Best Buy: Uber Technologies, Inc.

Why Uber, the ride-hailing and delivery giant, is at its current valuation one of the best buying opportunities in the market right now.

Hey there, partner! 👋

Welcome to another edition of ‘‘Best Buys’’. In these articles, I lay out what I think now is the best business to buy at a fair price.

If you’ve missed previous Best Buys, you can check those out here:

If you haven’t already, hit that follow button for FREE insights to fuel your investment journey. Whether you’re just starting or a seasoned investor, there’s something here for everyone.

Once you’ve finished this analysis, I’d love to hear your thoughts! If this resonates with you, be sure to comment, like, and share it with your Substack community. Your support makes all the difference!

Uber has become a household name for many users of the app. I’m guessing you might have heard the following:

‘‘I’m not in the mood to cook dinner. Do you want Uber?’’ or ‘‘Traffic is a complete pain in the ass right now, lets Uber to the place’’, and ‘‘Lets’s just Uber it, right?’’

When your business becomes a verb users use in their vocabulary, you know you’ve done something right. Here in The Netherlands, some of the biggest companies have also infiltrated our daily vocabulary. You know you’re doing something right when your business is mentioned daily, hourly, or even every minute.

Of course, this doesn’t make or break a business, but it’s a nice bonus.

What makes or breaks a business is wonderful growth opportunities, high returns on capital, expansion, and ever-increasing market dominance, and that’s why I’m bringing up Uber in this article. I want to bring Uber to your attention because Uber is currently ticking all the boxes.

Let’s go over the business and why Uber is a great opportunity, shall we?

Business Overview

Uber is the company that turned the traditional taxi industry on its head. Before Uber, catching a ride meant standing on a curb, hoping to flag down a cab, or calling a taxi dispatch center and waiting—sometimes impatiently—without knowing exactly when your driver would arrive or how much it would cost. It was an industry ripe for disruption: outdated, inconsistent, and often inconvenient for the average consumer.

Founded in 2009, Uber reimagined this process by introducing a seamless mobile app that connected riders with drivers in just a few taps. Uber's brilliance wasn’t just about providing a ride but creating a smarter, faster, and more transparent system. Suddenly, you could summon a car to your exact location, track its arrival in real-time, see an upfront fare estimate, and pay digitally—no cash or awkward haggling involved. It was simple, efficient, and a massive upgrade to the passenger experience.

But Uber didn’t stop there. What started as a solution to get a quick ride without waving down a cab evolved into something much bigger: a global platform for transportation, food delivery, and freight logistics. The company recognized its technology could do more than just move people; it could move anything. From getting your favorite meal delivered to your door with Uber Eats to helping businesses ship goods through Uber Freight, Uber has expanded into a one-stop ecosystem for mobility.

The shift wasn’t just about convenience but also about unlocking flexibility and opportunity. By enabling anyone with a car to earn income as a driver-partner, Uber disrupted the taxi industry and the job market. Drivers could now work on their own terms, creating a new wave of gig-economy employment.

In less than two decades, Uber transformed an outdated system into an on-demand, technology-driven service that operates in over 70 countries. It redefined how we think about getting around, turned smartphones into keys to transportation, and cemented itself as a leader in the “platform economy”—a business model built on connecting people and services with unmatched speed and efficiency.

From a local ridesharing service in San Francisco to a global giant with aspirations to power the future of mobility, Uber’s journey is a testament to what happens when technology meets human needs at just the right time.

Uber One-pager

Investment Thesis on Uber

Uber is painting a clear picture in its investor’s presentation that was published. In Q1 2021, roughly 21% of the users on the Uber app were using more services that Uber provides on its app. This number increased with a whopping 66.67% to 31% in Q4 2023, that’s impressive growth for Uber. This shows us that Uber can easily upsell their services to its users.

In addition to this, average multi-product consumers spent over 3x more than single-product consumers. This means that Uber is gaining more users that use more of its services and is spending more with Uber. Of course, this should align because it is worrying if users are using more services, but the revenue per user is not increasing. Still, Uber is extremely capable of making single users turn into multi-product users and, in return, generate more revenue for its business. QoQ and YoY Uber are showing consistent growth in these aspects of the business, which, in return, creates more revenue and, again, creates more value for its shareholders.

