5 High-Quality Stocks You Can’t Afford to Ignore in 2025

If the downturn continues, these picks could be your best bet. Don’t miss out.

The market looks rough. The last few weeks? Brutal.

But this is where high-quality companies start looking interesting again.

After all the price surges, some might finally return to fair value.

That’s where we strike.

Here are 5 stocks I’m watching in the coming months. You should also keep an eye out.

During this turmoil is where we strike.

Happy reading!

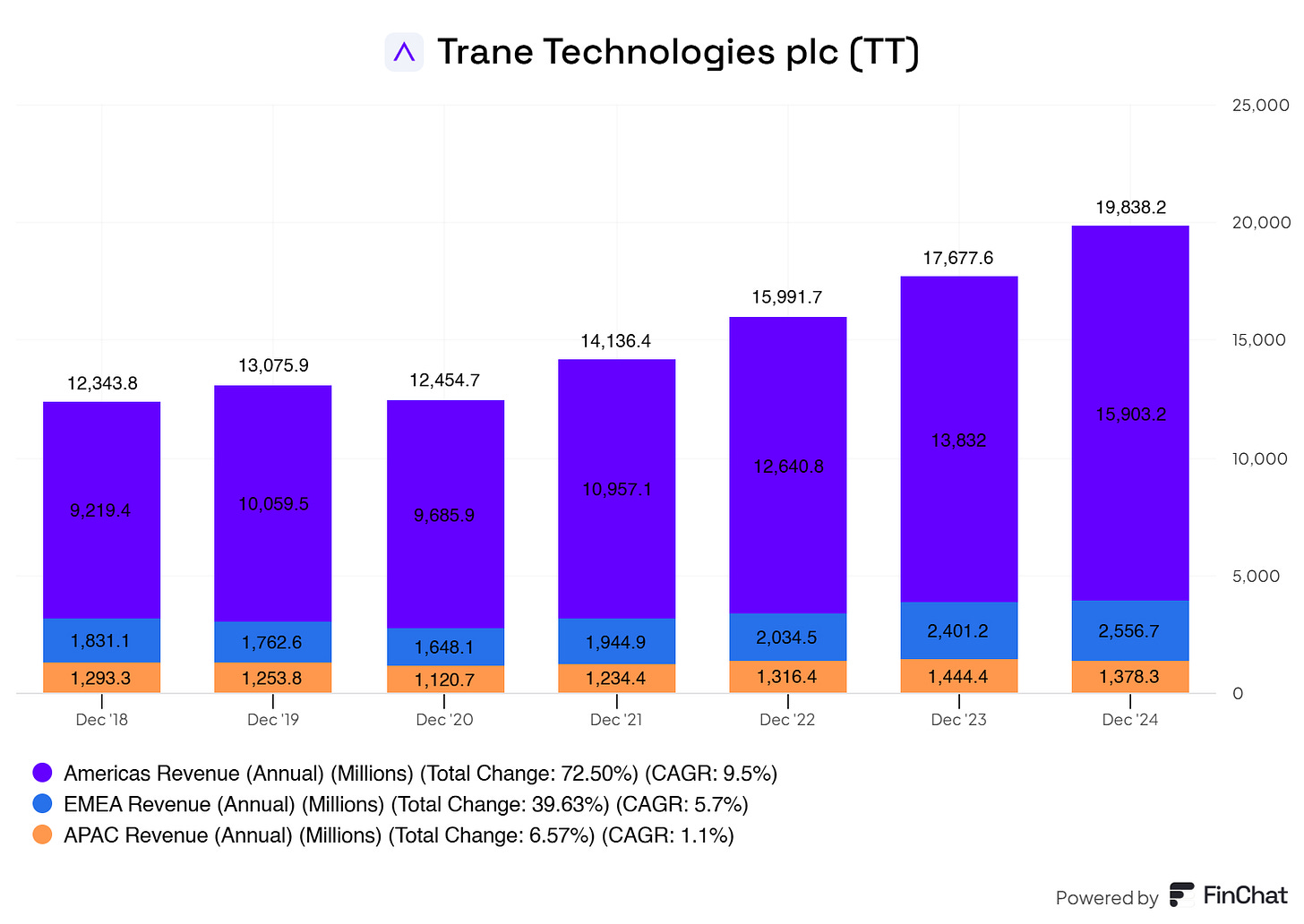

5. Trane Technologies (Ticker: TT)

Trane Technologies = The Silent Giant of Climate Control.

