10-Minute Breakdown: Does Palantir Deserve the Hype?

In the last four years and four months, Palantir grew its share price with a CAGR of a whopping 71.2%, high double digits growth, excellent margins, but something is holding us back, lets go over it!

Have you ever seen the movie ‘‘The Dark Knight’’ from 2008?

You probably have (If you have not seen it, I recommend it!)

In the film, Batman (Bruce Wayne) develops a surveillance system that turns every phone in Gotham into a sonar-based tracking device, effectively giving him real-time access to all communications and locations in the city.

This is eerily similar to how Palantir operates— analyzing vast amounts of data to track patterns, predict events, and provide intelligence to governments and organizations.

Morgan Freeman’s character, Lucius Fox, even disapproves of the ethical implications, just like how Palantir has been criticized for privacy concerns and its government contracts.

But unlike Batman, Palantir operates outside Gotham and collaborates with governments, corporations, and even the military worldwide.

So, is Palantir a revolutionary force in AI and data intelligence? Or is it just a controversial government contractor riding the AI hype train?

Let’s break it all down in a whiff.

Happy reading!

What Will be Discussed?

Business Overview

Revenue Breakdown

Key Performance Metrics

Management

Capital Efficiency by Management

Investment Thesis

Financial Snapshot

Assets Sheet

Liabilities Sheet

Financial Health Check

Cash Flow Insights

Competitive Landscape

Potential Risks

Valuation Breakdown

Final Thoughts

Business Overview

Simply put, Palantir is a data analytics and artificial intelligence company that helps organizations analyze absurd amounts of data to find patterns, predict outcomes, and make calculated decisions.

Palantir was initially funded by the CIA’s venture arm (In-Q-Tel) but has since expanded into government contracts, corporate clients, and AI-driven enterprise solutions.

You should think of Palantir as the ultimate intelligence tool, like in the film Batman (and Minority Report, Enemy of the State, and Snowden).

The big question is: How does Palantir generate its revenues, where are the revenues coming from, and what are its important KPIs?

Without taking any more of your time, let us dive deeper into the story of Palantir.

Revenue Breakdown

Palantir’s products are:

Palantir Gotham

Palantir Foundry

Palantir AIP (Artificial Intelligence Platform)

Unfortunately, Palantir doesn't report how much revenue comes from which product.

Palantir reports how much revenue is generated from governments with names like the military, CIA, FBI, and other agencies, as well as commercials with names like Airbus, BP, and Ferrari.

Let us go over these in short.

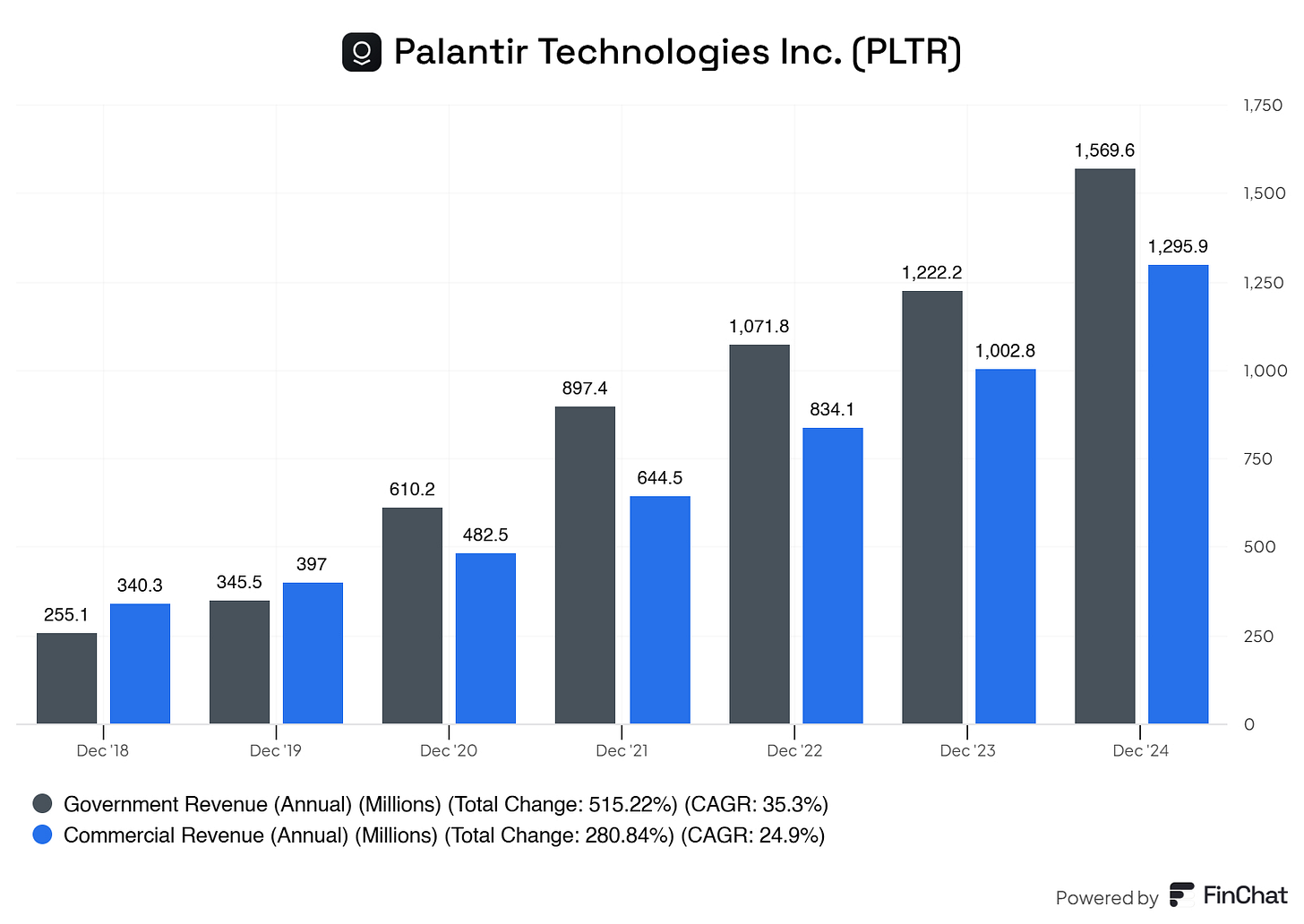

Stable and sustainable revenue growth. Palantir is showing stable and sustainable revenue growth. We could see significant growth like this continue in the coming years within their current phase.

