7 High-Quality Small Caps Poised for 10x Returns

These hidden compounders are quietly setting up to dominate their industries, before Wall Street even notices.

Fluenteers, welcome back — and a special salute to the Fluent Few, our inner circle of long-term compounders. 👋🏻

Every investor dreams of catching the next great business before the market wakes up.

That’s exactly what this list is about.

I’ve spent weeks filtering through hundreds of small and mid-caps to uncover the highest-quality names, companies with exceptional margins, high returns on capital, and management teams who actually think like owners.

Each company on this list passed at least 20 strict checks from my personal quality framework, the same process I use to find my own multi-baggers.

These are the small players quietly setting up to become the giants of tomorrow.

Miss them now, and you’ll be paying up for them later.

Bookmark this post. You’ll want to come back to it.

Happy compounding!

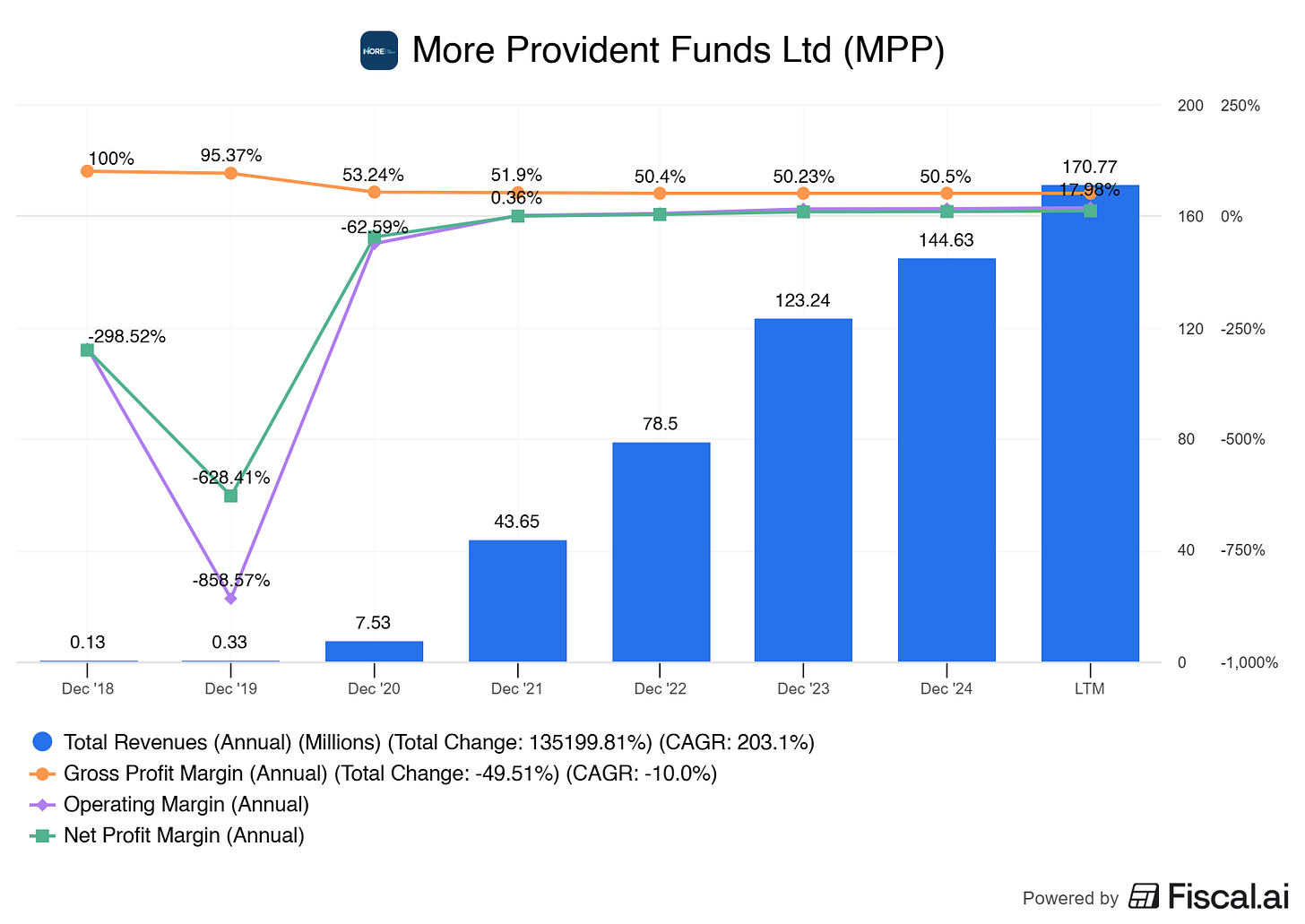

More Provident Funds Ltd (Ticker: $MPP.TA)

Building lasting financial confidence through disciplined fund management.

Provident Funds Ltd stands for integrity, precision, and transparency, qualities that turn capital into sustainable growth. With a data-driven approach and decades of financial expertise, the company delivers consistent value for both private and institutional investors.

Where the money comes from

Provident Funds generates its revenue through a stable and diversified model designed for resilience.

Performance and management fees on actively managed portfolios.

Long-term investment returns from equities, fixed income, and alternative markets.

Strategic partnerships that enhance scale and distribution.

Advisory and structuring services for institutional clients.

Each stream supports a sustainable foundation, recurring, predictable, and built on trust rather than speculation.

Why does the engine keep growing

Provident Funds doesn’t chase markets, it understands them. Growth is driven by a combination of discipline, data, and long-term thinking.

Consistent, inflation-beating returns across cycles.

Strong risk-adjusted performance through diversification.

Continuous reinvestment in analytics and portfolio technology.

Expanding client base through education and transparency.

Every success reinforces the next. Investors stay, portfolios mature, and the foundation strengthens.

What gives Provident Funds its edge

Provident Funds distinguishes itself not by marketing, but by measurable results. Its edge lies in the structure behind the performance:

Rigorous risk management that prioritizes capital protection.

Transparent reporting, investors always know where they stand.

Institutional-grade governance exceeding regulatory standards.

A research-led culture where every decision is justified by data.

Provident Funds doesn’t just promise stability, it proves it, year after year.

More than a fund manager

Provident Funds is a long-term partner in financial growth. It bridges traditional finance with modern intelligence, aligning capital with clarity and purpose.

Educates investors for stronger financial literacy.

Integrates sustainable and ethical investment principles.

Builds strategies designed for endurance, not speculation.

Provident Funds Ltd isn’t built on noise, it’s built on trust.

It’s redefining quality fund management through transparency, discipline, and measurable performance.

Cerillion Plc (Ticker: $CER.L)

Powering the world’s digital economies through intelligent billing, charging, and customer management.

Cerillion builds the technology backbone that keeps telecoms, utilities, and subscription businesses running, seamlessly, scalably, and profitably.

Cerillion’s revenues

Cerillion generates revenue from a diversified, recurring model that balances software licensing with long-term service contracts.

Enterprise software licenses and SaaS subscriptions for telecom and digital service providers.

Implementation, integration, and managed service fees.

Maintenance and support contracts with multi-year renewals.

Cloud hosting and data management for mission-critical operations.

This combination ensures predictable income and deep client relationships, every project becomes a partnership, not a transaction.

This engine will keep outperforming

Cerillion sits at the center of a global shift toward digital billing and subscription economies. As complexity grows, demand for integrated, automated systems accelerates.

High switching costs make customers loyal for the long term.

Continuous innovation in automation, CRM, and AI-driven analytics.

Expanding SaaS platform attracts new clients without heavy infrastructure needs.

Proven scalability, from regional operators to global enterprises.

Growth isn’t just about adding clients. It’s about deepening value within every client ecosystem.

What gives Cerillion its edge

Cerillion’s strength lies in its precision, technology that simplifies the complex.

Modular, end-to-end BSS/OSS platform built for flexibility and speed.

Rapid deployment and lower total cost of ownership than legacy competitors.

Deep sector expertise spanning telecom, energy, and digital media.

