10 Recession-Proof, High-Quality Stocks Built to Weather Any Storm

Recession-proof? Yes. There's companies out there that weather the worst weathers the best. And after that? They continue to run like normal.

2025(?)

2020

2007–2009.

1929.

The 1980s.

1873.

Brutal recessions. Each one left a mark.

But here’s the thing—every crash delivered both massive losses and massive gains.

The fearful got wiped out.

The patient? They built generational wealth.

And through it all, some companies barely flinched.

These aren’t just recession-proof.

They thrive under pressure.

Essential products.

Resilient margins.

Global demand.

Sticky customers.

Strong balance sheets.

Here are 10 companies built to weather any storm.

Happy reading!

P.S. Before we dive in—don’t miss your shot at joining the newsletter with a rare 33% discount.

This is the last flash sale for a long, long time—and if I ever run one again, it won’t be this generous.

⚠️ Once it's gone, it's gone. ⚠️

Many have already jumped in—don’t be the one who hesitates and misses out.

Lock in your spot now, and I’ll see you inside the members group.

10. Procter & Gamble (Ticker: PG)

P&G sells stuff people need, not just want. Think:

Toothpaste (Crest)

Laundry detergent (Tide)

Diapers (Pampers)

Toilet paper (Charmin)

Razors (Gillette)

In a recession, consumers might skip luxuries, but they’ll still brush their teeth, clean their clothes, and buy baby products. That keeps revenue flowing even when the economy stumbles.

Brand loyalty and pricing power? PG has it!

P&G owns brands that dominate their categories. That leads to:

Consumer stickiness (people rarely switch from Pampers to a generic diaper)

Room to raise prices without losing customers (especially in inflationary environments)

This ability to pass on costs helps protect margins.

P&G operates in over 180 countries. That reduces reliance on any single market and smooths out country-specific recessions.

PG is an operational, efficient machine.

They’re incredibly efficient. Over decades, they’ve built:

An unmatched supply chain

Strong relationships with retailers

Marketing machines that drive demand

This scale gives them a big edge over smaller competitors.

What is the best bandaid during recessions? Dividend. PG is a dividend king!

P&G has paid a dividend for 133 years.

It’s a Dividend King (50+ years of consecutive increases).

Free cash flow conversion is routinely above 90%.

Debt is the killer in recessions. PG? Manageable debt.

P&G carries manageable debt and maintains a high credit rating. In downturns, they don’t need to raise emergency funds or dilute shareholders.

Procter & Gamble checks every box:

✓ Durable demand in all economic cycles

✓ Strong brands with pricing power

✓ Global reach

✓ Reliable cash flow

✓ Shareholder-friendly management

It’s a textbook example of a high-quality, recession-resistant stock.

If you had invested during the pandemic, there were limited red days in your portfolio. In the end, you would’ve been up 76.8%. An annualized return of 15.36%.

How’s that for a consumer stock?

9. UnitedHealth Group Incorporated (Ticker: UNH)

UNH provides healthcare access, not just healthcare extras. Think:

Doctor visits (UnitedHealthcare)

Prescription meds (OptumRx)

Hospital care and preventive services

Employer and individual health plans

Medicare Advantage plans for seniors

In a recession, people might cut dining out or vacations, but not their health coverage or essential treatments. That keeps revenue stable even in tough times.

Brand trust and pricing power? UNH’s got it!

UnitedHealth is the largest health insurer in the U.S.. That brings:

Massive scale and cost advantages

Long-term contracts with employers and governments

Ability to negotiate better deals with hospitals and pharma

This protects profit margins while competitors scramble.

UNH has exposure to both sides of healthcare.

Through UnitedHealthcare, it insures people.

Through Optum, it delivers care, processes claims, and manages data.

That integration creates:

More control over costs

Higher efficiency

Deeper data-driven insights

Few companies can match that dual model.

Operational excellence? UNH runs like a machine.

They’ve built:

A massive healthcare data infrastructure

National networks of clinics, doctors, and pharmacies

A digital-first experience for both patients and providers

It’s the Amazon of healthcare—just quietly dominating.

What’s the best safety net in a downturn? Recurring revenue. UNH has it in spades.

80%+ of its revenue is recurring—thanks to long-term contracts with:

Employers

Governments (Medicare & Medicaid)

Individuals

That kind of visibility is rare in any industry.

High debt? Nope. UNH plays it smart.

Despite its size, UNH keeps its debt under control.

High cash generation and stable margins let it self-fund growth without taking risky financial bets.

