7 High-Quality Small-Caps You Need To Know Before They Take Off!

Small-caps have tremendous upside potential, like the ones I am mentioning here. 10x? Doable for most of these.

True 5x or 10x opportunities are found where the majority isn’t looking.

Small-caps and mid-caps have potential, and some have already built a strong and sustainable economic moat; they’re just extremely hard to find. But that is ending today. I will list high-quality small-caps that have already proven themselves and built a small moat around their castle.

Here are seven high-quality small-caps you have to put on your watchlist today.

7. Vitec Software Group AB (Ticker: VIT.B)

Quiet compounder in a mission-critical niche? Vitec owns it.

Vitec Software Group dominates in a unique and sticky corner of the tech world:

Vertical market software (VMS) tailored for niche industries

Serves essential professions like real estate, education, healthcare, energy, and more

Once embedded, Vitec’s solutions become hard to replace—customers rely on them daily to operate their businesses efficiently.

In short, it builds software that doesn’t just sell—it sticks.

Steady, predictable growth runway? Vitec has it.

Digital transformation is still sweeping through traditional industries:

Even small verticals are moving from legacy systems to modern SaaS

Businesses want tailored, industry-specific tools—not one-size-fits-all platforms

Vitec is expanding steadily through both organic growth and bolt-on acquisitions across the Nordics and beyond.

Its customer base is diversified, stable, and unlikely to churn.

Acquisition engine with a flywheel moat? Absolutely.

Vitec has a refined M&A model:

Targets profitable, niche software companies with sticky revenue

Leaves founders in place, decentralizes control, and integrates financially

Focuses on recurring revenue and long-term relationships

Its decentralized structure and cultural discipline create a moat that gets deeper with each deal.

High-margin, recurring cash flows? Without a doubt.

Vitec is a cash-flow machine disguised as a sleepy Nordic tech firm:

~85% of revenue is recurring

Operating margins consistently above 25%

Reinvestment and acquisition ROICs well above average

This is the kind of business that compounds steadily without needing to chase headlines.

Optionality through niche expansion? It's built in.

With each acquisition, Vitec opens doors to:

New geographies (especially within Europe)

Adjacent verticals with similar dynamics

Cross-selling and product integration over time

Its opportunity set grows as more software founders look to exit and join a long-term home.

Pricing power with lock-in? Quietly unstoppable.

Vitec benefits from:

Mission-critical products that run daily operations

High customer retention and very low churn

Ability to raise prices modestly without pushback

This isn’t flashy SaaS hype—it’s durable, profitable, and built for the long haul.

6. Craneware Plc (Ticker: CRW)

Dominating a high-stakes niche? Craneware owns it.

Craneware is the quiet leader in a space few investors watch closely—but U.S. hospitals can’t live without:

Revenue integrity and financial performance software

Serving 1,800+ U.S. hospitals and healthcare providers

Its solutions sit at the core of hospital billing, coding, compliance, and financial reporting—helping providers get paid accurately and stay out of trouble.

In short, Craneware ensures the business of healthcare actually works.

Structural tailwinds in a broken system? Craneware rides them.

U.S. healthcare is complicated, expensive, and increasingly digital:

Hospitals face relentless margin pressure and regulatory complexity

Billing errors and missed reimbursements cost billions every year

Value-based care models demand better data and analytics

Craneware’s platform is built to address exactly these challenges, and its strategic acquisition of Sentry Data Systems expanded its reach into pharmacy and analytics.

As healthcare reform deepens, Craneware becomes even more essential.

Moat through data, integration, and trust? You bet.

Craneware’s value isn’t just in its software—it’s in its deep domain expertise and embedded relationships:

Decades of data built into proprietary tools

Seamless integration with hospital systems (EHRs, billing, pharmacy)

Trusted relationships with top-tier U.S. health systems

Switching away isn’t just expensive—it’s risky. And in healthcare, nobody wants to take that risk.

Recurring revenue with strong unit economics? Absolutely.

Craneware delivers the kind of financial profile that value-oriented investors love:

~80%+ recurring revenue

High gross margins and scalable software delivery

Net dollar retention boosted by upsells and deeper integration

This is enterprise SaaS, but with healthcare durability built in.

Undervalued optionality in U.S. healthcare? It’s there.

Craneware is evolving beyond revenue integrity:

Advanced analytics for financial and clinical outcomes

Population health insights via Sentry Data’s pharmacy datasets

AI-driven tools for decision support and compliance

As hospitals look for smarter ways to cut waste, improve care, and stay solvent, Craneware is positioned to lead.

Sticky contracts, conservative culture? Quietly compounding.