Well-balanced revenue segments. Palantir isn't too reliant on the commercial segment or the government sector, as seen in both revenue.

Since 2018, Commercial Revenue has averaged 45.07% of total revenue, and the government segment has 54.93%.

Both segments have been stable ever since 2018, not showing any significant swings, indicating stability in their segments.

We note that Palantir is successfully expanding its commercial business, but government contracts still dominate. The commercial segment should continue growing at this pace. This, in return, could help diversify revenue and make Palantir less dependent on government contracts.

So, where is this revenue coming from?

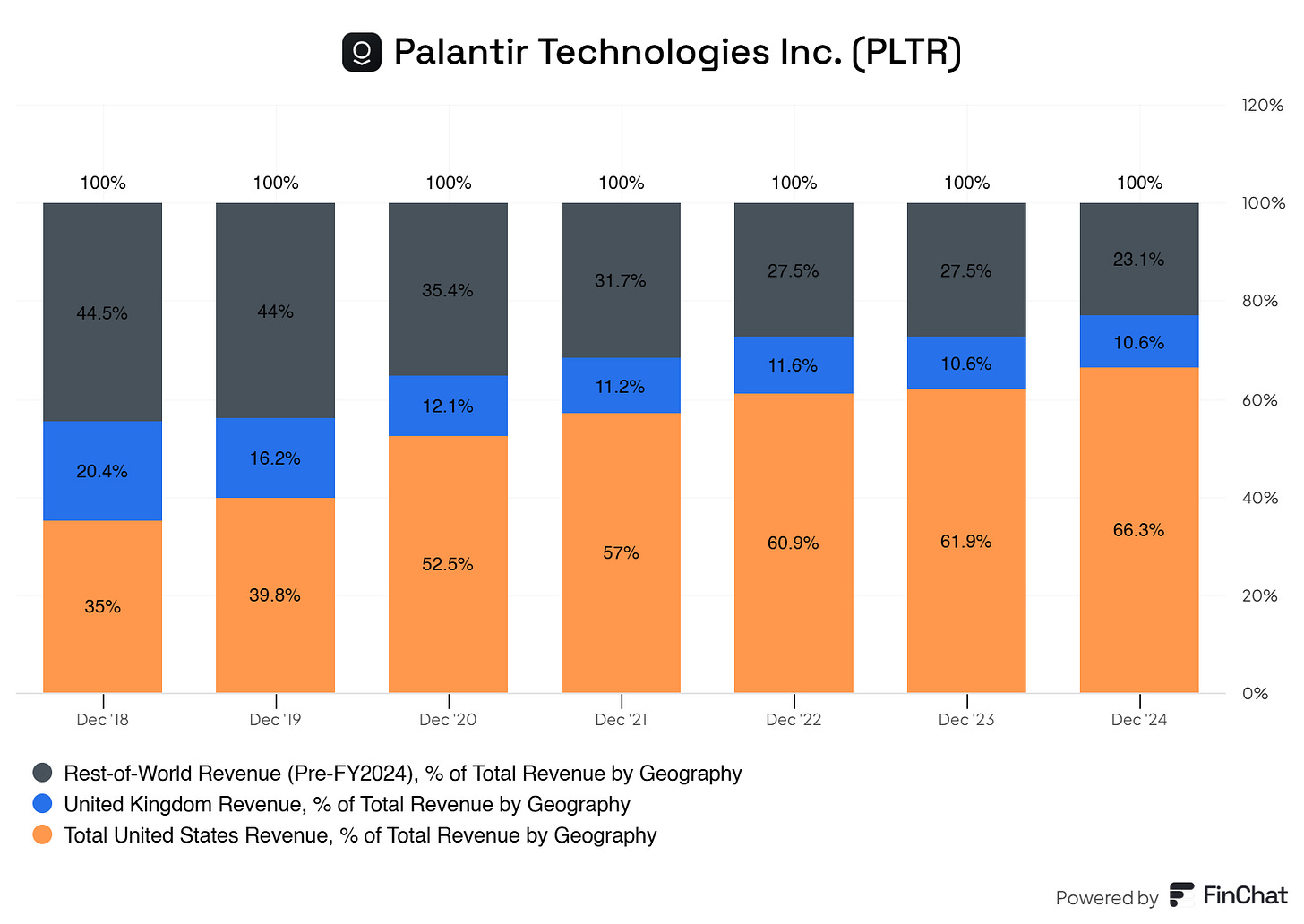

The United States sales are dominant. Palantir’s total revenue primarily comes from the United States. There’s some significant reliance on this part of the world (probably due to regulatory concerns, slower adaptation, and geopolitical factors)

The rest of the World is shrinking in share. This drop in this part of their revenues indicates slower international adaptation and Palantir’s stronger focus on domestic business.

