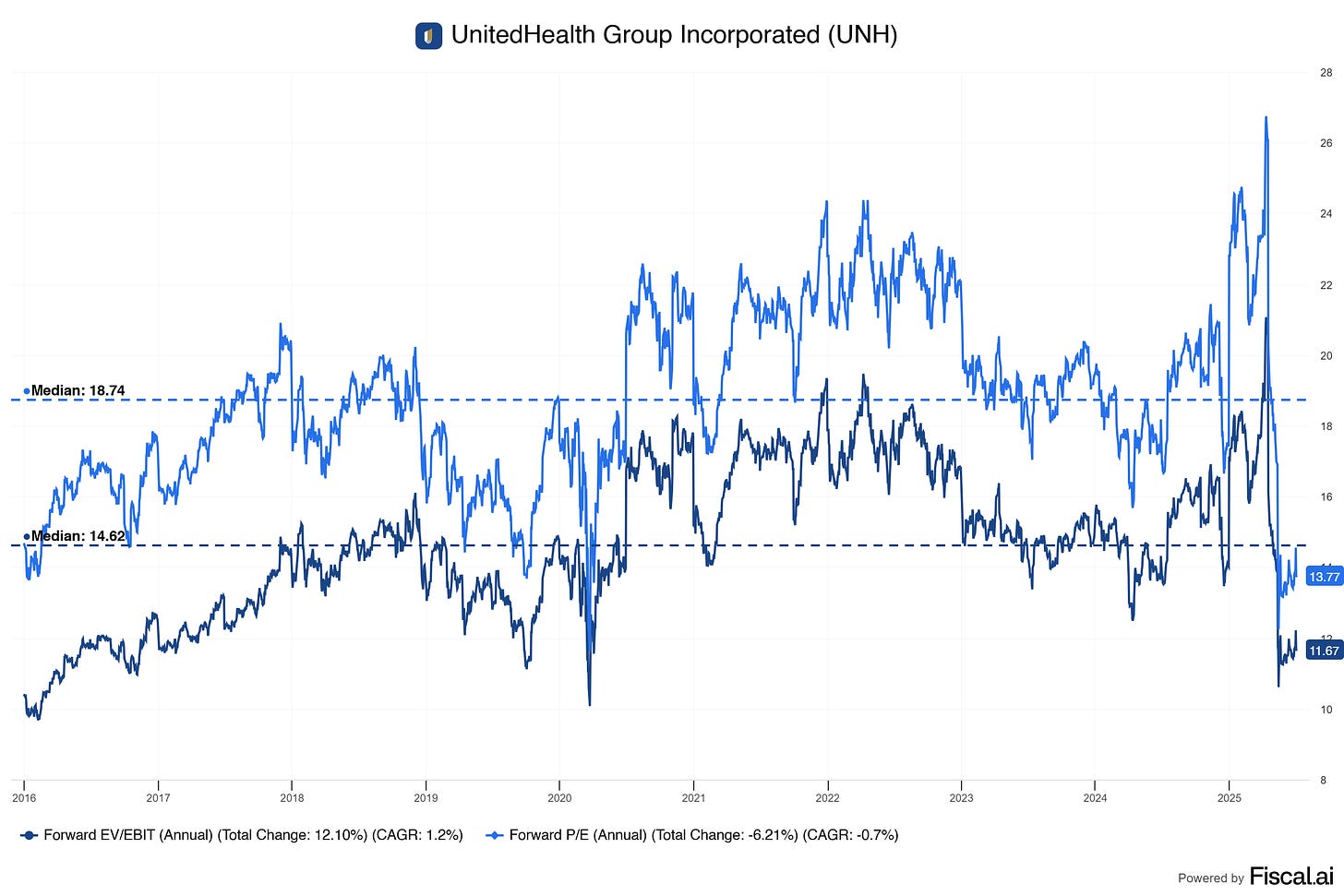

Top Pick Of July #5: UnitedHealth Group (Ticker: $UNH)

🚨 A slight warning before we go into UnitedHealth. UnitedHealth has been accused of fraudulent activities and is under investigation. I consider companies with these accusations to be extremely risky until everything is either cleared or resolved.

