5 Stocks That Are Ready to Beat the Market in 2025

As 2024 draws to a close, 2025 is all about fresh starts—and taking on the challenge of outperforming the almighty S&P 500. Ready? Let’s do this!

Hi, partner! 👋🏻

As 2025 approaches, it’s been another standout year for the markets and investors. The S&P 500 has surged an impressive 27% so far, and I’m thrilled to share that my own portfolio has matched this feat. In fact, since its inception on December 22, 2022, my portfolio is up a total of 60%—translating to a not-too-shabby compound annual growth rate (CAGR) of 26.10%.

Looking ahead to 2025, I plan to push for continued growth and hopefully outpace the S&P 500 again. But here’s the twist: I don’t treat the S&P 500 (or any index) as my benchmark. My real focus is finding stellar companies with the potential for big, long-term gains—even if it means I might sometimes lag broader indices.

But we can always play the game of ‘‘beating the S&P 500’’, right? Even though this is not our benchmark, it makes investing just a tad bit more ‘fun.’

Enough talking.

Let’s see what ten stocks might outperform in 2025 and why!

1. MacDonalds (NYSE: MCD)

McDonald’s Corporation is the world’s leading global food service retailer, serving millions of customers every day in over 100 countries. Founded in 1955 and headquartered in Chicago, Illinois, McDonald’s is renowned for its iconic menu items like the Big Mac, Fries, and Chicken McNuggets. With more than 40,000 restaurants worldwide, the company operates through a mix of company-owned and franchised locations. Focused on quality, convenience, and affordability, McDonald’s continues to innovate with digital ordering, delivery services, and sustainability initiatives, making it a household name and a symbol of fast-food excellence.

Consumers are spending less time at home, disposable income is growing globally, and the relentless pursuit of convenience is growing.

Here’s an excellent LinkedIn post talking more about these conveniences for consumers.

This is reflected in the industry's growth. The global fast food market was valued at USD 772.04 billion in 2023. It is projected to grow from $809.79 billion in 2024 to $1.186.44 billion by 2032, growing at a CAGR of 4.89% during the forecast period (2024-2032).

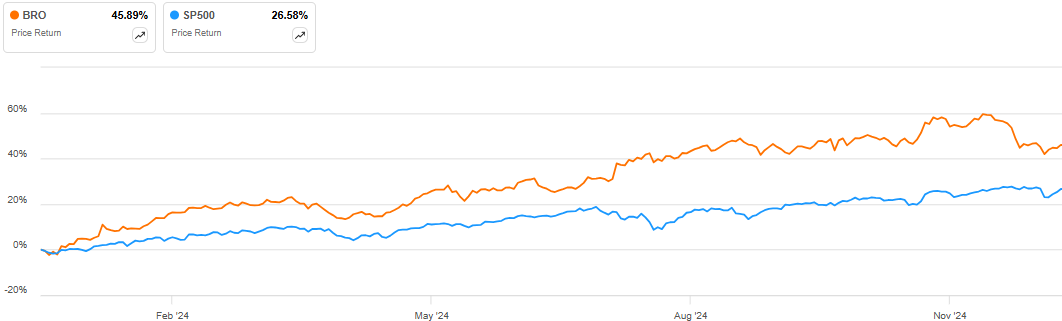

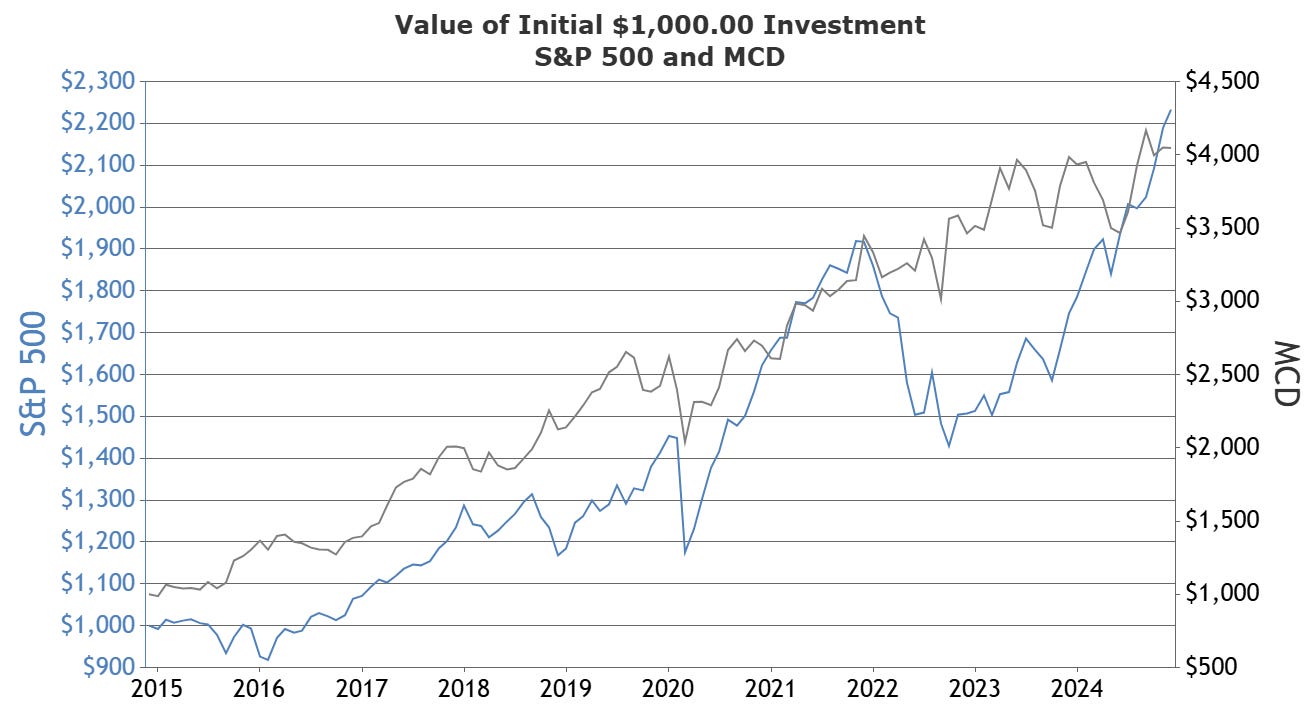

As shown above, McDonald's is not a stranger to beating the broader index. For most of the years, you were better off betting on this fast-food giant than the S&P 500. Of course, previous returns do not guarantee future returns, but it does paint a picture.

There’s a clear picture that we’re starting to have higher disposable incomes and a craving, increasing YoY, for more convenience. Mothers who usually keep up the home and ensure that everyone is fed work longer hours, and the demand for even more convenience is increasing. Yes, it's cliché, but it adds to the overall picture.

MacDonalds is at the top for these conveniences, benefiting greatly from it.