Key Performance Indicators

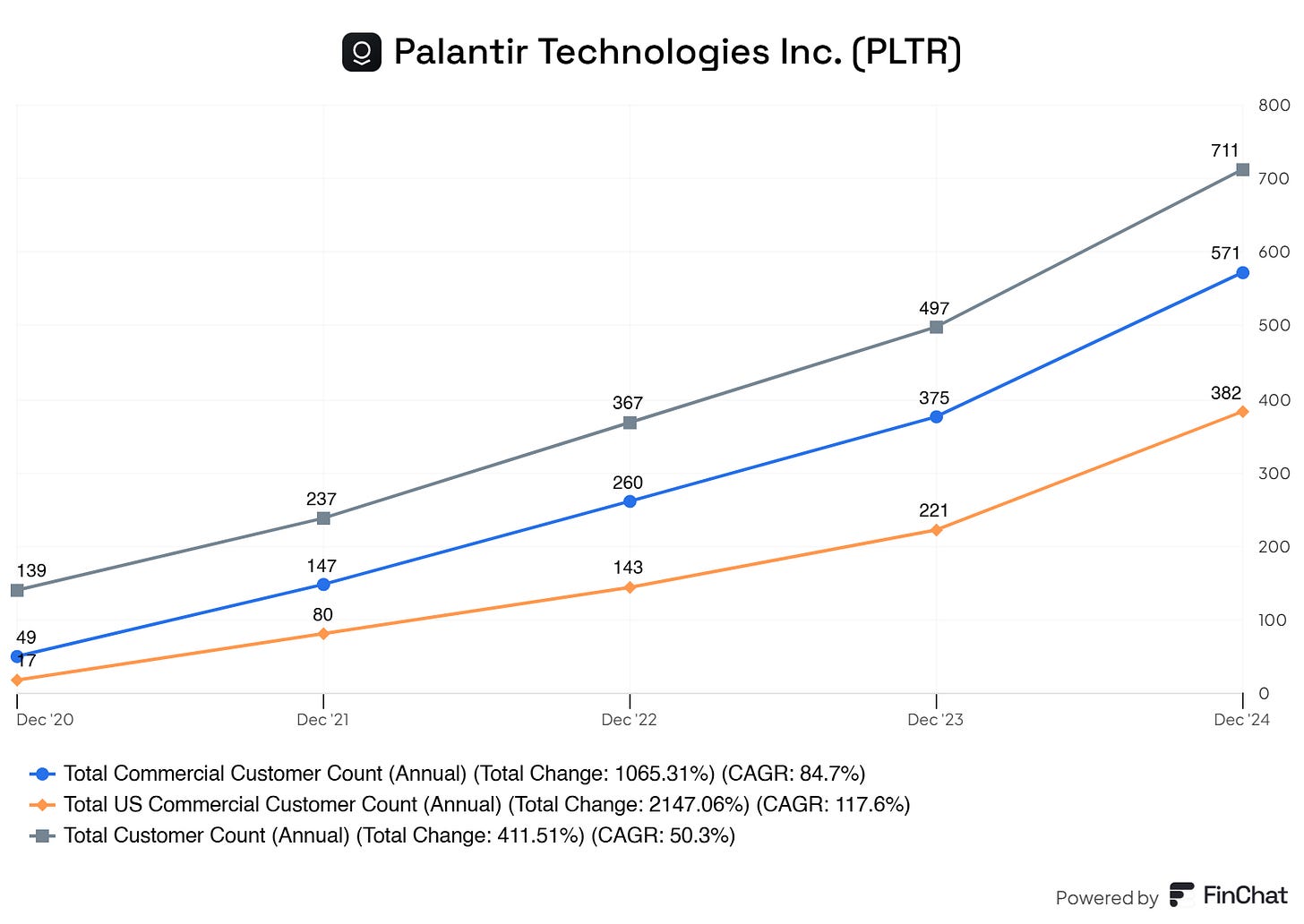

Explosive Commercial customer growth for Palantir. Palantir is successfully expanding beyond its government contract and attracting private-sector clients.

US Commercial is even more impressive. This suggests that Palantir’s commercial growth is heavily driven by the U.S. market rather than international expansion. It also aligns with their regional revenue trend, where the U.S. is becoming a larger share of their business.

While government contracts are still a key revenue source for Palantir, the commercial sector is now the primary growth driver.

Is this sustainable? For the coming years, I do expect, like everyone else, that Palantir will be able to maintain (hyper) growth for the coming years. Of course, the law of large numbers kicks in after this, and growth will inevitably slow down. But, for now, I expect Palantir to show impressive growth.

Short-term RPO is steadily increasing. This suggests consistent near-term revenue growth, as more contracts are set to be fulfilled within the next 12 months.

Long-term RPO is nearly doubling. This highlights Palantir’s ability to lock in multi-year contracts, ensuring a stable revenue stream in the years ahead.

Billing is through the roof. This indicates strong demand for Palantir’s services as more customers commit to spending on its platforms.

Declining net dollar retention (NDR). While existing customers are still spending more, their expansion rate has slowed. However, the rebound to 120% in 2024 suggests that customer spending is recovering. The current level is still excellent! I would suggest anything above 105% healthy for the company.

Management

Co-founder & Chairman Peter Thiel holds 100.3M shares worth $3.7B (4.40% of the total outstanding shares)

Co-founder, CEO & Director Alexander Karp holds 55.5M shares worth $2.0B (2.43% of the total outstanding shares)

Honorable mentions:

Independent Directors have most of their net worth in stocks. Because most of their wealth is locked into Palantir stock, shareholders can be more sure that their interests will align with those of Palantir’s shareholders. If they make a mistake, they feel it is in their pockets.

They’re significant skin in the game for all of management.

You know I have to put the famous quote in here.

‘‘Show me the incentive, and I will show you the outcome’’—Charlie Munger

Knowing that most of the wealth of the Palantir team is locked in stocks in the company, we can be more sure that decisions will be made that will benefit shareholders and, in return, benefit themself as well.

(The person you saw the first thing you opened this newsletter is the CEO, Alexander Karp)