Transparent pricing and performance metrics that clients can measure.

Cerillion doesn’t sell software, it sells stability, efficiency, and growth capacity.

More than a software company

Cerillion is redefining how digital service providers operate. It turns complexity into clarity, helping clients launch new services faster, bill accurately, and scale globally.

Enables providers to monetize innovation instantly.

Reduces operational overhead through intelligent automation.

Builds long-term trust through reliability and transparency.

Cerillion isn’t just powering digital transformation, it’s engineering the infrastructure behind it.

It’s not about billing systems.

It’s about business acceleration.

Bouvet ASA (Ticker: $BOUV.OL)

Transforming complexity into clarity through technology, design, and human insight.

Bouvet is a leading Nordic consultancy that bridges strategy, software, and sustainability, helping organizations build the digital foundations of tomorrow.

Cash comes from long-term partnerships

Bouvet’s revenue model is built on expertise, execution, and enduring client relationships.

Consulting and development services across IT, design, and business transformation.

Long-term digital partnerships with public institutions and leading enterprises.

Project-based and recurring contracts in software engineering, cloud, and cybersecurity.

Advisory and managed services for innovation, AI, and process automation.

Bouvet’s business grows by solving complex challenges, and turning them into measurable value.

How it gets even more robust

Bouvet’s growth is driven by trust, talent, and transformation.

As the demand for digital modernization accelerates, Bouvet remains the go-to partner for organizations seeking reliable, human-centered solutions.

Deep integration within clients’ strategic operations creates lasting contracts.

Multi-disciplinary teams combine design thinking with technical precision.

Expansion across the Nordics strengthens scale without sacrificing quality.

Continuous investment in people, Bouvet’s true competitive edge.

The company doesn’t just follow digital trends, it defines how digital transformation succeeds in practice.

What gives Bouvet its edge

Bouvet’s advantage lies in its combination of technical depth and human insight.

Transparent, collaborative culture that drives client trust.

Strong focus on sustainability and ethical technology use.

Proven track record across critical sectors, from energy to government.

Agile delivery models ensuring precision, adaptability, and speed.

Every Bouvet project carries the same DNA: clarity, accountability, and craftsmanship.

More than a consultancy

Bouvet is not simply a provider, it’s a partner in progress.

It unites creativity with engineering discipline, helping clients evolve through smarter systems and sharper strategies.

Builds digital ecosystems that last beyond the next upgrade.

Elevates customer experiences through design and data.

Fosters sustainable innovation at every stage of transformation.

Bouvet isn’t just building solutions.

It’s building capability, inside organizations, and across society.

Delta Israel Brands Ltd (Ticker: $DLTI.TA)

Defining everyday comfort through quality, innovation, and brand integrity.

Delta Israel Brands Ltd is one of the leading apparel and lifestyle companies in the Middle East, building trusted consumer relationships through timeless design, sustainable production, and omnichannel excellence.

How does it generate revenues? Well!

Delta’s revenue engine is built on a balanced blend of direct-to-consumer strength and global brand partnerships.

Retail and e-commerce sales through Delta’s owned stores and digital platforms.

Licensing and distribution of international brands across Israel and Europe.

Private-label manufacturing and B2B supply partnerships.

Subscription and loyalty programs that drive repeat customer engagement.

Every channel reinforces the other, retail builds awareness, digital builds scale, and partnerships build reach.

Growth, growth, and more growth

Delta’s growth story is powered by brand trust and operational precision. The company combines fashion agility with manufacturing discipline, an advantage few apparel groups can replicate.

Vertical integration ensures full control from design to shelf.

Strong e-commerce infrastructure supports fast market adaptation.

Expansion into lifestyle and athleisure segments captures long-term demand.

Commitment to sustainability enhances brand value and consumer loyalty.

Delta doesn’t just follow consumer trends, it shapes them through insight, design, and experience.

What gives Delta its edge

Delta’s power lies in consistency, consistent quality, delivery, and brand execution across every touchpoint.

Deep brand portfolio spanning everyday essentials to premium lines.

Advanced supply chain and logistics enabling rapid response to demand.