Another excellent growth driver for Uber and its investors is Uber One

Uber One is a premium paid membership that Uber offers to its users. This membership will cost users $9.99 per month and Uber currently has a whopping 19M users paying $9.99 monthly for this membership. Uber has managed to grow its memberships 3x since Q4 of 2021, which is extremely impressive. These members also spend more on the Uber app, roughly 3,4x more than non-members.

You would think this is where it stops for Uber, right? That’s where you’re wrong.

With its platform, Uber is expanding into the health scene, advertising, and Uber Direct. This tells us that management is constantly on the lookout for new opportunities to seize and create a new sustainable source of revenue, driving more value to its users and in return to its shareholders.

Delivery Segment of Uber

In its Delivery segment, Uber saw its Gross Bookings increase to a whopping $65B in 2023 with a YoY growth of 15%. Uber profitability soared along with its adjusted EBITDA reaching $1.5B in 2023, where Uber ‘only’ had an adjusted EBITDA of ($0.06B) in 2018. Uber reached its market leadership by leading in seven out of the top ten counties by Gross Bookings.

Uber also saw impressive growth with its consumers, growing 8%, trips per customer growing by 11%, 11% more merchants on its platform, and a 29% increase in couriers.

And this is solely the delivery segment of Uber, this kind of growth was also visible in its Mobility segment, lets take a closer look.

Mobility Segment of Uber

In its Mobility segment, Uber saw a Gross Booking value of $70B with a whopping 32% increase YoY. Ubers profitability increased, too, reaching an adjusted EBITDA of $5.0B in 2023 when it came from an adjusted EBITDA of $1.5B in 2018. Also, here, Uber was the global leader operating in 70 countries.

Along with its impressive growth, the fleet grew, too. With a 75% increase in drivers, 56% increase in vehicles, 39% increase in consumers, and 13% increase in trips per customer.

Something I really was impressed with seeing is that Uber noted that even in its most matured market, Uber is growing its consumers at a strong pace.

Australia had a penetration rate of roughly 13%; this grew to roughly 18%.

Brazil had a penetration rate of roughly 14%, which grew to 17%.

Canada had a penetration rate of roughly 8%; this grew to 13%.

Even in its ‘most mature’ market, Uber is successfully increasing its operations.

Uber is planting seeds globally, with the likes of Spain, Germany, Japan, South Korea, Italy, and Germany.

And is doing it so successfully, according to the data. If we take a look at South Korea and Argentina, we see their gross bookings, which are 10x and 11x. Uber's international expansion is not going well, but it’s going excellent. Many businesses tend to struggle to grow internationally, but Uber makes it look like a piece of cake.

Ubers Earnings Outlook

This three-year outlook was given at the beginning of 2023. What caught my eye was that Uber is expecting its Free Cash Flow to be 90% of its adjusted EBITDA, which is impressive.

For Q4 2024 Uber anticipates Adjusted EBITDA of $1.78 billion to $1.88 billion, which would represents 39% to 47% YoY growth, that’s impressive. Now, let's 4x the adjusted EBITDA, let's take $1.85B, to get the projected annual adjusted EBITDA, this would be an adjusted annualized EBITDA of roughly $7.4B. Now, Uber aims to convert 90% into free cash flow, and this would result in a $6.66B, which is, again, very impressive for Uber.

Uber is expected to grow it annually by roughly 30% for the next two years, and this would result in an FCF of $11.25B by the end of 2026. Analysts expect roughly $10B in FCF for 2026, making that Uber could beat these estimates.

The AV Side of Uber

Uber isn’t just a ride-hailing app—it’s a global mobility ecosystem with an unmatched ability to aggregate demand and supply. While concerns about autonomous vehicles (AVs) have created short-term market noise, the reality is far less threatening and far more opportunistic for Uber.

The rise of AVs—like those from Waymo and Tesla—has sparked fears of disintermediation, leading to exaggerated reactions like Uber's recent stock drop. Here’s the truth: building an AV platform from scratch is incredibly costly, time-consuming, and risky. Uber already has what AV fleet operators desperately need:

160+ million monthly active users who open Uber when they need to get somewhere.