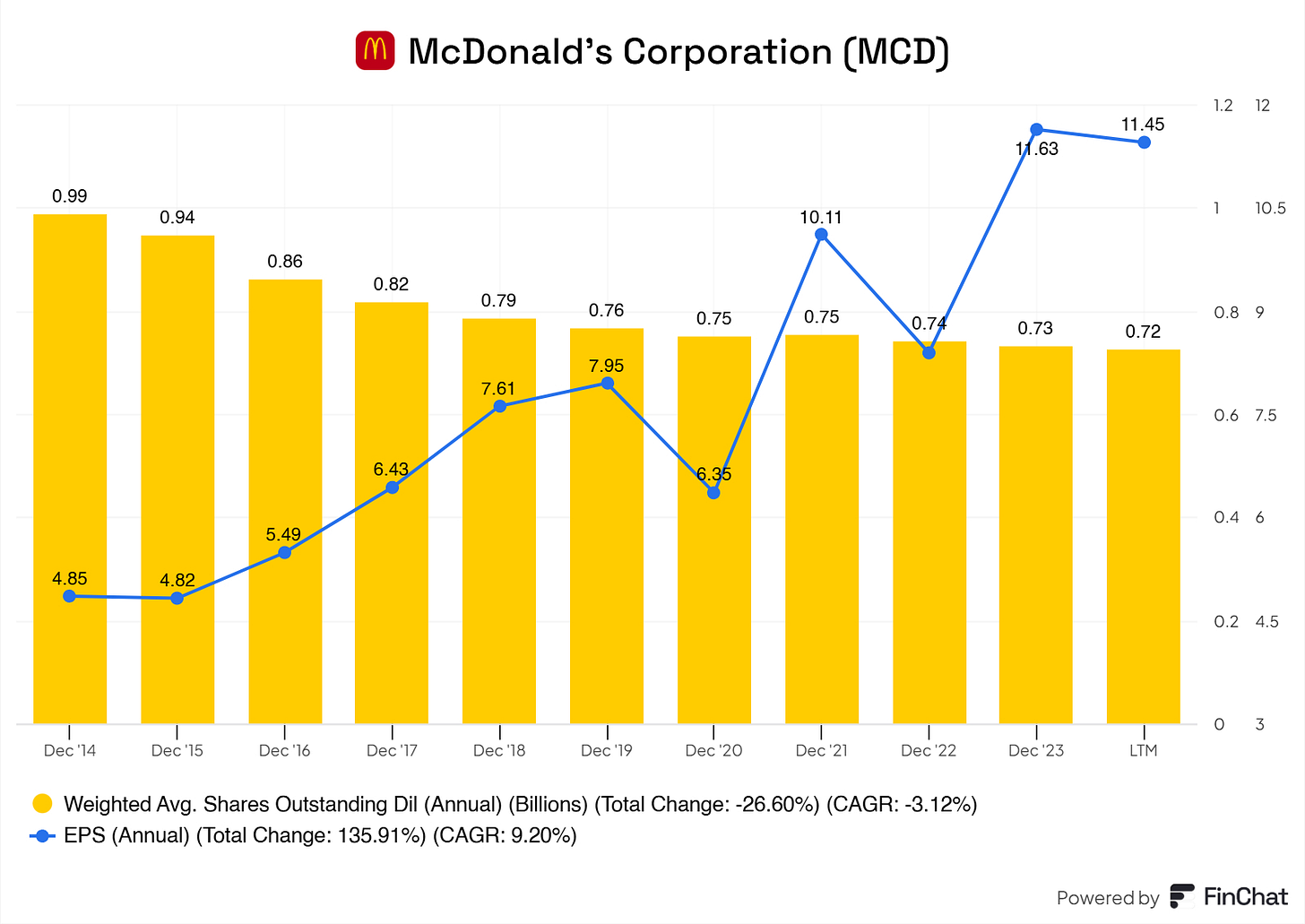

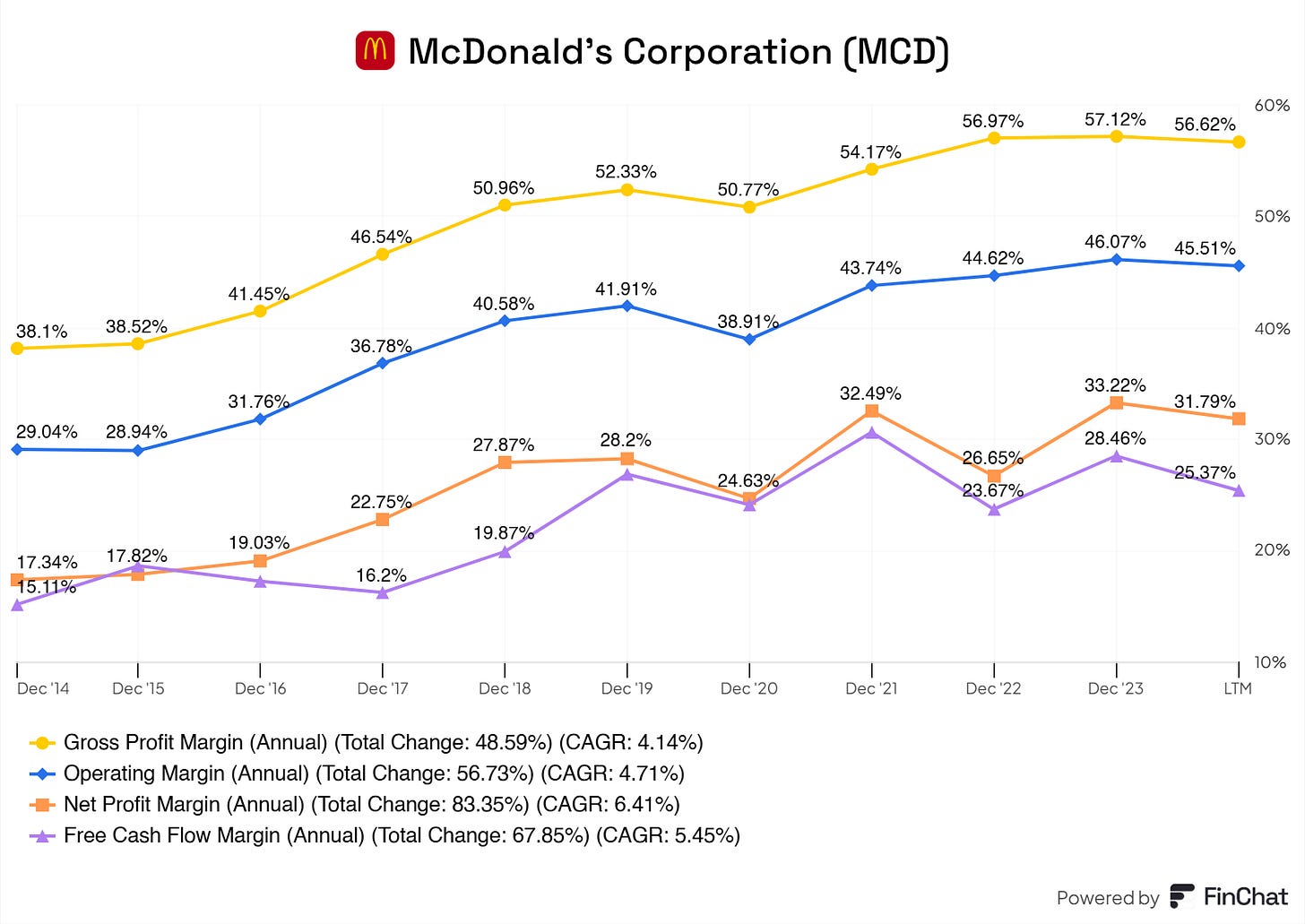

Besides this, there’s competent management, and McDonald's is rock solid during economic downturns; people keep eating (out). In addition, the business's margins and capital efficiency are also rock solid, creating more value for the business and its shareholders. MacDonald is also buying back shares, creating substantially more value for its shareholders, and MacDonald is determined to keep doing so; overall, it is lovely to see.

2. Brown & Brown (NYSE: BRO)

Brown & Brown, Inc. is one of the world's largest and most respected insurance brokerage firms. Founded in 1939, the company provides risk management solutions, insurance products, and services to businesses, individuals, and organizations. With a focus on innovation, integrity, and customer-first service, Brown & Brown operates through a decentralized model, empowering local offices to deliver personalized solutions while leveraging national resources. Headquartered in Daytona Beach, Florida, the company has over 15,000 teammates across more than 500 locations worldwide. Brown & Brown is committed to helping clients navigate risk and secure their future.

The son of J. Hyatt Brown, the founder of Brown & Brown, runs the business. J. Hyatt Brown still owns 13% of the business; talking about insider ownership, right? The son J. Powell Brown, holds roughly 1% of the shares, a tiny bit of inside ownership.