It dominates one of the most underrated but essential industries—heating, ventilation, and air conditioning (HVAC).

Trane isn’t just selling AC units. It’s building the future of energy-efficient climate solutions, perfectly aligned with the global push for sustainability and decarbonization.

And the best part? Recurring revenue.

Most industrial companies rely on one-time equipment sales. Trane locks in long-term service contracts and predictable aftermarket revenue, creating a cash machine.

Trane Technologies is built for resilience and growth.

Massive tailwind from energy efficiency regulations

Mission-critical products—HVAC isn’t optional

Strong pricing power and margin expansion

Aftermarket services drive recurring revenue

And the real kicker? Global reach.

As climate shifts and energy efficiency mandates tighten, demand for Trane’s solutions only increases. It’s not just riding the trend—it’s leading it.

Consistent execution. Strong market positioning. Reliable cash flow.

Trane Technologies isn’t just keeping environments cool—it’s keeping investors comfortable, too.

There’s more.

Trane Technologies has done excellent and successful acquisitions. Making them even more dominant in the industry.

How’s that for a ‘boring’ company?

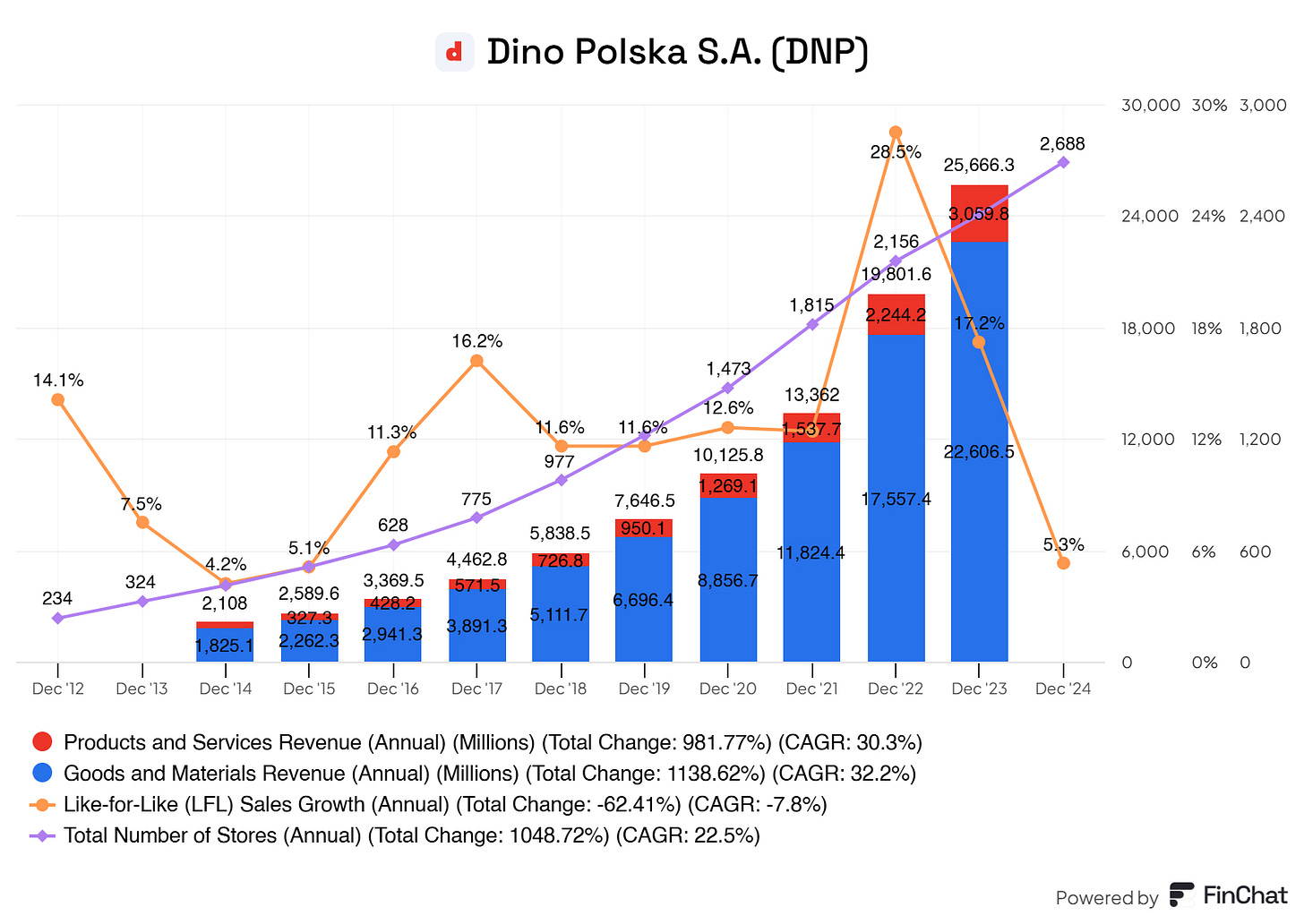

4. Dino Polska (Ticker: WSE.DNP)

Dino Polska = The Relentless Retail Machine.

It dominates one of the most defensive and stable industries—grocery retail.

Dino isn’t just expanding. It’s executing one of the fastest-growing supermarket rollouts in Europe.

And the best part? It owns its entire supply chain.

Most competitors rely on external logistics. Dino controls warehouses, distribution, and fresh food production, keeping costs low and margins strong.

Dino Polska is built for long-term dominance.

High-growth store expansion with no signs of slowing

Efficient operations with superior profitability vs. competitors

Essential product focus—grocery demand is recession-proof

And the biggest advantage? It’s still a domestic powerhouse.

While others expand aggressively and lose efficiency, Dino sticks to Poland—maximizing density, efficiency, and brand loyalty.

Strong execution. Strong moat. Strong returns.

Dino Polska isn’t just growing—it’s unstoppable.

You think it doesn’t get better?

Strong organic growth

YoY increases in new stores. Strategically located for optimal efficiency.

Sales areas keep on increasing. More square meters, more dominant.

Again. Absolute powerhouse.

Give me 5 seconds before we continue.

I’m bringing you high-quality content and highlighting the best of the best.

Return the favor—subscribe. It’s free.

Thanks for subscribing!

Now, let’s dive into three high-quality companies you need on your watchlist.