UnitedHealth checks every box:

✓ Healthcare demand doesn’t go away

✓ Vertical integration = efficiency and pricing power

✓ Massive scale and reliable contracts

✓ Strong free cash flow and financial discipline

✓ A top-tier operator in a defensive sector

It’s the perfect combo of quality and recession resistance—with healthcare as the tailwind.

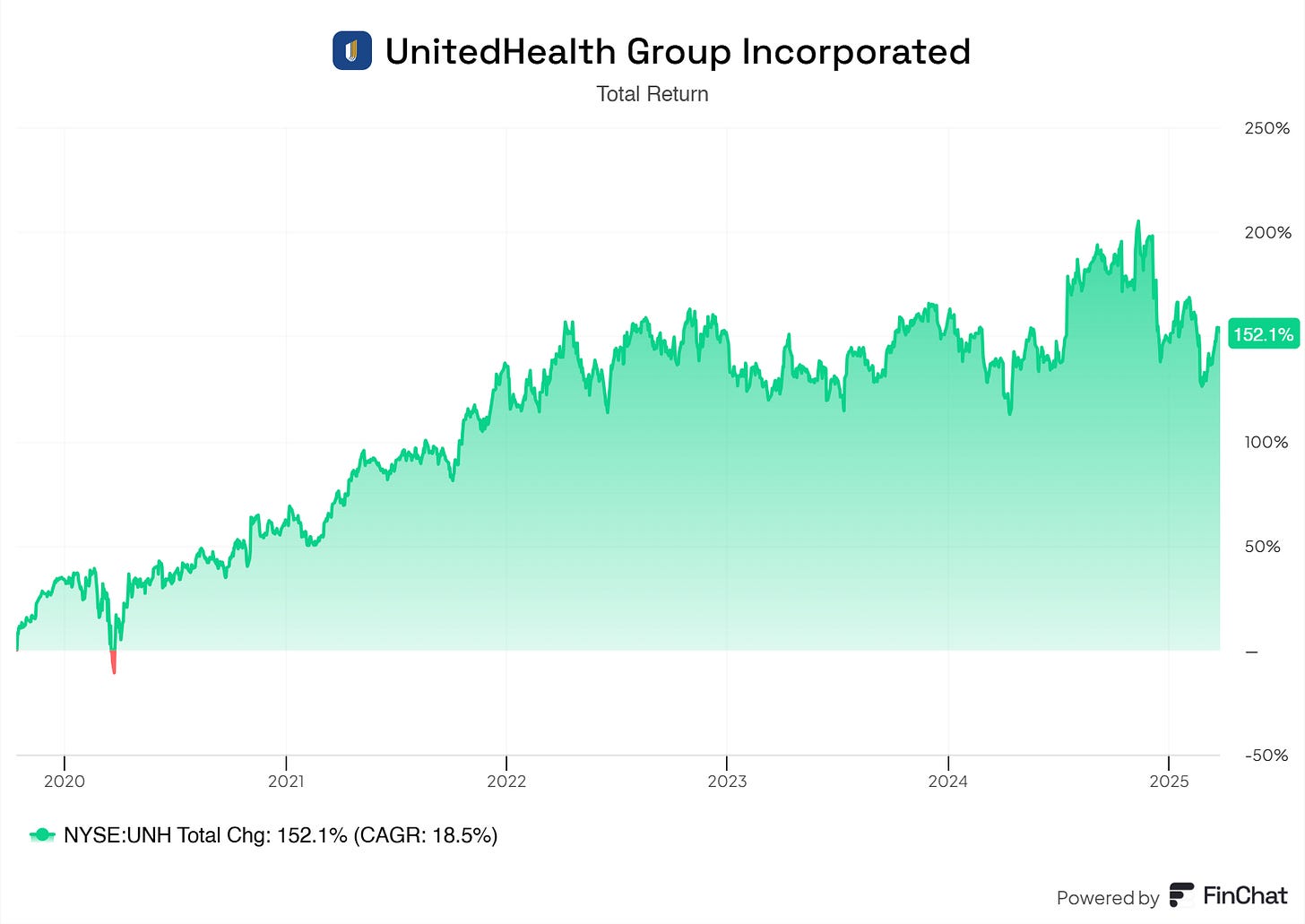

Healthcare is a must for every person. Results? Recession-proof and excellent returns.

8. Walmart Inc. (Ticker: WMT)

Walmart sells essentials, not just indulgences. Think:

Groceries

Toiletries

Cleaning supplies

Clothing

Over-the-counter medicine

In a recession, people still need to eat, clean, and take care of themselves. And when wallets tighten, they trade down—from expensive stores to Walmart. That actually boosts WMT’s traffic in tough times.

Brand loyalty and pricing power? Walmart is the king of low prices.