In addition, the global insurance brokerage market was valued at $287.40 billion in 2023 and is expected to grow at a CAGR of 9.2% from 2024 to 2030. The rising demand for insurance products drives the growth of the market. As economies expand, more individuals and businesses seek to protect their assets, income, and health through insurance.

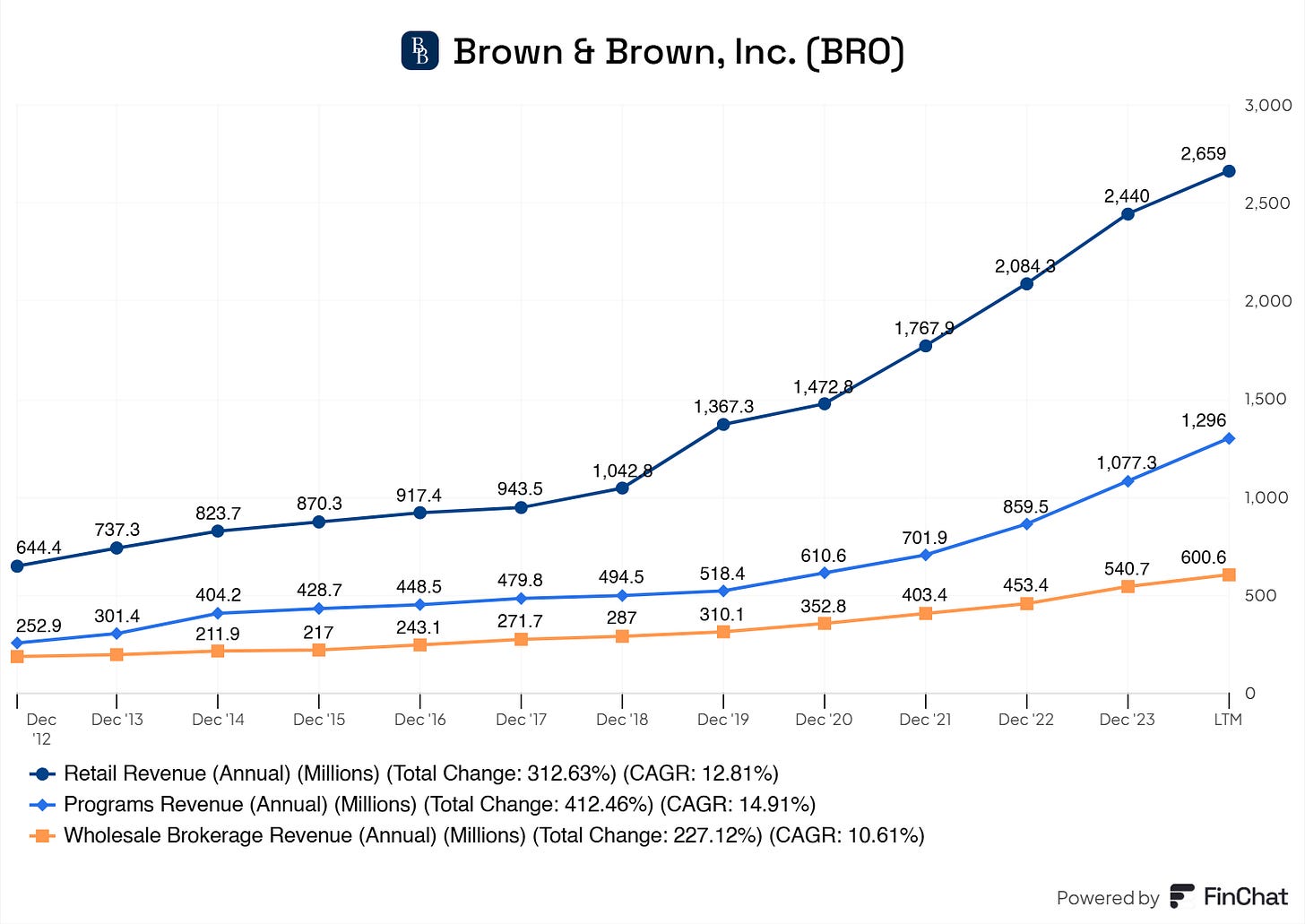

As we people are insuring more and have more to insure, the demand increases for fitting products that cover/insure the right product. Brown & Brown is in the middle of finding you the right coverage. Brown & Brown regularly do M&As to expand their offering, making it more niche and expanding globally.

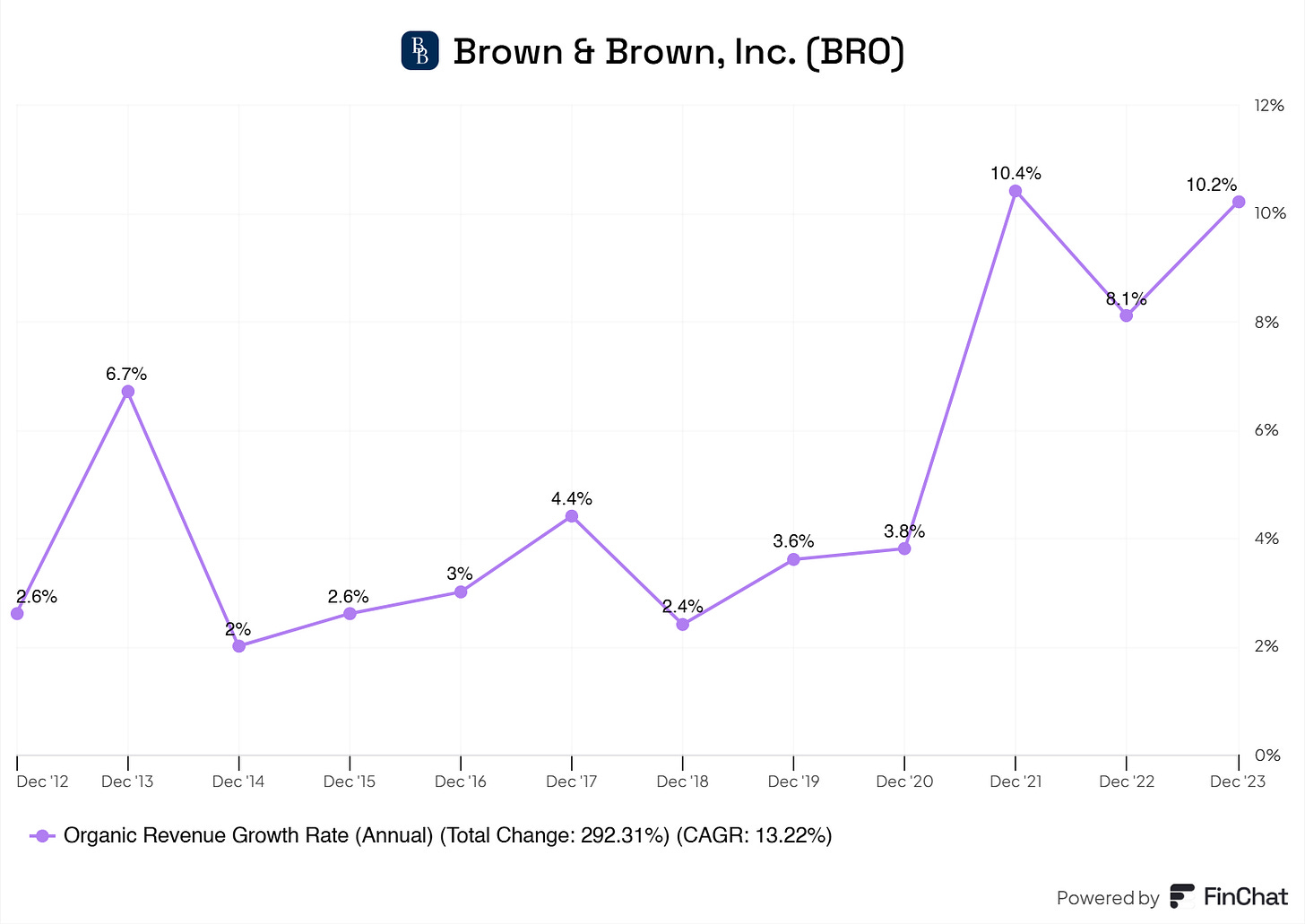

Fortunately, Brown & Brown is not reliant on these M&A’s, as shown by their organic revenue growth rate; it’s a monster in the right field moving in the right direction.