Billions of rides completed, generating unmatched data on routes, rider habits, and pricing—critical for optimizing AV deployment.

A hybrid platform that seamlessly integrates both human-driven and AV vehicles, ensuring unmatched flexibility and coverage.

For AV companies, partnering with Uber is a no-brainer. Trying to generate demand from scratch with limited AV fleets is like starting a fire with damp wood—slow, expensive, and inefficient. Uber is already the marketplace of choice, and it’s well-positioned to stay that way.

Adapt, Not Compete

Uber isn’t trying to build its own AVs—it’s building partnerships. By working with 14 AV suppliers (and counting), Uber avoids the capital-intensive R&D race while remaining the most efficient demand aggregator in the market.

Recent partnerships with WeRide, Waymo, and Aurora highlight its focus on being the AV platform of the future.

Uber’s entry into Abu Dhabi with commercial AVs shows its ability to scale partnerships globally.

Uber doesn’t need to “own” AVs; it just needs to host them. This strategy allows Uber to scale rapidly, cut costs, and future-proof its business as AV technology matures.

The AV market is projected to grow at a staggering CAGR of 63.5% through 2032. Uber is uniquely positioned to benefit:

AVs reduce cost per mile, making rides more affordable and increasing penetration into price-sensitive markets.

By integrating AVs, Uber improves margins—driver expenses shrink, but platform fees stay.

AV fleets will still require fleet management, charging infrastructure, and dynamic deployment, areas in which Uber already excels.

At scale, Uber becomes the central marketplace where AVs from Tesla, Waymo, and others compete for demand. Think of it as Amazon for rides—a neutral platform where all providers list their offerings.

