10-Minute Breakdown: Is Fortinet Worth Buying Right Now?

In five years, Fortinet has surged 387.51%. With strong margins, high returns on capital, and steady growth, there’s even more to the story!

Welcome back, quality investors! 👋🏻

Time is your most valuable asset, and I respect it more than any other writer on Substack. That’s why I’m launching a new series: "10-Minute Breakdown."

Not everyone has 30 to 50 minutes to read my deep dives. Some want a quick, high-quality investment case—something you can digest on your way to work, between meetings, or during a coffee break.

With this new format, I’ll give you everything you need to know about a company in 5 to 10 minutes—no fluff, just the essential insights. Whether you're looking for a stock to research further or want to stay informed, this series is built for you.

Let’s dive into the first one.

Happy reading!

Table of Content

Introduction

Business Overview

Revenue Breakdown

Key Performance Metrics

Management

Capital Efficiency by Management

Investment Thesis

Financial Snapshot

Assets Sheet

Liabilities Sheet

Financial Health Check

Cash Flow Insights

Competitive Landscape

Potential Risks

Valuation Breakdown

Final Thoughts

Introduction

In an era where cyber threats are evolving unprecedentedly, Fortinet (NASDAQ: FTNT) has positioned itself as a dominant force in network security. Founded in 2000, the company has built a reputation for delivering high-performance cybersecurity solutions, securing enterprises, service providers, and governments worldwide.

At the heart of Fortinet’s success is its FortiGate firewall platform, powered by proprietary security processors and AI-driven threat intelligence. Unlike many competitors that rely heavily on third-party software, Fortinet integrates security and networking at the hardware level, offering faster, more scalable, and cost-efficient solutions.

The company’s business model is built on two pillars: hardware sales and high-margin subscription services, creating a powerful combination of upfront revenue and recurring income. As organizations increasingly prioritize cybersecurity spending, Fortinet benefits from long-term industry tailwinds and the growing demand for zero-trust architecture, cloud security, and AI-powered threat detection.

With strong financials, impressive margins, and a history of outpacing industry growth, Fortinet remains a key player in a sector where security is no longer optional—it's essential.

Business Overview

How does Fortinet generate its revenue?

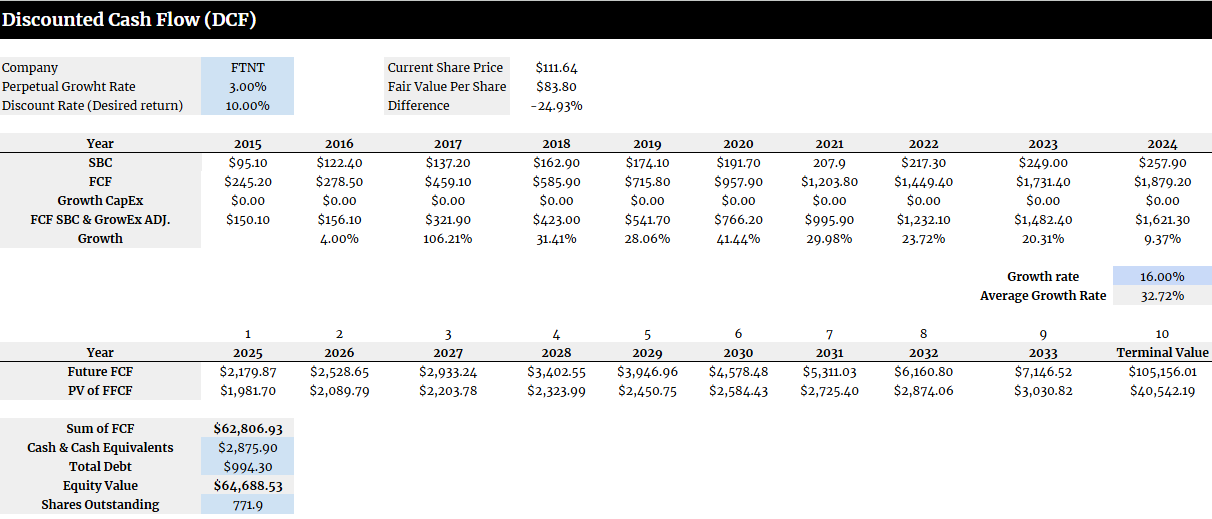

Product revenue (Accounts for 36.3% of Total Revenue)

Generated from selling FortiGate firewalls, secure networking appliances, and other security hardware.

Includes custom ASIC-based security processors, SD-WAN devices, and cloud security products.

Security Subscriptions Revenue (Accounts for 35.8% of Total Revenue)

Recurring revenue from threat intelligence, AI-driven security, and cloud-based protection.

This includes services like FortiGuard Security Services, which provides real-time updates for malware protection, web filtering, and intrusion prevention.

Technical Support & Other Revenue (Accounts for 27.9% of Total Revenue)

Revenue from FortiCare support contracts, providing software updates, customer support, and maintenance services.

Includes professional services, training programs, and consulting for enterprise clients.

Multiple revenue drivers. This ensures that when one segment faces temporary headwinds, other segments can take the blow.

All segments are scalable with each other. Fortinet can easily up-sell services and subscriptions when customers buy hardware, making these segments intertwined and robust.

Stable segments. All three segments have been stable since 2017, giving us investors more ease of mind and trust in Fortinet’s segments.

