9 Brilliant and Timeless Lessons Charlie Munger Has Taught Us—But Nobody Is Applying

These Munger principles will boost your results—if you actually apply them

Charlie Munger has provided investors worldwide, including me, with tremendous knowledge and mental models for performing at the highest level possible.

Although Munger has provided us with heaps of knowledge, many investors either do not apply his knowledge or tend to forget the importance of his expertise and lessons. This isn’t bad, not at all. But it does limit your success in the stock market, leaving significant returns on the table.

Here are nine timeless lessons Munger has taught us that will add tremendous value on a personal and investment level.

Timeless Lesson #1: Invert, Always Invert

"All I want to know is where I'm going to die, so I'll never go there."

What if solving a problem backward gave you the answer faster than going forward?

Most people seek success by chasing the right moves. Munger flipped that. He looked for what not to do and simply avoided it. You build guardrails around your behavior by inverting problems—asking "How can I fail?" instead of "How can I win?". This mindset reduces big mistakes, often more valuable than making brilliant moves.

The best investors aren't just savvy. They're excellent at avoiding stupidity.

Try this:

List 5 ways you could ruin your portfolio this year. Avoid those first.

Before any decision, ask: “What would guarantee failure?”

Add a “Don’t do” list to your investing checklist.

Study case studies of major blowups—learn what not to do.

Timeless Lesson #2: Know Your Circle of Competence

"Knowing what you don’t know is more useful than being brilliant."

The quickest way to lose money? Thinking you know more than you do.

Munger constantly emphasized knowing your own limits. You probably don't understand if you can’t explain how a business makes money in 1–2 sentences.

Staying inside your circle of competence doesn’t mean you never expand it—it means you’re honest about where it ends. Operating inside it creates confidence, clarity, and fewer errors.

You don’t need to be brilliant everywhere. Just competent in a few places.

Try this:

Define your circle: which industries or businesses do you truly understand?

Write a 2-sentence stock summary before buying—can you explain it simply?

Say “I don’t know” more often—it’s a strength.

Spend more time deepening your circle than expanding it too fast.

Timeless Lesson #3: Just Sit On Your Ass

"The big money is not in the buying or selling, but in the waiting."

Great returns often come from doing absolutely nothing.

In a world obsessed with action, Munger stood still. When he found a great business, he held it—and let compounding do the heavy lifting.

Impatience is the enemy of compounding. Markets tempt you to act constantly, but doing less often leads to more.

The hardest part of investing is not analysis—it’s sitting still when everyone else is moving.

Activity feels productive. But inactivity, when paired with quality, is powerful.

Try this:

Write down the holding period you plan for each investment.

Read about companies like Coca-Cola or Costco that Munger held for decades.

Check your portfolio monthly, not daily.

Replace the question “What should I buy?” with “What should I never sell?”

For your information: If you refer just 10 friends, you’ll unlock one month of free access to FluentInQuality PRO, which includes deep dives, best buys, and exclusive insights.

Timeless Lesson #4: Envy Is The Silent Killer

"Envy is a really stupid sin because it’s the only one you could never possibly have any fun at."

Comparison is the thief of both joy and good judgment.

Envy drives people to chase fads, time markets, and copy others' portfolios. Munger said it was the most useless emotion—painful without payoff.

It makes you abandon your strategy because someone else made money faster. That’s a losing game.

Successful investing comes from clarity, not comparison.

Ignore the scoreboard. Focus on your game.

Try this:

Mute or unfollow accounts that constantly show off wins or hype stocks.

Revisit your personal goals—are you trying to beat someone or build something?

Write down your investment thesis before reading opinions.

Practice gratitude—track your own progress, not someone else’s.

Timeless Lesson #5: Use a Multi-Disciplinary Toolkit

"You must know the big ideas in the big disciplines and use them routinely—all of them, not just a few."

You'll miss 90% of what matters if you only think in one way.

Munger believed the best decisions come from combining ideas from different fields, such as psychology, economics, math, history, and biology. It helps you see systems, incentives, and second-order effects that others miss.

This edge isn’t about IQ—it’s about perspective.

The more models you use, the fewer blind spots you have.

Try this:

Learn one concept from a field outside investing each month.

Study behavioral psychology—understanding yourself = understanding markets.

Read “Poor Charlie’s Almanack” for his favorite models.

Before making a decision, ask: “What lenses am I using? What am I missing?”

Timeless Lesson #6: Avoid Permanent Capital Loss

“It’s remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

You can’t compound if you lose your base.

Munger prioritized not losing money over making lots of it. Why? Because a 50% loss requires a 100% gain to break even. It’s not about avoiding volatility—it’s about avoiding permanent impairment: fraud, bad business models, overleverage.

Playing defense means you stay in the game long enough to let offense (compounding) work.

Survival is underrated. Avoiding ruin is a strategy.

Try this:

Avoid businesses with high debt and no clear cash flow.

Limit position sizes in speculative stocks.

Use stop-losses or mental sell-points on risky holdings.

Focus more on downside risk than upside potential.

Timeless Lesson #7: Be Rational, Even When It’s Hard

‘‘A lot of people with high IQs are terrible investors because they've got terrible temperaments.”

Emotion is the silent killer of returns.

Markets swing. Narratives shift. But Munger stayed even-keeled. He believed temperament mattered more than intelligence—and that most people fail not because they’re dumb, but because they can’t stay calm. Rationality means slowing down, thinking independently, and avoiding knee-jerk decisions.