Ubers Current Financials

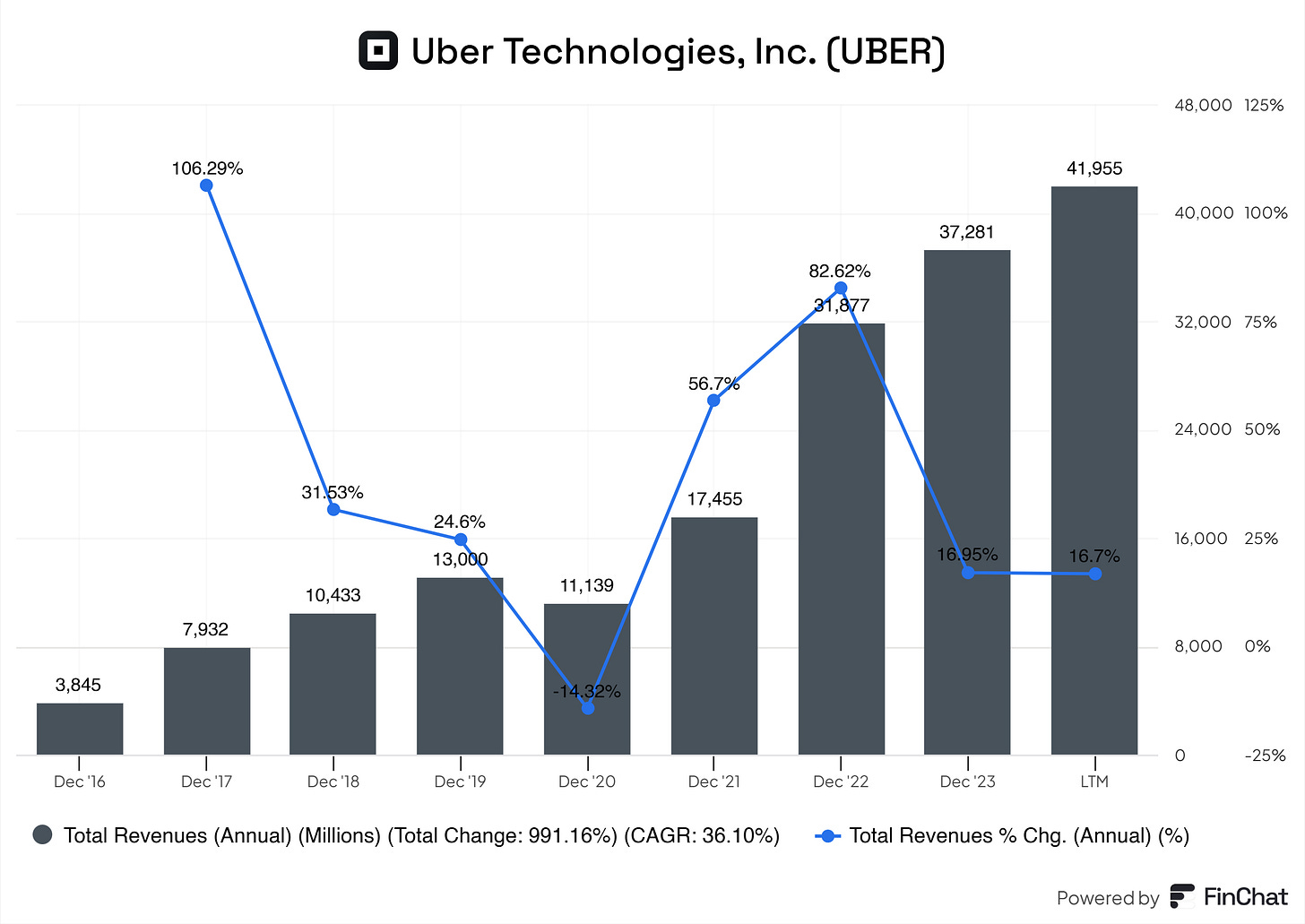

Uber has been growing its Total Revenue at double-digit rates, and it is expected to continue this growth rate for at least the next three years. Analysts expect roughly 18% growth for this year’s end, 16% for 2025, and 16% for 2026. I do think that these growth multiples are within Uber's reach and can/should be achieved.

Along with excellent total revenue growth, Uber’s net income should become more stable and profitable for the years to come. With Uber’s margin expansion, cost reduction, expansion, and overall better control, I estimate that Uber will end the year with $4B in net revenue, $5B in 2025, and $7B in 2026.

While we’re on the balance sheet, I do want to note the outstanding shares of Uber.

Uber has notoriously been diluting its shareholders; it’s not that relaxing to see that you’re being diluted with a positive CAGR of 24%.

But Uber did mention tackling the dilution, that is a positive sign. I am eager to see the dilution stock and also the likes with its stock-based compensation.

