Have you ever seen Iron Man suit up for the first time?

That moment when technology, intelligence, and imagination collide to create something the world has never seen before.

Now picture that — but instead of one man in a flying suit, it’s an entire company fueling the future of AI, gaming, and computing as we know it.

That’s NVIDIA in a nutshell.

Started as a niche graphics chipmaker, NVIDIA has morphed into the brain behind the most powerful technologies of our time — from training massive AI models like ChatGPT to powering autonomous vehicles to building the digital infrastructure of tomorrow’s data centers.

Like Stark Industries in the real world, NVIDIA doesn’t just follow tech trends — it defines them.

But here’s the big question:

Is NVIDIA just riding the AI hype wave?

Or are they building the picks and shovels of the next industrial revolution?

Let’s dig in.

Happy reading!

Table Of Contents

Business Overview

Revenue Breakdown

Key Performance Metrics

Management

Management Compensation & Salaries

Capital Efficiency

Investment Thesis

Financial Health

Assets Sheet

Liabilities Sheet

Financial Health Check

Cash Flow Analysis

Competition

Risks

Valuation

Final Thoughts

1. Business Overview

NVIDIA Corporation is a global leader in accelerated computing, best known for designing and manufacturing high-performance graphics processing units (GPUs) and system-on-a-chip units (SoCs). Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA has evolved from a niche graphics card provider for gamers into a foundational force behind some of the most transformative technologies of the 21st century.

NVIDIA operates across several high-growth sectors, including gaming, data centers, professional visualization, and automotive. Its flagship GPU product line, GeForce, dominates the gaming market, while its NVIDIA RTX and AI-focused A100/H100 chips power everything from real-time ray tracing in games to large-scale artificial intelligence workloads in cloud computing environments.

Through its CUDA programming platform and acquisition of companies like Mellanox and Arm (pending approval), NVIDIA continues to build a vertically integrated ecosystem around accelerated computing. The company also rapidly expands in AI infrastructure, offering full-stack solutions — hardware, software, and platforms — for enterprises, researchers, and governments.

NVIDIA aims to solve the world’s most complex problems through accelerated computing. From enabling breakthroughs in drug discovery and climate modeling to powering autonomous vehicles and generative AI, the company plays a critical role in shaping the future of multiple industries.

By combining cutting-edge hardware with a software-first mindset, NVIDIA has positioned itself as more than just a chipmaker — it's a platform company powering the next wave of computing innovation.