As shown in the graph below, Brown & Brown has already successfully beaten the &P 500 by almost double this year!

3. Berkshire Hathaway (NYSE: BRK.A)

Berkshire Hathaway Inc. is a multinational conglomerate holding company led by renowned investor Warren Buffett. Headquartered in Omaha, Nebraska, it owns a diverse portfolio of businesses across industries such as insurance, energy, manufacturing, retail, and transportation. Its subsidiaries include well-known brands like GEICO, BNSF Railway, See’s Candy, and Dairy Queen. Berkshire Hathaway is a major investor in publicly traded companies, including Apple and Coca-Cola. Berkshire Hathaway has become one of the world's most admired and financially successful companies, and it is known for its disciplined approach to value investing and long-term growth.

It should not surprise you that the business of a super investor is on the list. If there’s at least one person who knows how to run and handle a business in line with the needs of its shareholders, it will be Warren Buffet.

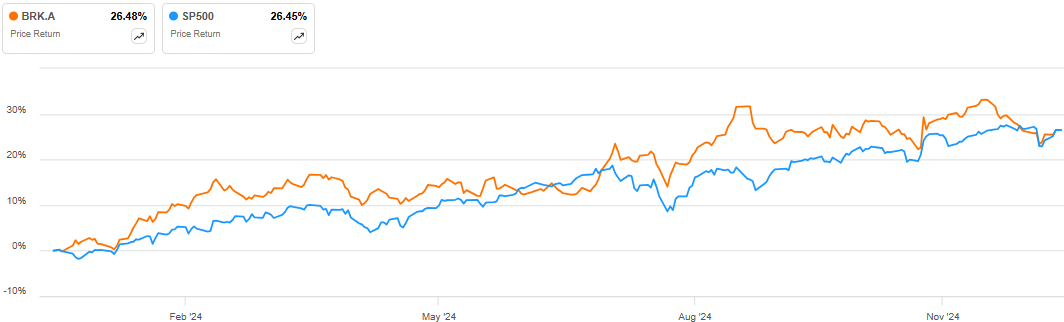

This year Berkshire managed to outperform the S&P 500 for the majority of the time, and that doesn’t surprise me. Warren is known for picking out the right stocks/businesses below fair value and keeping these to compound in the Berkshire portfolio over time. Besides stocks in their portfolio, Buffet owns multiple businesses, generating solid cash flows.

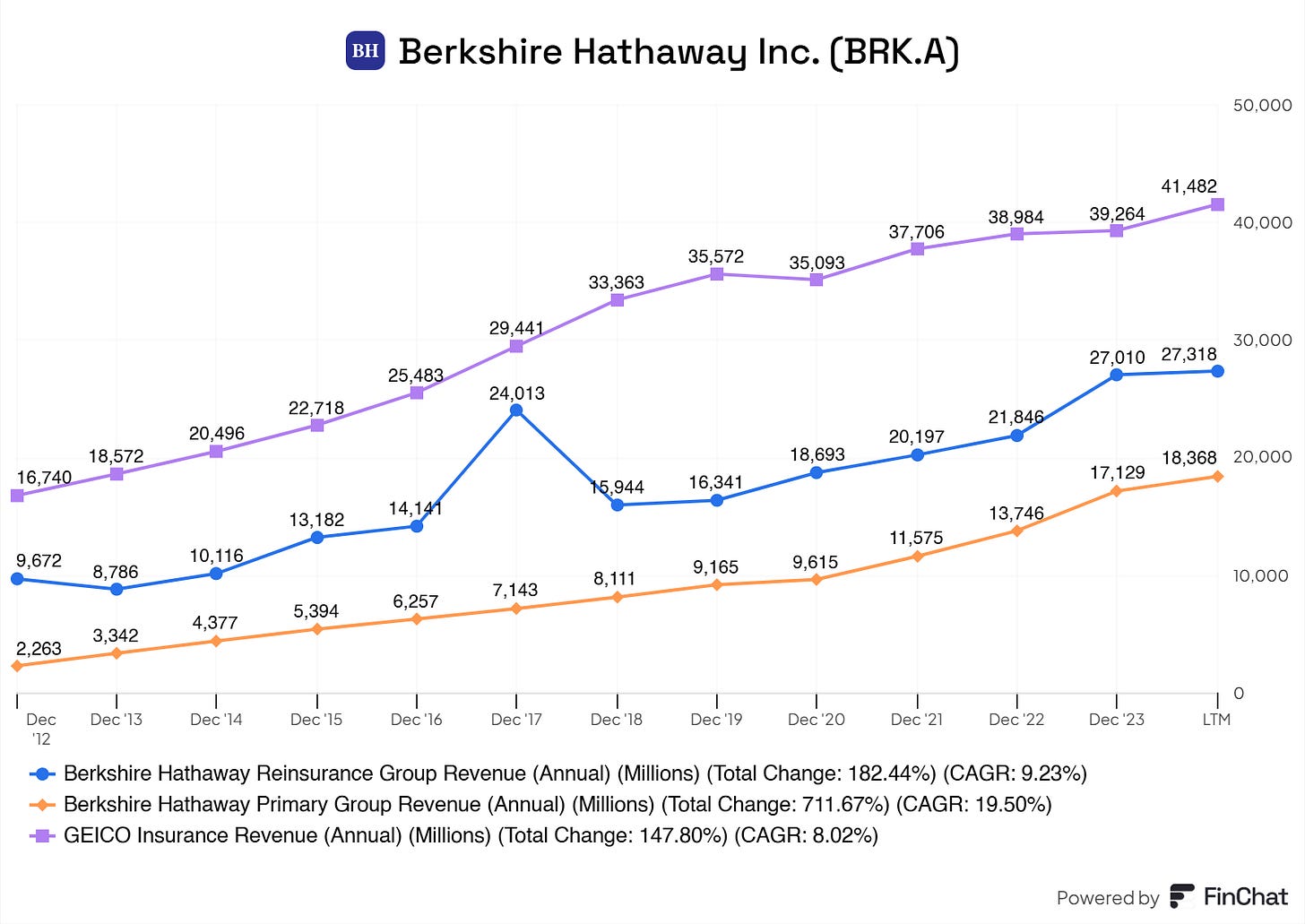

Here’s the revenue generated from the insurance businesses:

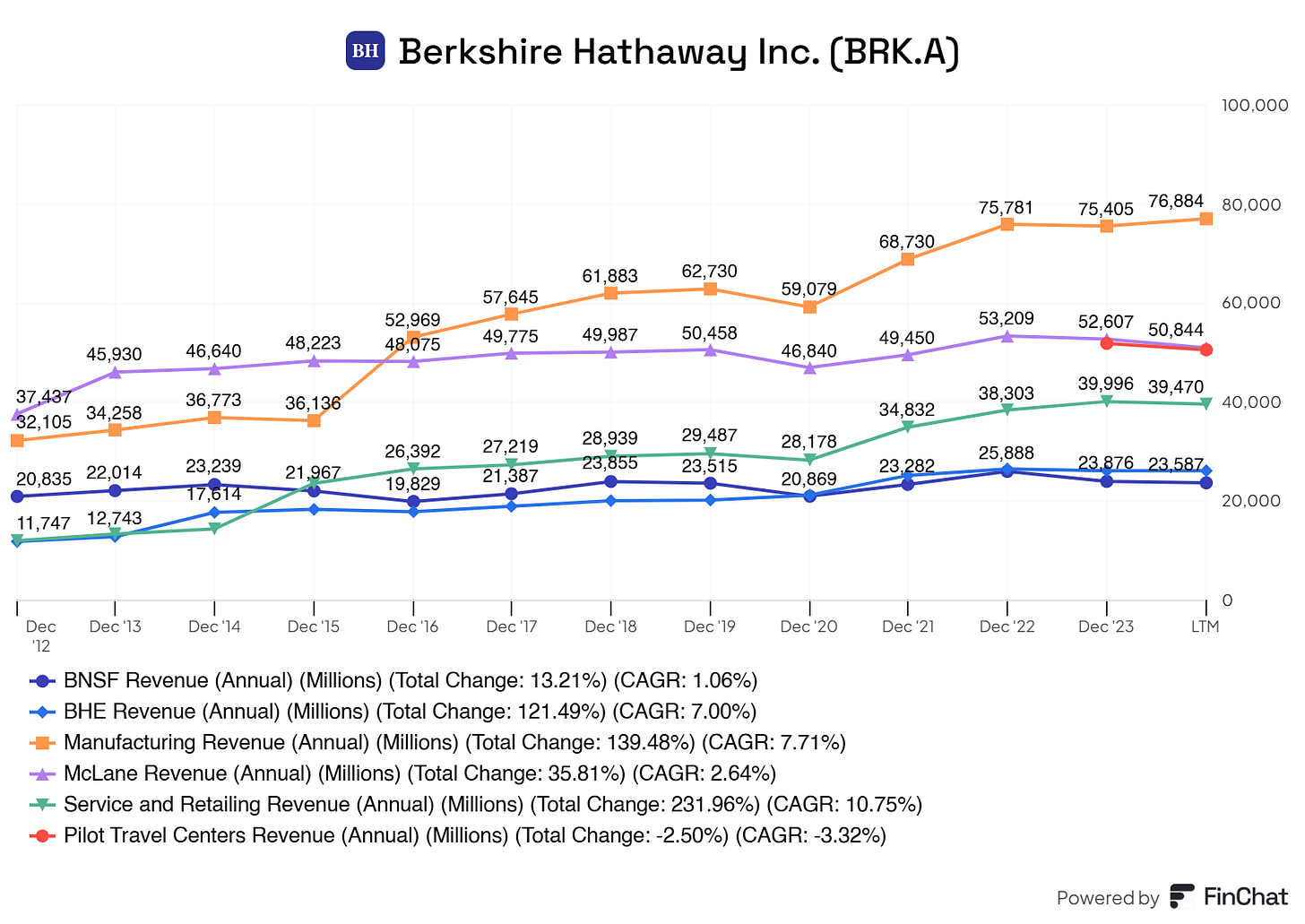

And here’s revenue generated from other businesses:

Overall, Berkshire is a compounding machine, and all the wheels/parts are perfectly aligned to outperform any other index out there.

Warren Buffet still owns 14%. Warren Buffet has significant skin in the game here!

4. Visa (NYSE: V)

Visa Inc. is a global leader in digital payments, enabling secure and seamless transactions across more than 200 countries and territories. Founded in 1958 and headquartered in San Francisco, California, Visa connects consumers, businesses, and financial institutions through its advanced payment network, VisaNet. The company’s innovative technologies power credit, debit, and prepaid card solutions, making electronic payments fast, reliable, and accessible. Committed to driving the future of commerce, Visa continues to expand financial inclusion and transform how the world pays and gets paid.

I did a deep dive on Visa ages ago, you can read it here, and I, not too long ago, wrote a ‘‘Best Buy’’ on Visa. You can read that here.

I’ve discussed this business a lot, and I personally hold a large chunk of capital in this business; it accounts for roughly 9% of my portfolio. This is because Visa and Mastercard run the whole payment industry together. Every transaction primarily comes from their network, and the fast scale of their operation is beyond our imagination. The global market for digital payment solutions is set to expand at a compound annual growth rate (CAGR) of 15.20% from 2023 to 2030, predicting a surge in market value to reach $24.31 trillion by 2030. Visa and Mastercard are the primary winners in the industry's overall growth, driven by the growing adoption of smartphones, wider internet penetration, innovative payment technologies, and burgeoning e-commerce activities.

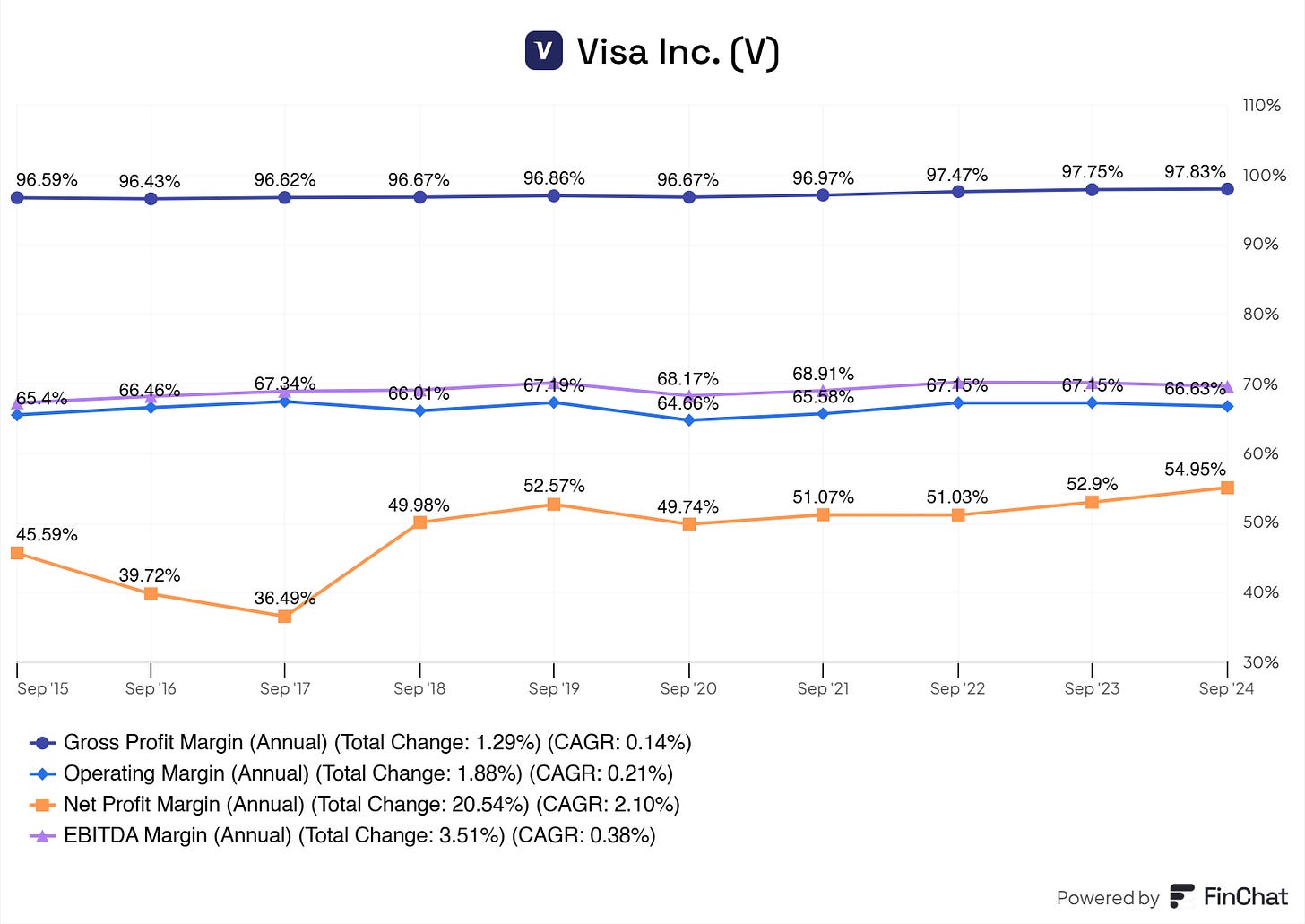

This is reflected in their margins, which is a good indication of how the business is positioned in the market.

