8 Wide and Deep Moat Companies You Must Know!

Winners tend to keep on winning. Here are 8 winners that could help your portfolio keep on winning.

Imagine you're storming a castle. Not just any castle, but one surrounded by towering stone walls, crocodile-infested moats, and archers ready to fire at anything that comes too close. Some businesses are like that—impenetrable, untouchable, and built to withstand waves of competition.

Today, we’re diving into 8 companies with the strongest, most unshakable moats in the market. These aren’t just good businesses but fortresses where rivals break their backs trying to compete. So sharpen your swords (or stock picks), and let’s ride into the most vigorous economic strongholds out there.

Happy reading!

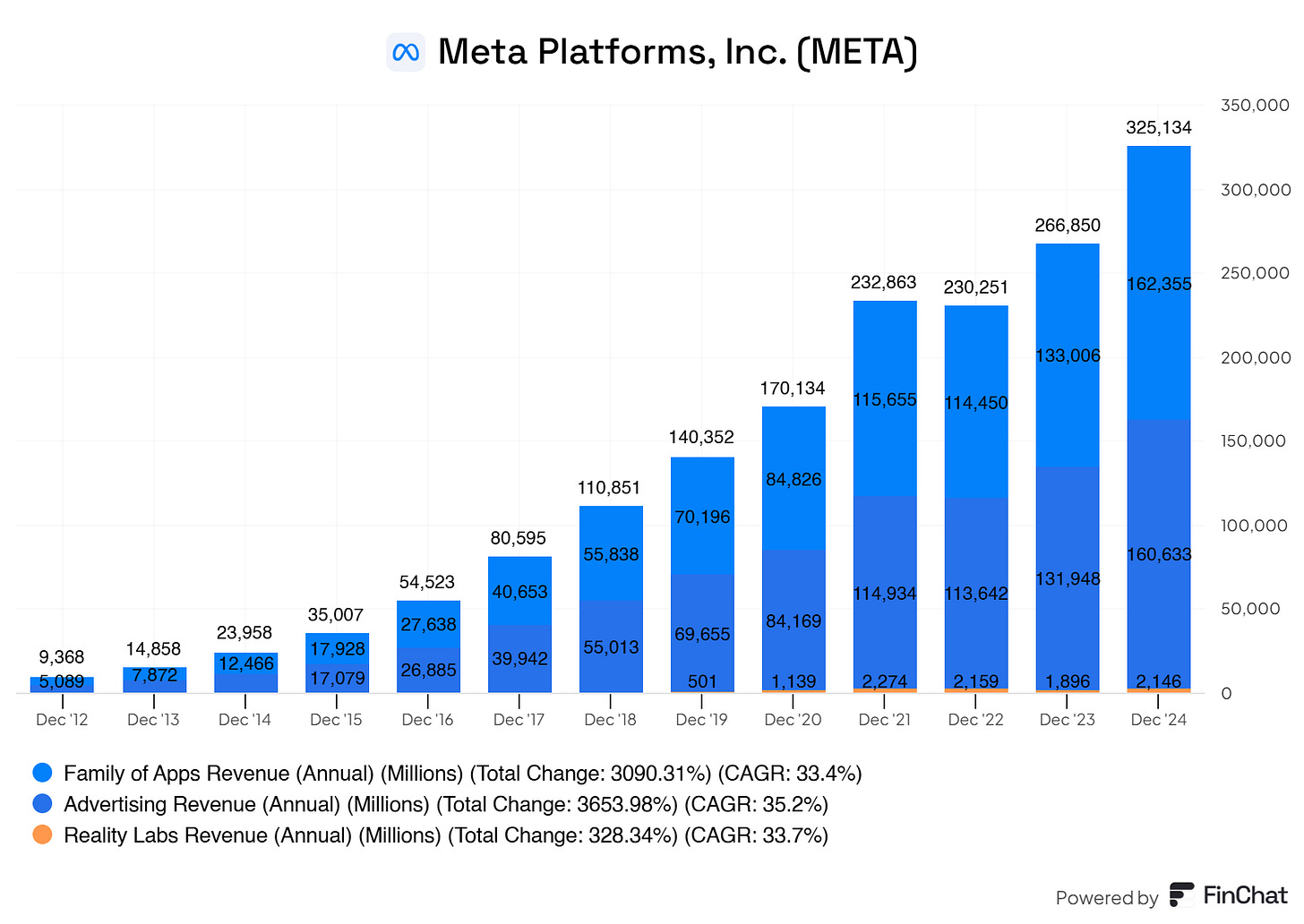

8. Meta Platforms, Inc.

Meta Platforms is the social media empire.