Revenue Breakdown

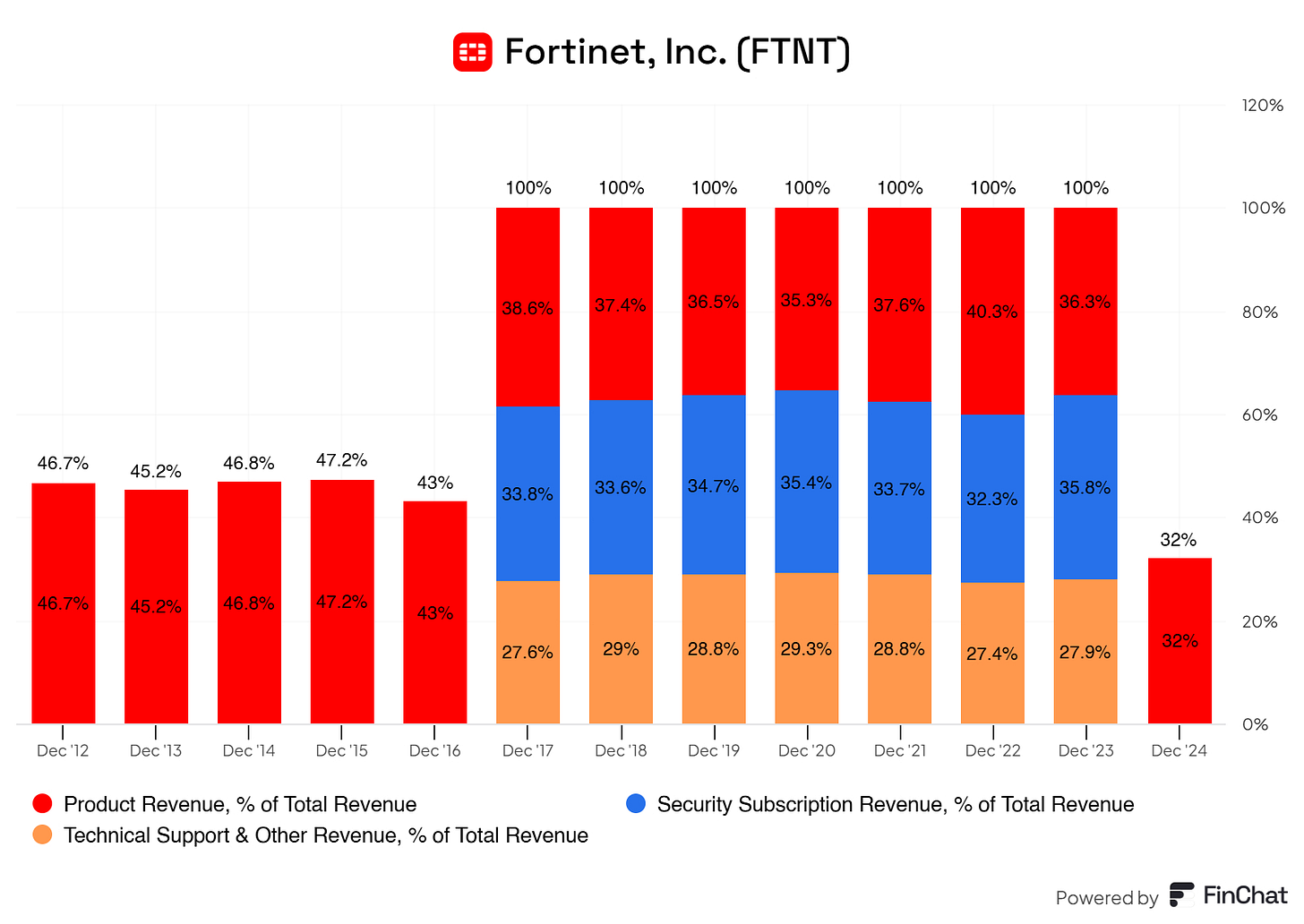

Stability across all regions. Fortinet is stable in its global customer case; no significant swings exist.

Fortinet isn’t reliant. Fortinet sells products and services that are well-diversified across the globe. There’s no worrying reliance on one country.

Balanced risk profile. Unlike competitors relying heavily on the U.S. or China, Fortinet’s geographic diversity reduces geopolitical and regulatory risks.

Key Performance Metrics

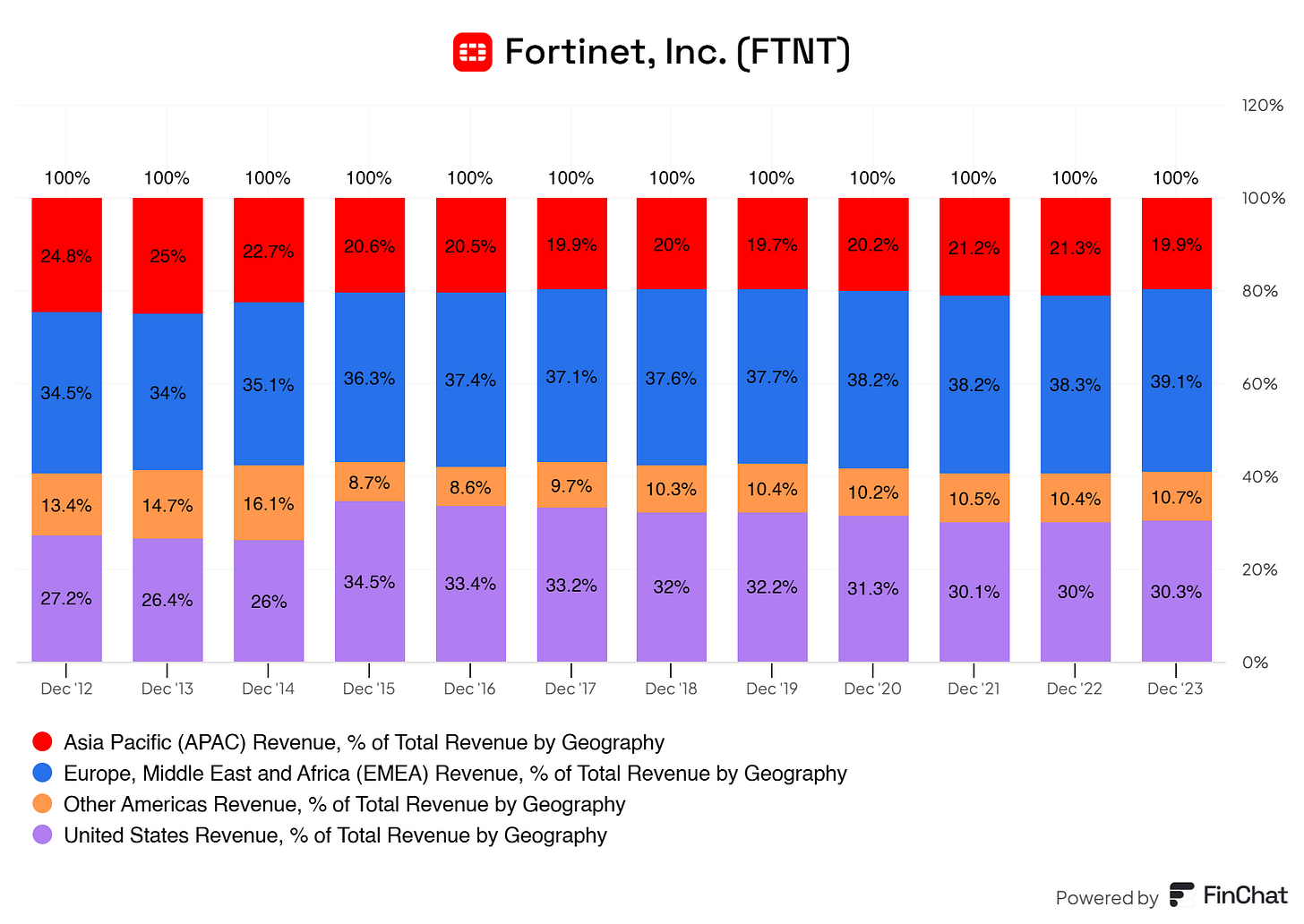

Sustained growth in billings & contracted revenue. Fortinet’s total billings have grown nearly 10x since 2012, with a 22% CAGR, reflecting strong customer demand and expansion. Remaining Performance Obligations (RPO)—a key indicator of future revenue—has increased nearly 4x since 2018, with a 24.9% CAGR, signaling robust backlog growth.

High revenue visibility & recurring growth. The narrowing gap between billings and RPO suggests an increasing shift toward subscription-based revenue, which enhances stability. Strong RPO growth means Fortinet has locked-in revenue streams, ensuring consistent future cash flow.

Security spending momentum. The acceleration in billings from 2020 onward aligns with rising cybersecurity threats and enterprise IT spending, positioning Fortinet as a beneficiary of long-term industry tailwinds. Customers commit to more significant, longer-term contracts, reflecting trust in Fortinet’s platform.

Management

Founder, Chairman & CEO Ken Xie owns roughly 8.3% of the total outstanding shares, worth roughly $6.5B

Founder, President, CTO & Director Michael Xie owns roughly 7.4% of the total outstanding shares, worth roughly $5.7B

Founders at the wheel. I love companies where the founder is at the wheel. Being a founder at the wheel usually means that the company is run more efficiently and has a more long-term mindset, focusing on long-term success and shareholder returns.

Significant skin in the game. Management with significant skin in the game tells us that, for the most part, management is aligned with shareholders. If management makes a mistake, they feel this mistake in their personal wealth, since it is mostly locked in their business. This makes sure management incentives align with those of us!

