Adobe Delivers Stellar Earnings, Yet Falls Short Against Market Expectations

A deep dive into Adobe's latest earnings report, its standout performance, and why the market remains unimpressed.

Hey there, partner! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Please share it on your social media

Comment below to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

Welcome to the first earnings review here on FluentInQuality!

Adobe's Q4 2024 earnings release showcased another record-breaking performance. The company reported revenue of $5.61 billion, an 11% year-over-year increase. This was driven by double-digit growth across its core segments: Creative Cloud, Document Cloud, and Experience Cloud. The Digital Media segment, which includes Creative Cloud and Document Cloud, grew by 12% year-over-year. Document Cloud revenue alone surged by 17%, demonstrating strong adoption of Adobe's AI-powered offerings.

In addition to revenue growth, Adobe's profitability metrics also improved significantly. GAAP earnings per share (EPS) grew to $3.79, up 17% from $3.23 in the prior-year quarter, while non-GAAP EPS rose to $4.81, a 13% increase from $4.27. Operating cash flows for the quarter reached a record $2.92 billion, further underscoring the company's financial strength.

However, despite these impressive numbers, Adobe's stock dropped 10% in after-hours trading. The decline stemmed from the company’s cautious guidance for fiscal year 2025, which projects slower-than-expected growth. While the market reacted negatively to this outlook, Adobe’s business fundamentals remain strong, positioning it as a long-term leader in the digital transformation and AI economy.

Highlights of Q4 2024

Record Revenue and Strong Growth Across Segments

Adobe reported record revenue of $5.61 billion for Q4 2024, an 11% year-over-year (YoY) increase. This growth underscores the company’s ability to capitalize on demand across its product portfolio.

Revenue by segment:

Digital Media segment: Contributed $4.15 billion, representing a 12% YoY growth. This segment includes Creative Cloud and Document Cloud, which demonstrate robust performance.

Creative Cloud revenue: Reached $3.30 billion, reflecting a 10% YoY increase. Growth was driven by continued customer adoption of AI-powered features and enhancements to the Creative Suite.

Document Cloud revenue: Grew by 17% YoY to $843 million, supported by strong demand for productivity and collaboration tools like Adobe Acrobat and Sign.

Digital Experience segment: Delivered $1.40 billion in revenue, reflecting a 10% YoY increase, with subscription revenue growing 13% to $1.27 billion. This growth was fueled by enterprises leveraging Adobe’s data-driven marketing tools.

Improved Profitability Metrics

GAAP operating income for Q4 2024 was $1.96 billion, compared to $1.74 billion in the same quarter last year, demonstrating strong operational efficiency.

GAAP net income was $1.68 billion, an increase from $1.48 billion in Q4 2023, driven by top-line growth and effective cost management.

GAAP diluted earnings per share (EPS) rose to $3.79, up 17% from $3.23 in Q4 2023.

Operating income reached $2.60 billion, an improvement from $2.34 billion YoY.

Non-GAAP EPS was $4.81, a 13% increase from $4.27 in Q4 2023.

Exceptional Cash Flow Generation

Adobe generated record operating cash flows of $2.92 billion during the quarter, underscoring its ability to convert earnings into cash and support future investments or shareholder returns.

The company repurchased approximately 4.6 million shares during Q4 2024, reflecting its ongoing commitment to enhancing shareholder value.