Revenue Breakdown

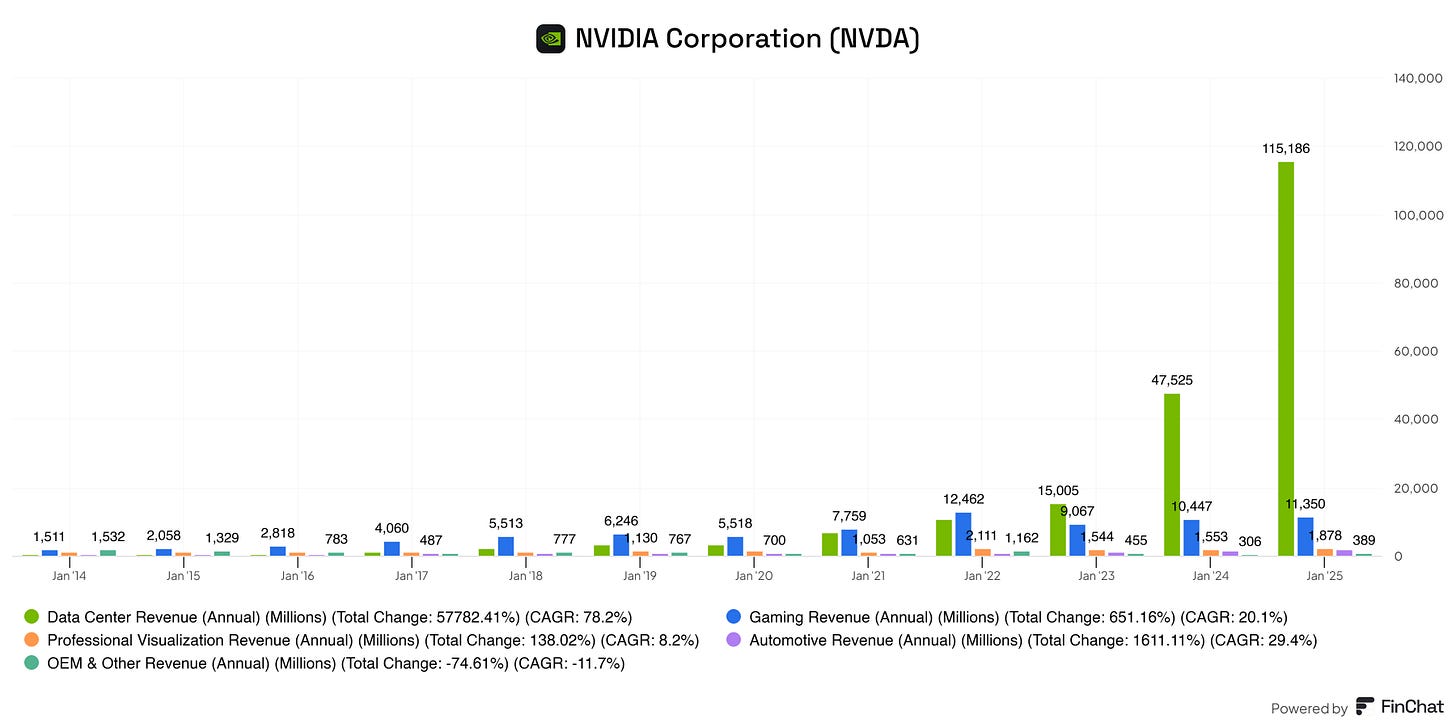

NVIDIA’s primary revenue drivers are:

Data Center (accounts for 88.3% of the total revenue LTM)

This is NVIDIA’s most significant and fastest-growing segment, focused on selling high-performance GPUs and software to power cloud computing, artificial intelligence (AI), and machine learning (ML) workloads.

Professional Visualisation (accounts for 1.4% of the total revenue LTM)

This segment provides GPUs, and software professionals use for tasks like 3D rendering, design, video editing, architecture, and simulation.

Gaming (accounts for 8.7% of the total revenue LTM)

NVIDIA’s most well-known segment is focused on providing GPUs for PC gaming.

Automotive (accounts for 1.3% of the total revenue LTM)

This segment provides computing platforms for autonomous driving, infotainment systems, and digital cockpits in vehicles.

OEM & Others (accounts for 0.3% of the total revenue LTM)

This is a catch-all segment that includes: Hardware sold to original equipment manufacturers (OEMs), Cryptocurrency mining processors (CMPs, when relevant), and Legacy products or tech not neatly fitting into other categories.

We can see as clearly as day that NVIDIA is primarily growing due to its data center revenue. Data center revenue grew from 4.8% of NVIDIA’s total revenue to 88.3% in 11 years, showing significant growth. Most of this growth is fueled by companies' intense CapEx spending for AI, which goes straight to NVIDIA’s pockets.