Strategic acquisitions turned Meta into the most dominant social media player today.

It started with Facebook. Then came the game-changing buyouts:

Instagram

WhatsApp

Oculus

Each move? Strengthened their moat. Eliminated competition. Cemented dominance.

More than just social media.

Meta isn’t just about feeds and likes anymore. It’s expanding into:

Family of apps

Reality Labs

VR & AR

They’re perfectly positioned for the future—staying ahead of trends and ahead of competition.

A moat built in just two decades.

Facebook may have launched in 2004, but since then, it has:

Fought off competitors

Blocked new entrants

Created a deep, wide moat in digital engagement

The beauty of it all?

Insane margins.

Mark Zuckerberg still owns 13.5% of the company.

Founder-led, shareholder-aligned, and value-driven.

Meta isn’t just surviving. It’s built to last.

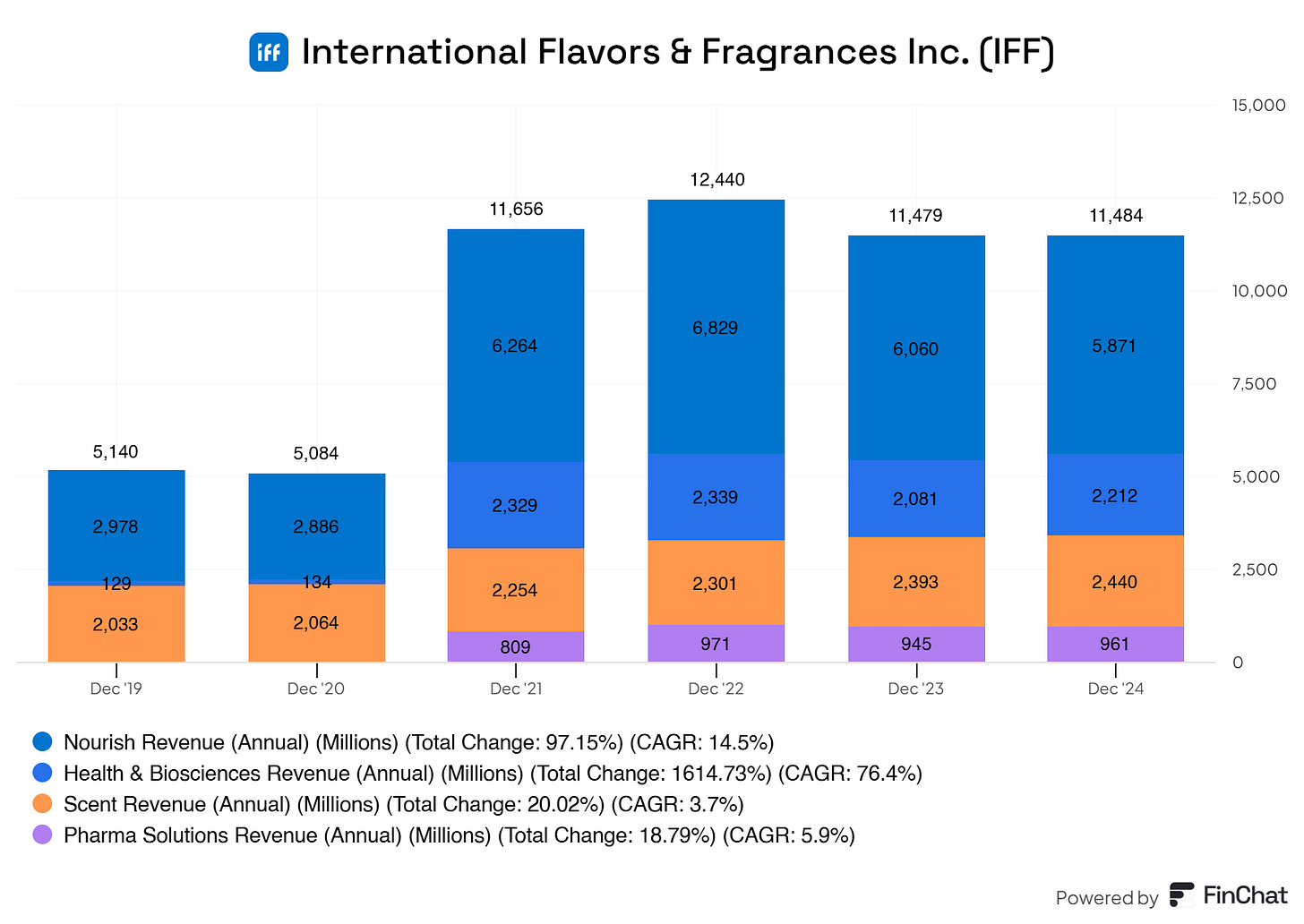

7. International Flavors & Fragrances (Ticker: IFF)

IFF is the silent giant behind what you taste & smell.

International Flavors & Fragrances (IFF) isn’t just another company—it’s the backbone of countless products you interact with daily.

Luxury perfumes? IFF is there.

Your favorite foods? IFF is behind the flavors.

Personal care & home products? IFF plays a key role.

A moat that keeps expanding

Through strategic acquisitions, including a massive merger with DuPont’s Nutrition & Biosciences division, IFF has:

Deepened its competitive moat

Strengthened its market position

Become the go-to supplier across multiple industries

From food & beverage to pharmaceuticals, IFF dominates the flavor, fragrance, and specialty ingredients markets.

Leading consumer trends, not following them.

IFF is perfectly positioned at the intersection of shifting consumer preferences:

Natural ingredients

Health & wellness

Sustainable production

Biotech-driven innovation

As demand for clean-label, sensory-driven products grows, IFF isn’t just keeping up—it’s leading.

A legacy of strength

Founded in 1889, IFF has spent over a century widening its moat.

Its strength?

Proprietary formulas

Deep customer relationships

High switching costs for clients who depend on IFF's expertise.

The bottom line?

Beyond strong margins and an unmatched competitive edge, IFF keeps innovating and evolving.