Capital Efficiency by Management

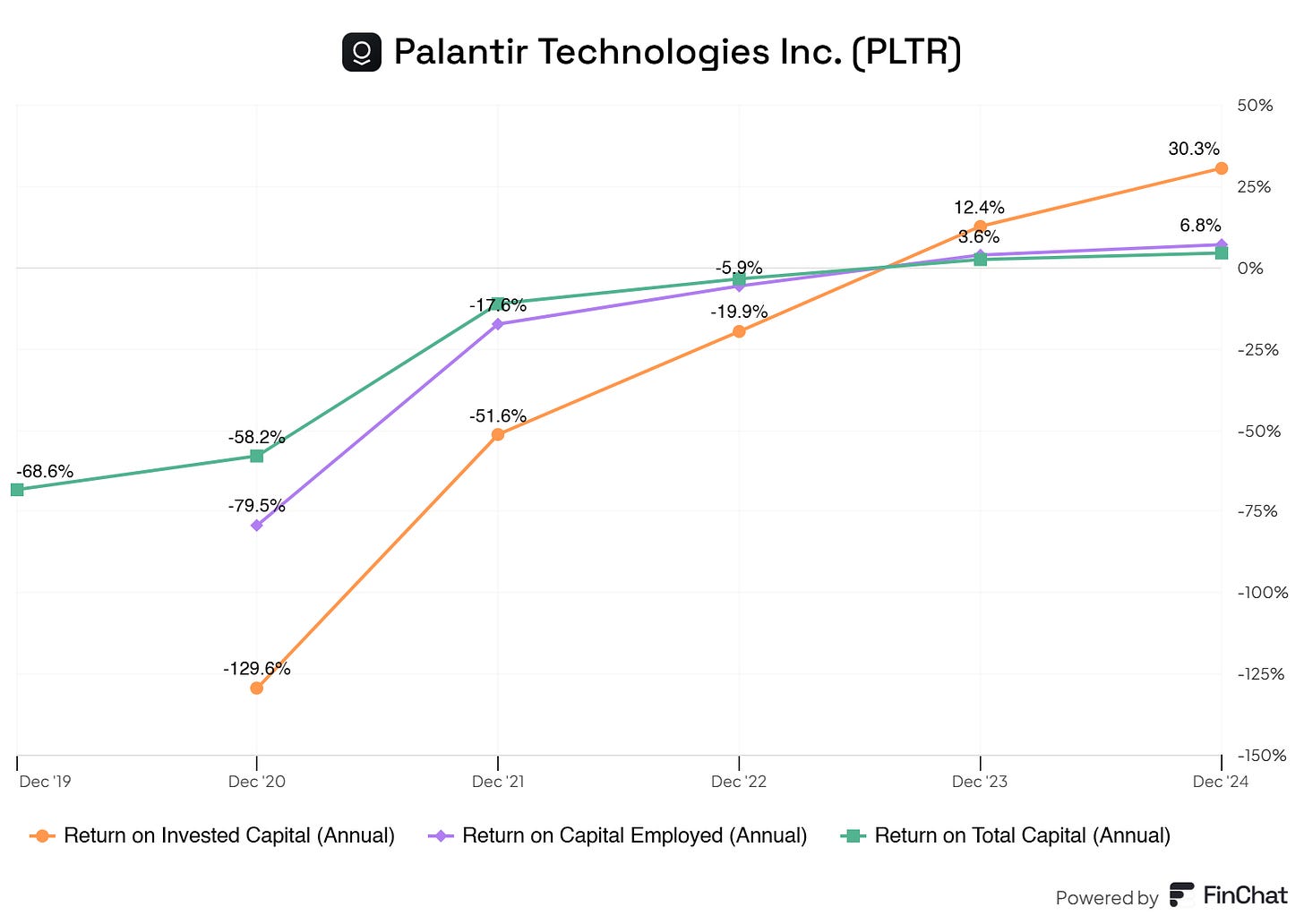

Is management awful capital allocators? No, they’re not. Palantir wasn’t netting any revenue until 2023, making their ROIC, ROTC, and ROCE negative.

In 2023 and 2024, Palantir is profitable. In recent years, Palantir has been profitable, and we have seen significant increases in their ROIC, ROTC, and ROCE.

We should see Palantir increasing these metrics in the coming years. Due to the company's nature, Palantir should be able to maintain at least a 20% ROIC for the coming years.

So, is this worrisome? No, they’re growing and have not become profitable for too long. Since becoming profitable, Palantir has rapidly improved its ROIC, ROTC, and ROCE, which is a good sign.

Investment Thesis

It’s indisputable that we’re still in an AI frenzy and AI-driven world in the last years and years. Now, I do not put the sample of an AI company on Palantir; however, Palantir is a key enabler of AI-driven enterprise and government transformation.

Palantir is riding a powerful secular trend in data analytics, artificial intelligence, and national security. As organizations globally increasingly prioritize data-driven decision-making and operational efficiency, Palantir’s advanced platforms—Gotham, Foundry, and Apollo—benefit significantly from this powerful and lasting secular trend.

The Data Explosion and AI Adoption

Exponential data growth across healthcare, governments, and many other industries requires scalable and intelligent analytics solutions. As data increases, so does the complexity of this data. Palantir is currently at the pinnacle of transforming this complex data into a valuable source of information for commercials and the government.

Enterprises are increasingly leveraging AI for automation, predictive insights, and optimization.

Digital Transformation in Enterprises

Companies globally are shifting toward cloud-based, AI-enhanced data platforms.

Palantir Foundry offers a low-code, highly integrated environment that enables businesses to unify and extract value from fragmented data sources.

Companies adopting Palantir’s platforms experience measurable efficiency gains, creating long-term customer lock-in and pricing power.

National Security and Defense Spending Tailwinds

Governments worldwide are allocating increasing budgets toward AI and defense analytics.

Palantir’s Gotham platform, deeply embedded in U.S. defense and intelligence agencies, provides mission-critical analytics and operational insights.

Geopolitical tensions and cybersecurity threats further reinforce the need for Palantir’s security and intelligence solutions.

Financial Sound

Palantir is on the road of margin expansion. From making losses to being profitable and seeing massive year-over-year increases in margins, Palantir will return greater shareholder returns in the future. For the coming years, more margin expansion is expected (due to all the heavy lifting being over, and focus on scaling will increase their margins significantly)

