7 Overlooked Small-Cap Serial Acquirers You’ll Wish You Found Sooner

These hidden players are flying low — but not for long.

Fluenteers, welcome back — and a special salute to the Fluent Few, our inner circle of long-term compounders and partners. 👋🏻

It feels illegal to share these small-cap serial acquirers with you.

I initially considered creating this article exclusively for the Fluent Few, our premium partners.

But something told me to share these with you. So I am.

These serial acquirers aren’t just playing the game. They’re dominating the game. All in their respective industries.

I’m confident you will find your next portfolio cornerstone in this list. That’s how powerful these companies are.

This list is free. But the next list with these once in a lifetime companies and opportunities will be reserved for our inner circle.

Do not miss out on future small-cap compounders, they’re not waiting on you.

Right now, you can join for only $34.99/month or $340/year.

👉 Go yearly and save $79.88.If you’re on iOS or Android, subscribe via the website. App stores charge a 30% fee, which makes it more expensive for you. The website saves you real money.

P.S. 7-day money back garantee. No questions asked. Win win.

Happy compounding!

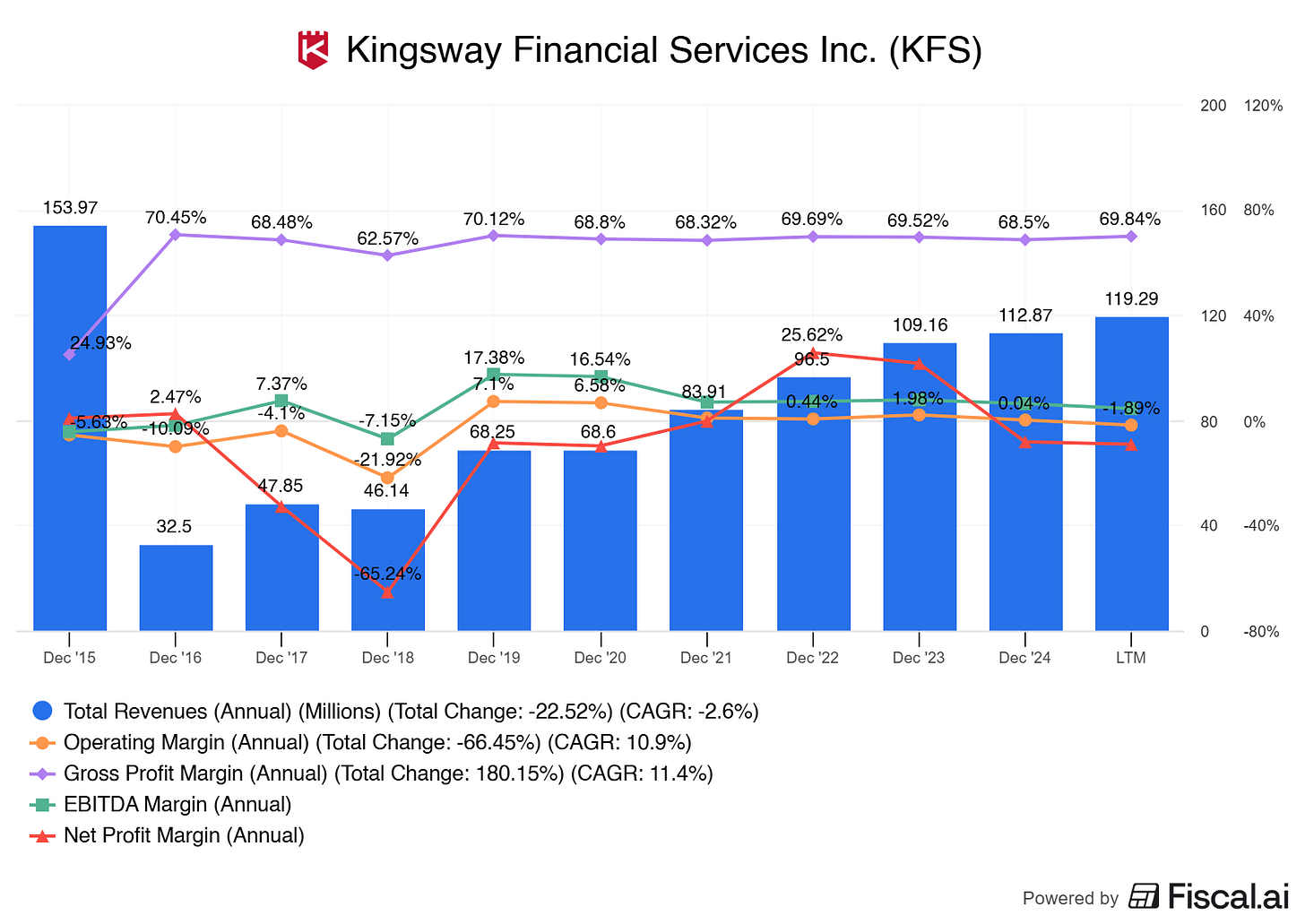

7. Kingsway Financial Services (Ticker: $KFS)

A Canada-based holding company listed on the NYSE.