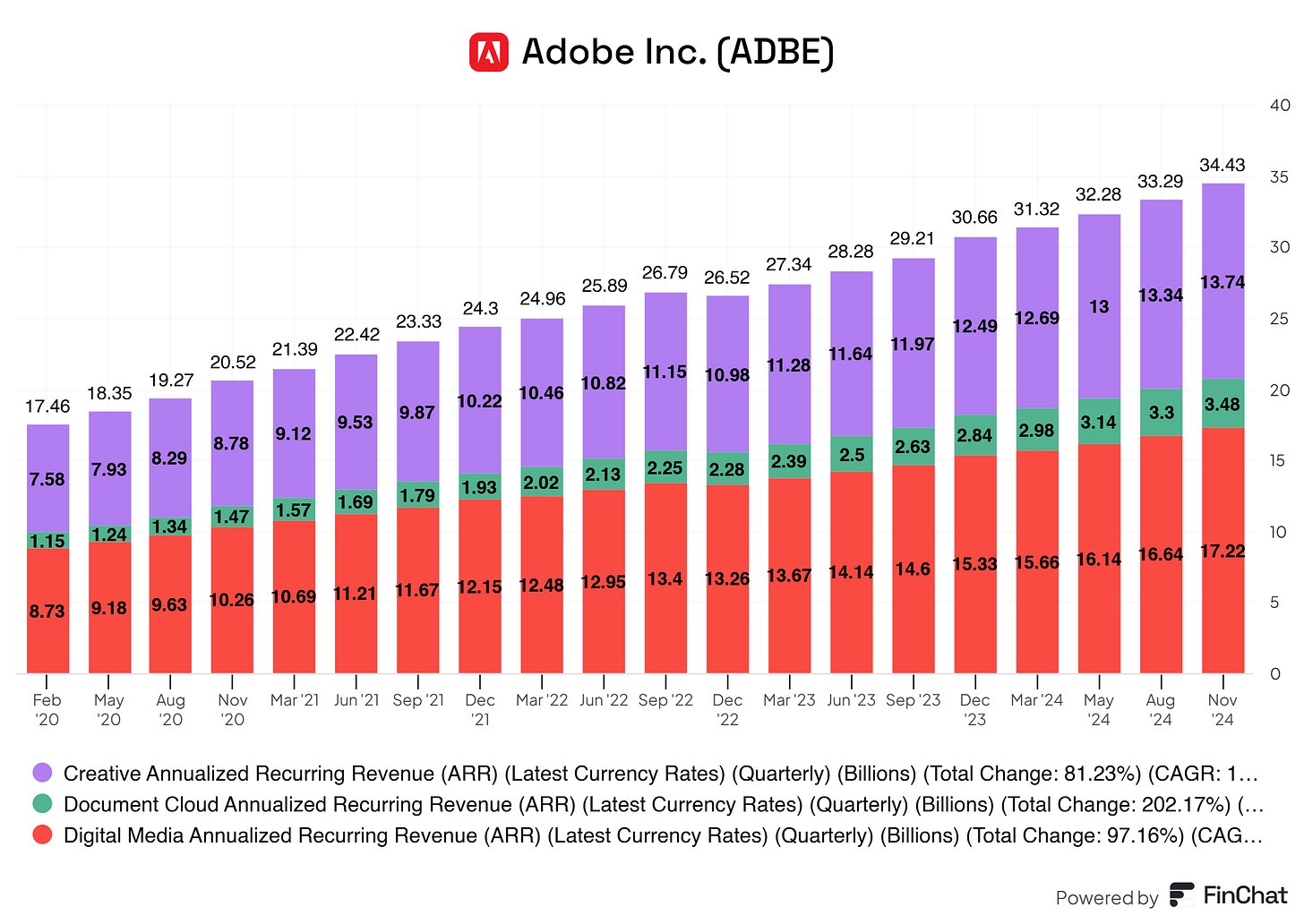

Annualized Recurring Revenue (ARR) Growth

Net new Digital Media ARR increased by $578 million during the quarter, totaling $17.33 billion. This is a testament to Adobe's ability to lock in long-term customer commitments.

Creative ARR grew to $13.85 billion, while Document Cloud ARR reached $3.48 billion.

Robust Remaining Performance Obligations (RPO)

Adobe exited the quarter with remaining performance obligations (RPO) of $19.96 billion, a 16% YoY growth. This highlights the company’s ability to secure long-term contracts and predictable revenue streams.