Discipline > dopamine.

Try this:

Before buying/selling, wait 24 hours. Let emotions cool.

Write down why you're acting—fear, FOMO, or logic?

Track emotional trades and compare performance.

Meditate, journal, or do anything to sharpen your mental clarity.

Timeless Lesson #8: Look for Lollapalooza Effects

‘‘When you get lollapalooza effects, things go nonlinear.”

When multiple forces align, results go exponential.

Munger loved finding businesses with multiple advantages: strong brands, great management, cost leadership, customer loyalty, etc. These “Lollapalooza effects” lead to dominant companies that snowball faster than others realize. Most investors only spot one factor—they miss the compounding power of overlap.

Look for multiple tailwinds—not just one.

Try this:

When analyzing a company, identify 3+ advantages, not just one.

Look for flywheel effects: where one strength fuels another.

Study Amazon, Apple, Costco—classic Lollapalooza cases.

Create a checklist: Are the advantages reinforcing each other?

Timeless Lesson #9: Always Keep Learning

“In my whole life, I have known no wise people who didn’t read all the time — none, zero.”

The best investors compound knowledge faster than capital.

Munger read constantly. He treated learning like breathing—non-negotiable.

He didn’t just learn about stocks—he studied history, biology, physics, and psychology. Each bit of knowledge became another tool, another edge.

The more you learn, the more patterns you see.

Try this:

Read 30 minutes every day. No excuses.

Alternate between investing, psychology, and biographies.

Join a learning group or book club to stay accountable.

Reflect weekly: What did I learn? How can I apply it?

Before You Go

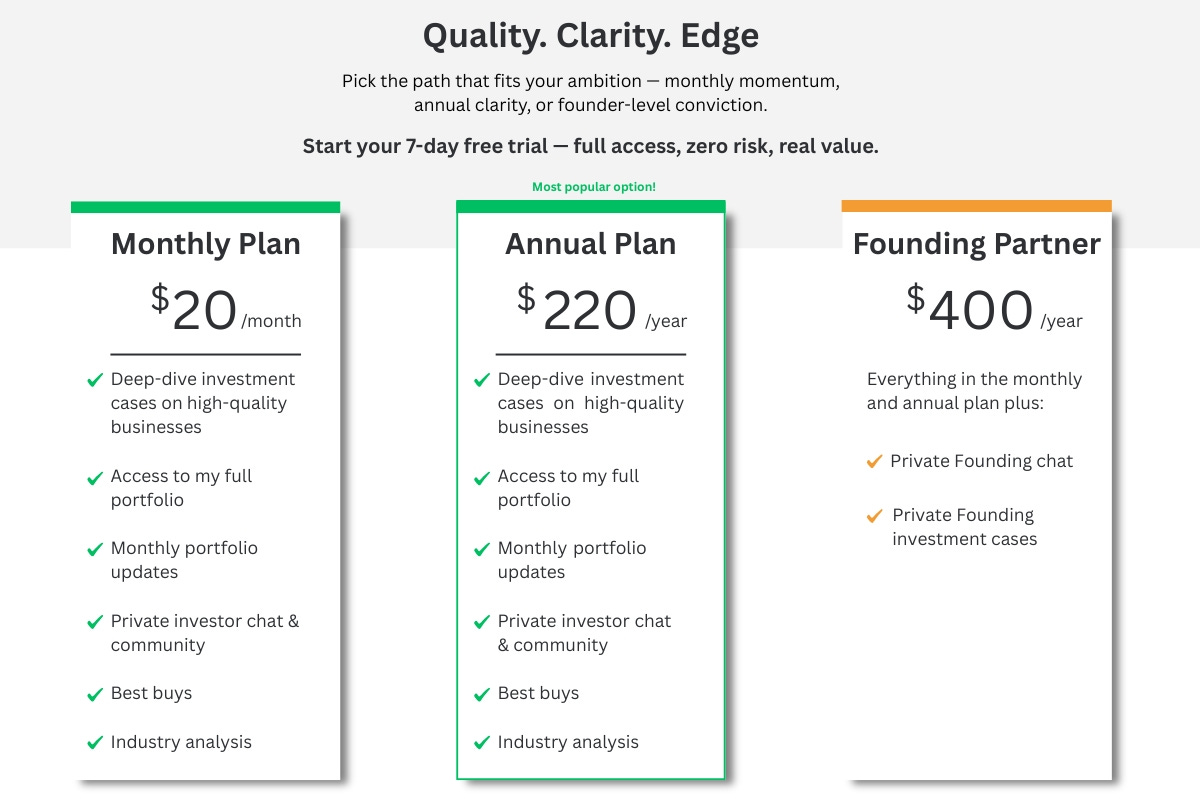

FluentInQuality PRO is the best it will ever be — and right now, it’s the cheapest it will ever be.

Why? Because I’m not chasing hype. I’m building long-term value for myself and the community of quality-focused investors growing here with me.

If you're serious about investing with clarity, discipline, and an edge...

The next piece drops this week.

🎁 Want Free Access?

Every friend you refer gets you closer to unlocking FluentInQuality PRO for free.

Share your unique link, and you’ll rack up rewards faster than compound interest.

Help me shape FluentInQuality into something you love opening every week.

💬 What topics do you want me to cover next?

💬 What was your favorite takeaway from this edition?

Drop a comment — I read and respond to every one.

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all my charting, fundamental analysis, and earnings tracking. You can now get 15% off for life on your subscription. Click here to start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.