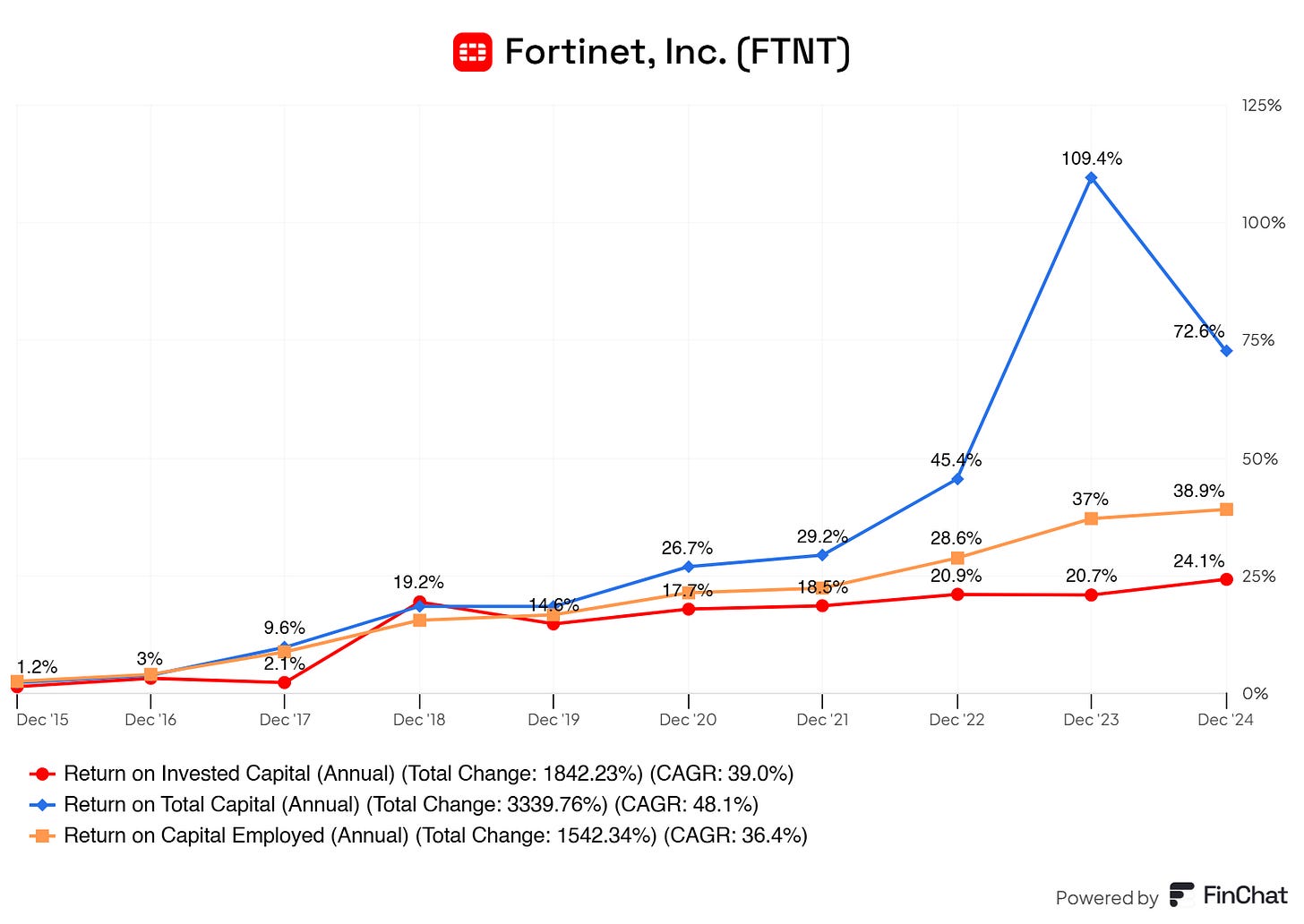

Capital Efficiency by Management

YoY increases in ROIC, ROCE, and ROTC. Fortinet is becoming more efficient at returning more value on its equity, debt, and invested capital.

Debt is working in their favor. The fact that ROTC is higher than ROCE and ROIC suggests that Fortinet's use of debt boosts returns rather than drags them down.

Exceptional capital efficiency. The high ROTC suggests Fortinet is making outstanding returns on its total capital, which is rare for tech companies. If sustainable, this could mean strong competitive advantages.

Investment Thesis

Fortinet is a prominent cybersecurity leader renowned for its comprehensive security solutions and robust financial performance. Below is a detailed investment thesis highlighting key aspects of the company:

1. Market Leadership and Innovation

Comprehensive security solutions: Fortinet offers an extensive range of cybersecurity products, including firewalls, intrusion prevention systems, and advanced threat protection, catering to diverse customer needs.

Proprietary technology: The company's unique ASIC-based architecture enhances performance and efficiency, providing a competitive edge in delivering high-speed security solutions.

2. Financial Performance and Growth

Revenue growth: In 2024,, Fortinet reported a total revenue of $5.96 billion, a 12.3% increase from $5.30 billion in 2023. Due to its subscription powerhouse, double-digit growth is expected for the foreseeable future.

Service revenue surge: Service revenue reached $3.85 billion in 2024, up 19.8% from $3.21 billion in 2023, indicating strong demand for subscription-based services.

Operating margins: The company achieved a GAAP operating margin of 30.5% in Q2 2024, reflecting operational efficiency. Fortinets margins across the board are stable; some margin expansion could be seen.

3. Diversified Revenue Streams

Product and service balance: Fortinet maintains a balanced revenue mix, with significant contributions from product sales and recurring service subscriptions, ensuring financial stability.

Global presence: Operating in over 100 countries, Fortinet's diversified customer base spans various industries, reducing dependency on any single market.

Service and subscription adaptability: Fortinet is following the digitalization trend very well. Hardware is still needed, but software and subscriptions are the new future. Fortinet is adapting wonderfully and executing excellently to meet consumers' new needs.

4. Strategic Positioning and Market Trends

AI integration: The company leverages artificial intelligence to enhance threat detection and prevention capabilities, positioning itself at the forefront of cybersecurity innovation.

SASE adoption: Fortinet's focus on Secure Access Service Edge (SASE) solutions aligns with the growing demand for integrated network and security services, expanding its market opportunities.

5. Financial Outlook

Optimistic projections: For 2025, Fortinet anticipates revenue between $6.65 billion and $6.85 billion, with billings estimated at $7.3 billion, indicating confidence in sustained growth.

Earnings growth: Adjusted earnings are expected to grow by 38% in 2025 and double digits in the years after. Sales will increase by 11% to $5.9 billion, reflecting strong financial health. This type of growth should continue in the coming years due to Fortinet's strong secular trend.

6. Expanding Cybersecurity Market

Market growth: The global cybersecurity market is projected to grow from $193.73 billion in 2024 to $562.72 billion by 2032, at a CAGR of 14.3%.

Increased cyber threats: The proliferation of e-commerce platforms, smart devices, and cloud deployments has led to a rise in cyber-attacks, prompting organizations to invest heavily in advanced cybersecurity solutions.

Financial Snapshot

Let us briefly go over what catches my eye here! We’ll discuss the positives and negatives. If something is not mentioned, consider it not noteworthy.