The 2025 Outlook and Market Reaction

Adobe has provided its guidance for fiscal year 2025, setting a more cautious tone than its previous growth trajectory. The company expects revenue to range between $23.30 billion and $23.55 billion for the year, representing an 8-10% year-over-year increase. While this growth rate is healthy, it marks a slight deceleration compared to the 11% growth achieved in 2024. Within the Digital Media segment, revenue is forecasted to reach $17.25 billion to $17.40 billion, reflecting moderated expectations for its core products. Similarly, the revenue of the Digital Experience segment is projected to grow steadily, with the company anticipating generating between $5.80 billion and $5.90 billion.

As it navigates a slower growth environment, profitability remains a focal point for Adobe. The company expects GAAP diluted earnings per share to range between $15.80 and $16.10, while non-GAAP EPS is projected to reach $20.20 to $20.50. This demonstrates Adobe’s continued emphasis on managing costs and maintaining strong operating margins, forecasted at approximately 46% on a non-GAAP basis. The company also reiterated its commitment to investing in key growth areas, particularly artificial intelligence and cross-cloud integrations, to reinforce its competitive positioning and drive customer adoption.

However, the market’s response to Adobe’s guidance was swift and negative. Following the earnings release, the stock dropped by approximately 10% in after-hours trading. Investors were concerned about the slower growth trajectory and its implications for Adobe’s long-term potential. The deceleration in revenue growth, particularly within the high-margin Digital Media segment, has raised questions about whether the company can sustain the momentum it has built over the years. This concern is amplified by the tech sector’s broader volatility amid macroeconomic uncertainty, which has heightened scrutiny of companies perceived to be entering a more mature growth phase.

Despite the immediate market reaction, Adobe’s underlying fundamentals remain robust. The company concluded 2024 with a record $17.33 billion in Annualized Recurring Revenue (ARR) for its Digital Media offerings, an increase of $2 billion over the fiscal year. Additionally, its Remaining Performance Obligations (RPO) grew 16% year-over-year to a staggering $19.96 billion, providing long-term visibility into revenue streams. These metrics underscore Adobe’s ability to maintain a recurring revenue base, even in challenging market conditions.

While the cautious outlook weighed on investor sentiment, Adobe’s long-term growth drivers remain intact. The company’s innovative integration of artificial intelligence across its Creative Cloud and Document Cloud platforms has improved customer workflows and expanded its addressable market. By continuing to enhance its AI capabilities and invest in its ecosystem, Adobe is positioning itself to capture the next wave of digital transformation across creative, productivity, and enterprise tools.

For long-term investors, the post-earnings pullback might present an opportunity to acquire shares in a company that consistently delivers operational excellence and industry leadership. While the market focuses on near-term challenges, Adobe’s strategic investments and enduring customer relationships suggest it remains well-positioned to navigate these headwinds and emerge even stronger in the years ahead.

Why the Long-Term Story Remains Intact

Adobe’s strong financial foundation, consistent innovation, and leadership in multiple digital markets underpin its long-term growth story, even amid short-term market concerns. Despite the tempered outlook for fiscal year 2025, the company remains one of the most resilient and innovative players in the technology sector.

Central to Adobe’s enduring strength is its business model, which relies heavily on recurring revenue streams. The company concluded fiscal year 2024 with $17.33 billion in Annualized Recurring Revenue (ARR) for its Digital Media segment, a testament to its ability to retain customers and drive consistent subscription growth. This model provides significant revenue visibility, as evidenced by its Remaining Performance Obligations (RPO), which grew to a record $19.96 billion, up 16% year-over-year. These figures demonstrate the stability and predictability of Adobe’s cash flows, even in less favorable market conditions.

Another critical factor is Adobe’s ongoing commitment to innovation, particularly in artificial intelligence. The company has been at the forefront of integrating generative AI into its flagship platforms, including Creative Cloud and Document Cloud. These advancements reshape the creative and productivity landscapes, making Adobe’s tools indispensable for professionals and enterprises. By embedding AI-driven features that enhance efficiency and unlock new capabilities, Adobe is driving customer retention and expanding its addressable market. This strategic focus ensures that the company remains a leader in its core segments while simultaneously positioning itself to capture emerging opportunities.