Transparent sustainability initiatives that resonate with conscious consumers.

Proven ability to scale regionally without losing brand identity.

Delta Israel Brands turns apparel into trust, every product reflects the discipline behind the brand.

More than a fashion company

Delta stands for more than clothing. It represents comfort, reliability, and the evolution of modern living.

Builds enduring customer relationships through transparency and quality.

Integrates design, technology, and sustainability at the core of production.

Operates with long-term vision, brands built to endure, not just sell.

Delta Israel Brands Ltd isn’t chasing fast fashion.

It’s creating timeless value, where design meets discipline, and comfort becomes culture.

PT Sariguna Primatirta Tbk (Ticker: $CLEO.JK)

PT Sariguna Primatirta Tbk, the company behind CLEO, has become a benchmark for quality, efficiency, and integrity in Indonesia’s bottled water industry. By combining innovation with disciplined execution, it turns a basic human need into a business of sustainable growth.

How the business flows

Sariguna operates through a vertically integrated model that captures value from production to point of sale. Its system is designed for scale, efficiency, resilience, and quality-assured.

Bottled water production under the CLEO brand and other labels.

Distribution through modern and traditional retail channels nationwide.

Regional manufacturing facilities that cut transport costs and reduce carbon footprint.

Expansion into value-added beverage categories and eco-friendly packaging.

Every link in the chain, from source to consumer, is built on precision, trust, and transparency.

The drivers behind the growth

Indonesia’s expanding middle class, urbanization, and focus on health have created strong, lasting demand for premium bottled water. Sariguna is perfectly positioned to serve that demand and lead it.

Widespread market coverage through a dense distribution network.

Consistent brand recognition and loyalty built over years of reliability.

Operational efficiency that safeguards margins amid rising costs.

Continuous reinvestment in purification and automation technologies.

Growth is not fueled by chance, but by control, control over quality, costs, and consumer connection.

What defines Sariguna’s strength

Sariguna’s true advantage lies in its standards, the discipline to maintain purity and precision at scale.

Water quality that meets international certification benchmarks.

Sustainable sourcing and waste reduction initiatives.

A brand identity rooted in safety, transparency, and community trust.

Proven governance and financial resilience across market cycles.

Each bottle of CLEO represents more than water, it reflects a promise kept, every time.

Beyond the bottle

Sariguna’s mission extends beyond business performance. The company views access to clean water as a shared responsibility, one that supports both public health and environmental balance.

Expanding community programs for safe drinking water access.

Investing in renewable energy and recyclable packaging.

Creating shared value across suppliers, employees, and local communities.

PT Sariguna Primatirta Tbk isn’t just producing bottled water.

It’s sustaining wellbeing, trust, and the environment, one drop at a time.

Emirates Driving Company P.J.S.C. (Ticker: $DRIVE)

Shaping safer roads through knowledge, precision, and innovation.

Emirates Driving Company (EDC) is the UAE’s leading driver education and training institution, setting national and regional standards in road safety, mobility education, and driver competence. Through technology, experience, and discipline, EDC transforms training into a lifelong culture of responsibility.

How the business moves forward

EDC’s operations merge education, regulation, and technology, creating a reliable ecosystem that serves both individual drivers and corporate fleets.

Comprehensive driver training programs for light, heavy, and specialized vehicles.

Corporate and government partnerships for fleet safety and skill certification.

Continuous testing, assessment, and licensing services in collaboration with authorities.

Expansion into digital learning and simulation-based training platforms.

Each service generates value through precision and compliance, ensuring that every driver trained represents a safer journey on the road.

What drives growth

As mobility expands across the UAE and beyond, demand for structured, high-quality driver education continues to rise. EDC’s growth is built on trust, regulation alignment, and technological innovation.

National population growth and tourism fuel rising training demand.

Strong institutional partnerships reinforce EDC’s leadership position.

Digital learning and VR simulation unlock scalable new revenue streams.

Continuous improvement culture aligns with government safety initiatives.

The result is a model that grows sustainably, every new learner adds to both business performance and national safety goals.