Shifts capital from legacy insurance operations into specialty investments.

Focuses on niche, cash-generative businesses in the U.S. and Canada.

From insurer to diversified investor

Specialty finance → Operates businesses in extended warranty, premium financing, and structured settlements.

Operating subsidiaries → Acquires and manages small, profitable companies in fragmented industries.

Capital deployment → Reinvests cash flow into new opportunities and debt reduction.

A model centered on value creation

Opportunistic acquisitions → Targets overlooked niches with strong recurring revenue.

Capital recycling → Shifts away from low-return legacy insurance into higher-yield assets.

Lean structure → Central team provides governance without heavy bureaucracy.

Focus on compounding → Profits reinvested to grow intrinsic value per share.

What makes Kingsway distinct

Transition story → Successfully pivoted from traditional insurer to diversified holding company.

Specialty focus → Operates in durable, less-competitive industries.

Shareholder alignment → Insider ownership ensures long-term value orientation.

Cash flow discipline → Emphasis on debt paydown and prudent capital allocation.

Beyond the numbers

Provides succession solutions for small business owners.

Strengthens communities by supporting essential local services.

Builds a diversified base of stable, cash-generating companies.

Kingsway Financial Services isn’t just an insurer.

It is an evolving holding company.

A disciplined allocator of capital.

A steady builder of shareholder value.