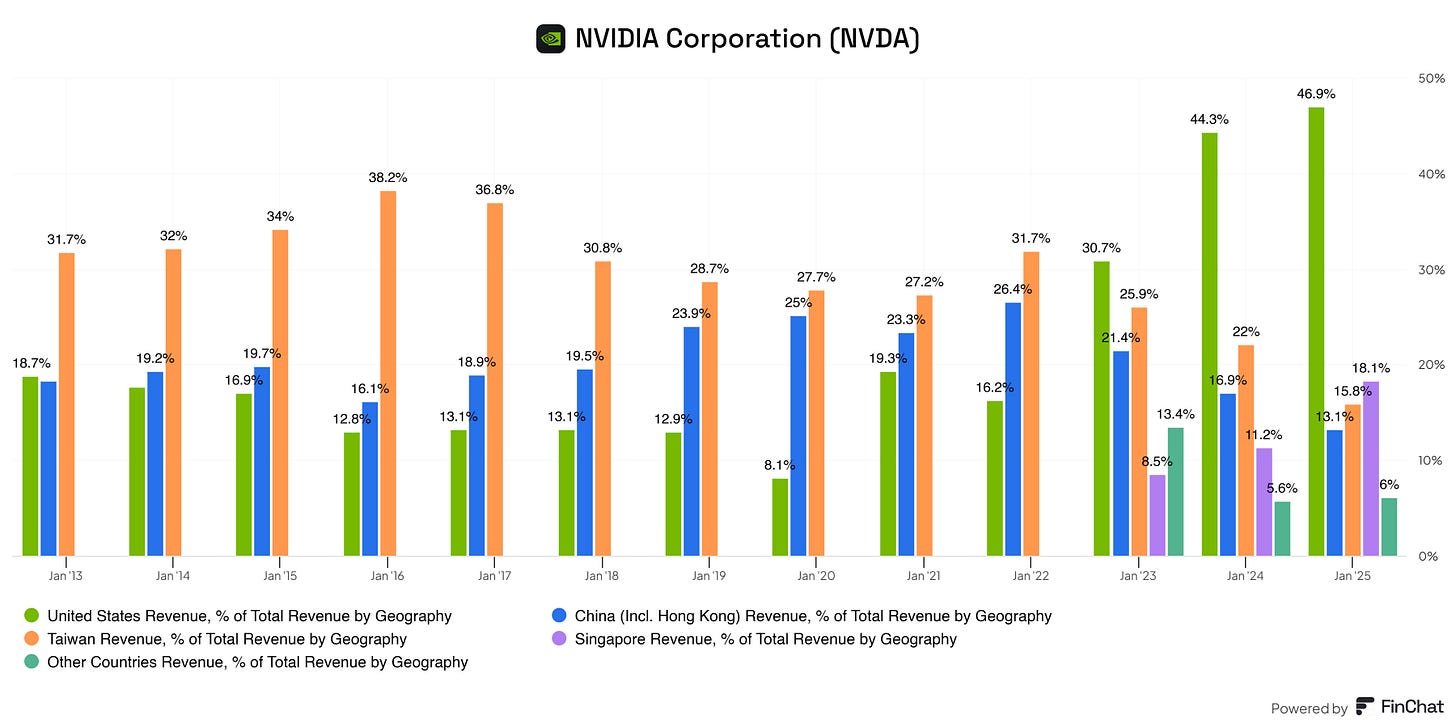

Where is all this revenue coming from globally?

Companies located in the United States are by far NVIDIA's biggest customers. Singapore is second, Taiwan is third, China (including Hong Kong) is fourth, and the remaining countries globally are combined.

Taiwan was the biggest customer of NVIDIA and its products for a while. After 2022, companies in the United States heavily invested in NVIDIA's products and services. In 2022, the United States was responsible for 16.2% of NVIDIA's revenue. One year later, this skyrocketed to 30.7%; as of January 2025, this has become 46.9%.

Overall takeaways

NVIDIA offers a broad portfolio of complementary products, boosting their respective value to customers.

NVIDIA is reliant on its data centers and the revenue that comes from them. Due to its reliance on this company segment, a cushion of safety is missing here.

NVIDIA is globally diversified, offering a cushion of safety in case of an economic downturn in one of the mentioned countries.