The foundation of excellence

EDC’s edge lies not only in what it teaches but how it teaches. The company combines human expertise with advanced systems to deliver measurable outcomes.

ISO-certified quality management and safety frameworks.

Proprietary digital platforms for testing, performance tracking, and feedback.

Experienced instructors trained to global standards.

Transparent performance metrics that ensure accountability and improvement.

This commitment to consistency has made EDC synonymous with professionalism and reliability across the UAE’s transport ecosystem.

Beyond driving education

EDC’s mission extends beyond licenses, it’s about shaping national awareness. The company plays an active role in building safer communities through education, innovation, and collaboration.

Public awareness campaigns promoting responsible driving behavior.

Research partnerships supporting traffic safety policy development.

Investment in technology that bridges training and real-world safety data.

Emirates Driving Company isn’t just teaching people to drive.

It’s teaching a nation how to move, responsibly, intelligently, and safely.

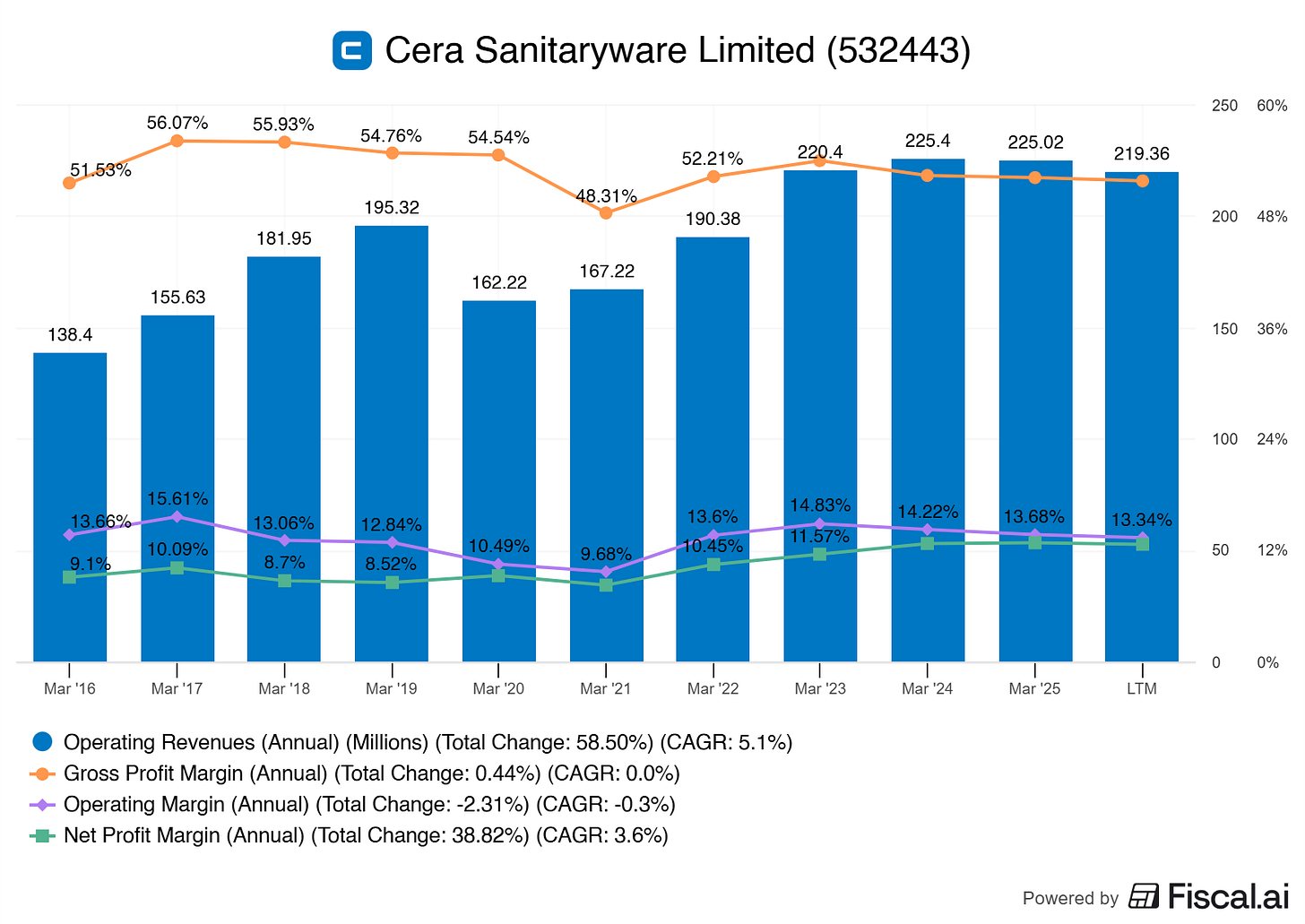

Cera Sanitaryware Limited (Ticker: $CERA.NS)

Where design meets durability.

Cera Sanitaryware Limited stands as one of India’s most trusted names in sanitaryware and bathroom solutions, a brand built on craftsmanship, innovation, and integrity. From homes to hotels, from modern apartments to infrastructure projects, Cera defines the art of hygiene with technology and timeless design.

How value is created

Cera’s business combines manufacturing precision with brand strength. Its integrated operations, from raw material processing to finished goods, give it control over quality, cost, and consistency.

Manufacturing and sale of sanitaryware, faucets, tiles, and wellness products.

Pan-India distribution network covering retail, real estate, and institutional clients.

Brand-driven growth supported by premium showrooms and digital presence.

Strategic partnerships with architects, developers, and design studios.

This model allows Cera to deliver both volume and value, scaling production without ever diluting the brand.

The engines of growth

Cera’s expansion is powered by urbanization, rising consumer aspirations, and the growing demand for lifestyle-driven interiors. But the company’s true strength lies in how it adapts, blending Indian scale with global sensibility.

Constant product innovation across design, materials, and water efficiency.