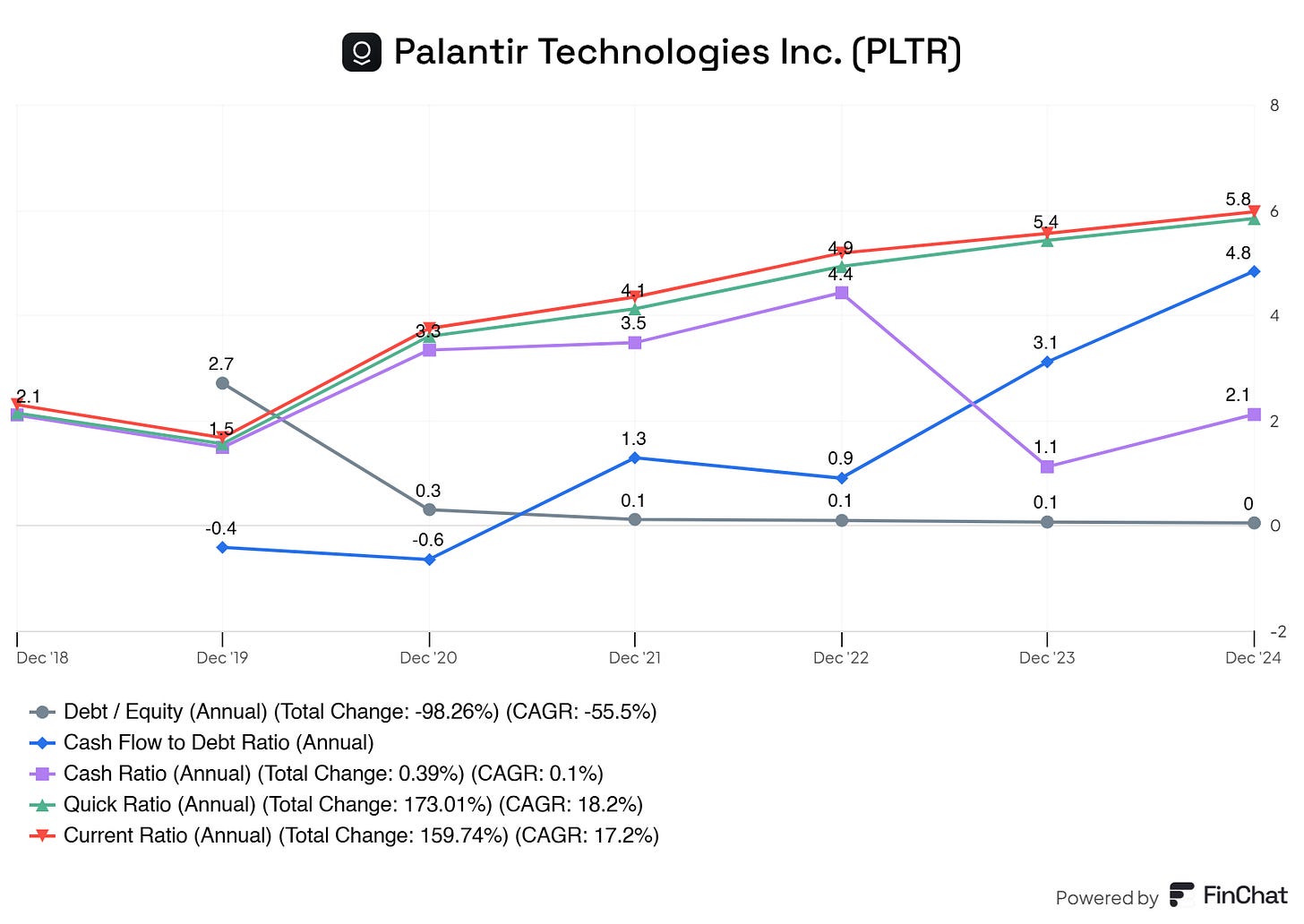

No debt! Palantir's net debt is—$4.990,8M on the balance sheet, and its LTM cash position is $2.098,5. Moreover, the business has a current ratio of 6, a quick ratio of 5.8, and a cash ratio of 2.1, making it financially fit. (No debt means no interest!)

"The company that has no debt can’t go bankrupt."—Peter Lynch

Financial Snapshot

With the investment thesis out of the way, let us go over the financials of Palantir in short. Like always, here I mention items that stand out in either a positive way or a negative way. If some item isn’t mentioned, I either missed it or deemed it fine.

(Yes, even I miss things sometimes)

Asset Sheet

Healthy cash and short-term investment positions. This gives Palantir a soft cushion to land if the company faces temporary headwinds, making the company more liquid.

Liabilities Sheet

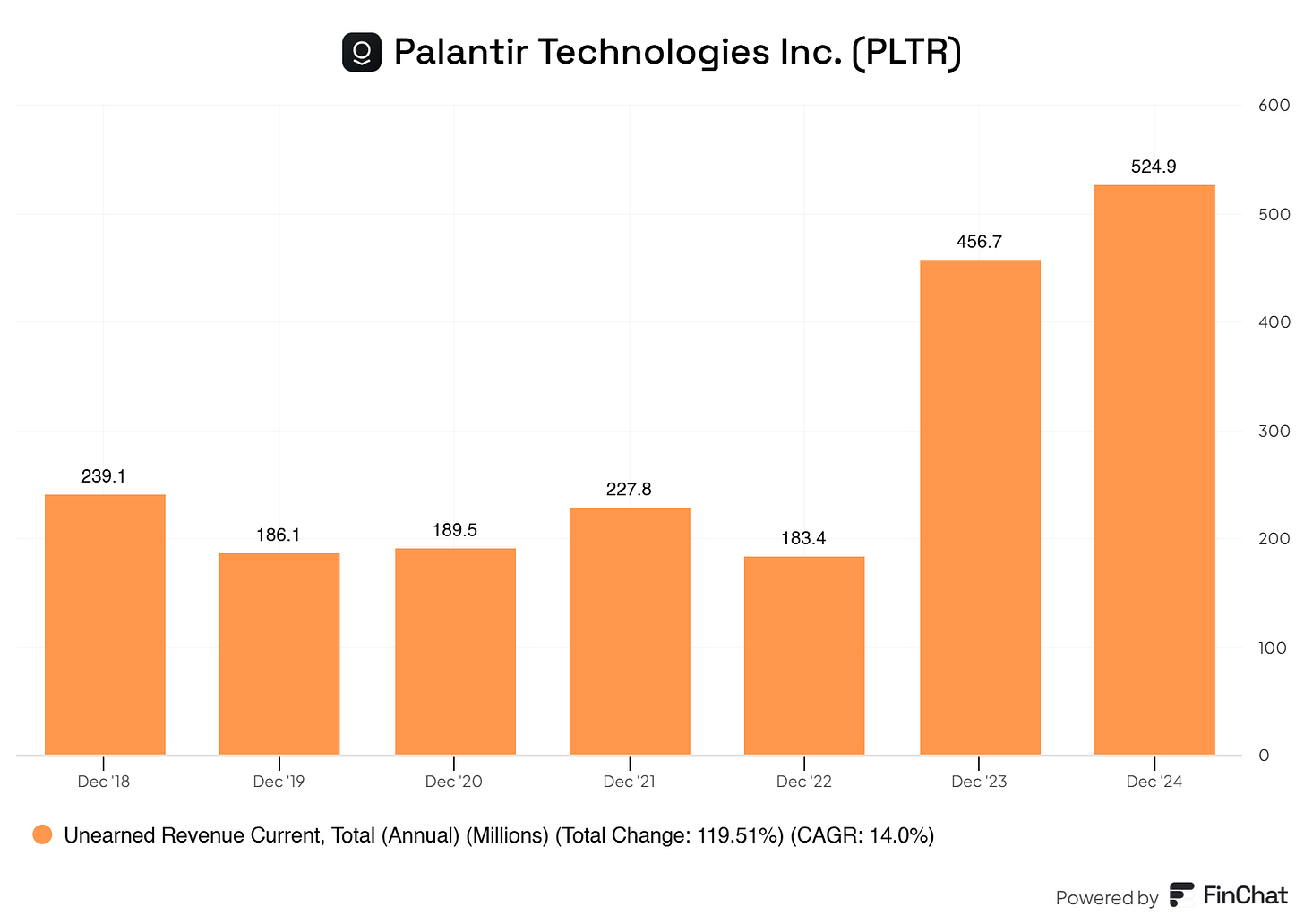

A significant spike in unearned revenue. This is a good sign as it suggests strong future revenue growth and increased customer commitments. This means that Palantir has secured a revenue pipeline. This reduces uncertainty, shows predictability, and increases customer commitment.