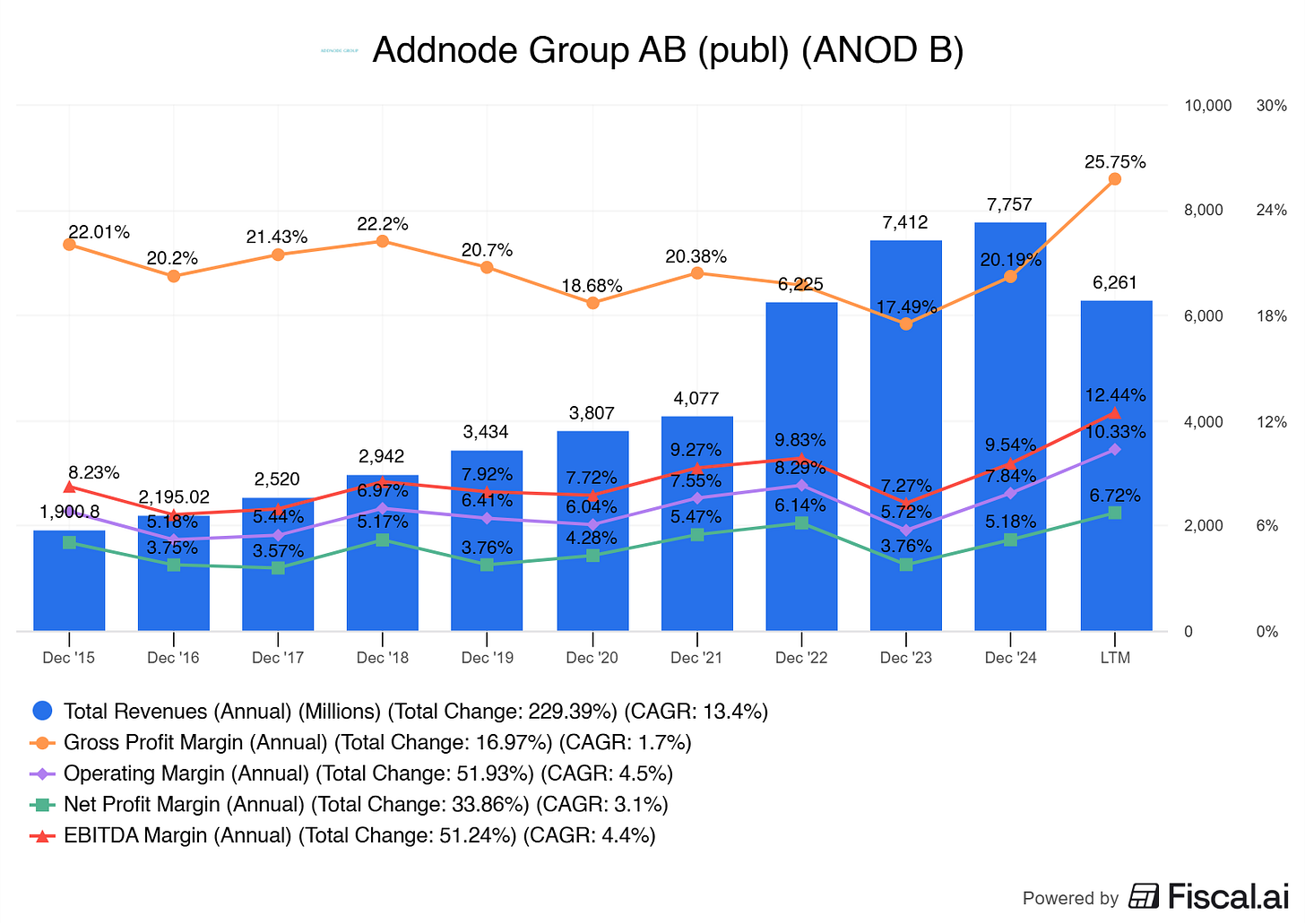

6. Addnode Group AB (Ticker: $ADNOD-B.ST)

A Swedish IT group focused on software and digital services.

Acquires and develops companies that enable digitalization in both public and private sectors.

Serves industries, municipalities, and governments across Europe and beyond.

From niche software firms to a global platform

Acquisitions → Buys specialized software and IT service providers.

Software solutions → Tools for design, product lifecycle management, and process automation.

Public sector IT → Systems for case management, archiving, and digital administration.

A model built on digital demand

Structural growth → Rides long-term trends in digitalization and cloud adoption.

Diversified portfolio → Balanced exposure across industry, public sector, and infrastructure.

Recurring revenues → Strong base from licenses, subscriptions, and maintenance.

Decentralized operations → Subsidiaries stay close to clients and markets.

What makes Addnode unique

Specialist focus → Deep expertise in engineering software and public-sector IT.

Acquisition engine → Proven track record of integrating niche digital firms.

Nordic roots, global reach → Strong base in Scandinavia, expanding internationally.

Resilient demand → Customers rely on mission-critical software and services.

Beyond the code

Supports sustainable cities with digital planning tools.

Enables innovation in design, manufacturing, and infrastructure.

Improves efficiency and transparency in government services.

Addnode isn’t just a software group.

It is an enabler of digital transformation.

A long-term consolidator of niche IT firms.

A quiet compounder in mission-critical technology.