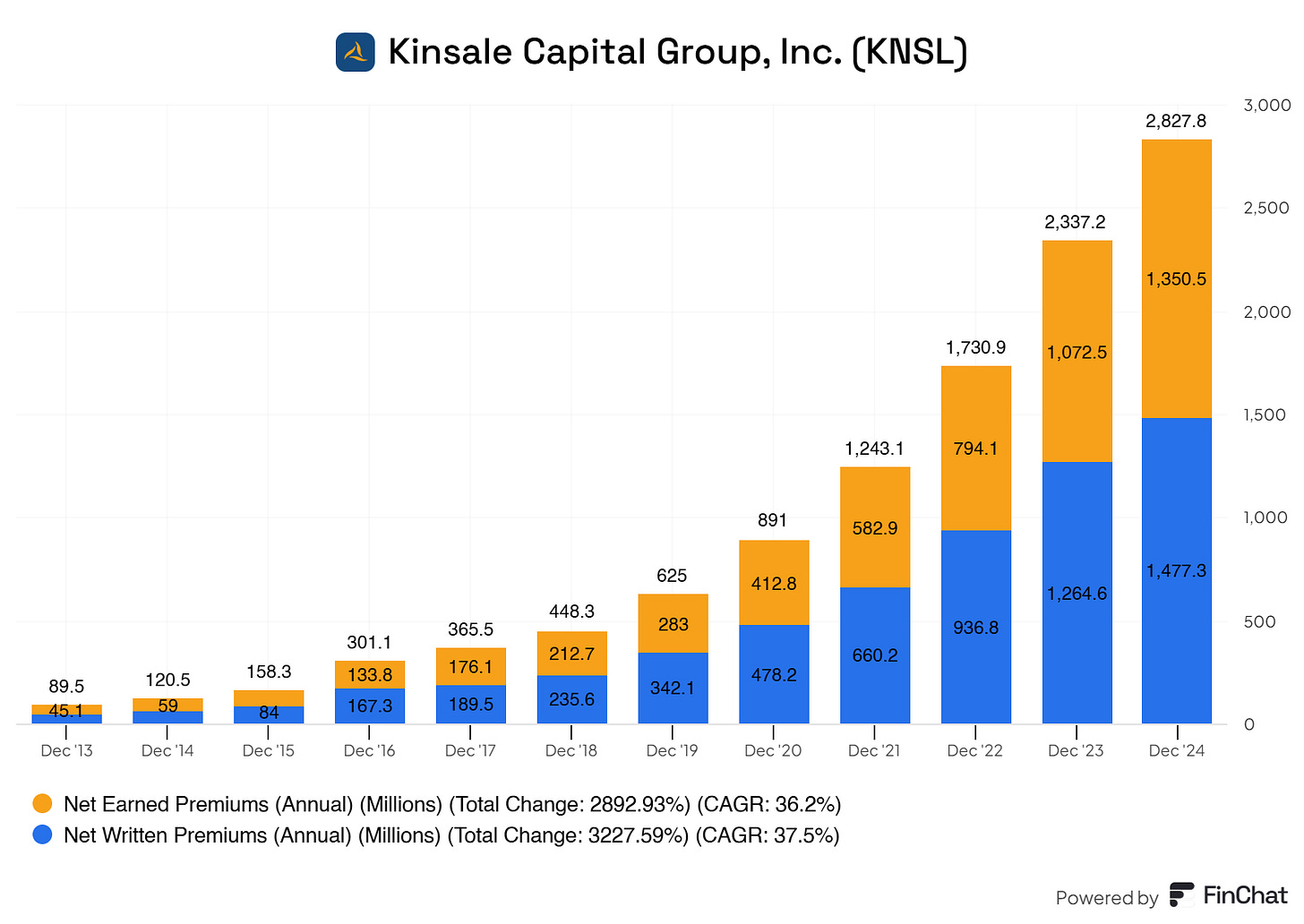

3. Kinsale Capital, Inc. (Ticker: KNSL)

Kinsale Capital Group – A Specialty Insurance Powerhouse.

They dominate the Excess & Surplus (E&S) market, covering hard-to-place small and mid-sized business risks.

Why Kinsale?

Rising Demand: Standard insurers are tightening up—E&S insurance is booming. Kinsale is in prime position.

Tech Advantage: Their proprietary platform makes underwriting faster, smarter, and more efficient.

Economic Growth: More business activity = more demand for specialized insurance.

A niche player with a massive runway.

Kinsale Capital boasts

Strong net written premiums

Strong net earned premiums

Decreasing loss ratio

Strong net retention ratio

On top of this all?

It has a strong balance sheet, management aligned with shareholders, great returns, and one of the most potent secular trends.

It is not ‘‘just an insurer’’. Kinsale is the best one out there.