Quick summary. Palantir has a superb balance sheet! Palantir has no debt, a strong cash position, unrealized revenue indicating predictability in their coming revenues, retaining earnings, and no accounts payables on the balance sheet.

Overall, superb! I do not deem anything worrisome here for Palantir.

Financial Health Check

You might see it coming, but here, there’s nothing but excellence across the board for Palantir as well.

Palantir has no debt. A company without any debt can (almost) never go bankrupt.

Solid current, quick, and cash ratios. Palantir can fulfill any liabilities without harming their company.

Cash flow to debt is a bit skewed. Due to SBC being roughly 60% in 2024, we get a 1.92 instead of 4.8 if we adjust this ratio. Still, this is robust for Palantir, knowing its superb and robust financial position.

Cash Flow Insights

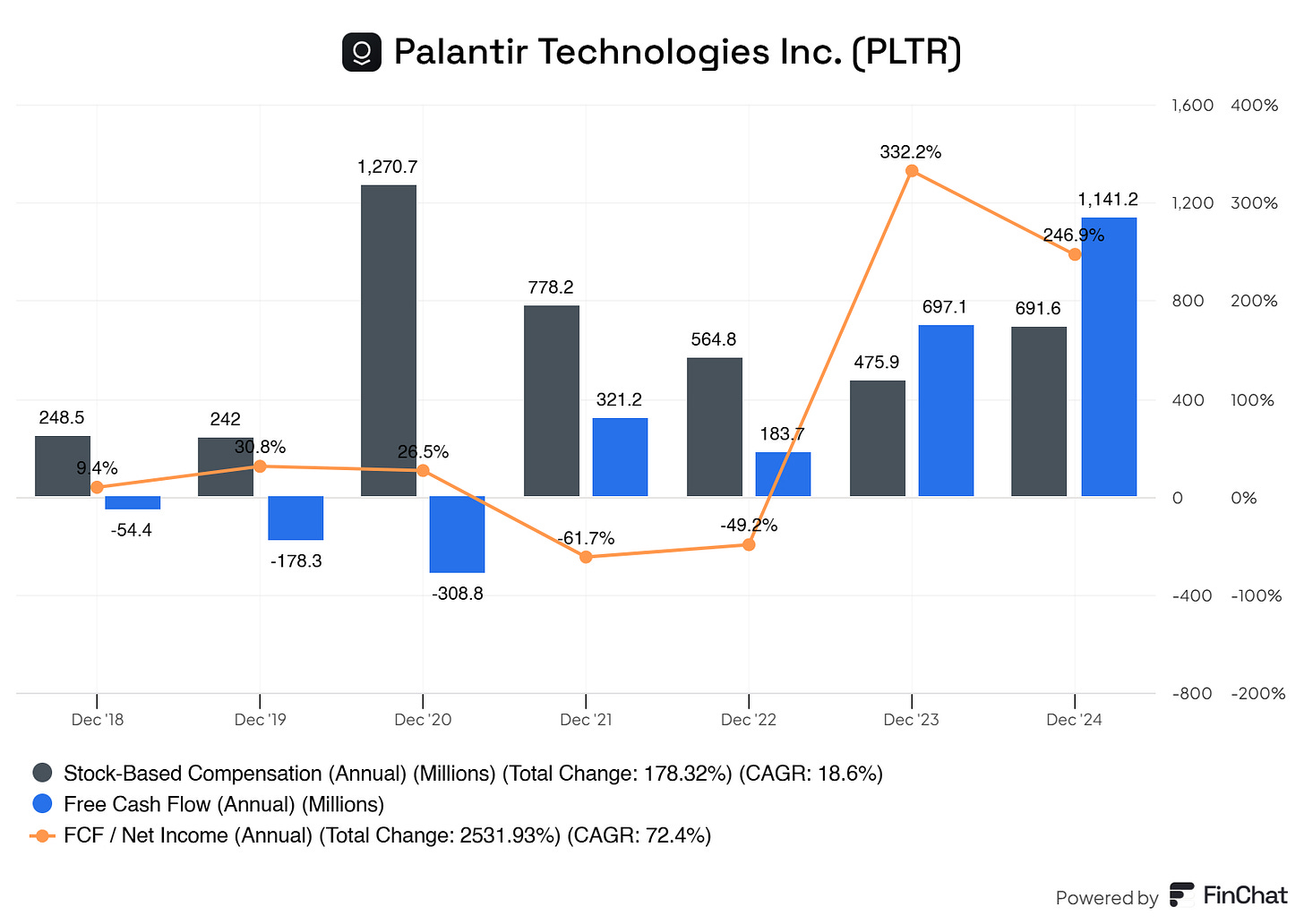

Excessive SBC. This SBC to FCF ratio would’ve been unacceptable for more mature companies. Palatir, however, is a growing company, and SBC is commonly used by companies in their (hyper) growth phase. For now, this doesn’t seem to be an issue. However, once Palantir starts maturing and growth ‘‘normalizes,’’ we would ideally like to see SBC to FCF be less than 5%.

Solid FCF growth, adjusted for SBC. Removing the SBC, we see a clear trend in FCF that is growing substantially, which is a good sign.

Palantir is converting efficiently. This is primarily due to SBC,y SBC,, depreciation, and amortization, but even after removing these, we get 150%, which is excellent!

Competitor Landscape

Palantir is involved in both the commercial and government landscapes, so I selected the following as Palantir's peers/competitors.

Booz Allen Hamilton

Northrop Grumman

Snowflake (it competes for enterprise customers)

Leidos Holdings

Return on Invested Capital (ROIC)

Palantir significantly outperforms in ROIC, suggesting it’s generating high returns relative to the capital it has invested. This is a strong indicator of capital efficiency.

Gross Profit Margin

Palantir has the highest gross profit margin, meaning it retains more revenue after direct costs than its competitors. This supports its premium pricing and SaaS business model.

Free Cash Flow (FCF) Margin

Palantir generates significantly more FCF relative to revenue, meaning it has a strong ability to reinvest in growth without needing external capital.

Revenue 5Y CAGR

Palantir has strong revenue growth, showing it is expanding quickly, though not at Snowflake’s level.