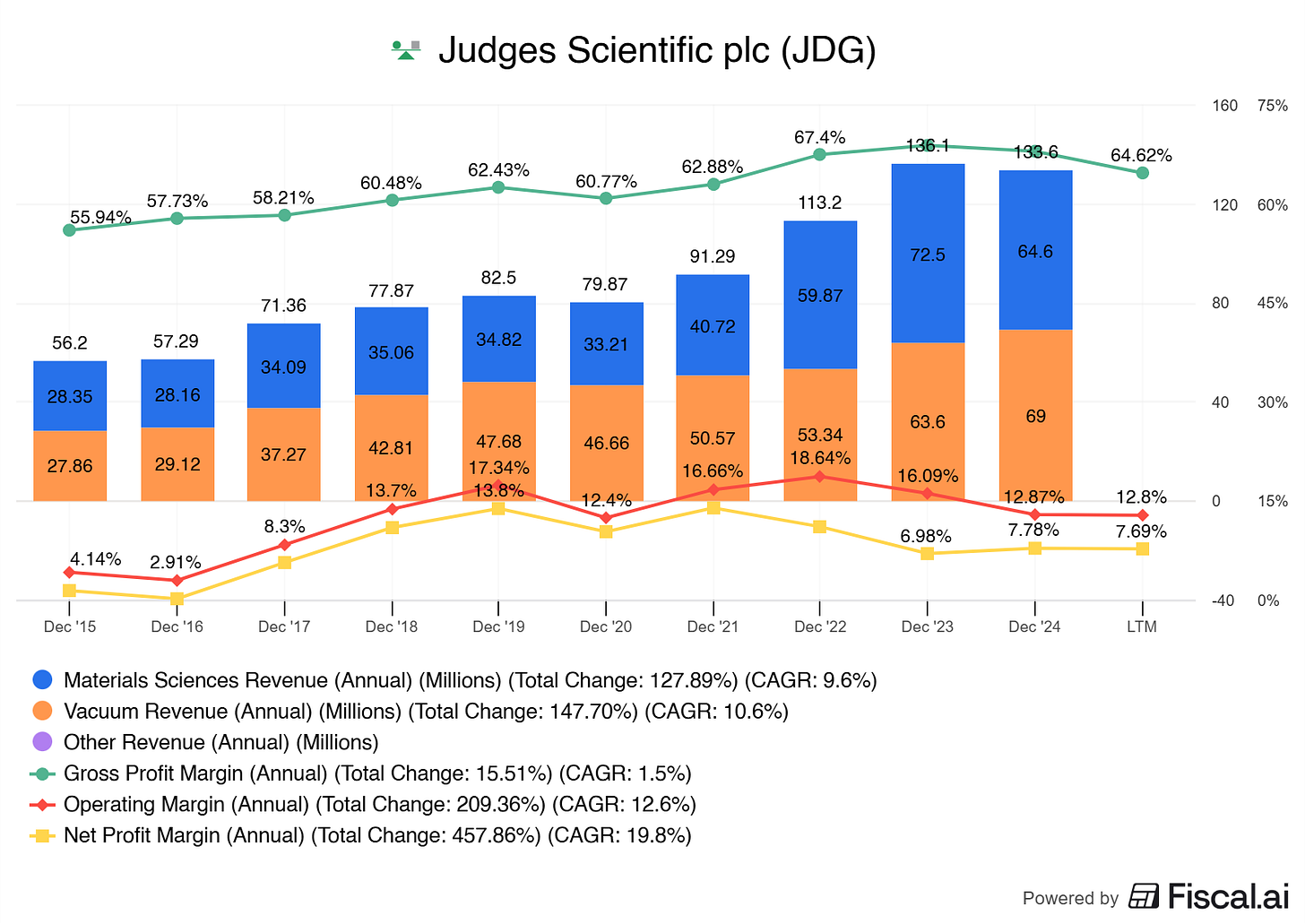

5. Judges Scientific (Ticker: $JDG.L)

A UK-based group of specialist scientific instrument companies.

Acquires, owns, and nurtures small, profitable businesses.

Supports global research through universities, laboratories, and industry.

Turning acquisitions into growth engines

Acquisitions → Buys niche, founder-led instrument makers.

Product sales → Precision tools for materials testing, microscopy, and environmental analysis.

Services & parts → Recurring revenue from maintenance, calibration, and spares.

Why this model compounds value

Disciplined buy-and-build → Proven strategy in fragmented markets.

Specialized niches → Focus on defensible, high-margin technologies.

Decentralized structure → Subsidiaries retain identity and expertise.

Strong cash flows → Low capital needs, high returns.

What sets Judges apart from the rest

Capital allocation skill → Track record of value-accretive acquisitions.

Niche leadership → Owns unique technologies with global relevance.

Light-touch management → Preserves culture and know-how in each business.

Resilient demand → Instruments tied to ongoing scientific progress.

Impact beyond financials

Enables research breakthroughs with precision tools.

Preserves craftsmanship in specialist manufacturing.

Compounds long-term value quietly and consistently.

Judges Scientific isn’t loud.

It’s precise.

It’s patient.

It’s a curator of scientific excellence and a builder of enduring value.

If you want charts like the one I use, start using Finchat.

They got everything, even segment detailed breakdowns, earning calls, screeners, super investor overview, and much, much more.

The kicker? Using my link, you'll receive 15% off your subscription.

Want to do it out first? Using my link, you can enjoy Finchat with all features without needing a card!

