7 High-Quality Mid-Caps You Need To Monitor Closely In 2025

It's often said that true wealth is build from holding small and mid-caps for a long period. Here are 7 that, sooner or later, you could hold forever.

Welcome back, Fluenteers!

We’ve previously discussed small-caps, and I've received numerous messages to cover mid-caps; that’s on today’s agenda. Small-caps often have wider and deeper economic moats compared to large-caps, offering more predictability and safety to quality investors like yourself and me. Today, we’re covering 7 small-caps with a robust economic moat, predictable revenues, a strong secular trend, and competent management at the helm of the company.

Here are the 7 small-caps that are worth a spot on your watchlist.

Happy compounding!

7. Sezzle Inc. (Ticker: SEZL)

Buy Now, Pay Smarter. Sezzle is rewriting the rules of credit.

Sezzle isn’t just another BNPL app.

It’s a mission-driven fintech with a clear focus:

Empower younger, underserved consumers with smarter, interest-free payment options.

While giants chase global scale, Sezzle sticks to what it does best:

Transparent installment plans

Strong merchant partnerships

Financial tools that build—not trap—consumer credit

This isn’t about debt. It’s about control, education, and trust.

A customer-first model with a purpose.

Sezzle built its platform on a foundation of ethical finance:

Zero-interest, pay-in-4 plans

No hidden fees or revolving debt

Credit-building features via partnerships (like Sezzle Up)

Emphasis on financial literacy and responsible spending

Its typical user isn’t maxing out cards—they’re managing tight budgets with discipline.

And that trust translates into loyalty, engagement, and repeat usage.

Small footprint. Sharp execution.

Unlike bloated competitors, Sezzle:

Stays lean with disciplined spending

Targets North America with localized precision

Keeps its underwriting tight and its fraud losses low

Avoids chasing unsustainable growth at all costs

This isn’t a blitzkrieg strategy. It’s a sustainable one.

Merchant-focused. Margin-aware.

Sezzle isn’t just loved by users. It’s a valuable tool for merchants:

Drives conversion and average order value

Integrates seamlessly into e-commerce stacks

Offers customer insights, real-time analytics, and repeat shopper data

It monetizes through merchant fees, not user exploitation.

As volume scales, margins also follow.

Turning the corner. Quietly.

After years of building the rails, Sezzle is shifting gears:

Achieved positive EBITDA and near break-even net income

Reduced costs and improved underwriting discipline

Expanded high-value partnerships (e.g., Target, GameStop)

Gaining wallet share in a saturated but stabilizing BNPL market

In an industry littered with flameouts, Sezzle is still standing—and turning profitable.

Optionality through simplicity.

Sezzle may look niche, but there’s leverage inside:

Credit reporting integrations → build long-term trust loops

Sezzle Premium → subscription revenue for power users

B2B tools → fraud management, customer analytics, financing solutions

International opportunities, selectively and sustainably

Every added layer reinforces the core value prop: smarter payments.

In a crowded space, Sezzle stands apart.

Not because it’s the biggest.

But because it’s:

Focused

Ethical

Capital-light

User-loved

Merchant-aligned

While competitors burn through cash and credibility, Sezzle quietly compounds both.

It’s not just buy now, pay later. It’s trust now, grow forever.

Sezzle isn’t for every investor.

But if you believe fintech can be lean, local, and principled, this just might be one to watch.

6. IES Holdings, Inc. (Ticker: IESC)

Power, connectivity, and the backbone of American industry. IES Holdings builds it all.

IES Holdings doesn’t build skyscrapers.

It builds what makes them work.

Electric systems. Communications infrastructure. Industrial automation.

IES is a quiet leader in essential, technical contracting and services across the U.S.

From data centers to schools, factories to solar farms—when things need to work, IES makes sure they do.

Four segments. One integrated engine.

IES operates through four distinct, cash-generating segments:

Communications – designs and installs structured cabling, data networks, and tech infrastructure

Residential – wiring and electrical services for homebuilders in high-growth regions

Commercial & Industrial – electrical contracting for large-scale facilities, including energy and manufacturing

Infrastructure Solutions – custom-engineered solutions for switchgear, control panels, and automation

Each segment serves a different market. Together, they create a diversified, recession-resilient revenue base.