Focus on mid- to premium-market consumers seeking modern solutions.

Capacity expansion and automation enhancing operational efficiency.

Deep brand loyalty built through reliability and after-sales service.

Every showroom, every faucet, every finish reflects Cera’s long-term philosophy: quality you can feel, trust you can measure.

Why Cera leads

Cera’s edge lies in its consistency, the ability to maintain global standards in a dynamic market.

Advanced production facilities using European technology.

Robust quality assurance ensuring defect-free, precision-engineered products.

Strong governance and transparent business practices earning investor trust.

Sustainable manufacturing with a focus on water conservation and energy efficiency.

Cera doesn’t compete on price, it competes on permanence.

Beyond bathrooms

Cera’s vision extends beyond products to purpose. It stands at the intersection of lifestyle, sustainability, and design, shaping how people experience everyday living spaces.

Promoting eco-conscious innovation and resource-efficient design.

Supporting infrastructure growth through reliable, scalable solutions.

Elevating Indian manufacturing to international standards of aesthetics and performance.

Cera Sanitaryware Limited isn’t just building bathrooms.

It’s shaping environments that last, functional, beautiful, and responsible by design.

The next list won’t be free.

These opportunities move fast, and the ones coming next will be exclusive to our Fluent Few, the inner circle compounding quietly ahead of the crowd.Right now, you can join for only $34.99/month or $340/year (save $79.88 yearly).

If you’re on iOS or Android, subscribe via the website, it’s 30% cheaper and keeps every cent working for you.

You’re fully protected by a 7-day money-back guarantee. No risk. No fine print. Just results.

Which of these companies are you diving deeper into?

Let me know in the comments. Let’s share insights and compound ideas together. 👇🏻

If you’d like to stay connected beyond this newsletter, you can find me on Instagram, Facebook, LinkedIn, Twitter, and YouTube.

Just click the button below to access all my channels in one place.

Thank you for reading, and for being part of this growing community of serious, long-term investors.

Your time and attention mean more than you think.

Next up: the Cembre investment case, dropping in days. It’s going to be one you won’t want to miss.

See you there — or be square.

And remember:

Great investments don’t shout. They compound quietly.

— Yorrin (FluentInQuality)