Assets Sheet

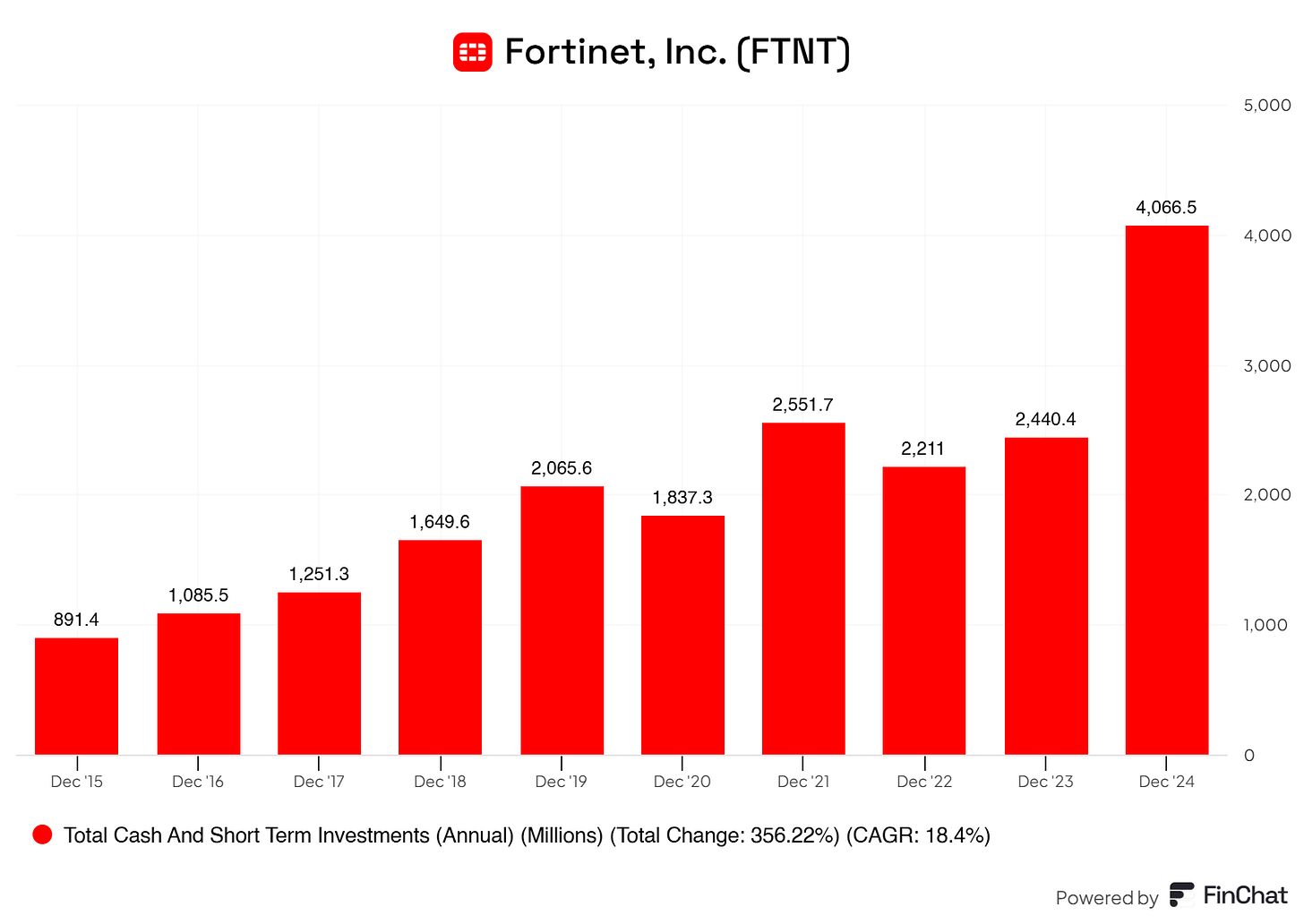

Substantial cash and short-term investment position. Fortinet boasts a strong cash and short-term investment position. This buffer allows Fortinet to weather the bad economic environment better.

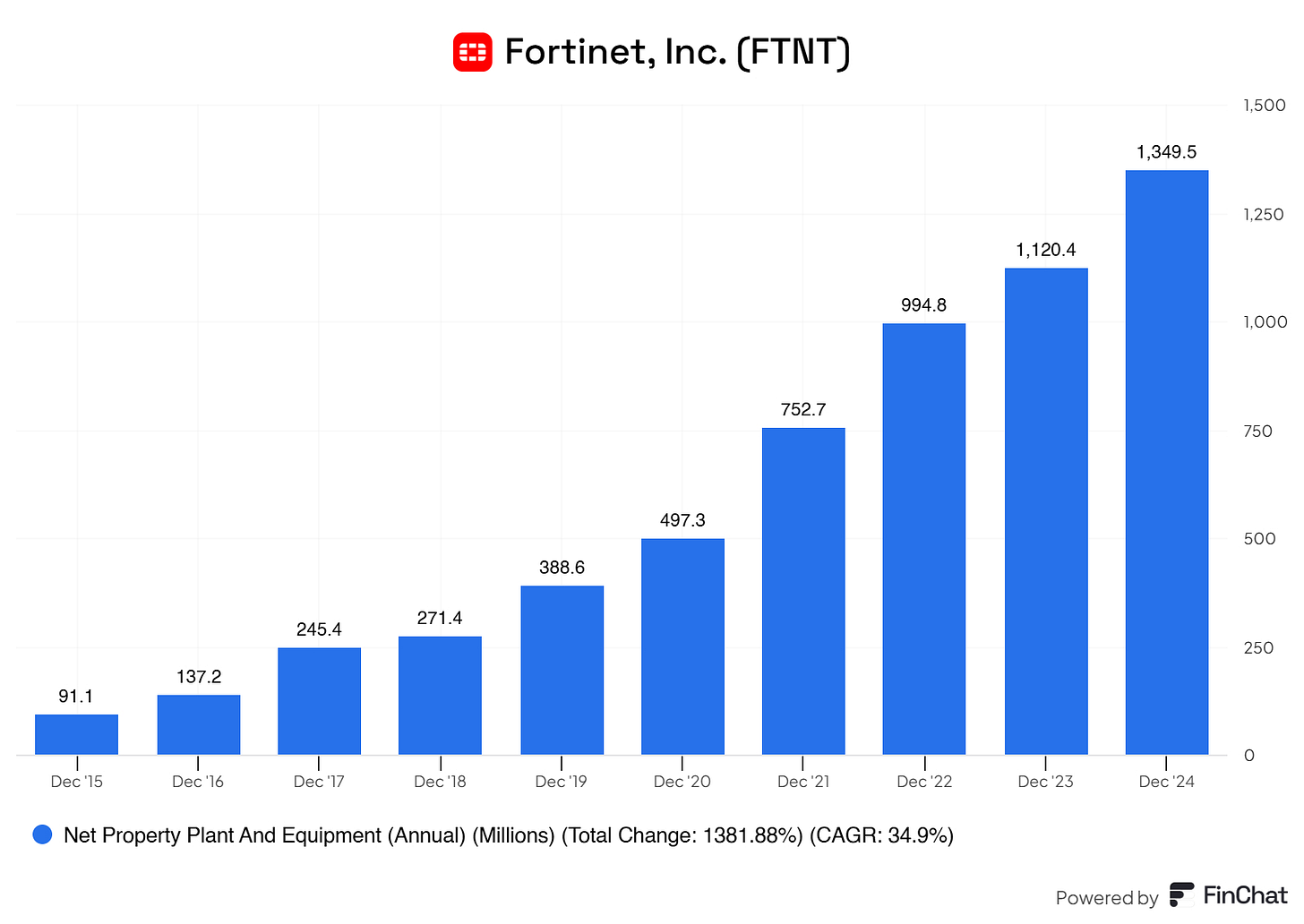

Substantial investment into PPE. The company is investing in its infrastructure, possibly expanding production capacity, building new facilities, or upgrading technology.

Investments for the future. Fortinet boasts a high ROIC, indicating that its PPE investment is paying off and will sustain its sustainable future growth.