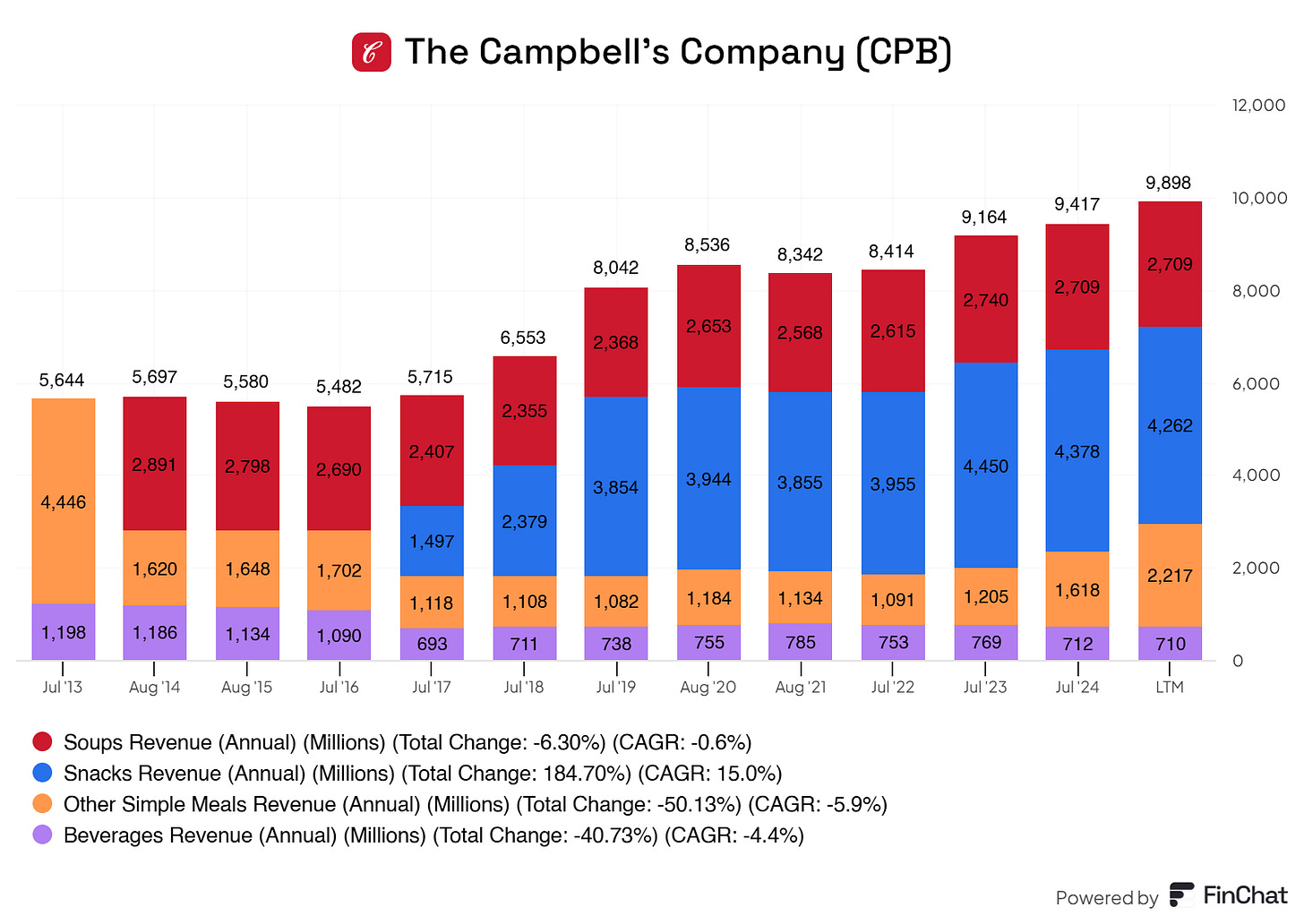

6. The Campbell's Company (Ticker: CPB)

Campbell’s is more than just soup.

It’s a staple in American households and a powerhouse in packaged foods.

From classic canned soups to a dominant snack empire, Campbell’s owns:

Pepperidge Farm

Goldfish

Snyder’s

Kettle Chips

Grocery aisles? Campbell’s quietly dominates them.

A moat built on acquisitions

Strategic buyouts like Bolthouse Farms, Pacific Foods, and Snyder’s-Lance strengthened its position.

Soups? Still the leader.

Snacks? A growing empire.

This diversified lineup gives Campbell’s the ability to adapt to changing consumer trends while keeping a firm grip on convenience foods.

Perfectly positioned for time

In a world of inflation and shifting habits, Campbell’s plays right into two major trends:

Affordable at-home meals – Families seek value. Campbell’s delivers.

Snacking culture – On-the-go and pantry staples? Campbell’s owns them.

A legacy that keeps improving and getting better.

Founded in 1869, Campbell’s has:

Massive brand strength

Unmatched distribution power

Pricing leverage & strong retailer relationships

New entrants? Breaking in isn’t easy.

At the end?

5. Brown-Forman Corporation (Ticker: BF.B)

Brown-Forman: The King of Premium Spirits.

It’s not just another liquor company—it’s a global powerhouse in high-end spirits.

With Jack Daniel’s, Woodford Reserve, Herradura, and Old Forester, Brown-Forman has built a legacy of:

Quality

Heritage

Market dominance

Their moat?

Strategic acquisitions and brand expansions have:

Deepened its competitive edge

Kept its brands at the top of the premium spirits market

Expanded its global reach to meet rising demand

The future is bright!

Two major trends are fueling growth:

Premiumization – Consumers are trading up to higher-end spirits. Brown-Forman is there to meet demand.

Global spirits consumption – Emerging markets are booming, giving Brown-Forman a massive growth runway.

A true legacy

Founded in 1870, Brown-Forman has built:

Unmatched brand strength

Pricing power that few can rival

Deep distributor relationships that keep competitors out

The premium spirits market isn’t easy to break into, and Brown-Forman’s moat ensures it stays on top.