UnitedHealth has denied all accusations.

UnitedHealth Group powers the backbone of modern healthcare.

It doesn’t just process claims—it connects the system.

Healthcare isn’t getting simpler.

It’s becoming larger, messier, and more demanding.

That’s where UnitedHealth Group thrives.

Where scale meets sensitivity

Where mistakes carry real consequences

Where trust is earned, not assumed

UnitedHealth doesn’t compete by being the cheapest.

It competes by being the most complete.

Core pillars:

UnitedHealthcare: Insurance and health benefits

Optum Health: Care delivery and value-based care

Optum Rx: Pharmacy services and benefits management

Optum Insight: Data, analytics, and clinical technology

Once embedded, it is rarely replaced.

Switching isn’t just about cost.

It’s about disruption. It’s about losing integrations. It’s about risking patient outcomes.

A switch risks clinical continuity.

A switch risks data integrity.

A switch risks network access.

When lives depend on seamless care, UnitedHealth Group stays.

The growth engine runs through scale and depth.

It’s not just about adding members.

It’s about deepening within each relationship.

More care sites

More risk-based contracts

More pharmacy fulfillment

More data-powered clinical decisions

More predictive care management

Every new service tightens the network.

Every data point strengthens the model.

Global vision. Local execution.

On the ground with physicians, care managers, and community clinics.

Integrated care delivery

Localized health plans

Real-time support for patients and providers

Customers don’t just buy coverage.

They buy coordination. They buy better outcomes.

Financially disciplined. Operationally vast.

Strong underwriting margins

Massive, recurring cash flows

Efficient capital allocation

Relentless investment in technology and care delivery

Secular growth drivers:

Aging global populations

Shift toward value-based care

Rising demand for pharmacy benefit management

Increasing reliance on data-driven clinical support

Each trend makes UnitedHealth Group more essential.

Not louder, just more inevitable.

It’s building the infrastructure of tomorrow’s healthcare.

Steady. Systemic. Installed to stay.