Liabilities Sheet

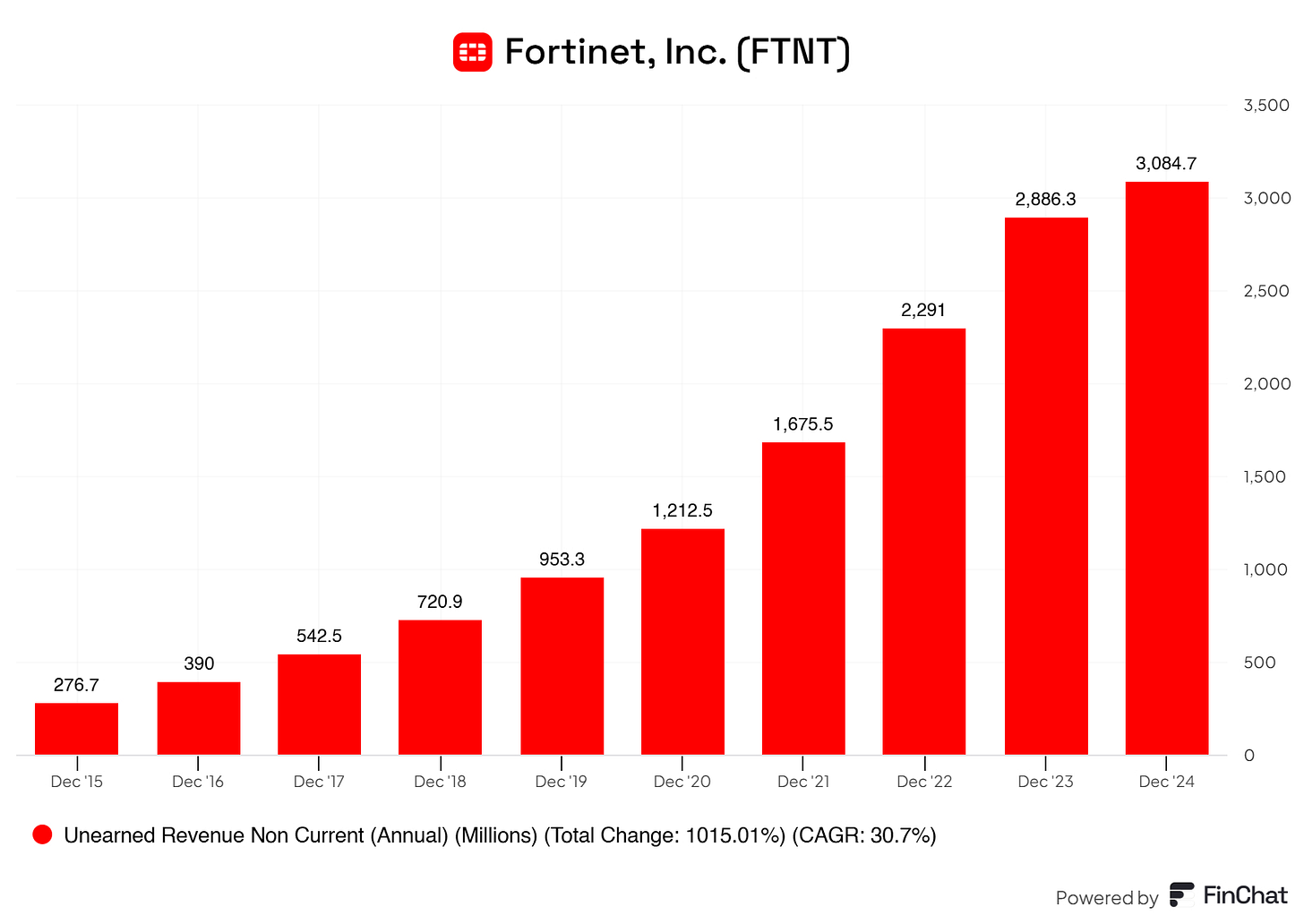

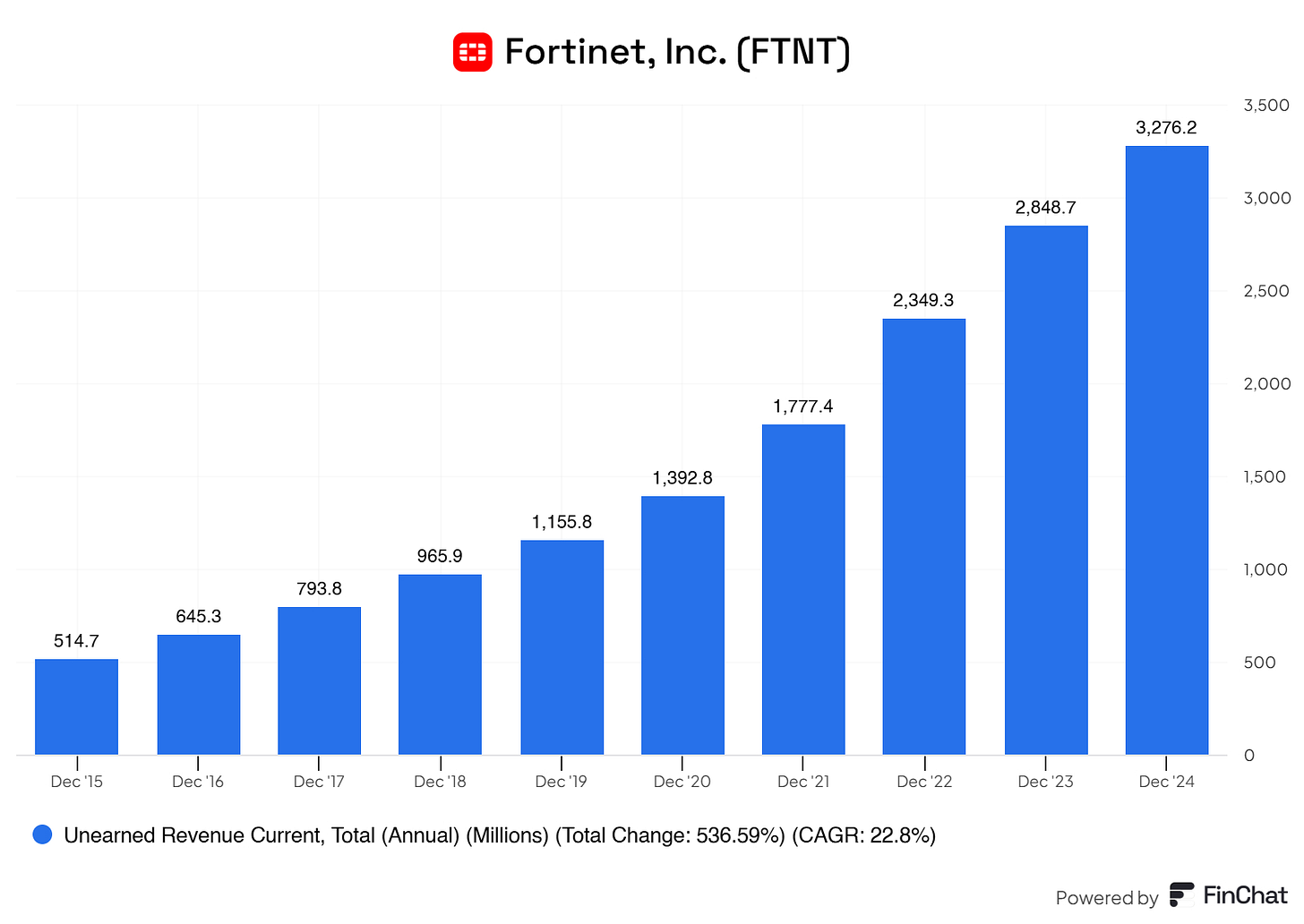

Fortinet liabilities are artificially boosted by Unearned Revenue, which isn’t what it looks like. This sharp increase indicates that Fortinet is locking in long-term contracts, particularly subscription-based security services. Suggests high customer retention and a strong recurring revenue base, which provides revenue visibility and reduces financial volatility.

Lower customer churn & high retention. A growing non-current unearned revenue balance suggests customers renewing and extending contracts. High retention rates reduce sales & marketing costs, making the business more efficient.

Alignment with non-current unearned revenue growth. The fact that both current and non-current unearned revenue are growing means Fortinet is securing both short-term and long-term contracts, creating a strong pipeline of recurring revenue.