Not a cyclical contractor. A long-term compounder.

While others chase project volume, IES plays the long game:

Focuses on recurring or essential services, not just one-off builds

Targets higher-margin technical niches, not commodity labor

Emphasizes decentralized leadership—each business runs like its own focused company

Operates with low corporate overhead, enabling reinvestment where it matters

Margins aren’t sky-high, but they’re consistent.

And the capital allocation? Quietly excellent.

Founder DNA. Owner mindset.

Chairman Jeff Gendell, through his fund, holds a significant stake in the business.

That ownership mentality trickles down:

Conservative use of leverage

Acquisitions focused on fit and returns, not hype

A deep bias toward cash flow over optics

It’s not the kind of company that hits earnings beats—it’s the kind that keeps showing up, year after year.

Tailwinds in every direction.

IES doesn’t need a boom to grow. It just needs the world to keep functioning—and modernizing:

Data infrastructure demand keeps rising with cloud and AI

Residential buildouts remain strong in the U.S. Sunbelt

Energy transition drives upgrades in industrial power systems

Automation and reshoring boost demand for control systems and custom fabrication

And IES is positioned right where those dollars are going.

Growth through execution, not excitement.

IES doesn’t issue bold forecasts or flash headlines.

Instead, it quietly delivers:

Mid-to-high single-digit organic growth

Healthy free cash flow conversion

A growing base of recurring and service-driven revenue

Smart tuck-in acquisitions that enhance—not dilute—the model

The result? A company that grows without chasing growth.

Underfollowed. Understated. Underappreciated.

IES Holdings won’t show up in your favorite tech ETF.

But it touches nearly everything that enables the modern economy—from broadband to electricity to industrial control.

In a world of hype cycles and fragile narratives, IES offers something rare:

Execution. Essentials. And endurance.

And that might be the most powerful compounder of all.

5. Tecnoglass Inc. (Ticker: TGLS)

Not just windows. Not just glass. Tecnoglass builds the skin of modern cities.

Tecnoglass Inc. operates in a space most investors overlook—

Architectural glass, aluminum, and window systems for commercial and residential buildings across the Americas.

But this isn’t commodity glass. This is:

Hurricane-resistant, energy-efficient facade tech

Built to meet strict U.S. building codes

Engineered from start to finish in a single, vertically integrated process

Once installed, it’s there for decades. Replacing it isn’t a decision—it’s a rebuild.

Built for the real economy. And built to last.

Demand for Tecnoglass isn’t optional—it's structural:

Urban migration is reshaping U.S. cities

Energy regulations are tightening, especially in the Sunbelt

Developers want performance, reliability, and code compliance

Tecnoglass delivers it all—faster and cheaper than competitors.

How? With Latin American cost efficiency and U.S. distribution muscle.

Vertical integration that feels like software.

Unlike fragmented peers, Tecnoglass does it all in-house:

Glass processing

Aluminum extrusion

Final assembly

Direct-to-developer logistics

The result?

Shorter lead times

Higher margins

Total quality control

Custom solutions at scale

This is manufacturing as a service, with long-term lock-in.

A U.S.-focused export story—with a moat.

Over 90% of revenue comes from the United States, especially Florida, Texas, and Georgia.

Key advantages:

Proximity: Colombia is closer to Miami than many U.S. factories

Speed: Faster delivery cycles due to direct shipping and strong logistics

Scale: Tecnoglass owns its distribution centers in the U.S.

It’s quietly become the go-to partner for mid- to high-rise development in key U.S. regions.

Led by founders. Run like owners.

Tecnoglass isn’t chasing trends—it’s building value, brick by brick:

Founder-led with deep operational roots

High insider ownership

Capital allocation focused on dividends, buybacks, and growth capex

No fluff, no flash—just compounding returns

ROIC stays healthy. Debt is under control. Execution is consistent.

Margins like software. Materials like steel.