Key Performance Indicators

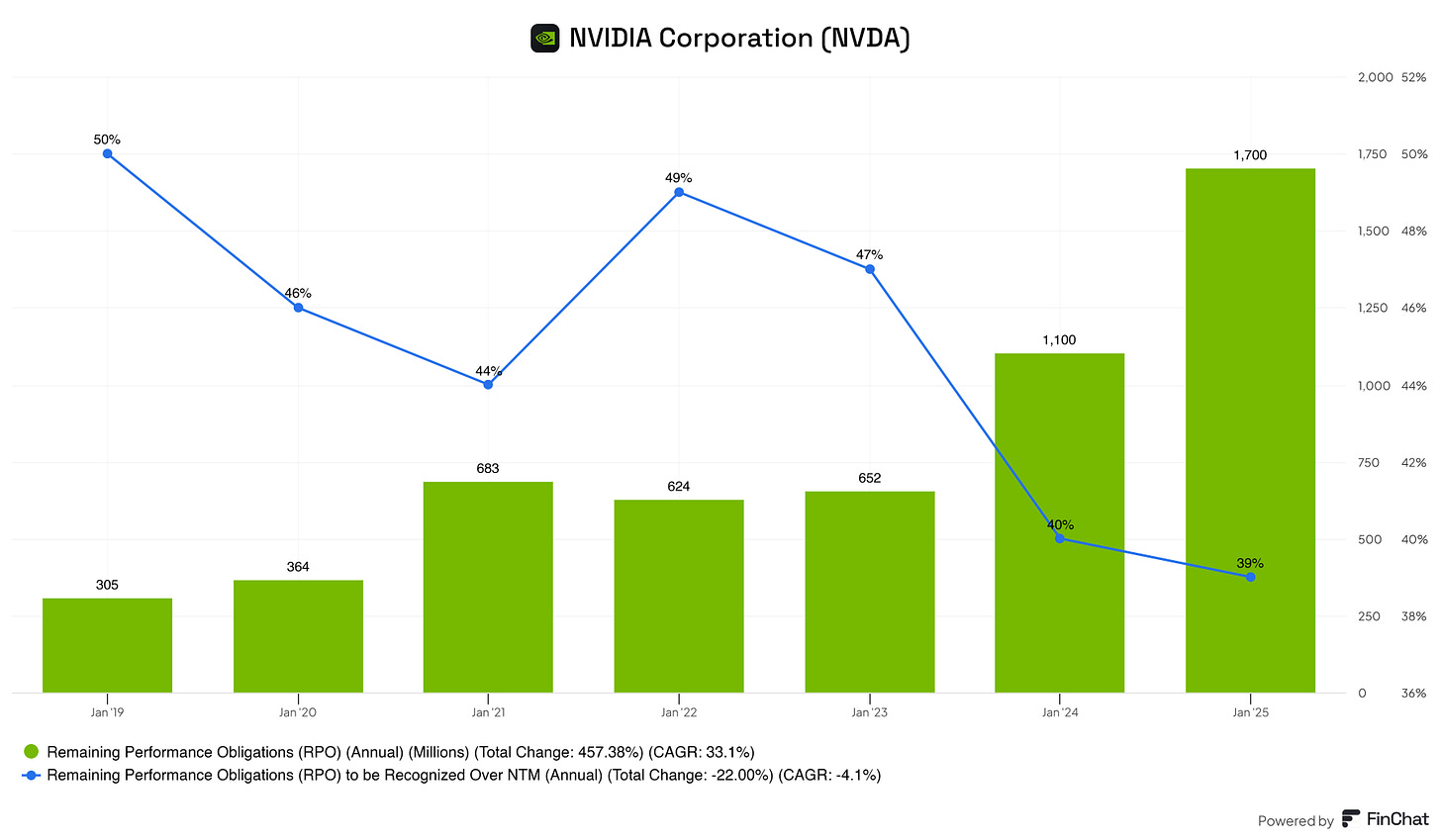

RPO represents the total value of future revenue from contracts that NVIDIA has yet to recognize.

It grew significantly from $305 million in Jan '19 to $1,700 million in Jan '25, a total increase of 457.38%.

Growth was steady, with notable jumps between Jan '20 ($364M) and Jan '21 ($683M), Jan '23 ($652M) and Jan '24 ($1,100M), before reaching $1,700M in Jan '25.

It started at 50% in Jan '19, peaked at 49% in Jan '22, but then declined to 39% by Jan '25, a total drop of 22.00% over the period. The decline suggests that a smaller portion of NVIDIA's backlog is expected to be converted into revenue within the next year, possibly indicating longer-term contracts or delayed project timelines.