High brand loyalty

Strong margins & steady cash flow

Family-controlled, ensuring long-term focus over short-term noise

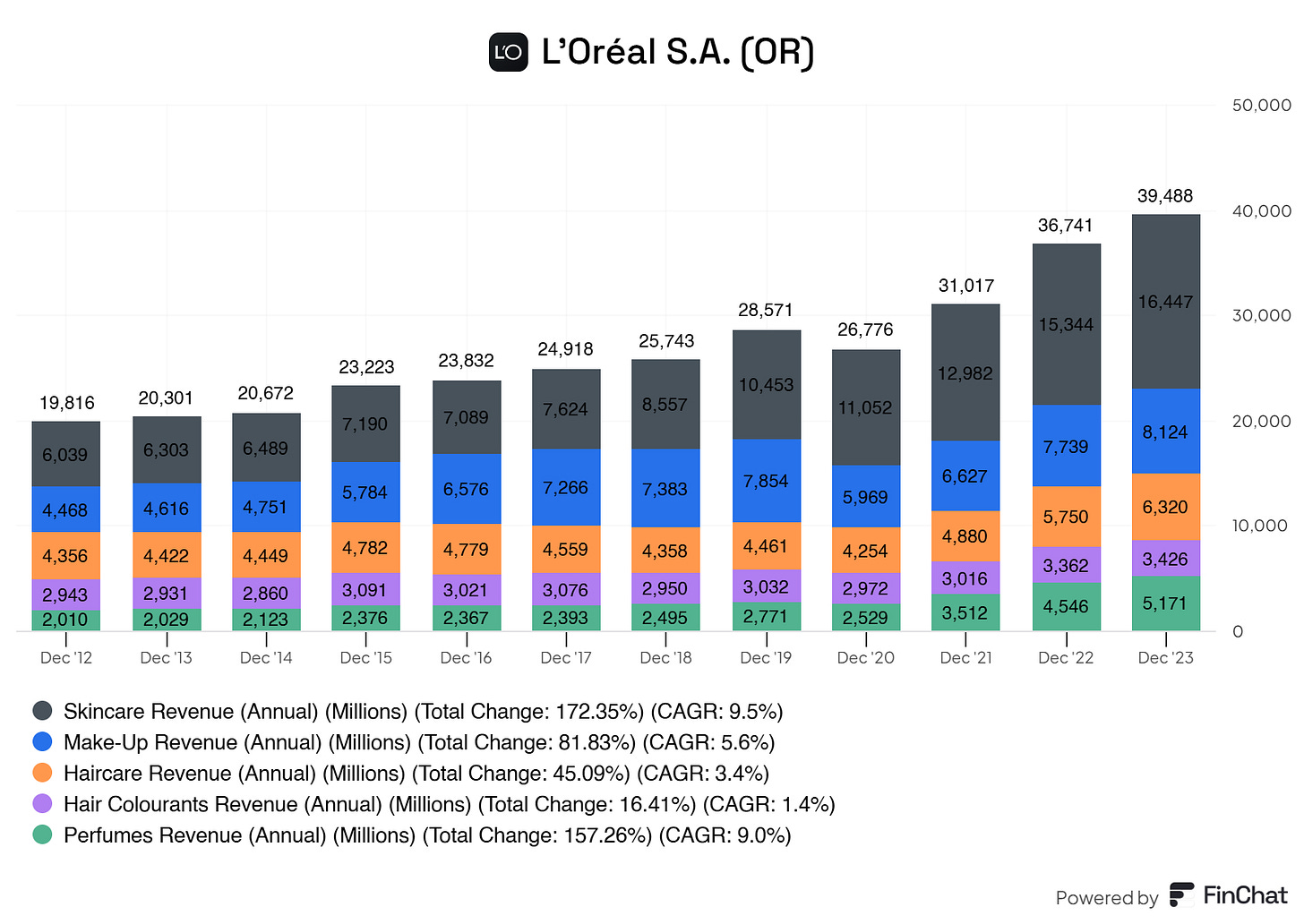

4. L’Óreal S.A. (Ticker: LCLCF)

L’Oréal doesn’t just sell makeup. It sells beauty.

Men chase prestige, money, status. Women do too. L’Oréal owns the beauty part. And beauty? It’s linked to status.

Their products carry a premium price tag. And everyone—everyone—has seen their makeup or hair products on the shelf.

A moat built over centuries.

Founded in 1909, L’Oréal has spent over a century building one of the deepest and widest moats in consumer goods.

