10 Powerful Investing Visuals to Boost Your Investing in 2025

Timeless lessons on compounding, patience, valuations, growth, and more— brought to life through impactful visuals.

Hi, partner! 👋🏻

Investing is full of lessons—compounding, patience, valuations—but let’s be honest, it’s easy to take these principles for granted.

We see charts, graphs, and insights daily, yet sometimes, we glance past them without fully appreciating their meaning. I’ll admit—I’ve done it too. The human mind loves autopilot, so we often overlook the simple truths that drive long-term success.

That’s why I want to use visuals in this article to reignite curiosity and remind ourselves of the power behind investing.

You might already recognize some of these visuals, but have you absorbed their lessons? I know I needed a refresher—and I think you’ll enjoy revisiting them too.

One last thing! You can now refer me to your friends or family and get access to exclusive content. You can see the rewards here. Simply share this article or my page, and you’ll receive 1 point per referral.

Now, let’s dive in.

Happy reading!

The Power of Compound Interest

Yes, I know. I hear you screaming behind your laptop, PC, or mobile, saying ‘‘I’ve seen this 1000x times on X or any other finance-related page or newsletter; we get it!’’.

I have to remind you, though.

Why? Because compound interest has to be one of the most wonderful and practical things you can use to your advantage. The returns can be so great with such limited effort that it almost sounds too good to be true, right?

By the age of 75, a $100 monthly investment with a 10% yearly return has grown to a whopping $1.49 million. The best thing is that, because your investments are simply compounded, it is 25x more than what you’ve contributed.

Have you noticed how interest starts to dominate growth after the first several decades? Time is the key component, as interest more than doubled the principal in 20 years. These early contributions gain the most because they have more time to develop. Timing the market is not nearly as important as time in the market.

This quote may be too familiar, but I must share it again.

"The first rule of compounding: Never interrupt it unnecessarily." - Charlie Munger

What should you take away from this visual?

Simple.

Start now, stay consistent, and let time do the heavy lifting!

Return on Invested Capital

High returns on invested capital must be the ninth wonder of the world if compounding is the eighth.

Naturally, the company's Weighted Average Cost of Capital (WACC) must be considered while examining the Return on Invested Capital (ROIC). The company is not adding value if the ROIC is 10% and the WACC is 10%. Here's a great example from Robbe Delaet:

‘‘For example, a company can borrow $100 mln at interest rates of 7% to make an acquisition, which only increases operating profits by $6 mln annually. As such, the firm will pay more to the bank compared to its growth in profits, destroying shareholder wealth.’’

Let's return to the image.

This graphic illustrates how Return on Invested Capital (ROIC) affects long-term investing results. It contrasts the growth of $100 invested in two businesses that reinvest half of their annual profits, one of which achieves a 30% return on capital (ROIC) and the other only a 10% rate.

The disparities become startling after ten years. While the business with a 10% ROIC hardly grows to $15.51, the one with a 30% ROIC compounds its investment to $105.54. The more profitable company outperforms its low-ROIC cousin almost seven times, even though they begin with the same initial investment and reinvest at the same rate.

The fundamental cause is straightforward: businesses with greater ROIC reinvest their profits at better rates, enabling earnings to compound far quicker. In this case, the low-ROIC company finds it difficult to reach even 1.8% annual growth, but the high-ROIC company efficiently grows at an annualized rate of about 7.4%. The disparity gradually deepens, highlighting the significance of capital efficiency for sustained growth.

This image teaches us a vital lesson: Growth is insufficient. What counts is how well a business turns capital into profits and whether it can reinvest those gains at comparable high rates. Businesses with consistently high returns on investment (ROIC) and reinvestment opportunities produce compounding machines that generate disproportionate returns.

Family-owned vs Non-Family-Owned Companies

It shouldn’t be a surprise that companies where families or founders at the wheel outperform companies where there’s your regular CEO.

Family or founder-led companies benefit from some things that help them outperform.

Long-term focus: Companies run by families are passed on with every generation, so decisions are made for the longer term, not shortsighted EPS targets, etc.

Large ownership stake in the business: With large amounts of skin in the game, heaps of their wealth is tied up in the company, resulting in a strong incentive to make decisions that ultimately benefit their business and shareholders.

Capital allocation: family and founder-led companies tend to invest back into the business at higher rates.