Tecnoglass looks like a factory stock, but performs like a compounder:

Gross margins ~40%

Operating margins in the high 20s

Recurring demand from replacement cycles and urban development

Optionality through new product launches and regional expansion

In a commodity world, it has built an identity and pricing power.

Not cyclical. Structural.

Tecnoglass isn’t just cycling, it’s anchoring itself to:

Climate-driven infrastructure mandates

Aging building stock needing upgrades

Developers seeking trusted, integrated partners

It’s not just a supplier. It’s the quiet foundation behind skylines.

This isn’t hype. This is execution.

Tecnoglass won’t be the stock you brag about at parties.

But in five years, it might be the one you’re glad you never sold.

4. Mycronic AB (Ticker: MYCR)

Precision behind the screens. Mycronic enables the invisible.

Mycronic AB isn’t a consumer tech name.

But its technology sits at the heart of the devices you use every day.

From smartphones to EV displays, Mycronic powers the machines that build the displays, with:

Laser-based mask writers for semiconductors and photomasks

High-speed pick-and-place machines for circuit boards

Jet printers and automation tools for electronics assembly

This is niche manufacturing tech. Critical, complex, and deeply embedded in global supply chains.

Not mass market. Mission-critical.

Mycronic dominates in corners others can’t reach:

One of the only global players in high-end mask writers

Supplies Tier-1 foundries and display makers in Asia, Europe, and the U.S.

Long product cycles, long relationships, long lead times

Clients don’t switch often.

Precision tools worth millions don’t get replaced on a whim.

This isn’t transactional—it’s entrenched.

Steady demand. Deep moats.

Mycronic serves markets where:

Display technology keeps evolving (OLED, MicroLED, foldables)

Semiconductor complexity is rising

Miniaturization and custom PCB design are accelerating

And it offers exactly what OEMs need:

Ultra-precise systems

Long lifespan and upgradeable platforms

Integrated service and support

Margins stay strong because switching costs are high, and trust is even higher.

Multi-niche. Multi-engine. Margin-rich.

Mycronic isn’t a one-product story. It’s a portfolio of high-margin segments:

Pattern Generators – industry-leading tech for advanced photomask production

Assembly Solutions – jet printers, mounters, and dispensers for PCB manufacturing

Global Services – recurring revenue through maintenance, upgrades, and training

Together they create:

Healthy gross margins (~45–50%)

Strong operating leverage

Global revenue mix with expanding service lines

This is a company that scales without chasing scale.

Swedish engineering with global reach.

Headquartered in Täby—but with feet on the ground in key tech hubs:

Strong presence in East Asia (Taiwan, South Korea, China)

Installed base across the U.S. and EU

Responsive R&D that evolves with customer roadmaps

It's small enough to focus, but global enough to matter.

Resilient. Disciplined. Ready.

Mycronic doesn’t swing for the fences. It is engineered for reliability:

Net cash balance sheet

Disciplined capital allocation

Steady R&D investment to stay ahead of the tech curve

Strong backlog visibility due to long order cycles

When the industry breathes in, Mycronic stays calm. When it breathes out, Mycronic compounds.

Quietly indispensable.

You won’t see the Mycronic logo on your next device.

However, its technology likely played a role in its creation.

That’s the kind of company worth paying attention to:

Complex, critical, and quietly compounding at the edge of visibility.

3. Fortnox AB (Ticker: FNOX)

Sweden’s quiet digital backbone. Fortnox powers the small business engine.

Fortnox isn’t trying to be everything to everyone.

It’s focused on one thing—giving Swedish small businesses the digital tools to thrive.

And it’s winning.

Cloud-based accounting, invoicing, payroll, and CRM

Tailored for the local tax code, business culture, and regulatory environment

Built for small companies, sole proprietors, and entrepreneurs

This isn’t a global SaaS blitz.

It’s embedded infrastructure—woven into the fabric of everyday business.

Niche. Local. Unstoppable.