Walmart is the go-to for value shoppers. That leads to:

Massive consumer stickiness (why pay more elsewhere?)

Negotiating power over suppliers to keep prices low

Private-label brands with healthy margins

Their size lets them squeeze better deals and still protect profits.

Walmart is everywhere. Literally.

With over 10,000 stores globally and a massive U.S. presence, Walmart isn’t just retail—it’s infrastructure.

They’re also growing online fast, competing directly with Amazon through Walmart.com and delivery/pickup services.

Operationally? Walmart is a beast.

They’ve built:

One of the world’s most efficient supply chains

Real-time inventory and pricing systems

Distribution networks that keep shelves stocked and costs down

This scale and execution crush smaller players.

Dividends? Walmart delivers.

Walmart has paid a dividend for nearly 50 years—increasing it consistently.

Add that to its stable earnings and massive cash flow, and it’s a reliable source of income, no matter what the market’s doing.

Debt? Under control.

Despite being a giant, Walmart keeps debt manageable.

They generate tons of cash and reinvest smartly—no reckless financial decisions here.

Walmart checks every box:

✓ Essential goods that keep selling

✓ Massive scale and world-class efficiency

✓ Loyal customer base that grows during downturns

✓ Online + offline dominance

✓ Steady cash flow, growing dividend

It’s the poster child for a recession-proof, high-quality stock.

Stability? Yes! Sustainable? Yes!

Recession proof? YES.

7. Costco Wholesale Corporation (Ticker: COST)

Costco doesn’t just sell stuff—it sells value. And in a recession, value wins.

Shoppers don’t go to Costco for fancy displays or trendy brands.

They go for bulk savings, trusted quality, and a shopping cart full of essentials. Think:

Toilet paper

Eggs and meat

Household cleaners

Vitamins

Gasoline

When times get tough, people buy more, less often, for cheaper. That’s Costco’s entire business model.

Brand loyalty? Costco has a cult following.

Customers pay to shop there—literally. With over 130 million members, it’s one of the only retailers in the world where:

Membership fees generate billions in high-margin revenue

Renewal rates are above 90% (insanely sticky)

Shoppers feel like they’re winning every time they leave with a trunk full of savings

That loyalty isn’t just emotional—it’s financial fuel.

Pricing power? Quiet but powerful.

Costco limits markups on products (usually 14% or less),

but still earns strong margins through:

Efficient bulk logistics

Member fees

Private-label dominance (Kirkland Signature is a beast)

In fact, Kirkland outsells major brands in many categories. That’s pricing power hidden in plain sight.

Operationally? Costco runs tight.

Its entire strategy is based on simplicity and scale.

They’ve built:

Streamlined warehouses (no fluff = lower cost)

Highly efficient inventory turnover

Deep supplier relationships for consistent quality and price

This keeps prices low and margins stable—even when inflation hits.

Dividend? Quietly consistent.

Costco pays a small but growing dividend—and throws in special dividends now and then (a shareholder bonus you don’t see often).

Plus, cash flow is strong and predictable.

Debt? Conservative.

Costco carries minimal debt relative to its size.

It prefers to grow slowly and sustainably—no empire-building through risky leverage.

Costco checks every box:

✓ Essential products in bulk = value shoppers love

✓ Recurring revenue from loyal memberships

✓ Private-label strength and unbeatable pricing

✓ Operational simplicity with massive efficiency

✓ Cash flow, conservative finances, long-term thinking

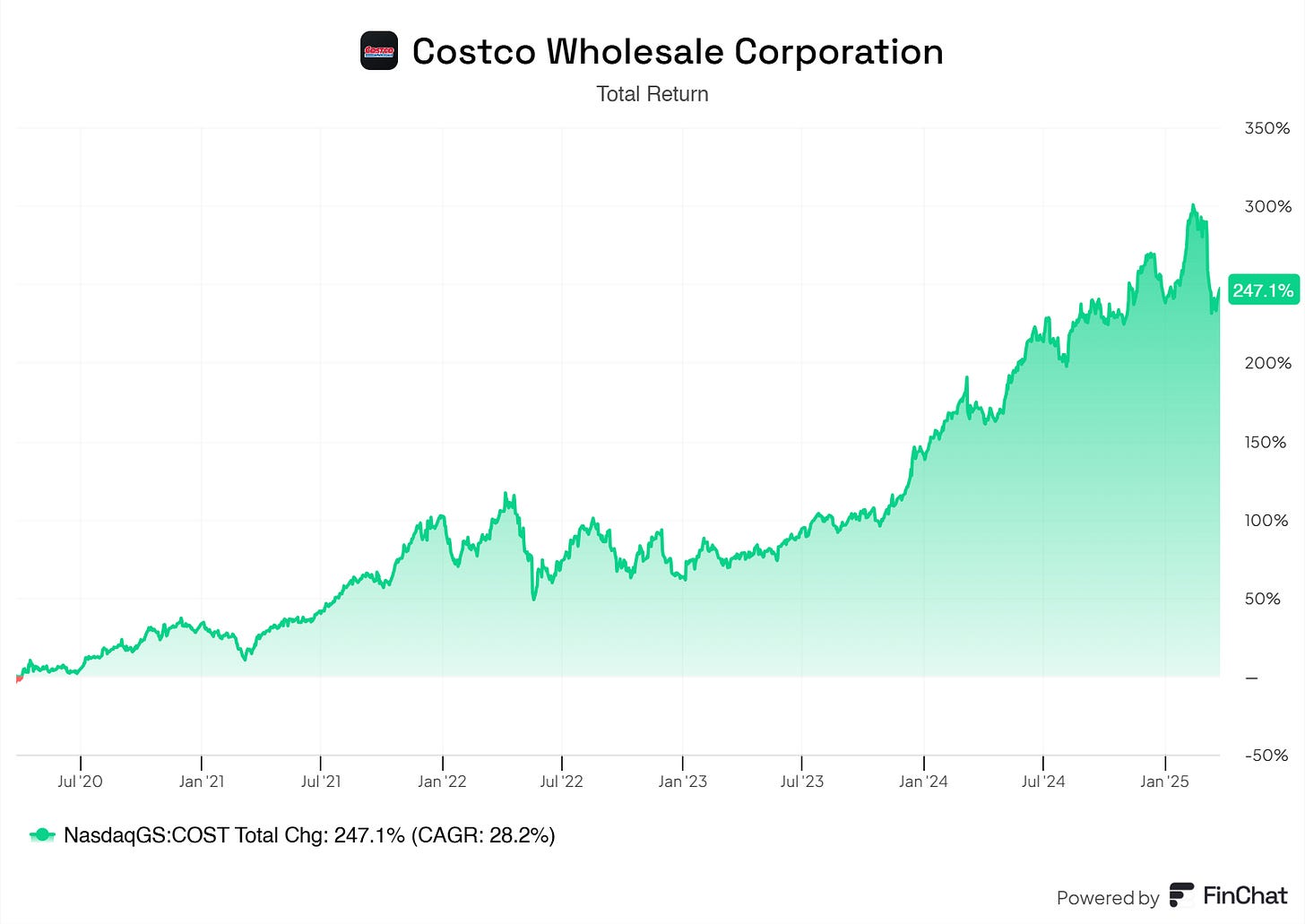

It’s not flashy. It’s just quietly one of the best-run, recession-resistant companies in the world.

6. Johnson & Johnson (Ticker: JNJ)

Johnson & Johnson isn’t just a healthcare company—it’s a cornerstone of stability.

Through wars, recessions, and market crashes—JNJ has kept doing what it does best:

Helping people live longer, healthier lives. Think:

Pain relief (Tylenol)

Baby care (Johnson’s)

Band-Aids

Medical devices

Cancer, immunology, and surgical treatments

Health doesn’t take a break during a downturn. That makes JNJ’s demand shockingly durable.

Household brands + hospital-grade treatments = unmatched balance.

JNJ touches both ends of the healthcare spectrum:

Trusted consumer products in every home

Complex drugs and surgical tools hospitals depend on

This dual focus brings diversification, recurring revenue, and pricing power across categories.

Pricing power? Quiet and mighty.

Pharmaceutical drugs and MedTech devices aren’t easily substituted

JNJ owns patented treatments in immunology, oncology, and neuroscience

Pricing is backed by innovation—not hype

Plus, healthcare systems worldwide rely on their products, recession or not.

Operational strength? Built over 100+ years.

JNJ has built:

Deep R&D pipelines

Global manufacturing at scale

Distribution in over 60 countries

They’re one of the few companies that can bring a drug from the lab to the shelf efficiently and globally.

Dividend king? You bet.

JNJ has raised its dividend for 61 consecutive years.

Few companies on Earth can say that.

Healthy payout ratios

Consistent earnings

Cash flow machines across segments

In short, it pays to hold JNJ long-term.

Debt? Responsible.

JNJ has a fortress balance sheet.

Even with acquisitions and R&D investments, it avoids excess leverage.

This gives it resilience and flexibility in any environment.