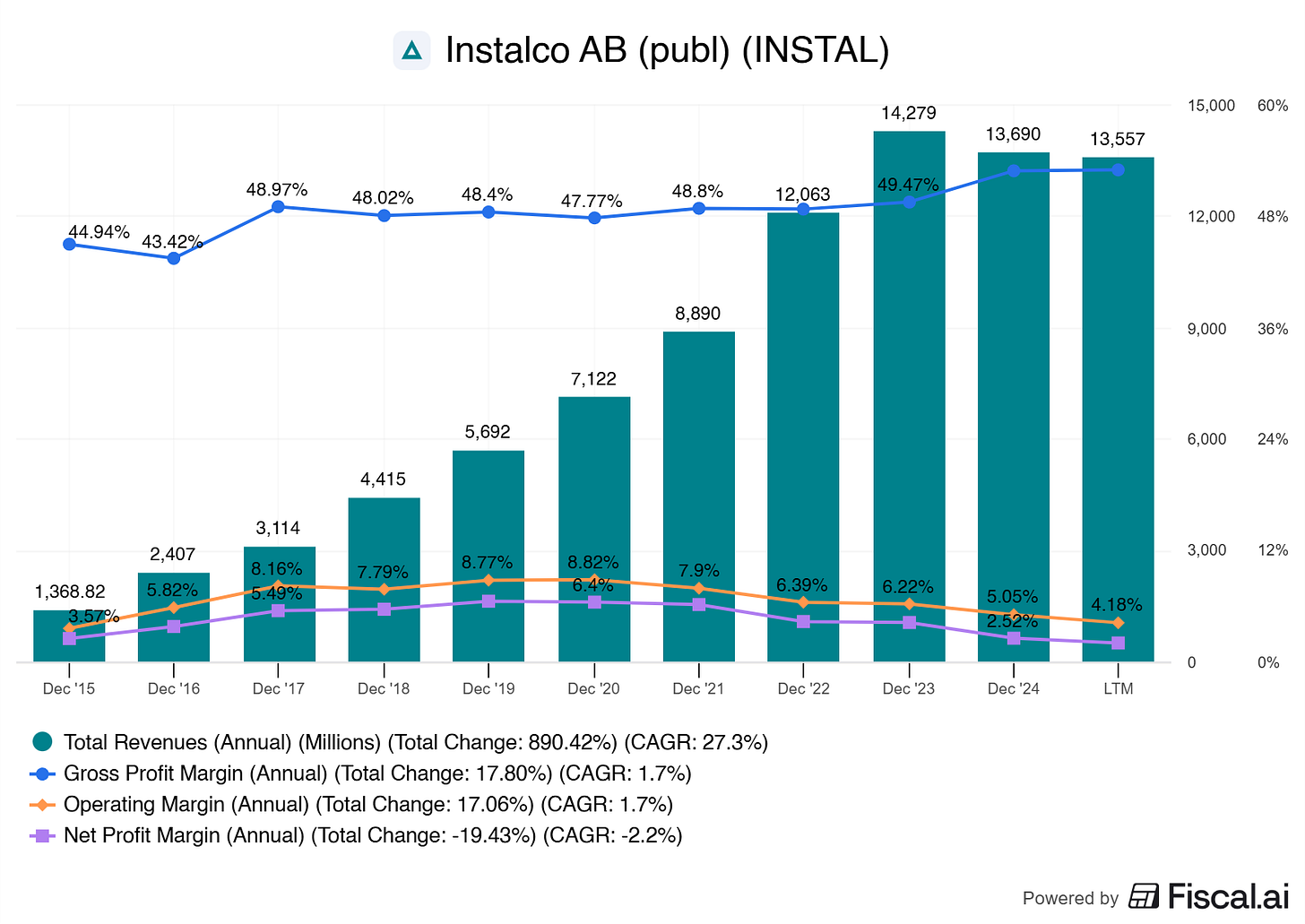

4. Instalco AB (Ticker: $INSTAL.ST)

A leading group of installation companies in electrical, heating & plumbing, ventilation, and industrial solutions.

Operates through a network of strong local subsidiaries.

Supports construction, infrastructure, and industry across Sweden, Norway, and Finland.

From local installers to a Nordic leader

Acquisitions → Buys established regional firms and retains their local identity.

Project delivery → Electrical, HVAC, plumbing, and industrial installations for buildings and infrastructure.

Service agreements → Recurring work in maintenance, repairs, and energy upgrades.

A model built for resilience and scale

Local autonomy → Subsidiaries keep entrepreneurial freedom and customer trust.

Regional density → Strong market positions in key Nordic cities and regions.

Balanced exposure → Mix of project revenues and recurring service income.

Cash discipline → Efficient integration and steady cash generation.

The strengths that make Instalco different

Consistent deal-making → Steady flow of value-accretive acquisitions.

Local roots, group muscle → Combines small-company flexibility with large-group resources.

Diversified platform → Covers multiple geographies, services, and end-markets.

Essential services → Demand sustained by long-term building and infrastructure needs.

Beyond the installations

Advances sustainability with energy-efficient and climate-smart solutions.

Preserves local expertise while providing stability and growth.

Builds the unseen infrastructure that societies rely on every day.

Instalco AB is more than a contractor.

It is a network of trusted local champions.

A quiet consolidator in essential services.

A reliable partner in the Nordics’ built environment.