Operating Margin

Palantir’s operating margin is lower than NOC and on par with LDOS, meaning it spends heavily on R&D and expansion.

Return on Capital Employed (ROCE)

Palantir lags in ROCE, meaning it could be less efficient at utilizing capital to generate profits compared to Booz Allen.

Diluted EPS 5Y CAGR

Palantir’s earnings per share have shrunk over the last 5 years due to stock-based compensation (SBC) dilution.

Palantir excels in profitability metrics like Gross Margin and Free Cash Flow, indicating a highly scalable and cash-generative model. However, its operating efficiency (ROCE) and EPS growth are concerning, mainly due to stock dilution and aggressive expansion spending.

Potential Risks

Government contracts. A large portion of Palantir’s revenue comes from U.S. government contracts. Revenue could decline if government spending slows or contracts are lost (due to political shifts or budget cuts). Government contracts are also subject to renewal risks—losing a major client could severely impact financials.

Scalability and commercial adaptation risks. Palantir is aggressively expanding into the commercial sector (Foundry platform) to reduce government reliance. Adoption has grown, but some businesses find Palantir’s software complex and expensive compared to alternatives. If commercial adoption doesn’t accelerate, growth could stall.

Regulatory and data privacy risks. Palantir operates in highly sensitive industries, dealing with government intelligence, healthcare, and finance. Increased regulation on AI, data privacy, and security (GDPR, U.S. government oversight) could restrict operations or increase compliance costs. Ethical concerns over how Palantir’s technology is used (e.g., surveillance, law enforcement) could trigger public backlash or legal scrutiny.

Valuation Breakdown

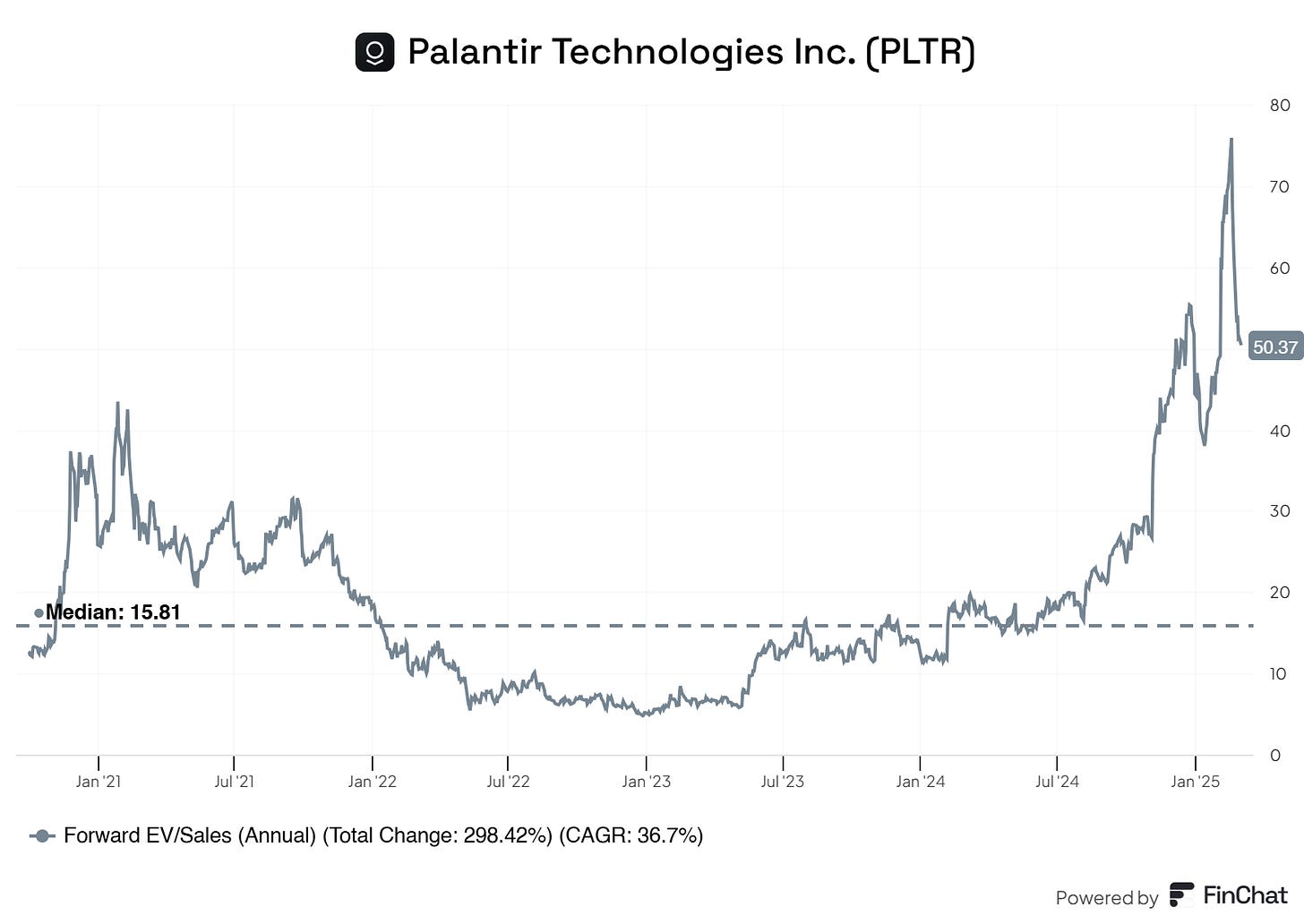

Running a reverse DCF tells us that in the current share price, 51.60% YoY (for 10 years) FCF growth is baked into the price. This is flat out ridiculous. Palantir is estimated to roughly grow its FCF 25% in YoY in this period. This means that Palantir is severely overvalued.

However, running a (reverse) DCF is questionable. So, let's examine other metrics.

Looking at the EV/Sales we can see that Palantir is still severely overvalued. The median is 15.81, but Palantir trades at 50.37. Now, even if we add a slight premium, and say 18x sales is more reasonable for Palantir. It is still severely overvalued.