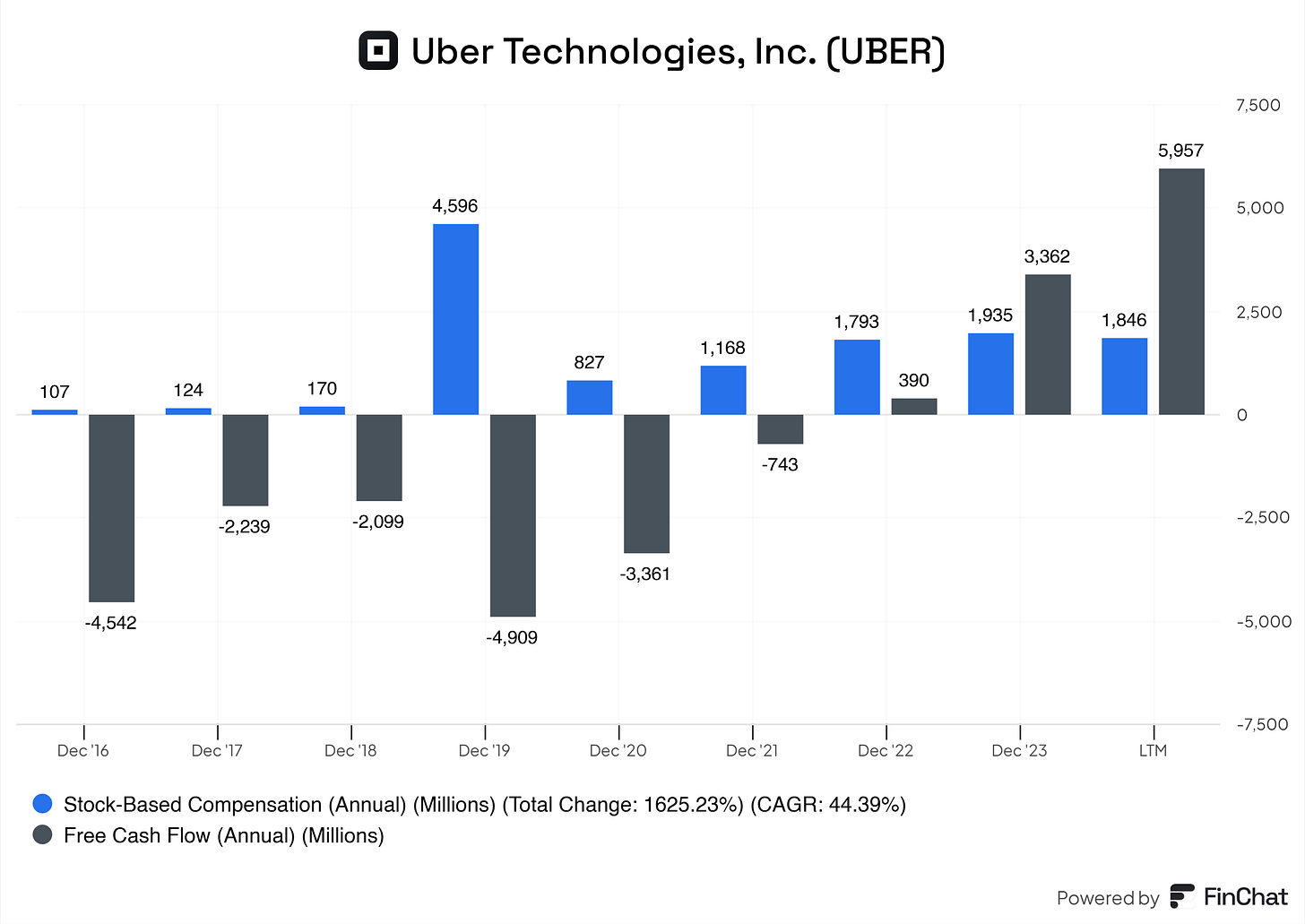

As you can see, SBC is taking up a large chunk compared to Uber’s FCF. Tackling the stock-based compensation would already be a good start for Uber in preventing further dilution; that would be step 1. Uber has enough equity to fund and invest in the business; raising more equity by handing out more shares seems.. useless as of now.

I will not go over Uber's balance sheet. Uber has a strong and healthy balance sheet, and for now, I do not see any red flags or items that we should keep an eye out for.

Uber's cash flow, as seen above, is modest, but SBC is taking up a huge chunk of it. Once SBC stops, I can be more pleasant about the FCF of Uber. But, for now, it is modest but does need to be kept in our sight.