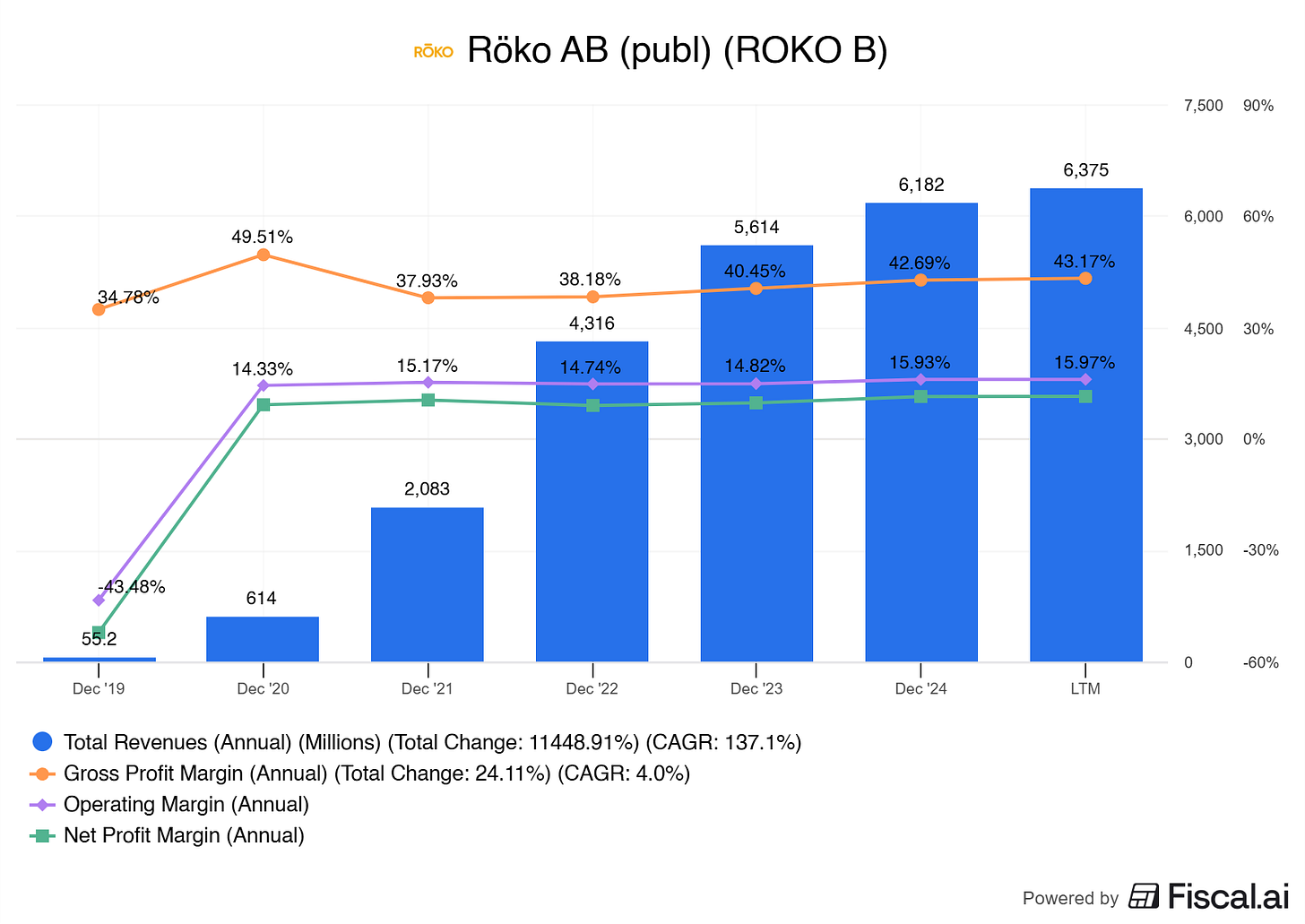

3. Röko AB Public (Ticker: $ROKO.B)

A Sweden-based investment firm with a permanent ownership model.

Focuses on profitable, founder-led small and mid-sized companies.

Operates across diverse industries in Europe.

From founder ownership to long-term partnership

Majority investments → Acquires controlling stakes while keeping entrepreneurs involved.

Business autonomy → Portfolio companies continue operating under their own brands.

Sustainable growth → Supports expansion without pressure for short-term exits.

A model designed for endurance

Evergreen capital → No fixed fund life, enabling decades-long ownership.

Entrepreneur alignment → Founders retain minority stakes, staying motivated to grow.

Decentralized structure → Each business manages itself with minimal central interference.

Steady compounding → Profits reinvested to fuel organic and acquisitive growth.

The qualities that make Röko distinct

Patient ownership → Builds value over decades, not years.

Broad reach → Active across industries, from niche manufacturing to services.

Founder trust → Appeals to entrepreneurs who want stability beyond private equity cycles.

Low leverage → Growth supported by strong cash flows, not heavy debt.

Beyond financial returns

Preserves entrepreneurial culture inside acquired firms.

Provides continuity for employees, customers, and suppliers.

Builds a diversified group of resilient European companies.

Röko isn’t a traditional private equity firm.

It is a long-term home for entrepreneurs.

A patient compounder of enduring businesses.

A builder of value across generations.