Less dilution: Family-owned businesses' incentive structures emphasize productive, long-term capital allocation plans and prudent share count reduction. There tends to be less stock-based compensation that dilutes existing owners’ claim on earnings.

Investing in founder-led or family-operated companies gives me an edge; it truly does. It is worth checking these types of businesses for an extended period and maybe adding a wonderful compounder to your portfolio.

There’s Always Reasons to Sell

The headlines and market analysts frequently forecast a disastrous decline when equities fall by 10% or more, calling it the next Black Swan event or the start of a protracted collapse.

These worries might appear reasonable in the short term, but how significant are they over time? The accompanying chart shows we have had many crises, like COVID-19, trade wars, government shutdowns, and oil price falls.

Despite these occurrences, the market's long-term direction is still overwhelmingly bullish. Every crisis was followed by growth and recovery, which eventually produced significant gains. The lesson learned? The markets are robust. Although volatility is unavoidable, a definite upward trend that rewards patience and long-term investing may be seen when focusing on the broader picture.

Stay invested in the stock market, and you’ll survive the next Black Swan when it hits.

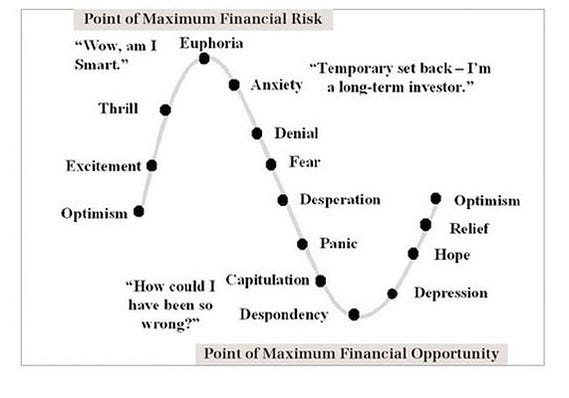

The Market Is Driven By Emotions

Emotions are the only factor driving the stock price in the short term, but the market always tracks earnings in the long run. This is one of the main causes of the long-term failure of swing trading, day trading, and short-term investing. Why? You claim to be able to forecast human emotions, yet no one can. You will succeed if you are invested, stay invested, and resist the temptation to be swayed by Mr. Market's emotions, which drive the market.

Make your estimates, assess the company, and purchase the stock. If your thesis or the business's core principles change, consider selling out. But never—I mean never—sell solely based on the price of a stock.

Topline Growth, The Long-Run Driver of Stock Performance

I trust we are all on the same page about investing in the long run. As the previous visual pointed out, stock prices are derivatives of earnings growth. The chart above supports this claim even more, showing that sales and profit growth are the key drivers of shareholder returns, especially from the 10-year perspective.

In the short run, price movements can vary with multiple factors, such as valuation multiples and market perception, but such variations are not long-lasting. Over time, the basics—consistent revenue growth, margin improvement, and free cash flow—drive total returns.

This is why buying into a high-quality compounder—a company that can increase its sales and earnings (per share) in the course of a year—is one of the most effective ways of amassing wealth. In the long run, the stock price usually moves in line with the business’s financial statements and thus benefits the long-only investors.

So, the lesson is rather straightforward: focus on companies to grow steadily and slowly wait and, the power of compounding work for you.

Margin of Safety

The margin of safety is your best friend when it comes to investing. Simply put, it is the difference between a stock's intrinsic value and its current share price. When considering investing in a company, the wider your margin of safety, the better.

For example, if a company's intrinsic value sits around $100 per share and you buy the stock for $70, you have a 30% margin of safety.

Valuation is not an exact science—we all know this. A margin of safety protects investors from misjudgment or unexpected bad news that could impact the business. It also limits downside risks if the stock price drops temporarily due to market volatility or economic headwinds. Buying below the intrinsic value gives us more room for the stock price to appreciate, increasing our upside potential.

In addition, it helps us stay more rational during downturns in the market since you know you’ve bought at a lower price (discount) than what the business is worth. It forces us investors to focus on the cold-hard fundamentals of the business rather than short-term hype or emotional decisions driven by Mr. Market.

The margin of safety is our insurance policy when investing. It protects us from being wrong—and let’s be honest, we all make mistakes from time to time—but it also gives us an edge when we’re right!