Fortnox thrives in a space where global giants often fail:

Highly regulated local workflows

Frequent tax and labor law changes

A fragmented customer base of non-technical users

And it turns these complexities into a competitive edge:

Plug-and-play simplicity

Industry-leading customer support

Constant product updates tuned to Sweden’s evolving needs

When your software just works for the local ecosystem, customers don’t leave.

They tell their friends.

Land-and-expand in its purest form.

The core strategy is simple—and beautifully efficient:

Win the customer with accounting

Layer on payroll, e-signing, CRM, time tracking, and more

Charge per module, per employee, per month

The longer you stay, the more you pay willingly.

Average revenue per customer keeps climbing.

Churn stays microscopic.

A platform, not a product.

Fortnox isn’t a tool. It’s becoming a business operating system:

Open APIs enable third-party integrations

A marketplace of partner apps adds long-tail functionality

Bank integrations, tax authorities, and accounting firms all plug in

The more nodes that connect, the harder it becomes to leave.

Every small business function is centralized in one clean interface.

Profit machine disguised as helpful software.

Under the hood, Fortnox is a financial outlier:

Gross margins above 80%

Operating margins hovering around 40%

Minimal sales costs thanks to strong word-of-mouth

Recurring revenue above 95%

It grows rapidly, reinvests wisely, and continues to generate cash.

A rare trifecta in European SaaS.

Optionality without distraction.

The core is Sweden, but Fortnox has levers:

Deepening wallet share with existing users

New verticals within the SME space

Potential regional expansion over the long term

More tools developed in-house or acquired surgically

No chasing scale for scale’s sake.

Every move ties back to simplicity and user experience.

Run by product-first thinkers.

The company’s culture is built around:

Continuous iteration

Customer feedback loops

Relentless focus on user ease

Leadership isn’t flashy, but they execute.

And they’ve proven they can scale without losing the simplicity that made them great.

Not loud. Not global. Not replaceable.

Fortnox doesn’t need to conquer the world.

It just needs to keep showing up, every day, for Sweden’s 1.3 million small businesses.

And it does—quietly, profitably, and with a product they can’t imagine working without.

2. Netwealth Group Limited (Ticker: NWL)

The quiet revolution in Australian wealth. Netwealth is building the pipes.

Netwealth Group isn’t a flashy fintech chasing trends.

It’s a technology-led platform reshaping how Australians manage and grow their wealth.

Think of it as the infrastructure layer for:

Financial advisers

High-net-worth individuals

SMSFs (Self-Managed Super Funds)

Family offices

It doesn’t compete with advisers—it empowers them.

And it continues to win market share year after year.

Built for the future of advice.

The financial advice industry in Australia is evolving:

Regulatory burdens are rising

Legacy platforms are clunky, expensive, and hard to integrate

Advisers need efficient tools, fast onboarding, and seamless client reporting

Netwealth meets that need with:

A clean, intuitive platform

Deep functionality: investments, tax, reporting, compliance

Strong third-party integration and APIs

Mobile-friendly, adviser-branded client portals

This is not a bank product retrofitted for wealth—it's wealth tech built from the ground up.

Modern wealth infrastructure with a 10-year head start.

Netwealth has spent over a decade refining its platform while competitors stood still:

Daily transaction visibility

Fast onboarding and account setup

Multi-asset, multi-model portfolios in one dashboard

Institutional-grade features for retail advisers

And it continues to add value—layer by layer, module by module.

The result? Advisers bring their clients. Clients bring their assets.

The flywheel turns.

Strong growth. Strong retention. High margin.

This isn’t just a better user experience—it’s a better business model:

Funds Under Administration (FUA) compound at double-digit rates

Net inflows consistently outperform peers

Operating margins above 40%

Low capital intensity, high recurring revenue

Add in platform fees, admin fees, and product margins—Netwealth captures value without overcharging.

Founder-led with skin in the game.

The Heine family continues to run the company and owns a significant stake.

That means:

Conservative balance sheet

Long-term thinking over quarterly optics

Reinvestment in tech, not marketing fluff

Relentless focus on adviser satisfaction

Culture matters—and Netwealth’s culture is one of trust, product obsession, and quiet dominance.

Optionality inside the engine.