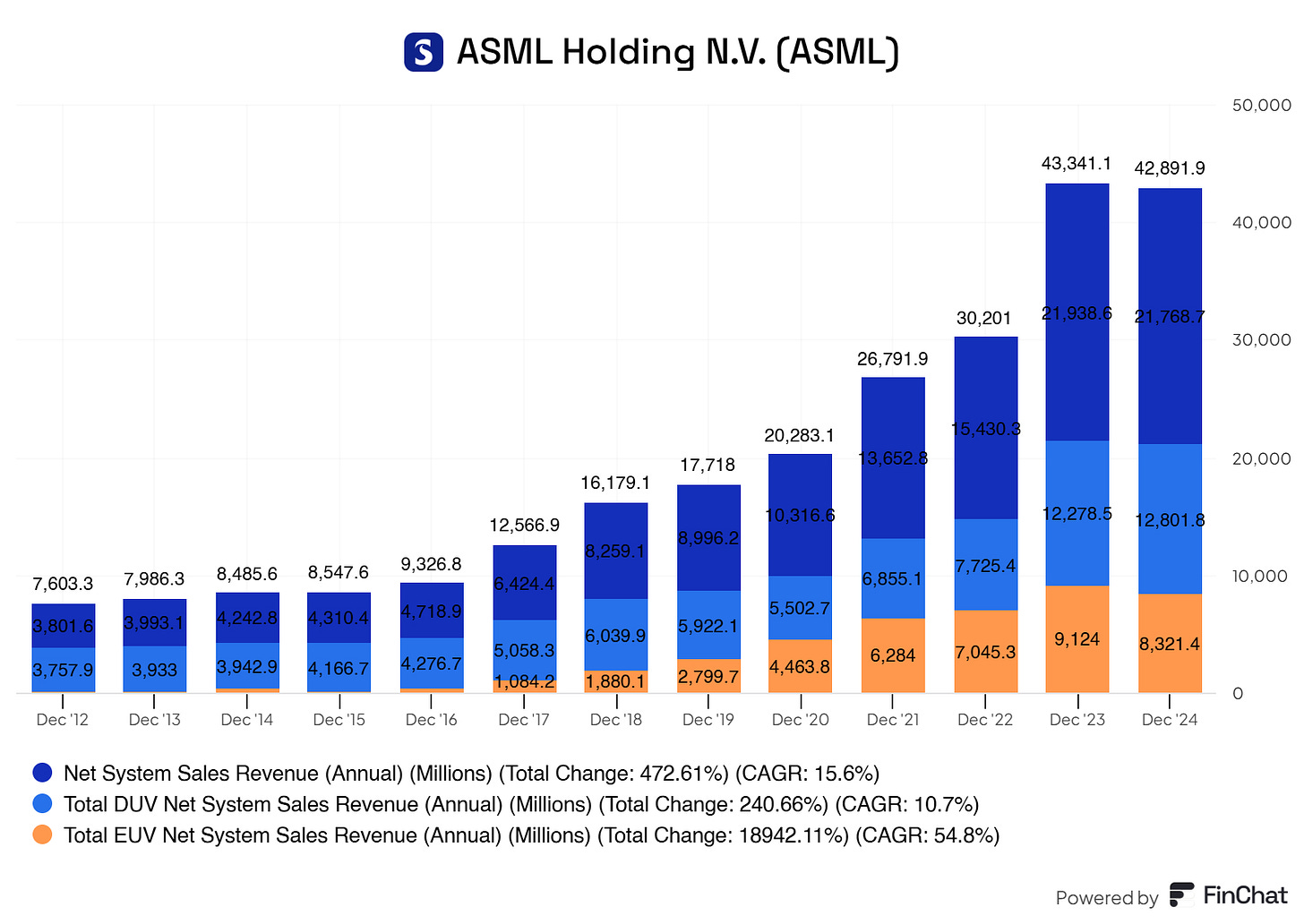

2. ASML Holding N.V. (Ticker: ASML)

ASML = The undisputed leader in semiconductors.

It rides one of the strongest secular trends out there (aside from defense stocks in today’s climate).

ASML builds the most advanced machines known to mankind. And they’re the only ones doing it.

Sure, Plasma lithography is trying to replicate them. But accuracy, precision, and trust keep ASML miles ahead—for decades to come.

ASML is built for stability.

Strong net bookings

Excellent service contracts on both new and older machines

Sustainable, predictable revenue streams

And the best part? Global diversification.

If one country faces headwinds, others pick up the slack. Investors don’t carry the burden.

I’m scaling ASML asap.

Could it drop further? Maybe.

If it does? Even better—more opportunities to add.