Visa and Mastercard hold such a big share that they can maintain these margins. With their scalability and network, nothing is impossible for them.

If you pick Visa or Mastercard, you might beat the index. Both are big players operating in a big field and reaping all the benefits with limited liabilities.

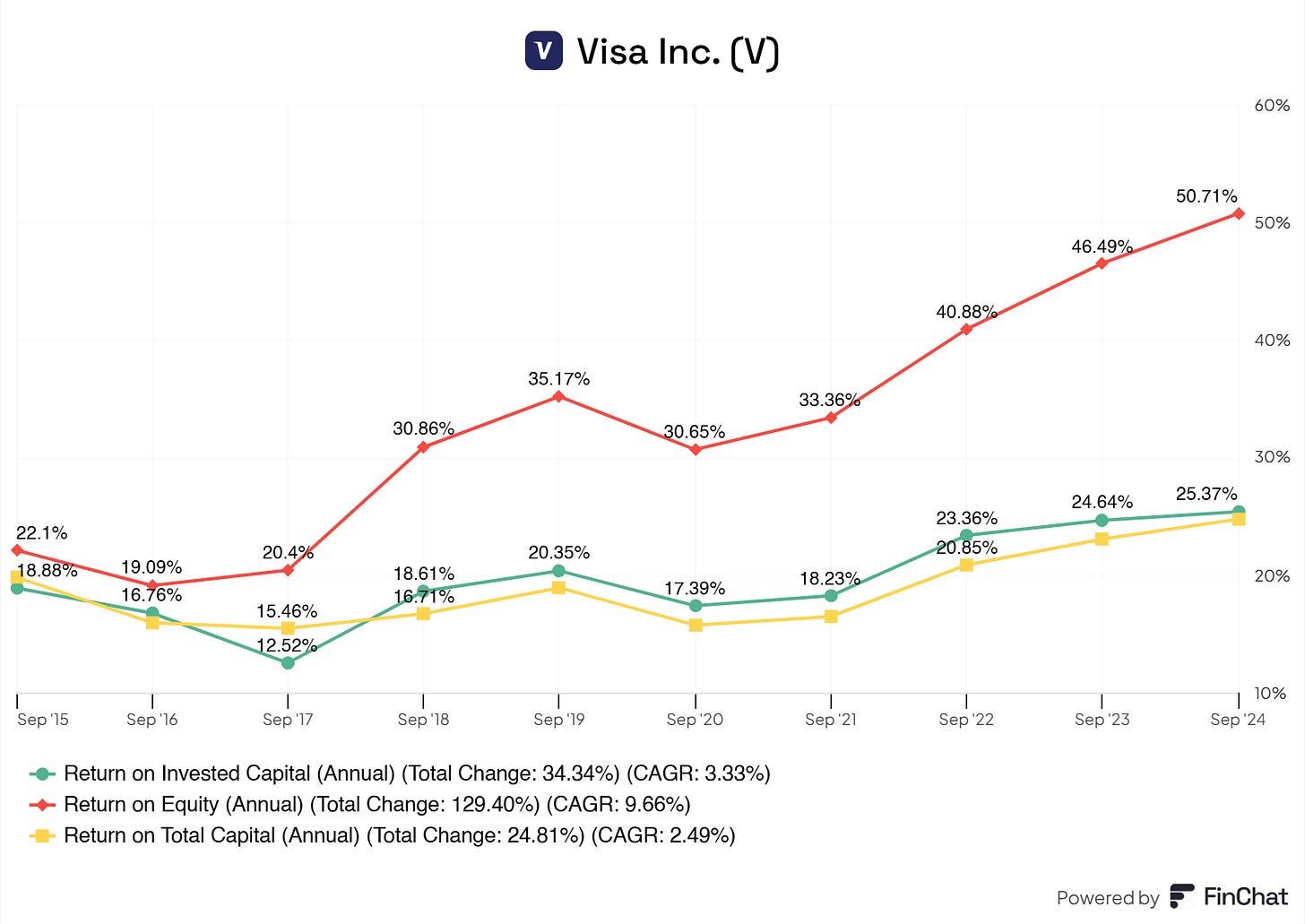

With all the cash flow coming in and the limited cash going toward expenses, Visa has plenty of room to invest in projects to further boost its market dominance, as shown by its ROIC. While heavily investing in the business and reaping the benefits of compounding, Visa also pays a modest dividend to even further boost shareholder returns. Overall, Visa is a high-quality business with an extremely long runway.

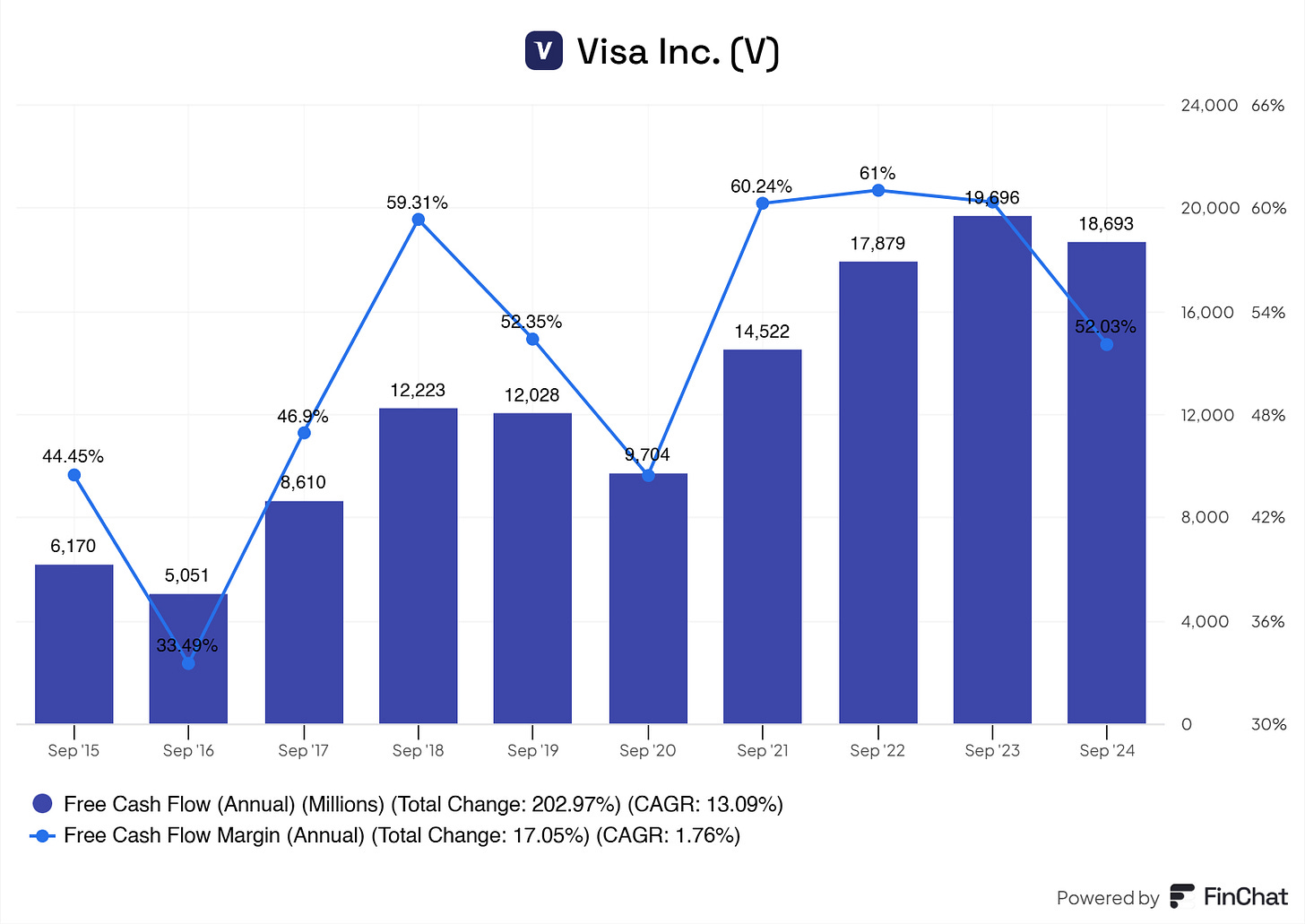

Cash/FCF is the bloodline of almost every business, and Visa generates cash like almost no other business, take a look at this.