Both combined, resulting in negative shareholder equity. Yes, these two combined are the primary causes for Fortinet's negative equity on the balance sheet. This, in return, also results in Fortinet having a negative ROE. Therefore, seeing what prompts this helps to better understand the balance sheet.

Financial Health Check

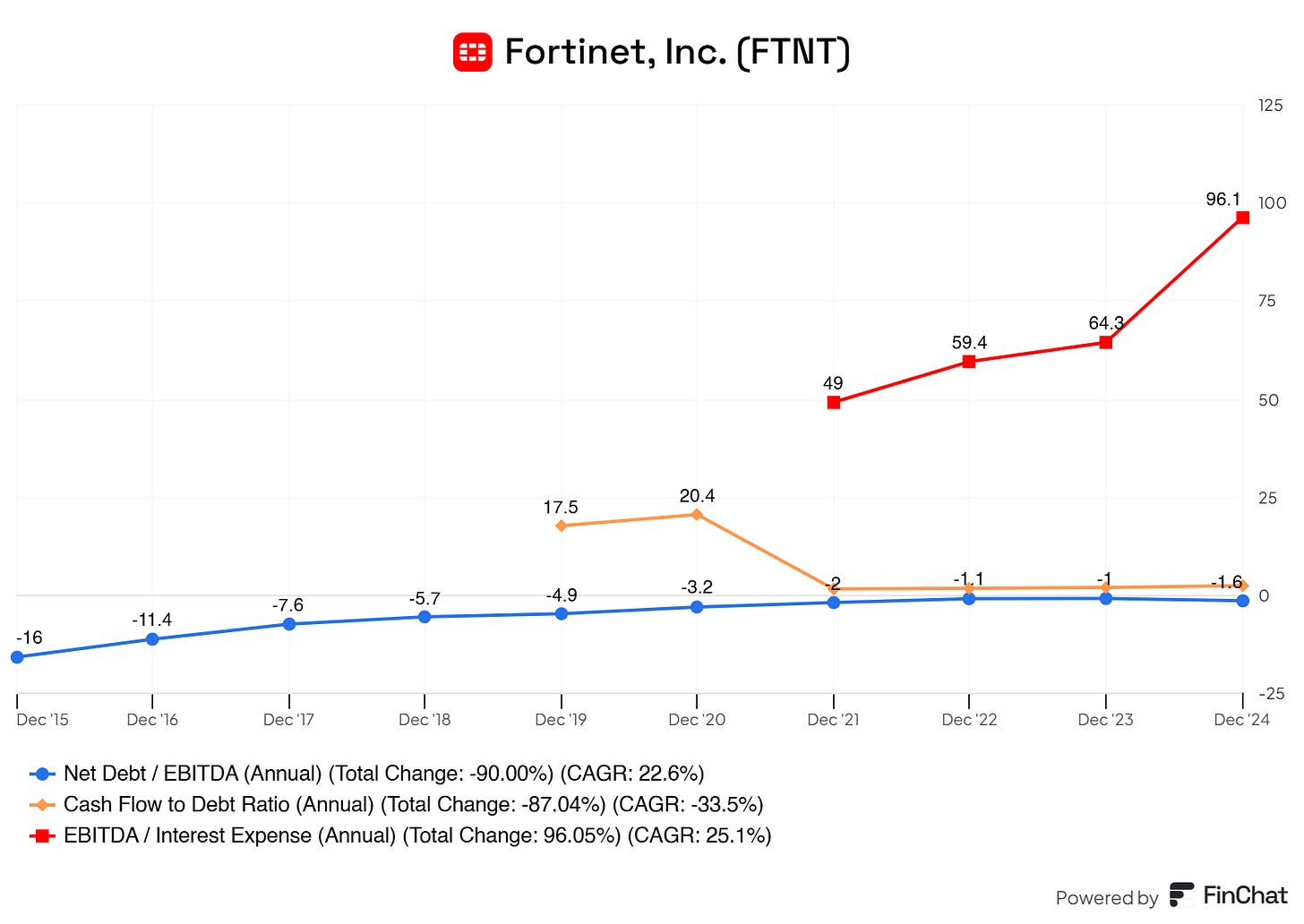

Net Debt / EBITDA: Improving capital structure. Fortinet has drastically improved its balance sheet over the years. The company is operating with a strong net cash position, giving it financial flexibility for investments, acquisitions, or buybacks.

Cash Flow to Debt Ratio: High but declining. While still healthy, this decline warrants a closer look at Fortinet’s cash flow trends and debt structure.

EBITDA / Interest expense: Massive interest coverage growth. This indicates low financial risk and no concerns about debt servicing. Fortinet's interest burden is negligible and could take on more debt if needed without financial strain.

This financial strength makes Fortinet resilient in economic downturns, flexible for M&A or reinvestments, and allows it to offer shareholder returns (buybacks, dividends) without debt concerns.

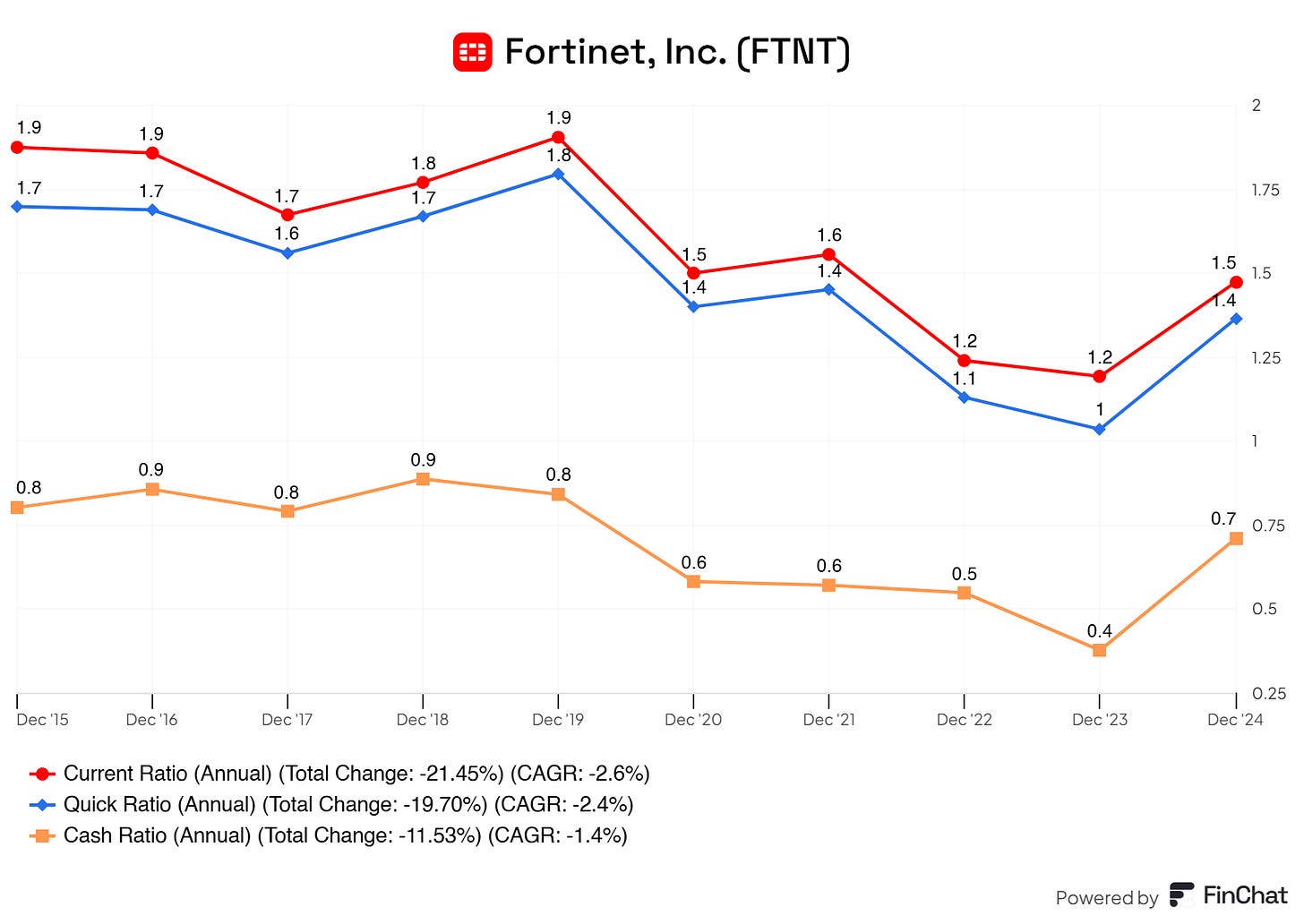

Declining liquidity ratios – but still healthy. Fortinet’s liquidity ratios have been gradually declining, suggesting reduced short-term assets relative to liabilities. While lower than before, a Current Ratio of 1.5 and a Quick Ratio of 1.4 are still healthy, indicating Fortinet can comfortably cover its short-term obligations.