NVIDIA's RPO has grown substantially, reflecting strong future revenue potential and business expansion. However, the decreasing percentage of RPO to be recognized within the next 12 months indicates that the company might be taking on longer-term commitments, which could delay revenue recognition but provide more sustained growth over time.

2. Management

Jensen Huang has one of the funniest and most inspiring LinkedIn profiles. Look at this:

From being a busboy/waiter for Denny’s for 5 years, Jensen Huang started NVIDIA and built one of the most important companies in the world. Jensen Huang has been around for almost 33 years, talking about a lasting CEO?!

Jensen Huang built an empire and still holds significant skin in the game. Currently, Jensen Huang holds 3.52% of the total outstanding shares worth roughly $101B. All of Jensen Huang's net worth is locked into NVIDIA.

This type of skin in the game is excellent. As investors, we can be more assured that Jensen Huang and his management will make decisions that are in the best interest of long-term value creation for both the company and its shareholders (including management themselves). Independent directors and other crucial management personnel all hold significant stakes in NVIDIA. This means that they're all likely to act in the best interest of their own pockets. How do they do this? Create long-term value.

I love seeing significant wealth locked in stakes in the companies they run and manage.

There’s no doubt here that Jensen Huang is an excellent CEO and that Jensen Huang has been creating shareholder and customer value since inception.

Management Compensation & Salaries

Over 90% of the CEO’s and over 50% of other Named Executive Officers’ (NEOs') target pay is performance-based and at-risk.

The performance components include:

Variable Cash Plan (based on annual financial goals)

Single-year PSUs (SY PSUs) and Multi-year PSUs (MY PSUs) tied to specific financial targets

Relative TSR (Total Shareholder Return) performance over three years compared to the S&P 500

Compensation is linked to pre-established corporate financial metrics, including:

Non-GAAP Operating Income

Non-GAAP Gross Margin

Revenue

Relative TSR

Payouts only occur if these metrics are met or exceeded, with clear thresholds, base, and stretch goals defined.

NVIDIA reported a 99th percentile TSR versus the S&P 500 over the last 3 years, and this was directly tied to maximum vesting of performance-based equity awards for executives.

In Fiscal 2024, executives reached or exceeded the highest goals, resulting in maximum or above-target payouts:

Revenue: $60.9B (vs. $29.5B stretch goal)

Non-GAAP Op. Income: $37.1B (vs. $11.9B stretch goal)

Gross Margin: 73.8% (vs. 68.5% stretch goal)

100% of the CEO’s equity awards are in the form of PSUs, which vest over multiple years, encouraging a focus on sustained performance, not short-term wins.

NVIDIA’s executive compensation structure is strongly aligned with long-term shareholder value creation. It emphasizes performance-based pay, rigorous financial targets, and shareholder-aligned metrics like TSR. This creates a clear incentive for executives to drive sustainable growth and returns.