It benefits from:

Long-term contracts with high switching costs

A conservative, quietly compounding mindset from management

Deep focus on profitability and shareholder value over hype

This isn’t the next unicorn—it’s the kind of business that wins by being boring, predictable, and critical behind the scenes.

Psssst! I’m providing extremely valuable content here; share the word with friends.

5. Graham Corporation (Ticker: GHM)

Critical tech in overlooked industries? Think of Graham.

Graham Corporation provides essential engineering solutions where failure is not an option:

Vacuum and heat transfer systems for defense, energy, and petrochemicals

Deep specialization in mission-critical systems for U.S. Navy submarines and aircraft carriers

It’s not flashy—but it’s foundational. Graham supplies the equipment that helps power plants run, ships sail, and refineries stay efficient.

In short, it operates in niches where quality, reliability, and precision matter more than anything else.

Defense-driven tailwinds? Graham’s just getting started.

With its acquisition of Barber-Nichols, Graham embedded itself even deeper in the U.S. defense supply chain:

Supporting next-gen nuclear submarines and carriers

Supplying turbo pumps, propulsion components, and high-performance systems

Global defense budgets are rising, and the U.S. Navy is modernizing. Graham is quietly riding that multi-decade wave, with long-cycle contracts and high barriers to entry.

It’s not just a contractor—it’s a strategic supplier.

Moat through engineering depth and trust? Absolutely.

Graham isn’t competing on price. It wins on:

Decades of engineering expertise

Rigorous quality assurance and certifications

Deep, sticky customer relationships in defense and energy

You don’t swap suppliers on a nuclear submarine. Trust is the moat, and Graham has earned it over decades.

Backlog, visibility, and durability? All three.

This isn’t boom-and-bust manufacturing. Graham has:

A growing multi-year backlog (record levels as of recent quarters)

High visibility from defense contracts

Stable base business in commercial energy and petrochem

Its revenue isn’t just recurring—it’s contractually locked in for years.

Optionality through energy transition and innovation? Quietly building.

Graham is positioning for the future:

Supporting small modular nuclear reactors (SMRs)

Exploring hydrogen and renewable fuel applications

Expanding Barber-Nichols’ reach into aerospace and advanced propulsion

It’s not betting the farm—it’s carefully stepping into new, adjacent opportunities with high technical overlap.

Disciplined, industrial DNA? Still compounding.

Graham’s edge comes from:

Conservative, capital-efficient management

A focus on ROIC and long-term shareholder value

Smart integration of acquisitions with cultural fit

This is industrial America at its best—quietly resilient, built to last, and slowly scaling its advantage.

4. Netcall Plc (Ticker: NET)

Helping slow industries move faster? Netcall is the engine.

Netcall powers digital transformation where it’s needed most—across healthcare, government, and financial services:

Low-code development tools for rapid app building

Intelligent automation and contact center software rolled into one platform

Its Liberty platform turns complex, manual processes into efficient, digital workflows—without needing a team of developers.

For customers buried in bureaucracy, Netcall isn’t just a tool—it’s a turning point.

Big institutions, big problems? Netcall solves them.

Public sector bodies and healthcare providers are under pressure:

Citizens expect digital-first services

Budgets are tight, but demand is rising

Legacy tech makes change slow and painful

Netcall gives these organizations a way out—faster deployment, fewer errors, lower cost.

It’s not chasing startups. It’s modernizing the backbone of society.

Hard to enter, harder to replace? Netcall thrives there.

This isn’t a plug-and-play software company.

Netcall builds long-term resilience through:

Deep integration with legacy infrastructure

Compliance with industry-specific regulations

Hands-on relationships with IT and operations teams

Once embedded, its software becomes part of the organization’s core workflows—making replacement costly and risky.

That’s a real moat, not just a sticky interface.

Recurring revenue and expanding margins? Check the model.

Netcall has been steadily transitioning into a high-quality SaaS business:

70% recurring revenue

High gross margins and strong operational leverage

Low churn and increasing upsell activity

The unit economics are solid—and improving with scale.

This is a software business getting stronger each quarter, without the hype.

Expanding product, growing runway? It’s already happening.

With one platform, Netcall serves multiple use cases:

Workflow automation

Citizen-facing apps

Contact center transformation

AI and analytics tools being added

Each customer win opens the door to more expansion—within the org and across adjacent sectors like education and logistics.

Optionality isn’t theoretical. It’s already in motion.

Underrated operator in a vital space? Netcall fits the bill.