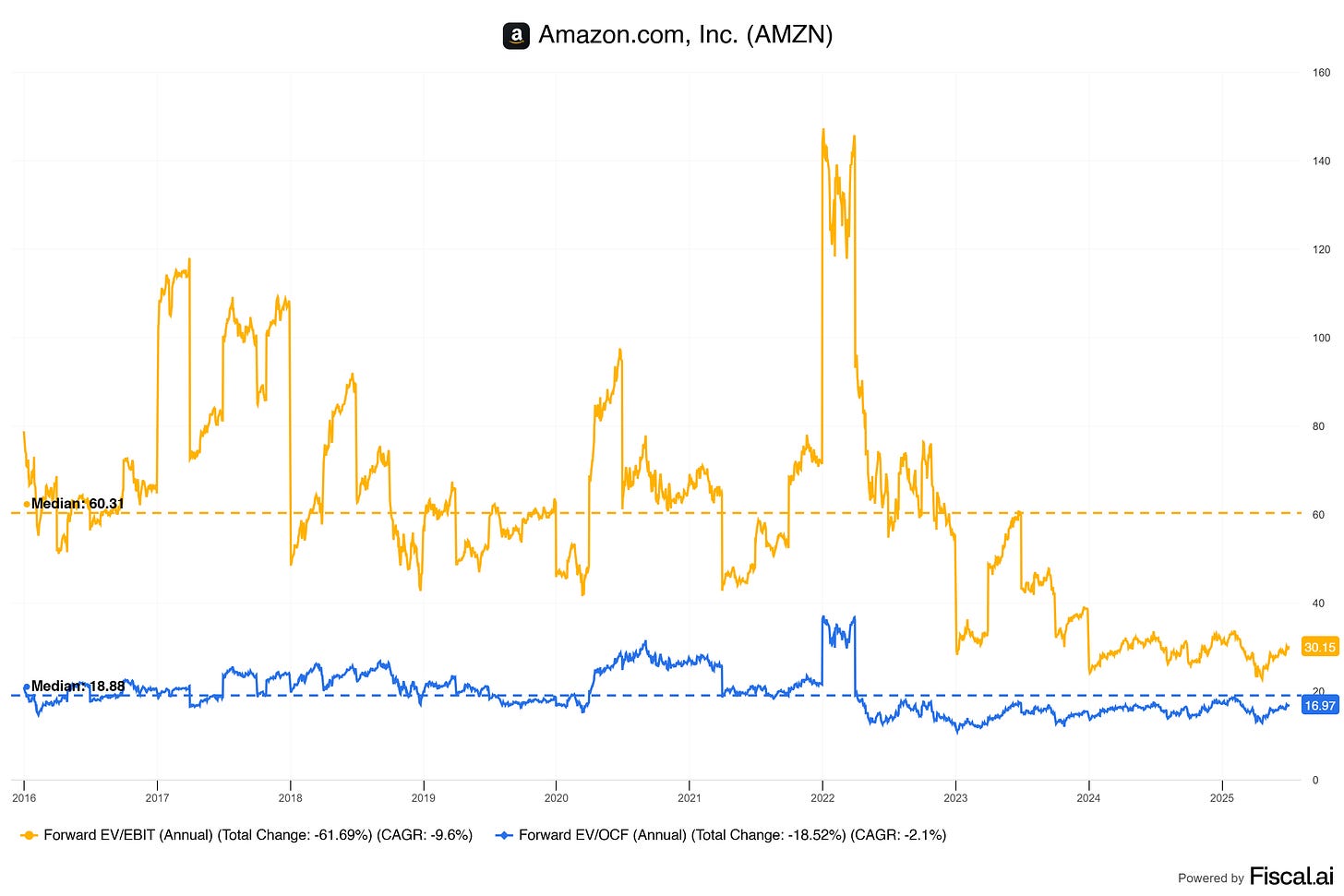

Top Pick Of July #4: Amazon (Ticker: $AMZN)

Built to move fast. Structured to last.

Amazon isn’t just a marketplace.

It’s the engine behind global commerce.

Products move faster. Expectations rise higher.

Customers don’t wait. They click, they buy, they want it now.

That’s Amazon’s home field.

Where speed shapes loyalty

Where scale creates dominance

Where reliability builds trust

Amazon doesn’t chase on price alone.

It wins on reach, execution, and habit.

Core pillars:

Online retail and third-party marketplace

Amazon Web Services (AWS)

Prime membership ecosystem

Fulfillment and logistics network

Advertising platform

Amazon is woven into the daily flow of consumers and businesses.

Its services are connected, sticky, and hard to untangle.

Walking away isn’t a simple switch.

It risks losing the infrastructure that keeps businesses running and customers returning.

The growth flywheel keeps turning:

More sellers join

More selection increases

More customers shop

More fulfillment centers open

More Prime members stay engaged

Every package strengthens the network.

Every click makes the platform smarter.

Global scale with local precision.

Warehouses, delivery stations, and data centers span continents.

Local routes, tailored Prime offers, and rapid last-mile delivery sharpen the edge.

Same-day fulfillment in major cities

Regional logistics hubs

Country-specific marketplaces

Amazon isn’t just shipping products.

It’s moving ideas, content, and computing power.

Financial strength and disciplined expansion:

Consistent operating cash flow

High-margin growth through AWS and Ads

Relentless reinvestment in logistics and technology

Efficiency gains that feedback into the system

Secular drivers pushing Amazon forward:

Rising e-commerce penetration

Continued shift to cloud computing

Increasing demand for fast, reliable delivery

Growing importance of digital advertising

Every trend deepens Amazon’s role in daily life.

The company scales without slowing. It adapts without pausing.

This is long-haul compounding.

A system that grows stronger with every order.

When customers demand speed, selection, and certainty,

Amazon doesn’t promise. It performs.

Now, let’s get into the most compelling best buys for July! 👇🏻