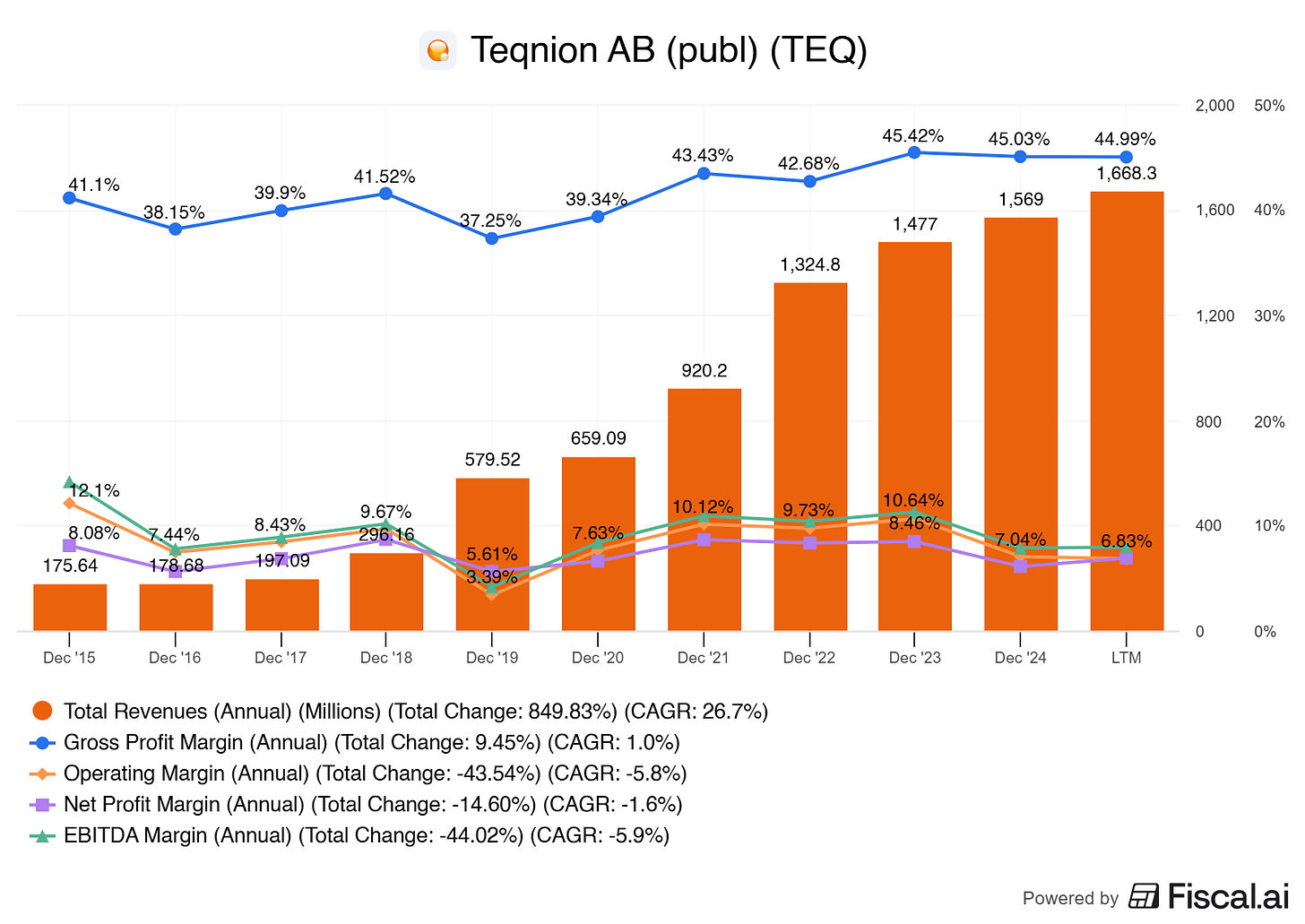

2. Teqnion AB (Ticker: $TEQ.ST)

A Swedish industrial group built on permanent ownership.

Acquires and develops small, profitable niche businesses.

Operates across technology, industry, infrastructure, and services.

From entrepreneurs to long-term partners

Acquisitions → Buys well-run, founder-led companies in technical niches.

Autonomy → Subsidiaries keep their brands, culture, and decision-making.

Growth support → Provides capital and a long-term owner with no exit horizon.

A model shaped by decentralization

Permanent ownership → No need to sell, enabling patient compounding.

Entrepreneurial culture → Values independence, speed, and accountability.

Small-company focus → Targets firms too niche for traditional private equity.

Disciplined capital use → Profits reinvested in new acquisitions and growth.

What makes Teqnion stand out

True decentralization → Portfolio companies run themselves without central bureaucracy.

Flexible scope → Invests across industries without narrow sector limits.

Founder-friendly approach → Offers stability and continuity to selling owners.

Long-term resilience → Diversified portfolio reduces reliance on any one market.

Beyond the acquisitions

Protects the legacy of entrepreneurial businesses.

Provides a permanent and stable platform for employees and customers.

Builds a compounder that grows stronger with every company added.

Teqnion isn’t just an acquirer.

It is an entrepreneurial ecosystem.

A decentralized compounder.

A long-term partner for small industrial champions.