This company reflects:

A disciplined, product-led growth strategy

Deep entrenchment in defensive end-markets

Strong cash generation and reinvestment in innovation

It’s not loud. It’s not flashy. But it’s delivering real transformation to systems that desperately need it—and getting rewarded along the way.

Before we go to the top three, there’s limited time left to join the FluentInQuality community at a discount before the price goes up.

I know you have been on the fence, join now before it’s too late.

3. Alpha Group International Plc (Ticker: ALPH)

Solving real-world currency headaches? Alpha makes it simple.

Alpha Group helps businesses navigate FX risk and manage cash across borders:

Provides tailored foreign exchange risk management

Offers treasury solutions for efficient international cash flow

Serves corporates, institutions, and private equity-backed firms

It’s not trying to be a bank. It’s building a better, more responsive alternative—focused purely on financial simplicity for global operators.

Global trade is messy. Alpha cleans it up.

Running a business across borders means exposure to currency swings, regulatory friction, and settlement delays.

Alpha steps in with:

Bespoke hedging strategies

Multi-currency cash management tools

Transparent pricing and human service over bank bureaucracy

As cross-border complexity grows, Alpha’s relevance grows with it.

Sticky relationships, not flashy tech? That’s the moat.

Alpha doesn’t win clients with billboards—it wins them with trust:

Deep, ongoing client relationships (not just transactions)

Tailored strategies, not cookie-cutter FX products

Focus on high-value, long-term corporate clients

Once Alpha becomes your FX partner, switching to a faceless institution is a tough sell.

It’s a human-first business wrapped in fintech efficiency.

Recurring, resilient, and scaling profitably? Absolutely.

Alpha combines financial discipline with strong growth:

High recurring revenue base

EBITDA margins above 30%

Growing AUM and client base without heavy capex or marketing spend

Its core FX business funds expansion, while the newer institutional cash management arm is scaling quickly.

Strong returns + conservative balance sheet = rare in fintech.

Optionality through scale and reach? Already unfolding.

What started with FX is expanding:

Institutional cash management gaining traction

Geographic expansion across Europe and North America

New products aimed at PE firms and multinational treasurers

Alpha is quietly becoming a full-spectrum treasury partner for the mid-market—a space banks increasingly neglect.

Underfollowed gem in financial services? That’s Alpha.

Alpha Group reflects:

Founder-led discipline and skin in the game

A client-first, service-led culture

A track record of profitable growth through execution, not hype

This isn’t a neobank. It’s a cash flow machine solving painful problems for global businesses—and compounding quietly in the background.

2. ATOSS Software (Ticker: AOF)

Helping companies master the most expensive resource? Atoss does it.

Atoss Software delivers workforce management solutions to organizations where labor is a core cost—and a competitive advantage:

Scheduling, time tracking, shift planning, and workforce analytics

Deep specialization in industries like retail, logistics, healthcare, and manufacturing

Trusted by giants like Deutsche Bahn, Lufthansa, and Edeka

Atoss doesn’t just manage employees—it helps complex businesses unlock flexibility, compliance, and cost efficiency at scale.

Labor cost pressure and compliance complexity? Atoss thrives in it.

Europe’s labor markets are tightening:

Rising wages, aging populations, and strict labor laws

Employees want flexibility; employers need productivity

Regulators are enforcing compliance with working hours and documentation

Atoss helps organizations walk this tightrope. Its software ensures the right people are in the right place at the right time—with full visibility and legal compliance.

Demand for this precision is growing by the year.

Deep integration and mission-critical status? That’s the moat.

Atoss is sticky—because switching is painful:

Integrates directly into HR, payroll, and ERP systems

Customized workflows for union agreements and local labor laws

Used daily by tens of thousands of employees and managers

Workforce management isn’t a nice-to-have—it’s operational infrastructure. Once embedded, Atoss becomes indispensable.

Recurring revenue, fat margins, and a growth engine? Check, check, check.

Atoss combines the best of SaaS economics with long-term customer relationships:

~90% recurring revenue

EBITDA margins consistently over 25%

Strong net retention from upsells and platform expansion

Its hybrid model (cloud + on-premise) meets customers where they are—and transitions them over time.

The result? Predictable, profitable, and steadily growing.

Europe today, broader ambitions tomorrow? That’s the play.

Atoss dominates in German-speaking Europe, but the story isn’t limited to the DACH region:

Expanding into Central and Eastern Europe

Larger enterprises rolling out Atoss across multi-national operations

Continued investment in cloud, AI, and automation features

There’s a long runway ahead. And with more labor volatility across Europe, Atoss becomes even more relevant.

Quietly elite in enterprise software? That’s Atoss.