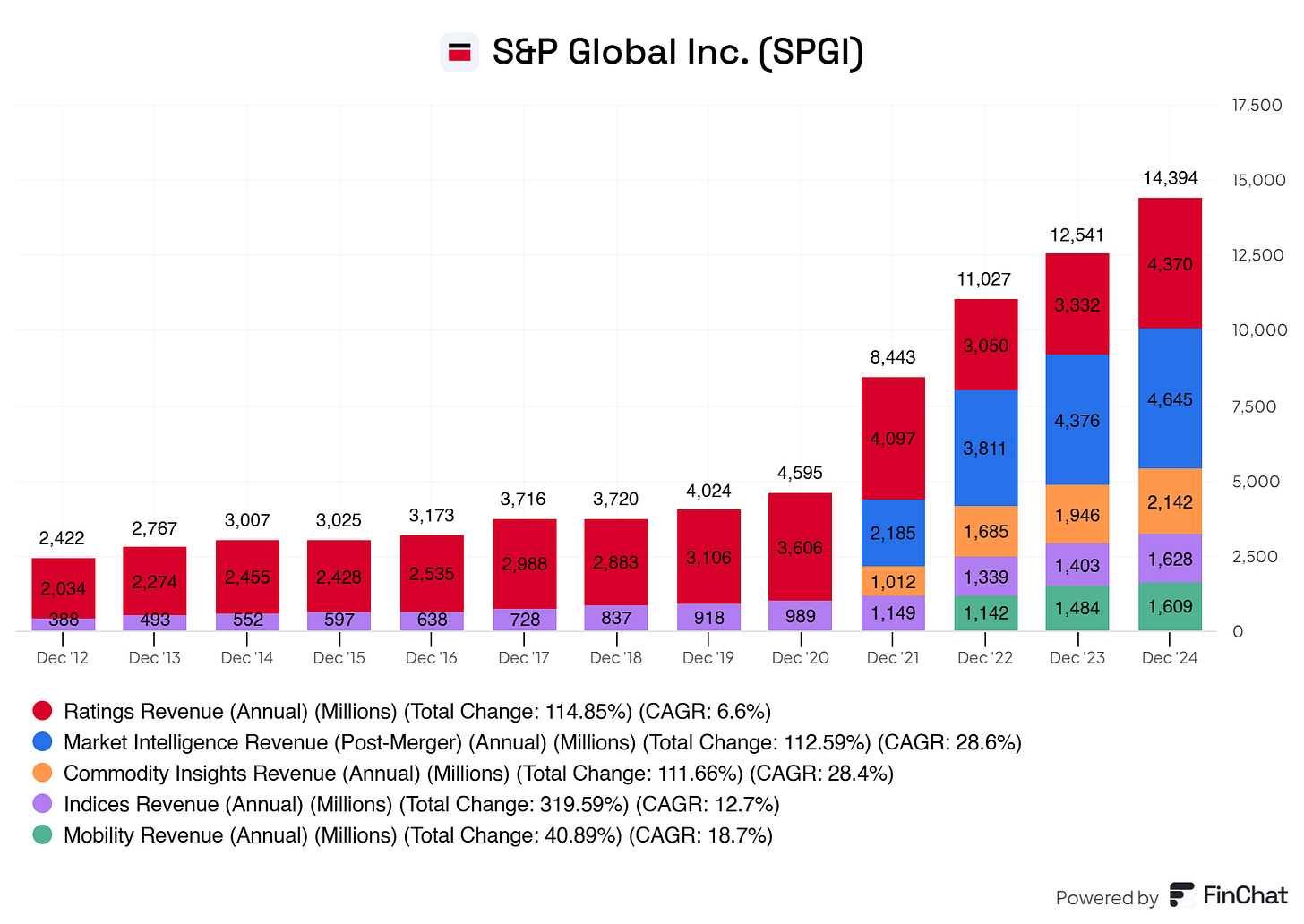

1. S&P Global (Ticker: SPGI)

S&P Global = The Backbone of Financial Markets.

It doesn’t just operate in finance—it powers it.

S&P Global dominates the credit ratings, financial data, and index industries, making it an irreplaceable force in global markets.

And the best part? Its business model is built for resilience.

When markets boom, S&P benefits from bond issuance and market activity.

When markets slow, its recurring data & analytics business keeps the cash flowing.

S&P Global is built for stability and long-term growth.

Near-monopoly in credit ratings (with Moody’s)

Mission-critical financial data—used by institutions worldwide

Indexing powerhouse—S&P 500 ETFs alone generate billions

Subscription-based revenue = predictable cash flow

And the real advantage? Unmatched pricing power.

As financial markets grow, so does demand for trusted credit ratings, analytics, and index-linked investments.

S&P Global isn’t just another financial firm—it’s the foundation of global finance.