Stocks vs Bonds vs Gold vs Dollar vs T-bills

I’ve received the question multiple times since I started publishing newsletters on stocks.

‘‘Why do you solely cover stocks, and do you invest in other assets like gold or bonds?’’

Let’s answer the latter. Should I invest in other assets?

I solely invest in stocks. I do not have a crypto portfolio, gold in my investment portfolio, or bonds in my investment portfolio.

I’m in favor of actually owning a part of a business. Companies grow their earnings, expand their operations, and increase their profitability over time. Owning an asset like this is more interesting to me, and I understand the business and its underlying fundamentals; this isn’t the case with gold or crypto.

Well, why do stocks outperform these other asset classes? Stocks and companies benefit greatly from compounding returns. especially when dividends are reinvested, these drive even higher returns. Compounding allows us investors to grow exponentially over decades. In addition, companies innovate, develop new technologies, and improve across the board, leading to higher revenues and profit, which, in return, increase the value of the stock.

Stocks also tend to outpace inflation. Why? Businesses can raise prices to grow their earnings, providing real returns compared to fixed-income investments like bonds.

I should note that stocks are riskier than gold, bonds, or real estate. Because the risk is greater, the return can be greater as well. Do not be fooled. If the reward is greater, so is the risk!

Over the past century, global economies have expanded, and markets have grown, increasing stock prices as businesses benefit from these economic developments.

Quality Investing

It matters what strategy or stock you pick; it truly does. Loads of investment strategies generate unique investing results, but one does take the cake, and that’s quality investing. There’s a good reason why I’ve switched from value investing to quality investing. Quality companies have consistent earnings growth, sustainable and stable profits, and high financial productivity, and they tend to reinvest their cashflows at better rates back into the business, driving more quality and value to the business and its shareholders. Quality companies tend to have better competitive advantages that enable them to maintain their dominant position in the market and uphold their excellent pricing power.

As shown in the graph, quality investing has proven to be the superior type of investing. This doesn’t mean everybody should be a quality investor, not at all. But this fits my needs and desires, so I consider myself a perfect candidate to be a quality investor.

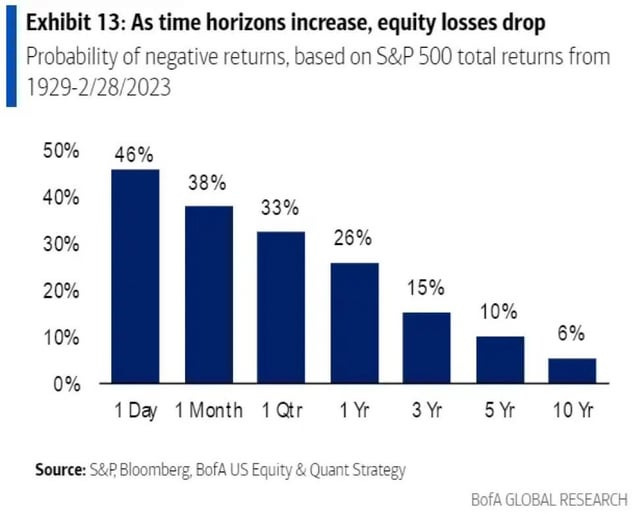

Time Horizon Increases, Equity Losses Drop

There is always a possibility that your stock(s) will go to $0 or that you will be in a drawdown for an extended period of time, but this isn’t permanent.

The longer you’re invested in the market, the smaller your chances of losing money increases. If your time horizon for investing is longer than 10 years, there’s a 6% chance of loss of equity. It is not a total loss of equity; it is just a loss of equity. This backs up every claim about investing and staying in the market. Time is your friend, and you should stay friends for as long as possible to reap the benefits.

It’s sometimes, I would argue, even most of the time, the best solution is to just sit on your hands and do nothing.

"The stock market is a device for transferring money from the impatient to the patient." – Warren Buffett

That was it for today!

Thank you for reading this article. I hope it has sparked something in you.

Sometimes, we need to stop and appreciate the things we tend to forget. Try to remind yourself daily of the beauty of investing; I’m also trying.

While you’re at it and haven’t done so, subscribe to my newsletter via the button here.

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack, you agree to my disclaimer, which can be read here.

Great article!