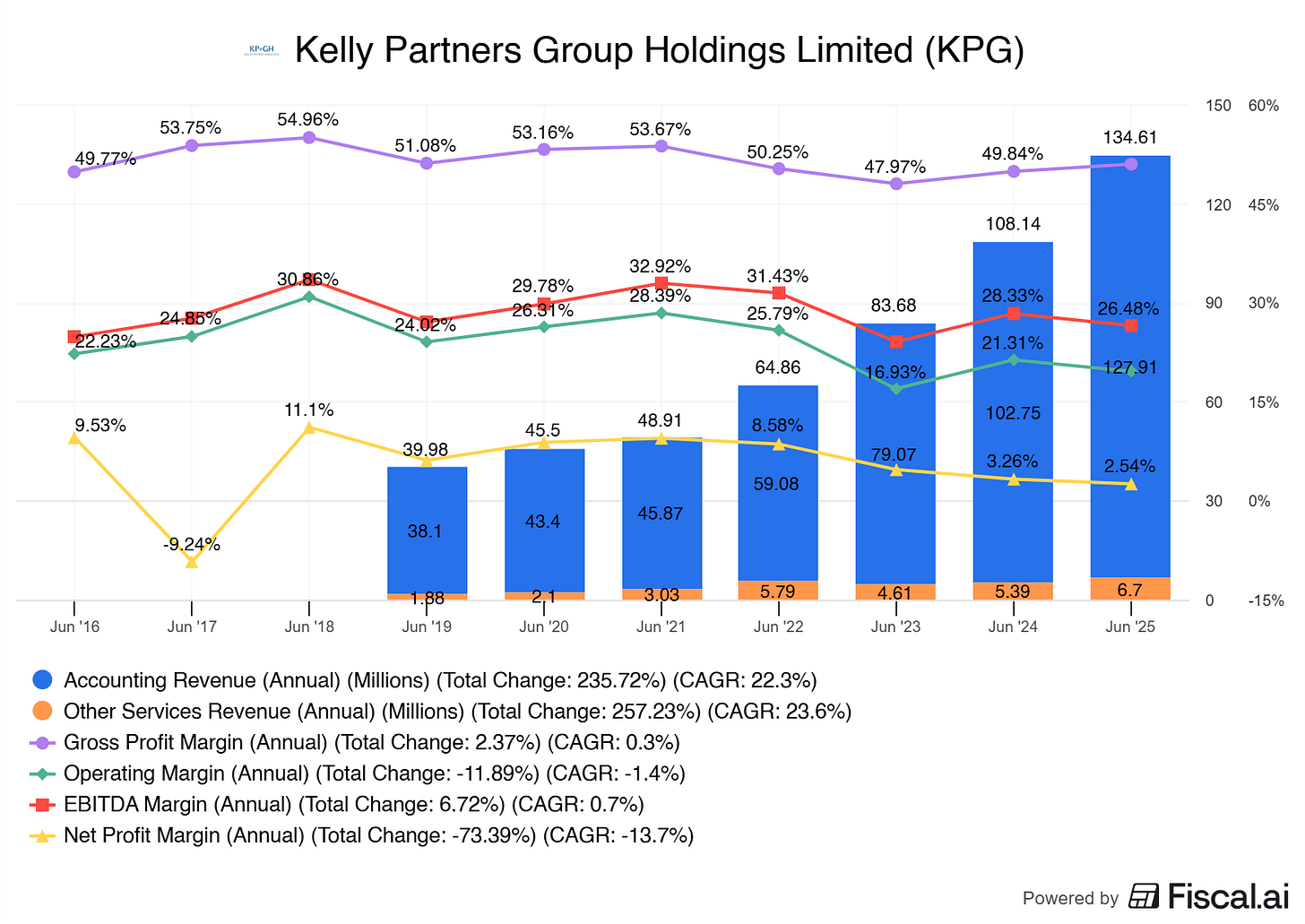

1. Kelly Partners Group (Ticker: $KPG.AX)

Kelly Partners Group: compounding through accounting

An Australian accounting network focused on private businesses and their owners.

Acquires and grows small, profitable accounting firms.

Serves entrepreneurs, families, and private enterprises across Australia.

From local practices to a national network

Acquisitions → Buys accounting firms and integrates them under the Kelly Partners brand.

Core services → Tax, audit, business advisory, and wealth management.

Recurring revenues → High client retention and annual compliance demand.

A model built for stability and scale

Partner alignment → Partner-ownership model ties incentives directly to performance.

Recurring demand → Accounting services are essential regardless of the cycle.

Operating platform → Centralized support in IT, marketing, and training.

Organic growth → Expands client wallet share through cross-selling services.

The traits that make Kelly Partners unique

Specialist focus → Dedicated to private business owners, not big corporates.

Brand strength → Unified national brand in a highly fragmented market.

Alignment of interests → Equity opportunities keep partners invested long term.

Proven compounder → Consistent double-digit revenue and profit growth.

Impact beyond financials

Supports entrepreneurs in building and protecting wealth.

Provides succession solutions for retiring accountants.

Builds a culture of service, trust, and long-term relationships.

Kelly Partners Group isn’t just an accounting firm.

It is a permanent platform for entrepreneurs.

A consolidator of a fragmented industry.

A long-term compounder in essential services.

That is it for today! I truly hope you found a gem that’s going on your watchlist. If you did, let me know which one made the list.

If you’re interested in connecting with me on other social media platforms, please visit my Linktree, which includes links to all my social media profiles, including X, Instagram, LinkedIn, Facebook, and YouTube.

I will see you in the next one!

And remember.

Great investments don’t shout. They compound quietly.

— Yorrin (FluentInQuality)