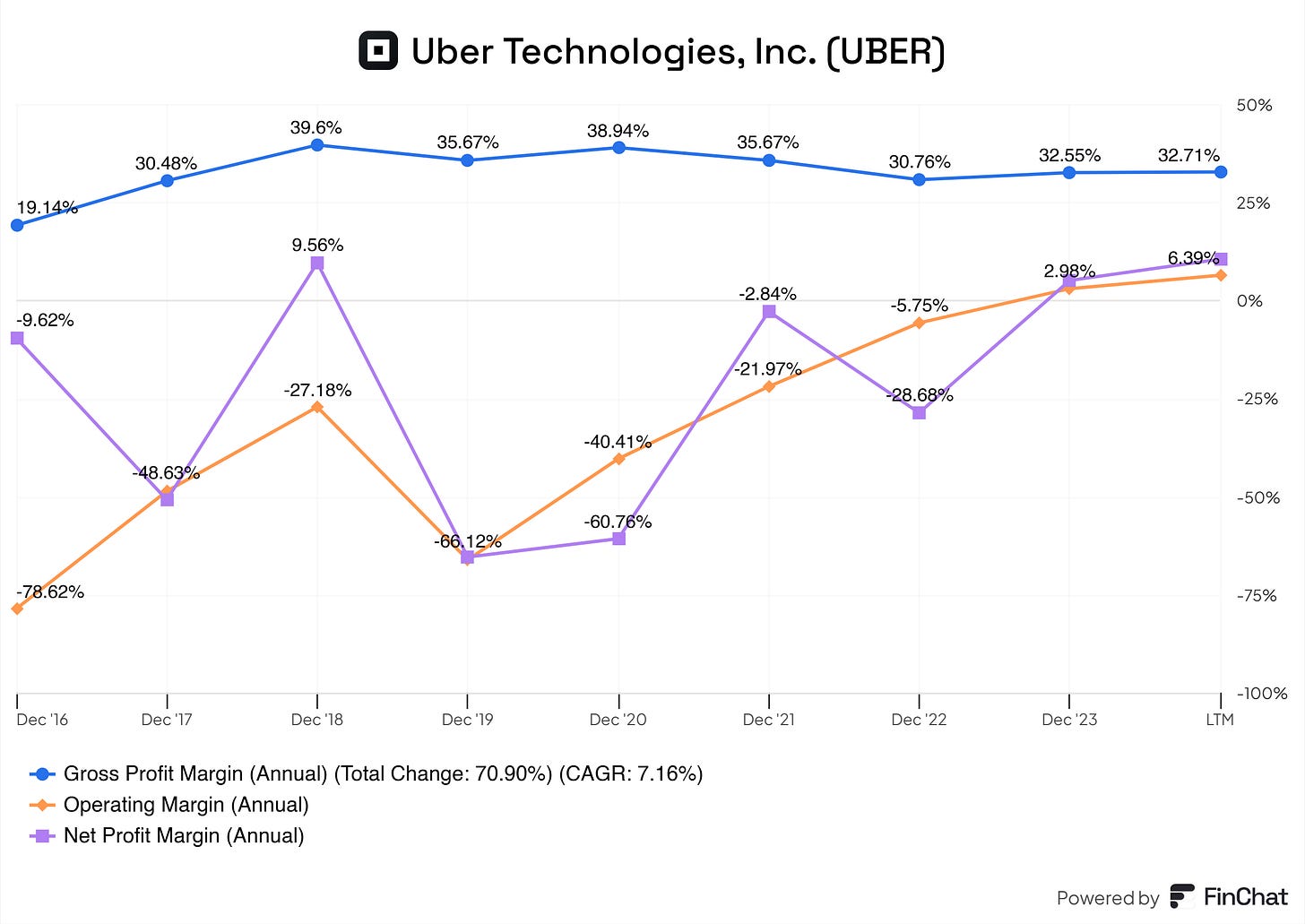

Uber is on its way with its margin expansion; they’re doing excellent. As the business keeps maturing, the margins will follow, especially with the way that Uber is currently going. Gross Profit Margins should and could remain stable at its current levels and I would love to see its Net Profit Margin reach 12%-14%, and operating margin between 8% and 10%.

Usually, I love to discuss the capital efficiency of the business, but Uber is not in the right phase right now. Uber has just been profitable, shifting the metrics all over the place. Also, with the current phase of Uber, hammering down on its ROIC and ROCE would be like asking a banana to start acting like an apple, bogus.

Now, what we’re all waiting for is the valuation of Uber.

Valuation

Discounted Cash Flow Method: $108.84

Multiples Valuation: $46.12

Benjamin Graham Valuation: $96.83

With the DCF I used a 17% growth rate, 2.5% perpetual growth rate, and 9% discount rate.)

End note

Thank you for reading!

Please note that anything I write about on all my platforms should not be considered investment advice. These are my humble opinions, and you should always research before making any decision, especially regarding investments. Please read the full disclaimer below.

Disclaimer

I do not own Uber shares and I do not intend on buying shares in the next six months.

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.

Great analysis, Fluent! 👏🏻👏🏻

Just finished reading the entire analysis—so much valuable information! It makes me even more convinced about UBER in the long run. Some data may no longer be relevant, but that doesn’t take away from the overall value of the insights. Thanks for this great analysis!