Survived two world wars.

Weathered recessions.

Thrived through weak consumer cycles.

Each challenge? It only made L’Oréal stronger.

Then there’s the unbeatable scale.

Competing with L’Oréal is a losing game.

They have capital. They have brand power. They ensure their name remains a household name, globally.

Even with billions in funding, rivals barely scratch the surface.

Skin in the game? Yes!

The Bettencourt family still holds 30% of outstanding shares. Legacy matters. Management is aligned with investors.

L’Oréal isn’t just a brand. It’s an empire.

Before we jump into the highly anticipated top three…

Subscribe to the newsletter.

Valuable insights

A like-minded community

Access to true quality

And the best part? It’s free.

Subscribe now—I’ll wait.

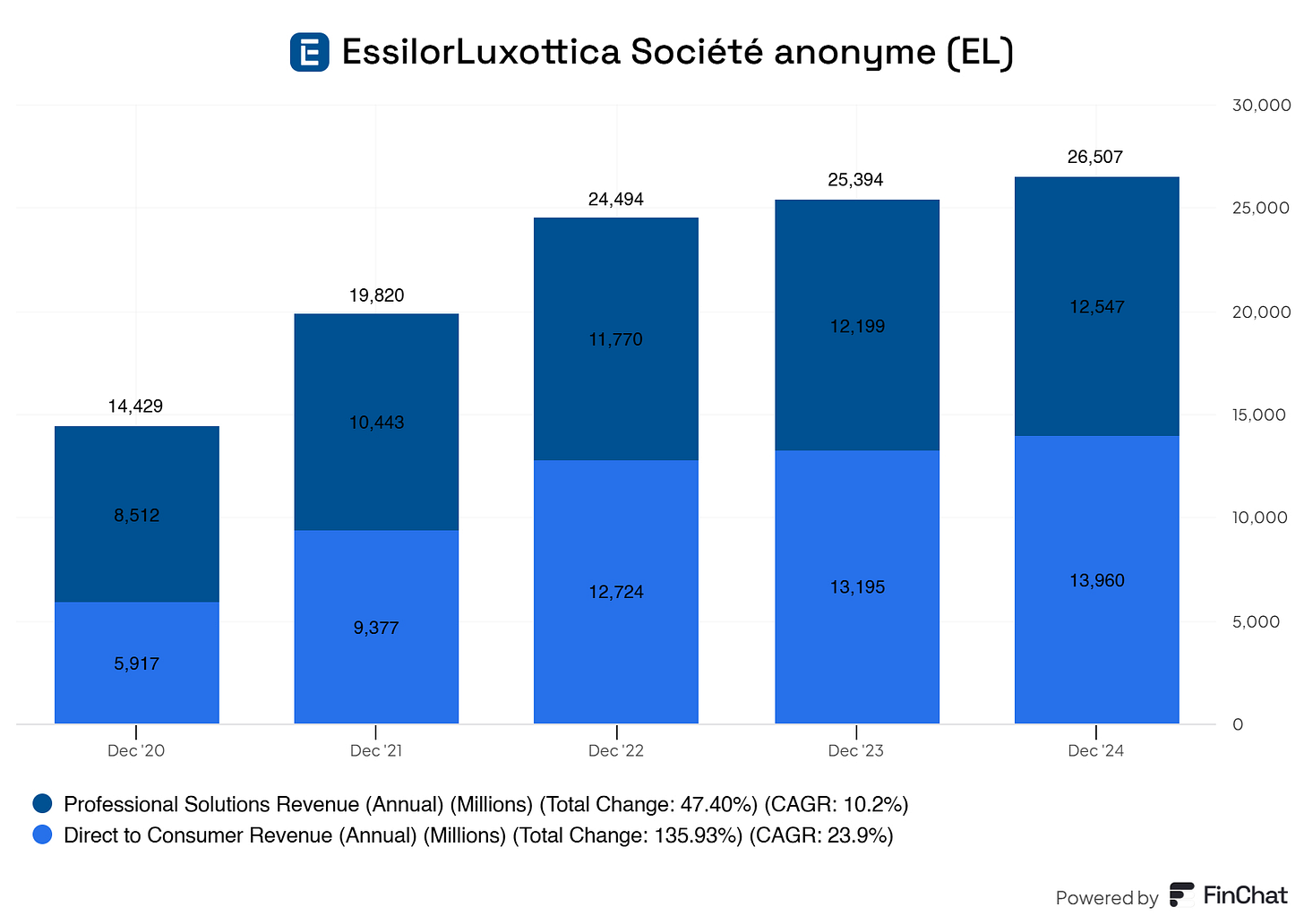

3. EssilorLuxottica Société anonyme (Ticker: ESLOF)

EssilorLuxottica is the undisputed eyewear giant.