This company reflects:

A focused, disciplined approach to product and market

High switching costs and recurring workflows

Long-term leadership with skin in the game

It’s not chasing trends. It’s executing a playbook that turns workforce complexity into a competitive edge—and doing it profitably.

1. Tatton Asset Management (Ticker: TAM)

Powering the professionals behind your portfolio? That’s Tatton.

Tatton Asset Management doesn’t sell funds to retail investors—it empowers the independent financial advisers (IFAs) who do.

It provides discretionary fund management (DFM) to 1,000+ IFA firms

Offers model portfolios and funds tailored for client outcomes

Handles the complexity so IFAs can focus on relationships and planning

Tatton sits at the center of a powerful flywheel: as more advisers outsource investment management, Tatton grows—quietly, consistently, and profitably.

Adviser shift toward simplicity? Tatton is the beneficiary.

The UK wealth industry is changing fast:

Advisers face rising compliance costs and admin burdens

Clients expect professional, consistent investment outcomes

Many IFAs are choosing to outsource portfolio management

Tatton makes that shift easy. Its low-cost, easy-to-integrate platform removes friction for advisers and improves results for clients.

This outsourcing trend has legs—and Tatton is riding it with precision.

Asset-light, capital-efficient, and scalable? Built that way.

Tatton’s model is designed to scale:

No need to build distribution—it rides the IFA network

No physical branches or heavy infrastructure

Expands through partnerships, not brute-force sales

It’s a modern, tech-enabled wealth business: lean, focused, and built for high margins.

Recurring revenue with impressive economics? That’s the story.

Tatton delivers beautiful financials:

~95% of revenue is recurring

Operating margins around 45%

ROCE consistently above 60%

Net cash on the balance sheet

Every £1 of AUM generates high-margin, recurring income—with minimal capital required to grow.

This is the kind of financial profile most fund managers wish they had.

More AUM, more leverage, more upside? Already underway.

Tatton is scaling smart:

AUM up 20%+ YoY, consistently hitting new highs

Strategic acquisitions expanding both capability and distribution

Deepening relationships with advisers, unlocking wallet share

As advisers grow, consolidate, and evolve, Tatton grows with them—without chasing high-cost growth.

The more assets it manages, the more leverage it gets. Simple, powerful math.

Underrated compounding engine in wealth? Tatton fits the mold.

Tatton Asset Management reflects:

A founder-led culture with discipline and long-term vision

A scalable model benefiting from deep industry trends

High-quality, recurring cash flows fueling both dividends and reinvestment

It’s not trying to be everything to everyone—it’s becoming indispensable to the right people.

🎁 Want Free Access To The Paid Option?

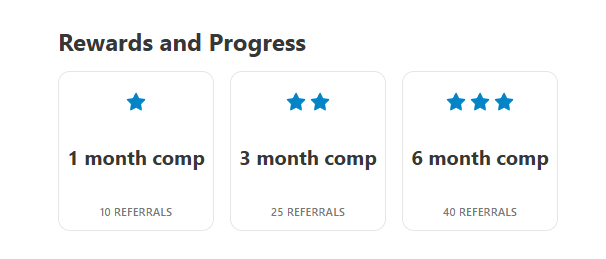

Every friend you refer gets you closer to unlocking FluentInQuality PRO for free.

Share your unique link, and you’ll rack up rewards faster than compound interest.

By referring just 10 friends to the newsletter, you'll get one month for free. Sharing one link with 5 friends and getting a free month? Yes, it’s that easy. Imagine sharing your link with 40 friends and getting half a year's worth of $110 for FREE!

Lastly.

Help me shape FluentInQuality into something you love opening every week.

💬 What topics do you want me to cover next?

💬 What was your favorite takeaway from this edition?

Drop a comment — I read and respond to every one.

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all my charting, fundamental analysis, and earnings tracking. You can now get 15% off for life on your subscription. Click here to start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

Hi FiC. I came across this post randomly. Or rather the Substack Algo thought I should see it. For context, I run a global quality equity fund for a family office. In amongst the usual suspects (MSFT, TSM, SPGI etc) and because the family in question is UK-based, there is a 25% allocation to UK equities, in which pool, I think you probably already know, quality companies are fewer and further between, necessitating research into much smaller market caps. I just thought you would like to know that the fund owns all of Craneware, Netcall and Alpha Group International and I rate all three highly, the latter so much that it is a top 5 position in a 200 stock fund- as big as Microsoft, Alphabet and Amazon! Private equity is also very keen and is sniffing around two out of the three as I write this. So here’s a hat tip to you and best wishes for your investment journey.

Aren’t most of these based in sub sectors where barriers to entry are particularly low?