Cash reserves have declined but stabilized. The Cash Ratio (strictest liquidity measure) declined from ~0.8x to 0.4x in 2023 but rebounded to 0.7x in 2024. This suggests Fortinet has spent some of its cash reserves—potentially for investments, share buybacks, or acquisitions.

The big picture: Is it a concern? Not a major red flag. While declining liquidity can be risky, Fortinet still has A strong balance sheet with net cash, rising unearned revenue, ensuring future cash inflows, and enough short-term assets to cover liabilities, with a 1.5x Current Ratio.

Cash Flow Insights

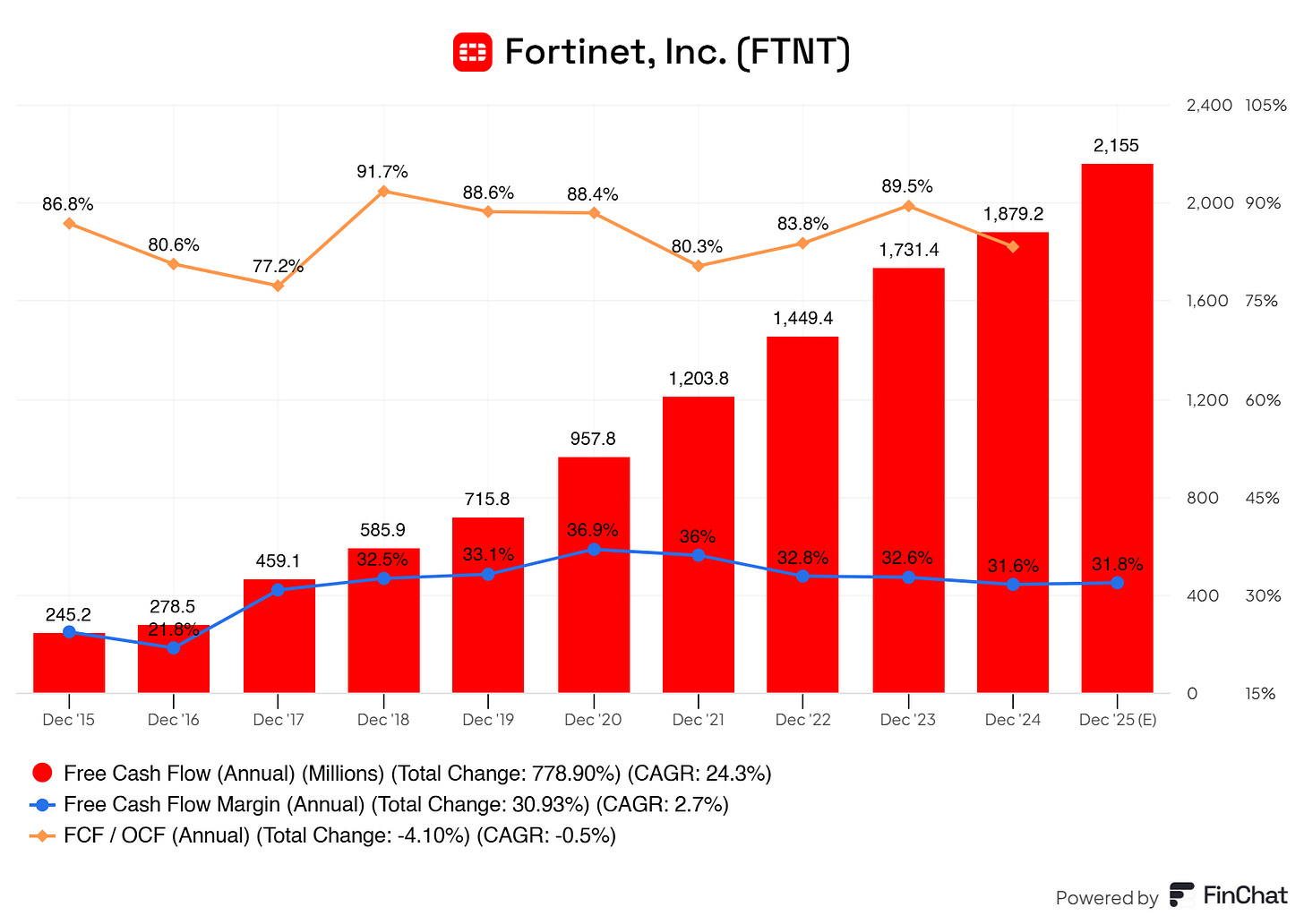

Strong Free Cash Flow Growth – Up nearly 8x since 2015. This indicates Fortinet is generating significantly more cash from operations, strengthening its financial flexibility. Cash flow growth outpacing revenue growth suggests improved operational efficiency and pricing power.

Free Cash Flow Margin – Consistently strong (~32-36%). While margins peaked at 36.9% in 2020, they’ve stabilized around 31.8%-32.6%. This means Fortinet converts ~1/3 of revenue directly into free cash flow, an excellent rate for a software/hardware company.

FCF to OCF Ratio – Slight decline but still healthy. The FCF/OCF ratio (how much of operating cash flow is converted into free cash flow) has declined slightly (-4.1%) over the years but remains stable at ~89% in 2023. However, a ratio near 90% is still excellent, indicating that most cash flow remains available for reinvestment or shareholder returns.

Competitor Landscape

Operating Margin (30.2%) – Among the Highest

FTNT has the second-highest operating margin, only behind Check Point (34.2%).

Significantly higher than Palo Alto (13.4%), CrowdStrike (-0.1%), and Zscaler (-4.6%), showing strong profitability.

Return on Invested Capital (ROIC) – 22% (Second Highest)

FTNT’s 22% ROIC is second only to Check Point (15.8%).

Far better than Zscaler (-7.7%) and CrowdStrike (1.1%), meaning Fortinet is using its capital efficiently to generate profits.

Return on Capital Employed (ROCE) – 36.6% (Best in Class)

FTNT dominates in ROCE, showing exceptional capital efficiency.

Crushes competitors like PANW (9%), CSCO (16.9%), and CRWD (1.4%).

Free Cash Flow (FCF) Margin – 31.2% (Strong & Above Average)

FTNT is in the upper tier, just behind Check Point (40.3%) and Palo Alto (37.1%).

Higher than Zscaler (-6.6%), Juniper (7.8%), and Cisco (21.6%), showing strong cash conversion.

Gross Profit Margin – 80.6% (Good, but Below Check Point & Zscaler)

Check Point (88.5%) and Zscaler (78%) have better gross margins, indicating stronger pricing power or cost structure.

Still, 80.6% is very strong and ahead of PANW (73.9%) and CRWD (75.2%).