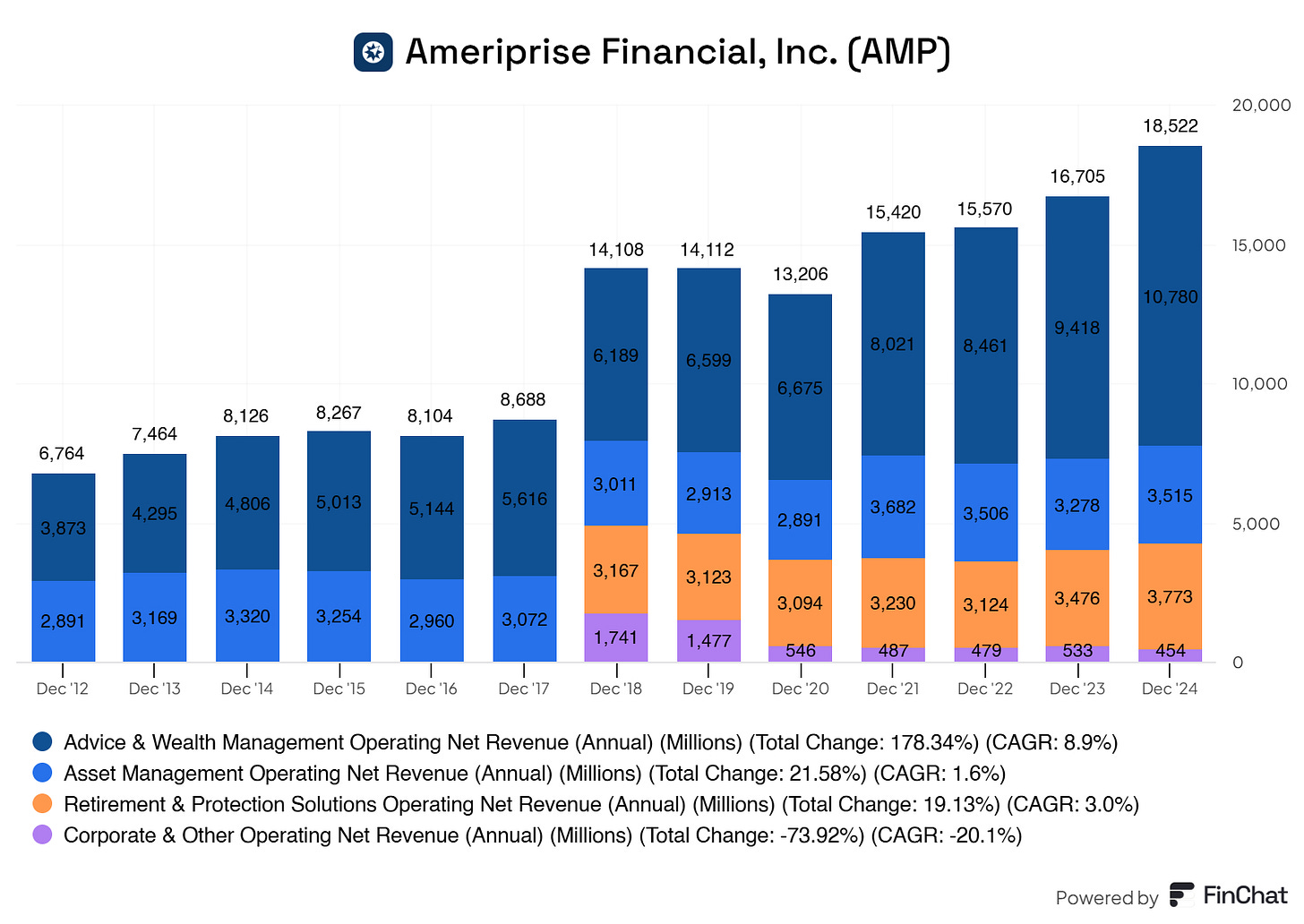

Honorable Mention

Here’s an honorable mention. A giant I feel I have to share with you.

Ameriprise Financial = The Quiet Giant of Wealth Management.

It doesn’t just operate in finance—it owns the client relationship.

Ameriprise isn’t a flashy Wall Street name, but it dominates where it matters most: financial planning, asset management, and retirement solutions.

And the best part? Recurring, fee-based revenue.

While others chase trading profits, Ameriprise locks in long-term advisory relationships, asset-based fees, and insurance premiums—creating a stable cash machine.

Ameriprise Financial is built for resilience and compounding growth.

Massive tailwind from aging demographics and retirement planning

Sticky client relationships—assets under management (AUM) drive long-term revenue

Wealth management + insurance = diversified, defensive earnings

Fee-based model shields it from market volatility

And the biggest advantage? Trust and retention.

In an industry where clients rarely switch advisors, Ameriprise thrives by keeping assets in-house—compounding its revenue for decades.

Consistent growth. Recurring revenue. Strong client loyalty.

Ameriprise Financial isn’t just managing wealth—it’s compounding it.

Before you go, share your thoughts!

Other suggestions? Leave a comment on this post.

And that is it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds to refer this edition to a friend? It will go a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Used Sources

Finchat is used for all the charts. Using my link, your subscription is now 15% cheaper. Click here to start today!

(I’m affiliated with Finchat, but not sponsored. With this link, your plan does NOT get more expensive; I only get a small cut of the cake.)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.

No Adobe? Lol. Sorry, couldn’t help myself.

Thank You!! 😊