For every dollar that Visa generates, roughly $0.50 to $0.60 converts straight to Free Cash Flow for the business, and Visa buys back shares with it, pays a dividend, limits its debt levels, and further boosts the overall business.

This is what a real compounder looks like.

5. Copart (NYSE: CPRT)

Copart, Inc. is a global leader in online vehicle auctions and remarketing services. Founded in 1982 and headquartered in Dallas, Texas, Copart connects buyers and sellers through its innovative digital auction platform. The company specializes in the resale and remarketing of vehicles, including cars, trucks, and motorcycles, for insurance companies, dealerships, rental car businesses, and individuals. With operations in over 200 locations across 11 countries, Copart offers a wide selection of vehicles and provides services like transportation, storage, and title processing. Known for its technology-driven approach, Copart continues to revolutionize the vehicle auction industry.

The global Online Salvage Auctions market was valued at $15.000M in 2023 and is anticipated to reach $67.900M by 2030, witnessing a CAGR of 25.0% during the forecast period 2024-2030. And Copart will be mainly benefiting from this growth due to the monopolistic type of business in this market.

The founder of Copart, Willis J. Johnson, still holds roughly 5% of the shares of the business. A. Jason Adair holds roughly 3% of the business, again a modest amount of skin in the game for this business. High levels of skin in the game is reflected in the overall performance of any business, therefore I allocated a large chunk in my portfolio to Copart.

What made it more interesting is the simplicity of the business and how resilliant this business is in every economic cycle. This type of business is needed even with all the technological advancement we’re making in the world.

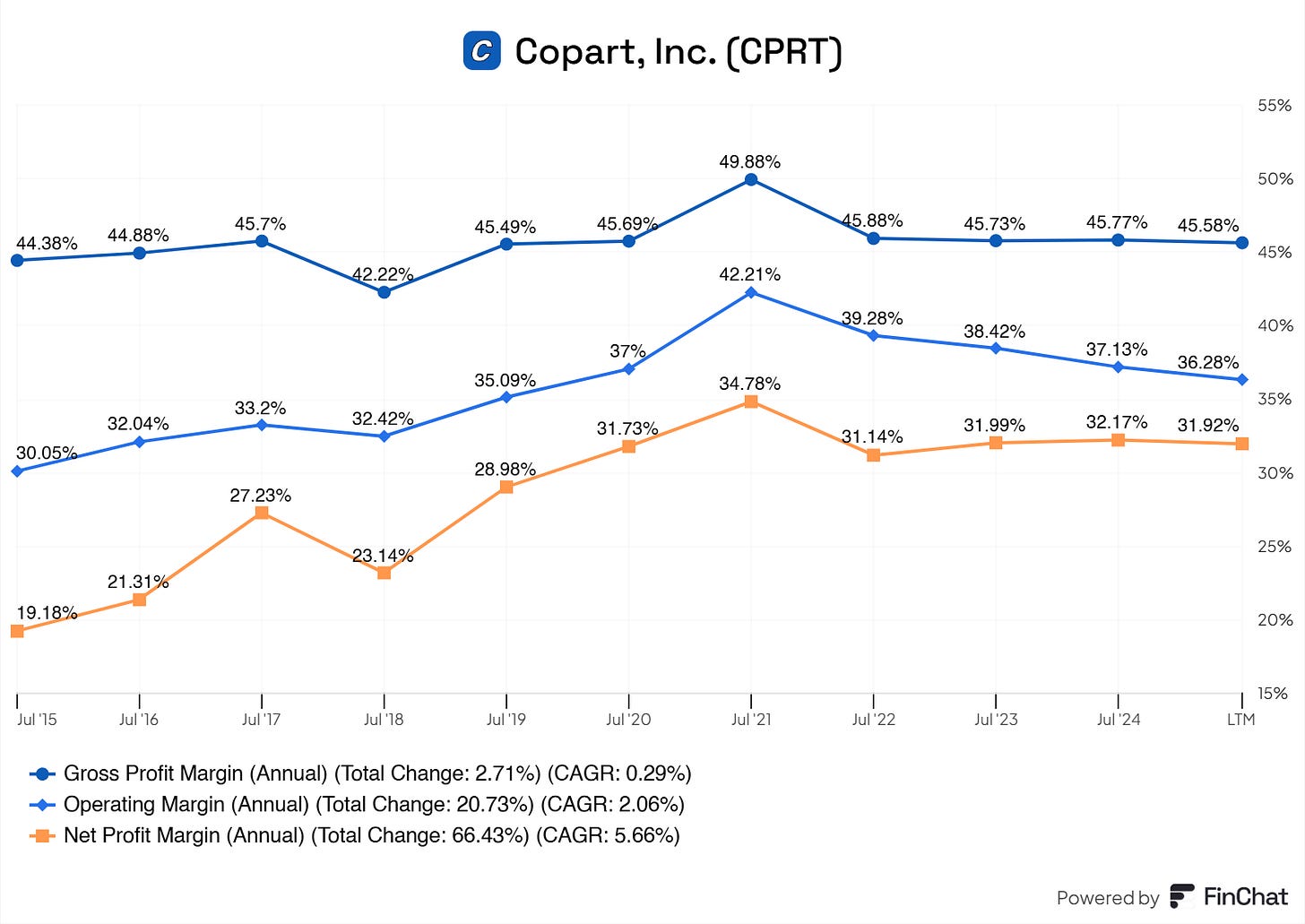

Copart also benefits from high and sustainable margins as shown below:

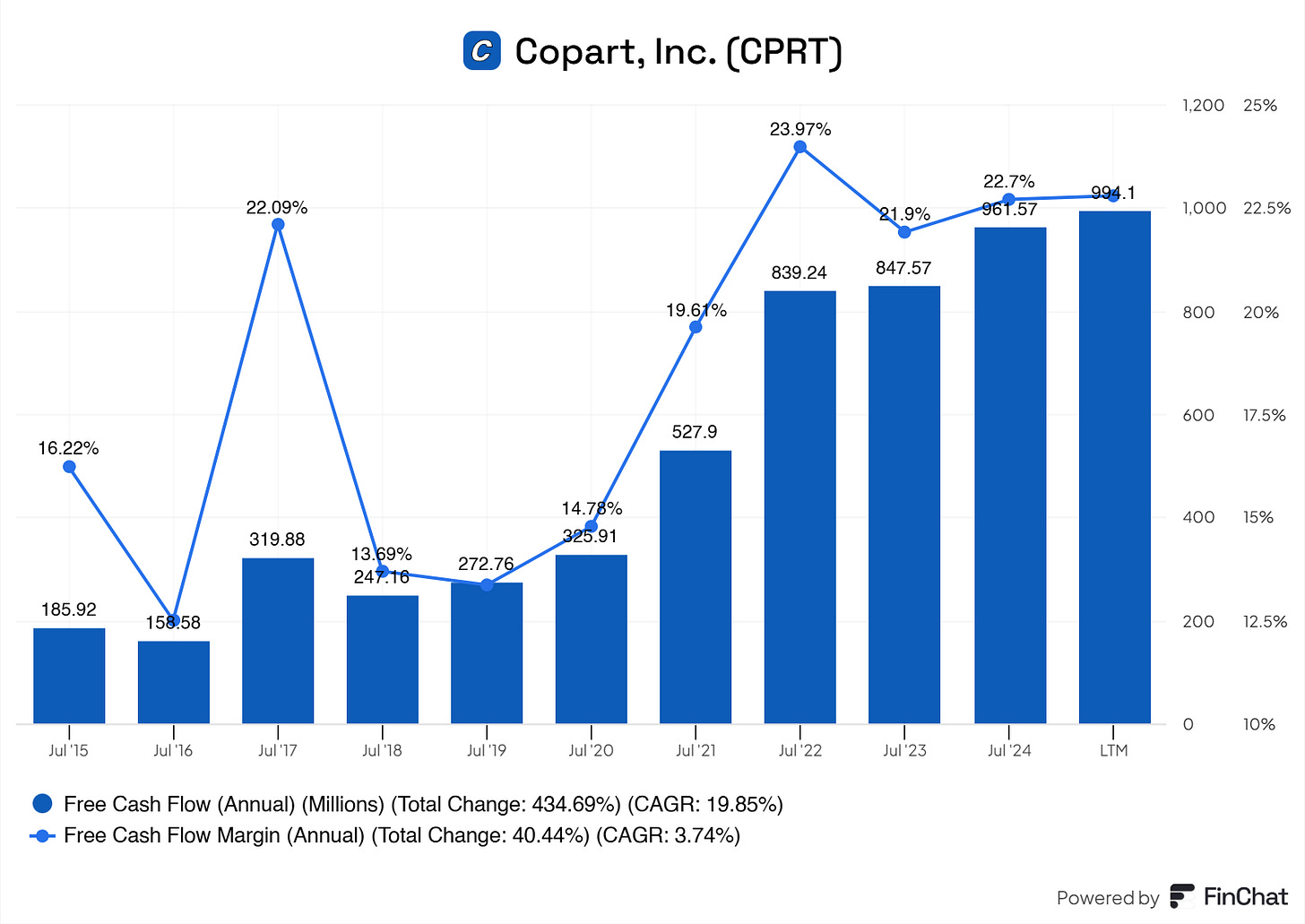

And Copart is also generating sustainable and, relative to the industry, solid cash flows.

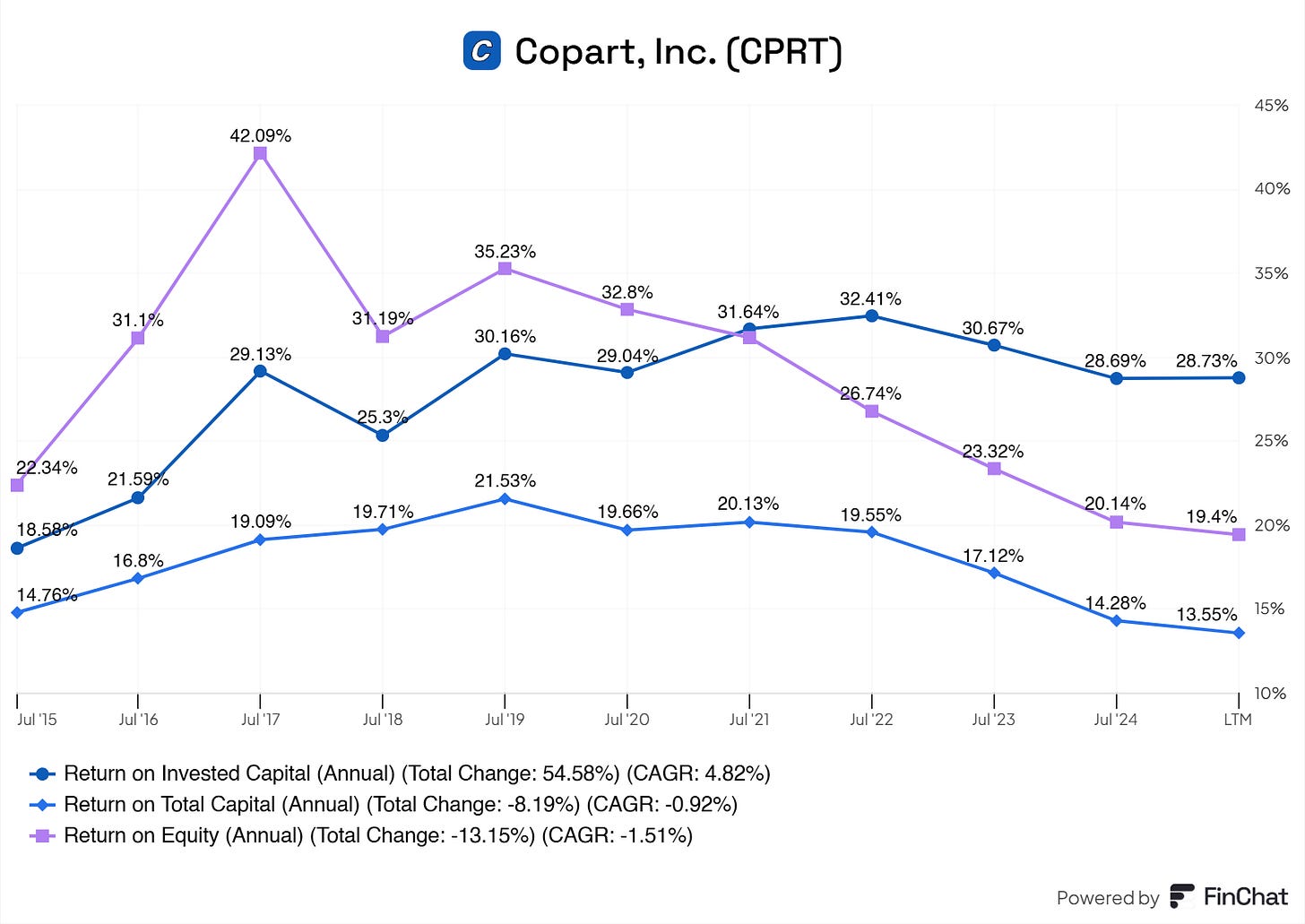

The outstanding sharecount for Copart has been somewhat stable, no significant dilution of shareholder which is a lovely bonus. Besides that is Copart expected to grow in the low teen double-digits for the coming years! Add to this the high FCF margin and excellent reinvestment rates of the business, Copart could be outshining the S&P 500 in 2025.

Conclusion

You might have noticed that all these businesses are high-quality, growth, value, and shareholder-oriented.

What I look for in companies to invest in management aligned with shareholders, consistent growth (not solely on price increases, for instance), companies that operate in crucial industries, and at least some degree of skin in the game.

Charlie Munger once famously said

"Show me the incentive, and I will show you the outcome."

And this is true when it comes to management and people in general. When their incentive is aligned with those of the shareholders and its partners, the outcome will also be aligned with them. If management gets credit for short-term goals, like quarterly hits or one year of X amount of growth, the outcome is not aligned with those of their partners, and in the long haul, the business will start to reflect this.

Investing in high-quality companies with competent management brings you a long way already. Doubling down on the company’s returns, industry, and growth potential gets you a tad bit further.

Here at FluentInQuality, we solely focus on these high-quality companies that will generate sustainable and modest returns but do so very consistently, making them of higher quality. In 2025, I’m eager to bring you along on this journey so we can enjoy the wonderful power of owning the best businesses out there, buying them at a fair price, and holding them for as long as possible.

Used Sources

Finchat for all the graphs in this article.

Disclaimer

I have a long and beneficial position in the shares of CPRT & V, either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.