Adobe’s financial discipline further reinforces its long-term investment appeal. The company’s ability to generate substantial cash flows—$2.92 billion in Q4 2024 alone—allows it to invest in strategic initiatives, fund share repurchase programs, and strengthen its balance sheet. This operational efficiency, combined with its focus on high-margin subscription offerings, allows Adobe to maintain profitability even as it navigates a slower growth environment.

Adobe’s diversified portfolio across Creative Cloud, Document Cloud, and Digital Experience Cloud ensures it is not overly reliant on any segment or product. Each platform is crucial in enabling digital transformation across industries, from creative professionals to large enterprises seeking data-driven marketing solutions. This diversification provides a hedge against potential slowdowns in individual markets and underscores the breadth of Adobe’s value proposition.

For long-term investors, Adobe represents a rare combination of growth, innovation, and resilience. The recent market pullback reflects concerns about short-term growth moderation but does not diminish the company’s position as a cornerstone of the digital economy. Adobe’s focus on delivering value through cutting-edge technology, its expansive customer base, and its robust financials all point to a business well-equipped to adapt to and thrive in an ever-evolving market landscape.

In summary, while the market has focused on Adobe’s cautious near-term guidance, its long-term trajectory remains compelling. With a solid foundation in recurring revenue, industry-leading innovation, and a commitment to operational excellence, Adobe is poised to continue delivering sustainable growth and value for its shareholders well into the future.

Closing Argument: Consistent Excellence Across Quarters

Adobe’s performance throughout fiscal year 2024 demonstrates why it remains a cornerstone of the digital economy and a high-quality business. Across every quarter, Adobe delivered consistent growth, strong profitability, and a clear commitment to innovation, reinforcing its position as a market leader.

In Q1 2024, Adobe's revenue was $5.18 billion, growing 11% year over year. This set the tone for a year of steady expansion across its Creative, Document, and Digital Experience Clouds. Even at the start of the fiscal year, Adobe showcased its ability to harness artificial intelligence to drive tool adoption, a theme that would define its success throughout 2024.

Q2 saw Adobe extend its growth streak, reporting revenue of $5.31 billion, up 10% year-over-year. The quarter highlighted the resilience of its subscription-based model, with Digital Media ARR growing to $16.25 billion. Strong customer adoption of AI-enhanced features continued to fuel demand, while operating cash flows surged to $1.94 billion, demonstrating exceptional operational efficiency.

In Q3, Adobe reached new heights, generating $5.41 billion in revenue, an 11% year-over-year increase. The company exited the quarter with $18.14 billion in remaining performance obligations (RPO), a 15% growth that underscored its ability to lock in long-term customer commitments. Adobe’s Document Cloud ARR alone reached $3.31 billion, highlighting its dominance in productivity tools.

Finally, Q4 capped off the year with record revenue of $5.61 billion, marking another 11% year-over-year growth. Operating cash flows hit $2.92 billion, the highest for the year, and Digital Media ARR surpassed $17.33 billion. By year-end, Adobe had generated $21.51 billion in annual revenue and $8.06 billion in cash flows from operations, solidifying its reputation for delivering exceptional financial results.

This consistent quarterly performance illustrates why Adobe is more than just a growth story—it is a business built on robust fundamentals. Its subscription-based model provides recurring and predictable revenue, while its focus on AI and innovation ensures it stays ahead of competitors. With a diversified product portfolio spanning creative, productivity, and enterprise solutions, Adobe is uniquely positioned to capture opportunities across multiple markets.

The market’s reaction to its FY 2025 guidance may reflect short-term concerns, but the broader narrative is clear: Adobe is a quality business with a proven track record of resilience, adaptability, and leadership. Its ability to consistently deliver growth and profitability for long-term investors makes it a compelling choice in the tech space.

Snapshot of Previous Earnings and Reactions

Disclaimer

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.

Great article! Thank you!