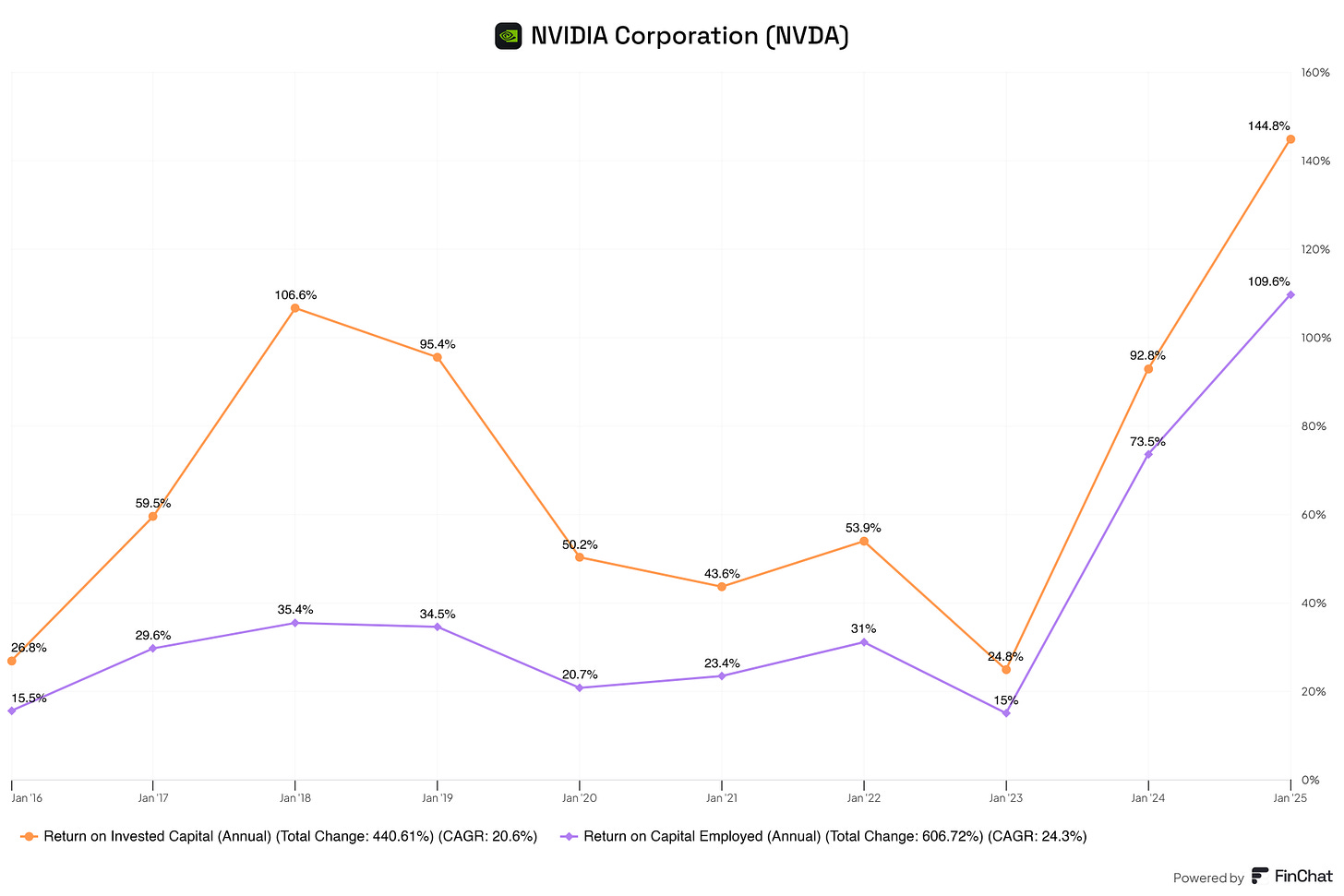

Capital Efficiency by Management

NVIDIA's ROIC and ROCE show remarkable growth, especially in the last two years (Jan '23 to Jan '25), reflecting strong operational efficiency and profitability. The sharp increases suggest NVIDIA capitalizes on high-growth sectors like AI, boosting margins and returns. However, the volatility (e.g., dips in 2020-2023) hints at sensitivity to market cycles or investment phases, which could pose risks if growth slows.

Overall excellence across the board for NVIDIA here!

This is where it gets interesting.

In the next section, we’ll examine NVIDIA’s financials, risks, and valuation, including my full investment thesis and whether I believe it’s a buy today.

This part is for FluentInQuality members only.

👉 Start a free 7-day trial to unlock it — no risk, cancel anytime.

3. Investment Thesis

Dominant Player in High-Growth Markets

NVIDIA is the undisputed leader in GPUs, which are critical for AI, gaming, data centers, and autonomous vehicles. The AI boom—think generative AI models, machine learning, and data analytics—is driving insane demand for NVIDIA’s chips. Their tech is basically the backbone of modern computing, and that’s not changing anytime soon…..