Netwealth isn’t standing still. It has levers:

Product innovation (alternative assets, ESG, private markets)

Expanding into adjacent services (insurance, estate planning)

Potential geographic expansion or white-label offerings

Deepening adviser penetration across Australia

Every new feature increases platform stickiness.

Every adviser who joins rarely leaves.

1. Medpace (Ticker: MEDP)

Clinical trials don’t run themselves. Medpace runs them better.

Medpace isn’t a biotech.

It doesn’t chase the next blockbuster drug or headline breakthrough.

Instead, it sits in the picks-and-shovels layer of modern medicine:

A full-service clinical contract research organization (CRO).

Its role?

Design, manage, and execute clinical trials for drug and device companies

Navigate regulatory hurdles with precision

Accelerate time-to-market for life-saving therapies

It’s behind the scenes, but essential to the entire drug development chain.

A single, integrated model in a fragmented industry.

Most CROs piece together acquisitions.

Medpace is built differently:

One global platform

Centralized systems and processes

Employees trained and retained in-house

No outsourcing to third parties

This means:

Cleaner data

Tighter timelines

Higher quality control

Greater client trust

In an industry where precision is non-negotiable, consistency is a competitive edge.

Founder-led. Discipline-first.

Founder CEO Dr. August Troendle still runs the show and owns a large chunk of the business.

He’s not interested in empire-building. He’s interested in excellence.

What that looks like:

Little to no M&A

Consistent margin discipline

Reluctance to chase revenue at the expense of execution

Surgical hiring to protect culture and control

This is rare in CRO land—and it shows up in the numbers.

Financials that compound quietly.

Medpace doesn’t burn cash. It mints it.

Operating margins ~25–30%

High return on capital with minimal debt

Steady revenue growth, fueled by long-term client relationships

Highly visible revenue stream tied to multi-year trial phases

Clients don’t switch mid-trial. And when Medpace executes well, they rarely switch at all.

Tailwinds from every direction.

The market for outsourced clinical research keeps expanding:

Biotech funding remains robust

Trials are getting more complex—and more global

Regulators are tightening standards, requiring expert navigation

Pharma prefers CROs that can manage everything under one roof

Medpace doesn’t need explosive growth to win.

It just needs the industry to keep trending toward complexity, and it is.

Operational leverage. Optionality ahead.

Every new trial adds scale to Medpace’s already efficient base.

But there’s more under the surface:

Deepening capabilities in oncology, rare diseases, and cell therapies

Geographic expansion into underpenetrated markets

Potential to broaden lab and imaging services to capture more value

No need to overreach—just keep tightening the flywheel.

Not the loudest in the room. But one of the best run.

Medpace won’t show up on your biotech watchlist.

It doesn’t sell drugs—it sells trust, speed, and clinical clarity.

It compounds because it delivers.

It retains clients because it doesn’t overpromise.

And in a world full of moving pieces, that kind of focus is hard to replace.

This isn’t a biotech bet. It’s a cash-generating engine behind them.

Medpace doesn’t need hype. It just needs another trial.

And they keep coming.

🔥 Serious About Investing? Let’s Get to Work.

You’ve read the free stuff.

Now imagine what you could do with everything behind the paywall:

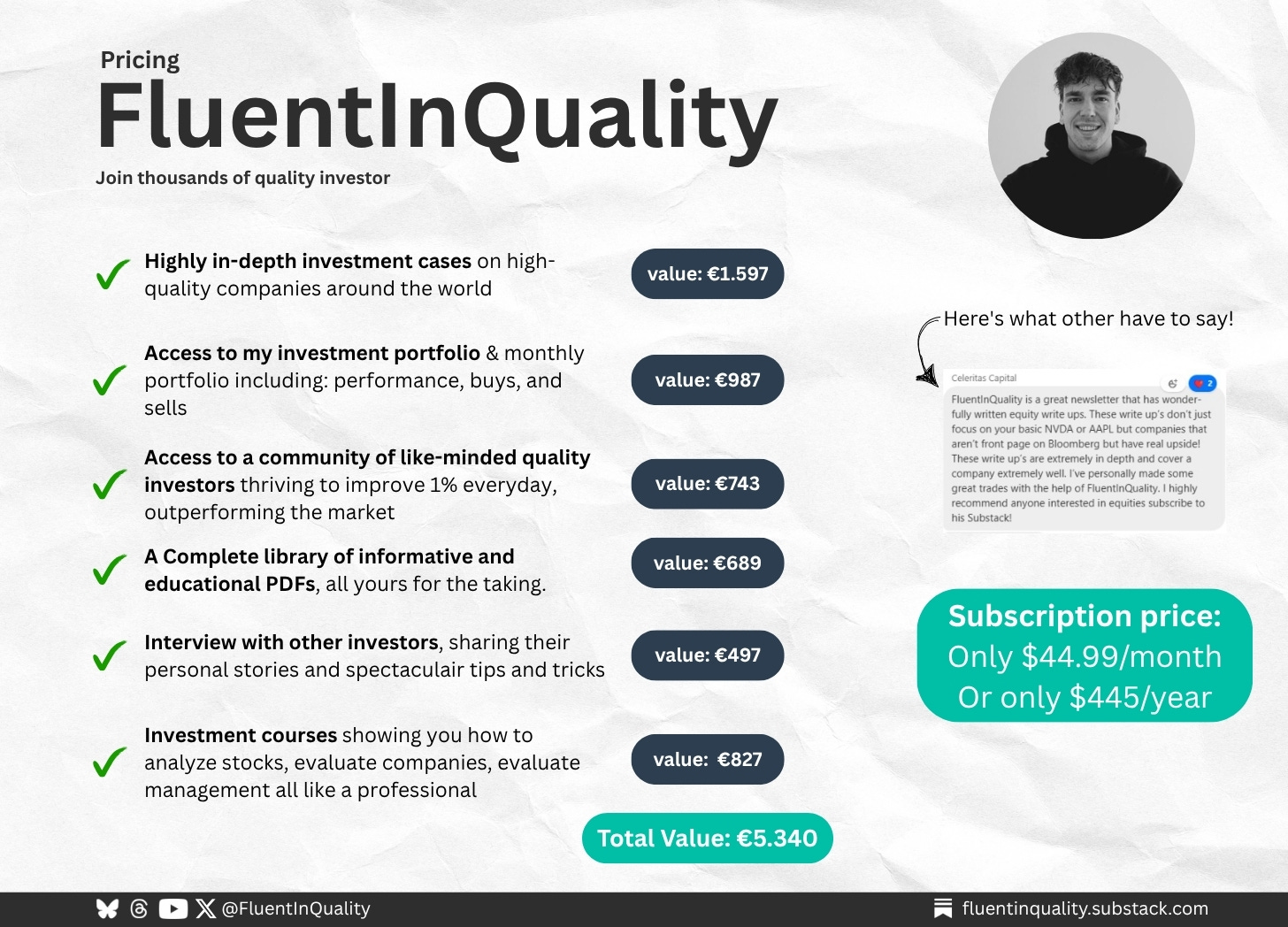

✅ In-depth investment breakdowns worth €1,597

✅ Access to my monthly portfolio: performance, buys, and sells (€987)

✅ A private community of like-minded investors (€743)

✅ Downloadable PDFs, tools, investor interviews, and more (€2,013 total)

Total value: €5,340 — Yours for just €44.99/month or €445/year.

This is not just information. It’s insight, strategy, and confidence — delivered weekly.

🟢 Join The Fluent Few and unlock your edge.

And that is it for today!

P.S.… if you’re enjoying FluentInQuality, could you take 3 seconds to refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world).

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Sources I Recommend

I use Finchat for all the charting, analysis, and keeping up with earnings calls. You can now get 15% off your subscription. Click here and start today!

Disclaimer

By accessing, reading, or subscribing to my content—whether on Substack, social media, or elsewhere—you acknowledge and agree to my disclaimer. Read the full disclaimer here.

Fortnox is being acquired.

”Biotech funding remains robust”… Are you sure lol 😀 Book to bill under 1 at the moment