Founded in 1849, EssilorLuxottica didn’t just enter the eyewear industry—it dominated from day one.

Wars? Recessions? Weak consumer cycles? It survived them all. And came out stronger.

Their moat? Keeps expanding.

How do you make a deep moat even deeper? Acquisitions.

Ray-Ban

BVLGARI

Burberry

Tiffany & Co.

Brunello

GrandVision

With every strategic buyout, EssilorLuxottica gained market share, improved products, and tightened its grip on the industry.

Now? It’s the dominant force in eyewear. Competitors don’t just face a strong brand—they face an empire. Breaking in isn’t just hard. It’s nearly impossible.

Skin in the game? You bet!

At the top sits Delfin S.à R.L., the investment vehicle of Leonardo Del Vecchio, founder of Luxottica. Still the majority shareholder.

The legacy continues. The dominance holds. EssilorLuxottica isn’t just here to stay—it’s here to lead.

The eyewear giant that keeps on giving.

2. LVMH Moët Hennessy - Louis Vuitton, Société Européenne (Ticker: LVMHF)

LVMH The Ultimate Luxury Empire.

If you’ve followed my portfolio updates, you’ve seen this name before.

Another giant. Another deep, unshakable moat.

Acquisitions that strengthen, not weaken

Most companies struggle to make acquisitions work. LVMH? It thrives on them.

Every buyout strengthens the brand.

Every deal takes market share from competitors.

Every acquisition seamlessly integrates, boosting sales through the roof.

A moat built over centuries

LVMH wasn’t built overnight. It traces back to 1365.

Centuries of dominance, brand power, and prestige make it nearly untouchable.

Family-Owned. Family-Run.

The Arnault family still owns a majority stake. And the CEO? Also an Arnault.

This isn’t just a company—it’s a legacy. Their name, reputation, and fortune depend on keeping LVMH thriving for another century.

A status symbol like no other

Owning LVMH products isn’t just about luxury—it’s about status and exclusivity.

Fashion

Watches & Jewelry

Perfume & Cosmetics

Fine Wine & Spirits

You can’t just walk in and buy it. Scarcity is part of the game.

LVMH Is Built to Last

A household name in luxury. A leader in every category it touches.

1. Hermès International Société en commandite par actions (Ticker: HESAY)

(Axel Olivier Dumas is now the CEO)

Spot the pattern? Family-owned dominance.

Hermès is no different. A legacy brand with a moat centuries deep.

Built on craftsmanship, not mass production

Founded in 1837, Hermès isn’t just luxury—it’s art.

Every item is handmade in Italy.

No outsourcing to China. No mass production.

Exclusivity and scarcity drive demand.

This isn’t about selling more. It’s about making every piece rare, coveted, and timeless.

Luxury, but different

Like LVMH, Hermès dominates:

Leather goods

Ready-to-wear & accessories

Silk & textiles

Perfume & beauty

Watches

But what sets Hermès apart? Roots. Tradition. Exclusivity. They don’t chase trends—they define them.

Family-Owned, Family-Led

71% owned by Hermès Family Group, H2 SAS, and H51 SAS.

More family ownership than institutional or retail investors.

A true generational empire.

Ultra-luxury, built to last

Hermès isn’t just a brand. It’s a legacy. It’s built to dominate the ultra-luxury sector for decades to come.

And that is it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Used Sources

Finchat is used for all the charts. Your subscription is now 15% cheaper. Click here to start today!

(I’m affiliated with Finchat, but not sponsored. With this link, your plan does NOT get more expensive; I only get a small cut of the cake. Thank you in advance)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.

These are great, and lack liquidity. Is there any ETF covering these?

Big fan of Hermès!