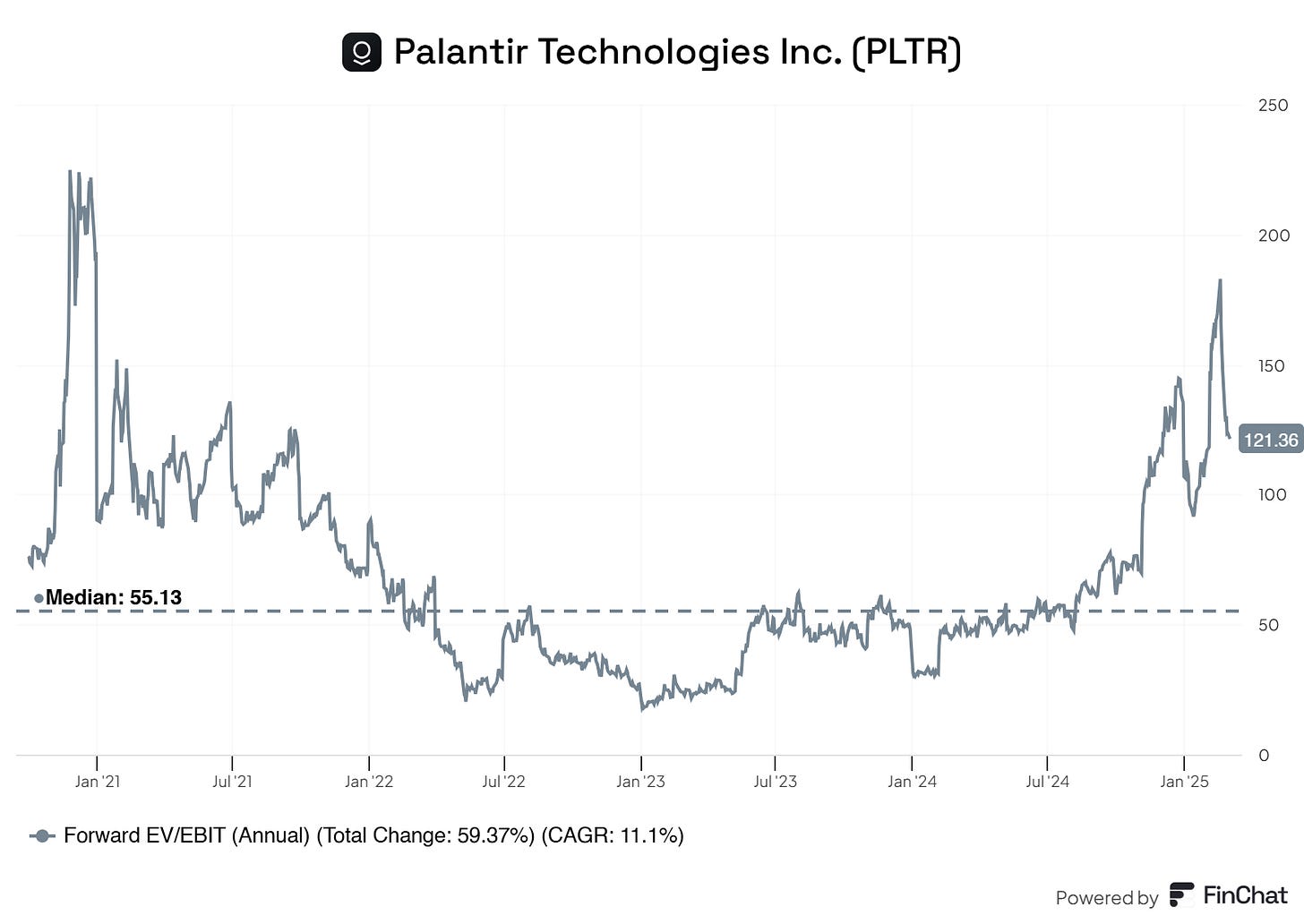

The same goes for Palantir’s EV/EBIT… Adding a slight premium, we could argue that EV/EBIT 59x is ‘reasonable’. Palantir is still trading at a 121.36x.

There are tremendous amounts of hope calculated into Palantir. Hope is not an effective investment strategy.

Hope doesn’t generate predictable, sustainable returns for investors.

Palantir is deemed to start reversing to the mean. When is the question, I can not predict the future. But it is bound to happen.

Final Thoughts

Let us collect our thoughts on Palantir here for a second, I still need to recover from going over Palantir’s current and future valuations… what a rollercoaster.

Palantir is a high-growth company operating at the intersection of AI, data analytics, and national security. Its ability to process vast amounts of data and provide actionable intelligence has made it a critical tool for government agencies and enterprises.

The company has shown stable revenue growth with a well-balanced mix between government and commercial segments. While government contracts remain its backbone, Palantir’s commercial expansion is gaining momentum, particularly in the U.S. market. This growth trajectory suggests continued diversification, reducing reliance on government spending. Note that we have to see a continuation in their commercial segment. This ensures more stability for Palantir, and in return, for its shareholders.

However, Palantir’s revenue is still heavily U.S.-centric, and international expansion has been slow. The company’s ability to penetrate global markets remains challenging due to regulatory hurdles and geopolitical risks.

Financially, Palantir has strong margins and free cash flow generation, positioning it well for long-term sustainability. However, stock-based compensation (SBC) and valuation concerns are significant risks. SBC remains high, leading to shareholder dilution, while Palantir’s premium valuation suggests that investors are pricing in a long runway for future growth. If growth slows, the stock may face downward pressure.

Palantir is riding a strong secular trend in data intelligence, AI-driven automation, and national security. The explosion of data across industries and the increasing demand for AI-enhanced decision-making ensures Palantir’s platforms remain essential. As companies and governments seek deeper insights from complex datasets, Palantir’s Gotham, Foundry, and Apollo platforms offer an indispensable advantage. Additionally, growing defense budgets and AI adoption will likely sustain demand for Palantir’s services in both public and private sectors.

That’s it for today!

PS…. if you’re enjoying FluentInQuality, can you take 3 seconds and refer this edition to a friend? It goes a long way in helping me grow the newsletter (and bring more quality investors into the world). Whenever you get a friend to sign up using the link below, you will be one step closer to some fantastic rewards.

Lastly, I would love to hear your input on how I can make FluentInQuality even more helpful for you! So, please leave a comment with:

Ideas you’d like covered in future posts.

Your takeaways from this post.

I read and respond to every comment! :-)

And remember…

Great investments don’t shout—they compound quietly.

- Yorrin (FluentInQuality)

Used Sources

Finchat is used for all the charts. You can now get 15% off from your subscription. Click here and start today!

(I’m affiliated. If you sign up using my link, your plan will not get more expensive due to the affiliate. You get a genuine discount!)

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.