Johnson & Johnson checks every box:

✓ Essential healthcare products across income levels

✓ Global reach and brand trust

✓ Pricing power through innovation and IP

✓ Massive, reliable free cash flow

✓ Rock-solid dividend with over 60 years of hikes

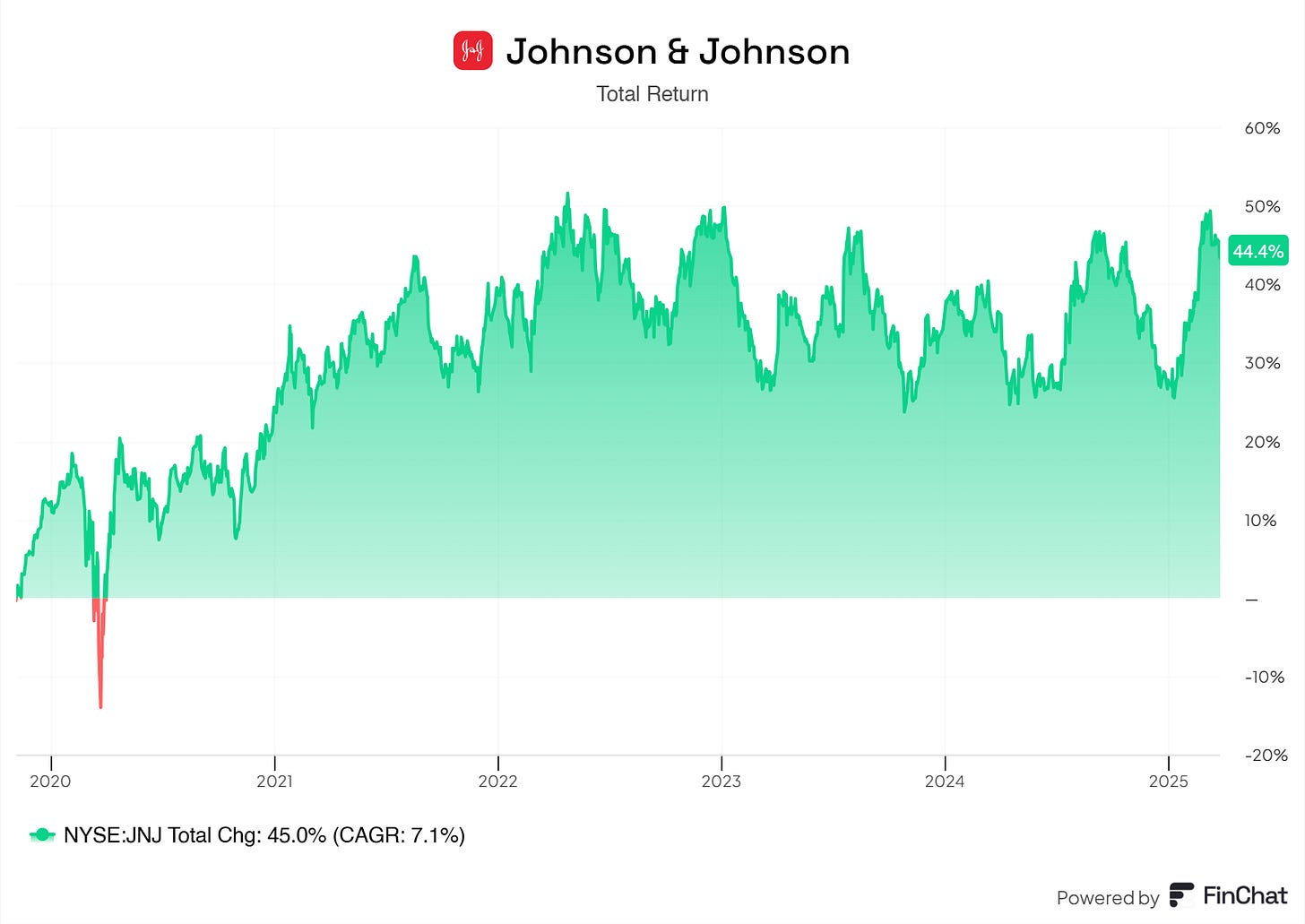

It’s a defensive juggernaut—and a forever stock for quality-focused investors.

Let’s go over the top five.

These names aren’t just popular.

They’re favorites—across the board.

Funds. Money managers. Retail investors. Pension funds.

Everyone wants in.

Why?

Because these five companies are built different.

✓ Unbeatable moats.

✓ Dominant positioning.

✓ Resilient in any market environment.

For free readers—this is where it ends.

But it doesn’t have to.

🚨 Claim your 33% flash sale now and keep reading. 🚨

It’s worth it.

You won’t regret it. That’s my promise to you.