Revenue Growth (5-Year CAGR) – 22.5% (Below CrowdStrike & Zscaler)

While 22.5% is solid, CrowdStrike (55.6%) and Zscaler (47.2%) are growing at more than double the rate.

Fortinet’s growth is strong, but it’s not a hyper-growth cybersecurity company like CRWD & ZS.

Potential Risks

Competitive Pressure in Cybersecurity. The cybersecurity market is highly competitive, with strong rivals like Palo Alto Networks (PANW), CrowdStrike (CRWD), Cisco (CSCO), and Check Point (CHKP).

Macroeconomic Headwinds (IT Spending Slowdown). Cybersecurity budgets remain strong, but an economic downturn or IT spending slowdown could delay new contracts and renewals.

Shift to Cloud & Subscription Model Execution Risks.

Cybersecurity Breaches & Reputational Risks. Fortinet sells security solutions, meaning any major security breach involving its products could severely harm its reputation and credibility.

Valuation Breakdown

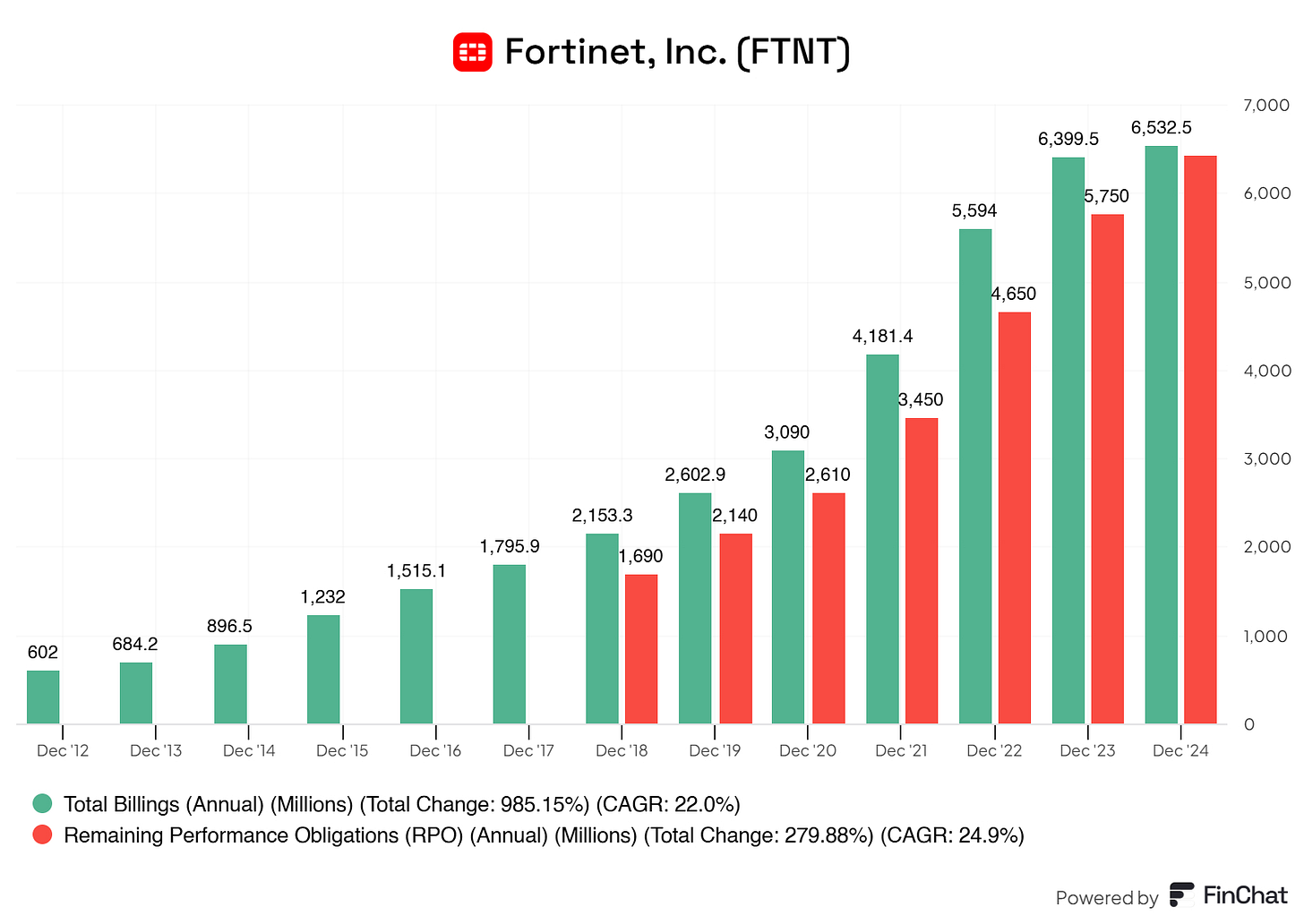

A reverse DCF with the following inputs:

Terminal growth rate of 3%

Discount rate of 10%

It tells us that Fortinet's FCF growth rate for the coming 10 years is 20.35% year over year, which is calculated in the price. Fortinet as of now has a FCF CAGR of 25%, making it seem like Fortinet is undervalued. However, analysts expect Fortinet to grow its FCF by roughly 14% in the same period.

I personally think that Fortinet can grow its FCF by roughly 15% to 17% in that period, which makes me assume that it is currently overvalued. Due to margins stabilizing, exponential revenue growth must be realized to sustain 20% + FCF growth for that period. I believe in Fortinet and its future, but 20% YoY FCF growth for 10 years seems too aggressive.

Taking the middle at a 16% growth rate, a fair value for Fortinet is roughly $83.80 per share. This means that at the current price, Fortinet is overvalued (according to my growth projections) by roughly 20%.

If you believe Fortinet can sustain higher growth rates, like 20%, it might be interesting at its current levels. Running a DCF on the 20% growth rate gives us a fair value of roughly $108.40 per share.

I’ll leave it up to you to decide whether Fortinet is interesting based on its valuation.

Fortinet would be included in my portfolio if its share price was within the $85 to $90 range.

Final Thoughts

It’s indisputable that Fortinet is well-positioned within the secular cybersecurity trend. With more attacks occurring online than physically, the demand for robust cybersecurity solutions has never been higher. Fortinet is at the heart of this transformation by offering hardware and software solutions for enterprises and governments.

Beyond its strategic positioning, Fortinet boasts strong fundamentals—consistent revenue, EPS, free cash flow growth, a competent management team with skin, and a healthy balance sheet. While risks exist, none currently pose an immediate concern. However, reputation risk is something to monitor. A breach or product failure could lead to a sharp decline in investor confidence, as we’ve seen before in cybersecurity. Unfortunately, operating in this industry means being an inevitable target—no company is immune. The key for Fortinet will be how quickly and effectively it responds to potential security incidents. Prevention is always preferable, but cyber threats evolve, and Fortinet must continuously adapt.

Fortinet appears to be reinvesting heavily into the business, positioning itself for strong future shareholder returns. The company's consistently rising ROIC and ROCE signal efficient capital allocation, reinforcing my confidence in its long-term potential. Additionally, Fortinet’s ongoing CapEx investments suggest a commitment to scaling operations, enhancing its competitive edge, and driving sustainable growth—all of which point to a promising future.

That said, I like Fortinet—but not at its current valuation. I need a more attractive entry point to meet my 10% annual return requirement. At today’s valuation, the risk-reward balance isn’t compelling enough. However, Fortinet remains firmly on my watchlist. Should my thesis evolve or a significant market event present a better opportunity, I’ll reassess whether it’s time to buy—or move on.

That’s it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

Used Sources

Finchat is used for all the charts. You can now get 15% off from your subscription. Click here and start today! (I’m affiliated. No, your plan is not getting more expensive due to the affiliate. You get a genuine discount!)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.